Beruflich Dokumente

Kultur Dokumente

06-Valuation & Cash Flow Analysis

Hochgeladen von

Pooja Ratra0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

384 Ansichten7 Seitenvaluation

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenvaluation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

384 Ansichten7 Seiten06-Valuation & Cash Flow Analysis

Hochgeladen von

Pooja Ratravaluation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

True-False

1. Estimating the worth of a company, one of its operating units, or its

ownership shares involves stock valuation.

2. Cash flow assessment plays a central role in analyzing the credit risk of

a company.

3. Operating cash flow minus cash outlays to replace existing operating

capacity is free cash flow.

4. The amount available to finance planned expansion of operating ca-

pacity, reduce debt, pay dividends, or repurchase stock is distributable cash

flow.

5. In applying the discounted free cash flow valuation model, the discount

rate used is the average cost of capital.

6. A simplified version of the discounted free cash flow valuation model

assumes a zero-growth perpetuity for future cash flows. This assumption is best

applied to growth companies with stable cash flow patterns.

7. FASB believes that the most useful predictor of future cash flows is

future accrual accounting earnings.

8. Accrual accounting produces an earnings number that smoothes out

the unevenness in year-to-year cash flows, and provides an estimate of sustain-

able annualized long-run future free cash flows.

9. The two most significant explanations for variations in the earnings

multiple are risk differences and maturity of the firm.

10. A component that is valuation-relevant and expected to persist into the

future is a permanent earnings component.

11. A component that is unrelated to future free cash flows or future earn-

ings and is not pertinent to assessing current share price is a noise component.

12. Extraordinary gains and losses are regarded as value irrelevant earn-

ings.

13. Earnings are considered high quality when they are reliable.

14. As transitory components become a more important part of a firms

reported earnings, the reported earnings are more quality enhanced.

15. Firms that earn less than the cost of equity capital produce negative

abnormal earnings.

16. A firm has earnings above the cost of debt financing if the return on

equity exceeds the return on assets.

17. An earnings surprise results from incorrect estimates of future earn-

ings.

18. A term lending agreement has an original maturity of more than 1 year

but less than 5 years.

19. A bond that has collateral to protect the bondholder is referred to as a

debenture bond.

20. The written agreement between the borrowing company and its credi-

tors is referred to as the indenture.

Multiple-Choice Questions

Select the best answer from those provided.

21. The corporate valuation approach uses basic accounting measures to

assess the amount, timing, and

a. certainty of a companys past operating cash flows or earnings.

b. certainty of a companys future non-operating cash flows or earnings.

c. uncertainty of a companys future operating cash flows or earnings.

d. uncertainty of a companys future non-operating cash flows or earn-

ings.

22. The steps involved in corporate valuation are forecasting future values

of some financial attribute that drives a companys value, determining the risk

associated with that forecasted value, and determining the

a. future values of the value-relevant attribute.

b. certain future value of earnings.

c. present value of a companys earnings.

d. discounted present value of the expected future values of the value-

relevant attribute.

23. According to the discounted free cash flow valuation model, the market

value of common shares depends upon investors

a. future expectations about the future economic prospects of free cash

flows.

b. current expectations about the future economic prospects of free cash

flows.

c. future expectations about the current economic prospects of free cash

flows.

d. current expectations about the current economic prospects of free cash

flows.

24. A simplified version of the discounted free cash flow valuation model

assumes a zero-growth perpetuity for future cash flows. This assumption is best

applied to

a. start-up companies with stable cash flow patterns.

b. growth companies with increasing cash flow patterns.

c. growth companies with stable cash flow patterns.

d. mature firms with stable cash flow patterns.

1 06-Valuation & Cash Flow Analysis

25. Recent research indicates that stock returns correlate better with

a. accrual earnings than realized operating cash flows.

b. cash basis earnings than realized operating cash flows.

c. realized operating cash flows than accrual earnings.

d. future operating cash flows than accrual earnings.

26. The reciprocal of the risk-adjusted equity cost of capital used is the

a. return on assets.

b. return on common equity.

c. price earnings ratio.

d. profit margin on sales.

27. If a company currently earns $5.00 per share, and has a risk-adjusted

cost of equity capital of 9%, a share of common stock should theoretically sell

for

a. $ 0.45.

b. $ 5.00.

c. $ 48.00.

d. $ 55.55.

28. If a company currently earns $6.00 per share, and has a risk-adjusted

cost of equity capital of 12.5%, a share of common stock should theoretically

sell for

a. $ 0.75.

b. $ 6.00.

c. $ 48.00.

d. $ 75.75.

29. If most firms price/earnings ratios are between 10 and 15, what is the

range of average risk-adjusted equity cost of capital?

a. 6.67% to 10%

b. 6.67% to 15%

c. 10% to 15%

d. 10% to 16.67%

30. Risky firms have a higher risk-adjusted cost of capital. Which one of

the following factors would contribute to that firm also having a high

price/earnings ratio?

a. High earnings per share

b. Low earnings per share

c. Growth opportunities

d. High risk and high P/E ratio cannot occur simultaneously.

31. To obtain a better current price, the net present value of future growth

opportunities (NPVGO) can be calculated and

a. added to the price per share calculated from the P/E ratio.

b. subtracted from the price per share calculated from the P/E ratio.

c. multiplied by the price per share calculated from the P/E ratio.

d. divided into the price per share calculated from the P/E ratio.

32. The net present value of future growth opportunities will contribute to

an above average P/E multiple when the retention ratio (k) is

a. positive and the return on new investment is lower than the cost of

equity capital.

b. positive and the return on new investment is greater than the cost of

equity capital.

c. negative and the return on new investment is lower than the cost of

equity capital.

d. negative and the return on new investment is greater than the cost of

equity capital.

33. A component that is valuation-relevant but is not expected to persist

into the future is a

a. permanent earnings component.

b. transitory earnings component.

c. noise component.

d. quiet component.

34. Income from continuing operations, excluding special or nonrecurring

items, is regarded as

a. permanent earnings.

b. transitory earnings.

c. value-irrelevant earnings.

d. quiet.

35. Income or loss from discontinued operations is regarded as

a. permanent earnings.

b. transitory earnings.

c. value-irrelevant earnings.

d. quiet.

36. A cumulative effect adjustment to income due to a change in account-

ing principles is regarded as

a. permanent earnings.

b. transitory earnings.

2 06-Valuation & Cash Flow Analysis

c. value-irrelevant earnings.

d. quiet.

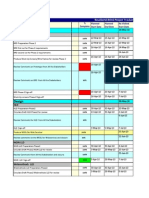

Table 6-1

Firm A Firm B Firm C

Reported EPS $12 $15 $18

Analysts EPS decomposition:

Permanent component (P = 5) 80% 60% 75%

Transitory component (T = 1) 10% 35% 25%

Value-irrelevant component (0 = 0) 10% 5% 0%

37. Refer to Table 6-1. The implied share price of Firm As stock is

a. $12.00.

b. $48.00.

c. $49.20.

d. $54.40.

38. Refer to Table 6-1. The implied share price of Firm Bs stock is

a. $15.00.

b. $45.00.

c. $50.25.

d. $55.25.

39. Refer to Table 6-1. The implied share price of Firm Cs stock is

a. $18.00.

b. $63.00.

c. $72.00.

d. $90.00.

40. Refer to Table 6-1. The implied total earnings multiple of Firm A is

a. 1.00.

b. 4.10.

c. 5.00.

d. 10.00.

41. Refer to Table 6-1. The implied total earnings multiple of Firm B is

a. 1.00.

b. 3.00.

c. 3.35.

d. 12.00.

42. Refer to Table 6-1. The implied total earnings multiple of Firm C is

a. 1.00.

b. 3.75.

c. 4.00.

d. 15.00.

43. Which one of the following is an example of sustainable earnings?

a. Loss from debt retirement

b. Expenditures for advertising

c. Earnings from repeat customers

d. Gain from corporate restructuring

44. As transitory components become a more important part of a firms

reported earnings, the reported earnings

a. become a more reliable indicator of sustainable cash flows.

b. are more quality enhanced.

c. are a more reliable indicator of fundamental value.

d. are a less reliable indicator of sustainable cash flows.

45. The assessment of earnings quality is best accomplished through the

use of which one of the following?

a. Single-step financial statements

b. Balance sheet and cash flow statement

c. Multi-step income statement, balance sheet, and cash flow statement

d. Single-step income statement, balance sheet, and cash flow statement

46. According to the abnormal earnings approach of equity valuation, in-

vestors willingly pay a premium for those firms that

a. earn less than the cost of equity capital.

b. produce negative abnormal earnings.

c. produce positive abnormal earnings.

d. earn an amount equal to the equity cost of capital.

47. Firms that earn less than the cost of equity capital have a share price

a. above the market average.

b. equal to book value.

c. above book value.

d. below book value.

48. The price of equity at time 0 is equal to the

a. book value of equity at time 0.

b. expected abnormal earnings in all future periods.

3 06-Valuation & Cash Flow Analysis

c. book value of equity at time 0 plus expected abnormal earnings in all

future periods divided by discount factors for all future periods.

d. book value of equity at time 0 minus expected abnormal earnings in all

future periods divided by discount factors for all future periods.

49. What are the abnormal earnings of a firm that has NOPAT of $40,000

with an equity cost of capital of 10%, when the book value at the beginning of

period is $800,000?

a. $ (40,000)

b. $ (80,000)

c. $ 40,000

d. $ 80,000

Table 6-2

Firm A Firm B Firm C

NOPAT $6,000 $14,000 $18,000

r 10% 8% 12%

BVt

1

$100,000 $150,000 $190,000

50. Refer to Table 6-2. What are the abnormal earnings for Firm A?

a. $ (4,000)

b. $ (6,000)

c. $ 4,000

d. $ 6,000

51. Refer to Table 6-2. What are the abnormal earnings for Firm B?

a. $ 1,000

b. $ 2,000

c. $ 12,000

d. $ 14,000

52. Refer to Table 6-2. What are the abnormal earnings for Firm C?

a. $ (2,400)

b. $ (4,800)

c. $ 4,800

d. $ 9,600

53. Refer to Table 6-2. Assume that Firm A can increase NOPAT by $4,000,

by cutting costs. Abnormal earnings would be

a. $ (1,000).

b. $ 0.

c. $ 1,000.

d. $ 1,500.

54. Refer to Table 6-2. Assume that Firm B can divest itself of $20,000 of

unproductive capital with NOPAT falling by only $3,000. Abnormal earnings are

a. $200.

b. $400.

c. $600.

d. $800.

55. A company with a return on equity that consistently exceeds the indus-

try average ROE will generally have shares that sell at a

a. market-to-book ratio equal to the industry average.

b. lower market-to-book ratio than the industry average.

c. higher market-to-book ratio than the industry average.

d. higher market price than its competitors.

56. Prior to the announcement of bad news earnings (a negative earnings

surprise), stock returns exhibit

a. a negative drift downward.

b. no change in stock returns.

c. a negative drift downward followed by an immediate upward drift.

d. a positive drift upward.

57. The interest rate on a revolving loan will usually

a. be below prime interest.

b. be equal to prime interest.

c. remain fixed.

d. float.

58. Short-term notes sold directly to investors by large, highly rated com-

panies are called

a. commercial paper.

b. secured notes.

c. bonds.

d. debentures.

59. A bond that is considered unsecured is referred to as a

a. debenture bond.

b. sinking fund bond.

c. senior bond.

d. callable bond.

60. A qualitative assessment of the business, its customers and suppliers,

and managements character and capability is known as

4 06-Valuation & Cash Flow Analysis

a. covenants.

b. due diligence.

c. indenture.

d. debenture.

61. The degree to which cash needs can be satisfied during periods of

fiscal stress is known as

a. credit availability.

b. credit worthiness.

c. working capital.

d. financial flexibility.

62. Operating cash flows are typically negative for

a. established growth companies.

b. emerging companies.

c. mature companies.

d. blue-chip companies.

Essay and Computational Questions

63. P/E ratios are a useful indicator and tool when performing valuation

and comparing firms. List three factors that should be considered or adjusted

for when comparing P/E ratios among different firms.

64. Earnings Surprises:

a. Define Earnings Surprise

b. One measure for expected earnings this quarter (t) could be earnings

for the same quarter last year (t-4). List some of the disadvantages to using this

measure.

c. Suggest a better measure for expected earnings.

65. A useful first step in valuation or forecasting is to identify the different

components of earnings. Below is the Income Statement for the fiscal year 2004

for Temporaire, Inc. Answer the following questions:

a. Assuming the company faces a 30% tax rate:

What portion (in $) of the earnings number would you consider per-

manent?

What portion (in $) of the earnings number would you consider transi-

tory?

What portion (in $) of the earnings number would you consider valua-

tion-irrelevant?

b. Explain your calculations.

Income statement for the year 2004Sales 14,859

Cost of good sold (9,847)

Gross profit 5,012

SG&A (2,549)

Operating income 2,463

Gain on sale of fixed assets 76

Income before interest and taxes 2,539

Interest expense (153)

Income before special items and taxes 2,386

Gain on early retirement of long term debt 53

Restructuring charges (85)

Pretax income 2,354

Income tax (702)

Net income from continuing operations 1,652

Loss from discontinued operations (net of tax) (97)

Loss from plant confiscated in Venezuela (net of tax) (84)

Cumulative effect of change in depreciation

method for fixed assets (net of tax) (16)

1,455

Answers

1. E;False

2. E;True

3. E;True

4. E;True

5. M;False

6. M;False

7. M;False

8. M;True

9. M;False

10. E;True

11. E;True

12. M;False

13. M;False

14. M;False

15. M;True

16. M;True

5 06-Valuation & Cash Flow Analysis

17. M;True

18. M;True

19. M;False

20. M;True

21. E;(c)

22. M;(d)

23. M;(b)

24. M;(d)

25. M;(a)

26. M;(c)

27. M;(d)

28. M;(c)

29. D;(a)

30. M;(c)

31. M;(a)

32. D;(b)

33. E;(b)

34. M;(a)

35. M;(b)

36. M;(c)

37. M;(c)

38. M;(c)

39. M;(c)

40. M;(b)

41. M;(c)

42. M;(c)

43. M;(c)

44. M;(d)

45. M;(c)

46. M;(c)

47. M;(d)

48. M;(c)

49. M;(a)

50. M;(a)

51. M;(b)

52. M;(b)

53. M;(b)

54. M;(c)

55. M;(c)

56. M;(a)

57. M;(d)

58. M;(a)

59. M;(a)

60. M;(b)

61. M;(d)

62. M;(b)

Explanation to Selected Multiple-Choice Questions

27. EPS $5.00/cost of equity capital 9% = $55.55

28. EPS $6.00/cost of equity capital 12.5% = $48.00

29. P/E = 1/r 10 =1/r r = 1/10 r = 10%, 15 = 1/r r = 1/15 r = 6.67%

37. .80 $12 = $9.60 5 =$ 48.00

.10 $12 = $1.20 1 =$ 1.20

.10 $12 = $1.20 0 =$ 0.00

Implied share price $ 49.20

38. .60 $15 = $9.00 5 =$ 45.00

.35 $15 = $5.25 1 =$ 5.25

.05 $15 = $0.75 0 =$ 0.00

Implied share price $ 50.25

39. .75 $18 = $13.50 5 =$ 67.50

.25 $18 = $ 4.50 1 =$ 4.50

.00 $18 = $ 0.00 0 =$ 0.00

Implied share price $ 72.00

40. Implied share price $49.20/EPS $12.00 = 4.1

41. Implied share price $50.25/EPS $15.00 = 3.35

42. Implied share price $72.00/EPS $18.00 = 4.0

49. Abnormal earnings =

NOPAT $40,000 (r.10 book value $800,000) = $40,000

50. Abnormal earnings = NOPAT $6,000 (r.10 book value $100,000) =

$4,000

6 06-Valuation & Cash Flow Analysis

51. Abnormal earnings = NOPAT $14,000 (r.08 book value $150,000)

= $2,000

52. Abnormal earnings = NOPAT $18,000 (r.12 book value $190,000)

= $4,800

53. Abnormal earnings = NOPAT ($6,000 + $4,000) (r.10 book value

$100,000) = $0

54. Abnormal earnings = NOPAT ($14,000 3,000) [(r.08 book value

$150,000 $20,000)]

= $600

63. Suggested Answer: Risk differences, Growth opportunities, Earnings

components (valuation irrelevant, permanent, and transitory).

64 Suggested Answer:

a. Difference between the estimated (or expected) earnings numbers and

the actual reported (or announced) earnings.

b. Some disadvantages: does not take into account non-recurring items

that were included in previous corresponding period earnings. Does not take

into account new information and events that occurred after the previous corre-

sponding period.

c. Adjust previous corresponding period earnings to reflect transitory

items plus new information that became available in the interim. Consider using

analyst forecasts.

65 Suggested Answer:

PermanentIncome before special items and taxes (net of tax) 1,670

Transitory*Gain on early retirement of long term debt (net of tax) 37

Restructuring charges (net of tax) (60)

Loss from discontinued operations (net of tax) (97)

Loss from plant confiscated in Venezuela (net of tax) (84)

Total (203)

Valuation irrelevantCumulative effect of change in depreciation method

for fixed assets (net of tax) (16)

* Inclusion in the Transitory category is not clear cut and depends on

the assumptions made about the nature and history of the company.

7 06-Valuation & Cash Flow Analysis

Das könnte Ihnen auch gefallen

- Value Chain Management Capability A Complete Guide - 2020 EditionVon EverandValue Chain Management Capability A Complete Guide - 2020 EditionNoch keine Bewertungen

- Capital Budgeting Decisions A Clear and Concise ReferenceVon EverandCapital Budgeting Decisions A Clear and Concise ReferenceNoch keine Bewertungen

- Active and Passive InvestmentDokument4 SeitenActive and Passive InvestmentBradley CarrollNoch keine Bewertungen

- Residual Income ValuationDokument21 SeitenResidual Income ValuationqazxswNoch keine Bewertungen

- Option MoneynessDokument26 SeitenOption MoneynessVaidyanathan RavichandranNoch keine Bewertungen

- Assignment 1 - Investment AnalysisDokument5 SeitenAssignment 1 - Investment Analysisphillimon zuluNoch keine Bewertungen

- Push Vs Pull SystemDokument3 SeitenPush Vs Pull SystemRamesh ReddyNoch keine Bewertungen

- Currency DerivativesDokument25 SeitenCurrency DerivativesDarshitSejparaNoch keine Bewertungen

- Risk & ReturnDokument20 SeitenRisk & Returnjhumli100% (1)

- Investment FinalDokument20 SeitenInvestment FinalSahitha KusumaNoch keine Bewertungen

- Dividend Discount Model in Valuation of Common StockDokument15 SeitenDividend Discount Model in Valuation of Common Stockcaptain_bkx0% (1)

- Ratio AnalysisDokument24 SeitenRatio Analysisrleo_19871982100% (1)

- Introduction To Financial ManagemntDokument29 SeitenIntroduction To Financial ManagemntibsNoch keine Bewertungen

- Investing Is An Art Not A ScienceDokument4 SeitenInvesting Is An Art Not A SciencemeetwithsanjayNoch keine Bewertungen

- MARKOWITZ Portfolio TheoryDokument32 SeitenMARKOWITZ Portfolio TheoryDicky IrawanNoch keine Bewertungen

- Materi TVM 1 Dan TVM 2 PDFDokument73 SeitenMateri TVM 1 Dan TVM 2 PDFamirah muthiaNoch keine Bewertungen

- Tutorial 4 AnwersDokument6 SeitenTutorial 4 AnwersSyuhaidah Binti Aziz ZudinNoch keine Bewertungen

- Cash Flow StatementDokument18 SeitenCash Flow StatementSriram BastolaNoch keine Bewertungen

- Module 2 Time Value of MoneyDokument42 SeitenModule 2 Time Value of MoneyNani MadhavNoch keine Bewertungen

- Delgado - Forex: The Fundamental Analysis.Dokument10 SeitenDelgado - Forex: The Fundamental Analysis.Franklin Delgado VerasNoch keine Bewertungen

- Financial Instruments: The Building Blocks: Corporate Financial Strategy 4th Edition DR Ruth BenderDokument12 SeitenFinancial Instruments: The Building Blocks: Corporate Financial Strategy 4th Edition DR Ruth BenderAin rose100% (1)

- Capital Budgeting TechniquesDokument10 SeitenCapital Budgeting TechniqueslehnehNoch keine Bewertungen

- SAPM Punithavathy PandianDokument22 SeitenSAPM Punithavathy PandianVimala Selvaraj VimalaNoch keine Bewertungen

- Cash Flow StatementDokument4 SeitenCash Flow StatementSmit ShahNoch keine Bewertungen

- CFP Case StudyDokument2 SeitenCFP Case StudyPankaj SrivastavaNoch keine Bewertungen

- Derivatives Notes and Tutorial 2017Dokument16 SeitenDerivatives Notes and Tutorial 2017Chantelle RamsayNoch keine Bewertungen

- Taha Popatia-Artt Business SchoolDokument7 SeitenTaha Popatia-Artt Business SchooltasleemfcaNoch keine Bewertungen

- 5 - Capital Budgeting - Risk & UncertaintyDokument22 Seiten5 - Capital Budgeting - Risk & UncertaintySymron KheraNoch keine Bewertungen

- Chapter 13Dokument11 SeitenChapter 13Hương LýNoch keine Bewertungen

- A Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDDokument11 SeitenA Study Applying DCF Technique For Valuing Indian IPO's Case Studies of CCDarcherselevators100% (1)

- R32 Market-Based Valuation Q Bank PDFDokument7 SeitenR32 Market-Based Valuation Q Bank PDFZidane KhanNoch keine Bewertungen

- Wealth Maximization ObjectiveDokument8 SeitenWealth Maximization ObjectiveNeha SharmaNoch keine Bewertungen

- Management Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099Dokument15 SeitenManagement Accounting Group-8: Anuraag S.Shahapur-14021 SINDHU S.-14154 Pooja Chiniwalar-14099prithvi17Noch keine Bewertungen

- Investment Decision MethodDokument44 SeitenInvestment Decision MethodashwathNoch keine Bewertungen

- R22 Capital Structure Q Bank PDFDokument6 SeitenR22 Capital Structure Q Bank PDFZidane KhanNoch keine Bewertungen

- Discounted Cash Flow (DCF) ModellingDokument43 SeitenDiscounted Cash Flow (DCF) Modellingjasonccheng25Noch keine Bewertungen

- Impact of Dividend PolicyDokument12 SeitenImpact of Dividend PolicyGarimaNoch keine Bewertungen

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Dokument27 SeitenBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Presented By-Group 11 Umashankar Joshi (131) Ruchi Gupta (132) Ravish Kapoor (133) Archana Madhu KumaraDokument45 SeitenPresented By-Group 11 Umashankar Joshi (131) Ruchi Gupta (132) Ravish Kapoor (133) Archana Madhu KumaraRuchi GuptaNoch keine Bewertungen

- Risk N Return BasicsDokument47 SeitenRisk N Return BasicsRosli OthmanNoch keine Bewertungen

- Decision Areas in Financial ManagementDokument15 SeitenDecision Areas in Financial ManagementSana Moid100% (3)

- Dipers and Beer Wal-Mart Case StudyDokument2 SeitenDipers and Beer Wal-Mart Case Studysagar pawarNoch keine Bewertungen

- Assignment Ratio AnalysisDokument7 SeitenAssignment Ratio AnalysisMrinal Kanti DasNoch keine Bewertungen

- Intrinsic Value and Stock ValuationDokument5 SeitenIntrinsic Value and Stock Valuationconnect.rohit85Noch keine Bewertungen

- EdpDokument18 SeitenEdpAbhinav VermaNoch keine Bewertungen

- Based On Session 5 - Responsibility Accounting & Transfer PricingDokument5 SeitenBased On Session 5 - Responsibility Accounting & Transfer PricingMERINANoch keine Bewertungen

- Cost of Capital, WACC and BetaDokument3 SeitenCost of Capital, WACC and BetaSenith111Noch keine Bewertungen

- Systematic Unsystematic RiskDokument34 SeitenSystematic Unsystematic Riskharsh thakkarNoch keine Bewertungen

- Ratio Analysis Assignment 2020Dokument1 SeiteRatio Analysis Assignment 2020Nguyễn Thu TrangNoch keine Bewertungen

- Nestle IndiaDokument38 SeitenNestle Indiarranjan27Noch keine Bewertungen

- Corporate Finance NPV and IRR SolutionsDokument3 SeitenCorporate Finance NPV and IRR SolutionsMark HarveyNoch keine Bewertungen

- Assignment of Time Value of MoneyDokument3 SeitenAssignment of Time Value of MoneyMuxammil IqbalNoch keine Bewertungen

- Investment Valuation RatiosDokument18 SeitenInvestment Valuation RatiosVicknesan AyapanNoch keine Bewertungen

- FCFEDokument7 SeitenFCFEbang bebetNoch keine Bewertungen

- Bond RatingsDokument2 SeitenBond RatingscciesaadNoch keine Bewertungen

- Time Value of Money ScriptDokument15 SeitenTime Value of Money ScriptSudheesh Murali NambiarNoch keine Bewertungen

- Determinants of Dividend Payout RatioDokument16 SeitenDeterminants of Dividend Payout RatioSabin Subedi100% (1)

- CHAPTER 6 Time Value of MoneyDokument44 SeitenCHAPTER 6 Time Value of MoneyAhsanNoch keine Bewertungen

- Leverage: Let's DiscussDokument9 SeitenLeverage: Let's DiscussClaudette ManaloNoch keine Bewertungen

- Sample of The Fin320 Department Final Exam With SolutionDokument10 SeitenSample of The Fin320 Department Final Exam With Solutionnorbi113100% (1)

- 2 Hardeep Singh Research Article May 2011Dokument17 Seiten2 Hardeep Singh Research Article May 2011Pooja RatraNoch keine Bewertungen

- Arguments in Favour of A Fixed RateDokument1 SeiteArguments in Favour of A Fixed RatePooja RatraNoch keine Bewertungen

- Cob Douglas Production TheoryDokument7 SeitenCob Douglas Production Theoryamkumar1975Noch keine Bewertungen

- 9 - Constrained Optimisation PDFDokument20 Seiten9 - Constrained Optimisation PDFDan EnzerNoch keine Bewertungen

- ResellerId ROSS Project Tracker Jul28,2010Dokument436 SeitenResellerId ROSS Project Tracker Jul28,2010Pooja RatraNoch keine Bewertungen

- 2 Hardeep Singh Research Article May 2011Dokument17 Seiten2 Hardeep Singh Research Article May 2011Pooja RatraNoch keine Bewertungen

- Advertising Management PGPM 09 11Dokument18 SeitenAdvertising Management PGPM 09 11Pooja RatraNoch keine Bewertungen

- Deal As SystemDokument6 SeitenDeal As SystemPooja RatraNoch keine Bewertungen

- Delhi Metro Route MapDokument1 SeiteDelhi Metro Route Mapnakulyadav7Noch keine Bewertungen

- FR NP Plan v0 11 PDFDokument27 SeitenFR NP Plan v0 11 PDFPooja RatraNoch keine Bewertungen

- Marketing ReferenceDokument25 SeitenMarketing ReferencePooja RatraNoch keine Bewertungen

- Mountain ManDokument8 SeitenMountain ManSakshi Kharbanda100% (1)

- SupervisionDokument31 SeitenSupervisionLamar LakersInsider Bryant100% (1)

- Survey ResultsDokument23 SeitenSurvey ResultsPooja RatraNoch keine Bewertungen

- Disclosure 1Dokument14 SeitenDisclosure 1Pooja RatraNoch keine Bewertungen

- Equity Valuation Formulas William L. Silber and Jessica WachterDokument5 SeitenEquity Valuation Formulas William L. Silber and Jessica WachterSanu SayedNoch keine Bewertungen

- Prospecto de Facebook 2012Dokument201 SeitenProspecto de Facebook 2012Henkel GarciaNoch keine Bewertungen

- OB Survey FinalDokument7 SeitenOB Survey FinalPooja RatraNoch keine Bewertungen

- Transparency, Financial Accounting Information, and Corporate GovernanceDokument23 SeitenTransparency, Financial Accounting Information, and Corporate Governance25061950Noch keine Bewertungen

- Cost Accounting-1Comprehensive 2014-JaganathDokument5 SeitenCost Accounting-1Comprehensive 2014-JaganathSayma Ul Husna Himu50% (2)

- Accounts Receivable and Inventory ManagementDokument54 SeitenAccounts Receivable and Inventory Managementirma makharoblidzeNoch keine Bewertungen

- ACI - Study Guide (Singapore)Dokument156 SeitenACI - Study Guide (Singapore)Karim Soliman100% (1)

- 2008 HSBC Annual Report and Accounts EnglishDokument34 Seiten2008 HSBC Annual Report and Accounts EnglishigharieebNoch keine Bewertungen

- Chapter 7Dokument36 SeitenChapter 7Marwa HassanNoch keine Bewertungen

- Module B Dec 2017answerDokument10 SeitenModule B Dec 2017answerConnieChoiNoch keine Bewertungen

- The Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Dokument50 SeitenThe Meaning of Interest Rate: Cecchetti, Chapter 7 Mishkin, Chapter 2Trúc Ly Cáp thịNoch keine Bewertungen

- Annualized Cost: NPC TheDokument12 SeitenAnnualized Cost: NPC TheSupratno ArhamNoch keine Bewertungen

- Unsecured ST FinancingDokument5 SeitenUnsecured ST FinancingJann KerkyNoch keine Bewertungen

- CAP II - Revision Test Paper - Dec 2019Dokument206 SeitenCAP II - Revision Test Paper - Dec 2019Shraddha NepalNoch keine Bewertungen

- Departmental AccountDokument3 SeitenDepartmental AccountAnupam BaliNoch keine Bewertungen

- Week 5 Learning EbookDokument251 SeitenWeek 5 Learning EbookAnniNoch keine Bewertungen

- Trade Discounts + Cash DiscountsDokument13 SeitenTrade Discounts + Cash Discountsrommel legaspi71% (7)

- FM Final ReviewerDokument42 SeitenFM Final ReviewerMaryJaneNoch keine Bewertungen

- Week 1 Calculate Future Value and Present Value of Money: Business FinanceDokument6 SeitenWeek 1 Calculate Future Value and Present Value of Money: Business FinanceTwelve Forty-fourNoch keine Bewertungen

- CH 7 Vol 1 2012 AnswersDokument18 SeitenCH 7 Vol 1 2012 Answersprince karlNoch keine Bewertungen

- Lease InterestDokument34 SeitenLease InterestRen SensonNoch keine Bewertungen

- AP1 Receivables 2Dokument17 SeitenAP1 Receivables 2Crazy Solo100% (1)

- The Lucas Asset Pricing Model: 1 Introduction/SetupDokument9 SeitenThe Lucas Asset Pricing Model: 1 Introduction/SetupnencydhamejaNoch keine Bewertungen

- Econ CH 14Dokument12 SeitenEcon CH 14BradNoch keine Bewertungen

- Chapter 3 Problems - Ia Part 2Dokument16 SeitenChapter 3 Problems - Ia Part 2KathleenCusipagNoch keine Bewertungen

- Assignment PAD370 - Increase Home OwnershipDokument16 SeitenAssignment PAD370 - Increase Home Ownershipizatul294100% (1)

- Instructional Materials FOR V: Aluation Concepts and MethodsDokument36 SeitenInstructional Materials FOR V: Aluation Concepts and MethodsShahida Rodny NoronaNoch keine Bewertungen

- Project Top Glove CompletedDokument45 SeitenProject Top Glove CompletedWan Chee57% (7)

- Bond MathematicsDokument35 SeitenBond Mathematicsrohan.explorerNoch keine Bewertungen

- Investments: IFRS Questions Are Available at The End of This ChapterDokument44 SeitenInvestments: IFRS Questions Are Available at The End of This Chapteralexstets4553Noch keine Bewertungen

- AICPA Released Questions FAR 2015 DifficultDokument33 SeitenAICPA Released Questions FAR 2015 DifficultAZNGUY100% (2)

- ForexDokument110 SeitenForexKrishnaNoch keine Bewertungen

- WCM Optimum Credit PolicyDokument21 SeitenWCM Optimum Credit PolicyLekha V P NairNoch keine Bewertungen

- The Climb - Level UpDokument122 SeitenThe Climb - Level UpMicheleLemesNoch keine Bewertungen