Beruflich Dokumente

Kultur Dokumente

Standard Costing

Hochgeladen von

Samuel Dwumfour0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten8 Seitengood

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldengood

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten8 SeitenStandard Costing

Hochgeladen von

Samuel Dwumfourgood

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

Learning Objectives

To understand the meaning of standard costing, its meaning and

definition

To learn its advantages and limitations

To learn how to set of standards and determinations

To learn how to revise standards

Introduction

You know that management accounting is managing a business through accounting information.

In this process, management accounting is facilitating managerial control. It can also be applied

to your own daily/monthly expenses, if necessary. These measures should be applied correctly so

that performance takes place according to plans. Planning is the first tool for making the control

effective. The vital aspect of managerial control is cost control. ence, it is very important to

plan and control costs. !tandard costing is a techni"ue which helps you to control costs and

business operations. It aims at eliminating wastes and increasing efficiency in performance

through setting up standards or formulating cost plans.

Meaning of Standard

#hen you want to measure some thing, you must take some parameter or yardstick for

measuring. #e can call this as standard. #hat are your daily expenses$ %n average of &'() If

you have been spending this much for so many days, then this is your daily standard expense.

The word standard means a benchmark or yardstick. The standard cost is a predetermined cost

which determines in advance what each product or service should cost under given

circumstances.

In the words of *acker and +acobsen, ,Standard cost is the amount the firm thinks a product or

the operation of the process for a period of time should cost, based upon certain assumed

conditions of efficiency, economic conditions and other factors.-

Definition

The .I/%, 0ondon has defined standard cost as ,a predetermined cost which is calculated from

managements standards of efficient operations and the relevant necessary expenditure.- They are

the predetermined costs on technical estimate of material labor and overhead for a selected

period of time and for a prescribed set of working conditions. In other words, a standard cost is a

planned cost for a unit of product or service rendered.

The techni"ue of using standard costs for the purposes of cost control is known as standard

costing. It is a system of cost accounting which is designed to find out how much should be the

cost of a product under the existing conditions. The actual cost can be ascertained only when

production is undertaken. The predetermined cost is compared to the actual cost and a variance

between the two enables the management to take necessary corrective measures.

Advantages

!tandard costing is a management control techni"ue for every activity. It is not only useful for

cost control purposes but is also helpful in production planning and policy formulation. It allows

management by exception. In the light of various ob1ectives of this system, some of the

advantages of this tool are given below2

3. Efficiency measurement44 The comparison of actual costs with

standard costs enables the management to evaluate performance of

various cost centers. In the absence of standard costing system, actual

costs of different period may be compared to measure efficiency. It is

not proper to compare costs of different period because circumstance

of both the periods may be different. !till, a decision about base period

can be made with which actual performance can be compared.

5. Finding of variance44 The performance variances are determined by

comparing actual costs with standard costs. /anagement is able to

spot out the place of inefficiencies. It can fix responsibility for

deviation in performance. It is possible to take corrective measures at

the earliest. % regular check on various expenditures is also ensured by

standard cost system.

6. Management by exception44 The targets of different individuals are

fixed if the performance is according to predetermined standards. In

this case, there is nothing to worry. The attention of the management is

drawn only when actual performance is less than the budgeted

performance. /anagement by exception means that everybody is

given a target to be achieved and management need not supervise each

and everything. The responsibilities are fixed and every body tries to

achieve his/her targets.

7. Cost control44 8very costing system aims at cost control and cost

reduction. The standards are being constantly analy9ed and an effort is

made to improve efficiency. #henever a variance occurs, the reasons

are studied and immediate corrective measures are undertaken. The

action taken in spotting weak points enables cost control system.

'. Right decisions44 It enables and provides useful information to the

management in taking important decisions. :or example, the problem

created by inflating, rising prices. It can also be used to provide

incentive plans for employees etc.

;. Eliminating inefficiencies44 The setting of standards for different

elements of cost re"uires a detailed study of different aspects. The

standards are set differently for manufacturing, administrative and

selling expenses. Improved methods are used for setting these

standards. The determination of manufacturing expenses will re"uire

time and motion study for labor and effective material control devices

for materials. !imilar studies will be needed for finding other

expenses. %ll these studies will make it possible to eliminate

inefficiencies at different steps.

Limitations of Standard Costing

3. It cannot be used in those organi9ations where non4standard products

are produced. If the production is undertaken according to the

customer specifications, then each 1ob will involve different amount of

expenditures.

5. The process of setting standard is a difficult task, as it re"uires

technical skills. The time and motion study is re"uired to be

undertaken for this purpose. These studies re"uire a lot of time and

money.

6. There are no inset circumstances to be considered for fixing standards.

The conditions under which standards are fixed do not remain static.

#ith the change in circumstances, if the standards are not revised the

same become impracticable.

7. The fixing of responsibility is not an easy task. The variances are to be

classified into controllable and uncontrollable variances. !tandard

costing is applicable only for controllable variances.

:or instance, if the industry changed the technology then the system will not be suitable. In that

case, we will have to change or revise the standards. % fre"uent revision of standards will

become costly.

Setting Standards

<ormally, setting up standards is based on the past experience. The total standard cost includes

direct materials, direct labor and overheads. <ormally, all these are fixed to some extent. The

standards should be set up in a systematic way so that they are used as a tool for cost control.

=arious 8lements which Influence the !etting of !tandards

Setting Standards for Direct Materials

There are several basic principles which ought to be appreciated in setting standards for direct

materials. >enerally, when you want to purchase some material what are the factors you

consider. If material is used for a product, it is known as direct material. ?n the other hand, if the

material cost cannot be assigned to the manufacturing of the product, it will be called indirect

material. Therefore, it involves two things2

@uality of material

Price of the material

#hen you want to purchase material, the "uality and si9e should be determined. The standard

"uality to be maintained should be decided. The "uantity is determined by the production

department. This department makes use of historical records, and an allowance for changing

conditions will also be given for setting standards. % number of test runs may be undertaken on

different days and under different situations, and an average of these results should be used for

setting material "uantity standards.

The second step in determining direct material cost will be a decision about the standard price.

/aterialAs cost will be decided in consultation with the purchase department. The cost of

purchasing and store keeping of materials should also be taken into consideration. The procedure

for purchase of materials, minimum and maximum levels for various materials, discount policy

and means of transport are the other factors which have bearing on the materials cost price. It

includes the following2

.ost of materials

?rdering cost

.arrying cost

The purpose should be to increase efficiency in procuring and store keeping of materials. The

type of standard used44 ideal standard or expected standard44 also affects the choice of standard

price.

Setting Direct Labor Cost

If you want to engage a labor force for manufacturing a product or a service for which you need

to pay some amount, this is called wages. If the labor is engaged directly to produce the product,

this is known as direct labor. The second largest amount of cost is of labor. The benefit derived

from the workers can be assigned to a particular product or a process. If the wages paid to

workers cannot be directly assigned to a particular product, these will be known as indirect

wages. The time re"uired for producing a product would be ascertained and labor should be

properly graded. Bifferent grades of workers will be paid different rates of wages. The times

spent by different grades of workers for manufacturing a product should also be studied for

deciding upon direct labor cost. The setting of standard for direct labor will be done basically on

the following2

!tandard labor time for producing

0abor rate per hour

!tandard labor time indicates the time taken by different categories of labor force which are as

under2

!killed labor

!emi4skilled labor

Cnskilled labor

:or setting a standard time for labor force, we normally take in to account previous experience,

past performance records, test run result, work4study etc. The labor rate standard refers to the

expected wage rates to be paid for different categories of workers. Past wage rates and demand

and supply principle may not be a safe guide for determining standard labor rates. The

anticipation of expected changes in labor rates will be an essential factor. In case there is an

agreement with workers for payment of wages in the coming period, these rates should be used.

If a premium or bonus scheme is in operation, then anticipated extra payments should also be

included. #here a piece rate system is used, standard cost will be fixed per piece. The ob1ect of

fixed standard labor time and labor rate is to device maximum efficiency in the use of labor.

Setting Standards of Overheads

The next important element comes under overheads. The very purpose of setting standard for

overheads is to minimi9e the total cost. !tandard overhead rates are computed by dividing

overhead expenses by direct labor hours or units produced. The standard overhead cost is

obtained by multiplying standard overhead rate by the labor hours spent or number of units

produced. The determination of overhead rate involves three things2

Betermination of overheads

Betermination of labor hours or units manufactured

.alculating overheads rate by dividing % by *

The overheads are classified into fixed overheads, variable overheads and semi4variable

overheads. The fixed overheads remain the same irrespective of level of production, while

variable overheads change in the proportion of production. The expenses increase or decrease

with the increase or decrease in output. !emi4variable overheads are neither fixed nor variable.

These overheads increase with the increase in production but the rate of increase will be less than

the rate of increase in production. The division of overheads into fixed, variable and semi4

variable categories will help in determining overheads.

Determination of Standard Costs

ow should the ideal standards for better controlling be determined$

3. Betermination of .ost .enter

%ccording to +. *etty, ,% cost center is a department or part of a department or an item of

e"uipment or machinery or a person or a group of persons in respect of which costs are

accumulated, and one where control can be exercised.- .ost centers are necessary for

determining the costs. If the whole factory is engaged in manufacturing a product, the factory

will be a cost center. In fact, a cost center describes the product while cost is accumulated. .ost

centers enable the determination of costs and fixation of responsibility. % cost center relating to a

person is called personnel cost center, and a cost center relating to products and e"uipments is

called impersonal cost center.

5. .urrent !tandards

% current standard is a standard which is established for use over a short period of time and is

related to current condition. It reflects the performance that should be attained during the current

period. The period for current standard is normally one year. It is presumed that conditions of

production will remain unchanged. In case there is any change in price or manufacturing

condition, the standards are also revised. .urrent standard may be ideal standard and expected

standard.

6. Ideal !tandard

This is the standard which represents a high level of efficiency. Ideal standard is fixed on the

assumption that favorable conditions will prevail and management will be at its best. The price

paid for materials will be lowest and wastes etc. will be minimum possible. The labor time for

making the production will be minimum and rates of wages will also be low. The overheads

expenses are also set with maximum efficiency in mind. %ll the conditions, both internal and

external, should be favorable and only then ideal standard will be achieved.

Ideal standard is fixed on the assumption of those conditions which may rarely exist. This

standard is not practicable and may not be achieved. Though this standard may not be achieved,

even then an effort is made. The deviation between targets and actual performance is ignorable.

In practice, ideal standard has an adverse effect on the employees. They do not try to reach the

standard because the standards are not considered realistic.

7. *asic !tandards

% basic standard may be defined as a standard which is established for use for an indefinite

period which may a long period. *asic standard is established for a long period and is not

ad1usted to the preset conations. The same standard remains in force for a long period. These

standards are revised only on the changes in specification of material and technology

productions. It is indeed 1ust like a number against which subse"uent process changes can be

measured. *asic standard enables the measurement of changes in costs. :or example, if the basic

cost for material is Ds. 5( per unit and the current price is Ds. 5' per unit, it will show an

increase of 5'E in the cost of materials. The changes in manufacturing costs can be measured by

taking basic standard, as a base standard cannot serve as a tool for cost control purpose because

the standard is not revised for a long time. The deviation between standard cost and actual cost

cannot be used as a yardstick for measuring efficiency.

'. <ormal !tandards

%s per terminology, normal standard has been defined as a standard which, it is anticipated, can

be attained over a future period of time, preferably long enough to cover one trade cycle. This

standard is based on the conditions which will cover a future period of five years, concerning one

trade cycle. If a normal cycle of ups and downs in sales and production is 3( years, then standard

will be set on average sales and production which will cover all the years. The standard attempts

to cover variance in the production from one time to another time. %n average is taken from the

periods of recession and depression. The normal standard concept is theoretical and cannot be

used for cost control purpose. <ormal standard can be properly applied for absorption of

overhead cost over a long period of time.

;. ?rgani9ation for !tandard .osting

The success of standard costing system will depend upon the setting up of proper standards. :or

the purpose of setting standards, a person or a committee should be given this 1ob. In a big

concern, a standard costing committee is formed for this purpose. The committee includes

production manager, purchase manager, sales manager, personnel manager, chief engineer and

cost accountant. The cost accountant acts as a co4coordinator of this committee.

F. %ccounting !ystem

.lassification of accounts is necessary to meet the re"uired purpose, i.e. function, asset or

revenue item. .odes can be used to have a speedy collection of accounts. % standard is a pre4

determined measure of material, labor and overheads. It may be expressed in "uality and its

monetary measurements in standard costs.

Revision of Standards

:or effective use of this techni"ue, sometimes we need to revise the standards which follow for

better control. 8ven standards are also sub1ected to change like the production method,

environment, raw material, and technology.

!tandards may need to be changed to accommodate changes in the organi9ation or its

environment. #hen there is a sudden change in economic circumstances, technology or

production methods, the standard cost will no longer be accurate. !tandards that are out of date

will not act as effective feed forward or feedback control tools. They will not help us to predict

the inputs re"uired nor help us to evaluate the efficiency of a particular department. If standards

are continually not being achieved and large deviations or variances from the standard are

reported, they should be carefully reviewed. %lso, changes in the physical productive capacity of

the organi9ation or in material prices and wage rates may indicate that standards need to be

revised. In practice, changing standards fre"uently is an expensive operation and can cause

confusion. :or this reason, standard cost revisions are usually made only once a year. %t times of

rapid price inflation, many managers have felt that the high level of inflation forced them to

change price and wage rate standards continually. This, however, leads to reduction in value of

the standard as a yardstick. %t the other extreme is the adoption of basic standard which will

remain unchanged for many years. They provide a constant base for comparison, but this is

hardly satisfactory when there is technological change in working procedures and conditions.

Summary

*asically, standard costing is a management tool for control. In the process, we have taken

standards as parameters for measuring the performance. .ost analysis and cost control is

essential for any activity. .ost includes material labor and overheads. !ometimes, we need to

revise the standards due to change in uses, raw material, technology, method of production etc.

:or a proper organi9ation, it is re"uired to implement this under a committee for the activity. It is

a continued activity for the optimum utili9ation of resources.

Das könnte Ihnen auch gefallen

- Handling Your Sex DriveDokument9 SeitenHandling Your Sex DriveSamuel DwumfourNoch keine Bewertungen

- NewGRE WordsDokument7 SeitenNewGRE WordsMatt Daemon Jr.Noch keine Bewertungen

- Section 12 LymphaticsDokument5 SeitenSection 12 LymphaticsSamuel DwumfourNoch keine Bewertungen

- How To Create A CompanyDokument30 SeitenHow To Create A CompanySamuel DwumfourNoch keine Bewertungen

- Chapter08 002 PricingDokument71 SeitenChapter08 002 PricingSamuel DwumfourNoch keine Bewertungen

- Section 2 SKINDokument48 SeitenSection 2 SKINSamuel DwumfourNoch keine Bewertungen

- Section 1 General ProblemsDokument44 SeitenSection 1 General ProblemsSamuel DwumfourNoch keine Bewertungen

- 1000 Most Common Words (SAT)Dokument70 Seiten1000 Most Common Words (SAT)grellian95% (20)

- Section 16 PoisonsDokument60 SeitenSection 16 PoisonsSamuel DwumfourNoch keine Bewertungen

- Section 7 RespiratoryDokument26 SeitenSection 7 RespiratorySamuel DwumfourNoch keine Bewertungen

- Break Even AnalysisDokument18 SeitenBreak Even AnalysisSamuel DwumfourNoch keine Bewertungen

- Liver Cleasing TherapyDokument31 SeitenLiver Cleasing TherapySamuel DwumfourNoch keine Bewertungen

- Section 3 ExtremitiesDokument19 SeitenSection 3 ExtremitiesSamuel DwumfourNoch keine Bewertungen

- Section 6 UrinaryDokument18 SeitenSection 6 UrinarySamuel DwumfourNoch keine Bewertungen

- Section 2 SKINDokument48 SeitenSection 2 SKINSamuel DwumfourNoch keine Bewertungen

- Audit ReportsDokument5 SeitenAudit ReportsSamuel DwumfourNoch keine Bewertungen

- Chapter 16 Financial Assets and Liabilities: 1. ObjectivesDokument13 SeitenChapter 16 Financial Assets and Liabilities: 1. Objectivessamuel_dwumfourNoch keine Bewertungen

- Receivable 1Dokument4 SeitenReceivable 1Samuel DwumfourNoch keine Bewertungen

- Chapter 16 Financial AssetsDokument3 SeitenChapter 16 Financial AssetsSamuel DwumfourNoch keine Bewertungen

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDokument3 SeitenChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourNoch keine Bewertungen

- Chapter 17 Accounting for Taxation and Deferred TaxesDokument23 SeitenChapter 17 Accounting for Taxation and Deferred TaxesSamuel DwumfourNoch keine Bewertungen

- Ch17 AnsDokument13 SeitenCh17 AnsSamuel DwumfourNoch keine Bewertungen

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDokument3 SeitenChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourNoch keine Bewertungen

- Ch18 AnsDokument5 SeitenCh18 AnsSamuel DwumfourNoch keine Bewertungen

- Solution Financial Reporting May 2011Dokument12 SeitenSolution Financial Reporting May 2011Samuel DwumfourNoch keine Bewertungen

- Solution Corporate Reporting Strategy May 2007Dokument10 SeitenSolution Corporate Reporting Strategy May 2007Samuel DwumfourNoch keine Bewertungen

- Associates Chapter 21 SummaryDokument6 SeitenAssociates Chapter 21 SummarySamuel DwumfourNoch keine Bewertungen

- Associates Chapter 21 SummaryDokument6 SeitenAssociates Chapter 21 SummarySamuel DwumfourNoch keine Bewertungen

- Solution Public Sector Accounting May 2010Dokument10 SeitenSolution Public Sector Accounting May 2010Samuel DwumfourNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Wage and Tax Statement: Page 1 / 4Dokument4 SeitenWage and Tax Statement: Page 1 / 4blon majorsNoch keine Bewertungen

- Nashville State Community College Payroll Accounting - ACCT 2200Dokument9 SeitenNashville State Community College Payroll Accounting - ACCT 2200Bryan Derick Rivad Rafanan0% (1)

- En-PP - 78-Year 2015Dokument24 SeitenEn-PP - 78-Year 2015Eko SanjayaNoch keine Bewertungen

- Guide To The Cambodian Labour Law For The Garment Industry: (Revised 2020)Dokument69 SeitenGuide To The Cambodian Labour Law For The Garment Industry: (Revised 2020)Lay TekchhayNoch keine Bewertungen

- SAP Human Resources: Personnel AdministrationDokument24 SeitenSAP Human Resources: Personnel AdministrationManzar AlamNoch keine Bewertungen

- 13 December 2017 Ordinary Council Meeting Agenda With Attachments RedactedDokument450 Seiten13 December 2017 Ordinary Council Meeting Agenda With Attachments Redactedjolyon AttwoollNoch keine Bewertungen

- 20190924TB PDFDokument40 Seiten20190924TB PDFdddibalNoch keine Bewertungen

- Integrating Personnel and Organizational Management in SAPDokument89 SeitenIntegrating Personnel and Organizational Management in SAPnaren_3456Noch keine Bewertungen

- 2022 HO 49 Labor Law Labor StandardsDokument10 Seiten2022 HO 49 Labor Law Labor Standardskat perezNoch keine Bewertungen

- Calculating Daily Rates and Monthly Salaries FairlyDokument3 SeitenCalculating Daily Rates and Monthly Salaries FairlyDerixk StarNoch keine Bewertungen

- ProjectDokument64 SeitenProjectkamsyNoch keine Bewertungen

- 19732ipcc CA Vol2 Cp3Dokument43 Seiten19732ipcc CA Vol2 Cp3PALADUGU MOUNIKANoch keine Bewertungen

- SC rules RA 9504 exemptions apply for full 2008Dokument38 SeitenSC rules RA 9504 exemptions apply for full 2008Darrel John SombilonNoch keine Bewertungen

- Cost Accounting - ch10Dokument33 SeitenCost Accounting - ch10Nur RezzaNoch keine Bewertungen

- Chapter 7 Employee BenefitsDokument21 SeitenChapter 7 Employee BenefitsPahrol RoziNoch keine Bewertungen

- Mba Iv, Ir-Gratuity ActDokument19 SeitenMba Iv, Ir-Gratuity Actmanu KartikayNoch keine Bewertungen

- Resolving A Wage Distortion DisputeDokument5 SeitenResolving A Wage Distortion DisputeLynette OmNoch keine Bewertungen

- MinimumwagesactDokument24 SeitenMinimumwagesactRamandeep KaurNoch keine Bewertungen

- Wage Code SummaryDokument7 SeitenWage Code Summaryqubrex1100% (1)

- Factories Act Working HoursDokument11 SeitenFactories Act Working HoursViraj SinghNoch keine Bewertungen

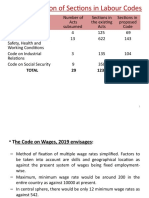

- Rationalization of Sections in Labour Codes: Total 29 1232 480Dokument49 SeitenRationalization of Sections in Labour Codes: Total 29 1232 480AadhityaNoch keine Bewertungen

- Metropolitan V NPWCDokument2 SeitenMetropolitan V NPWCGui EshNoch keine Bewertungen

- SJR 382Dokument5 SeitenSJR 382Thomas MatesNoch keine Bewertungen

- LaborDokument78 SeitenLaborReyes BeeNoch keine Bewertungen

- Compensation BCIDokument44 SeitenCompensation BCIBacquial, Phil Gio E. (Phil Gio)Noch keine Bewertungen

- PROJECT Final Vaishali MamDokument51 SeitenPROJECT Final Vaishali MamSanket MhetreNoch keine Bewertungen

- Payment of Gratuity ActDokument7 SeitenPayment of Gratuity ActUttaraVijayakumaranNoch keine Bewertungen

- Eagle Security v. NLRCDokument7 SeitenEagle Security v. NLRCApa MendozaNoch keine Bewertungen

- Cases. 12. III. D.2-5Dokument127 SeitenCases. 12. III. D.2-5Lecdiee Nhojiezz Tacissea SalnackyiNoch keine Bewertungen

- Labor Digest Summary: Univ of Pangasinan Faculty v. Univ of PangasinanDokument9 SeitenLabor Digest Summary: Univ of Pangasinan Faculty v. Univ of PangasinanKarla BeeNoch keine Bewertungen