Beruflich Dokumente

Kultur Dokumente

Ccra Level 1 Contents

Hochgeladen von

Anil BambuleOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ccra Level 1 Contents

Hochgeladen von

Anil BambuleCopyright:

Verfügbare Formate

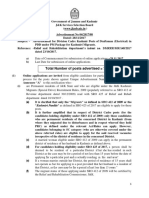

Contents

PAGE

About the authors I-3

MODULE 1

FINANCIAL STATEMENTS ANALYSIS

1

INTRODUCTION : ROLE OF FINANCIAL STATEMENTS

1.1 Introduction : Role of Financial Statements 3

1.2 Understanding Auditors Report and other sources of information of financial information 5

1.3 Understanding Accounting Equation 7

1.4 Understanding Relationship between constituents of Financial Statements 9

1.5 Understanding the Structure of Financial Statements 11

1.6 Profit and Loss Appropriation Account 25

SUMMARY OF THE CHAPTER 26

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 27

2

RELEVANCE OF NOTES TO ACCOUNTS AND SCHEDULES

TO FINANCIAL STATEMENTS

2.1 Significant Accounting Policies 30

2.2 Disclosures 35

SUMMARY OF THE CHAPTER 40

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 41

I-5

3

NUANCES OF ACCOUNTING: INVENTORIES, DEPRECIATION,

EPS, INTANGIBLE ASSETS

3.1 Nuances of Accounting : Inventories, Depreciation, EPS, Intangible Assets 45

3.2 Valuation of Inventories 45

3.3 Methods of Depreciation 52

3.4 Earnings per Share 54

3.5 Intangible assets 57

3.6 Deferred Taxes 58

3.7 Foreign Exchange Gain/Loss 60

SUMMARY OF THE CHAPTER 63

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 65

4

RATIO ANALYSIS

4.1 Introduction to Ratio Analysis 69

4.2 Calculate and interpret ratios 70

4.3 Calculate and interpret certain ratios 76

4.4 Uses and limitations of ratio analysis 79

4.5 Trailing ratios, forward ratios 80

4.6 Valuation ratios 82

4.7 Credit specific ratios 85

4.8 Ratios during Mergers and Acquisitions, Leverage Buyouts and Restructuring 87

4.9 Evaluate two companies using ratio analysis 88

4.10 DuPont Analysis and its importance 92

SUMMARY OF THE CHAPTER 94

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 96

5

FINANCIAL MODELLING AND COVENANT TESTING

5.1 Financial modelling 103

5.2 How to project financial statements 104

5.3 Covenant testing using financial projections 106

5.4 Elements of cost drivers, revenue drivers, etc. 107

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 108

6

NUANCES OF LEASES, HIRE PURCHASE, PENSION LIABILITIES AND

CLASSIFICATION OF INVESTMENTS IN FINANCIAL ASSETS

6.1 Leases 109

6.2 Hire Purchase 112

6.3 Defined contribution and Defined benefit pension plans 115

6.4 Classification of Investments in Financial Assets 116

SUMMARY OF THE CHAPTER 117

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 119

PAGE

I-6 CONTENTS

7

RED FLAGS

SUMMARY OF THE CHAPTER 132

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 133

8

INDIAN GAAP & IFRS SIMILARITIES & DIFFERENCES

8.1 Components of financial statements 136

8.2 Format of presentation of financial statements 137

8.3 Statement of Changes in Equity 137

8.4 Important Constituents of Balance Sheet 137

8.5 Important Constituents of Statement of Profit and Loss Account 139

8.6 Statement of Cash flow 141

8.7 Consolidated financial statements 141

8.8 Others 142

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 143

MODULE 2

CREDIT SPECIFIC ANALYSIS

9

LIQUIDITY ANALYSIS

9.1 Liquidity Defined 149

9.2 Solvency & Liquidity 150

9.3 Measures of Liquidity 151

9.4 Quick Ratio/Quick Assets 153

9.5 Liquidity Analysis & Credit Ratings 154

9.6 The Debt Maturity Schedule 155

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 156

10

STRESS TESTING

10.1 Key steps in stress testing 159

10.2 Framework for Developing Scenarios 160

10.3 Revenue Drivers 161

10.4 Cost Drivers 162

10.5 Leveraged Balance Sheets 163

10.6 Impending Capital Raising Plans 164

10.7 Internal, Industry and Environmental Considerations 165

10.8 Commodities and Stressed Scenarios 166

10.9 Scenario - Base, Bear, Bull 167

10.10 Construct and Interpret of all three Scenarios 170

10.11 Base Scenario 170

PAGE

CONTENTS I-7

10.12 Bear Case Scenario 174

10.13 Bull Case Scenario 177

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 178

11

COMPARISON : SECTOR VERSUS GLOBAL

11.1 Comparisons in Financials 180

11.2 Why Compare 181

11.3 Who is a Peer? 183

11.4 Peers by Industry 184

11.5 Peers by Size 185

11.6 Comparison at Industry Level 186

11.7 Peers around the World 187

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 188

12

LIQUIDATION SCENARIO

12.1 Senior & Subordination in Bonds/Debt 189

12.2 How the Hierarchy of Seniority Develops 191

12.3 Seniority/Subordination 192

12.4 Within Bondholders 193

12.5 Liquidation Scenarios 194

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 196

13

EVENT, M&A/LBO

13.1 Mergers & Acquisitions 200

13.2 Valuation of the Acquisition Target 201

13.3 Projecting Future Performance 202

13.4 The Analysts Agenda 203

13.5 A Case 204

13.6 Key Ratios if Synergies work out 208

13.7 Key Ratios if Synergies do not work out 209

13.8 Leveraged Buyouts 210

SUMMARY OF THE CHAPTER 211

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 213

MODULE 3

UNDERSTANDING ON BONDS

14

COVENANTS

14.1 Covenants 217

PAGE

I-8 CONTENTS

14.2 Goals of Covenant Testing 221

14.3 Example of a Covenant Breach 222

14.4 Types of Covenants 223

14.5 Debt incurrence covenant 224

14.6 Restricted payments (RP) covenant 225

14.7 Limitation on lien 226

14.8 Limitation sale-and-leaseback transactions 227

14.9 Limitation on asset sale 228

14.10 Change of control 229

14.11 Mergers & acquisitions (M&A) 230

14.12 Transactions with affiliates 231

14.13 Early redemption covenant 232

14.14 Default 233

14.15 Other covenants 234

14.16 Indenture Analysis 235

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 237

15

PRICING, SPREADS AND CURVES

15.1 Types of Bonds, Features & Characteristics 239

15.2 FIS types by original maturity and issuer 241

15.3 FIS instruments and regulation in India 248

15.4 FIS types by cash flow pattern 252

15.5 FIS types by interest rate 253

15.6 FIS types by credit rating 256

15.7 FIS types by seniority 258

15.8 FIS types by redemption feature 259

15.9 FIS types by market type 260

15.10 Yield Curve, Types, Shapes and Yield Spread 264

15.11 Interest rate and term structure 265

15.12 Term structure: shapes 267

15.13 Term structure of rates : shifts 268

15.14 Yield Spread 271

15.15 Periodic Rate, Spot Rate and Forward Rate 272

15.16 Valuation Curves 274

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 275

16

CREDIT DEFAULT SWAP (CDS)

16.1 Credit default swap (CDS) and its features 276

16.2 Credit default swap (CDS) Settlement 278

16.3 Credit events 279

16.4 Types of Credit default swap (CDS) 281

PAGE

CONTENTS I-9

16.5 Basket CDS 281

16.6 Index and Tranched Index CDS 282

16.7 Total Return Swap 283

16.8 RBI guidelines on CDS in Indian market 285

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 287

17

SENIORITY RANKING

17.1 Senior & Subordination in Bonds/Debt 288

17.2 How the Hierarchy of Seniority Develops 290

17.3 Seniority/Subordination 291

17.4 Within Bondholders 292

17.5 Liquidation Scenarios 293

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 295

18

RICH CHEAP ANALYSIS

18.1 Rich Cheap Analysis 296

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 299

19

BOND VALUATION MEASURES INCLUDING

SWAPS, OAS, YTW, YTM

19.1 Valuation of Bonds, Clean & Dirty Price, YTM 300

19.2 Measure of return 303

19.3 Coupon 305

19.4 Current Yield 306

19.5 Yield-to-maturity (YTM) 307

19.6 Holding Period Return (HPR) 308

19.7 Price/YTM is not a Judgment Tool 309

19.8 Clean price and Dirty Price 310

19.9 Term Structure and its theories 311

19.10 Interest rate and term structure 311

19.11 Theories on term structure shape 313

19.12 Duration 314

19.13 The Properties of Duration 315

19.14 The Effect of Changing Interest Rates on Bond Values 316

19.15 Modified duration 318

19.16 Price Value of a Basis Point (PVBP) 320

MODULE SUMMARY 320

ATTEMPT THE FOLLOWING QUESTIONS BASED ON THE LEARNING 323

PAGE

I-10 CONTENTS

Das könnte Ihnen auch gefallen

- Financial Management: Partner in Driving Performance and ValueVon EverandFinancial Management: Partner in Driving Performance and ValueNoch keine Bewertungen

- Equis Process Manual Annexes Jan 2012 FinalDokument84 SeitenEquis Process Manual Annexes Jan 2012 FinalVj ReddyNoch keine Bewertungen

- PFMU Financial Procedures Manual Revised Feb 2020Dokument121 SeitenPFMU Financial Procedures Manual Revised Feb 2020ballah.barcNoch keine Bewertungen

- The Use of Financial Ratios in MergersDokument362 SeitenThe Use of Financial Ratios in Mergerssmh9662Noch keine Bewertungen

- FAU S20 Examiner's ReportDokument11 SeitenFAU S20 Examiner's ReportZraylNoch keine Bewertungen

- Credit Analysis of Financial InstitutionsDokument11 SeitenCredit Analysis of Financial InstitutionsPayal PatelNoch keine Bewertungen

- BA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?Dokument5 SeitenBA7062 EXIM Management Unit - I Important Questions: Part-A-MARKS 1. What Is DGFT?PranavNoch keine Bewertungen

- 8524Dokument7 Seiten8524KhurramRiaz100% (1)

- KPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The BasicsDokument40 SeitenKPMG IFRS Practice Issues For Banks Fair Value Measurement of Derivatives - The Basicshui7411Noch keine Bewertungen

- Ifsa Chapter17Dokument67 SeitenIfsa Chapter17luu hung100% (1)

- Chapter-1 of Advanced AccountingDokument4 SeitenChapter-1 of Advanced AccountingAsif AliNoch keine Bewertungen

- March 2010 Part 1 InsightDokument73 SeitenMarch 2010 Part 1 InsightLegogie Moses Anoghena100% (1)

- Course Outline-MIS-305 - Spring-2011Dokument4 SeitenCourse Outline-MIS-305 - Spring-2011Oprichito AkjonNoch keine Bewertungen

- Chapter 17Dokument48 SeitenChapter 17ruth_erlynNoch keine Bewertungen

- Principles of AuditingDokument2 SeitenPrinciples of AuditingbalachmalikNoch keine Bewertungen

- 8533 Audit Course OutlineDokument10 Seiten8533 Audit Course OutlineAdaamShabbirNoch keine Bewertungen

- Week 1 Workshops Learning Activity: RequiredDokument3 SeitenWeek 1 Workshops Learning Activity: RequiredRegina AtkinsNoch keine Bewertungen

- Ba Zc411 Ec-3r Second Sem 2019-2020Dokument4 SeitenBa Zc411 Ec-3r Second Sem 2019-2020AAKNoch keine Bewertungen

- A Project On Working Capital Management or Fund ManagementDokument84 SeitenA Project On Working Capital Management or Fund ManagementSandhadi Ganesh100% (1)

- AF301 Fair V Alue Accounting - Lecture - HandoutDokument8 SeitenAF301 Fair V Alue Accounting - Lecture - HandoutAmiteshNoch keine Bewertungen

- Aqa Accn1 W Ms Jun09Dokument9 SeitenAqa Accn1 W Ms Jun09Drake SwansonNoch keine Bewertungen

- Financial Services BBM NotesDokument44 SeitenFinancial Services BBM Notesmanjunatha TKNoch keine Bewertungen

- 09-MWSS2013 Part2-Observations and RecommendationsDokument128 Seiten09-MWSS2013 Part2-Observations and RecommendationsEppie SeverinoNoch keine Bewertungen

- PGDM Syllabus NewDokument66 SeitenPGDM Syllabus Newbkpanda20065753Noch keine Bewertungen

- Atswa Cost AccountingDokument504 SeitenAtswa Cost Accountinggarba shuaibuNoch keine Bewertungen

- MU PLC Annual Report 2002 Financial StatementsDokument21 SeitenMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNoch keine Bewertungen

- Finance Asia Vault Wetfeet: BooksDokument5 SeitenFinance Asia Vault Wetfeet: BooksSandeep ChiluveruNoch keine Bewertungen

- Sales Forecasting in Small and Medium-Sized Enterprises: Timo HaatajaDokument47 SeitenSales Forecasting in Small and Medium-Sized Enterprises: Timo HaatajaJudha PHNoch keine Bewertungen

- A - Level Accounting: June 2008: Unit 6 - Mark SchemeDokument14 SeitenA - Level Accounting: June 2008: Unit 6 - Mark SchemeDannyshrewNoch keine Bewertungen

- Itungan+Procons FVC Vs RSEDokument8 SeitenItungan+Procons FVC Vs RSECaroline SanjoyoNoch keine Bewertungen

- Sweet Dreams Inc. Case AnalysisDokument13 SeitenSweet Dreams Inc. Case Analysisdontcare3267% (3)

- ABBDokument14 SeitenABBSyed Faizan100% (2)

- Free Cash Flow Valuation: Wacc FCFF VDokument6 SeitenFree Cash Flow Valuation: Wacc FCFF VRam IyerNoch keine Bewertungen

- STATADokument58 SeitenSTATARiska GrabeelNoch keine Bewertungen

- Case 2-1 - Solution: Estimated Time To Complete This Case Is Two HoursDokument10 SeitenCase 2-1 - Solution: Estimated Time To Complete This Case Is Two HoursLavanya TadepalliNoch keine Bewertungen

- Christoph NedopilDokument28 SeitenChristoph Nedopilnapodefaz1969Noch keine Bewertungen

- Principles-Versus Rules-Based Accounting Standards: The FASB's Standard Setting StrategyDokument24 SeitenPrinciples-Versus Rules-Based Accounting Standards: The FASB's Standard Setting StrategyEhab AgwaNoch keine Bewertungen

- Importanat Questions - Doc (FM)Dokument5 SeitenImportanat Questions - Doc (FM)Ishika Singh ChNoch keine Bewertungen

- AssigmentDokument8 SeitenAssigmentnonolashari0% (1)

- John A. Parnell - Nonmarket Strategy in Business Organizations-Springer International Publishing (2019)Dokument208 SeitenJohn A. Parnell - Nonmarket Strategy in Business Organizations-Springer International Publishing (2019)armandoibanezNoch keine Bewertungen

- Summer Internship Project Report: Submitted in Partial Fulfillment of MMS ProgramDokument27 SeitenSummer Internship Project Report: Submitted in Partial Fulfillment of MMS ProgramafzalkhanNoch keine Bewertungen

- Consuming Passions: Sue BrearDokument2 SeitenConsuming Passions: Sue Brearobert07Noch keine Bewertungen

- Has IFRS Enhanced Accounting Uniformity?Dokument28 SeitenHas IFRS Enhanced Accounting Uniformity?gkrNoch keine Bewertungen

- An Appraisal of The Efficiency and Impact of Cost Control System On ProfitabilityDokument121 SeitenAn Appraisal of The Efficiency and Impact of Cost Control System On ProfitabilityEmmanuel KingsNoch keine Bewertungen

- 14) Dec 2004 - ADokument16 Seiten14) Dec 2004 - ANgo Sy VinhNoch keine Bewertungen

- Sure Shot Guide To Become A CA PDFDokument22 SeitenSure Shot Guide To Become A CA PDFnavya sruthiNoch keine Bewertungen

- Crocs 2015 Investor Day PresentationDokument114 SeitenCrocs 2015 Investor Day PresentationbiggercapitalNoch keine Bewertungen

- Inventory Valuation Quiz SolutionDokument5 SeitenInventory Valuation Quiz SolutionmagicsohailNoch keine Bewertungen

- Philips Corporate Valuation Project PDFDokument13 SeitenPhilips Corporate Valuation Project PDFNariman MamadoffNoch keine Bewertungen

- Financial Ratios Analysis Project at Nestle and Engro Foods: Executive SummaryDokument9 SeitenFinancial Ratios Analysis Project at Nestle and Engro Foods: Executive SummaryMuhammad Muzamil HussainNoch keine Bewertungen

- Advanced Financial Accounting and Corporate Reporting - Semester-5Dokument9 SeitenAdvanced Financial Accounting and Corporate Reporting - Semester-5furqan haider shahNoch keine Bewertungen

- Results: Ba2: Chapter 1 - Knowledge Check: The Context of Management AccountingDokument163 SeitenResults: Ba2: Chapter 1 - Knowledge Check: The Context of Management AccountingBảo Lê GiaNoch keine Bewertungen

- FYBBI Sem 1 SyllabusDokument7 SeitenFYBBI Sem 1 SyllabusSunil RawatNoch keine Bewertungen

- Tutorial Letter 204/2020: Project Management (Hons)Dokument5 SeitenTutorial Letter 204/2020: Project Management (Hons)meshNoch keine Bewertungen

- CFA Level I 2014 2015 Program ChangesDokument2 SeitenCFA Level I 2014 2015 Program ChangeskamleshNoch keine Bewertungen

- Acca 2.4 Revision Question BankDokument6 SeitenAcca 2.4 Revision Question BankJoy Nelson-Graham50% (2)

- The Growth of Specialized and Fashion RMG of BangladeshDokument41 SeitenThe Growth of Specialized and Fashion RMG of BangladeshAsm TowheedNoch keine Bewertungen

- Financial Statements Analysis: About The AuthorsDokument6 SeitenFinancial Statements Analysis: About The AuthorsSaurabhKumarNoch keine Bewertungen

- Ccra Level 2 SyllabusDokument8 SeitenCcra Level 2 SyllabusPavan ValishettyNoch keine Bewertungen

- Introduction To Financial Analysis 1702314047. PrintDokument492 SeitenIntroduction To Financial Analysis 1702314047. PrintKIng KumarNoch keine Bewertungen

- STFC Ar 13 14Dokument215 SeitenSTFC Ar 13 14Anil BambuleNoch keine Bewertungen

- Basel II Pillar 3 Disclosure Q3 2012Dokument3 SeitenBasel II Pillar 3 Disclosure Q3 2012Anil BambuleNoch keine Bewertungen

- A Report On Fundamentals of Economic Value AddedDokument39 SeitenA Report On Fundamentals of Economic Value AddedKishan TankNoch keine Bewertungen

- Single Investment ULIP For HNI SHNIDokument1 SeiteSingle Investment ULIP For HNI SHNIAnil BambuleNoch keine Bewertungen

- Magic of EquityDokument6 SeitenMagic of EquityNitin Govind BhujbalNoch keine Bewertungen

- Mutual Fund Distribution ModelDokument387 SeitenMutual Fund Distribution ModelAnil BambuleNoch keine Bewertungen

- Nissanrenaultmerger 12724042133265 Phpapp02Dokument17 SeitenNissanrenaultmerger 12724042133265 Phpapp02Anil BambuleNoch keine Bewertungen

- CD-37-Budget and Budgetary ControlDokument89 SeitenCD-37-Budget and Budgetary ControlAnil BambuleNoch keine Bewertungen

- ICRA's Credit Rating Methodology For Non-Banking Finance CompaniesDokument6 SeitenICRA's Credit Rating Methodology For Non-Banking Finance CompaniesAnil BambuleNoch keine Bewertungen

- Investment Analysis and Portfolio ManagementDokument102 SeitenInvestment Analysis and Portfolio ManagementPankaj Bhasin88% (8)

- NCFM BsmeDokument96 SeitenNCFM BsmeAstha Shiv100% (1)

- Credit Risk ManagementDokument64 SeitenCredit Risk Managementcherry_nu100% (12)

- Credit Management & Appraisal SystemDokument60 SeitenCredit Management & Appraisal SystemAnil BambuleNoch keine Bewertungen

- Shriram Transport Finance Company LTD, MeghanDokument26 SeitenShriram Transport Finance Company LTD, MeghanAnil Bambule100% (1)

- Corporate Social ResponsibilityDokument115 SeitenCorporate Social ResponsibilityAkshat KaulNoch keine Bewertungen

- DNB - co.in-BFSI Sector in IndiaDokument9 SeitenDNB - co.in-BFSI Sector in IndiaAnil BambuleNoch keine Bewertungen

- Ethics in Business: Insider Trading CaseDokument4 SeitenEthics in Business: Insider Trading CaseAnil BambuleNoch keine Bewertungen

- Log in ActionDokument85 SeitenLog in ActionAnil BambuleNoch keine Bewertungen

- Triangular ArbitrageDokument5 SeitenTriangular ArbitrageAnil BambuleNoch keine Bewertungen

- Foreign Exchange Risks ExplainedDokument24 SeitenForeign Exchange Risks ExplainedWisDomRaazNoch keine Bewertungen

- BusinessLaw 2012Dokument170 SeitenBusinessLaw 2012rommel_007100% (1)

- Investment Management Is The Professional Management of Various SecuritiesDokument7 SeitenInvestment Management Is The Professional Management of Various SecuritiesAnil BambuleNoch keine Bewertungen

- IFMDokument24 SeitenIFMAnil BambuleNoch keine Bewertungen

- ICRA's Credit Rating Methodology For Non-Banking Finance CompaniesDokument6 SeitenICRA's Credit Rating Methodology For Non-Banking Finance CompaniesAnil BambuleNoch keine Bewertungen

- BY: Anil M Bambule MBA1201003 Anildvhimsr3@gmail - Co.inDokument9 SeitenBY: Anil M Bambule MBA1201003 Anildvhimsr3@gmail - Co.inAnil BambuleNoch keine Bewertungen

- India Yamaha Motor Pvt. LTD: Presented byDokument10 SeitenIndia Yamaha Motor Pvt. LTD: Presented byAnil BambuleNoch keine Bewertungen

- Investment Analysis and Portfolio ManagementDokument102 SeitenInvestment Analysis and Portfolio ManagementPankaj Bhasin88% (8)

- CaptilDokument183 SeitenCaptilAnil BambuleNoch keine Bewertungen

- NCFM BsmeDokument96 SeitenNCFM BsmeAstha Shiv100% (1)

- NMR 8 Suryanto Dan Dai 2016 PDFDokument15 SeitenNMR 8 Suryanto Dan Dai 2016 PDFanomimNoch keine Bewertungen

- L6M5 Tutor Notes 1.0 AUG19Dokument22 SeitenL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNoch keine Bewertungen

- LEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Dokument247 SeitenLEER PRIMERO Christian Suter - Debt Cycles in The World-Economy - Foreign Loans, Financial Crises, and Debt Settlements, 1820-1990-Westview Press - Routledge (1992)Juan José Castro FrancoNoch keine Bewertungen

- End of Chapter 1 Exercises - Toralde, Ma - Kristine E.Dokument7 SeitenEnd of Chapter 1 Exercises - Toralde, Ma - Kristine E.Kristine Esplana ToraldeNoch keine Bewertungen

- Hotel ProjectDokument38 SeitenHotel ProjectMelat MakonnenNoch keine Bewertungen

- SBT PDFDokument9 SeitenSBT PDFrijulalktNoch keine Bewertungen

- L& T Buy BackDokument4 SeitenL& T Buy BackteammrauNoch keine Bewertungen

- Sweetheart Loan - Florendo Vs CADokument2 SeitenSweetheart Loan - Florendo Vs CAErmeline TampusNoch keine Bewertungen

- Topic: Financial Management Function: Advantages of Profit MaximizationDokument4 SeitenTopic: Financial Management Function: Advantages of Profit MaximizationDilah PhsNoch keine Bewertungen

- Money MarketDokument20 SeitenMoney Marketmanisha guptaNoch keine Bewertungen

- L2 Business PlanDokument26 SeitenL2 Business PlanMohammad Nur Hakimi SulaimanNoch keine Bewertungen

- FINA3080 Assignment 1 Q&ADokument4 SeitenFINA3080 Assignment 1 Q&AJason LeungNoch keine Bewertungen

- Financial EconomicsDokument19 SeitenFinancial Economicsseifeldin374Noch keine Bewertungen

- Tax Invoice: ALWAR GAS SERVICE (000010176)Dokument1 SeiteTax Invoice: ALWAR GAS SERVICE (000010176)VijendraNoch keine Bewertungen

- 28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteDokument4 Seiten28 U.S. Code 3002 - Definitions - U.S. Code - US Law - LII - Legal Information InstituteMatías PierottiNoch keine Bewertungen

- Course Outline S1 2022Dokument5 SeitenCourse Outline S1 2022Woon TNNoch keine Bewertungen

- FM 415 Money MarketsDokument50 SeitenFM 415 Money MarketsMarc Charles UsonNoch keine Bewertungen

- Syndicate 6 - Gainesboro Machine Tools CorporationDokument12 SeitenSyndicate 6 - Gainesboro Machine Tools CorporationSimon ErickNoch keine Bewertungen

- Column 24 Understanding The Kelly Criterion 2Dokument7 SeitenColumn 24 Understanding The Kelly Criterion 2TraderCat SolarisNoch keine Bewertungen

- CR Sample L6 Module 2 PDFDokument4 SeitenCR Sample L6 Module 2 PDFDavid JonathanNoch keine Bewertungen

- International Trading Regulation Hannan Aminatami AlkatiriDokument11 SeitenInternational Trading Regulation Hannan Aminatami AlkatiriAlyssa Khairafani GandamihardjaNoch keine Bewertungen

- (C501) (Team Nexus) Assignment 1Dokument14 Seiten(C501) (Team Nexus) Assignment 1Mohsin Md. Abdul KarimNoch keine Bewertungen

- RakibulDokument20 SeitenRakibulMeltrice RichardsonNoch keine Bewertungen

- Essentials of Budgetary ControlDokument13 SeitenEssentials of Budgetary ControlShashiprakash SainiNoch keine Bewertungen

- Value Based Questions in Economics Class XIIDokument8 SeitenValue Based Questions in Economics Class XIIkkumar009Noch keine Bewertungen

- CA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111Dokument20 SeitenCA Inter Advanced Accounting Full Test 1 May 2023 Unscheduled Test Paper 1674112111pari maheshwariNoch keine Bewertungen

- Cpa Review School of The Philippines For Psba Integrated ReviewDokument13 SeitenCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagNoch keine Bewertungen

- Draftsman (Electrical)Dokument7 SeitenDraftsman (Electrical)suhail ahmadNoch keine Bewertungen

- PDFDokument52 SeitenPDFnaveen mamidiNoch keine Bewertungen

- Consumer Durable LoansDokument10 SeitenConsumer Durable LoansdevrajkinjalNoch keine Bewertungen