Beruflich Dokumente

Kultur Dokumente

Pay Clauses

Hochgeladen von

Roshan de Silva0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten3 SeitenPay Clauses

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenPay Clauses

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten3 SeitenPay Clauses

Hochgeladen von

Roshan de SilvaPay Clauses

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

LawTrends

A publication of Eastman & Smith Ltd.

December 2010

volume 8 number 3

Ofces

Toledo Ofce:

One Seagate, 24th Floor

P.O. Box 10032

Toledo, Ohio 43699-0032

Telephone: 419-241-6000

Fax: 419-247-1777

Columbus Ofce:

100 E. Broad Street, Suite 2100

Columbus, Ohio 43215

Telephone: 614-564-1445

Fax: 614-280-1777

Findlay Ofce:

510 S. Main Street

Findlay, Ohio 45840

Telephone: 419-424-5847

Fax: 419-424-9860

Novi Ofce:

28175 Haggerty Road

Novi, Michigan 48377

Telephone: 248-994-7757

Fax: 248-994-7758

www.eastmansmith.com

About the photo: Associate Patrick A. Sadowski at our new Findlay ofce.

Shifting the Risk: The Enforceability of

Contingent Payment Clauses

by Amy J . Borman and Matthew D. Harper

Every construction contract carries the risk that the property owner

will not pay for the work performed. In larger projects, the general contractor

traditionally bears that risk, not the subcontractors. However, subcontractors

should be aware that their construction contract could contain a contingent

payment clause that shifts the risk of non-payment down to the subcontractor.

This article discusses these clauses and their enforceability.

A contingent payment clause can take two basic forms: a pay-when-

paid or a pay-if-paid clause. The rst does not shift the risk of non-payment

to the subcontractor, but the second does exactly that. Each is explored further

below.

First, a typical pay-when-paid clause might state:

Payments will be made monthly as the work progresses for the value

of the completed work as determined by the Contractor, Owner, and

Architect. Invoices from the Subcontractor for progress billings must

be in our hands by the 25th day of the month and will be paid:

LawTrends, December 2010 2

a. Terms: Payment upon receipt of funds from the Owner.

Under a pay-when-paid clause, payment is tied to when an upper-level contractor gets paid, but courts do

not interpret these clauses to shift entirely the risk of nonpayment to lower-level contractors. Thus, a pay-when-

paid clause still embraces the traditional view that the general contractor bears the risk of non-payment by an

owner.

In Thomas J. Dyer Company v. Bishop International Engineering Company, the Sixth Circuit Court of

Appeals created the payment procedure to be followed when a contract contains a pay-when-paid clause. The

case concerned a general contractor who refused to pay his sub-contractors after the owner declared bankruptcy

because the contract stated that the general contractor only had to pay his subcontractors when he was paid. The

Court disagreed and held that a pay-when-paid clause contains an unconditional promise to pay. The Court held

that an upper-level contractor still bears the risk of non-payment and that a pay-when-paid clause only postpones

payment. Under Dyer, payment to subcontractors must occur either (1) when a general contractor gets paid, or

(2) after a reasonable period of time.

Second, a typical pay-if-paid clause might state:

Payments will be made monthly as the work progresses for the value of the completed work as determined

by the Contractor, Owner, and Architect. Invoices from the Subcontractor for progress billings must be in

our hands by the 25th day of the month and will be paid:

a. Terms: Payments from the Owner to General Contractor are a condition precedent to General Con-

tractors payment to Subcontractor.

A pay-if-paid clause is tied to whether an upper-level contractor receives payment from the owner. As

drafted, the pay-if-paid clause means a subcontractor only gets paid if the contractor gets paid. Because of the

potentially severe results of such a shift, courts require very precise contract language making clear the parties

intended such a result. Specically, both Ohio and Michigan courts require a clear statement that payment by

the owner is a condition precedent to the general contractors duty to pay the subcontractor. If there is any

confusion as to the intent of the parties, courts will interpret the provision as pay-when-paid and keep the risk of

payment with the upper-level contractor.

Equity and freedom of contract are the two competing policies governing the interpretation and enforce-

ment of pay-if-paid clauses. Under traditional notions of equity, the general contractor should bear the nancial

risk of non-payment because he or she is in direct privity of contract with the owner. Presumably, the general

contractor has better knowledge of whether the owner might not be able to pay and will be in a better position to

resolve any disputes that might result in the owners refusal to pay. Moreover, the general contractor is often more

nancially able to bear non-payment than subcontractors who may be smaller and less equipped to bear the risk

of an insolvent owner.

Conversely, public policy also favors the freedom of contract, particularly in the commercial setting. Un-

der this notion, if a subcontractor freely enters into a contract, it should be enforced on its terms. The courts strict

requirement of precise language to enforce a pay-if-paid clause balances these competing policies.

LawTrends, December 2010 3

_______________

Disclaimer

The articles in this newsletter have been prepared by Eastman & Smith Ltd. for informational pur-

poses only and should not be considered legal advice. This information is not intended to create, and receipt

of it does not constitute, an attorney/client relationship.

Copyright 2010

_______________

Mr. Harper is a member of the Firm. He represents owners, contractors, subcontrac-

tors and suppliers in complex, multi-party commercial construction disputes. He also provides

representation to parties involved in residential projects as well as clients in disputes involving

real estate, land use, and zoning and eminent domain. In addition, Mr. Harper advises clients

regarding mechanics liens.

While contingent payment clauses are enforceable under both Ohio and Michigan law, a pay-if-paid clause

will not interfere with a subcontractors ability to seek other legal remedies against the general contractor. For

example, under the Michigan Builders Trust Fund Act (MBTFA), a general contractor is required to pay its sub-

contractors before it pays itself. Therefore, if a general contractor pays subcontractors on the basis of percentage

of work completed, including making payments to itself, and then fails to pay the subcontractors upon comple-

tion, the subcontractors can bring a claim under the MBTFA for recoupment of the progress payments made by

the general contractor to itself.

The bottom line is that subcontractors must pay attention to contract language to make sure they know

exactly what risk they are assuming. For more information on contingent payment clauses, please contact Amy

J . Borman in our Columbus ofce (614-564-1445) or Matthew D. Harper in our Toledo ofce (419-241-6000).

Amy J. Borman is a member of the Firm and located primarily in our Columbus ofce.

She has signicant experience in advising clients on compliance with emerging legislative and

statutory issues in the areas of education and business law.

Melissa A. Gerber, law clerk, contributed to this article. She is a third year law student at the Ohio State

University.

Das könnte Ihnen auch gefallen

- Hot-Finished Circular Hollow Sections, Section Properties Dimensions & PropertiesDokument20 SeitenHot-Finished Circular Hollow Sections, Section Properties Dimensions & Properties_darkangel26_Noch keine Bewertungen

- Universal Beams (UB), Section Properties Dimensions & PropertiesDokument6 SeitenUniversal Beams (UB), Section Properties Dimensions & PropertiesRoshan de SilvaNoch keine Bewertungen

- Assignment - MappingDokument1 SeiteAssignment - MappingRoshan de SilvaNoch keine Bewertungen

- Hot-Finished Circular Hollow Sections, Section Properties Dimensions & PropertiesDokument20 SeitenHot-Finished Circular Hollow Sections, Section Properties Dimensions & Properties_darkangel26_Noch keine Bewertungen

- Steel Section WeightDokument25 SeitenSteel Section WeightRoshan de Silva100% (1)

- Question List On Contract AdministrationDokument6 SeitenQuestion List On Contract AdministrationRoshan de SilvaNoch keine Bewertungen

- UKCDokument10 SeitenUKCRoshan de Silva0% (1)

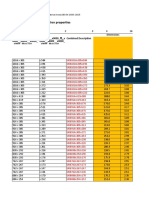

- Sr. Professional Category Foreacast (Manpower) Until 10/12 After 10/12 Jan Feb A Manpower A.1 DirectDokument2 SeitenSr. Professional Category Foreacast (Manpower) Until 10/12 After 10/12 Jan Feb A Manpower A.1 DirectRoshan de SilvaNoch keine Bewertungen

- Results PhotographyDokument1 SeiteResults PhotographyRoshan de SilvaNoch keine Bewertungen

- Estimation Sheet: Project: HV Cable Condition Assessment Qtn. / Job No: MQ3475Dokument4 SeitenEstimation Sheet: Project: HV Cable Condition Assessment Qtn. / Job No: MQ3475Roshan de SilvaNoch keine Bewertungen

- Daily Activity Report: Date Project Contract No. Project Completion DateDokument2 SeitenDaily Activity Report: Date Project Contract No. Project Completion DateRoshan de SilvaNoch keine Bewertungen

- Question List On Tendering (Part 1 of Procurement and Tendering)Dokument3 SeitenQuestion List On Tendering (Part 1 of Procurement and Tendering)Roshan de SilvaNoch keine Bewertungen

- Cost Planning at A GlanceDokument1 SeiteCost Planning at A GlanceRoshan de SilvaNoch keine Bewertungen

- Our Next 5 Year Forecast: UAE Driving LicenseDokument1 SeiteOur Next 5 Year Forecast: UAE Driving LicenseRoshan de SilvaNoch keine Bewertungen

- IT# Description QTY Unit: Materials Plant Hire ManpowerDokument1 SeiteIT# Description QTY Unit: Materials Plant Hire ManpowerRoshan de SilvaNoch keine Bewertungen

- Price AdjustmentsDokument9 SeitenPrice AdjustmentsRoshan de Silva100% (1)

- Main Contractor - Larsen and Toubro Limited Sub Contractor - Danway EMEDokument7 SeitenMain Contractor - Larsen and Toubro Limited Sub Contractor - Danway EMERoshan de SilvaNoch keine Bewertungen

- Lighting and Small Power Works at New Ablution Room and New Male ToiletDokument10 SeitenLighting and Small Power Works at New Ablution Room and New Male ToiletRoshan de SilvaNoch keine Bewertungen

- Water Treatement PlantDokument1 SeiteWater Treatement PlantRoshan de SilvaNoch keine Bewertungen

- Excel QS FMT Cash Flow - LaborDokument1 SeiteExcel QS FMT Cash Flow - LaborRoshan de SilvaNoch keine Bewertungen

- Division 1 - Generally: Desert Mirage Building Works, Landscape & InfrastructureDokument1 SeiteDivision 1 - Generally: Desert Mirage Building Works, Landscape & InfrastructureRoshan de SilvaNoch keine Bewertungen

- Excel QS FMT Cash Flow - MaterialDokument1 SeiteExcel QS FMT Cash Flow - MaterialRoshan de SilvaNoch keine Bewertungen

- Geotechnical LayersDokument1 SeiteGeotechnical LayersRoshan de SilvaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- People Vs Del Rosario GR. 127755 April 14, 1999Dokument11 SeitenPeople Vs Del Rosario GR. 127755 April 14, 1999Aldrin MontescoNoch keine Bewertungen

- Pryce Corp Vs PagcorDokument2 SeitenPryce Corp Vs PagcorEdmund AquinoNoch keine Bewertungen

- 6 Complaint-For-Forcible-EntryDokument4 Seiten6 Complaint-For-Forcible-EntryIanLightPajaro100% (1)

- Davila-Bardales v. INS, 1st Cir. (1995)Dokument13 SeitenDavila-Bardales v. INS, 1st Cir. (1995)Scribd Government DocsNoch keine Bewertungen

- Oman Penal Code (1974/7)Dokument25 SeitenOman Penal Code (1974/7)Social Media Exchange Association100% (2)

- VOL. 388, SEPTEMBER 5, 2002 351: Alfonso vs. Alonzo-LegastoDokument16 SeitenVOL. 388, SEPTEMBER 5, 2002 351: Alfonso vs. Alonzo-LegastoAngelie FloresNoch keine Bewertungen

- Voluntary Separation Agreement - SampleDokument4 SeitenVoluntary Separation Agreement - Sampleabdul_salahi100% (1)

- PCGG Vs SandiganbayanDokument16 SeitenPCGG Vs SandiganbayanROSALIENoch keine Bewertungen

- Banco Filipino Savings and Mortgage BankDokument2 SeitenBanco Filipino Savings and Mortgage BankYani RamosNoch keine Bewertungen

- Civics & Economics Notes 2.01-2.03Dokument5 SeitenCivics & Economics Notes 2.01-2.03Matt ByrneNoch keine Bewertungen

- BP 22, Estafa, Corporation CheckDokument9 SeitenBP 22, Estafa, Corporation CheckSamantha PapellerasNoch keine Bewertungen

- John Hay Peoples Alternative Coalition vs. Lim: FactsDokument4 SeitenJohn Hay Peoples Alternative Coalition vs. Lim: FactsRiona Vince SaliotNoch keine Bewertungen

- Chapter 4Dokument23 SeitenChapter 4Dennis Aran Tupaz AbrilNoch keine Bewertungen

- United States of America Ex Rel. Frank E. Darrah v. Joseph R. Brierley, Superintendent, State Correctional Institution at Philadelphia, Pennsylvania, 415 F.2d 9, 3rd Cir. (1969)Dokument6 SeitenUnited States of America Ex Rel. Frank E. Darrah v. Joseph R. Brierley, Superintendent, State Correctional Institution at Philadelphia, Pennsylvania, 415 F.2d 9, 3rd Cir. (1969)Scribd Government DocsNoch keine Bewertungen

- Tormey v. The Vons Companies, Inc. Et Al - Document No. 6Dokument4 SeitenTormey v. The Vons Companies, Inc. Et Al - Document No. 6Justia.comNoch keine Bewertungen

- Hirday Nath v. Ram Chandra, AIR 1929 Cal 445Dokument9 SeitenHirday Nath v. Ram Chandra, AIR 1929 Cal 445alpesh upadhyayNoch keine Bewertungen

- Magno VsDokument2 SeitenMagno Vsai ning100% (1)

- Special Provisions Relating To Certificate For The Recovery of Certain DuesDokument3 SeitenSpecial Provisions Relating To Certificate For The Recovery of Certain DuesAbdullah Al MasumNoch keine Bewertungen

- The 28 Great Ideas That Changed The World ShowDokument69 SeitenThe 28 Great Ideas That Changed The World ShowJeff AkinNoch keine Bewertungen

- Barbara Lim Cheng Sim V Uptown Alliance (M)Dokument33 SeitenBarbara Lim Cheng Sim V Uptown Alliance (M)Zaki ShukorNoch keine Bewertungen

- Case 9Dokument2 SeitenCase 9William DC RiveraNoch keine Bewertungen

- Tort Law - GeneralDokument28 SeitenTort Law - Generallegalmatters90% (10)

- Radiowealth Finance Company vs. Del Rosario, 335 SCRA 288, July 06, 2000Dokument13 SeitenRadiowealth Finance Company vs. Del Rosario, 335 SCRA 288, July 06, 2000TNVTRLNoch keine Bewertungen

- Implications of Ethical Tradition For Business 021923Dokument13 SeitenImplications of Ethical Tradition For Business 021923Raven DometitaNoch keine Bewertungen

- Secretary of DOTC vs. MabalotDokument1 SeiteSecretary of DOTC vs. Mabalotfinserglen choclit lopezNoch keine Bewertungen

- Motion For Reinvestigation CRIMPRO 2014Dokument3 SeitenMotion For Reinvestigation CRIMPRO 2014KM Mac83% (6)

- Case Digest by Ainna Fathi: Case: The Roman Catholic Bishop of Jaro v. Gregorio de La Peña (26 PHIL. 144), Nov. 21, 1913Dokument3 SeitenCase Digest by Ainna Fathi: Case: The Roman Catholic Bishop of Jaro v. Gregorio de La Peña (26 PHIL. 144), Nov. 21, 1913jbandNoch keine Bewertungen

- Project - DPC, Vivek Kumar Sai, Roll 146, Batch XDokument27 SeitenProject - DPC, Vivek Kumar Sai, Roll 146, Batch XVivek Sai100% (3)

- Art. 13 - US Vs Dela Cruz GR 7094Dokument2 SeitenArt. 13 - US Vs Dela Cruz GR 7094Lu CasNoch keine Bewertungen

- Ethics - Module 2Dokument18 SeitenEthics - Module 2Dale CalicaNoch keine Bewertungen