Beruflich Dokumente

Kultur Dokumente

Company Report: Ativo Research's Investment Conclusion

Hochgeladen von

lurk29Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Company Report: Ativo Research's Investment Conclusion

Hochgeladen von

lurk29Copyright:

Verfügbare Formate

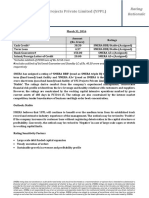

Company Report

October 23, 2009

COMPANY OVERVIEW STRONG SELL

Forecasted Upper Limit $ 3.76 IMMERSION CORP

Best Estimate $ 2.46

Forecasted Lower Limit $ 1.61 IMMR

Last Price $ 4.30

Rating Move: Downgraded

Ativo Research’s Investment Conclusion

Ativo Research projects as of this date that IMMR will GREATLY UNDERPERFORM the market averages over the Prior Change: Upgrade to Neutral 08/07/09

next 6 to 12 months leading to our decision of a STRONG SELL. Our decision is based on (1) valuation, which Sector: Computer Storage & Peripherals

compares the firm’s intrinsic value against the price of its stock, (2) intermediate and long-term price momentum, (3)

other measures of fundamental trend and (4) qualitative analysis. Asset Class: Microcap

Region: United States

Control IndexTM - History Most Control IndexTM

The Control IndexTM, which determines Ativo's

Unfavorable investment recommendation, incorporates seven

individual component scores. First having a Control

IndexTM score above 80 are rated as strong buys,

100 100 between 71 and 80 are rated as buys, between 21

through 70 are rated as neutral, between 11 through

20 are rated as sells, and below 11 are rated as strong

sells. The panel on the left presents an analysis of the

80 80 Control IndexTM. The line chart represents the score

of the component in the last year.

The bar chart to the left shows the range of the score

in the last three years. The red stripe indicates the

60 60 current/latest value and the dark blue bars bracketing

the stripe indicate the maximum and minimum values

of the score in the three years.

40 40

20 20

0 0

O N D J F M A M J J A S Three Year

Range

Rating Model Components Rating Model Components

The seven components of the Control IndexTM can be

grouped into three categories (1) Valuation, (2) Price

Overall Score 2 Momentum and (3) Fundamental Trend. All factors

incorporated in the overall score are assigned a

percentile score between 0 (low) and 100 (high)

based on each firm's relative position relative to all

other firms in the Ativo forecast universe. Scores that

Intrinsic Fair Value 7

are blank indicate that there is not enough

information to compute the score at this time. In such

Growth Adjusted Earnings Multiple (PEG) cases, the overall score is derived from the available

components

The valuation component comprises the Intrinsic Fair

Value and PEG scores. The momentum component

Price Momentum 11 comprises the Price Momentum score, which

incorporates both short and long term relative price

momentum of the stock to the market. The Earnings

Surprise, Sales Growth, Return on Investment Trend

and Return Since Last Turning Point scores make up

Earnings Surprise the Fundamental Trend component of the rating

model. The Valuation scores have the highest

Sales Growth weighting in the Control IndexTM .The weights of the

seven components are periodically modified

Return On Investment (ROI) Trend 2 depending upon market conditions and through a

proprietary feedback system which captures the

contribution towards alpha generated from each of

Return Since Last Turning Point 60

the components.

0 20 40 60 80 100

Ativo Research LLC Tel: 312.263.0027 Page 1 of 4

11 S LaSalle Street Suite 820 Fax: 312.263.0007

Chicago IL 60603-1232 www.ativoresearch.com

Company Report

October 23, 2009

TM

CONTROL INDEX COMPONENTS STRONG SELL

IMMR

Valuation Score - History Most Valuation:

Unfavorable Intrinsic Fair Value

100 100 This factor compares the current price with Ativo's

intermediate term target, which is based on cash

flow, profitability, discount rate forecasts, sales

growth and asset growth over a three-to-five year

80 80 period. Ativo's discount rate estimates are

continuously revised such that at any given time

approximately 50% of firms (capitalization

60 60 weighted) will be overvalued and 50% will be

undervalued.

Growth Adjusted Earnings

40 40 Multiple (PEG)

To derive this factor, the current P/E ratio is divided

by the per-share, inflation-adjusted asset growth.

20 20 This ratio incorporates a 52-week-out earnings

forecast which is updated on a weekly basis, and it

differs from the typical PEG ratio. The traditional

PEG ratio divides the earnings multiple by the

0 0 unadjusted earnings growth forecast, which includes

Three Year anticipated inflation, so it can not be used to compare

O N D J F M A M J J A S Range values from different time periods and it can not be

used to compare firms in different countries.

Price Momentum Score - History Price Momentum

Most Our overall price momentum score has two

components, Trend and Deviation.

Unfavorable

100 100 Deviation is the percentile ranking of the current

deviation of the firm’s relative stock price from the

39-week average pre-tax relative shareholder wealth

index, also adjusted for volatility.

80 80

By adjusting Trend and Deviation for past volatility

we are essentially standardizing them. The adjusted

60 60 variables capture only the meaningful variations in

the data. For example, a certain value of Trend

might be very significant for a stock with low

historical volatility, while it would be of less

40 40 significance for a stock with high historical

volatility. The adjustment we make is to divide the

unadjusted Trend and the unadjusted Deviation by

the logarithm of the past volatility of the relative

20 20 shareholder wealth index.

Fundamental Trend:

0 0

Three Year

Earnings Surprise

O N D J F M A M J J A S Range The earnings surprise component compares the

average of earnings surprises relative to forecasts for

the past two quarters.

Fundamental Trend Score - History Sales growth

This component is based on the percentage change

Average over the last two quarters of trailing four-quarter

100 100 sales per share.

Return on Investment (ROI)

Trend

80 80 This indicator measures the degree to which the

firm is improving its real economic performance

relative to the corporate sector as a whole. The

60 60 calculation evaluates the forecasted trend in ROI

over the next five fiscal years and then compares

that trend with actual performance over the past

three fiscal years.

40 40 Return Since Last Turning Point

This indicator recognizes that different firms can do

better or worse in different types of markets.

20 20 Performance is measured since the last market

turning point, which is identified by Ativo's ongoing

review as representing a fundamental change in the

character of market conditions. These turning points

0 0 typically unfold once or twice a year, often around

quarter-end dates. For a look at the most recent

O N D J F M A M J J A S Three Year

turning point, see page 3.

Range

Ativo Research LLC Tel: 312.263.0027 Page 2 of 4

11 S LaSalle Street Suite 820 Fax: 312.263.0007

Chicago IL 60603-1232 www.ativoresearch.com

Company Report

October 23, 2009

INDUSTRY/MARKET OVERVIEW STRONG SELL

IMMR Industry: Computer Storage & Peripherals

Competitor Control IndexTM Scores Industry Competitors

Investment decisions regarding individual firms

should be considered within the context of industry

IMMR 2 sectors. Although a specific stock may be highly

rated, investors will often wish to consider other

similar firms that may be rated even more highly.

ACTI 6

The horizontal bar chart compares IMMR to the

LCRD 47 firms in its sub-industry group closest in market

capitalization. In cases where five firms are not

available in the same sub-industry we picked firms in

PRST 1 the same industry group.

DTLK 2

TACT 27

0 20 40 60 80 100

Competitor Short Term Returns Competitor Short Term Returns

The graph on the left shows overall investment

performance for the selected firms, as well as

100% indicating the degree to which individual stocks are

moving together or apart. Firms in the upper-right

corner of the graph have been consistent relative

outperformers, while those in the lower-left corner

80% LCRD of the graph are persistent underperformers. Firms in

the upper-left corner have been weak in the medium

term, but strong more recently, and vice versa for

60% firms in the lower-right corner. The sizes of the

3 Month Return

circles indicate the relative market capitalizations of

the firms.

40%

20% PRST TACT

IMMR DTLK

0%

ACTI

-20%

-100% -50% 0% 50% 100% 150% 200%

1 Year Return

ATIVO Market Sentiment Indicators Market Sentiment Indicators

135 Ativo measures market sentiment by categorizing

factors affecting market performance. These factors

130 are tracked by calculating the performance of a

group of stocks that are sensitive to that particular

125 market factor.

The Cost of Capital Factors Index is comprised

120 of stocks that benefit from a drop in the cost of

capital.

115 The Flight to Safety Index measures the

performance of stocks in response to financial

110 strains and other crises.

The stocks in the GDP Factors Index thrive in

105 response to a rise in economic activity.

100 The goal of tracking these indexes is to capture

major changes in the market trend in order to make

95 strategic decisions going forward. These indexes are

updated and plotted weekly, as shown in the chart

90 on the left. Within three to five weeks the change in

market trend becomes obvious. The most recent

85 turning point was 3/6/2009.

A M J J A S O N D J F M A M J J A S O

Cost of Capital Factors Index GDP Factors Index Flight To Safety Factors Index

Ativo Research LLC Tel: 312.263.0027 Page 3 of 4

11 S LaSalle Street Suite 820 Fax: 312.263.0007

Chicago IL 60603-1232 www.ativoresearch.com

Company Report

October 23, 2009

IMPORTANT DISCLOSURES

Ratings

Definitions Ativo Investment Philosophy

Strong Buy 81 + Expected to significantly outperform the S&P 500 producing above Ativo's valuation framework is based on the

average returns. financial economics research pioneered by Merton

Miller, Franco Modigliani and others at the

Buy 71 - 80 Expected to outperform the S&P 500 producing above average returns. University of Chicago. Ativo's contribution is the

empirical validation and practical application that

Neutral 21 - 70 Expected to perform in line with the S&P 500 with average returns. make these principles useful in making investment

decisions. Ativo’s valuation approach incorporates

Sell 11 - 20 Expected to underperform the S&P 500 producing below-average discounted cash flow return on investment

returns. (DCFROI), cost of capital, growth and life-cycle

Strong Sell 1 - 10 Expected to significantly underperform the S&P 500 producing below theory.

below-average returns.

The Ativo framework incorporates two dimensions.

The fundamental valuation dimension recognizes

Based on traditional non-weighted percentiles, a stock would be assigned a percentile of X because it had that stock prices are primarily determined by future

cash flows and discount rates, each of which is

an Overall Score greater than the Overall Score of X% of the stocks. Our approach is based on weighted influenced by distinct and separate factors.

percentiles under which a stock is assigned a percentile of X because the sum of the market cap of all firms Fundamental data on all companies is normalized to

account for the effects of inflation and back out

with a worse or equal Overall Score is equal to X% of the total market cap of all firms. accounting distortions that can occur due to

flexibility in GAAP reporting. This process allows

us to correctly measure the assets employed and the

net cash receipts generated by companies. The

Coverage: As of the date this report was published, Ativo Research, LLC covered and rated resulting discounted cash flow return on investment

(DCFROI) reflects economic reality as opposed to

4290 companies with 13.9 % rated Strong Buy, 5.6% rated Buy, 47.4% rated accounting convention. The second dimension is

Neutral, 12.7% rated Sell and 20.4% rated Strong Sell. focused on momentum. Adding a sales and profits

momentum overlay to fundamental data improves

the quality of the resulting forecasts. Incorporating

price momentum along with volatility estimates

improves investment performance, recognizing that

Disclosures and Disclaimers – Ativo Research, LLC while fundamental valuation is the most important

Ativo Research, LLC (“Ativo”) produced this report in its entirety. The information presented in this long-term measure, short-term and medium-term

performance is often dominated by market trends,

report has been obtained from sources deemed to be reliable, but Ativo does not make any representation sector rotation, and investor sentiment. This

about the accuracy, completeness, or timeliness of this information. This report was produced by Ativo for momentum indicator is implemented by calculating

short and medium-term performance since the last

informational purposes only and nothing contained herein should be construed as an offer to buy or sell or “turning point”; a proprietary methodology that

as a solicitation of an offer to buy or sell any security or derivative instrument. This report is current only identifies significant character changes in the marke

as of the date that it was published and the opinions, estimates, ratings and other information may change

without notice or publication. Past performance is no guarantee of future results. Prior to making an

investment or other financial decision, please consult with your financial, legal and tax advisors. Ativo

shall not be liable for any party’s use of this report.

Ativo is not a broker-dealer and does not buy, sell, maintain a position, or make a market in any security

referred to herein. Ativo has not sought, nor does it intend to seek investment banking revenues from any

company discussed or referred to in this report. During the past 12 months, Ativo has not received

compensation from any company discussed or referred to in this report. An affiliate of Ativo may buy or

sell the securities referred to herein.

COPYRIGHT © 2009 Ativo Research, LLC. – Unauthorized duplication and distribution of this report is

strictly prohibited.

Ativo Research LLC Tel: 312.263.0027 Page 4 of 4

11 S LaSalle Street Suite 820 Fax: 312.263.0007

Chicago IL 60603-1232 www.ativoresearch.com

Das könnte Ihnen auch gefallen

- Stock and CommDokument11 SeitenStock and CommTed MaragNoch keine Bewertungen

- Palantir Stock Research 11.23.23 From FORD ResearchDokument3 SeitenPalantir Stock Research 11.23.23 From FORD Researchphysicallen1791Noch keine Bewertungen

- Aray FordDokument3 SeitenAray Fordphysicallen1791Noch keine Bewertungen

- Romeo Power Stock Analysis & RatingsDokument8 SeitenRomeo Power Stock Analysis & RatingsdbsuppNoch keine Bewertungen

- Sell Sell Sell Sell: Alteryx IncDokument5 SeitenSell Sell Sell Sell: Alteryx IncHsiehNoch keine Bewertungen

- SUNPHARMA StockReportDokument14 SeitenSUNPHARMA StockReportJyotishman SahaNoch keine Bewertungen

- Case Analysis (Cisco)Dokument9 SeitenCase Analysis (Cisco)Faisal SunnyNoch keine Bewertungen

- TASK-14: Submitted By: Anjali Kanwar Junior Research Analyst 22WM60 B2Dokument10 SeitenTASK-14: Submitted By: Anjali Kanwar Junior Research Analyst 22WM60 B2Anjali KanwarNoch keine Bewertungen

- ABANDO Answer Sheet (Ratio Analysis)Dokument3 SeitenABANDO Answer Sheet (Ratio Analysis)ALEXANDRINE NICOLE ABANDONoch keine Bewertungen

- Rossari Biotech Stock Pitch: Leading Specialty Chemical Firm with Strong GrowthDokument6 SeitenRossari Biotech Stock Pitch: Leading Specialty Chemical Firm with Strong GrowthTanmoy PramanikNoch keine Bewertungen

- Symphony Life (Symlife-Ku) : Earnings Per ShareDokument1 SeiteSymphony Life (Symlife-Ku) : Earnings Per ShareCf DoyNoch keine Bewertungen

- IBD Stock Checklist: Market Direction and Industry Group ForssrmDokument2 SeitenIBD Stock Checklist: Market Direction and Industry Group ForssrmPerry BeanNoch keine Bewertungen

- Sectorwatch Salesforce Partners - July 2018Dokument23 SeitenSectorwatch Salesforce Partners - July 2018Mike ParadisNoch keine Bewertungen

- Reuters Company Research: National Bank of Greece (ADR) (NBG)Dokument8 SeitenReuters Company Research: National Bank of Greece (ADR) (NBG)ScovillezNoch keine Bewertungen

- Arbutus Biopharma Corp. REPORT 11.29.23Dokument3 SeitenArbutus Biopharma Corp. REPORT 11.29.23physicallen1791Noch keine Bewertungen

- V33 C06 004kluoDokument9 SeitenV33 C06 004kluoanisdangasNoch keine Bewertungen

- UBER Stock Forecast, Price Targets and Analysts PredictionsDokument1 SeiteUBER Stock Forecast, Price Targets and Analysts Predictionsdaniel chuaNoch keine Bewertungen

- How Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountDokument11 SeitenHow Much Interest Is Your Broker Paying You?: Pays Up To 3.83% On Idle Cash in Your Brokerage AccountRenéNoch keine Bewertungen

- SMERA assigns BBB rating to YFC Projects Private LimitedDokument2 SeitenSMERA assigns BBB rating to YFC Projects Private Limitedlalit rawatNoch keine Bewertungen

- ICICIBANK StockReport 20231101 1053Dokument13 SeitenICICIBANK StockReport 20231101 1053SaadNoch keine Bewertungen

- Factsheet Bluechip DecDokument2 SeitenFactsheet Bluechip Decsiddeshkhandekar00Noch keine Bewertungen

- 3M India Share Price, Financials and Stock AnalysisDokument9 Seiten3M India Share Price, Financials and Stock AnalysisGaganNoch keine Bewertungen

- Reuters Company Research: Manitowoc Company, Inc. (MTW)Dokument8 SeitenReuters Company Research: Manitowoc Company, Inc. (MTW)ScovillezNoch keine Bewertungen

- Jamna Auto Share Price, Jamna Auto Stock Price, JDokument2 SeitenJamna Auto Share Price, Jamna Auto Stock Price, Jmuthu27989Noch keine Bewertungen

- IRB StockReport 20231024 0120Dokument14 SeitenIRB StockReport 20231024 0120Ashutosh AgarwalNoch keine Bewertungen

- DS Report Group 3 NNDokument16 SeitenDS Report Group 3 NNAmogh Parde (Finance 21-23)Noch keine Bewertungen

- Accel Entertainment Inc. $11.34 Rating: NeutralDokument3 SeitenAccel Entertainment Inc. $11.34 Rating: Neutralphysicallen1791Noch keine Bewertungen

- Indotech Transformers LimitedDokument6 SeitenIndotech Transformers LimitedMonika GNoch keine Bewertungen

- MICA Final Placement Report - 201Dokument12 SeitenMICA Final Placement Report - 201Nisha ChaudharyNoch keine Bewertungen

- ARAYDokument5 SeitenARAYphysicallen1791Noch keine Bewertungen

- Overview of Company: Ranks Amongst The Top 5 Private CompaniesDokument9 SeitenOverview of Company: Ranks Amongst The Top 5 Private Companiessimran salujaNoch keine Bewertungen

- Statistical Techniques - Brand Usage Profile Analysis BUPA - Client Friendly Explanation - InternalDokument9 SeitenStatistical Techniques - Brand Usage Profile Analysis BUPA - Client Friendly Explanation - InternalFangting DuNoch keine Bewertungen

- PENIND StockReport 20230828 1023Dokument14 SeitenPENIND StockReport 20230828 1023Chetan ChouguleNoch keine Bewertungen

- SADIF-Investment AnalyticsDokument12 SeitenSADIF-Investment AnalyticsTony ZhangNoch keine Bewertungen

- SURVIVING DOWNTURNS WITH LONG-TERM EARNINGS GROWTHDokument3 SeitenSURVIVING DOWNTURNS WITH LONG-TERM EARNINGS GROWTHsatish sNoch keine Bewertungen

- UntitledDokument8 SeitenUntitledTOSHAK SHARMANoch keine Bewertungen

- Company Research Highlights: Chemtura CorpDokument4 SeitenCompany Research Highlights: Chemtura CorpjaxstrawNoch keine Bewertungen

- Indian Premier League - FinalDokument12 SeitenIndian Premier League - FinalLucky Lucky67% (3)

- Stocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic TimesDokument4 SeitenStocks - Stocks From This Sector Have Rallied 2,100% Expect Good Times To Roll - The Economic Timeserkant007Noch keine Bewertungen

- Ep Del: Equity and Commodity Derivatives N SelioDokument7 SeitenEp Del: Equity and Commodity Derivatives N SelioMysterious 16Noch keine Bewertungen

- Reports CRMDokument11 SeitenReports CRMderek_2010Noch keine Bewertungen

- Stocks To Buy - Stocks That Held The Fort For 3 Best Performing PMSes in Last One Year - The Economic TimesDokument3 SeitenStocks To Buy - Stocks That Held The Fort For 3 Best Performing PMSes in Last One Year - The Economic TimesSam vermNoch keine Bewertungen

- Solved-Urban Outfitters ValuationDokument77 SeitenSolved-Urban Outfitters ValuationArslan HafeezNoch keine Bewertungen

- EFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUDokument1 SeiteEFI - FS Moderate Portolio ETP - 2023.Q3.EN - EUpderby1Noch keine Bewertungen

- Indigopnts Stockreport 20231022 2029Dokument14 SeitenIndigopnts Stockreport 20231022 2029Ayush SaxenaNoch keine Bewertungen

- Frequent Pattern To Promote Sale For Selling Associated Items For PDFDokument6 SeitenFrequent Pattern To Promote Sale For Selling Associated Items For PDFHillaryNoch keine Bewertungen

- Business Ststistics - RMB 104Dokument3 SeitenBusiness Ststistics - RMB 104Anup vermaNoch keine Bewertungen

- Icroeconomics: The Revenue Functions of A MonopolyDokument4 SeitenIcroeconomics: The Revenue Functions of A MonopolyChanguoi YOtoNoch keine Bewertungen

- INFIBEAM-StockReport-20230919-0135Dokument13 SeitenINFIBEAM-StockReport-20230919-0135sunny996316192Noch keine Bewertungen

- 2Dokument36 Seiten2Amit PoddarNoch keine Bewertungen

- 2 Titan India TP Report FY 2019Dokument76 Seiten2 Titan India TP Report FY 2019karthikkarunanidhi180997Noch keine Bewertungen

- BT Pro Rating ReportDokument13 SeitenBT Pro Rating ReportAY6061Noch keine Bewertungen

- Apollo Hospitals Enterprise Limited: Strong BUYDokument9 SeitenApollo Hospitals Enterprise Limited: Strong BUYakumar4uNoch keine Bewertungen

- Putting Technical Tools To The TestDokument2 SeitenPutting Technical Tools To The TestHomero García AlonsoNoch keine Bewertungen

- Blog 4 TablesDokument8 SeitenBlog 4 TablesTevaOnlineforBusinessNoch keine Bewertungen

- Statistical Analysis of Home Selling Prices in VirginiaDokument45 SeitenStatistical Analysis of Home Selling Prices in VirginiammdinarNoch keine Bewertungen

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Dokument5 SeitenPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNoch keine Bewertungen

- Vascon Engineers LTD Financial Results and PriceDokument1 SeiteVascon Engineers LTD Financial Results and PricePillu The DogNoch keine Bewertungen

- Fixed Operating Cost 40,000: T8.1 Calaulate Tollowng andDokument3 SeitenFixed Operating Cost 40,000: T8.1 Calaulate Tollowng andMavani snehaNoch keine Bewertungen

- Kisan Diwas - 2013Dokument9 SeitenKisan Diwas - 2013sumeetchhabriaNoch keine Bewertungen

- Sap Fico GlossaryDokument12 SeitenSap Fico Glossaryjohnsonkkuriakose100% (1)

- BILAX BrochureDokument8 SeitenBILAX BrochureJeremy GordonNoch keine Bewertungen

- Past BillsDokument9 SeitenPast BillsRahul BhatiaNoch keine Bewertungen

- Case Studies 1Dokument3 SeitenCase Studies 1Kenny Ang0% (2)

- Garantias Copikon VenezuelaDokument3 SeitenGarantias Copikon VenezuelaMaria SanzNoch keine Bewertungen

- Small Business & Entrepreneurship - Chapter 14Dokument28 SeitenSmall Business & Entrepreneurship - Chapter 14Muhammad Zulhilmi Wak JongNoch keine Bewertungen

- Belgian Ale by Pierre Rajotte (1992)Dokument182 SeitenBelgian Ale by Pierre Rajotte (1992)Ricardo Gonzalez50% (2)

- NewfundoptionextpitchesDokument6 SeitenNewfundoptionextpitchesSunil GuptaNoch keine Bewertungen

- GST Functional BOE Flow Phase2Dokument48 SeitenGST Functional BOE Flow Phase2Krishanu Banerjee89% (9)

- Setup QUAL2E Win 2000 PDFDokument3 SeitenSetup QUAL2E Win 2000 PDFSitole S SiswantoNoch keine Bewertungen

- William Mougayar: Designing Tokenomics and Tokens 2.0Dokument16 SeitenWilliam Mougayar: Designing Tokenomics and Tokens 2.0rammohan thirupasurNoch keine Bewertungen

- Peace Corps FINANCIAL ASSISTANTDokument1 SeitePeace Corps FINANCIAL ASSISTANTAccessible Journal Media: Peace Corps DocumentsNoch keine Bewertungen

- Business Development Manager Research in Chicago IL Resume Christine HorwitzDokument2 SeitenBusiness Development Manager Research in Chicago IL Resume Christine HorwitzChristineHorwitzNoch keine Bewertungen

- Pocket ClothierDokument30 SeitenPocket ClothierBhisma SuryamanggalaNoch keine Bewertungen

- Digest Fernandez Vs Dela RosaDokument2 SeitenDigest Fernandez Vs Dela RosaXing Keet LuNoch keine Bewertungen

- Print Control PageDokument1 SeitePrint Control PageCool Friend GksNoch keine Bewertungen

- 13-0389 Bus Times 157Dokument7 Seiten13-0389 Bus Times 157Luis DíazNoch keine Bewertungen

- ГОСТ 27693-2012Dokument66 SeitenГОСТ 27693-2012Carolyn HaleNoch keine Bewertungen

- Overview of Stock Transfer Configuration in SAP-WMDokument11 SeitenOverview of Stock Transfer Configuration in SAP-WMMiguel TalaricoNoch keine Bewertungen

- El Al.Dokument41 SeitenEl Al.Chapter 11 DocketsNoch keine Bewertungen

- Child Part Quality Plan1Dokument20 SeitenChild Part Quality Plan1Anonymous gZmpEpUXNoch keine Bewertungen

- From Homeless To Multimillionaire: BusinessweekDokument2 SeitenFrom Homeless To Multimillionaire: BusinessweekSimply Debt SolutionsNoch keine Bewertungen

- How To Remove Ink From Clothes - 11 Steps - Wikihow PDFDokument8 SeitenHow To Remove Ink From Clothes - 11 Steps - Wikihow PDFmilan_lahiruNoch keine Bewertungen

- El Trimestre Económico - Índice XXX AniversarioDokument100 SeitenEl Trimestre Económico - Índice XXX AniversarioJuanNoch keine Bewertungen

- Managing Account PortfoliosDokument14 SeitenManaging Account PortfoliosDiarra LionelNoch keine Bewertungen

- Fashion Cycle - Steps of Fashion CyclesDokument3 SeitenFashion Cycle - Steps of Fashion CyclesSubrata Mahapatra100% (1)

- Bermuda SWOT, Trade & EconomyDokument6 SeitenBermuda SWOT, Trade & EconomysreekarNoch keine Bewertungen

- Auditor's Cup Questions-2Dokument8 SeitenAuditor's Cup Questions-2VtgNoch keine Bewertungen

- gb10nb37lz 179Dokument10 Seitengb10nb37lz 179Jan RiskenNoch keine Bewertungen