Beruflich Dokumente

Kultur Dokumente

Topic 6 Inventory Valuation Exercise - Final Exam Sem May 2013

Hochgeladen von

theatresonicOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Topic 6 Inventory Valuation Exercise - Final Exam Sem May 2013

Hochgeladen von

theatresonicCopyright:

Verfügbare Formate

Final Exam Sem May 2013 (Inventory Valuation)

The following inventory information is taken from Kaka Tradings store for January 2013:

Jan Purchases Jan Sales

Unit RM Unit

1 50 3.00 4 70

3 100 3.15 10 100

6 120 3.25 29 170

23 100 3.40

31 50 3.50

Total 420 Total 340

The business uses perpetual inventory system. During the month of January, the business

sold 340 units at the price of RM4.00 per unit.

Using the First In First Out (FIFO) and Weighted Average methods, you are required to:

i) prepare appropriate tables to show the movement of inventory

(10)

ii) show the effects on profit and loss

(8)

ii) Based on your above analysis, explain which inventory valuation method should

Kaka Trading use. Justify.

Answer:

i) The movement of inventory:

First In First Out (FIFO) method

Date Purchase at Cost

Value (RM)

Sales

Quantity

(unit)

Sales at Cost Value Balance (Value of

Ending Inventory)

1/1 50@ RM3.00

3/1 100 @ RM3.15 50 @ RM3.00

100@RM 3.15

4/1 70 50 @ RM3.00

20 @ RM 3.15

80 @ RM3.15

6/1 120@ RM3.25 600 @ RM4.70 80 @ RM3.15

120 @ RM3.25

10/1 100 80 @ RM3.15

20 @ RM3.25

100 @ RM3.25

23/1 100 @ RM3.40 100 @ RM3.25

100 @ RM3.40

29/1 170 100 @ RM 3.25

70 @ RM 3.40

30 @ RM 3.40

30/1 50 @ RM 3.50

30 @ RM3.40

50 @ RM 3.50

Weighted Average

Date Purchase at Cost

Value (RM)

Sales

Quantity

(unit)

Sales at Cost Value Balance (Value of

Ending Inventory)

1/1 50@ RM3.00

3/1 100 @ RM3.15 (50 @ RM3.00) +

100 @ RM 3.15

= RM 150 + RM

315

50 + 100

= RM 465

150

= RM 3.10

150 @ RM3.10

4/1 70 @ RM

3.10

80 @ RM3.10

6/1 120@ RM3.25 (80 @ RM3.10) +

120 @ RM 3.25

= RM 248 + RM

390

80 + 120

= RM 638

200

= RM 3.19

200 @ RM3.19

10/1 100 @ RM

3.19

100 @ RM3.19

23/1 100 @ RM3.40 (100 @ RM3.19) +

100 @ RM 3.40

= RM 319 + RM

340

100 + 100

= RM 659

200

= RM 3.30

200 @ RM3.30

29/1 170 @ RM

3.30

30 @ RM 3.30

30/1 50 @ RM 3.50 (30 @ RM3.30) +

50 @ RM 3.50

= RM 99 + RM 175

30 + 50

= RM 274

80

= RM 3.43

80 @ RM3.43

ii) effects on profit or loss:

Cost Of Goods Sold (COGS):

FIFO = (50 @ RM3.00) + (20 @ RM 3.15) +

(80 @ RM 3.15) + (20 @ RM 3.25) +

(100 @ RM 3.25) +( 70 @ RM 3.40)

= RM 1,093

Weighted Average = (70 @ RM3.10) + (100 @ RM 3.19) +

(170 @ RM 3.30)

= RM 1,097

Gross profit:

FIFO = Sales COGS

= (340 x RM 4.00) RM 1,093

= RM 1,360 RM 1,093

= RM 267

Weighted Average = Sales COGS

= (340 x RM 4.00) RM 1,097

= RM 1,360 RM 1,097

= RM 263

iii)

FIFO method

Cost Of Goods Sold under FIFO method is lower compared to the Weighted

Average method. This means that income reported for January would be much

higher, RM267 using the FIFO cost-flow assumptions. FIFO method gives better

profit with the excess amount of RM4.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Chronology - Event Batu PutehDokument167 SeitenChronology - Event Batu PutehtheatresonicNoch keine Bewertungen

- The Mythos of The ArkDokument48 SeitenThe Mythos of The ArktheatresonicNoch keine Bewertungen

- DownloadDokument2 SeitenDownloadtheatresonicNoch keine Bewertungen

- The Royal Arch Exaltation CeremonyDokument22 SeitenThe Royal Arch Exaltation Ceremonytheatresonic100% (3)

- Magner 22 User ManualDokument10 SeitenMagner 22 User ManualtheatresonicNoch keine Bewertungen

- Cfp-9353-Gryphon Graphite Chemical Industries LTDDokument2 SeitenCfp-9353-Gryphon Graphite Chemical Industries LTDtheatresonicNoch keine Bewertungen

- Entered Apprentice Fellow Craft Master Mason: 1st Degree 2nd Degree 3rd DegreeDokument22 SeitenEntered Apprentice Fellow Craft Master Mason: 1st Degree 2nd Degree 3rd DegreetheatresonicNoch keine Bewertungen

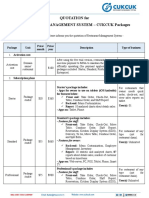

- Quotation For Restaurant Management System - Cukcuk PackagesDokument2 SeitenQuotation For Restaurant Management System - Cukcuk PackagestheatresonicNoch keine Bewertungen

- Frequently Ask Questions (Faq) Perlindungan Tenang Voucher (PTV)Dokument6 SeitenFrequently Ask Questions (Faq) Perlindungan Tenang Voucher (PTV)theatresonicNoch keine Bewertungen

- Seminar Tawau - Kawalselia Kelengkapan ElektrikDokument43 SeitenSeminar Tawau - Kawalselia Kelengkapan ElektriktheatresonicNoch keine Bewertungen

- Senerath Gunawardena Marketing PlanDokument21 SeitenSenerath Gunawardena Marketing PlantheatresonicNoch keine Bewertungen

- Rank Picture Thought Leader InfoDokument7 SeitenRank Picture Thought Leader InfotheatresonicNoch keine Bewertungen

- Hari Raya Aidilfitri NoticeDokument1 SeiteHari Raya Aidilfitri NoticetheatresonicNoch keine Bewertungen

- Slides - Presentation To TCIA - FINALDokument43 SeitenSlides - Presentation To TCIA - FINALtheatresonic100% (1)

- Realmalay PDFDokument326 SeitenRealmalay PDFtheatresonicNoch keine Bewertungen

- Defining The Benefits of It Investments in Business PracticeDokument8 SeitenDefining The Benefits of It Investments in Business PracticetheatresonicNoch keine Bewertungen

- Malay Chiri Sanskrit PDFDokument36 SeitenMalay Chiri Sanskrit PDFtheatresonicNoch keine Bewertungen

- FuelDokument16 SeitenFueltheatresonicNoch keine Bewertungen

- Muhammadiyah-Nahdlatul Ulama (Nu) : Monumental Cultural Creativity Heritage of The World ReligionDokument22 SeitenMuhammadiyah-Nahdlatul Ulama (Nu) : Monumental Cultural Creativity Heritage of The World ReligiontheatresonicNoch keine Bewertungen

- Central KitchenDokument13 SeitenCentral KitchentheatresonicNoch keine Bewertungen

- Sales Tools (OMS-1)Dokument19 SeitenSales Tools (OMS-1)theatresonicNoch keine Bewertungen

- Standard Operation Procedures Food and BDokument2 SeitenStandard Operation Procedures Food and BtheatresonicNoch keine Bewertungen

- 5-08 StudentRecruitmentDokument28 Seiten5-08 StudentRecruitmenttheatresonicNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 3M Knowledge Management-Group 1Dokument22 Seiten3M Knowledge Management-Group 1Siddharth Sourav PadheeNoch keine Bewertungen

- CCM Parameters vs. J1939 ParametersDokument3 SeitenCCM Parameters vs. J1939 Parameterszxy320dNoch keine Bewertungen

- AILET Last 5 Year Question Papers Answer Key 2019 2023Dokument196 SeitenAILET Last 5 Year Question Papers Answer Key 2019 2023Pranav SinghNoch keine Bewertungen

- Rich Dad Poor Dad: Book SummaryDokument7 SeitenRich Dad Poor Dad: Book SummarySnehal YagnikNoch keine Bewertungen

- Life Cycle AssessmentDokument11 SeitenLife Cycle Assessmentrslapena100% (1)

- Chapter 19 Homework SolutionDokument3 SeitenChapter 19 Homework SolutionJack100% (1)

- Research On DemonetizationDokument61 SeitenResearch On DemonetizationHARSHITA CHAURASIYANoch keine Bewertungen

- Advantages and Disadvantages of Shares and DebentureDokument9 SeitenAdvantages and Disadvantages of Shares and Debenturekomal komal100% (1)

- In Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Dokument126 SeitenIn Re: Rnnkeepers Usa Trust. Debtors. - Chapter LL Case No. 10 13800 (SCC)Chapter 11 DocketsNoch keine Bewertungen

- IELTS Writing Task 1 Sample - Bar Chart - ZIMDokument28 SeitenIELTS Writing Task 1 Sample - Bar Chart - ZIMPhương Thư Nguyễn HoàngNoch keine Bewertungen

- Chapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013Dokument32 SeitenChapter 01 - PowerPoint - Introduction To Taxation in Canada - 2013melsun007Noch keine Bewertungen

- Managing People in Global Markets-The Asia Pacific PerspectiveDokument4 SeitenManaging People in Global Markets-The Asia Pacific PerspectiveHaniyah NadhiraNoch keine Bewertungen

- The Pioneer 159 EnglishDokument14 SeitenThe Pioneer 159 EnglishMuhammad AfzaalNoch keine Bewertungen

- Conservation Communities - Urban Land MagazineDokument3 SeitenConservation Communities - Urban Land MagazineJohnnazaren MisaNoch keine Bewertungen

- Ol NW Mock 2022 Economics 2Dokument2 SeitenOl NW Mock 2022 Economics 2Lukong EmmanuelNoch keine Bewertungen

- 64 Development of Power Operated WeederDokument128 Seiten64 Development of Power Operated Weedervinay muleyNoch keine Bewertungen

- GCCA Newsletter - FEBRUARY 2023Dokument1 SeiteGCCA Newsletter - FEBRUARY 2023ArnaldoFortiBattaginNoch keine Bewertungen

- Rasanga Curriculum VitaeDokument5 SeitenRasanga Curriculum VitaeKevo NdaiNoch keine Bewertungen

- Inventory ValuationDokument2 SeitenInventory ValuationJonathan WilderNoch keine Bewertungen

- The Proof of Agricultural ZakatDokument7 SeitenThe Proof of Agricultural ZakatDila Estu KinasihNoch keine Bewertungen

- Clean Wash EN 2Dokument2 SeitenClean Wash EN 2Sean HongNoch keine Bewertungen

- Pub Rethinking Development GeographiesDokument286 SeitenPub Rethinking Development Geographiesxochilt mendozaNoch keine Bewertungen

- Global Wealth Databook 2017Dokument165 SeitenGlobal Wealth Databook 2017Derek ZNoch keine Bewertungen

- Aprroved MPS EPDokument1 SeiteAprroved MPS EPAlverastine AnNoch keine Bewertungen

- Abstract, Attestation & AcknowledgementDokument6 SeitenAbstract, Attestation & AcknowledgementDeedar.RaheemNoch keine Bewertungen

- Byju'S Global Expansion: International Business ProjectDokument13 SeitenByju'S Global Expansion: International Business ProjectGauravNoch keine Bewertungen

- Sim CBM 122 Lesson 3Dokument9 SeitenSim CBM 122 Lesson 3Andrew Sy ScottNoch keine Bewertungen

- 39 1 Vijay KelkarDokument14 Seiten39 1 Vijay Kelkargrooveit_adiNoch keine Bewertungen

- 3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeDokument4 Seiten3.1.2 Exceptions To Prior Notice of The Assessment. - Pursuant To Section 228 of The Tax CodeLab Lee0% (1)

- Economics Environment: National Income AccountingDokument54 SeitenEconomics Environment: National Income AccountingRajeev TripathiNoch keine Bewertungen