Beruflich Dokumente

Kultur Dokumente

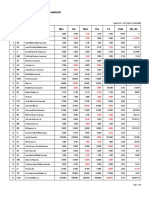

Manila Standard Today - Business Daily Stocks Review (June 3, 2014)

Hochgeladen von

Manila Standard TodayCopyright

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Manila Standard Today - Business Daily Stocks Review (June 3, 2014)

Hochgeladen von

Manila Standard TodayCopyright:

MST Business Daily Stocks Review

M

S

T

Tuesday, June 3, 2014

52 Weeks

High Low

STOCKS

105.5

56

99

66.2

114

82.5

78.2

50

21

15.36

37.85

22.8

24

7.5

2.98

2.5

139.5

69.35

2.09

1.64

38.85

21.6

117

65

145

103

515

299

74.5

40.75

206.4

105.7

1450

1015

160

110

2.92

2.25

Asia United Bank

Banco de Oro Unibank Inc.

Bank of PI

China Bank

Bright Kindle Resources

COL Financial

Eastwest Bank

Filipino Fund Inc.

I-Remit Inc.

Macay Holdings

Metrobank

Natl Reinsurance Corp.

PB Bank

Phil. National Bank

Phil. Savings Bank

PSE Inc.

RCBC `A

Security Bank

Sun Life Financial

Union Bank

Vantage Equities

40.5

30

7.87

5

2.2

0.88

1.59

1.2

24.9

9.9

138

45

20

12

125

62.5

3.25

2.62

29.3

9.82

26

21.5

8.24

0.82

39.5

20

8.6

5.8

22

8.48

7.9

4.25

15.9

8.68

27.45

12.2

113.8

48.9

27.4

12.5

0.021

0.0110

15.98

12

4.25

1.81

0.87

0.32

186.2

108.4

12.24

8.55

55.5

38.5

5.2

1.93

41.4

20.35

24.2

10.1

397

246

21

7.22

6.8

4

16.3

11

19.48

11.5

11.18

4.33

6.15

4.12

2.49

1.1

7.5

2.28

5.75

4

314.6

200

1.98

0.9

2.1

1.69

0.157

0.102

3.3

1.59

3

1.37

135.4

87

2.92

2.25

1.1

0.550

13

8.2

2.4

1.25

Aboitiz Power Corp.

Agrinurture Inc.

Alliance Tuna Intl Inc.

Alsons Cons.

Asiabest Group

Bogo Medellin

C. Azuc De Tarlac

Century Food

Chemphil

Chemrez Technologies Inc.

Cirtek Holdings (Chips)

Concepcion

Da Vinci Capital

Del Monte

DNL Industries Inc.

Emperador

Energy Devt. Corp. (EDC)

EEI

First Gen Corp.

First Holdings A

Ginebra San Miguel Inc.

Greenergy

Holcim Philippines Inc.

Integ. Micro-Electronics

Ionics Inc

Jollibee Foods Corp.

Lafarge Rep

Liberty Flour

LMG Chemicals

Manila Water Co. Inc.

Megawide

Mla. Elect. Co `A

Pancake House Inc.

Pepsi-Cola Products Phil.

Petron Corporation

Phinma Corporation

Phoenix Petroleum Phils.

RFM Corporation

Roxas and Co.

Roxas Holdings

Salcon Power Corp.

San MiguelPure Foods `B

Seacem

Splash Corporation

Swift Foods, Inc.

TKC Steel Corp.

Trans-Asia Oil

Universal Robina

Victorias Milling

Vitarich Corp.

Vivant Corp.

Vulcan Indl.

0.69

0.46

61

40

28.4

18.86

7.3

5.58

6.3

2.800

1.69

0.91

688

485

18.1

0.147

63

44

3.96

2.51

6.99

3.9

0.26

0.151

899

685

9.3

5.7

50

34

7.68

3.95

1.02

0.58

28.4

12.96

0.81

0.500

6.33

4.06

7.65

4.8

9.66

3

0.0550

0.027

2.7

1.23

0.77

0.355

3.4

2

125

55.75

2.4

1.5

0.420

0.260

1213

605

2.54

1.04

1.4

1.03

0.295

0.136

0.300

0.150

0.630

0.270

Abacus Cons. `A

Aboitiz Equity

Alliance Global Inc.

Anscor `A

Asia Amalgamated A

ATN Holdings B

Ayala Corp `A

Cosco Capital

DMCI Holdings

F&J Prince A

Filinvest Dev. Corp.

Forum Pacific

GT Capital

House of Inv.

JG Summit Holdings

Lopez Holdings Corp.

Lodestar Invt. Holdg.Corp.

LT Group

Mabuhay Holdings `A

Metro Pacific Inv. Corp.

Minerales Industrias Corp.

MJCI Investments Inc.

Pacifica `A

Prime Media Hldg

Prime Orion

Republic Glass A

San Miguel Corp `A

Seafront `A

Sinophil Corp.

SM Investments Inc.

Solid Group Inc.

South China Res. Inc.

Top Frontier

Unioil Res. & Hldgs

Wellex Industries

Zeus Holdings

10.42

27

3.09

0.240

35.7

7.1

6.73

5.6

5.2

2.44

2.6

1.21

0.083

0.83

1.21

0.445

2.76

2.27

1.73

4.31

0.138

0.640

26.9

4.45

26.9

3.52

3.95

21.9

1.35

4.1

2.4

7.1

8990 HLDG

Anchor Land Holdings Inc.

A. Brown Co., Inc.

Arthaland Corp.

Ayala Land `B

Belle Corp. `A

Cebu Holdings

Cebu Prop. `A

Cebu Prop. `B

Century Property

City & Land Dev.

Cityland Dev. `A

Crown Equities Inc.

Cyber Bay Corp.

Empire East Land

Ever Gotesco

Global-Estate

Filinvest Land,Inc.

Interport `A

Megaworld Corp.

MRC Allied Ind.

Phil. Estates Corp.

Phil. Realty `A

Primex Corp.

Robinsons Land `B

Rockwell

Shang Properties Inc.

SM Prime Holdings

Sta. Lucia Land Inc.

Starmalls

Suntrust Home Dev. Inc.

Vista Land & Lifescapes

3.79

12

0.99

0.182

23

4.25

4.26

2.8

2.65

1.08

1.21

0.97

0.060

0.49

0.9

0.230

1.3

1.18

1.06

2.75

0.070

0.330

17.9

2.5

18.54

1.45

2.71

14.1

0.58

3.05

0.57

4.37

1.92

1.5

47

28.9

0.93

0.61

16.88

8.28

0.2090

0.1090

5.4

2.97

84.8

44.8

3.28

1.99

6.56

3.72

1300

1052

1833

1113

9.99

7.18

2.02

1.2

107.3

75.2

12.5

8.72

0.026

0.012

9.5

5.81

3.4

1.15

4.32

1.9

1.06

0.62

3.49

1.91

17.36

7.5

0.465

0.36

17.5

13.78

7.35

4.2

2.97

1.85

18

8.8

150

89

15.88

7.40

3290

2572

0.360

0.250

47.5

32.3

60.5

48

1.07

0.59

2.7

1.68

11.46

9.6

0.48

0.310

1.6

1.04

2GO Group

ABS-CBN

APC Group, Inc.

Bloomberry

Boulevard Holdings

Calata Corp.

Cebu Air Inc. (5J)

Discovery World

DFNN Inc.

FEUI

Globe Telecom

GMA Network Inc.

Harbor Star

I.C.T.S.I.

IPeople Inc. `A

IP E-Game Ventures Inc.

Jackstones

Leisure & Resorts

Liberty Telecom

Macroasia Corp.

Manila Bulletin

Manila Jockey

Melco Crown

NOW Corp.

Pacific Online Sys. Corp.

PAL Holdings Inc.

Paxys Inc.

Phil. Racing Club

Phil. Seven Corp.

Philweb.Com Inc.

PLDT Common

PremiereHorizon

Puregold

Robinsons RTL

STI Holdings

Transpacific Broadcast

Travellers

Waterfront Phils.

Yehey

0.0055

4.78

23.35

0.315

19

19.38

1.26

1.13

16.5

0.6

1.23

1.310

0.066

0.073

4.22

28.55

4.49

0.660

3.93

0.026

7.24

19.76

34.4

0.047

321

0.019

0.0028

1.72

11.7

0.225

6.2

6

0.5

0.79

4.93

0.385

0.3000

0.2950

0.012

0.014

1.400

14.22

1.47

0.220

1.16

0.016

4.02

7.8

7.56

0.033

220

0.0087

Abra Mining

Apex `A

Atlas Cons. `A

Basic Energy Corp.

Benguet Corp `A

Benguet Corp `B

Century Peak Metals Hldgs

Coal Asia

Dizon

Geograce Res. Phil. Inc.

Lepanto `A

Lepanto `B

Manila Mining `A

Manila Mining `B

Marcventures Hldgs., Inc.

Nickelasia

Nihao Mineral Resources

Omico

Oriental Peninsula Res.

Oriental Pet. `A

Petroenergy Res. Corp.

Philex `A

PhilexPetroleum

Philodrill Corp. `A

Semirara Corp.

United Paragon

49.9

535

60

10.26

9.5

115

80.5

1080

28

504

30

7.1

5.81

107

74.5

1005

ABS-CBN Holdings Corp.

Ayala Corp. Pref B

Benguet Corp. Con. Pref

GMA Holdings Inc.

Leisure and Resort

PCOR-Preferred

SMC Preferred A

SMPFC Preferred

1.6

3.22

0.0010

1.39

LR Warrant

Megaworld Corp. Warrants

101.5

94

Double Dragon

First Metro ETF

Previous

Close

High

Low

FINANCIAL

71.7

71.7

71

87.90

89.75

87.80

85.65

87.00

86.00

54.80

55.00

54.80

2.67

2.61

2.51

15

15.5

15

30.8

31.5

30

7.65

7.65

7.65

2.30

2.65

2.35

27.50

27.90

27.10

85.1

85.85

85.05

1.32

1.36

1.26

24.00

24.00

23.70

92.60

94.00

92.00

128.00

128.30

128.10

279.6

280

279.4

55

55.2

53.8

125

128.3

124.8

1403.00

1404.00

1402.00

122.00

123.00

122.50

2.72

2.73

2.73

INDUSTRIAL

36.5

36.95

6.45

4

4.01

3.91

1.47

1.47

1.45

1.79

1.94

1.79

10.8

10.98

10.8

80.00

89.50

80.10

73.00

75.00

70.00

16.8

16.9

16.8

85

72.05

72

4.29

4.60

4.35

14.2

14.2

14

38

46

39.6

1.77

1.85

1.74

21

21.05

20.9

9.790

10.100

9.57

11.78

12.00

11.66

5.98

6.15

5.96

10.80

10.80

10.54

20.45

21.1

20.3

70.7

70.9

70

16.88

17.96

17.96

0.0100

0.0110

0.0100

14.78

15.20

14.80

6

6.72

5.41

0.540

0.600

0.570

180.40

183.60

180.40

10.14

10.26

10.16

61.00

61.00

61.00

3.31

3.64

3.3

25.7

26.15

25.85

12.860

13.020

12.860

258.00

262.00

260.00

30.30

31.00

30.35

4.85

4.9

4.67

12.00

12.10

11.98

10.68

10.66

10.32

6.38

6.49

6.30

6.49

6.52

6.40

3.05

2.86

2.85

7.83

7.85

7.76

4.8

4.61

4.6

240

242

240

1.82

2.65

1.78

1.84

1.85

1.8

0.148

0.140

0.138

1.91

2.50

1.86

2.46

2.55

2.45

149.2

154.50

150.00

5.06

5.1

5

0.7

0.72

0.69

11.10

11.00

11.00

1.42

1.45

1.42

HOLDING FIRMS

0.520

0.510

0.490

55.20

56.20

55.20

30.55

30.75

30.15

6.98

7.00

6.96

2.00

2.00

1.96

1.62

1.6

1.6

627.5

641.5

628

9.6

9.8

9.5

74.95

78.00

74.65

3

3

3

4.75

5.00

4.96

0.160

0.155

0.150

855

863

855.5

6.10

6.20

5.98

48.50

50.40

48.75

4.91

4.96

4.87

0.76

0.76

0.74

15

15.1

14.94

0.68

0.68

0.68

5.21

5.25

5.15

4.7

4.8

4.78

3.23

3.25

3.25

0.0380

0.0370

0.0370

1.730

1.730

1.730

0.570

0.560

0.550

2.52

2.51

2.51

76.60

76.95

76.00

2.18

2.30

2.18

0.365

0.540

0.540

779.00

787.50

774.00

1.38

1.37

1.37

1.16

1.15

1.10

89.80

90.00

87.10

0.2100

0.2200

0.2100

0.1820

0.1820

0.1750

0.380

0.390

0.380

PROPERTY

7.890

8.160

7.910

13.08

13.10

12.90

1.40

1.39

1.25

0.290

0.285

0.280

30.65

31.75

30.55

5.48

5.1

4.76

5.26

5.23

5.15

5.7

6

5.1

5.7

5.7

5.7

1.42

1.43

1.4

1.82

1.83

1.78

1.12

1.10

1.10

0.088

0.087

0.086

0.70

0.74

0.69

0.960

0.980

0.960

0.255

0.270

0.255

1.93

1.93

1.92

1.62

1.75

1.60

1.25

1.29

1.21

4.65

4.76

4.64

0.0990

0.1000

0.0990

0.3500

0.3500

0.3350

0.6100

0.6200

0.6100

2.63

2.98

2.98

22.30

22.30

22.00

1.9

1.9

1.85

3.29

3.30

3.18

16.50

16.68

16.46

0.81

0.84

0.8

3.69

3.74

3.57

1.280

1.310

1.250

6.230

6.270

6.160

SERVICES

3

3.15

2.9

36

37

36

0.740

0.760

0.700

11.20

11.50

11.20

0.1340

0.1350

0.1300

3.08

3.2

3.06

54.8

55.7

54.3

1.95

1.95

1.88

7.75

7.60

7.55

1104

1110

1104

1690

1730

1690

7.55

7.70

7.55

1.73

1.83

1.76

110.1

112.5

110.2

11.48

11.48

11.48

0.014

0.014

0.013

4.35

5.5

4.21

6.86

7.00

6.84

1.95

1.95

1.89

2.06

2.11

2.01

1.030

1.06

1.000

2.09

2.27

2.12

13.4

13.44

13.02

0.390

0.385

0.370

15.26

15.26

15.26

5.46

5.59

5.39

2.35

2.4

2.35

9.25

9.7

9.25

91.00

91.00

90.00

5.15

5.26

5.15

2878.00

2890.00

2878.00

0.455

0.475

0.445

41.45

42.05

41.30

66.90

68.00

67.10

0.77

0.77

0.75

2.03

2.1

1.71

9

9.1

8.95

0.320

0.320

0.305

1.360

1.320

1.320

MINING & OIL

0.0045

0.0047

0.0044

3.20

3.20

3.02

13.96

13.92

13.84

0.260

0.260

0.255

9.65

10

9.22

9.5

9.6

9.45

0.84

0.85

0.83

1.45

1.48

1.42

9.17

9.20

8.90

0.410

0.415

0.410

0.405

0.405

0.390

0.410

0.410

0.400

0.0180

0.0180

0.0170

0.0180

0.0180

0.0180

4.65

4.68

4.61

27.75

28.05

27.55

2.71

2.83

2.69

0.4600

0.4600

0.4400

2.030

2.050

1.960

0.0180

0.0180

0.0180

6.29

6.29

6.25

9.07

9.19

9.05

7.28

7.6

7.26

0.037

0.037

0.037

380.00

384.40

381.00

0.0110

0.0110

0.0110

PREFERRED

36.6

37

36.25

526

526

520

26.5

26.5

26.5

7.5

7.4

7.39

1

1

1

104.7

104.8

104.6

75.9

76.1

75.95

1035

1035

1030

WARRANTS & BONDS

1.110

1.130

1.070

3.38

3.5

3.49

SME

9.84

10.24

9.5

EXCHANGE TRADED FUNDS

108.5

109.6

108.5

Close Change Volume

Net Foreign

Trade/Buying

71.5

89.30

86.80

55.00

2.51

15.44

31.2

7.65

2.35

27.90

85.65

1.3

23.70

92.40

128.30

279.4

55

128

1402.00

123.00

2.73

-0.28

1.59

1.34

0.36

-5.99

2.93

1.30

0.00

2.17

1.45

0.65

-1.52

-1.25

-0.22

0.23

-0.07

0.00

2.40

-0.07

0.82

0.37

21,860

3,835,420

1,463,340

55,710

1,409,000

1,900

543,900

1,600

51,000

2,100

4,587,670.00

592,000

40,100

1,918,860

1,010

7,590

168,590.00

1,408,070

130

84,600

28,000

1,165,641.00

104,734,700.50

-13,539,776.50

36.8

4.01

1.47

1.89

10.98

80.50

72.00

16.82

72

4.55

14.2

41

1.8

20.9

9.830

11.74

6.00

10.54

20.9

70.8

17.96

0.0100

14.94

5.5

0.590

183.60

10.18

61.00

3.35

26.1

12.900

260.20

31.00

4.75

12.00

10.40

6.39

6.49

2.85

7.79

4.6

241

2.29

1.85

0.140

2.24

2.52

153.3

5.05

0.71

11.00

1.44

0.82

0.25

0.00

5.59

1.67

0.63

-1.37

0.12

-15.29

6.06

0.00

7.89

1.69

-0.48

0.41

-0.34

0.33

-2.41

2.20

0.14

6.40

0.00

1.08

-8.33

9.26

1.77

0.39

0.00

1.21

1.56

0.31

0.85

2.31

-2.06

0.00

-2.62

0.16

0.00

-6.56

-0.51

-4.17

0.42

25.82

0.54

-5.41

17.28

2.44

2.75

-0.20

1.43

-0.90

1.41

4,937,100

8,000

83,000

28,714,000

300

640

3,770

456,500

100

993,000

29,900

297,800

3,329,000

78,400

15,943,900

11,844,600

8,133,500

279,300

3,730,400

472,170

100

78,200,000

310,200

8,968,600

178,000

398,090

1,220,600

50

158,000

2,127,200

456,900

104,190

3,400

544,000

2,493,100

16,600

1,422,700

305,500

4,000

387,600

3,000

5,400

13,666,000

62,000

530,000

2,736,000

8,998,000

1,365,960

220,500

1,547,000

700

688,000

68,753,395.00

0.510

56.20

30.55

7.00

1.96

1.6

641

9.69

78.00

3

4.97

0.155

859

6.00

50.00

4.9

0.76

14.98

0.68

5.19

4.78

3.25

0.0370

1.730

0.560

2.51

76.20

2.20

0.540

784.00

1.37

1.10

90.00

0.2100

0.1800

0.380

-1.92

1.81

0.00

0.29

-2.00

-1.23

2.15

0.94

4.07

0.00

4.63

-3.13

0.47

-1.64

3.09

-0.20

0.00

-0.13

0.00

-0.38

1.70

0.62

-2.63

0.00

-1.75

-0.40

-0.52

0.92

47.95

0.64

-0.72

-5.17

0.22

0.00

-1.10

0.00

701,000.00

2,046,400.00

8,540,700

62,900

22,000

5,000

160,650

2,802,700

2,758,050

35,000

119,000

120,000

128,960

63,600

839,300

1,132,000

22,000

4,455,200

50,000

15,107,000

75,000

5,000

1,000,000

14,000

93,000

1,000

57,150

25,000

12,450,000

455,860

87,000

161,000

24,530

2,030,000

670,000

140,000

7.940

13.10

1.36

0.285

31.75

4.8

5.15

5.42

5.7

1.42

1.83

1.10

0.086

0.71

0.970

0.270

1.92

1.74

1.26

4.7

0.0990

0.3500

0.6200

2.98

22.20

1.88

3.19

16.58

0.8

3.74

1.300

6.260

0.63

0.15

-2.86

-1.72

3.59

-12.41

-2.09

-4.91

0.00

0.00

0.55

-1.79

-2.27

1.43

1.04

5.88

-0.52

7.41

0.80

1.08

0.00

0.00

1.64

13.31

-0.45

-1.05

-3.04

0.48

-1.23

1.36

1.56

0.48

11,373,000

2,300

240,000

3,870,000

9,665,300

87,314,000

701,900

41,100

1,000

3,080,000

17,000

8,000

930,000

13,885,000

969,000

530,000

8,054,000

108,917,000

2,986,000

83,100,000

500,000

30,000

660,000

1,000

2,950,500

483,000

160,000

9,809,800

581,000

109,000

449,000

23,277,600

3

36.95

0.700

11.20

0.1300

3.09

55.15

1.95

7.55

1104

1720

7.55

1.77

112.3

11.48

0.014

4.57

6.98

1.95

2.08

1.010

2.15

13.22

0.385

15.26

5.59

2.4

9.25

90.00

5.20

2888.00

0.460

41.50

67.75

0.77

2.1

9

0.320

1.320

0.00

2.64

-5.41

0.00

-2.99

0.32

0.64

0.00

-2.58

0.00

1.78

0.00

2.31

2.00

0.00

0.00

5.06

1.75

0.00

0.97

-1.94

2.87

-1.34

-1.28

0.00

2.38

2.13

0.00

-1.10

0.97

0.35

1.10

0.12

1.27

0.00

3.45

0.00

0.00

-2.94

84,000

44,200

29,432,000

1,262,000

103,250,000

108,000

93,940

78,000

70,000

110

32,380

26,900

272,000

825,610

200

26,800,000

126,000

488,800

9,000

293,000

2,850,000

255,000

81,600

210,000

800

6,000

260,000

18,000

2,760

963,700

120,310

3,480,000

2,453,000

2,474,300

4,416,000

89,000

9,113,900

380,000

1,000

0.0046

3.20

13.88

0.255

10

9.6

0.85

1.43

8.90

0.410

0.390

0.405

0.0170

0.0180

4.65

27.75

2.69

0.4600

2.020

0.0180

6.29

9.1

7.34

0.037

383.00

0.0110

2.22

0.00

-0.57

-1.92

3.63

1.05

1.19

-1.38

-2.94

0.00

-3.70

-1.22

-5.56

0.00

0.00

0.00

-0.74

0.00

-0.49

0.00

0.00

0.33

0.82

0.00

0.79

0.00

281,000,000

108,000

1,116,000

950,000

43,900

43,200

918,000

9,663,000

40,000

230,000

26,640,000

10,740,000

52,800,000

38,400,000

883,000

2,838,200

881,000

40,000

797,000

30,000,000

26,000

4,001,100

574,300

6,100,000

176,080

1,200,000

36.8

520

26.5

7.4

1

104.6

76

1030

0.55

-1.14

0.00

-1.33

0.00

-0.10

0.13

-0.48

216,400

20,060

300

112,000

550,000

29,250

775,940

1,150

1.090

3.5

-1.80

3.55

499,000

16,000

9.5

-3.46

12,320,900

1,770,668.00

109.6

1.01

3,860

5,425.00

-25,600.00

10,815,190.00

-94,079,718.50

-658,710.00

-6,717,452.00

-2,566.00

-83,980.00

-4,124,206.00

29,780,065.00

28,050.00

-5,301,300.00

20,300.00

567,220.00

1,679,144.00

6,480.00

171,100.00

-6,952,165.00

-436,270.00

-1,320,825.00

14,678,168.00

23,893,188.00

-10,953,916.00

-680,774.00

26,029,545.00

-5,056,821.50

-434,000.00

2,722,906.00

1,199,144.00

-54,280.00

36,542,401.00

-233,234.00

-8,639,345.00

526,446.00

-143,918.00

-1,429,990.00

-12,657,838.00

-5,751,253.00

1,762,324.00

9,200.00

149,776.00

-230,060.00

-57,350.00

589,930.00

-956,950.00

76,264,700.00

280,000.00

53,252,067.00

5,380,290.00

44,907,000.00

6,164,715.00

125,601,371.00

-198,400.00

18,255,140.00

-15,250.00

27,849,315.00

-168,940.00

-6,685,712.00

8,588,231.00

-1,644,256.50

13,300.00

35,849,640.00

435,956.00

266,369.00

1,310.00

4,877,095.00

-13,672,192.00

-51,500.00

811,610.00

3,226,770.00

66,300.00

11,904,240.00

82,256,580.00

-15,386,710.00

-10,108,045.00

-11,593,778.00

-28,159,439.00

113,500.00

9,676,734.00

182,200.00

3,090.00

98,858.00

25,365,205.00

41,624,885.00

-2,892,487.00

284,418.00

60,060.00

-570,400.00

-72,082,340.00

44,500.00

-54,120,730.00

-34,749,693.00

1,444,000.00

-80,000.00

-6,033,215.00

61,000.00

525,548.00

4,940.00

-2,674,050.00

-248,400.00

-46,100.00

36,532,915.00

-59,880.00

2,000.00

33,056,240.00

-1,983,225.00

-28,776,516.00

1,643,660.00

-7,390.00

-759,500.00

Das könnte Ihnen auch gefallen

- Manila Standard Today - Business Daily Stocks Review (June 9, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (June 9, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 12, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 12, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 13, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 13, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 8, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 8, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 6, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 6, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 28, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 28, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 14, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 14, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 13, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 13, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 7, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 7, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 20, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 20, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 20, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 20, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 6, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 6, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 16, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 16, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 31, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 31, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 23, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 23, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 12, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 12, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 2, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 2, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 29, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 29, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 27, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 27, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 1, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 1, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 1, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 1, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 10, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 10, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 25, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 25, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 19, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 19, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 21, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 21, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (August 5, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (August 5, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 26, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 26, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 18, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 18, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 1, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 1, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 11, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 11, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 27, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 27, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 17, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 17, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 10, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 10, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 11, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 11, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 22, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 22, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 10, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 10, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 4, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 4, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 9, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 9, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (September 24, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (September 24, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 7, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 7, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 2, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 2, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 13, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 13, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 17, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 17, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (April 8, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (April 8, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (September 2, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (September 2, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (August 5, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (August 5, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (September 10, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (September 10, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 2, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 2, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 10, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 10, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 11, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 11, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (August 23, 2013Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (August 23, 2013Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 13, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 13, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (October 29, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (October 29, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 6, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 6, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (January 02, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (January 02, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 18, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 18, 2014)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (November 18, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (November 18, 2013)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (August 4, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (August 4, 2014)Manila Standard TodayNoch keine Bewertungen

- Silicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityVon EverandSilicon Triangle: The United States, Taiwan, China, and Global Semiconductor SecurityNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (December 23, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (December 23, 2014)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 22, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 22, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 9, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 9, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 8, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 8, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 29, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 29, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 3, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 3, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 5, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 5, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 4, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 4, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 15, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 20, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 20, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (June 2, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (June 2, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Dokument1 SeiteManila Standard Today - Business Weekly Stock Review (May 25 - 29, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (February 5, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (February 5, 2014)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 26, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 26, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 15, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 15, 2015)Guillerson AlanguilanNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 25, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 25, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 13, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 13, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (March 6, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (March 6, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 18, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 18, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (July 3, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (July 3, 2014)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 12, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 12, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Dokument1 SeiteManila Standard Today - Busines Weekly Stock Review (May 4-8, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 11, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 11, 2015)Manila Standard TodayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (May 08, 2015)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (May 08, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 6, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 6, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 7, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 7, 2015)Manila Standard TodayNoch keine Bewertungen

- The Standard - Business Daily Stocks Review (May 5, 2015)Dokument1 SeiteThe Standard - Business Daily Stocks Review (May 5, 2015)Manila Standard TodayNoch keine Bewertungen

- Rdo 105 - 2023Dokument1 SeiteRdo 105 - 2023May Ann Saranza - LustivaNoch keine Bewertungen

- MD NAME ListDokument27 SeitenMD NAME ListNovelyn DalumpinesNoch keine Bewertungen

- Concrete Client List PDFDokument19 SeitenConcrete Client List PDFClef GonadanNoch keine Bewertungen

- Manila Standard Today - Business Daily Stock Review (November 28, 2014)Dokument1 SeiteManila Standard Today - Business Daily Stock Review (November 28, 2014)Manila Standard TodayNoch keine Bewertungen

- List of Bayad Centers - As of May 26, 2021Dokument576 SeitenList of Bayad Centers - As of May 26, 2021Leo MaravilloNoch keine Bewertungen

- I. GENERAL PROVISIONS (Article 1156 To 1162)Dokument6 SeitenI. GENERAL PROVISIONS (Article 1156 To 1162)George JR. E. SilandoteNoch keine Bewertungen

- Date Consignee/Recipient Documents Sent Waybill NumberDokument1 SeiteDate Consignee/Recipient Documents Sent Waybill NumberRenshel Joy OnnaganNoch keine Bewertungen

- Road MetroManilaBusOperatorsDokument30 SeitenRoad MetroManilaBusOperatorsAnna Katrina VistanNoch keine Bewertungen

- WEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield NosDokument8 SeitenWEEKLY REPORT - Price Movement: Sym Name Mon Tue Wed Thu Fri NFB - Nfs Yield Nosανατολή και πετύχετεNoch keine Bewertungen

- List of Watsons StoresDokument12 SeitenList of Watsons Storessisang98147Noch keine Bewertungen

- PESONet ParticipantsDokument2 SeitenPESONet ParticipantsMoi SeeNoch keine Bewertungen

- Bank ListsDokument4 SeitenBank ListsMhickLuceroNoch keine Bewertungen

- Branch List Saturday Banking As of October29Dokument4 SeitenBranch List Saturday Banking As of October29Luis EvascoNoch keine Bewertungen

- List of 262 Philippine IT Parks and CentersDokument12 SeitenList of 262 Philippine IT Parks and CentersJoan Plete-KoNoch keine Bewertungen

- History and companies of the Philippine Stock ExchangeDokument11 SeitenHistory and companies of the Philippine Stock ExchangeBeberlie LapingNoch keine Bewertungen

- Syllabus ObliconDokument5 SeitenSyllabus ObliconPat TrickNoch keine Bewertungen

- Tallest Buildings in The PhilippinesDokument12 SeitenTallest Buildings in The Philippinesjendel manahanNoch keine Bewertungen

- List of CompaniesDokument8 SeitenList of Companieskirstin pizzaNoch keine Bewertungen

- List of Project FinalDokument9 SeitenList of Project FinalClyde LabayNoch keine Bewertungen

- Manila Standard Today - Business Daily Stocks Review (May 22, 2013)Dokument1 SeiteManila Standard Today - Business Daily Stocks Review (May 22, 2013)Manila Standard TodayNoch keine Bewertungen

- PWHS 18th Foundation Day CelebrationDokument1 SeitePWHS 18th Foundation Day CelebrationLakanPHNoch keine Bewertungen

- Qualified Contestable Customers - March 2022 DataDokument103 SeitenQualified Contestable Customers - March 2022 Datadexterbautistadecember161985Noch keine Bewertungen

- Joint and Solidary Obligations Case DigestDokument12 SeitenJoint and Solidary Obligations Case DigestNoirahgap AnigerNoch keine Bewertungen

- PhilTech GuideDokument3 SeitenPhilTech GuidekristineNoch keine Bewertungen

- 2013 MWC Standard Drawings 09032013Dokument139 Seiten2013 MWC Standard Drawings 09032013Mark Roger II HuberitNoch keine Bewertungen

- Filipino EntrepreneursDokument2 SeitenFilipino EntrepreneursTrishia TaladtadNoch keine Bewertungen

- Top 10 Real Estate Developers in The Philippines: Source: Ayala Land, Inc. 2022 Integrated Annual ReportDokument5 SeitenTop 10 Real Estate Developers in The Philippines: Source: Ayala Land, Inc. 2022 Integrated Annual ReportremingiiiNoch keine Bewertungen

- Obligations Contracts CASE AssignmentsDokument7 SeitenObligations Contracts CASE AssignmentsMyfanwy DecenaNoch keine Bewertungen

- 0009 Voters - List. Bay, Laguna - Brgy Bitin - Precint.0131aDokument4 Seiten0009 Voters - List. Bay, Laguna - Brgy Bitin - Precint.0131aIwai MotoNoch keine Bewertungen

- Employer-Employee Relationships and Classes of EmployeesDokument3 SeitenEmployer-Employee Relationships and Classes of EmployeesvinaNoch keine Bewertungen