Beruflich Dokumente

Kultur Dokumente

Preparation of Consolidated Financial Statements

Hochgeladen von

fmsalehin94060 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten3 SeitenThis document provides details on Takeda Pharmaceutical Company Limited's accounting policies and procedures for preparing their consolidated financial statements for fiscal year 2007. It discusses their scope of consolidation, application of the equity method, accounting settlement dates, valuation methods for major assets and liabilities, accounting standards for reserves, hedge accounting policies, valuation of consolidated subsidiaries' assets and liabilities, amortization of goodwill and negative goodwill, and the scope of funds included in the consolidated statements of cash flows.

Originalbeschreibung:

Business Combination

Originaltitel

qr2007_full_f22_en

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides details on Takeda Pharmaceutical Company Limited's accounting policies and procedures for preparing their consolidated financial statements for fiscal year 2007. It discusses their scope of consolidation, application of the equity method, accounting settlement dates, valuation methods for major assets and liabilities, accounting standards for reserves, hedge accounting policies, valuation of consolidated subsidiaries' assets and liabilities, amortization of goodwill and negative goodwill, and the scope of funds included in the consolidated statements of cash flows.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

121 Ansichten3 SeitenPreparation of Consolidated Financial Statements

Hochgeladen von

fmsalehin9406This document provides details on Takeda Pharmaceutical Company Limited's accounting policies and procedures for preparing their consolidated financial statements for fiscal year 2007. It discusses their scope of consolidation, application of the equity method, accounting settlement dates, valuation methods for major assets and liabilities, accounting standards for reserves, hedge accounting policies, valuation of consolidated subsidiaries' assets and liabilities, amortization of goodwill and negative goodwill, and the scope of funds included in the consolidated statements of cash flows.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

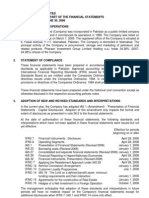

Takeda Pharmaceutical Company Limited (4502)

Consolidated Financial Statements for Fiscal 2007

- 26 -

(5) Preparation of Consolidated Financial Statements

1) Scope of Consolidation

Number of consolidated subsidiaries: 47 companies

Names of principal companies and changes in scope of consolidated subsidiaries:

Refer to Consolidated Subsidiaries and Affiliates in The Takeda Group.

2) Application of the Equity Method

Number of affiliated companies accounted for by the equity method: 17 companies

Names of principal companies and changes in scope of affiliated companies accounted for by the equity method:

Refer to Consolidated Subsidiaries and Affiliates in The Takeda Group.

3) Information Related to Account Settlement Date of Consolidated Subsidiaries and etc.

The accounting settlement date for Tianjin Takeda Pharmaceuticals Co., Ltd., a consolidated subsidiary, and TAP

Pharmaceutical Products Inc., an equity method-applied affiliate, is December 31. For preparation of consolidated financial

statements, tentative financial statements of these two companies as of the date of consolidated accounting settlement were

used.

4) Accounting standards

a. Valuation of major assets

-- Securities

Trading securities: Fair value (Cost of securities sold is primarily calculated using the

moving-average method.)

Held-to-maturity securities: Valued at amortized cost (straight-line method)

Other securities

With market value: Valued at fair value based on market prices at the balance sheet date

(Valuation gains and losses are fully capitalized, and selling costs are

primarily calculated using the moving-average method.)

Without market value: Valued primarily at cost using the moving-average method

-- Derivatives:

Fair value

-- Inventories

Merchandise and finished products: Valued at lower of cost or market using the weighted average cost

method

Semi-finished products and work-in-progress: Valued at lower of cost or market using the weighted average cost

method

Raw materials and supplies: Valued at lower of cost or market using the moving-average method

b. Method for depreciation of tangible fixed assets and real estate for lease

The Company and its domestic consolidated subsidiaries primarily use the declining-balance method. However, for

buildings (excluding attached facilities) acquired on or after April 1, 1998, the straight-line method is employed.

Consolidated subsidiaries outside Japan primarily use the straight-line method.

Estimated useful lives are mainly as follows:

Buildings and structures: 15-50 years

Machinery, equipment and carriers: 4-15 years

c. Accounting Standards for Major Reserves

-- Allowance for doubtful receivables:

To protect against potential losses from uncollectible notes and accounts receivable, the Company and its domestic

consolidated subsidiaries provide for uncollectible receivables based on historical loss ratios. Specific claims are

evaluated for the likelihood of recovery and provision is made to the allowance for doubtful receivables in the amount

deemed uncollectible.

Foreign consolidated subsidiaries primarily provide for estimated unrecoverable losses on specific claims.

-- Reserve for bonuses:

To appropriate funds for the payment of bonuses to employees, the reserve for bonuses is provided according to the

expected amount of the payment for employees enrolled at the end of the fiscal year, based on the applicable period.

Takeda Pharmaceutical Company Limited (4502)

Consolidated Financial Statements for Fiscal 2007

- 27 -

-- Reserve for retirement benefits:

To cover payment of retirement benefits to employees, reserves are provided as follows:

Takeda provides for retirement benefits based on the estimated value of the retirement benefit obligation as of the

end of the fiscal year, less estimated fair amounts funded under contributory and qualified pension plans.

Four of the consolidated subsidiaries provide for retirement benefits based on the estimated value of the retirement

benefit obligation as of the end of the fiscal year projected at the beginning of each fiscal year, less estimated fair

amounts funded under qualified pension plans.

Other consolidated subsidiaries provide a reserve for retirement benefits equivalent to the amount that would be

required to be paid if all eligible employees voluntarily terminated their employment at the balance sheet date.

Prior service cost is amortized using the straight-line method over a fixed number of years (generally five years)

within the average remaining years of service when obligations arise.

Actuarial gains and losses are expensed mainly on a straight-line basis over the certain years (generally five years)

within the average remaining years of service of employees, allocated proportionately starting from the year each

respective gain or loss occurred.

(Additional Information)

Takeda reviewed its traditional retirement benefit plan. As a result of this review, a part of Takedas lump-sum

retirement payment plan was replaced with a defined-contribution pension plan in and after April 2007. In connection

with this change, gains from change in retirement benefits system of 1,031 million were recorded in accordance

with the Accounting of Switchover Between Retirement Benefit Plans (Corporate Accounting Standards

Application Guide No. 1, issued by the Corporate Accounting Standards Committee on January 31, 2002).

-- Reserve for directors retirement bonuses

To cover payment of retirement bonuses to directors, the reserve for directors retirement bonuses is stated as the

amount to be paid in accordance with internal regulations.

-- Reserve for SMON compensation

The reserve for SMON compensation is stated at an amount calculated in accordance with the Memorandum

Regarding the Settlements and the settlements entered into with the Nationwide Liaison Council of SMON Patients

Associations, etc. in September 1979, in order to prepare for the future costs of health care and nursing with regard to

the subjects of the settlements applicable to the Company as of the end of the period.

d. Accounting for Lease Transactions

Finance lease transactions other than those for which ownership is deemed to be transferred to the lessee are accounted

for as ordinary lease transactions.

e. Principal Methods of Hedge Accounting

-- Methods of hedge accounting

The Takeda Group uses mainly deferred hedging. However, under certain conditions, forward exchange contracts and

interest rate swaps are accounted for as if each hedging instrument and hedged item were one combined financial

instrument.

-- Hedging instruments, hedged items and hedging policies

The Takeda Group uses interest swaps and option transactions to hedge the portion of cash flow related to future asset

management income, which is linked to short-term variable interest rates. In addition, the Takeda Group uses forward

foreign exchange contracts and currency options to hedge those foreign currency-denominated transactions that can

be individually recognized and are financially material. These hedge transactions are conducted in accordance with

established regulations regarding scope of usage and standards for selection of counterparty financial institutions.

-- Method of assessing effectiveness of hedges

Preliminary testing is conducted using statistical methods such as regression analysis, and post-testing is conducted

using comparative analysis.

f. Other

Consumption taxes are excluded from revenues and expenses.

5) Valuation of Assets and Liabilities of Consolidated Subsidiaries

Assets and liabilities of consolidated subsidiaries are evaluated by the partial market value method.

6) Amortization of good will and negative good will

Good will is amortized in equal amounts over a period appropriate for each subsidiary (mostly five years).

Takeda Pharmaceutical Company Limited (4502)

Consolidated Financial Statements for Fiscal 2007

- 28 -

7) Scope of Funds in Consolidated Statements of Cash Flows

Cash and cash equivalents in the consolidated statements of cash flows comprise cash on hand, demand deposits, and short-

term investments that are readily convertible into cash, are exposed to insignificant risk of changes in value and are

redeemable in three months or less from each acquisition date.

Das könnte Ihnen auch gefallen

- Notes To The Company Accounts: 37 Accounting PoliciesDokument7 SeitenNotes To The Company Accounts: 37 Accounting PoliciesManu KmrNoch keine Bewertungen

- Accounting of Life Insurance CompaniesDokument4 SeitenAccounting of Life Insurance CompaniesAnish ThomasNoch keine Bewertungen

- Ias-33 EpsDokument59 SeitenIas-33 Epssyed asim shahNoch keine Bewertungen

- Notes To and Forming Part of The Financial Statements: For The Year Ended June 30, 2009Dokument26 SeitenNotes To and Forming Part of The Financial Statements: For The Year Ended June 30, 2009Sohail Humayun KhanNoch keine Bewertungen

- Accounting of Life Insurance Companies: Prakash VDokument4 SeitenAccounting of Life Insurance Companies: Prakash VSaurav RaiNoch keine Bewertungen

- IFRS Financials Jun 2014Dokument25 SeitenIFRS Financials Jun 2014Navin KumarNoch keine Bewertungen

- Date: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDDokument14 SeitenDate: 2009.03.31. Accounting Policies: Chambal Fertilisers & Chemicals LTDJayverdhan TiwariNoch keine Bewertungen

- Accounting StandardsDokument50 SeitenAccounting StandardsMadhurima MitraNoch keine Bewertungen

- Schedule - Specimen of Statement of Significant Accounting PoliciesDokument16 SeitenSchedule - Specimen of Statement of Significant Accounting Policiesav_meshramNoch keine Bewertungen

- Accounting StandardDokument5 SeitenAccounting StandardJyoti JoshiNoch keine Bewertungen

- EFU Accounting PoliciesDokument9 SeitenEFU Accounting PoliciesJaved AkramNoch keine Bewertungen

- Ifrs VS Us - GaapDokument20 SeitenIfrs VS Us - Gaapalokshri25Noch keine Bewertungen

- Afsr M1Dokument22 SeitenAfsr M1Tayyab AliNoch keine Bewertungen

- Mutual Recognition Means That National Financial Statements Are Accepted AbroadDokument7 SeitenMutual Recognition Means That National Financial Statements Are Accepted Abroadইবনুল মাইজভাণ্ডারীNoch keine Bewertungen

- Mohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Dokument4 SeitenMohammed Bilal Choudhary (Ju2021Mba14574) Activity - 1 Fsra 1Md BilalNoch keine Bewertungen

- Fsa Part-3Dokument26 SeitenFsa Part-3lakshya jainNoch keine Bewertungen

- Earnings Per Share: Accounting Standard (AS) 20Dokument26 SeitenEarnings Per Share: Accounting Standard (AS) 20Charls As AsNoch keine Bewertungen

- Document From Adhu PDFDokument46 SeitenDocument From Adhu PDFBasavaraj S PNoch keine Bewertungen

- TataDokument56 SeitenTataAndreea GeorgianaNoch keine Bewertungen

- 2020 - PFRS For SEs NotesDokument16 Seiten2020 - PFRS For SEs NotesRodelLabor100% (1)

- Applying FI Mar2016Dokument53 SeitenApplying FI Mar2016Vikas Arora100% (1)

- Attock Petroleum Limited Notes To and Forming Part of The Financial Statements For The Year Ended June 30, 2008 1. Legal Status and OperationsDokument18 SeitenAttock Petroleum Limited Notes To and Forming Part of The Financial Statements For The Year Ended June 30, 2008 1. Legal Status and OperationsNasir AliNoch keine Bewertungen

- Accounting Standards (Satyanath Mohapatra)Dokument39 SeitenAccounting Standards (Satyanath Mohapatra)smrutiranjan swain100% (1)

- Accounting PolicyDokument28 SeitenAccounting PolicyAkshay AnandNoch keine Bewertungen

- Accounting Standaed FinalDokument6 SeitenAccounting Standaed FinalPrachee MulyeNoch keine Bewertungen

- Tata Technologies Inc.Dokument16 SeitenTata Technologies Inc.sanjit kadneNoch keine Bewertungen

- Accounting Policies - Study Group 4IDokument24 SeitenAccounting Policies - Study Group 4ISatish Ranjan PradhanNoch keine Bewertungen

- Statement of ComplianceDokument21 SeitenStatement of ComplianceFaiz Smile BuddyNoch keine Bewertungen

- Notes To The Group Financial StatementsDokument42 SeitenNotes To The Group Financial StatementsChinh Lê ĐìnhNoch keine Bewertungen

- Significant Accounting Policies TVS MotorsDokument12 SeitenSignificant Accounting Policies TVS MotorsArjun Singh Omkar100% (1)

- Continous Assignment 2: Mittal School of BusinessDokument8 SeitenContinous Assignment 2: Mittal School of BusinessMd UjaleNoch keine Bewertungen

- General Insurance Accounting: PG JoshiDokument6 SeitenGeneral Insurance Accounting: PG JoshiSanya BajajNoch keine Bewertungen

- Ias - 33Dokument4 SeitenIas - 33Asad TahirNoch keine Bewertungen

- Financial Analysis of Berger PaintsDokument8 SeitenFinancial Analysis of Berger PaintsArun PrasadNoch keine Bewertungen

- Analysisoffinancialstatementofasianpaintsltd 130904112245Dokument7 SeitenAnalysisoffinancialstatementofasianpaintsltd 130904112245Amit PandeyNoch keine Bewertungen

- IAS33Dokument24 SeitenIAS33Elizabeth MarlitaNoch keine Bewertungen

- FARMOD23 Earnings Per Share ForprintDokument10 SeitenFARMOD23 Earnings Per Share Forprintcarl patNoch keine Bewertungen

- Indian Accounting Standard (IND As) 33, IAS 33 Earnings Per Share - Taxguru - inDokument6 SeitenIndian Accounting Standard (IND As) 33, IAS 33 Earnings Per Share - Taxguru - inaaosarlbNoch keine Bewertungen

- Summary ValuationDokument25 SeitenSummary ValuationsMNoch keine Bewertungen

- Earning Bjectives: 1 2016 Mcgraw-Hill Education. All Rights ReservedDokument4 SeitenEarning Bjectives: 1 2016 Mcgraw-Hill Education. All Rights ReservedjakeNoch keine Bewertungen

- Earning Per ShareDokument22 SeitenEarning Per Sharekimuli FreddieNoch keine Bewertungen

- 7 Description of BusinessDokument5 Seiten7 Description of BusinesssahilNoch keine Bewertungen

- Accounting Standards Board (ASB) in 1977Dokument15 SeitenAccounting Standards Board (ASB) in 1977Viswanathan SrkNoch keine Bewertungen

- IAS 33 - Earnings Per Share PDFDokument26 SeitenIAS 33 - Earnings Per Share PDFJanelle SentinaNoch keine Bewertungen

- Accounting Standards Board (ASB) in 1977Dokument15 SeitenAccounting Standards Board (ASB) in 1977ashish kumar jhaNoch keine Bewertungen

- Financial Analysis For Eastman KodakDokument4 SeitenFinancial Analysis For Eastman KodakJacquelyn AlegriaNoch keine Bewertungen

- Ind-AS PDFDokument4 SeitenInd-AS PDFManish MalikNoch keine Bewertungen

- Section 4 IDokument22 SeitenSection 4 ISatish Ranjan PradhanNoch keine Bewertungen

- MSFT Notes00Dokument16 SeitenMSFT Notes00Sourav KarnNoch keine Bewertungen

- Summary Due To Law ChangeDokument35 SeitenSummary Due To Law ChangeAayush NigamNoch keine Bewertungen

- Ar-18 9Dokument5 SeitenAr-18 9jawad anwarNoch keine Bewertungen

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDokument43 SeitenVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNoch keine Bewertungen

- Accounting PoliciesDokument9 SeitenAccounting PoliciesKivumbi WilliamNoch keine Bewertungen

- Plugin Ifrs Investment Funds Issue 1b 686Dokument0 SeitenPlugin Ifrs Investment Funds Issue 1b 686xuhaibimNoch keine Bewertungen

- Accounting StandardsDokument26 SeitenAccounting StandardsAbhishek Chaturvedi100% (1)

- Mutual Fund AccountingDokument4 SeitenMutual Fund AccountingPrasad Volvoikar100% (2)

- Company 02Dokument2 SeitenCompany 02Maheen NoorNoch keine Bewertungen

- IND As SummaryDokument41 SeitenIND As SummaryAishwarya RajeshNoch keine Bewertungen

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Von Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Noch keine Bewertungen

- 2 InventoryValuationandIASDokument10 Seiten2 InventoryValuationandIASfmsalehin9406Noch keine Bewertungen

- CFR Delivery of GoodsDokument2 SeitenCFR Delivery of Goodsfmsalehin9406Noch keine Bewertungen

- GCA Latest Updates On International Valuation Standards - 092021Dokument6 SeitenGCA Latest Updates On International Valuation Standards - 092021fmsalehin9406Noch keine Bewertungen

- Deferred Tax IAS 12 by CPA Dr. Peter NjugunaDokument53 SeitenDeferred Tax IAS 12 by CPA Dr. Peter Njugunafmsalehin9406Noch keine Bewertungen

- Corporate GuaranteeDokument5 SeitenCorporate Guaranteefmsalehin9406Noch keine Bewertungen

- First Bangladesh Fixed Income Fund First Bangladesh Fixed Income FundDokument23 SeitenFirst Bangladesh Fixed Income Fund First Bangladesh Fixed Income Fundfmsalehin9406Noch keine Bewertungen

- Agency Agreement - ASL - Final FormatDokument11 SeitenAgency Agreement - ASL - Final Formatfmsalehin9406Noch keine Bewertungen

- Guide Capitalisation BRWG CostsDokument2 SeitenGuide Capitalisation BRWG Costsfmsalehin9406Noch keine Bewertungen

- AWS Agency AgreementDokument10 SeitenAWS Agency Agreementfmsalehin9406Noch keine Bewertungen

- Agency AgreementDokument5 SeitenAgency Agreementfmsalehin9406Noch keine Bewertungen

- Guide Capitalisation BRWG CostsDokument2 SeitenGuide Capitalisation BRWG Costsfmsalehin9406Noch keine Bewertungen

- C. Procedure of AmalgamationDokument2 SeitenC. Procedure of Amalgamationfmsalehin9406Noch keine Bewertungen

- Top 100 Quantitative Aptitude QuestionsDokument16 SeitenTop 100 Quantitative Aptitude QuestionsNishant LôveaNoch keine Bewertungen

- Customer Satisfaction in Imphal Urban Co-Operative Bank LTD, ManipurDokument6 SeitenCustomer Satisfaction in Imphal Urban Co-Operative Bank LTD, ManipurRohit SharmaNoch keine Bewertungen

- DI CFS FSI Outlook-BankingDokument70 SeitenDI CFS FSI Outlook-Bankinghuizhi guoNoch keine Bewertungen

- Loan Restructuring AgreementDokument3 SeitenLoan Restructuring AgreementRaymond Rogacion100% (1)

- AXIO Loan AgreementDokument28 SeitenAXIO Loan AgreementSudarshan KulkarniNoch keine Bewertungen

- Sarfaesi: Dr. Sujata Bali Associate Professor, UPES School of Law, Dehradun Sbali@ddn - Upes.ac - inDokument27 SeitenSarfaesi: Dr. Sujata Bali Associate Professor, UPES School of Law, Dehradun Sbali@ddn - Upes.ac - inTC-6 Client Requesting sideNoch keine Bewertungen

- Time Value For Money (Compatibility Mode)Dokument87 SeitenTime Value For Money (Compatibility Mode)Azman ScxNoch keine Bewertungen

- Manhattan Test 1 AnswersDokument48 SeitenManhattan Test 1 AnswersChen Cg100% (1)

- Assignment - Carson1 - Due Date 18-07-2013Dokument1 SeiteAssignment - Carson1 - Due Date 18-07-2013Arnold NitinNoch keine Bewertungen

- Globe Telecommunications Report: in Partial Fulfillment of The Requirement For The Subject Advanced Accounting IDokument41 SeitenGlobe Telecommunications Report: in Partial Fulfillment of The Requirement For The Subject Advanced Accounting IPatricia Deanne Markines PacanaNoch keine Bewertungen

- 2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)Dokument44 Seiten2-Ch. (Partnership Firm-Basic Concepts (Ver.-5)Vinay Chawla100% (1)

- Chapter No.9Dokument6 SeitenChapter No.9Kamal Singh100% (1)

- Financial Accounting II: PressDokument46 SeitenFinancial Accounting II: PressmollaparaamrasobaiNoch keine Bewertungen

- Parcor 003Dokument26 SeitenParcor 003Vincent Larrie MoldezNoch keine Bewertungen

- John Lewis Marketing Report MBA 2017Dokument20 SeitenJohn Lewis Marketing Report MBA 2017adamNoch keine Bewertungen

- Annual Report FY2021Dokument234 SeitenAnnual Report FY2021Tamish GuptaNoch keine Bewertungen

- Nertila FeruliDokument69 SeitenNertila FerulisuelaNoch keine Bewertungen

- Gcse Economics: Paper 2 How The Economy WorksDokument20 SeitenGcse Economics: Paper 2 How The Economy WorkskaruneshnNoch keine Bewertungen

- Turquía 7.25% - 2038 - US900123BB58Dokument61 SeitenTurquía 7.25% - 2038 - US900123BB58montyviaderoNoch keine Bewertungen

- Final HDFC ProjectDokument45 SeitenFinal HDFC ProjectAbhishek SainiNoch keine Bewertungen

- PT Gajah Tunggal TBK GJTLDokument3 SeitenPT Gajah Tunggal TBK GJTLDaniel Hanry SitompulNoch keine Bewertungen

- Government of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberDokument2 SeitenGovernment of Tamilnadu Treasury Bill For Salary (Employee) : Drawing Officer Treasury Reference NumberMani Vannan JNoch keine Bewertungen

- Jawaban KK Pengantar Akuntansi 2 After MidtermDokument8 SeitenJawaban KK Pengantar Akuntansi 2 After Midtermdinda ardiyaniNoch keine Bewertungen

- Syllabus For Banking and Insurance: Sem 1 1. Environment and Management of Financial ServicesDokument44 SeitenSyllabus For Banking and Insurance: Sem 1 1. Environment and Management of Financial ServicesVinod TiwariNoch keine Bewertungen

- Project 1Dokument57 SeitenProject 1RubikaNoch keine Bewertungen

- Investment Appraisal With Solved ExamplesDokument29 SeitenInvestment Appraisal With Solved Examplesnot toothlessNoch keine Bewertungen

- Econ 0-Mudule 4 (2022-2023)Dokument22 SeitenEcon 0-Mudule 4 (2022-2023)Bai NiloNoch keine Bewertungen

- PukuDokument23 SeitenPukuSree HarshaNoch keine Bewertungen

- UNITED COCONUT PLANTERS BANK vs. SPOUSES SAMUEL and ODETTE BELUSODokument11 SeitenUNITED COCONUT PLANTERS BANK vs. SPOUSES SAMUEL and ODETTE BELUSOCyrine CalagosNoch keine Bewertungen