Beruflich Dokumente

Kultur Dokumente

Chap 3 For Stu

Hochgeladen von

phong92Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 3 For Stu

Hochgeladen von

phong92Copyright:

Verfügbare Formate

International Financial Management Chapter 3 Prepared by Wikrom Prombutr

1

Chapter 3: The Balance of Payments

Chapter Objective:

This chapter serves to introduce the student to the balance of payments. How it is constructed and how

balance of payments data may be interpreted.

The Balance of Payments is the statistical record of international transactions between the residents of

a given country and the residents of the rest of world over a certain period of time presented in the

form of double-entry bookkeeping.

Example:

Suppose that Maplewood Bicycle in Maplewood, Missouri, USA imports $100,000 worth of bicycle

frames from Mercian Bicycles in Darby England.

- There will exist a $100,000 credit recorded by Mercian that offsets a $100,000 debit at Maplewoods

bank account.

- This will lead to a rise in the supply of dollars and the demand for British pounds.

Logic: demand of English product what do you need to be able to get the product? () increase in

demand for what do you have to use to get ? ($) increase in supply of $.

What can we learn from the BOP? As you can see from the example above

1. BOP provides detailed information about the supply and demand of the countrys currency.

2. BOP data can be used to evaluate the performance of the country in international economic

competition. For example, if a country is experiencing persistent BOP deficits, it may signal that the

countrys industries lack competitiveness.

3.1

3.2

3.3

3.4 3.5

3.6

3.6

3.7

3.8

International Financial Management Chapter 3 Prepared by Wikrom Prombutr

2

BOP accounts are composed of

1. The current account (CA) includes all purchases (-) and sales (+) of goods and services. (i.e. import

and export)

2. The capital account (KA) includes all purchases (-) and sales (+) of assets such as stocks, bonds, bank

accounts, real estate, and businesses.

3. The official reserve account (RA) includes all purchases (-) and sales (+)of international reserve assets

such as, foreign exchanges, gold, and special drawing rights (SDRs).

4. Statistical Discrepancy (SD)

Theres going to be some omissions and misrecorded transactionsso we use a plug figure to get

things to balance in the residual manner.

2009 U.S. Balance of Payments Data

Credit (+, money inflow ): receipt (of foreign currency) from foreigners this creates demand for $.

Debit (-, money outflow ): payment to foreigners (using $) this creates supply of $.

Credits Debits

Current Account (CA)

1

Exports

2116

2 Imports

-2405.6

3 Unilateral transfer 19.2 -149.4

Balance on CA

-419.8

Capital Account(KA)

4

Direct Investment

152.1

-221

5 Portfolio investment 376.6 -549.4

6 Other investment

616.3

-93.5

Balance on KA 281.1

7 Statistical Discrepancies (SD) 190.9

Overall Balance 52.2

Official Reserve Account (RA)

-52.2

3.9

3.9

3.10

3.10

3.11

3.11

3.12

3.13 3.14

3.15 3.16

3.17

3.18

3.19

3.20

3.21

3.22

International Financial Management Chapter 3 Prepared by Wikrom Prombutr

3

U.S. BOP in 2009 shows that

Current Account (CA):

U.S. exports were $2,116.0 billion

U.S. imports were $2,405.6 billion.

CA includes (items 1,2) trade account (all imports and exports of goods and services)

(item 3) unilateral transfers of foreign aid.

If the debits (from Imports) exceed the credits (from Exports), then a country is running a trade

deficit.

If the credits (from Exports) exceed the debits (from Imports), then a country is running a trade

surplus.

The current account balance, which is defined as exports minus imports plus unilateral transfers, that is,

(1 ) + (2) + (3), was negative, $41 9.8 billion.

The United States thus had a balance-of-payments deficit on the current account in 2009.

The current account deficit implies that the United States used up more output than it produced.

Since a country must finance its current account deficit either by borrowing from foreigners or by

drawing down on its previous accumulated foreign wealth.

Capital Account (KA):

(4) U.S. direct investment overseas was $221.0 billion.

Foreign direct investment in the United States was $152.1 billion.

(5) Foreigners invested $376.6 billion in U.S. financial securities whereas Americans invested $549.4

billion in foreign securities, realizing a deficit, $172.8 billion.

(6) Other investments

Inflow = 616.3

Outflow = -93.5

Net Inflow = 522.8

International Financial Management Chapter 3 Prepared by Wikrom Prombutr

4

International Financial Management Chapter 3 Prepared by Wikrom Prombutr

5

Official Reserve Account (RA):

When the United States and foreign governments wish to support the value of the dollar in the foreign

exchange markets, they sell international reserve assets to buy dollars. These transactions, which

give rise to the demand for dollars, will be recorded as a positive entry under official reserves. On the

other hand, if governments would like to see a weaker dollar, they sell dollars and buy gold, foreign

currencies, and SDRs. These transactions, which give rise to the supply of dollars, will be recorded as

a negative entry under official reserves. The more actively governments intervene in the foreign

exchange markets, the greater the official reserve entry.

The table shows that to accommodate a $52.2 billion balance-of-payment surplus, the U.S. increased its

external reserve holdings by the same amount. When the U.S. increases its reserve holdings by either

adding to its reserve holdings or retiring debts, it will spend funds, which will be recorded under debits.

The official reserve account includes transactions undertaken by the authorities to finance the overall

balance and intervene in foreign exchange markets.

BOP Identity

Theoretically, BCA + BKA + BRA = 0

Note: Under a pure flexible exchange rate regime, BCA + BKA = 0

No BRA No intervention No control over the exchange rate

Practically, BCA + BKA + SD + BRA = 0

(-419.8) + (281.1) + (190.9) + (-52.2) = 0

3.23 3.24

3.24 3.25

3.26

3.27

3.28

3.29

3.30

Das könnte Ihnen auch gefallen

- The Balance of PaymentsDokument39 SeitenThe Balance of PaymentsmubinaNoch keine Bewertungen

- China's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeVon EverandChina's Trump Card: Cryptocurrency and its Game-Changing Role in Sino-US TradeNoch keine Bewertungen

- Balance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Dokument27 SeitenBalance of Payments:: Chapter Objectives & Lecture Notes FINA 5500Anonymous H0SJWZE8100% (1)

- Examples of Int'l Transactions in BPDokument5 SeitenExamples of Int'l Transactions in BPAubrey Markus JikunanNoch keine Bewertungen

- 3 Chap3cho2slotsDokument27 Seiten3 Chap3cho2slotshoang nguyen dangNoch keine Bewertungen

- 03 Balance of PaymentsDokument31 Seiten03 Balance of PaymentsNikhil SoiNoch keine Bewertungen

- Macro 9 - Balance of PaymentDokument13 SeitenMacro 9 - Balance of PaymentNelson TohNoch keine Bewertungen

- 3 Chap3 IBFDokument27 Seiten3 Chap3 IBFLe Hong Phuc (K17 HCM)Noch keine Bewertungen

- Tai Chinh Quoc Te Nguyen Cam Nhung c2 The Balance of Payments (Cuuduongthancong - Com)Dokument40 SeitenTai Chinh Quoc Te Nguyen Cam Nhung c2 The Balance of Payments (Cuuduongthancong - Com)Thái Nguyễn Thị HồngNoch keine Bewertungen

- Structural Models of Exchange Rate Determination: Example IV.1Dokument18 SeitenStructural Models of Exchange Rate Determination: Example IV.1Issa AdiemaNoch keine Bewertungen

- Bai 2 - Chu Chuyen Von Quoc Te (Autosaved) (Compatibility Mode)Dokument33 SeitenBai 2 - Chu Chuyen Von Quoc Te (Autosaved) (Compatibility Mode)pham nguyetNoch keine Bewertungen

- MBBBF PPTDokument71 SeitenMBBBF PPTamittrehan88Noch keine Bewertungen

- Presented By: Anuj Goyal NMIMS MumbaiDokument20 SeitenPresented By: Anuj Goyal NMIMS MumbaiKaran DayrothNoch keine Bewertungen

- Bai 2 - Chu Chuyen Von Quoc Te (Autosaved) (Compatibility Mode)Dokument33 SeitenBai 2 - Chu Chuyen Von Quoc Te (Autosaved) (Compatibility Mode)pham nguyetNoch keine Bewertungen

- Chapter 8Dokument28 SeitenChapter 8Aman Singh RajputNoch keine Bewertungen

- The Balance of Payments: InternationalDokument21 SeitenThe Balance of Payments: InternationalLalu RockNoch keine Bewertungen

- Balance of Payments AccountingDokument20 SeitenBalance of Payments AccountingWilly AndersonNoch keine Bewertungen

- Ch.2 - International Flow of FundDokument88 SeitenCh.2 - International Flow of FundDavid GeorgeNoch keine Bewertungen

- 12 - Chapter 3Dokument30 Seiten12 - Chapter 3Karan KhatriNoch keine Bewertungen

- Balance of Payment: Project ReportDokument19 SeitenBalance of Payment: Project ReportS.S.RulesNoch keine Bewertungen

- National Income Accounting and The Balance of Payments The National Income AccountsDokument7 SeitenNational Income Accounting and The Balance of Payments The National Income AccountsRitesh SinghaiNoch keine Bewertungen

- Economics - The Balance of Payments AccountsDokument11 SeitenEconomics - The Balance of Payments AccountsAshraf AminNoch keine Bewertungen

- BopDokument36 SeitenBopNadeem AhmadNoch keine Bewertungen

- Eop (Bop)Dokument36 SeitenEop (Bop)Mohsan SheikhNoch keine Bewertungen

- Balance of PaymentsDokument4 SeitenBalance of PaymentsOsman JallohNoch keine Bewertungen

- Balance of PaymentsDokument40 SeitenBalance of PaymentsKamal KantNoch keine Bewertungen

- Factors Affecting Spot Exchange RatesDokument60 SeitenFactors Affecting Spot Exchange RatesJames JohnNoch keine Bewertungen

- Unit 2 - BOP (International Finance)Dokument6 SeitenUnit 2 - BOP (International Finance)undesastreordenadoNoch keine Bewertungen

- TBChap 003Dokument49 SeitenTBChap 003Robert MahroukNoch keine Bewertungen

- Bo PDokument29 SeitenBo PSanjay SharmaNoch keine Bewertungen

- Chapter 3 - Balance of PaymentDokument19 SeitenChapter 3 - Balance of PaymentAisyah AnuarNoch keine Bewertungen

- Balance of Payments: Pankaj Kumar International Business EnvironmentDokument55 SeitenBalance of Payments: Pankaj Kumar International Business EnvironmentChanisha KathuriaNoch keine Bewertungen

- International Flow of Funds and International Monetary SystemDokument13 SeitenInternational Flow of Funds and International Monetary SystemAbhishek AbhiNoch keine Bewertungen

- Balance of PaymentsDokument21 SeitenBalance of PaymentsKiran Kumar KuppaNoch keine Bewertungen

- BOPDokument7 SeitenBOPJoshua BrownNoch keine Bewertungen

- Eun 9e International Financial Management PPT CH03 Accessible 0Dokument19 SeitenEun 9e International Financial Management PPT CH03 Accessible 0MS Fin.Noch keine Bewertungen

- 2 Balance of PaymentDokument26 Seiten2 Balance of PaymentkayeNoch keine Bewertungen

- The Balance of Payments: Chapter ObjectiveDokument20 SeitenThe Balance of Payments: Chapter ObjectiveBigbi KumarNoch keine Bewertungen

- Macroeconomics Canadian 7Th Edition Abel Solutions Manual Full Chapter PDFDokument36 SeitenMacroeconomics Canadian 7Th Edition Abel Solutions Manual Full Chapter PDFkevin.reider416100% (11)

- Macroeconomics Canadian 7th Edition Abel Solutions Manual 1Dokument36 SeitenMacroeconomics Canadian 7th Edition Abel Solutions Manual 1marychaveznpfesgkmwx100% (27)

- EC563 Lecture 1 - International FinanceDokument30 SeitenEC563 Lecture 1 - International FinanceOisín Ó CionaoithNoch keine Bewertungen

- Balance of Payments Made SimpleDokument23 SeitenBalance of Payments Made SimpleSta KerNoch keine Bewertungen

- Balance of Payments: Phil Bryson Global Trade and FinanceDokument35 SeitenBalance of Payments: Phil Bryson Global Trade and Financesaketmba1Noch keine Bewertungen

- BopDokument11 SeitenBopPallak ObhanNoch keine Bewertungen

- Balance of Payments ContinuedDokument2 SeitenBalance of Payments ContinuedBeville BlackmanNoch keine Bewertungen

- StudentDokument30 SeitenStudentKevin CheNoch keine Bewertungen

- The Balance of Payments: Presented By: Amol DhawaleDokument9 SeitenThe Balance of Payments: Presented By: Amol DhawalerupalirautscribdNoch keine Bewertungen

- Lecture 2: Canada's Balance of PaymentsDokument4 SeitenLecture 2: Canada's Balance of PaymentsmbizhtkNoch keine Bewertungen

- Chapter 2-Flow of FundsDokument78 SeitenChapter 2-Flow of Fundsธชพร พรหมสีดาNoch keine Bewertungen

- Session 2 - Balance of PaymentsDokument5 SeitenSession 2 - Balance of PaymentsRochelle DanielsNoch keine Bewertungen

- Definition of Balance of PaymentsDokument29 SeitenDefinition of Balance of PaymentsKaran KhatriNoch keine Bewertungen

- Chapter 10Dokument5 SeitenChapter 10Bethari LarasatiNoch keine Bewertungen

- ME Class 11-12Dokument25 SeitenME Class 11-12Dixith GandheNoch keine Bewertungen

- BekiDokument5 SeitenBekiBetel KetemaNoch keine Bewertungen

- Balance of PaymentsDokument30 SeitenBalance of PaymentsRohanAwtani100% (1)

- Disequilibrium in Balance of Payment and Methods To CorrectDokument16 SeitenDisequilibrium in Balance of Payment and Methods To CorrectShivank Saxena100% (1)

- cd8cd552db28943f022096d821b9a279 (1)Dokument12 Seitencd8cd552db28943f022096d821b9a279 (1)Azri LunduNoch keine Bewertungen

- Balance of Payments and Exchange Rate DeterminationDokument48 SeitenBalance of Payments and Exchange Rate DeterminationTom WongNoch keine Bewertungen

- CH 3Dokument16 SeitenCH 3h.b. akshayaNoch keine Bewertungen

- Cobros Pendientes de Comprobantes Al WhatsappDokument8 SeitenCobros Pendientes de Comprobantes Al WhatsappIndustrias GuaralactNoch keine Bewertungen

- Mesopotamia: The History of ForexDokument8 SeitenMesopotamia: The History of ForexRamiza BanuNoch keine Bewertungen

- Imports of Goods and ServicesDokument79 SeitenImports of Goods and ServicesAdnan MurtovicNoch keine Bewertungen

- Assignment On International Monetary System: Prepared ForDokument6 SeitenAssignment On International Monetary System: Prepared ForMd Nazmus SakibNoch keine Bewertungen

- g7 Impact On The World EconomyDokument17 Seiteng7 Impact On The World EconomyJasmineNoch keine Bewertungen

- Chapter 11Dokument6 SeitenChapter 11Vũ Nhi AnNoch keine Bewertungen

- International Economic Institutions (Imf, World Bank, Wto)Dokument9 SeitenInternational Economic Institutions (Imf, World Bank, Wto)Ashwani BhallaNoch keine Bewertungen

- Sepa InfoV2.JsonDokument8 SeitenSepa InfoV2.JsonjuanmipriaanNoch keine Bewertungen

- Liza Case AnalysisDokument2 SeitenLiza Case AnalysismarybernadithNoch keine Bewertungen

- Ach Bank & Branch Code GuideDokument20 SeitenAch Bank & Branch Code GuideTeresa ShiuNoch keine Bewertungen

- Problem Set 2 - SolutionsDokument15 SeitenProblem Set 2 - SolutionsSagar Bansal67% (3)

- (Oxford Handbooks) Arvid Lukauskas, Robert M. Stern, Gianni Zanini - Handbook of Trade Policy For Development-Oxford University Press (2013) PDFDokument1.019 Seiten(Oxford Handbooks) Arvid Lukauskas, Robert M. Stern, Gianni Zanini - Handbook of Trade Policy For Development-Oxford University Press (2013) PDFpelosileeNoch keine Bewertungen

- IB PPT On IMFDokument22 SeitenIB PPT On IMFAtul YadavNoch keine Bewertungen

- Multilateralism and Regionalism in Global Economic GovernanceDokument215 SeitenMultilateralism and Regionalism in Global Economic GovernanceRizky Thesalonika YulyantiNoch keine Bewertungen

- a27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eDokument762 Seitena27272636 s dndjdjdjd ansjdns sc7727272726 wuqyqqyyqwywyywwy2ywywyw6 4 u ssbsbx d d dbxnxjdjdjdnsjsjsjallospspsksnsnd s sscalop sksnsks scslcoapa ri8887773737372 d djdjwnzks sclalososplsakosskkszmdn d ebwjw2i2737721osjxnx n ksjdjdiwi27273uwzva sclakopsisos scaloopsnx_01_eRed DiggerNoch keine Bewertungen

- RO10 ProposalDokument21 SeitenRO10 ProposalDan EnicaNoch keine Bewertungen

- 1 Perfect Capital MobilityDokument3 Seiten1 Perfect Capital MobilityvxrNoch keine Bewertungen

- ProtectionismDokument51 SeitenProtectionismKhy Nellas-LeonorNoch keine Bewertungen

- International FinanceDokument32 SeitenInternational FinanceahmeddanafNoch keine Bewertungen

- International Trade TheoryDokument28 SeitenInternational Trade TheoryArpita ArtaniNoch keine Bewertungen

- EBRD TFP Rudolf Putz Vienna 26 Sept 2017Dokument10 SeitenEBRD TFP Rudolf Putz Vienna 26 Sept 2017moulayhadjer5Noch keine Bewertungen

- Balance of Payments WorksheetDokument3 SeitenBalance of Payments WorksheetPrineet AnandNoch keine Bewertungen

- Economics Paper 2 SL PDFDokument9 SeitenEconomics Paper 2 SL PDFsansNoch keine Bewertungen

- Debt Crisis in GreeceDokument9 SeitenDebt Crisis in GreeceHải TrầnNoch keine Bewertungen

- What Is Dependency Theory To What ExtentDokument6 SeitenWhat Is Dependency Theory To What ExtentHansTzNoch keine Bewertungen

- JE InFINeeti Nemani Sri Harsha 28KADokument2 SeitenJE InFINeeti Nemani Sri Harsha 28KAMehulNoch keine Bewertungen

- Chapter 1: Introduction: An Introduction To International Economics: New Perspectives On The World EconomyDokument20 SeitenChapter 1: Introduction: An Introduction To International Economics: New Perspectives On The World EconomyJanangNoch keine Bewertungen

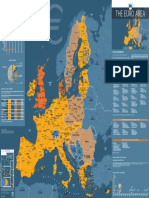

- The Euro AreaDokument1 SeiteThe Euro AreaDaiuk.DakNoch keine Bewertungen

- How Sarvatobhadra Chakra Is Used in Predicting The Forex MarketsDokument12 SeitenHow Sarvatobhadra Chakra Is Used in Predicting The Forex MarketsShyam S Kansal100% (1)

- The Globalization of World Economics FCDokument26 SeitenThe Globalization of World Economics FCWrenz ivan TanNoch keine Bewertungen