Beruflich Dokumente

Kultur Dokumente

Academy Awards, Sharon Stone and Market Efficiency

Hochgeladen von

pjs15Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Academy Awards, Sharon Stone and Market Efficiency

Hochgeladen von

pjs15Copyright:

Verfügbare Formate

1

Columbia University

Graduate School of Business

B7313

Securities Analysis

EMBA Elective C Professor Paul J ohnson

Fall 2004 Room 105 Warren Hall

Office Hours: By appointment and by telephone. Office Phone: (212) 293-3402

Academy Awards, Sharon Stone and Market Efficiency

Market efficiency may be the most emotional topic that market practitioners can discuss.

Virtually all of the academic studies suggest that the efficiency of the market is remarkably high.

In fact, market anomalies are rare and usually apply to only a handful of specific stocks for a

specific period of time. Despite these studies, most, if not virtually all, market practitioners

believe that the efficiency of the stock market lies somewhere between nonexistent and

inconsequential. We find this paradox to be interesting.

Academy Awards

We have had the opportunity to conduct the follow experiment. We asked students in a

investment class to pick individually their best selection as to who would win the Academy

Awards. We picked 12 categories for this contest; the first six categories were the most obvious

1

and the second six were somewhat obscure

2

, at least to people outside Hollywood.

To make the contest interesting, the student with the greatest number of correct answers would

win $50, depending on the contest. Being starving graduate students, it was more than enough

money to keep them interested and motivate them to pick their best guesses. In addition to

tallying each students entrant, we also tallied how many students selected each nominee within

each category (median). We then determined that each nominee with the greatest number of

votes in each category to be the groups selection and we considered this to be the consensus

view. We then waited for the actual results to be announced, usually a few weeks later. The

results always surprised us.

We have conducted this experiment five times. The results from each year are presented in

Tables 1- 4 at the back of this essay. Table 1 presents the results from 1995 and 1996, Table 2

present the 1997 results, Table 3 present the results from 2002 (we took a few years off from the

1

Best Actor Male, Best Actor Female, Best Supporting Actor Male, Best Supporting Actor Female, Best Picture,

and Best Director

2

Original Screenplay, Adapted Screenplay, Cinematography, Film Editing, Original Score and Original Song

2

contest), and Table 4 the results from 2004 (again we skipped a yearhey, it is a part-time gig!).

In 1997 we conducted the experiment in three different investment classes, two at the Graduate

School of Business, Columbia University, the third at the Graduate School of Business,

University of California, Berkeley. The 1997 results included the largest sample size and

resulted in the most robust outcome, all of which is summarized in Table 6. In 2002, we

conducted the contest in two different investment classes at Columbia, with a bit smaller

population than the 1997 results. The 2002 contest was the most surprising because it produced

the least robust results of all of the experiments. Although the size of the participants in the

2004 was small (at least by recent standards in the contest), the results mimicked the outcomes

of prior years and reversed the unusual results produced in 2002

What is interesting in the results from the contest in each of the years is that the group selection,

the consensus view, has an amazing track record at picking the winners of the actual Academy

Awards. In fact, although the consensus view was beat for the first time in the 2002 contest, it

had never lost to a student in any other year. The consensus had tied the best student in some of

the years, but had an almost perfect record in predicting the winners. The second surprise from

the contest is that the consensus did remarkably well despite the low score of the average student

(this held true even in 2002). In each case, the consensus view scored more than the correct

answers of the average studentin 1995, 1996 and 1997 the consensus scored more than twice

the average student. This is fascinating. The third surprise is how few data points are needed

before a powerful consensus is created. For instance, there were only 22 entrants in the 1995

contest and, despite the low population, the results are equally robust as contests in the later

years based on a higher number of entrants. Although the data suggests that the contest does not

need many contestants to produce a robust outcome, the 1997 contest shows what happens as the

population increases. Using the summary data presented in Table 2, the results show that the

consensus managed to guess 11 correct answers out of a possible 12 that year. The best

human scored 10 and the average contestant scored only 4.5 correct answers. In 2004 the

consensus correctly guessed all 12 winners for the first time in the contest. Although 2004 is

perceived as an easy year, with all of the favorites pulling through to win their category, the

average student guessed only 7 correctly. Although the average for correct answers from the

students was well above past averages, it was still below the results for the consensus. In

addition, although one student also guessed all 12 categories correctly, thus matching the

consensus, the second highest scoring student guessed only 11 correctly, matching the pattern

in prior contests. Therefore, despite the relatively higher scores in 2004 (hence the moniker of

being easy), the results followed exactly the same pattern of past contests.

As a consequence of the results from all of the contests, it is clear that the consensus is a

powerful force.

Consensus Mechanics - The importance of being independent

What is going on here? How can a consensus produce such amazing results, when the average

participant scored so poorly?

3

The key to understanding the results is the notion of independent errors. The explanation goes

like this. Each participant will make mistakes as to their individual guesses. But few will guess

all 12 categories incorrectly. Most will have an informed opinion on at least a few of the

categories. Each person will have seen the movies or read a review or two; they will be exposed

to public opinion; and some will be influenced by the winners of the Golden Globe Awards (that

were announced earlier in the year). Nevertheless, each person will have a different opinion as

to the potential winners. The interesting part of the contest is that the errors begin to cancel each

other out. There is only one actual winner (unknown at the time), but there are four non-winners

(although even being nominated is a form of winning!). Therefore, simple statistics suggest that

the winning guesses will begin to reinforce each other, while the losing guesses will begin to

cancel each other out. However, all of this presupposes that the guesses are not completely

random. If each student guessed randomly, then the statistics would predict that each of the five

nominees would receive the same number of votes and the no real consensus would be formed.

Therefore, the contest assumes that each student has at least a non-random opinion (technically,

we only need some of the students to have a non-random opinion for the consensus to form, but

the consensus becomes more robust as the non-randomness of opinion increases.) The key to

the contest is that the various opinions begin to cancel each other out when they are wrong and

reinforce each other when they are right. Therefore, all that is needed is a slight bit of correct

information to enter the contest for a consensus view to begin to emerge. We call this the power

of independent errors and very powerful it is. But the contest does not always work this way.

Repeatability - one may win this year, but will not the next

Despite the apparent power of consensus, the systems is not without its flaws and potential

weaknesses. What happens when errors no longer remain independent? Interestingly, the

students guesses are influenced by many sources, but sometimes the world decides that one

particular entrant is just going to win. This was the case for the English Patient as the Best

Picture nominee in 1997. The movie had received the most nominations, had won the Golden

Globe Award and had received the critics support. It was just going to win! The popular

opinion was reflected in the contest results. Out of a possible 128 entrants, 100 selected the

English Patient to win84% of the student selections. Not surprising, the movie did win.

Chalk one up for the consensus, and most of the students.

But sometimes the popular press is not correct in pre-selecting a winner as was the case for

Best Actress in 1996. In a similar fashion as in the Best Picture contest in 1997, the press

decided that Sharon Stone was going to win for her role in Casino. She had won the Golden

Globe Award and the hearts of the critics. Once again this opinion showed itself in the contest

results. Roughly 85% of the students selected her to win. Nevertheless, she was edged out by

Susan Surandon for her role in Dead Man Walking. In this case the consensus was wrong.

Both situations represent a case of non-independent errors. Many of the students were

influenced by a similar, external opinion. Despite strong evidence that no one knows who will

win the award, the students were overly influenced by the opinion of the popular press. This

resulted in non-independent thinking and a fragile consensus. In one case, the consensus was

right, but in the other it was wrong. Independent of the outcome, both cases are examples where

4

the independent thinking collapsed and produced a fragile consensus. Interestingly, a similar

phenomenon of non-independent thinking occurs when group members are allowed to discuss

their guesses ahead of time. In these situations, the loudest, and often the most confident, in the

group tends to have influence over the groups thinking and can influence individual selection.

Although we have not run the experiment with a group discussion, the academic literature on

management theory is chock full of similar experiments. This phenomenon is referred to as

group think, and can be viewed simply as a case of non-independent thinking or non-

independent errors. This example parallels the role of the press or a well-respected analyst as a

lighting rod to galvanize opinion in the stock market, many times resulting in a less robust

consensus view!

One additional potential flaw of the system of selecting a consensus is when there are too few

contestants. It is clear from our work that the more, the merrier. The power of the consensus

clearly strengthens as the number of contestants increases (although, as we pointed out earlier, a

key criteria is that the individuals are at least partially independent in their thinking). How many

are needed is beyond the scope of our experiment, but it is clear that as the number of

participants decreases, the power of the consensus weakens.

One of the key outcomes of this experiment is that when enough, at least partially informed,

and reasonably independent participants, are allowed to select individual results, the consensus

results will be powerful. In most cases, the consensus will be more accurate than all of the

participants and significantly more robust that the average participant. This is a very powerful

metaphor for the stock market.

It is also important to note that it would be unlikely that a single individual would do well each

year. One student may produce the highest number of correct answers one year, maybe even

beating the consensus that year (it has only happened once in the five contests), but it is doubtful

that the same student would do it a second year. In most cases, the student was lucky. Odds are

high that the luck would not return to the same student two years in a row.

Is there an Academy Award in the Stock Market?

We believe that there are many parallels between our Academy Awards contest and the stock

market. In the stock market, individual compete with each other to have a better guess as to the

true value of individual securities. No participants knows for sure the true value of these stocks

and no participant has complete knowledge. Most believe themselves to be well informed.

Nevertheless, we all make mistakes. But rarely are these mistake the same across all individuals.

In fact, many of our best guesses have a fare amount of correct information. The things that we

know to be true tend to be common among other participants and the things that we know, but

are not correct (errors), tend to be individual. Therefore, our errors tend to cancel themselves out

while our correct guesses tend to reinforce themselves. In this same way, the Academy Awards

contest draws an interesting and powerful metaphor for investing.

Interestingly, the metaphor actually maps well even when it breaks down. For instance, there are

times when public opinion is influenced by external influences or information. In some of the

5

instances this information is powerful enough to influence individual decision making. In these

cases, the errors become non-independent because we are all starting to think alike. This is a

form of group think. In the stock market we tend to call these manias or panics. Manias when

the consensus opinion of value becomes overly inflated and panics when the consensus

opinion becomes too negative (actually, unlike the Academy Awards contest, the stock market

is dynamic and manias/panics generally begin to feed on themselves exaggerating the direction

of the consensus view). Manias, and panics, are merely a case of group think and non-

independent errors. Interestingly, the simple model of guessing the Academy Awards can

explain much of the stock market behavior in these situations.

The stock market also has periods of low activity, when there are not enough participants in a

situation to produce a robust consensus. We tend to call these situations neglected stocks. Once

again, the Academy Awards contest is an apt metaphor.

Although the 2004 contest put the results back on track, we continue to be troubled by the results

in 2002? Unlike all other years, the result for 2002 did not follow the same pattern and the

consensus did not produce the same impressive results. Interestingly, although the best human

guesses did in fact beat the consensus for the first time, the number of correct guesses by the

winner was no better than in years past and the average student was well below prior year

contests as well. It may be important to note that one distinct feature of the 2002 contest is that

no clear consensus opinion emerge in many of the categories and, even the Hollywood experts

agreed, the Oscar winners that year were surprising. Therefore, the lesson to be learned is that

when no clear consensus is at work, surprise outcomes produce unusual winners. Ironically, the

2002 Academy Awards mirror the U.S. stock market for the same period: no clear consensus on

market direction, unusual outcomes in stock performance and unpredicted winners (stocks and

money managers).

Market Efficiency

How does all of this relate to market efficiency? Even the academics have some trouble in

defining precisely what is market efficiency. Nevertheless, we will settle on a simple definition.

We believe that a market is efficient when no individual can out guess the market as to the true

value of any individual stock consistently over time. On any given day, we may concede that a

few individuals can out guess the market as to the true value of a specific stock (ala the 2002

Academy Awards), but these same individuals cannot out guess the market as to the true value of

this same stock consistently over time. Another way of saying this is that no individual can out

guess the market as to the value of multiple stocks on a consistent basis.

The Academy Awards contest certainly supports the notion that the consensus is a very powerful

mechanism, particularly when a few assumptions are made. What is interesting is that nowhere

in the contest have we asked the participants to be rational. Our only request is that they are

independent from each other and at least partially informed. Once these two conditions are met,

the consensus appears to be the most robust prediction as to the best guess or most true value at

least over time (although 2002-like outcomes do happen in the stock market as well). I would

suggest that for most stocks in the stock market, these conditions hold, most of the time. Yes, it

6

does appear that manias and panics can develop, but they appear to be relatively infrequent.

Making the case that most investors believe themselves to be at least partially informed also

seems to be an easy assumption. Finally, in terms of acting independently, again this appears to

be a reasonable assumption, most of the time. With all of these conditions in place, the Acadeny

Awards metaphor would suggest that the market is efficient for most companies, most of the

time.

Where does this leave us?

Interesting question. When there are enough, informed investors acting independently, the

consensus view will be more powerful than any individuals view, and the market will be

essentially efficient for that security (remember that this has nothing to do with acting

rationally). It is only when these conditions fail that the market becomes less efficient. When

there are not enough participants, the stock becomes neglected and may become miss-priced.

When investors stop acting independently, they may begin to exhibit group think and either a

mania (positive) or a panic (negative) may ensue. The rest of the time, the market will be better

than man, at least individual man.

So the next time you watch the Academy Awards, think about your investment strategy. And

visa versa. Each time you invest, remember the power of the consensus.

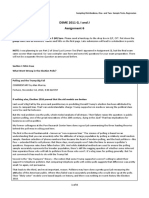

Academy Awards Experiment

Table 1

1995 1996

Humans Humans

Consensus Best 2nd Best Average Consensus Best 2nd Best Average

I 4 5 2 2.40 3 4 4 2.00

II 5 4 6 2.73 5 4 3 2.58

Total 9 9 8 5.13 8 8 7 4.58

Participants 22 33

Table 2

1997 1997

PJ MM

Humans Humans

Consensus Best 2nd Best Average Consensus Best 2nd Best Average

I 5 3 5 2.57 5 4 5 2.60

II 5 5 2 2.30 4 4 3 2.22

Total 10 8 7 4.87 9 8 8 4.82

Participants 28 55

1997 1997

PS All

Humans Humans

Consensus Best 2nd Best Average Consensus Best 2nd Best Average

I 5 5 4 2.48 6 5 5 2.55

II 5 4 4 2.33 5 4 3 2.27

Total 10 9 8 4.81 11 9 8 4.82

Participants 42 125

Table 3

2002 2002

PJ MM

Humans Humans

Consensus Best 2nd Best Average Consensus Best 2nd Best Average

I 2 2 2 1.70 2 5 5 2.10

II 2 4 4 1.70 3 3 3 1.70

Total 4 6 6 3.40 5 8 8 3.80

Participants 49 54

2002

All

Humans

Consensus Best 2nd Best Average

I 2 5 5 1.90

II 3 3 3 1.70

Total 5 8 8 3.60

Participants 103

Table 4

2004

MM

Humans

Consensus Best 2nd Best Average

I 6 6 6 4.00

II 6 6 5 3.00

Total 12 12 11 7.00

Participants 46

Das könnte Ihnen auch gefallen

- Statistics HMWKDokument12 SeitenStatistics HMWKAnterika Williams100% (1)

- Institute of Rural Management Anand: Mid Term Examination (Open Book)Dokument5 SeitenInstitute of Rural Management Anand: Mid Term Examination (Open Book)YashNoch keine Bewertungen

- Movie World: Submitted byDokument18 SeitenMovie World: Submitted byVishnu PrasadNoch keine Bewertungen

- Predicting Presidential Elections and Other Things, Second EditionVon EverandPredicting Presidential Elections and Other Things, Second EditionBewertung: 5 von 5 Sternen5/5 (1)

- Swanson Clement PollingDokument27 SeitenSwanson Clement PollingNational Press FoundationNoch keine Bewertungen

- Eco ProjectDokument14 SeitenEco ProjectSaarthak RastogiNoch keine Bewertungen

- The Utility Approach To DecisionsDokument6 SeitenThe Utility Approach To DecisionsVinh TranNoch keine Bewertungen

- January 2012Dokument4 SeitenJanuary 2012edoneyNoch keine Bewertungen

- Missing the Mark: Why So Many School Exam Grades are Wrong – and How to Get Results We Can TrustVon EverandMissing the Mark: Why So Many School Exam Grades are Wrong – and How to Get Results We Can TrustNoch keine Bewertungen

- Heuristics and Biases: Why We Occasionally Make Stupid ChoicesDokument84 SeitenHeuristics and Biases: Why We Occasionally Make Stupid ChoicesDeepshikha YadavNoch keine Bewertungen

- Target Audience Research Objective IIDokument18 SeitenTarget Audience Research Objective IIMarcus RhodesNoch keine Bewertungen

- Competitive Success: Building Winning Strategies with Corporate War GamesVon EverandCompetitive Success: Building Winning Strategies with Corporate War GamesNoch keine Bewertungen

- Sample Undergraduate Thesis PDFDokument6 SeitenSample Undergraduate Thesis PDFrachelphillipsbillings100% (2)

- IELTS Reading Recent Actual Test 12 With AnswerDokument13 SeitenIELTS Reading Recent Actual Test 12 With AnswerNhung NguyễnNoch keine Bewertungen

- Anomalies CooperationDokument30 SeitenAnomalies CooperationDiogo MarquesNoch keine Bewertungen

- Critical ApproachesDokument19 SeitenCritical Approachesapi-314773049Noch keine Bewertungen

- Lecture 6Dokument22 SeitenLecture 6heidi_olson09Noch keine Bewertungen

- Reading Passage 1: You Should Spend About 20 Minutes On Questions 1-13 Which Are Based On Reading Passage 1. ADokument14 SeitenReading Passage 1: You Should Spend About 20 Minutes On Questions 1-13 Which Are Based On Reading Passage 1. AminakshiminsNoch keine Bewertungen

- A Comparison of Forecasting Methods: Fundamentals, Polling, Prediction Markets, and ExpertsDokument25 SeitenA Comparison of Forecasting Methods: Fundamentals, Polling, Prediction Markets, and ExpertsreginaxyNoch keine Bewertungen

- F in Exams: The Very Best Totally Wrong Test AnswersVon EverandF in Exams: The Very Best Totally Wrong Test AnswersBewertung: 3.5 von 5 Sternen3.5/5 (319)

- Econ 203 Final ProjectDokument8 SeitenEcon 203 Final Projectapi-341699951Noch keine Bewertungen

- DSME 2011 G, I and J Assignment 6: Sampling Distributions, One-And Two - Sample Tests, RegressionDokument8 SeitenDSME 2011 G, I and J Assignment 6: Sampling Distributions, One-And Two - Sample Tests, RegressionmikotggNoch keine Bewertungen

- CH 13 Reasoning & Decision MakingDokument60 SeitenCH 13 Reasoning & Decision MakingbbsuperNoch keine Bewertungen

- Our Stock Is Rising: An Elementary Student’s Introduction to the Stock MarketVon EverandOur Stock Is Rising: An Elementary Student’s Introduction to the Stock MarketNoch keine Bewertungen

- The Condom Project: Amit Gupta Samuel Hwang Eric MakhniDokument9 SeitenThe Condom Project: Amit Gupta Samuel Hwang Eric Makhniakinky3sumNoch keine Bewertungen

- Imat Past Paper 2021Dokument44 SeitenImat Past Paper 2021Student Adda100% (1)

- Revised QP CB X English PT2Dokument17 SeitenRevised QP CB X English PT2kulkarniyuvika7Noch keine Bewertungen

- The Case Against CompetitionDokument5 SeitenThe Case Against CompetitionAbhishek AnandNoch keine Bewertungen

- Apariencia en EmpleosDokument41 SeitenApariencia en EmpleosJuan Carlos LeonNoch keine Bewertungen

- SAMPELINGDokument32 SeitenSAMPELINGakashscribd01Noch keine Bewertungen

- Political Polling: Emily Swanson, Associated Press Ruth Igielnik, Pew ResearchDokument30 SeitenPolitical Polling: Emily Swanson, Associated Press Ruth Igielnik, Pew ResearchNational Press FoundationNoch keine Bewertungen

- Portfolio AssignmentDokument5 SeitenPortfolio Assignmentapi-315339415Noch keine Bewertungen

- Psychology - The Paradox of UnanimityDokument9 SeitenPsychology - The Paradox of UnanimityPamela SantosNoch keine Bewertungen

- Dwnload Full Exploring Social Psychology 8th Edition Myers Solutions Manual PDFDokument35 SeitenDwnload Full Exploring Social Psychology 8th Edition Myers Solutions Manual PDFsiphilisdysluite7xrxc100% (12)

- Finally, A Use For The U.S. News Law School RankingsDokument8 SeitenFinally, A Use For The U.S. News Law School RankingsNoah ChauvinNoch keine Bewertungen

- Why Teachers and Sumo Wrestlers Sometimes CheatDokument6 SeitenWhy Teachers and Sumo Wrestlers Sometimes CheatPauline Jasmine DaroNoch keine Bewertungen

- Judgment and Decision Making: How Heuristics and Biases Impact ChoicesDokument43 SeitenJudgment and Decision Making: How Heuristics and Biases Impact ChoicesYana KarismaNoch keine Bewertungen

- Canuckology: From Dollars to Donuts—Canada's Premier Pollsters Reveal What Canadians Think and WhyVon EverandCanuckology: From Dollars to Donuts—Canada's Premier Pollsters Reveal What Canadians Think and WhyBewertung: 3 von 5 Sternen3/5 (1)

- Yysurvery ResultsDokument1 SeiteYysurvery ResultsthomasNoch keine Bewertungen

- School of Distance Education Universiti Sains Malaysia: A. B. C. D. eDokument4 SeitenSchool of Distance Education Universiti Sains Malaysia: A. B. C. D. eHanya DhiaNoch keine Bewertungen

- Project IdeasDokument10 SeitenProject IdeasAli SultanNoch keine Bewertungen

- Video Games Dissertation IdeasDokument4 SeitenVideo Games Dissertation IdeasCollegePapersForSaleUK100% (1)

- University English QuestionsDokument3 SeitenUniversity English QuestionsAndrew ChanNoch keine Bewertungen

- Questions of Trust: August 2012Dokument13 SeitenQuestions of Trust: August 2012Knowledge Is ManiaNoch keine Bewertungen

- Engineering Probability and Statistics Problem SetDokument37 SeitenEngineering Probability and Statistics Problem SetCorazon Francisco AustriaNoch keine Bewertungen

- Insurance New S You Can Use: The Greatest BusinessDokument4 SeitenInsurance New S You Can Use: The Greatest BusinessPaul DonovanNoch keine Bewertungen

- Feature, Oscars - KT PDFDokument2 SeitenFeature, Oscars - KT PDFAnonymous gQz6NI0Noch keine Bewertungen

- Understanding Opportunity CostDokument2 SeitenUnderstanding Opportunity CostFritzie Ann ZartigaNoch keine Bewertungen

- Social Forces: Selfishness or Altruism?: Behavioural FinanceDokument19 SeitenSocial Forces: Selfishness or Altruism?: Behavioural FinanceJayesh RathodNoch keine Bewertungen

- CH5 Exercises Solutions PDFDokument23 SeitenCH5 Exercises Solutions PDFhelloagainhelloNoch keine Bewertungen

- CostlyParticipation Jan 12 2017Dokument42 SeitenCostlyParticipation Jan 12 2017Anonymous lEJuFJMNoch keine Bewertungen

- Handout Logic 13Dokument4 SeitenHandout Logic 13meainlashari7Noch keine Bewertungen

- The Psychological Impact of Maximizing ChoicesDokument18 SeitenThe Psychological Impact of Maximizing ChoicesThu but biNoch keine Bewertungen

- Senior Thesis UdelDokument4 SeitenSenior Thesis Udelrachelphillipsbillings100% (1)

- Ut Dissertation FormatDokument4 SeitenUt Dissertation FormatPaperWritingServiceSuperiorpapersSpringfield100% (1)

- Toddlers and Tiaras Research ProposalDokument8 SeitenToddlers and Tiaras Research Proposalapi-476153841Noch keine Bewertungen

- Distressed Debt Investing - Wisdom From Seth Klarman - Part 1Dokument5 SeitenDistressed Debt Investing - Wisdom From Seth Klarman - Part 1pjs15100% (1)

- MKT Outlook Q1 2013Dokument87 SeitenMKT Outlook Q1 2013pjs15Noch keine Bewertungen

- The Graham + Dodd Luncheon Symposium Transcript 20081002Dokument69 SeitenThe Graham + Dodd Luncheon Symposium Transcript 20081002pjs15Noch keine Bewertungen

- A Conversation With Benjamin GrahamDokument2 SeitenA Conversation With Benjamin Grahampjs15Noch keine Bewertungen

- How To Handle Your MoneyDokument7 SeitenHow To Handle Your Moneypjs150% (1)

- Toward A Science of Security AnalysisDokument4 SeitenToward A Science of Security Analysispjs15Noch keine Bewertungen

- BRK PainewebberDokument60 SeitenBRK Painewebberscottleey50% (2)

- Should Rich But Losing Corporations Be LiquidatedDokument2 SeitenShould Rich But Losing Corporations Be Liquidatedpjs15Noch keine Bewertungen

- Advice From A Value Investor Best Inver Asset ManagementDokument6 SeitenAdvice From A Value Investor Best Inver Asset Managementpjs15Noch keine Bewertungen

- Benjamin Graham's Impact on the Financial Analysis ProfessionDokument1 SeiteBenjamin Graham's Impact on the Financial Analysis Professionpjs15Noch keine Bewertungen

- Options Strategies Quick GuideDokument36 SeitenOptions Strategies Quick GuideParikshit KalyankarNoch keine Bewertungen

- Security in An Insecure WorldDokument13 SeitenSecurity in An Insecure Worldpjs15Noch keine Bewertungen

- Benjamin Graham's Memoirs Reveal His Early Career Success on Wall StreetDokument11 SeitenBenjamin Graham's Memoirs Reveal His Early Career Success on Wall Streetpjs15Noch keine Bewertungen

- Small Slam ArticleDokument3 SeitenSmall Slam ArticleceojiNoch keine Bewertungen

- The Right Stuff - Why Walter Schloss Is Such A Great InvestorDokument6 SeitenThe Right Stuff - Why Walter Schloss Is Such A Great Investorpjs15Noch keine Bewertungen

- Darwins Mind The Evolutionary Foundations of Heuristics and Biases 122002 James MontierDokument32 SeitenDarwins Mind The Evolutionary Foundations of Heuristics and Biases 122002 James Montierpjs15Noch keine Bewertungen

- Are Investors Reluctant To Realize Their LossesDokument0 SeitenAre Investors Reluctant To Realize Their LossesdyashyNoch keine Bewertungen

- What Drives The Disposition Effect - An Analysis of A Long-Standing Preference-Based ExplanationDokument48 SeitenWhat Drives The Disposition Effect - An Analysis of A Long-Standing Preference-Based Explanationpjs15Noch keine Bewertungen

- Chanos Transcript - Charlie RoseDokument25 SeitenChanos Transcript - Charlie Rosepjs15Noch keine Bewertungen

- Biological Basis For Errors in Risk AssessmentDokument24 SeitenBiological Basis For Errors in Risk Assessmentpjs15Noch keine Bewertungen

- Nickerson Confirmation BiasDokument46 SeitenNickerson Confirmation BiasZeghaiderNoch keine Bewertungen

- Why Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock MarketDokument8 SeitenWhy Strategy Matters - Exploring The Link Between Strategy, Competitive Advantage and The Stock Marketpjs15Noch keine Bewertungen

- Where's The Bar - Introducing Market-Expected Return On InvestmentDokument17 SeitenWhere's The Bar - Introducing Market-Expected Return On Investmentpjs15Noch keine Bewertungen

- Judgment in Managerial Decision Making SummaryDokument9 SeitenJudgment in Managerial Decision Making Summaryapi-26172897100% (1)

- 1995.12.13 - The More Things Change, The More They Stay The SameDokument20 Seiten1995.12.13 - The More Things Change, The More They Stay The SameYury PopovNoch keine Bewertungen

- Valuation - MauboussinDokument4 SeitenValuation - MauboussinRamesh Mane100% (2)

- Value Explosion - Exploring Barriers To Entry For Internet CompaniesDokument12 SeitenValue Explosion - Exploring Barriers To Entry For Internet Companiespjs15Noch keine Bewertungen

- Bank Balance Sheet ManagementDokument4 SeitenBank Balance Sheet Managementkung siew houngNoch keine Bewertungen

- Bella Employment Agency Chart of Accounts and General LedgerDokument17 SeitenBella Employment Agency Chart of Accounts and General LedgerDeimos DeezNoch keine Bewertungen

- Proformarechnung 11479 PDFDokument2 SeitenProformarechnung 11479 PDFNicolae HincuNoch keine Bewertungen

- Syllabus (Economic Analysis For Business)Dokument5 SeitenSyllabus (Economic Analysis For Business)S TMNoch keine Bewertungen

- StudentDokument49 SeitenStudentKevin Che100% (1)

- Anti-Competitive Agreements and Abuse of Dominant PositionDokument3 SeitenAnti-Competitive Agreements and Abuse of Dominant PositionNHASSER PASANDALANNoch keine Bewertungen

- MANISH Reliance Fresh Repaired)Dokument55 SeitenMANISH Reliance Fresh Repaired)manishvikasNoch keine Bewertungen

- Iho1 Robot Spare: QuotationDokument3 SeitenIho1 Robot Spare: QuotationChandru ChristurajNoch keine Bewertungen

- Financial Behavior of Abm Students As Indication of Their Financial LiteracyDokument77 SeitenFinancial Behavior of Abm Students As Indication of Their Financial LiteracyXiao Lai100% (2)

- Student life amid high inflationDokument2 SeitenStudent life amid high inflationNgaymai TrongxanhNoch keine Bewertungen

- Economics 2 0525 Cameroon General Certificate of Education BoardDokument3 SeitenEconomics 2 0525 Cameroon General Certificate of Education BoardTheodore YimoNoch keine Bewertungen

- Sapna's Resume PDFDokument3 SeitenSapna's Resume PDFDeepak kumarNoch keine Bewertungen

- Ros Rof z5575Dokument1 SeiteRos Rof z5575Chaitanya ZirkandeNoch keine Bewertungen

- Advantages of Joint Stock CompaniesDokument2 SeitenAdvantages of Joint Stock Companiesrahmatullah HamidiNoch keine Bewertungen

- Plano Catalogue Airsoft23 ENEuro EndDokument32 SeitenPlano Catalogue Airsoft23 ENEuro EndGUILLERMO MUÑOZ TRONCOSONoch keine Bewertungen

- Coercive Offers and Defence Strategies from a Shareholder PerspectiveDokument5 SeitenCoercive Offers and Defence Strategies from a Shareholder PerspectiveVijay Mahantesh SulibhaviNoch keine Bewertungen

- Application For Registration As An Australian Company: 1 State/territory of RegistrationDokument10 SeitenApplication For Registration As An Australian Company: 1 State/territory of Registrationquaz4Noch keine Bewertungen

- Chapter 5 - Accounting EquationDokument17 SeitenChapter 5 - Accounting EquationRiya AggarwalNoch keine Bewertungen

- Chapter 10 Cycle InventoryDokument32 SeitenChapter 10 Cycle InventoryTeklay TesfayNoch keine Bewertungen

- Contract No. 1 Domestic ContractDokument5 SeitenContract No. 1 Domestic ContractbillNoch keine Bewertungen

- Business-Model-Canvas - 2 - XenithDokument2 SeitenBusiness-Model-Canvas - 2 - XenithSwarup PottaNoch keine Bewertungen

- Obalana W09GroupAssignmentDokument9 SeitenObalana W09GroupAssignmentwilliamslaw123 WilliamsNoch keine Bewertungen

- Recovery Notice Virendra Hiremath 970542-7ccd2a736ec9341aDokument2 SeitenRecovery Notice Virendra Hiremath 970542-7ccd2a736ec9341aSandesh BnNoch keine Bewertungen

- EV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20Dokument13 SeitenEV 2 - KVS Agra XI Acc QP & MS (Annual Exam) 19-20minita sharmaNoch keine Bewertungen

- Analysis of Trend and Growth Rate of Indian Textile IndustryDokument10 SeitenAnalysis of Trend and Growth Rate of Indian Textile IndustryMariamNoch keine Bewertungen

- FMS2021 0743rdInternationalConferenceDokument28 SeitenFMS2021 0743rdInternationalConferenceVania Dinda AzuraNoch keine Bewertungen

- NR7413407451445605Dokument2 SeitenNR7413407451445605gajetushanayaNoch keine Bewertungen

- South Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test BankDokument38 SeitenSouth Western Federal Taxation 2019 Corporations Partnerships Estates and Trusts 42nd Edition Raabe Test Bankmateosowhite100% (14)

- PowerPoint PresentationDokument221 SeitenPowerPoint PresentationPutri jayantiNoch keine Bewertungen

- CH 4 FinalDokument31 SeitenCH 4 FinalSudip BaruaNoch keine Bewertungen