Beruflich Dokumente

Kultur Dokumente

FA2P

Hochgeladen von

dainokaiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FA2P

Hochgeladen von

dainokaiCopyright:

Verfügbare Formate

4

Chapter

2

P2-1C S-Curve Disc Golf Course was opened on March 1 by Chris Heeren. The following

selected events and transactions occurred during March:

Mar. 1 Invested $30,000 cash in the business in exchange for common stock.

3 Purchased Barrys Golf Land for $18,000 cash. The price consists of land $15,000, shed

$2,000, and equipment $1,000. (Make one compound entry.)

5 Advertised the opening of the disc golf course, paying advertising expenses of

$500.

6 Paid cash $600 for a one-year insurance policy.

10 Purchased golf discs and other equipment for $1,100 from Disccraft Company

payable in 30 days.

18 Received $740 in cash for golf fees earned.

19 Sold 100 coupon books for $10 each. Each book contains 4 coupons that enable the

holder to play one round of disc golf.

25 Declared and paid a $400 cash dividend.

30 Paid salaries of $250.

30 Paid Disccraft Company in full.

31 Received $500 cash for fees earned.

Chris Heeren uses the following accounts: Cash, Prepaid Insurance, Land, Buildings, Equipment,

Accounts Payable, Unearned Revenue, Common Stock, Dividends, Golf Revenue, Advertising

Expense, and Salaries Expense.

Instructions

Journalize the March transactions.

P2-2C Stefan Gwenani is a licensed architect. During the first month of the operation of her

business, the following events and transactions occurred.

April 1 Stockholders invested $25,000 cash in exchange for common stock.

1 Hired a secretary-receptionist at a salary of $700 per week payable monthly.

2 Paid office rent for the month $900.

3 Purchased architectural supplies on account from Sky Company $4,000.

10 Completed blueprints on a structure and billed the client $3,700.

11 Received $2,000 cash advance from Micheala Falk.

20 Received $2,100 cash for services completed and delivered to John Carl.

30 Paid secretary-receptionist for the month $2,800.

30 Paid $1,600 to Sky Company for accounts payable due.

Stefan uses the following chart of accounts: No. 101 Cash, No. 112 Accounts Receivable, No. 126

Supplies, No. 201 Accounts Payable, No. 209 Unearned Revenue, No. 311 Common Stock;

No. 400 Service Revenue, No. 726 Salaries Expense, and No. 729 Rent Expense.

Instructions

(a) Journalize the transactions.

(b) Post to the ledger accounts.

(c) Prepare a trial balance on April 30, 2011.

P2-3C Clapton Services was formed on May 1, 2011. The following transactions took place

during the first month.

Transactions on May 1:

1. Stockholders invested $70,000 cash in exchange for common stock.

2. Hired two employees to work in the warehouse. They will each be paid a salary of $3,000 per

month.

3. Signed a 2-year rental agreement on a warehouse; paid $18,000 cash in advance for the first year.

4. Purchased furniture and equipment costing $30,000. A cash payment of $5,000 was made im-

mediately; the remainder will be paid in 6 months.

5. Paid $1,680 cash for a one-year insurance policy on the furniture and equipment.

PROBLEMS: SET C

Journalize a series of

transactions.

(SO 2, 4)

Journalize transactions, post,

and prepare a trial balance.

(SO 2, 4, 6, 7)

Trial balance totals $35,200

Journalize transactions, post,

and prepare a trial balance.

(SO 2, 4, 6, 7)

Problems: Set C 5

Transactions during the remainder of the month:

6. Purchased basic office supplies for $500 cash.

7. Purchased more office supplies for $1,500 on account.

8. Total revenues earned were $21,000$8,000 cash and $13,000 on account.

9. Paid $400 to suppliers for accounts payable due.

10. Received $3,000 from customers in payment of accounts receivable.

11. Received utility bills in the amount of $200, to be paid next month.

12. Paid the monthly salaries of the two employees, totalling $6,000.

Instructions

(a) Prepare journal entries to record each of the events listed. (Omit explanations.)

(b) Post the journal entries to T accounts.

(c) Prepare a trial balance as of May 31, 2011.

P2-4C The trial balance of Hammermeister Co. shown below does not balance.

HAMMERMEISTER CO.

Trial Balance

June 30, 2011

Debit Credit

Cash $ 3,424

Accounts Receivable $ 2,731

Supplies 2,000

Equipment 2,600

Accounts Payable 3,657

Unearned Revenue 1,184

Common Stock 8,000

Dividends 800

Service Revenue 3,280

Salaries Expense 3,100

Office Expense 810

$13,225 $18,361

Each of the listed accounts has a normal balance per the general ledger. An examination of the

ledger and journal reveals the following errors.

1. Cash received from a customer in payment of its account was debited for $490, and Accounts

Receivable was credited for the same amount. The actual collection was for $940.

2. The purchase of a computer on account for $1,200 was recorded as a debit to Supplies for

$1,200 and a credit to Accounts Payable for $1,200.

3. Services were performed on account for a client for $900. Accounts Receivable was debited

for $900, and Service Revenue was credited for $90.

4. A debit posting to Salaries Expense of $800 was omitted.

5. A payment of a balance due for $306 was credited to Cash for $306 and credited to Accounts

Payable for $360.

6. The payment of a $600 cash dividend was debited to Salaries Expense for $600 and credited

to Cash for $600.

Instructions

Prepare a correct trial balance. (Hint: It helps to prepare the correct journal entry for the trans-

action described and compare it to the mistake made.)

P2-5C The Hose Theater, owned by Josh Hossan, will begin operations in March. The Hose

will be unique in that it will show only triple features of sequential theme movies. As of March 1,

the ledger of Hose showed: No. 101 Cash $9,000, No. 140 Land $15,000, No. 145 Buildings (con-

cession stand, projection room, ticket booth, and screen) $30,000, No. 157 Equipment $10,000,

No. 201 Accounts Payable $7,000, and No. 311 Common Stock $57,000. During the month of

March the following events and transactions occurred.

Mar. 2 Rented three Star Wars movies to be shown for the first 3 weeks of March. The film

rental was $4,500; $1,500 was paid in cash and $3,000 will be paid on March 10.

3 Ordered three Star Trek movies to be shown the last 10 days of March. It will cost $400

per night.

Trial balance totals $117,300

Prepare a correct trial balance.

(SO 7)

Trial balance totals $16,265

Journalize transactions, post,

and prepare a trial balance.

(SO 2, 4, 6, 7)

6 Chapter 2 Problems: Set C

Mar. 9 Received $5,000 cash from admissions.

10 Paid balance due on Star Wars movies rental and $2,100 on March 1 accounts

payable.

11 Hose Theater contracted with Mike Faulk to operate the concession stand. Faulk is to

pay 15% of gross concession receipts (payable monthly) for the right to operate the

concession stand.

12 Paid advertising expenses $500.

20 Received $6,000 cash from customers for admissions.

20 Received the Star Trek movies and paid the rental fee of $4,000.

31 Paid salaries of $2,500.

31 Received statement from Mike Faulk showing gross receipts from concessions of

$7,000 and the balance due to Hose Theater of $1,050 ($7,000 15%) for March. Faulk

paid one-half the balance due and will remit the remainder on April 5.

31 Received $10,000 cash from customers for admissions.

In addition to the accounts identified above, the chart of accounts includes: No. 112 Accounts

Receivable, No. 405 Admission Revenue, No. 406 Concession Revenue, No. 610 Advertising

Expense, No. 632 Film Rental Expense, and No. 726 Salaries Expense.

Instructions

(a) Enter the beginning balances in the ledger. Insert a check mark () in the reference column

of the ledger for the beginning balance.

(b) Journalize the March transactions.

(c) Post the March journal entries to the ledger. Assume that all entries are posted from page 1

of the journal.

(d) Prepare a trial balance on March 31, 2011. Trial balance totals $69,800

Das könnte Ihnen auch gefallen

- Chapter 2 SolutionDokument19 SeitenChapter 2 SolutionabeeraNoch keine Bewertungen

- Ifrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeDokument54 SeitenIfrs Edition: Prepared by Coby Harmon University of California, Santa Barbara Westmont CollegeUltramen CosmosNoch keine Bewertungen

- 4 Completing The Accounting Cycle PartDokument1 Seite4 Completing The Accounting Cycle PartTalionNoch keine Bewertungen

- KASUS Pertemuan 6Dokument2 SeitenKASUS Pertemuan 6Errol FerdianzyahNoch keine Bewertungen

- NML Serie 44 Indonesia Maritime HotspotDokument108 SeitenNML Serie 44 Indonesia Maritime Hotspotabdul malik al fatahNoch keine Bewertungen

- Position Paper From Delegate of Timor LesteDokument3 SeitenPosition Paper From Delegate of Timor LesteJhoy FalsonNoch keine Bewertungen

- CH 7Dokument9 SeitenCH 7Karina AcostaNoch keine Bewertungen

- Accounting Cash Flow StatementDokument9 SeitenAccounting Cash Flow StatementAbiNoch keine Bewertungen

- Chapter 9 Economic Growth II. Technology, Empirics, and PolicyDokument7 SeitenChapter 9 Economic Growth II. Technology, Empirics, and PolicyJoana Marie CalderonNoch keine Bewertungen

- Contingencies Presented Below Are Three Independent Situations PDFDokument1 SeiteContingencies Presented Below Are Three Independent Situations PDFAnbu jaromiaNoch keine Bewertungen

- CV Didik Pradjoko Departemen of History Faculty of Humanities University of IndonesiaDokument9 SeitenCV Didik Pradjoko Departemen of History Faculty of Humanities University of Indonesiairwanbasri86Noch keine Bewertungen

- Multinational Corporations and The Erosion of State SovereigntyDokument4 SeitenMultinational Corporations and The Erosion of State SovereigntyPolar Ice100% (1)

- Thailand Country ReportDokument31 SeitenThailand Country ReportrinaldiNoch keine Bewertungen

- Dampak Pencemaran Waduk Saguling Terhadap Budidaya Ikan Jaring TerapungDokument21 SeitenDampak Pencemaran Waduk Saguling Terhadap Budidaya Ikan Jaring TerapungYudha ArdanaNoch keine Bewertungen

- Tutorial 2Dokument2 SeitenTutorial 2KHANH Du NgocNoch keine Bewertungen

- Brief Summary of New ZealandDokument3 SeitenBrief Summary of New ZealandJesusa VillanuevaNoch keine Bewertungen

- MODELING ISLAND REGION DEVELOPMENTDokument14 SeitenMODELING ISLAND REGION DEVELOPMENTAisa100% (1)

- CH 17Dokument6 SeitenCH 17Rabie HarounNoch keine Bewertungen

- Problems: Set B: InstructionsDokument2 SeitenProblems: Set B: InstructionsflrnciairnNoch keine Bewertungen

- Processing Accounting Information: QuestionsDokument57 SeitenProcessing Accounting Information: QuestionsYousifNoch keine Bewertungen

- Hawaiian Traditions and DancesDokument4 SeitenHawaiian Traditions and DancesAnugrah WijagauNoch keine Bewertungen

- Dampak Perang Rusia-Ukraina Terhadap Perekonomian IndonesiaDokument6 SeitenDampak Perang Rusia-Ukraina Terhadap Perekonomian IndonesiaHASAN SAIFULLAH EKONOMI SYARIAHNoch keine Bewertungen

- SEO Optimized Trial Balance for Cruise TheaterDokument4 SeitenSEO Optimized Trial Balance for Cruise Theaterايهاب غزالةNoch keine Bewertungen

- Chapter 4 AssignmentDokument3 SeitenChapter 4 Assignmentfatima airis aradais100% (1)

- Fin. Acc - Chapter-2 JournalDokument4 SeitenFin. Acc - Chapter-2 JournalFayez AmanNoch keine Bewertungen

- CH 02Dokument3 SeitenCH 02vivienNoch keine Bewertungen

- CH 1 ProblemsDokument8 SeitenCH 1 Problemsbangun7770% (1)

- Holz Disc Golf Course March TransactionsDokument3 SeitenHolz Disc Golf Course March TransactionsJunnieNoch keine Bewertungen

- Accounting Questions 22Dokument3 SeitenAccounting Questions 22rln0518Noch keine Bewertungen

- Q1. Frontier Park Was Started On April 1 by H. Hillenmeyer. The Following Selected Events and Transactions Occurred During AprilDokument3 SeitenQ1. Frontier Park Was Started On April 1 by H. Hillenmeyer. The Following Selected Events and Transactions Occurred During AprilShamun Zia100% (1)

- Chapter 2 Math For PracticeDokument3 SeitenChapter 2 Math For Practiceehratul.bagNoch keine Bewertungen

- Journal ClassDokument1 SeiteJournal ClassKhondokar ShantoNoch keine Bewertungen

- Problems Set CDokument5 SeitenProblems Set CDiem Khoa PhanNoch keine Bewertungen

- Problem Set 1 SolutionsDokument15 SeitenProblem Set 1 SolutionsCosta Andrea67% (3)

- 1 Accounting-Week-2assignmentsDokument4 Seiten1 Accounting-Week-2assignmentsTim Thiru0% (1)

- Fin. Acc. Chapter-2 Tabular AnalysisDokument2 SeitenFin. Acc. Chapter-2 Tabular AnalysisFayez AmanNoch keine Bewertungen

- Journalizing - ExercisesDokument6 SeitenJournalizing - ExercisesSophia Criciel GumatayNoch keine Bewertungen

- ACC 205 Complete Class HomeworkDokument41 SeitenACC 205 Complete Class HomeworkAvicciNoch keine Bewertungen

- Wild Chap 1Dokument7 SeitenWild Chap 1Rahul GargNoch keine Bewertungen

- Accounting Final SyllabusDokument8 SeitenAccounting Final SyllabusRoufRobin0% (1)

- CH 01Dokument2 SeitenCH 01vivien0% (1)

- Fundamentals of Accounting-I WorksheetDokument7 SeitenFundamentals of Accounting-I WorksheetLee HailuNoch keine Bewertungen

- FA3PDokument4 SeitenFA3PdainokaiNoch keine Bewertungen

- Quest 1Dokument7 SeitenQuest 1btetarbeNoch keine Bewertungen

- Accounting II Chapters 12, 13, 14 ReviewDokument10 SeitenAccounting II Chapters 12, 13, 14 ReviewJacKFrost1889Noch keine Bewertungen

- 2-1A, 2A QsDokument2 Seiten2-1A, 2A QsA.K.M. Rubyat Hasan ApuNoch keine Bewertungen

- 01 FA Practice Handout (16!08!12)Dokument7 Seiten01 FA Practice Handout (16!08!12)Makhmoor SyedNoch keine Bewertungen

- Exercises 1Dokument8 SeitenExercises 1Altaf HussainNoch keine Bewertungen

- Tutorial Before UTS Peng Akun 1Dokument11 SeitenTutorial Before UTS Peng Akun 1Fanji AriefNoch keine Bewertungen

- Fundamental - I WorksheetDokument3 SeitenFundamental - I WorksheetuuuNoch keine Bewertungen

- Chapter 1 and 2Dokument5 SeitenChapter 1 and 2Kei HanzuNoch keine Bewertungen

- ACC 205 Complete Class HomeworkDokument40 SeitenACC 205 Complete Class HomeworkSwadesh BangladeshNoch keine Bewertungen

- Soal LatihanDokument15 SeitenSoal LatihanRafi FarrasNoch keine Bewertungen

- Excercise Chapter 2Dokument2 SeitenExcercise Chapter 2Loan VũNoch keine Bewertungen

- BU8101 Sem3 - Group 11Dokument63 SeitenBU8101 Sem3 - Group 11Shweta SridharNoch keine Bewertungen

- Caribbean Examinations CouncilDokument4 SeitenCaribbean Examinations CouncilAneilRandyRamdialNoch keine Bewertungen

- (Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailDokument3 Seiten(Academic Review and Training School, Inc.) 2F & 3F Crème BLDG., Abella ST., Naga City Tel No.: (054) 472-9104 E-MailMichael BongalontaNoch keine Bewertungen

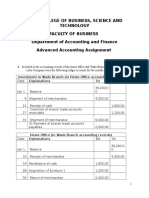

- Hope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentDokument6 SeitenHope College of Business, Science and Technology Faculty of Business Department of Accounting and Finance Advanced Accounting AssignmentShumebeza BaylleNoch keine Bewertungen

- Conta FinancieraDokument21 SeitenConta FinancieraAdrian TajmaniNoch keine Bewertungen

- Analyze Financial StatementsDokument2 SeitenAnalyze Financial StatementsRabie HarounNoch keine Bewertungen

- Erli Chen Fabrication III - EtchingDokument18 SeitenErli Chen Fabrication III - EtchingG Karthik ReddyNoch keine Bewertungen

- Calculation of Earthing and Screening EffectsDokument10 SeitenCalculation of Earthing and Screening EffectsVictor AgueroNoch keine Bewertungen

- Learn Any Language in 6 MonthsDokument6 SeitenLearn Any Language in 6 Monthsdainokai100% (2)

- Awea Permitting Small WindDokument44 SeitenAwea Permitting Small Windyuvarajnarayanasamy100% (1)

- High Voltage Engineering (Lucas)Dokument212 SeitenHigh Voltage Engineering (Lucas)myerten100% (6)

- Underground Cable Installation Manual WordDokument74 SeitenUnderground Cable Installation Manual Worddainokai100% (2)

- FA3PDokument4 SeitenFA3PdainokaiNoch keine Bewertungen

- FA1PDokument3 SeitenFA1PdainokaiNoch keine Bewertungen

- Islanding Detection and Control of Islanded Single and Two-Parallel Distributed Generation Units PDFDokument131 SeitenIslanding Detection and Control of Islanded Single and Two-Parallel Distributed Generation Units PDFdainokaiNoch keine Bewertungen

- Nonlinear-Coupled Electric-Thermal Modeling of Underground Cable SystemsDokument11 SeitenNonlinear-Coupled Electric-Thermal Modeling of Underground Cable SystemsdainokaiNoch keine Bewertungen

- High-Voltage Underground CableDokument1 SeiteHigh-Voltage Underground CabledainokaiNoch keine Bewertungen

- 5 Transfer of OwnershipDokument14 Seiten5 Transfer of OwnershipDesai SarvidaNoch keine Bewertungen

- Accounting Standards For Islamic BanksDokument79 SeitenAccounting Standards For Islamic BanksAlma AlmicaNoch keine Bewertungen

- Answer To Ejectment ComplaintDokument4 SeitenAnswer To Ejectment ComplaintKayelyn Lat75% (4)

- Classified Advertising: Ramadan Ramadan Timing TimingDokument2 SeitenClassified Advertising: Ramadan Ramadan Timing TimingSwamy Dhas DhasNoch keine Bewertungen

- FLORIDA REAL ESTATE LAW GUIDEDokument10 SeitenFLORIDA REAL ESTATE LAW GUIDErclemente010% (1)

- TACTICAL FINANCING DECISIONSDokument24 SeitenTACTICAL FINANCING DECISIONSAccounting TeamNoch keine Bewertungen

- Business Mathematics FinalDokument93 SeitenBusiness Mathematics FinalEbisa Deribie100% (1)

- Econ 301 Past Final Exams With SolutionsDokument18 SeitenEcon 301 Past Final Exams With SolutionsmauveskiersNoch keine Bewertungen

- Frontline Relocation BrochureDokument8 SeitenFrontline Relocation Brochurecheru6715Noch keine Bewertungen

- Punjab Municipal Act 1911 PDFDokument17 SeitenPunjab Municipal Act 1911 PDFAnonymous 4cxYhRej9Noch keine Bewertungen

- 89Dokument90 Seiten89tariquewali11Noch keine Bewertungen

- Now This Rent Agreement Witnesseth As Under:-FIXED-TERM AGREEMENT: Tenants Agree To Rent This Dwelling For A Fixed Term of 11 MonthsDokument3 SeitenNow This Rent Agreement Witnesseth As Under:-FIXED-TERM AGREEMENT: Tenants Agree To Rent This Dwelling For A Fixed Term of 11 Monthssalman khanNoch keine Bewertungen

- Land Module Handbook - Single HonoursDokument42 SeitenLand Module Handbook - Single HonoursEdwin OlooNoch keine Bewertungen

- Negros Navigation Co., Inc. and SubsidiariesDokument48 SeitenNegros Navigation Co., Inc. and SubsidiarieskgaviolaNoch keine Bewertungen

- Land Laws..Dokument17 SeitenLand Laws..Mayuri KhandelwalNoch keine Bewertungen

- Encouraging Low Cost Home Ownership in East Lothian A Feasibility StudyDokument91 SeitenEncouraging Low Cost Home Ownership in East Lothian A Feasibility StudytheredcornerNoch keine Bewertungen

- Civil Law Bar Exam: Damages for Death of Unborn ChildDokument13 SeitenCivil Law Bar Exam: Damages for Death of Unborn ChildAlyk Tumayan CalionNoch keine Bewertungen

- Schedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Dokument10 SeitenSchedule of Taxes - 2020-2021 South MCD (Commisioner Proposal)Cool-tigerNoch keine Bewertungen

- Property Tax BookDokument187 SeitenProperty Tax BookgokedaNoch keine Bewertungen

- Module-Leasing and Hire Purchase Calculation of Lease RentalsDokument5 SeitenModule-Leasing and Hire Purchase Calculation of Lease RentalsSINDHU NNoch keine Bewertungen

- OCA Affidavit for Business PermitDokument2 SeitenOCA Affidavit for Business Permitaira alyssa caballeroNoch keine Bewertungen

- Enterprise Rental Agreement 68LK2HDokument3 SeitenEnterprise Rental Agreement 68LK2HDan YoungNoch keine Bewertungen

- Real Estate Economics QuestionsDokument6 SeitenReal Estate Economics QuestionsJuan Carlos Nocedal100% (3)

- Guia de Venta de Inmuebles WAELLIS UKDokument2 SeitenGuia de Venta de Inmuebles WAELLIS UKjalpe1000Noch keine Bewertungen

- Taxation of Non-Bank Financial Intermediaries PhilippinesDokument12 SeitenTaxation of Non-Bank Financial Intermediaries Philippinesjosiah9_5Noch keine Bewertungen

- UntitledDokument17 SeitenUntitledapi-26443221Noch keine Bewertungen

- Tamil Nadu Government Gazette: Part III-Section 1 (A)Dokument12 SeitenTamil Nadu Government Gazette: Part III-Section 1 (A)foreswarcontactNoch keine Bewertungen

- Neill-Wycik Owner's Manual From 1975-1976 PDFDokument22 SeitenNeill-Wycik Owner's Manual From 1975-1976 PDFNeill-WycikNoch keine Bewertungen

- Baltimore Afro-American Newspaper, October 9, 2010Dokument20 SeitenBaltimore Afro-American Newspaper, October 9, 2010The AFRO-American NewspapersNoch keine Bewertungen

- Bar Review Lecture - VATDokument71 SeitenBar Review Lecture - VATIsagani DionelaNoch keine Bewertungen