Beruflich Dokumente

Kultur Dokumente

Banking Weekly Feb 21, 2014

Hochgeladen von

asingh0001Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Banking Weekly Feb 21, 2014

Hochgeladen von

asingh0001Copyright:

Verfügbare Formate

Banking Weekly - Update for the week ended Feb 21, 2014

Abhinesh Vijayaraj

abhinesh@sparkcapital.in

+91. 44. 4344 0006

Jyothi Kumar Varma

jyothikumar@sparkcapital.in

+91. 44. 4344 0033

Navin Babu

navin@sparkcapital.in

+91. 44. 4344 0165

Date 24 Feb, 2014

BSE SENSEX 20701

NIFTY 6155

BSE BANKEX 12049

CRR % 4.00

SLR % 23.00

Reverse Repo % 7.00

Repo % 8.00

MSF% 9.00

Base Rate % 10.00/10.25

Deposit Rate % 8.00/9.10

INR/ US$ 62.07

WPI% 5.05

CPI% 8.79

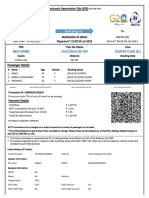

Sensex UP 1.64%ending at 20701 wow; Bankex UP 3.36%to 12049

The BSE Sensex was UP 1.64% for the week ending at 20701, an increase of 334 points while the BSE Bankex was UP 3.36% (up 392

points) over previous week to end at 12049.

The Spark NBFC Index was UP 4.52% to close at 127.34 from previous weeks close of 121.83 (Index value:100 on 01/01/2012)

Key Takeaways

The 10Y G-Sec yield was DOWN 2bps wow ending at 8.79% and the 5Y yield was DOWN 4bps wow at 8.92%.

Spread between 10Y and 6M G-sec yields remained FLAT at (22)bps, with the 10Y yield remaining lower than the 6M yield.

The 10Y bond yields moved DOWN in US (2.73%) by 1bps, UK (2.78%) by 1bps, Brazil (4.85%) by 9bps and moved UP in China

(4.55%) by 6bps.

For the fortnight ended Feb 07, credit grew 15.04% yoy while the deposits grew by 15.58% yoy. During the fortnight, banks credit off take

was UP by Rs.604bn while the deposits were UP by Rs.465bn.

ICICIBC CDS rate was DOWN wow by 19bps to 284bps while SBIN CDS rate was UP 7bps wow to 283bps.

The 10Y AAA spread was UP 4bps at 0.91% and the 5Y AAA was DOWN 8bps to 0.82%.

CD rates were DOWN by 7bps for 3M (9.68%), 2bps for 6M (9.73%) and 2bps for 12M (9.73%).

Spread between overnight rate and 12M OIS rate trended higher to 62bps, suggesting that the market is expecting rates to increase by

~62bps from 8.04% in the next 12 months.

Call money rate was DOWN 185bps to 7.00%, from the 8.85% levels seen during the preceding week.

INR appreciated by 0.02% wow against the USD, closing at 62.07 in the spot markets, while the USD/INR forward rates were lower

across tenors by ~0.1% wow.

Gold price was UP 1.3% wow at INR 30,585 per 10gm in INR terms and UP in USD terms by 0.7% wow and closed at USD 1,320 per

troy ounce.

8

%

4

%

4

%

4

%

4

%

4

%

3

%

2

%

2

%

1

%

1

%

0

%

-

1

%

-

1

%

-

1

%

-

1

%

-

3

%

-

3

%

-

3

%

-

4

%

-

4

%

-

6

%

7

%

6

%

5

%

5

%

4

%

1

%

0

%

-

1

%

-

3

%

-

4

%

-10%

-6%

-2%

2%

6%

10%

A

X

S

B

I

I

B

K

M

B

S

I

B

I

C

I

C

I

B

C

H

D

F

C

B

I

O

B

Y

E

S

S

B

I

N

C

B

K

U

N

B

K

P

N

B

J

K

B

K

D

C

B

B

K

V

B

F

B

V

Y

S

B

C

U

B

K

B

O

B

B

O

I

I

N

B

K

C

R

P

B

K

R

E

P

C

O

S

H

T

F

M

M

F

S

P

F

C

H

D

F

C

L

I

C

H

F

I

D

F

C

S

C

U

F

C

I

F

C

R

E

C

Stock price movement (wow)

1

News and RBI Notifications during the week

News during the week

Board / Management change

Bank of India has informed that the tenure of Shri Harvinder Singh, as part time Non Official Director, has expired on January 31, 2014. As such he ceases to be a director of

the bank w.e.f. February 01, 2014.

Bank of Baroda has informed that the Central Government has appointed Dr. K. P. Krishnan as Government Nominee Director of Bank of Baroda vice Shri Alok Nigam w.e.f.

February 19, 2014. Shri Alok Nigam ceased to be a Director on the Board of the Bank.

PNB sells stake in IFFSL: Punjab National Bank has informed that the Bank has decided to sell its entire stake in India Factoring & Financial Solutions Ltd. (IFFSL) to parent

promoter Fll (FIM Bank Malta). The transaction is to be completed during the current quarter ending 31.03.2014.

Decrease in Foreign investment limit from 54% to 52.50% in IDFC Limited: RBI notified that Foreign Institutional Investors (FIIs), through primary market and stock

exchanges, can now purchase up to 52.50 per cent of the paid up capital of M/s IDFC Limited under the Portfolio Investment Scheme (PIS). The company has passed

resolutions agreeing for decreasing the limit from 54 per cent to 52.50 per cent for the purchase of its equity shares and convertible debentures by FIIs. The RBI also notified that

the foreign share holding by FIIs in M/s IDFC Limited has crossed the overall limit of its paid-up capital.

Reserve Bank to enforce strict regime on UBI: United Bank of India (UBI), which has seen erosion of capital due to bad loans and higher provisioning, is to be told by the

Reserve Bank of India (RBI) to implement prompt corrective action according to a media article. Once this is initiated, the bank will have to present and implement a capital

restoration plan, restrict expansion of risk-weighted assets and not be allowed to enter new businesses, while being barred from accessing high-cost deposits. Also, there would

be no dividend payment.

Public sector banks to get Rs 112bn as capital infusion from Government of India in FY15: The government has put Rs 140bn crore in PSBs this financial year (2013-14)

and Rs 622bn in PSBs between 2005-06 and 2013-14.

SBI to lend up to Rs 100bn to six telecom companies: State Bank of India (SBI) has decided to lend up to Rs 100bn to six telecom companies that won airwaves in the

bandwidth auction concluded last week, but will limit its exposure by taking assets as security for any loan according to a media article.

Indian banks lose Rs 173bn in fraud cases: Indian banks lost as much as Rs 173bn during 2012-13 due to fraud, in a near four-fold jump over the previous fiscal, according

to a media article. Private banks account for about 75% of the total number of cases registered, but they lost only Rs 9.7bn while the state-run banks lost as much as Rs 163bn

during the year.

KKR's Kravis sees opportunity in banks' stressed assets: KKR closed a $2-billion Special Situations Fund globally, which will invest in distressed assets.

CholamandalamInvestment to raise Rs 3.15bn from IFC: Cholamandalam Investment and Finance Company plans to raise Rs 3.15bn (about $50 million) from the

International Finance Corporation (IFC). The money will be infused in the form of a Tier-II debt investment by subscribing to unsecured non-convertible debentures to be issued

by the company.

RBI Notifications

Foreign Direct Investment (FDI) into a Small Scale Industrial Undertakings (SSI) / Micro & Small Enterprises (MSE): The Reserve Bank has allowed micro and small

enterprises (MSEs) who have de-registered their small scale industry status to sell stake to foreign investors to help them attract funds. It has been decided that such companies

may issue shares or convertible debentures to a person resident outside India to the extent of 24% of its paid -up capital.

2

Key Industry Trends

10Y G-Sec yields down 2bps wow and 5Y yields down 4bps wow

Source: Bloomberg

Spread between 10Y and 6M bond yields move to (22)bps

Source: Bloomberg

The yield curve has remained steady wow

Source: Bloomberg

10Y bond yields down in US, UK & Brazil & up in China

,

Source: Bloomberg

8.81% 8.79%

8.96%

8.92%

8.6%

8.7%

8.8%

8.9%

9.0%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

10Y G-Sec Yield 5Y G-Sec Yield

2.74% 2.73%

2.79% 2.78%

4.49%

4.55%

4.94%

4.85%

2.0%

3.0%

4.0%

5.0%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

US UK China Brazil

9.03%

9.01%

-0.22%

-0.22%

-0.3%

-0.2%

-0.1%

0.0%

0.1%

8.4%

8.6%

8.8%

9.0%

9.2%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

6M G-Sec yield Spread between 10Y and 6M yields (RHS)

6.0%

7.0%

8.0%

9.0%

10.0%

3M 6M 1Y 2Y 3Y 5Y 6Y 7Y 8Y 9Y 10Y 11Y 12Y 13Y 14Y

28-Sep-10 15-Jul-13 14-Feb-14 21-Feb-14

3M CD rates down 7bps, 6M down 2bps & 12M down 2bps wow

2

Source: Bloomberg

5-year CDS rates down 19bps wow for ICICI and up 7bps for SBI

e

Source: Bloomberg

3

Key Industry Trends

10Y AAA bond spread up 4bps wow, 5Y spread down 8bps wow

Source: Bloomberg

TED spreads contracts to 20bps

Source: Bloomberg

318 316

306

303

284

290

301

295

276

283

200

250

300

350

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

ICICI Bank CDS (bps) SBI CDS (bps) (RHS)

0.90%

0.89%

0.86%

0.87%

0.91%

0.86%

0.83%

0.89%

0.91%

0.82%

0.7%

0.8%

0.9%

1.0%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

10Y Corporate AAA Spreads 5Y Corporate AAA Spreads

8.6%

8.8%

9.0%

9.2%

9.4%

9.6%

9.8%

10.0%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

3M 6M 12M

0.24% 0.24% 0.23% 0.24% 0.23%

0.05%

0.02%

0.08%

0.02%

0.04%

0.00%

0.05%

0.10%

0.15%

0.20%

0.25%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

3-month LIBOR % (RHS) 3-month US T-Bill% (RHS)

4

Key Industry Trends

1Y FW OIS and overnight rate spread moved higher to 56bps

Source: Bloomberg

Call money rates down wow to 7.00%

Source: Bloomberg

Forward USD/INR rates was marginally lower across tenors

Source: Bloomberg

Gold in INR terms up 1.3% wow and up 0.7% wow in US$ terms

Source: Bloomberg

7.60%

8.80%

8.00%

8.85%

7.00%

5.0%

5.5%

6.0%

6.5%

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

58

60

52

-32

62

(40)

(20)

-

20

40

60

80

7.0%

7.5%

8.0%

8.5%

9.0%

9.5%

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

Overnight rate 12M OIS Spread (bps) (RHS)

63.27 63.22

64.55 64.45

67.05

66.86

60

62

64

66

68

70

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

3M forward rate 6M forward rate 12M forward rate

29,703

27,600

29,801

30,178

30,585

1,260

1,246

1,260

1,311

1,320

1,200

1,240

1,280

1,320

1,360

26,000

27,000

28,000

29,000

30,000

31,000

24-Jan 31-Jan 7-Feb 14-Feb 21-Feb

Gold Price in Rs. per 10g. Gold Price in US$ per troy ounce (RHS)

5

Valuation Matrix Banks

Bank

Net Interest Income, Rs. bn Operating Profits, Rs. bn PAT, Rs. bn Gross NPA FY13-15E CAGR NIM

FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E NII PAT ABV FY13 FY14E FY15E

AXSB 96.7 116.7 125.2 93.0 108.6 115.3 51.6 57.5 57.8 1.2% 1.4% 1.4% 14% 6% 13% 3.3% 3.5% 3.4%

BOB 113.2 120.9 144.6 90.0 92.9 110.6 44.1 45.9 53.0 2.4% 3.4% 3.8% 13% 10% 1% 2.4% 2.2% 2.3%

BOI 90.2 106.3 125.0 74.6 86.7 99.8 27.5 28.3 36.1 3.0% 2.9% 3.0% 18% 15% 6% 2.3% 2.3% 2.3%

CBK 78.8 87.8 106.2 58.9 65.4 79.0 28.7 23.7 32.6 2.6% 2.9% 3.4% 16% 7% 2% 2.2% 2.1% 2.2%

CRPBK 34.3 39.3 45.5 30.4 32.3 36.6 14.3 6.8 11.0 1.7% 3.0% 3.3% 15% -12% -14% 2.1% 2.1% 2.2%

CUBK 6.2 7.7 8.9 5.2 5.9 6.9 3.2 3.6 4.0 1.1% 1.7% 1.8% 20% 12% 14% 3.3% 3.4% 3.4%

DEVB 2.8 3.7 4.3 1.3 1.9 2.4 1.0 1.5 1.7 3.3% 2.6% 2.4% 23% 29% 16% 3.1% 3.2% 3.2%

FB 19.7 21.8 24.8 14.6 15.1 18.1 8.4 7.9 10.3 3.5% 2.8% 2.8% 12% 11% 10% 3.2% 3.2% 3.2%

HDFCB 158.1 183.7 224.1 114.3 146.2 184.1 67.3 85.6 108.4 1.0% 1.1% 1.1% 19% 27% 20% 4.8% 4.6% 4.6%

INBK 45.2 44.2 50.8 30.6 27.6 31.6 15.8 11.1 11.7 3.4% 3.5% 4.0% 6% -14% 0% 3.2% 2.8% 2.8%

ICICIBC 138.7 165.9 190.4 132.0 163.1 176.2 84.7 96.0 105.2 3.3% 3.2% 3.5% 17% 11% 10% 3.0% 3.3% 3.3%

IIB 22.3 28.7 34.5 18.4 25.2 30.3 10.6 13.7 17.0 1.0% 1.2% 1.2% 24% 27% 16% 3.7% 3.9% 3.9%

JKBK 23.2 26.7 30.1 18.1 19.1 21.8 10.6 12.6 13.8 1.6% 1.7% 1.8% 14% 14% 17% 3.7% 3.9% 3.9%

VYSB 15.4 17.2 19.4 9.9 11.8 13.4 6.1 7.0 8.4 1.8% 1.7% 1.7% 12% 17% 18% 3.3% 3.3% 3.3%

IOB 52.5 56.2 62.5 38.2 38.4 41.3 5.6 5.0 5.9 4.1% 5.5% 6.1% 9% 2% -23% 2.4% 2.4% 2.3%

KMB 32.1 37.3 43.6 21.6 26.1 30.7 13.6 15.1 17.9 1.6% 2.0% 1.8% 17% 15% 21% 4.6% 4.7% 4.9%

KVB 11.6 12.7 15.8 8.5 8.3 11.1 5.5 3.8 7.0 1.0% 1.4% 1.5% 17% 13% 10% 3.0% 2.7% 2.9%

PNB 148.6 163.6 181.2 109.1 109.0 119.3 47.5 34.4 47.4 4.4% 5.0% 5.0% 10% 0% 2% 3.4% 3.4% 3.4%

SBIN 443.3 494.5 565.0 310.8 297.6 332.5 141.0 106.5 133.4 4.8% 5.8% 6.0% 13% -3% -3% 3.3% 3.2% 3.2%

SIB 12.8 14.0 17.0 8.5 9.2 11.4 4.7 5.2 6.5 1.4% 1.6% 1.6% 15% 18% 12% 3.0% 2.8% 2.9%

UNBK 75.4 82.3 93.3 55.8 55.6 61.4 21.6 19.1 24.6 3.0% 3.9% 4.3% 11% 7% -15% 2.8% 2.6% 2.6%

YES 22.2 26.6 31.5 21.4 26.0 30.5 13.0 15.7 18.3 0.2% 0.4% 0.5% 19% 19% 21% 2.8% 2.9% 3.1%

6

Valuation Matrix Banks (Contd)

Bank

RoE RoA ABV/share Rs. P/ABV (x) CMP Shares M.Cap Target

Rating

FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY14E FY15E (Rs.) (mn) Rs. bn P/ABV(x)

Price

(Rs.)

AXSB 18.4% 16.2% 14.3% 1.6% 1.6% 1.4% 694 790 889 1.5 1.3 1193 469 560.0 1.1 977 SELL

BOB 15.4% 14.0% 14.5% 0.9% 0.8% 0.8% 631 621 644 0.8 0.8 518 432 224.0 0.7 479 SELL

BOI 12.9% 11.6% 13.3% 0.7% 0.6% 0.6% 281 301 317 0.6 0.5 168 643 107.8 0.5 144 SELL

CBK 13.2% 9.5% 11.4% 0.7% 0.5% 0.6% 397 426 411 0.5 0.5 214 461 98.8 0.5 196 SELL

CRPBK 16.1% 7.0% 10.7% 0.8% 0.3% 0.5% 533 413 397 0.5 0.6 224 168 37.5 0.5 198 SELL

CUBK 22.3% 19.3% 18.2% 1.6% 1.4% 1.4% 32 36 42 1.3 1.1 47 538 25.0 1.4 58 BUY

DEVB 11.6% 15.1% 14.4% 1.0% 1.3% 1.2% 36 42 48 1.2 1.1 51 250 12.8 1.4 66 BUY

FB 13.9% 11.9% 14.1% 1.3% 1.1% 1.2% 69 76 85 1.0 0.9 73 855 62.8 1.2 101 BUY

HDFCB 20.3% 21.5% 22.6% 1.8% 1.9% 2.0% 150 180 216 3.7 3.1 664 2395 1591.0 3.6 776 BUY

INBK 16.1% 10.3% 10.1% 1.0% 0.6% 0.6% 187 193 187 0.5 0.5 90 430 38.5 0.4 79 SELL

ICICIBC 13.3% 13.7% 13.5% 1.7% 1.7% 1.6% 559 612 676 1.7 1.5 1025 1155 1183.8 1.7 1182 BUY

IIB 17.5% 16.6% 17.7% 1.6% 1.7% 1.7% 143 166 194 2.4 2.0 392 523 205.0 2.5 485 BUY

JKBK 23.6% 23.6% 22.0% 1.6% 1.7% 1.7% 1000 1173 1373 1.1 1.0 1334 48 64.7 1.2 1648 BUY

VYSB 14.6% 12.2% 11.3% 1.2% 1.2% 1.3% 292 370 409 1.5 1.3 540 187 101.3 1.5 613 BUY

IOB 5.0% 4.0% 4.4% 0.2% 0.2% 0.2% 84 62 50 0.7 0.9 46 1154 52.8 0.5 25 SELL

KMB 15.6% 13.9% 13.7% 1.8% 1.8% 1.9% 123 153 179 4.4 3.8 672 768 516.3 4.5 811 BUY

KVB 19.0% 11.9% 19.7% 1.3% 0.8% 1.2% 278 292 337 1.1 0.9 314 107 33.6 1.2 404 BUY

PNB 16.5% 10.6% 13.3% 1.0% 0.7% 0.8% 679 661 713 0.8 0.8 535 362 193.7 0.7 479 SELL

SBIN 15.4% 9.8% 10.9% 1.0% 0.6% 0.7% 1125 1044 1048 1.4 1.4 1502 747 1121.4 1.2 1297 SELL

SIB 19.2% 17.0% 18.6% 1.0% 1.0% 1.0% 20 21 24 1.0 0.9 21 1342 27.9 1.0 24 BUY

UNBK 15.0% 11.9% 14.4% 0.8% 0.6% 0.6% 207 145 149 0.7 0.7 103 741 76.4 0.6 84 SELL

YES 24.8% 24.2% 23.2% 1.5% 1.5% 1.5% 162 195 236 1.6 1.3 306 360 110.4 2.0 470 BUY

Valuation Matrix NBFCs

Source: Spark Capital Research Prices as of Feb 21, 2014

NBFC

Net Interest Income, Rs. bn Operating Profits, Rs. bn PAT, Rs. bn Gross NPA FY13-15E CAGR NIM

FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E NII PAT ABV FY13 FY14E FY15E

CIFC 11.4 14.8 17.5 5.7 8.1 10.2 3.1 3.6 4.6 1.0% 1.9% 2.3% 24% 23% 17% 7.0% 7.0% 6.8%

HDFC 62.7 72.2 82.2 68.1 76.6 85.8 49.4 55.6 62.3 0.7% 0.7% 0.8% 14% 12% 12% 3.6% 3.4% 3.3%

IDFC 25.7 26.7 26.8 29.4 30.5 30.2 18.4 20.2 20.4 0.2% 0.3% 0.3% 2% 5% 9% 4.3% 4.0% 3.7%

LICHF 15.3 19.1 22.0 14.5 18.4 20.5 10.2 12.9 14.2 0.6% 0.6% 0.6% 20% 18% 16% 2.2% 2.3% 2.3%

MMFS 22.4 27.5 34.9 15.3 18.4 24.3 8.8 8.6 11.7 3.0% 5.0% 5.5% 25% 15% 13% 9.4% 8.9% 9.2%

PFC 61.9 85.3 89.4 60.5 81.8 87.9 43.9 56.4 62.9 0.9% 0.7% 0.8% 20% 20% 17% 4.2% 4.9% 4.4%

REC 53.8 69.1 75.5 53.9 68.2 75.9 39.1 46.2 53.8 0.4% 0.3% 0.3% 19% 17% 23% 4.6% 4.8% 4.5%

REPCO 1.4 1.8 2.4 1.2 1.7 2.3 0.8 1.1 1.5 1.5% 1.4% 1.6% 31.2% 37.6% 16.6% 4.4% 4.5% 4.5%

SCUF 16.6 18.3 21.7 10.5 11.7 13.8 4.5 5.1 6.0 2.2% 2.3% 2.4% 14% 16% 21% 11.4% 11.2% 11.7%

SHTF 34.6 36.7 39.6 28.6 29.2 30.0 13.5 12.6 13.6 3.2% 3.9% 5.5% 7% 0% 15% 7.7% 7.1% 6.8%

NBFC

RoE RoA ABV/share Rs. P/ABV (x) CMP Shares M.Cap Target

Rating

FY13 FY14E FY15E FY13 FY14E FY15E FY13 FY14E FY15E FY14E FY15E (Rs.) (mn) Rs. bn P/ABV(x)

Price

(Rs.)

CIFC 18.1% 17.1% 18.6% 2.0% 1.9% 1.9% 134.6 148.5 183.5 1.5 1.2 228 143.2 32.6 1.6 293 BUY

HDFC 22.5% 20.9% 21.0% 2.5% 2.4% 2.3% 157.0 177.9 196.8 4.5 4.1 801 1546.4 1238.0 3.6 712 SELL

IDFC 14.1% 14.1% 12.9% 2.9% 2.8% 2.4% 90.0 96.9 107.3 1.0 0.9 95 1512.4 143.9 1.2 130 BUY

LICHF 16.8% 18.4% 17.5% 1.4% 1.5% 1.4% 122.9 144.0 166.7 1.4 1.2 201 505.0 101.6 1.6 266 BUY

MMFS 23.9% 18.1% 21.1% 3.6% 2.7% 3.0% 74.5 79.2 95.2 3.2 2.7 257 520.0 133.8 2.2 209 SELL

PFC 19.6% 22.0% 21.2% 2.9% 3.1% 3.0% 174.6 198.8 237.6 0.8 0.6 154 1319.9 202.9 0.8 186 BUY

REC 24.3% 24.3% 23.1% 3.3% 3.2% 3.2% 172.7 204.7 259.4 0.9 0.7 184 987.5 182.1 1.1 277 BUY

REPCO 17.1% 15.9% 19.1% 2.4% 2.5% 2.8% 96.4 111.2 131.1 3.0 2.5 330 62.2 20.5 2.8 369 BUY

SCUF 22.8% 20.3% 19.2% 2.9% 3.0% 3.1% 379.3 468.5 556.2 2.0 1.7 960 55.4 53.2 2.0 1112 BUY

SHTF 20.5% 16.3% 15.4% 2.3% 1.9% 1.9% 306.5 355.6 407.1 1.7 1.4 588 226.9 133.5 1.3 529 SELL

Spark Disclaimer

Spark Capital Advisors (India) Private Limited (Spark Capital) and its affiliates are engaged in investment banking, investment advisory and institutional equities. Spark Capital is registered

with SEBI as a Stock Broker and Category 1 Merchant Banker.

This document does not constitute or form part of any offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. This document is

provided for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Nothing in this document should be construed as investment or

financial advice, and nothing in this document should be construed as an advice to buy or sell or solicitation to buy or sell the securities of companies referred to in this document.

Each recipient of this document should make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this

document (including the merits and risks involved), and should consult its own advisors to determine the merits and risks of such an investment. This document is being supplied to you solely

for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole or in part, for any purpose. This report is

not directed or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state, country or other jurisdiction, where such distribution,

publication, availability or use would be contrary to law, regulation or which would subject Spark Capital and/or its affiliates to any registration or licensing requirement within such

jurisdiction. The securities described herein may or may not be eligible for sale in all jurisdictions or to a certain category of investors. Persons in whose possession this document may come are

required to inform themselves of and to observe such applicable restrictions. This material should not be construed as an offer to sell or the solicitation of an offer to buy any security in any

jurisdiction where such an offer or solicitation would be illegal.

Spark Capital makes no representation or warranty, express or implied, as to the accuracy, completeness or fairness of the information and opinions contained in this document. Spark Capital ,

its affiliates, and the employees of Spark Capital and its affiliates may, from time to time, effect or have effected an own account transaction in, or deal as principal or agent in or for the

securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any company

referred to in this report.

This report has been prepared on the basis of information, which is already available in publicly accessible media or developed through an independent analysis by Spark Capital. While we

would endeavour to update the information herein on a reasonable basis, Spark Capital and its affiliates are under no obligation to update the information. Also, there may be regulatory,

compliance or other reasons that prevent Spark Capital and its affiliates from doing so. Neither Spark Capital nor its affiliates or their respective directors, employees, agents or representatives

shall be responsible or liable in any manner, directly or indirectly, for views or opinions expressed in this report or the contents or any errors or discrepancies herein or for any decisions or

actions taken in reliance on the report or the inability to use or access our service in this report or for any loss or damages whether direct or indirect, incidental, special or consequential

including without limitation loss of revenue or profits that may arise from or in connection with the use of or reliance on this report.

Spark Capital and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. To enhance transparency, Spark Capital has

incorporated a disclosure of interest statement in this document. This should however not be treated as endorsement of views expressed in this report:

Absolute Rating Interpretation

BUY Stock expected to provide positive returns of > 15% over a 1-year horizon

ADD Stock expected to provide positive returns of >5% - <15% over a 1-year horizon

REDUCE Stock expected to provide returns of <5% - -10%, over a 1-year horizon

SELL Stock expected to fall >10% over a 1-year horizon

Analyst Certification of Independence

The views expressed in this research report accurately reflect the analysts personal views about any and all of the subject securities or issuers; and no part of the research

analysts compensations was, is or will be, directly or indirectly, related to the specific recommendation or views expressed in the report.

Additional Disclaimer for US Institutional Investors

This research report prepared by Spark Capital Advisors (India) Private Limited is distributed in the United States to US Institutional Investors (as defined in Rule 15a-6 under the Securities

Exchange Act of 1934, as amended) only by Decker & Co, LLC, a broker-dealer registered in the US (registered under Section 15 of Securities Exchange Act of 1934, as amended). Decker & Co

accepts responsibility on the research reports and US Institutional Investors wishing to effect transaction in the securities discussed in the research material may do so through Decker & Co. All

responsibility for the distribution of this report by Decker & Co, LLC in the US shall be borne by Decker & Co, LLC. All resulting transactions by a US person or entity should be effected through

a registered broker-dealer in the US. This report is not directed at you if Spark Capital Advisors (India) Private Limited or Decker & Co, LLC is prohibited or restricted by any legislation or

regulation in any jurisdiction from making it available to you. You should satisfy yourself before reading it that Decker & Co, LLC and Spark Capital Advisors (India) Private Limited are

permitted to provide research material concerning investment to you under relevant legislation and regulations;

Disclosure of interest statement Yes/No

Analyst ownership of the stock Yes bank

Group/directors ownership of the stock CIFC

Broking relationship with the company covered No

Investment banking relationship with the company covered No

Das könnte Ihnen auch gefallen

- SBI Securities Morning Update - 13-01-2023Dokument7 SeitenSBI Securities Morning Update - 13-01-2023deepaksinghbishtNoch keine Bewertungen

- Banking Sector UpdateDokument27 SeitenBanking Sector UpdateAngel BrokingNoch keine Bewertungen

- Monthly Test - February 2020Dokument7 SeitenMonthly Test - February 2020Keigan ChatterjeeNoch keine Bewertungen

- Banking AwarenessDokument6 SeitenBanking AwarenessYashJainNoch keine Bewertungen

- Monthly Beepedia July 2022Dokument132 SeitenMonthly Beepedia July 2022not youNoch keine Bewertungen

- Beepedia Monthly Current Affairs October 2022Dokument137 SeitenBeepedia Monthly Current Affairs October 2022Sovan KumarNoch keine Bewertungen

- Financials Result ReviewDokument21 SeitenFinancials Result ReviewAngel BrokingNoch keine Bewertungen

- Banking Result UpdatedDokument18 SeitenBanking Result UpdatedAngel BrokingNoch keine Bewertungen

- INR Touches Record Low but Rallies on RBI MeasuresDokument8 SeitenINR Touches Record Low but Rallies on RBI MeasuresKeigan ChatterjeeNoch keine Bewertungen

- 29.11.22 - Morning Financial News UpdatesDokument5 Seiten29.11.22 - Morning Financial News UpdatesraviNoch keine Bewertungen

- Biz-Scoop - July 27Dokument1 SeiteBiz-Scoop - July 27VarunSoodNoch keine Bewertungen

- Markets For You - 27.03.12Dokument2 SeitenMarkets For You - 27.03.12Bharat JadhavNoch keine Bewertungen

- RBI monetary policy and its impact on stock market sectorsDokument9 SeitenRBI monetary policy and its impact on stock market sectorsSreenivas KuppachiNoch keine Bewertungen

- Market Outlook: Dealer's DiaryDokument24 SeitenMarket Outlook: Dealer's DiaryAngel BrokingNoch keine Bewertungen

- Market Outlook 16th September 2011Dokument6 SeitenMarket Outlook 16th September 2011Angel BrokingNoch keine Bewertungen

- GK Bullet - SBI PO (Mains) II PDFDokument33 SeitenGK Bullet - SBI PO (Mains) II PDFgaurav singhNoch keine Bewertungen

- SBI Securities Morning Update - 17-10-2022Dokument5 SeitenSBI Securities Morning Update - 17-10-2022deepaksinghbishtNoch keine Bewertungen

- Mid Quarter Monetary Policy Review March 2012Dokument2 SeitenMid Quarter Monetary Policy Review March 2012Prashant KumarNoch keine Bewertungen

- Banking ResultReview 2QFY2013Dokument24 SeitenBanking ResultReview 2QFY2013Angel BrokingNoch keine Bewertungen

- Weekly Market UpdateDokument1 SeiteWeekly Market UpdateNeeta ShindeyNoch keine Bewertungen

- SBI Securities Morning Update - 02-11-2022Dokument5 SeitenSBI Securities Morning Update - 02-11-2022deepaksinghbishtNoch keine Bewertungen

- Monthly Beepedia August 2022Dokument129 SeitenMonthly Beepedia August 2022Sakshi SharmaNoch keine Bewertungen

- Monthly Beepedia August 2022Dokument129 SeitenMonthly Beepedia August 2022Rahul AnandNoch keine Bewertungen

- RBI Monthly Roundup: On-tap bank licence rejections, outward remittances hit record highDokument122 SeitenRBI Monthly Roundup: On-tap bank licence rejections, outward remittances hit record highAtul sharmaNoch keine Bewertungen

- Market Outlook 16th March 2012Dokument4 SeitenMarket Outlook 16th March 2012Angel BrokingNoch keine Bewertungen

- MD MN 12Dokument1 SeiteMD MN 12Venugopal Balakrishnan NairNoch keine Bewertungen

- RBI keeps repo rate unchanged and other banking newsDokument51 SeitenRBI keeps repo rate unchanged and other banking newsunikxocizmNoch keine Bewertungen

- 8th April Monetary PolicyDokument3 Seiten8th April Monetary PolicyNeeleshNoch keine Bewertungen

- Equity Report by Ways2Capital 02 June 2014Dokument10 SeitenEquity Report by Ways2Capital 02 June 2014Ways2CapitalNoch keine Bewertungen

- Niveshak July 2013Dokument28 SeitenNiveshak July 2013Niveshak - The InvestorNoch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) February 2023Dokument101 SeitenBeepedia Monthly Current Affairs (Beepedia) February 2023Rishabh MalhotraNoch keine Bewertungen

- RBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFDokument5 SeitenRBI Policy Review: Turning Hawkish: Normalization of Policy Corridor and Introduction of SDFswapnaNoch keine Bewertungen

- SBI Securities Morning Update - 21-10-2022Dokument5 SeitenSBI Securities Morning Update - 21-10-2022deepaksinghbishtNoch keine Bewertungen

- Beepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023Dokument48 SeitenBeepedia Weekly Current Affairs (Beepedia) 1st-8th December 2023SHANTANU MISHRANoch keine Bewertungen

- Daily Equity Market Report-16 Jan 2015Dokument4 SeitenDaily Equity Market Report-16 Jan 2015NehaSharmaNoch keine Bewertungen

- Weekly Beepedia 01st To 08th August 2022Dokument44 SeitenWeekly Beepedia 01st To 08th August 2022Subhajyoti RoyNoch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) December 2022Dokument116 SeitenBeepedia Monthly Current Affairs (Beepedia) December 2022Sovan KumarNoch keine Bewertungen

- India Market Outlook Aug 2013Dokument4 SeitenIndia Market Outlook Aug 2013sindu_lawrenceNoch keine Bewertungen

- IDirect Banking SectorReport Mar2014Dokument16 SeitenIDirect Banking SectorReport Mar2014Tirthajit SinhaNoch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) October 2023Dokument121 SeitenBeepedia Monthly Current Affairs (Beepedia) October 2023Vikram SharmaNoch keine Bewertungen

- Current Affairs: 01st Feb 2022 To 10th Feb 2022 CADokument47 SeitenCurrent Affairs: 01st Feb 2022 To 10th Feb 2022 CAShubhendu VermaNoch keine Bewertungen

- RBI's Policy Stance: Medium Term Versus Short TermDokument3 SeitenRBI's Policy Stance: Medium Term Versus Short TermShay WaxenNoch keine Bewertungen

- MOStMarketOutlook2ndApril2024Dokument10 SeitenMOStMarketOutlook2ndApril2024Sandeep JaiswalNoch keine Bewertungen

- PSBs Posted Net Loss Rs 18000 CRDokument3 SeitenPSBs Posted Net Loss Rs 18000 CRDynamic LevelsNoch keine Bewertungen

- Beepedia Monthly Current Affairs (Beepedia) April 2023 PDFDokument134 SeitenBeepedia Monthly Current Affairs (Beepedia) April 2023 PDFSAI CHARAN VNoch keine Bewertungen

- Banking: Spike in Wholesale RatesDokument6 SeitenBanking: Spike in Wholesale RatesnnsriniNoch keine Bewertungen

- MOSt Market Outlook 7 TH February 2024Dokument10 SeitenMOSt Market Outlook 7 TH February 2024Sandeep JaiswalNoch keine Bewertungen

- MOStMarketOutlook21stMarch2024Dokument10 SeitenMOStMarketOutlook21stMarch2024Sandeep JaiswalNoch keine Bewertungen

- Analysis Central BankingDokument12 SeitenAnalysis Central Bankingjohann_747Noch keine Bewertungen

- 66 - Banks - Sector UpdateDokument3 Seiten66 - Banks - Sector UpdategirishrajsNoch keine Bewertungen

- News Flash 17.11.2017Dokument1 SeiteNews Flash 17.11.2017Prabhat SingalNoch keine Bewertungen

- RBI Policy Weak Policy Given The Economy & Frozen Credit MarketsDokument10 SeitenRBI Policy Weak Policy Given The Economy & Frozen Credit MarketsKeigan ChatterjeeNoch keine Bewertungen

- SBI Becomes First Japan Group To List in HKDokument8 SeitenSBI Becomes First Japan Group To List in HKishan_mishra85Noch keine Bewertungen

- Banking Sector Analysis and Stock ValuationDokument40 SeitenBanking Sector Analysis and Stock Valuationnitish_735Noch keine Bewertungen

- Market Outlook 12th March 2012Dokument4 SeitenMarket Outlook 12th March 2012Angel BrokingNoch keine Bewertungen

- IndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBDokument4 SeitenIndusInd Bank-2QFY14 Result Update - 15 October 2013 Longtermgrp++ NBdarshanmaldeNoch keine Bewertungen

- Markets For You - 24 March 2015Dokument2 SeitenMarkets For You - 24 March 2015Rahul SaxenaNoch keine Bewertungen

- Wholesale borrowing rates likely to fall in FY15Dokument73 SeitenWholesale borrowing rates likely to fall in FY15girishrajsNoch keine Bewertungen

- Financial Soundness Indicators for Financial Sector Stability in BangladeshVon EverandFinancial Soundness Indicators for Financial Sector Stability in BangladeshNoch keine Bewertungen

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsVon EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNoch keine Bewertungen

- Calculating GDP: Income, Production and Expenditure MethodsDokument6 SeitenCalculating GDP: Income, Production and Expenditure Methodsasingh0001Noch keine Bewertungen

- IBEF Auto Components 261112Dokument37 SeitenIBEF Auto Components 261112asingh0001Noch keine Bewertungen

- Four Lessons For Transforming African AgricultureDokument11 SeitenFour Lessons For Transforming African AgricultureNabeel HNoch keine Bewertungen

- An Indian Writer of British DescentDokument1 SeiteAn Indian Writer of British Descentasingh0001Noch keine Bewertungen

- International Debt Securities - All IssuersDokument1 SeiteInternational Debt Securities - All Issuersasingh0001Noch keine Bewertungen

- LG Annual Report 2012Dokument54 SeitenLG Annual Report 2012asingh0001Noch keine Bewertungen

- Katherine Beauchamp Mansfield Was Born in Colonial Newzealand in 1888Dokument1 SeiteKatherine Beauchamp Mansfield Was Born in Colonial Newzealand in 1888asingh0001Noch keine Bewertungen

- E&Y - Emerging Entertainment MarketsDokument48 SeitenE&Y - Emerging Entertainment Marketsasingh0001Noch keine Bewertungen

- India External DebtDokument9 SeitenIndia External Debtasingh0001Noch keine Bewertungen

- Electricity in IndiaDokument35 SeitenElectricity in Indiaasingh0001Noch keine Bewertungen

- The Case of MalaysiaDokument48 SeitenThe Case of Malaysiaasingh0001Noch keine Bewertungen

- Prospects For Global Defence Export Industry in Indian Defence MarketDokument80 SeitenProspects For Global Defence Export Industry in Indian Defence MarketSathish GanesanNoch keine Bewertungen

- Gross Domestic Savings and Gross Domestic Capital Formation - Xlsgross Domestic Savings and Gross Domestic Capital FormationDokument4 SeitenGross Domestic Savings and Gross Domestic Capital Formation - Xlsgross Domestic Savings and Gross Domestic Capital Formationasingh0001Noch keine Bewertungen

- Pro Proctor Guide v2Dokument16 SeitenPro Proctor Guide v2Agnes BofillNoch keine Bewertungen

- PDF 05 EuroMedJeunesse Etude LEBANON 090325Dokument28 SeitenPDF 05 EuroMedJeunesse Etude LEBANON 090325ermetemNoch keine Bewertungen

- Gorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockDokument1 SeiteGorgeous Babe Skyy Black Enjoys Hardcore Outdoor Sex Big Black CockLorena Sanchez 3Noch keine Bewertungen

- Introduction To Ultrasound: Sahana KrishnanDokument3 SeitenIntroduction To Ultrasound: Sahana Krishnankundu.banhimitraNoch keine Bewertungen

- 14312/BHUJ BE EXP Sleeper Class (SL)Dokument2 Seiten14312/BHUJ BE EXP Sleeper Class (SL)AnnuNoch keine Bewertungen

- Doosan Generator WarrantyDokument2 SeitenDoosan Generator WarrantyFrank HigueraNoch keine Bewertungen

- Concept of Islam and Muslim UmmahDokument8 SeitenConcept of Islam and Muslim Ummahapi-370090967% (3)

- Annex 3 Affidavit of Undertaking DO 3 2018Dokument1 SeiteAnnex 3 Affidavit of Undertaking DO 3 2018Anne CañosoNoch keine Bewertungen

- DENR V DENR Region 12 EmployeesDokument2 SeitenDENR V DENR Region 12 EmployeesKara RichardsonNoch keine Bewertungen

- Uan Luna & Ernando AmorsoloDokument73 SeitenUan Luna & Ernando AmorsoloGeorge Grafe100% (2)

- Projector - Manual - 7075 Roockstone MiniDokument20 SeitenProjector - Manual - 7075 Roockstone Mininauta007Noch keine Bewertungen

- CA ruling assailed in land title reconstitution caseDokument8 SeitenCA ruling assailed in land title reconstitution caseHannah VictoriaNoch keine Bewertungen

- Philippine Anti CyberbullyingDokument4 SeitenPhilippine Anti CyberbullyingCalimlim Kim100% (2)

- Bmu AssignmnetDokument18 SeitenBmu AssignmnetMaizaRidzuanNoch keine Bewertungen

- CFPB Your Money Your Goals Choosing Paid ToolDokument6 SeitenCFPB Your Money Your Goals Choosing Paid ToolJocelyn CyrNoch keine Bewertungen

- Unit 1-5Dokument122 SeitenUnit 1-5STUTI RAJNoch keine Bewertungen

- Emortgage Overview Eclosing - BBoikeDokument7 SeitenEmortgage Overview Eclosing - BBoikechutiapanti2002Noch keine Bewertungen

- H.C.G. Paper 1 History & Civics examDokument5 SeitenH.C.G. Paper 1 History & Civics examGreatAkbar1100% (1)

- Republic of The Philippines Manila First DivisionDokument10 SeitenRepublic of The Philippines Manila First DivisionDino Bernard LapitanNoch keine Bewertungen

- Lacson Vs Roque DigestDokument1 SeiteLacson Vs Roque DigestJestherin Baliton50% (2)

- Gulliver's Travels to BrobdingnagDokument8 SeitenGulliver's Travels to BrobdingnagAshish JainNoch keine Bewertungen

- Ethics Paper 1Dokument9 SeitenEthics Paper 1api-314968337Noch keine Bewertungen

- Comprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012Dokument2 SeitenComprehension and Essay Writing Junior Judicial Assistant Delhi High Court 2012varaki786Noch keine Bewertungen

- Emery Landlord Dispute 2015Dokument2 SeitenEmery Landlord Dispute 2015Alex GeliNoch keine Bewertungen

- Property ValuationDokument2 SeitenProperty Valuationprazol112233Noch keine Bewertungen

- The East India CompanyDokument7 SeitenThe East India CompanyArman HbibNoch keine Bewertungen

- 3059 10-5 TenderBulletinDokument56 Seiten3059 10-5 TenderBulletinFadyNoch keine Bewertungen

- Property LawDokument10 SeitenProperty LawVaalu MuthuNoch keine Bewertungen

- Canadian Administrative Law MapDokument15 SeitenCanadian Administrative Law MapLeegalease100% (1)

- AD&D Crime and PunishmentDokument10 SeitenAD&D Crime and PunishmentI_NiemandNoch keine Bewertungen