Beruflich Dokumente

Kultur Dokumente

04 Lending - Overview

Hochgeladen von

thichnhiu0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten26 Seitenlending overview

peter rose

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenlending overview

peter rose

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten26 Seiten04 Lending - Overview

Hochgeladen von

thichnhiulending overview

peter rose

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 26

Lending:

Policies and procedures

Chapter 16

Contents

Types of Loans

Factors Affecting the Mix of Loans Made

Credit analysis

Steps in the Lending Process

Loan Review and Loan Workouts

Optional readings

Regulation of Lending

Creating a Written Loan Policy

16-2

Introduction

Banks main job is to make loans

Loans support the growth of new businesses and jobs within

the lenders market area

Loans frequently convey information to the marketplace

about a borrowers credit quality

The lending process should be carefully monitored

16-3

Types of Loans

Real Estate Loans (including mortgage)

Financial Institution Loans

Agriculture Loans

Commercial and Industrial Loans

Loans to Individuals

Miscellaneous Loans

Lease Financing Receivables

16-4

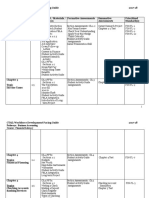

TABLE 161 Loans Outstanding for All FDIC-Insured Banks as of

December 31, 2010 (consolidated domestic and foreign offices)

16-5

E.g: ACB

Types of Loans (continued)

Factors Determining the Growth and Mix of Loans

Characteristics of the market area

Lender size

Wholesale lenders vs. retail credit

Experience and expertise of management

Loan policy

Expected yield of each type of loan

Regulation

General rule: A lending institution should make the types of

loans for which it is the most efficient producer

16-8

Regulation of Lending

The mix, quality, and yield of the loan portfolio are heavily

influenced by regulation

Examples of lending regulations:

Total loan to a single customer normally cannot exceed 15

percent of a single banks equity (legal lending limit)

Any loans made are subject to examination and review

16-9

Regulation of Lending (continued)

Uniform Financial Institutions Rating System

Each banking firm is assigned a numerical rating based on the

quality of its asset portfolio

The federal examiner may assign one of these ratings:

1 = strong performance

2 = satisfactory performance

3 = fair performance

4 = marginal performance

5 = unsatisfactory performance

16-10

Regulation of Lending (continued)

Asset Quality

Criticized loans: good but not in full compliance with the

banks loan policy

Scheduled loans: significant weaknesses (credit

concentration in a borrower or an industry)

Adversely classified loans

Substandard loans: problems with repayment abilities &

collateral

Doubtful loans: high probability of uncollectible loss

Loss loans: uncollectible

16-11

Regulation of Lending (continued)

CAMELS Rating

Capital adequacy

Asset quality

Management quality

Earnings record

Liquidity position

Sensitivity to market risk exposure

All six dimensions of performance are combined into one overall

numerical rating, referred to as the CAMELS rating

Depository institutions whose overall rating is low tend to be

examined more frequently than the highest-rated institutions

16-12

Establishing a Good Written Loan Policy

Important in order to meet regulatory standards

What should a written loan policy contain?

A goal statement for the entire loan portfolio

Specification of lending authority of each loan officer and

loan committee

Lines of responsibility in making assignments and

reporting information

Operating procedures for soliciting, evaluating and

making loan decisions

Required documentation for all loans

16-13

Establishing a Good Written Loan Policy (cont)

Lines of authority for maintaining and reviewing credit files

Guidelines for taking, evaluating, and perfecting loan

collateral.

Procedures for setting loan rates and fees and the terms for

repayment of loans

A statement of quality standards applicable to all loans

A statement of the preferred upper limit for total loans

outstanding

A description of the lending institutions principal trade area

Procedures for detecting and working out problem loan

situations.

16-14

Steps in lending process 6 steps

1. Find prospective customers

Individuals: normally come to the bank

Business loans: through salespeople contacts

2. Evaluate customers character and sincerity of

purpose

Interview: customer explains his credit needs

Loan officer to assess customers sincerity

3. Make site visit & evaluate credit records of customer

Location and condition of property

Records of customers previous loans

Steps in lending process

4. Evaluate customers financial condition

Does customer have sufficient cash flow and backup assets to

repay the loan?

5. Assess collateral & sign the loan agreement

6. Monitor customers compliance with the agreement

Ensure terms are being followed, principal and interest are

paid in time

Visit customers & explore new opportunities

Credit analysis

Is the borrower creditworthy?

How to structure the loan so that lender is protected and

borrower is able to repay

Can lender secure its claim on the collateral in the event of

loan default

Credit Analysis: What Makes a Good Loan?

1. Is the Borrower Creditworthy? The Cs of Credit

Character

Specific purpose of loan and serious intent to repay the loan

Capacity

Legal authority to sign binding contract

Cash

Ability to generate enough cash to repay loan

Collateral

Adequate assets to support the loan

Conditions

Economic conditions faced by borrower

Control

Does loan meet written loan policy and how would loan be affected

by changing laws and regulations

16-18

Credit Analysis: What Makes a Good Loan?

(continued)

2. Can the Loan Agreement Be Properly Structured

and Documented?

Draft a loan agreement that meets the borrowers need for

funds with a comfortable repayment schedule

Proper accommodation of a customer may involve lending

more or less money than requested over a longer or shorter

period

16-19

Credit Analysis: What Makes a Good Loan?

(continued)

3. Can lender secure its claim on the collateral in the event of

loan default?

Reasons for Taking Collateral

If the borrower cannot pay, the pledge of collateral gives the lender

the right to seize and sell those assets

It gives the lender a psychological advantage over the borrower

Types of Collateral

Accounts Receivables

Factoring

Inventory

Real Property

Personal Property

Personal Guarantees

16-20

EXHIBIT 161 Safety Zones Surrounding Funds Loaned in

Order to Protect a Lender

16-21

TABLE 164 Sources of Information Frequently Used in Loan

Analysis and Evaluation by Lenders and Loan Committees

16-22

Parts of a Typical Loan Agreement

The Note: principal, interest, terms of repayment

Collateral

Covenants

Affirmative

Negative

Borrower Guaranties

Events of Default

16-23

Loan Review

1. Carrying out reviews of all types of loans on a periodic basis

2. Structuring the loan review process: check

Record of borrower payments

Quality and condition of collateral

Completeness of loan documentation

Evaluation of borrowers financial condition

Assessment as to whether the loan fits with the lenders loan policies

3. Reviewing Largest Loans Most Frequently

4. Conducting More Frequent Reviews of Troubled Loans

5. Accelerating the Loan Review Schedule if Economy or Industry

Experiences Problems

16-24

Loan Workouts

Loan workout the process of recovering funds from a problem

loan situation

Warning Signs of Problem Loans

1. Unusual or unexpected delays in receiving financial statements

2. Any sudden changes in accounting methods

3. Restructuring debt or eliminating dividend payments or changes in

credit rating

4. Adverse changes in the price of stock

5. Losses in one or more years

6. Adverse changes in capital structure

7. Deviations in actual sales from projections

8. Unexpected or unexplained changes in deposits

16-25

Loan Workouts (continued)

What steps should a lender take when a loan is in trouble?

1. Do not forget the goal: Maximize full recovery of funds

2. Rapid detection and reporting of problems is essential

3. Loan workout should be separate from lending function

4. Should consult with customer quickly regarding possible options

5. Estimate resources available to collect on loan

6. Conduct tax and litigation search

7. Evaluate quality and competence of management

8. Consider all reasonable alternatives

Preferred option: Seek a revised loan agreement

16-27

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Industry 4.0 TenderDokument58 SeitenIndustry 4.0 TenderSoumya Ranjan SubudhiNoch keine Bewertungen

- Graded Questions Ifrs CompleteDokument343 SeitenGraded Questions Ifrs Completebelijob50% (2)

- General Mathematics: I.2 Learning ActivitiesDokument6 SeitenGeneral Mathematics: I.2 Learning ActivitiesAndrea InocNoch keine Bewertungen

- CG Alias - AnswDokument2 SeitenCG Alias - AnswMohamad YusofNoch keine Bewertungen

- Lic Nir QuestionaireDokument3 SeitenLic Nir Questionaireneville79Noch keine Bewertungen

- BSA2A WrittenReports Thrift-BanksDokument5 SeitenBSA2A WrittenReports Thrift-Banksrobert pilapilNoch keine Bewertungen

- RBS & Faysal BankDokument13 SeitenRBS & Faysal BankOmer MirzaNoch keine Bewertungen

- Commerce Lesson PlanDokument6 SeitenCommerce Lesson PlanPrince Victor0% (1)

- Activity 2Dokument5 SeitenActivity 2Honey Grace TangarurangNoch keine Bewertungen

- Pacing Guide-Financial LiteracyDokument6 SeitenPacing Guide-Financial Literacyapi-377548294Noch keine Bewertungen

- Short-Term Loan Remittance Form (STLRF)Dokument2 SeitenShort-Term Loan Remittance Form (STLRF)maricorNoch keine Bewertungen

- Updated Standard Form For Bidding of Goods - Doc New CheklistDokument140 SeitenUpdated Standard Form For Bidding of Goods - Doc New CheklistleoNoch keine Bewertungen

- Bank Statement March - 2019Dokument13 SeitenBank Statement March - 2019Rowella De MesaNoch keine Bewertungen

- ONGC - EPP - Apple Offer - 03-10-22Dokument3 SeitenONGC - EPP - Apple Offer - 03-10-22sameer bakshiNoch keine Bewertungen

- Account Opening FormDokument3 SeitenAccount Opening FormJoseph VJNoch keine Bewertungen

- Public Provident Fund Scheme 1968: Salient FeaturesDokument16 SeitenPublic Provident Fund Scheme 1968: Salient FeaturesjyottsnaNoch keine Bewertungen

- Month Wise Checklist For Submission of Various ReturnsDokument3 SeitenMonth Wise Checklist For Submission of Various Returnsadith24Noch keine Bewertungen

- Digest of G.R. No. 157314 July 29, 2005Dokument2 SeitenDigest of G.R. No. 157314 July 29, 2005oliveNoch keine Bewertungen

- MIT43RMNHDokument180 SeitenMIT43RMNHexecutive engineerNoch keine Bewertungen

- Carana BankDokument26 SeitenCarana BankRakesh Kolasani NaiduNoch keine Bewertungen

- Mitc For Amazon Pay Credit CardDokument7 SeitenMitc For Amazon Pay Credit CardBlain Santhosh FernandesNoch keine Bewertungen

- Emv2000 L2 2.0Dokument623 SeitenEmv2000 L2 2.0OgarSkaliNoch keine Bewertungen

- Finacle Menu/command To Print Pass BookDokument4 SeitenFinacle Menu/command To Print Pass BookSanjeevKumarNoch keine Bewertungen

- 3 de Thi ToeicDokument115 Seiten3 de Thi ToeicTiểu MinhNoch keine Bewertungen

- Data Guide PDFDokument141 SeitenData Guide PDFRudi MSNoch keine Bewertungen

- Updated KYCDokument3 SeitenUpdated KYCSarvar PathanNoch keine Bewertungen

- Bismillah Group ScandalDokument3 SeitenBismillah Group ScandalAhmad HNoch keine Bewertungen

- GuggenheimDokument5 SeitenGuggenheimRochester Democrat and ChronicleNoch keine Bewertungen

- CV - Ca. Vaibhav GattaniDokument2 SeitenCV - Ca. Vaibhav GattaniCA Vaibhav GattaniNoch keine Bewertungen

- Accounting Systems For Thrift Co-Operatives Promoted by Co-OperativeDokument42 SeitenAccounting Systems For Thrift Co-Operatives Promoted by Co-OperativemadhanagopalNoch keine Bewertungen