Beruflich Dokumente

Kultur Dokumente

F446 Student Chap 24 - 8th Ed

Hochgeladen von

Juncheng WuOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

F446 Student Chap 24 - 8th Ed

Hochgeladen von

Juncheng WuCopyright:

Verfügbare Formate

F446 Chapter 24 Student Handout (8

th

edition)

Chapter 24: Swaps

Background

Interest ate Swaps

Currenc! Swaps

Credit Swaps

Swaps and Credit isk Concerns

" " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " " "

Background: # swap is an agree$ent %etween two parties (ca&&ed

counterparties) to e'change speci(ied periodic cash (&ows in the (uture

%ased on so$e under&!ing instru$ent or price (e)g)* a (i'ed or (&oating rate

on a %ond or note)) +hi&e the instru$ent under&!ing the swap $a!

change* the %asic princip&e o( a swap agree$ent is the sa$e* in that there

is a restructuring o( asset or &ia%i&it! cash (&ows in a pre(erred direction %!

the transacting parties) Co$$ercia& %anks and in,est$ent %anks are

$a-or participants in this $arket as dea&ers* traders* and users (or

proprietar! hedging purposes) Insurance co$panies ha,e on&! recent&!

adopted hedging strategies using swaps)

Co$paring (orwards* (utures* options* and swaps* a&though si$i&ar in

$an! wa!s* the (o&&owing distinguishing characteristics cause the

instru$ents to %e di((erentiated:

(.) # swap can %e ,iewed as a port(o&io o( (orward contracts with

di((erent $aturit! dates) Since cash (&ows on (orward contracts

are s!$$etric* the sa$e can %e said o( swaps) /his is in contrast

to options* whose cash (&ows are as!$$etric (truncated either on

the positi,e or negati,e side depending upon the position))

(2) /he introduction o( a swap inter$ediar! reduces the credit risk

e'posure and the in(or$ation and $onitoring costs that are

associated with a port(o&io o( indi,idua& (orward contracts)

(0) +hi&e (utures and options are $arked to $arket continuous&!*

swaps are $arked to $arket at coupon pa!$ent dates* and

(orward contracts are sett&ed on&! upon de&i,er! (at $aturit!))

/here(ore* the credit risk e'posure is greatest under a (orward

contract* where no third part! guarantor e'ists* as is the case (or

options (the options c&earing corporation (or e'change"traded

options) and swaps (the swap inter$ediar!))

.

F446 Chapter 24 Student Handout (8

th

edition)

(4) /he transactions cost is highest (or the option (the nonre(unda%&e

option pre$iu$)* ne't (or the swap (the swap inter$ediar!1s (ee)*

and (ina&&! (or the (orward contract (which has no up"(ront

pa!$ent))

(2) Swaps ha,e a &onger $aturit! than an! other instru$ent and

pro,ide an additiona& opportunit! (or FIs to hedge &onger ter$

positions at &ower cost)

Interest ate Swaps: Interest rate swaps are %! (ar the &argest seg$ent o(

the g&o%a& swap $arket) Conceptua&&!* an interest rate swap is a

succession o( (orward contracts on the interest rate33 arranged %! two

parties) In a swap* the swap buyer agrees to $ake a nu$%er o( (i' interest

rate pa!$ents on periodic sett&e$ent dates to the swap seller) /he se&&er o(

the swap in turn agrees to $ake (&oating " rate pa!$ents to the swap

%u!er on the sa$e periodic sett&e$ent dates)

In undertaking this transaction* the FI that is the (i'ed"rate pa!er is

seeking to trans(or$ the ,aria%&e"rate nature o( its &ia%i&ities into (i'ed"

rate &ia%i&ities to %etter $atch the (i'ed returns earned on its assets)

4eanwhi&e* the FI that is the ,aria%&e"rate pa!er seeks to turn its (i'ed"

rate &ia%i&ities into ,aria%&e"rate &ia%i&ities to %etter $atch the ,aria%&e

returns on its assets)

Example: Consider two FIs* with the (irst FI %eing a $one! center %ank

that has raised 5.66 $i&&ion o( its (unds %! issuing (our"!ear* $ediu$"

ter$ notes with 78 annua& (i'ed coupons rather than re&!ing on short"

ter$ deposits to raise (unds) 9n the asset side o( its port(o&io* the %ank

$akes co$$ercia& and industria& (C:I) &oans whose rate are inde'ed to

annua& changes in the ;ondon Inter%ank 9((ered ate (;IB9) <Banks

current&! inde' $ost &arge C:I &oans to either ;IB9 or the (edera&

(unds rate in the $one! $arket=) #s a resu&t o( ha,ing (&oating"rate

(asset) &oans and (i'ed"rate &ia%i&ities* the $one! center %ank has a

negati,e duration gap* with the duration o( its assets %eing &ess than that

o( its &ia%i&ities (D

A

>kD

L

? 6))

9ne wa! (or the %ank to hedge this e'posure is to shorten the duration or

interest rate sensiti,it! o( its &ia%i&ities %! trans(or$ing the$ into short "

ter$ (&oating rate &ia%i&ities that %etter $atch the duration characteristics

o( its asset port(o&io) /he %ank can $ake changes either on or o(( the

2

F446 Chapter 24 Student Handout (8

th

edition)

%a&ance sheet) 9n the %a&ance sheet* the %ank cou&d attract an additiona&

5.66 $i&&ion in short"ter$ deposits that are inde'ed to the ;IB9 rate in

a $anner si$i&ar to its &oans) #&ternati,e&!* the %ank cou&d go o(( the

%a&ance sheet and se&& an interest rate swap* there%! entering into a swap

agree$ent to $ake the (&oating"rate pa!$ent side o( a swap

agree$ent)

/he second part! in the swap is a sa,ings %ank that has in,ested 5.66

$i&&ion in (i'ed"rate residentia& $ortgages o( &ong duration) /o (inance

this residentia& $ortgage port(o&io* the sa,ings %ank has had to re&! on

short"ter$ certi(icates o( deposit with an a,erage duration o( one !ear)

9n $aturit!* these C@s ha,e to %e ro&&ed o,er at the current $arket rate)

#s such* the sa,ings %ankAs asset"&ia%i&it! %a&ance sheet structure is the

re,erse o( the $one! center %ankAs* where D

A

> kD

L

B 6) /he sa,ings %ank

cou&d hedge its interest rate risk e'posure %! trans(or$ing the short"

ter$ (&oating"rate nature o( its &ia%i&ities into (i'ed"rate &ia%i&ities that

%etter $atch the &ong"ter$ $aturit!Cduration structure o( its assets) 9((

the %a&ance sheet* the sa,ings %ank can %u! a swap* there%! taking the

(i'ed pa!$ent side o( a swap agree$ent)

/his swap agree$ent can %e arranged direct&! %etween the parties) It is

$ore &ike&! that an FIDanother %ank or an in,est$ent %ankDwou&d act

as either a %roker or an agent* recei,ing a (ee (or %ringing the two parties

together or inter$ediating (u&&! %! accepting the credit e'posure risk and

guaranteeing the cash (&ows under&!ing the swap contract) B! acting as a

principa& as we&& as an agent* the FI can add a credit risk pre$iu$ to the

(ee) Conceptua&&!* when a third"part! FI (u&&! inter"$ediates the swap*

that FI is rea&&! entering into two separate swap agree"$ents* one with the

$one! center %ank and one with the sa,ings %ank)

For si$p&icit!* a plain vanilla (i'ed"(&oating rate swap (standard agree"

$ent without an! specia& (eatures) is %eing considered* where a third"

part! inter$ediar! acts as a si$p&e %roker or agent %! %ringing together

two FIs with opposing interest rate risk e'posures to enter into a swap

agree$ent or contract)

0

F446 Chapter 24 Student Handout (8

th

edition)

Financing Cost esu&ting (ro$ Interest ate Swap (in 5 $i&&ions):

4one! Ctr Bank Sa,ings Bank

Cash outflows (ro$ %a&ance

sheet (inancing (>78)(5.66) (>C@)(5.66)

Cash inflows (ro$ swap (78)(5.66) (;IB9 E 28)(5.66)

Cash outflows (ro$ swap >(;IB9 E 28)(5.66) 333(>78)(5.66) 3333

Net cash (&ows >(;IB9 E 28)(5.66) >(F8 E C@ ate > ;IB9)(5.66)

4kt rate a,ai&a%&e on:

Garia%&e"rate de%t ;IB9 E 2)28

Fi'ed"rate de%t ..8

Fro$ the e'a$p&e* in the a%sence o( de(au&tCcredit risk* on&! the $one!

center %ank is rea&&! (u&&! hedged* gi,en that the 78 pa!$ent it recei,es

(ro$ the sa,ings %ank at the end o( the !ear a&&ows it to $eet the pro$ised

78 coupon rate pa!$ents to its note ho&ders regard&ess o( the return it

recei,es (ro$ its ,aria%&e"rate asset &oans) B! contrast* the sa,ings %ank

recei,es ,aria%&e"rate pa!$ents %ased on ;IB9 E 28* !et it is Huite

possi%&e that the C@ rate the sa,ings %ank has to pa! on its deposit

&ia%i&ities doesnAt e'act&! track (%asis risk) the ;IB9"inde'ed pa!$ents

paid %! the $one! center %ank ,ia the swap) /here are two possi%&e

sources o( this %asis risk:

(.) C@ rates do not e'act&! $atch the $o,e$ents o( ;IB9 rates

o,er ti$e since the (or$er (C@ rates) are deter$ined in the

de$otic33 $one! $arket and the &atter (;IB9 rates)

in the Iurodo&&ar

(2) /he creditCde(au&t risk pre$iu$ on the sa,ings %ankAs C@s $a!

increase o,er ti$e) /hus* the E28 add"on to ;IB9 $a! %e

insu((icient to hedge the sa,ings %ankAs cost o( (unds)

4

F446 Chapter 24 Student Handout (8

th

edition)

ea&iJed Cash F&ow on an Interest ate Swap: /he rea&iJed or actua&

path o( interest (;IB9) rates o,er the (our"!ear &i(e o( the contract are

(Si$i&ar to I'a$p&e 24"2* and /a%&e 24"0 on pg FF2)

Ind o( Kr ;IB9

. F8

2 8

0 8

4 F

/he $one! center %ankAs ,aria%&e pa!$ents to the sa,ing %ank were

(;IB9 E 28)(5.66 $i&&ion)) /he (i'ed annua& pa!$ents the sa,ing %ank

$ade to the $one! center %ank were the sa$e each !ear* (78)(5.66

$i&&ion))

."Kr Cash Cash Let M$t

Ind o( ."Kr ;IB9 M$t %! M$t %! 4ade %!

Kr ;IB9 E28 4CB Sa,ings Bank 4CB

. F8 78 53333 53333 53333

2 88 .68 53333 53333 53333

0 88 .68 53333 53333 53333

4 F8 78 53333 53333 53333

/ota& 53333 53333 53333

Swaps can a&wa!s %e $o&ded or tai&ored to the needs o( the transacting

parties as &ong as one part! is wi&&ing to co$pensate the other part! (or

accepting nonstandard ter$s or o(("$arket swap arrange$ents* usua&&!

in the (or$ o( an up"(ront (ee or pa!$ents) e&a'ing a standardiJed swap

can inc&ude specia& interest rate ter$s and inde'es as we&& as a&&owing (or

,ar!ing notiona& ,a&ues under&!ing the swap) /his (&e'i%i&it! is use(u&

when one o( the parties has hea,! in,est$ents in $ortgages that are fully

amortized (annua& and $onth&! cash (&ows on the $ortgage port(o&io

re(&ect repa!$ents o( %oth principa& and interest such that the periodic

pa!$ent is kept constant) Fi'ed"rate $ortgages nor$a&&! ha,e &arger

pa!$ents o( interest than principa& in the ear&! !ears* with the interest

co$ponent (a&&ing as $ortgages approach $aturit!)) 9ne possi%i&it! is (or

the sa,ings %ank to enter into a $ortgage swap to hedge the a$ortiJing

nature o( the $ortgage port(o&io or a&ternati,e&! to a&&ow the notiona&

,a&ue o( the swap to dec&ine at a rate si$i&ar to the dec&ine in the principa&

co$ponent o( the $ortgage port(o&io)

2

F446 Chapter 24 Student Handout (8

th

edition)

#nother e'a$p&e o( a specia& t!pe o( interest swap is the in,erse floater

swap* which was engineered %! $a-or FIs as part o( structured note

(inancing dea&s to &ower the cost o( (inancing to ,arious go,ern$ent

agencies) In this arrange$ent* a go,ern$ent agenc! issues notes to

in,estors with a coupon that is eHua& to F8 > ;IB9* an in,erse (&oating

coupon) +hen $arket rates (a&& (;IB9 decreases)* the coupon recei,ed

%! the in,estor increases (increasesCdecreases)) /he go,ern$ent agenc!

then con,erts this spread &ia%i&it! (F8 > ;IB9) into a ;IB9 &ia%i&it!

%! entering into a swap with an FI dea&er) In e((ect* the cost o( note issue

is ;IB9 to the agenc! p&us an! (ees re&ating to the swap) (I( ;IB9 were

to increase to 88* the pro$ised coupon wou&d %e >.8) Since negati,e

coupons canAt %e paid* the actua& coupon paid to the in,estor is 68))

4acrohedging with Swaps: /he duration $ode& shown in Chapters 22

and 20 to esti$ate the opti$a& nu$%er o( (utures and options contracts to

hedge an FIAs duration gap can %e app&ied to esti$ate the opti$a& nu$%er

o( swap contracts)

/he resu&ting eHuation is:

where: N

S

N Lotiona& ,a&ue o( swap contracts needed

D

A

kD

L

N FIAs &e,eraged duration gap

A N SiJe o( the FIAs assets

D

fixed

N duration o( the (i'ed"p$t go,t %ond o( swap

D

float

N duration o( the swap"p$t inter,a& go,t %ond

(Sa$p&e pro%&e$* I'a$p&e 24"0* pg FF2))

Currenc! Swaps: Swaps can %e used to hedge currenc! risk e'posures o(

FIs) Currenc! swaps can %e used to i$$uniJe FIs against e'change rate

risk when the! $is$atch the currencies o( their assets and &ia%i&ities)

Fi'ed"Fi'ed Currenc! Swaps: Consider that a O)S) FI has a&& o( its 5.66

$i&&ion (i'ed"rate assets deno$inated in do&&ars) It is (inancing part o( its

asset port(o&io with a P26 $i&&ion issue o( (our"!ear* $ediu$"ter$ British

pound ster&ing notes that ha,e a (i'ed annua& coupon o( 88) B!

co$parison* there is a O)Q) FI that has a&& its assets deno$inated in

6

F446 Chapter 24 Student Handout (8

th

edition)

ster&ing* whi&e it is part&! (unding those assets with 5.66 $i&&ion issue o(

(our"!ear* $ediu$" ter$ do&&ar notes with a (i'ed annua& coupon o( 88)

#ssu$e that the do&&arCpound e'change rate is 52CP.)

/hese two FIs are e'posed to opposing currenc! risks) /he O)S) FI is

e'posed to the risk that the do&&ar wi&& depreciate against the pound o,er

the ne't (our !ears* $aking it $ore cost&! to co,er the annua& coupon

interest pa!$ents and the principa& repa!$ent on its pound"deno$inated

notes) #&ternati,e&!* the O)Q) FI is e'posed to the do&&ar appreciating

against the pound* $aking it $ore di((icu&t to co,er the do&&ar coupon and

the principa& pa!$ents on its (our"!ear 5.66 $i&&ion note issue out o(

ster&ing cash (&ows on its assets)

Financing Costs esu&ting (ro$ a Fi'ed"Fi'ed Currenc! Swap #gree$ent

(in 5 $i&&ions):

O)S) FI O)Q) FI

Cash outflows (ro$ %a&ance

sheet (inancing (>88)(P26) (>88)(5.66)

Cash inflows (ro$ swap (88)(P26) (88)(5.66)

Cash outflows (ro$ swap (>88)(5.66) (>88)(P26)

Net cash (&ows (>88)(5.66) (>88)(P26)

4kt rate a,ai&a%&e on

@o&&ar"deno$inated notes 8)28

Mound"deno$inated notes 8)28

Example 2! (pg FFF): +ith this swap* the O)Q) FI sends annua&

pa!$ents in pounds to co,er the coupon and principa& repa!$ents o( the

O)S) FIAs pound note issue* and the O)S) FI sends annua& do&&ar pa!$ents

to the O)Q) FI to co,er the interest and principa& pa!$ents on its do&&ar

note issue) Both FIs a&so trans(or$ the pattern o( their pa!$ents at a

&ower rate than i( the! had $ade changes on the %a&ance sheet)

In this e'a$p&e* %oth &ia%i&ities %ear a (i'ed 88 interest rate) /his is not a

necessar! reHuire$ent (or the (i'ed"(i'ed currenc! swa! agree$ent)

Supposing that the O)S) FIAs note coupons were 48 per annu$* whi&e the

O)Q) FIAs note coupons were 88* the swap pa!$ents o( the O)S) FI wou&d

re$ain unchanged* %ut the O)Q) FIAs ster&ing pa!$ents wou&d %e reduced

%! P2 $i&&ion (or 54 $i&&ion) in each o( the (our !ears) /his di((erence

cou&d %e $et either %! so$e up"(ront pa!$ent %! the O)Q) FI to the O)S)

FI* re(&ecting the di((erence in the present ,a&ue o( the two (i'ed cash

F

F446 Chapter 24 Student Handout (8

th

edition)

(&ows* or %! annua& pa!$ents that resu&t in Jero net present ,a&ue

di((erences a$ong the (i'ed"(i'ed currenc! swap participantsA pa!$ents)

#&so note that i( the e'change rate changed (ro$ the rate (52CP.)* either

one or the other side wou&d %e &osing in the sense that new swap $ight %e

entered into at an e'change rate $ore (a,ora%&e to one part!) (I( the

do&&ar were to appreciate against the pound o,er the &i(e o( the swap* the

agree$ent wou&d %eco$e $ore cost&! o( the O)S FI)) +h!R

I( the us (i had not entered in to the swap gi,en that the 5 is appreciating

against the Iurodo&&ar

Fi'ed"F&oating Currenc! Swap: B! co$%ining a (i'ed"(&oating interest

rate swap descri%ed ear&ier* with a currenc! swap* a fixed!floatin"

currenc! swap is produced (a h!%rid o( the two p&ain ,ani&&a swaps that

were considered ear&ier))

Example 2!# (pg FF8"FF7): # O)S) FI that ho&ds (&oating"rate* short"ter$

O)S) do&&ar"deno$inated assets has (inanced this asset port(o&io with a P26

$i&&ion* (our"!ear note issue with (i'ed 88 annua& coupons deno$inated

in pounds) #&ternati,e&!* a O)Q) FI that ho&ds &ong"ter$* (i'ed"rate assets

deno$inated in pounds has (inanced this port(o&io with 5.66 $i&&ion

short"ter$ do&&ar"deno$inated Iuro C@s whose rates re(&ect changes in

one"!ear ;IB9 p&us a 28 pre$iu$) #s a resu&t* the O)S) FI is (aced

with %oth an interest rate risk and a (oreign e'change risk ) I( do&&ar

short"ter$ rates (a&& and the do&&ar depreciates against the pound* the FI

$a! (ace a pro%&e$ in co,ering its pro$ised (i'ed"coupon and principa&

pa!$ents on the pound"deno$inated note) /he O)Q) FI a&so (aces interest

rate and (oreign e'change rate risk e'posures) I( O)S) interest rates rise

and the do&&ar appreciated against the pound* the O)Q) FI wi&& (ind it $ore

di((icu&t to co,er its pro$ised coupon and principa& pa!$ents on its

do&&ar"deno$inated C@s out o( the cash (&ows (ro$ its (i'ed"rate pound

asset port(o&io) Iach FI can achie,e its o%-ecti,e o( &ia%i&it!

trans(or$ation %! engaging in a (i'ed"(&oating currenc! swap) # (easi%&e

swap wou&d %e one in which each !ear* the two FIs swap pa!$ents at so$e

prearranged do&&arCpound e'change rate (assu$e 52CP.))

8

F446 Chapter 24 Student Handout (8

th

edition)

Financing Costs esu&ting (ro$ the Fi'ed"F&oating Currenc! Swap (in

$i&&ions):

O)S) FI O)Q) FI

Cash outflows (ro$ %a&ance

sheet (inancing (>88)(P26) >(;IB9 E 28)(5.66)

Cash inflows (ro$ swap (88)(P26) (;IB9 E 28)(5.66)

Cash outflows (ro$ swap >(;IB9 E 28)(5.66) (>88)(P26)

Net cash out(&ows >(;IB9 E 28)(5.66) (>88)(P26)

4kt rate a,ai&a%&e on

5"deno$inated ,ar rate ;IB9 E 2)28

P"deno$inated (i'ed rate 78

ea&iJed Cash F&ows on a Fi'ed"F&oating Currenc! Swap (in $i&&ions)

Fi'ed ate

F&oating ate Ma!$ent %! O)Q) FI Let Ma!$ent

;IB9 Ma!$ent %!

33333333333333333333333333

%! O)S) FI

Kear ;IB9 E 28 O)S) Bank (5s) (Ps) (5 at 52CP.) (5s)

. F8 78 53333 P3333 53333 53333

2 6 8 53333 P3333 53333 53333

0 8 .6 53333 P3333 53333 53333

4 2 F 53333 P3333 53333 53333

/ota& net pa!$ent 53333

Credit Swaps: In recent !ears the (astest growing t!pes o( swaps ha,e %een

those de,e&oped to %etter a&&ow FIs to hedge their credit risk* so"ca&&ed credit

swaps or credit de(au&t swaps (C@s)) /his is i$portant (or two reasons:

(.) Credit risk is sti&& $ore &ike&! to cause an FI to (ai& than is either

interest rate risk or (oreign e'change (FS) risk)

(2) C@Ss a&&ow FIs to $aintain &ong"ter$ custo$er &ending

re&ationships without %earing the (u&& credit risk e'posure (or$ those

re&ationship

Federa& eser,e Board Chair$an Treenspan credited this $arket in the

ear&! 2666s with e((ecti,e&! shi(ting a signi(icant part o( %anksA risk (ro$

their corporate &oan port(o&ios) Howe,er* Treenspan a&so co$$ented that

these deri,ati,e securities are prone to induce specu&ati,e e'cesses that

need to %e contained through regu&ation* super,ision* and pri,ate sector

action)

7

F446 Chapter 24 Student Handout (8

th

edition)

/ota& eturn Swaps: # &ender can use a tota& return swap to hedge (or a

possi%&e change in credit risk e'posure) # total return swap in,o&,es

swapping an o%&igation to pa! interest at a speci(ied (i'ed or (&oating rate

(or pa!$ents representing the tota& return on a &oan or a %ond (interest

and principa& ,a&ue changes) o( a speci(ied a$ount)

Example 2!$ (pg F8.): #n FI &ends 5.66 $i&&ion to a BraJi&ian $anu"

(acturing (ir$ at a (i'ed rate o( .68) /he FI hedges an une'pected

increase in the %orrowerAs credit risk %! entering into a tota& return swap in

which it agrees to pa! a tota& return %ased on an annua& (i'ed rate (f N .28)

p&us changes in the $arket ,a&ue o( BraJi&ian (O)S)"deno$inated)

go,ern$ent de%t (changes in the ,a&ue o( these %onds re(&ect the po&itica&

and econo$ic e,ents in the (ir$As ho$e countr! and thus wi&& %e corre&ated

with the credit risk o( the BraJi&ian %orrowing (ir$)) In return* the FI

recei,es a ,aria%&e $arket rate pa!$ent o( interest annua&&! (."!r ;IB9

rate N ..8)) #t the end o( the swap p$t date* the BraJi&ian %ond had a

secondar! $arket ,a&ue o( 76 due to an increase in countr! risk)

Cash F&ows on a /ota& eturn Swap:

Cash F&ows on a /ota& eturn Swap:

#nnua& Cash F&ow

(or Kr . through #dditiona&

Fina& Kr M$t %! FI /ota& eturn

Cash inflow on swap ."!r ;IB9 D ."!r ;IB9

to FI &ender (..8) (..8)

Cash outflow on swap Fi'ed rate (f) %

&

> %

'

to other FI (.28) (76 > .66)

(.28 E N .28 > .68 N 28)

33333333333333333333333333333

Let pro(it 78

Lote that hedging credit risk in this (ashion a&&ows the FI to $aintain its

.6

F446 Chapter 24 Student Handout (8

th

edition)

custo$er re&ationship with the BraJi&ian (ir$ (and perhaps earn (ees (ro$

se&&ing other (inancia& ser,ices to that (ir$) without %earing a &arge a$ount

o( credit risk e'posure) Further* since the BraJi&ian &oan re$ains on the

FIAs %a&ance sheet* the BraJi&ian (ir$ $a! not know its &oan is %eing

hedged)

#&ternati,e&!* the swap does not co$p&ete&! hedge credit risk in this case)

Speci(ica&&!* %asis risk is present to the e'tent that the credit risk o( the

BraJi&ian (ir$As O)S) do&&ar &oan is i$per(ect&! corre&ated with BraJi&ian

countr! risk re(&ected in the price o( the BraJi&ian (O)S) do&&ar) %onds)

Mure Credit Swaps: +hi&e tota& return swaps can %e used to hedge credit

risk e'posure* the! contain an e&e$ent o( interest rate risk as we&& as credit

risk) In the preceding e'a$p&e* i( the ;IB9 rate changes* the net cash

(&ows on the tota& return swap wi&& change* e,en though the credit risks o(

the under&!ing &oans (and %onds) ha,e not changed) /o strip out the

Uinterest rateV sensiti,e e&e$ent o( tota& return swaps* a (pure) credit swap

has %een de,e&oped) /he FI &ender wi&& send (each swap period) a fixed (ee

or pa!$ent (&ike an insurance pre$iu$) to the FI counterpart!) I( the FI

&enderAs &oan or &oans do not de(au&t* it wi&& recei,e nothing %ack (ro$ the

FI counterpart!) I( the &oan or &oans de(au&t* the FI counterpart! wi&& co,er

the de(au&t &oss %! $aking a de(au&t pa!$ent that is o(ten eHua& to the par

,a&ue o( the origina& &oan $inus the secondar! $arket ,a&ue o( the de(au&ted

&oan) /hus* a pure credit swap is &ike %u!ing credit insurance andCor a

$u&ti"period credit option)

..

F446 Chapter 24 Student Handout (8

th

edition)

Swaps and Credit isk Concerns: In contrast to (utures and options

$arkets* swap $arkets ha,e historica&&! %een go,erned %! ,er! &itt&e

regu&ationDthere is no centra& go,erning %od! o,erseeing swap $arket

operations) /he Internationa& Swaps and @eri,ati,es #ssociation (IS@#)*

esta%&ished in .782* is a g&o%a& trade association which esta%&ishes* re,iews*

and updates the code o( standards (the &anguage and pro,isions) (or swap

docu$entation) It a&so acts as the spokesgroup (or the industr! on

regu&ator! changes and issues* pro$otes the de,e&op$ent o( risk

$anage$ent practices (or swap dea&ers* pro,ides a (oru$ (or in(or$ing

and educating swap $arket participants a%out re&e,ant issues* and sets

standards o( co$$ercia& conduct (or its $e$%ers) Further* %ecause

co$$ercia& %anks are the $a-or swap dea&ers* the swap $arkets are

su%-ect* indirect&!* to regu&ations i$posed %! the %oard o( go,ernors o( the

(edera& reser,e *the (dic * and other %ank regu&ator! agencies charged with

$onitoring %ank risk)

/o the e'tent that swap acti,it! is part o( a %ankAs o,era&& %usiness* swap

$arkets are $onitored (or a%uses) In,est$ent %anks and insurance

co$panies ha,e recent&! %eco$e %igger p&a!ers in the swap $arkets*

howe,er* and these dea&ers ha,e genera&&! %een su%-ect to (ew regu&ations

on their swap dea&ings)

Ti,en the ro&e that swaps p&a!ed in the (inancia& crisis* the (edera&

go,ern$ent has proposed regu&ating the$ $ore hea,i&!) In 9cto%er 2667*

the 9,er"the"Counter @eri,ati,es 4arket #ct was passed) /his was

(o&&owed %! the +a&& Street e(or$ and Mrotection #ct o( 26.6) /he acts

esta%&ished a (ra$ework (or the co$prehensi,e regu&ation o( the o,er"the"

counter (9/C) deri,ati,es) /he regu&ations reHuire centra& c&earing and

e'change trading (or speci(ied swaps* and esta%&ished ru&es (or disc&osure*

reporting* and record keeping o( a&& swaps) /he acts reHuire swap dea&ers

and $a-or swap participants to register with either the Co$$odit! Futures

/rading Co$$ission (CF/C) or the Securities and I'change Co$$ission

(SIC)) Further* the acts granted authorit! to (edera& (inancia& regu&ators

(to inc&ude the SIC* CF/C* F@IC* the Board o( To,ernors o( the Fed* the

Lationa& Credit Onion #d$inistration* the 9((ice o( the Co$ptro&&er o( the

Currenc!* the 9((ice o( the /hri(t Super,ision) to o,ersee an! agree$ents)

Both regu&ators and $arket participants ha,e a heightened awareness o(

credit risks) I( a transaction is not structured care(u&&!* it $a! pass a&ong

unintended risks to participants* e'posing the$ to higher (reHuenc! and

.2

F446 Chapter 24 Student Handout (8

th

edition)

se,erit! o( &osses than i( the! had he&d an eHui,a&ent cash position) /he

point in Huestion %eco$es* UIs credit or de(au&t risk on swaps the sa$e as or

di((erent (ro$ the credit risk on swaps and the credit risk on &oansRV In

(act* there are three $a-or di((erences* resu&ting in the %e&ie( that credit risk

on swaps is genera&&! $uch &ess than that on a &oan)

/hese di((erences are:

.) Nettin" and swaps: 9ne (actor that $itigates the credit risk on swaps

is the netting o( swap pa!$ents) Iach part! o( a swap ca&cu&ates the net

di((erence %etween the two pa!$ents* and a sing&e pa!$ent (or the net

di((erence is $ade %! one part! to the other) Further* when two parties

ha,e &arge nu$%ers o( contracts outstanding against each other* the! tend

to net across contracts) /his process* ca&&ed netting %! no,ation * which

(urther reduces the potentia& risk o( &oss i( so$e contracts are in the $one!

and others are out o( the $one! to the sa$e counterpart!)

2) %ayment flows are interest and not principal: +hi&e currenc! swaps

in,o&,e swaps o( interest and principa&* interest rate swaps in,o&,e swaps o(

interest pa!$ents on&! $easured against so$e notiona& principa& ,a&ue)

/his suggests that the de(au&t risk on such swaps is &ess than that on a

regu&ar &oan* where %oth interest and principa& are e'posed to credit risk)

0) Standby letters of credit: In cases where swaps are $ade %etween

parties o( di((erent credit standing* such that one part! percei,es a

signi(icant risk o( de(au&t %! the other part!* the poor Hua&it! credit risk

part! $a! %e reHuired to %u! a stand%! &etter o( credit (or another (or$ o(

per(or$ance guarant!) (ro$ a third"part! high"Hua&it! FI such that i(

de(au&t occurs* the stand%! &etter o( credit wi&& pro,ide the swap pa!$ents

in &ieu o( the de(au&ting part!) Further* &ow"Hua&it! counterparties are

increasing&! reHuired to post co&&atera& in &ieu o( de(au&t)

.0

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- F446 Chapter 1 Student Handout (8 Edition)Dokument7 SeitenF446 Chapter 1 Student Handout (8 Edition)Juncheng WuNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Version 2 Page 1Dokument32 SeitenVersion 2 Page 1Juncheng WuNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- CH 15Dokument25 SeitenCH 15Juncheng Wu100% (1)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Untitled 1Dokument25 SeitenUntitled 1Juncheng Wu0% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- PRJMGTDokument3 SeitenPRJMGTJuncheng WuNoch keine Bewertungen

- F305 Syllabus 2013Dokument10 SeitenF305 Syllabus 2013Juncheng WuNoch keine Bewertungen

- Important Dates TTHDokument1 SeiteImportant Dates TTHJuncheng WuNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- RM Model For R & SME and Corporate Customers Final Draft April 27 2021Dokument27 SeitenRM Model For R & SME and Corporate Customers Final Draft April 27 2021daniel nugusieNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Pay Slip Format 1Dokument6 SeitenPay Slip Format 1Rahmath RahmathNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- How We Classify CountriesDokument2 SeitenHow We Classify Countriesyogeshdhuri22Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Price Earnings Ratio AnalysisDokument7 SeitenPrice Earnings Ratio AnalysisNimish VarmaNoch keine Bewertungen

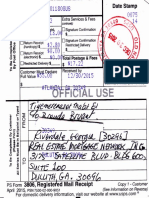

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDokument13 SeitenAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- RBI Circular - Release of Property Documents On Rep - 230915 - 085021Dokument2 SeitenRBI Circular - Release of Property Documents On Rep - 230915 - 085021Motorola G6Noch keine Bewertungen

- Concept of Outreach in Microfinance Institutions:: Indicator of Success of MfisDokument6 SeitenConcept of Outreach in Microfinance Institutions:: Indicator of Success of MfisRiyadNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Home LoanDokument19 SeitenHome LoanghanshyamNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- College Admission Fee ChallanDokument1 SeiteCollege Admission Fee ChallanlubnaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Bil Tee - Harsh VirkDokument18 SeitenBil Tee - Harsh Virkharsh virkNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- CRMDokument32 SeitenCRMJoel Dsouza100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- NPS LeafletDokument2 SeitenNPS LeafletMOHIT GUPTA jiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Deed of Trust: State of - Rev. 133A2C4Dokument9 SeitenDeed of Trust: State of - Rev. 133A2C4MaryNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Far East Bank v. Gold Palace, G.R. No. 168274, 2008Dokument2 SeitenFar East Bank v. Gold Palace, G.R. No. 168274, 2008Rizchelle Sampang-ManaogNoch keine Bewertungen

- TallyDokument27 SeitenTallyvinothkumararaja8249Noch keine Bewertungen

- Remedies in RightsDokument6 SeitenRemedies in RightsRebel X100% (1)

- Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelDokument6 SeitenImpact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelYusuf HusseinNoch keine Bewertungen

- Q3FY24 TranscriptDokument21 SeitenQ3FY24 TranscriptAshu KumarNoch keine Bewertungen

- General Escrow InstructionsDokument5 SeitenGeneral Escrow InstructionsndevereauxNoch keine Bewertungen

- Internship Report of National Bank of PakistanDokument104 SeitenInternship Report of National Bank of PakistanHusnain BalochNoch keine Bewertungen

- Project Report of DISA 2.0 CourseDokument12 SeitenProject Report of DISA 2.0 CourseCA Nikhil BazariNoch keine Bewertungen

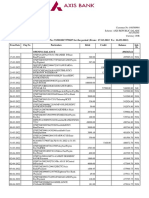

- Statement of Axis Account No:913010017379687 For The Period (From: 17-03-2022 To: 16-09-2022)Dokument7 SeitenStatement of Axis Account No:913010017379687 For The Period (From: 17-03-2022 To: 16-09-2022)Om Namah ShivayNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Lec 5 B Problem Journal 2 A-6Dokument9 SeitenLec 5 B Problem Journal 2 A-6Shahjahan DashtiNoch keine Bewertungen

- First Flight LogisticsDokument7 SeitenFirst Flight Logisticsmahato28Noch keine Bewertungen

- 121CLEPLUGDokument236 Seiten121CLEPLUGHR20169Noch keine Bewertungen

- FBL 2021Dokument467 SeitenFBL 2021mehar kashif100% (1)

- DemontizationDokument17 SeitenDemontizationAthik AhmedNoch keine Bewertungen

- Murabaha PDFDokument5 SeitenMurabaha PDFWaqas Ahmad0% (1)

- Univ of Brunei-Statement of PurposeDokument2 SeitenUniv of Brunei-Statement of Purposeayu abidinNoch keine Bewertungen

- Cefefi PDFDokument8 SeitenCefefi PDFSahil SaabNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)