Beruflich Dokumente

Kultur Dokumente

Nike Inc (1) .

Hochgeladen von

Jayzie LiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nike Inc (1) .

Hochgeladen von

Jayzie LiCopyright:

Verfügbare Formate

Kenkel, Kerins, Kruse, Seifert 1

I. Introduction

Kimi Ford, a portfolio manager at NorthPoint Group, was reviewing the financials of Nike Inc. to

consider u!ing shares for the fund she managed, the NorthPoint "arge#$ap Fund. % week efore Kimi

Ford egan her research, Nike Inc. held an anal!sts& meeting to reveal their '((1 fiscal results and for

management to communicate a strateg! to revitali)e the compan!. Nike&s revenues since 1**+ had ceased

to grow from ,*.( illion, and net income had now fallen ,''( million -,.((// # ,0.(//1. In addition

a stud! printed in 2usiness 3eek revealed that Nike&s market share in the 4.S. athletic shoe industr! had

fallen from 5. percent in 1**+ to 5' percent in '(((. In the meeting, management planned to raise

revenues ! developing more athletic#shoe products in the mid#priced range, sold at ,+(#,*(. Nike also

planned to push its apparel line and e6ert more e6pense control. 7uring the meeting, Nike&s e6ecutives

e6pressed that the compan! would still continue with a long#term revenue growth target at .#1( percent and

earnings#growth targets aove 10 percent.

Kimi Ford decided that it was necessar! to develop her own discounted#cash#flow forecast in

order to arrive at a proper investment decision for her mutual fund. 8er forecast proved that at a 1( percent

discount rate, that Nike&s stock price was overvalued at ,0.*0 per share. In addition, a sensitivit! anal!sis

she created revealed that Nike stock was undervalued at discount rates less than *.5 percent. Ford was not

clear on a decision to u! Nike stock, so she asked 9oanna $ohen to estimate Nike&s weighted average cost

of capital.

II. Cost of Capital Calculations

$ohen calculated a weighted average cost of capital -3%$$1 of ..: percent ! using the capital asset

pricing model -$%P/1 for Nike Inc. ;he prolem with $ohen&s calculations is that she used the ook

value for oth det and e<uit!. 3hile the ook value of det is accepted as an estimate of market value,

ook value of e<uit! should not e used when calculating cost of capital. ;he market value of e<uit! is

found ! multipl!ing the stock price of Nike Inc. ! the numer of shares outstanding.

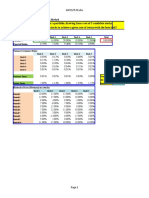

Market Value of Equity

E = Stock Price # Shares Outstanding

,5'.(* '+1.0

E = ,11,5'+.55

;his figure is much different than the ook value of e<uit! that 9oanna $ohen used -,:,5*5.0(1. In

addition, for market value of det, $ohen uses the ook value, when in fact she should have discounted the

Kenkel, Kerins, Kruse, Seifert '

value of long#term det that appears on the alance sheet. ;he market value of det is found ! adding the

current portion of long#term det, notes pa!ale, and long#term det discounted at Nike&s current coupon.

Market Value of Debt

D = Current LT Notes Payable LT Debt (discounted)

,0.5( ,.00.:( ,51=.+'

D = ,1,'++.5'

4sing these figures, we can now find the market value of Nike Inc., and the compan!&s capital structure.

Weight of Debt Weight of Equity

3 > 7 ?7@A 3 > A ?7@A

3 > ,1,'++.5' ,1',+(5..= 3 > ,11,5'+.55 ,1',+(5..=

1(.(0B .*.*0B

;he ne6t issue at hand is finding the correct costs of det and e<uit! in order to find an accurate calculation

of 3%$$. $ohen used the '(#!ear !ield on 4.S. ;reasuries as the risk free rate, which we found to e the

correct figure given that Nike Inc. det was valued over '0 !ears. 2ecause there is no other given !ield

that is comparale to a '0#!ear valuation period, our risk free rate used in calculations is 0.+5 percent.

9ust as important as choosing a risk free rate is choosing the appropriate market risk premium.

;here are two historical e<uit! risk premiums given for a time period from 1*'= to 1***C Geometric mean

and arithmetic mean. ;he geometric mean is a etter estimate for longer life valuation while the arithmetic

mean is etter for a one#!ear estimated e6pected return. ;herefore, we chose to use the geometric mean to

coincide with the choice to use the '(#!ear !ield on 4.S. ;reasuries, which is 0.* percent.

Ne6t, we had to decide on a eta to use for Nike Inc. for use in the $%P/ approach. ;he logical

choice was to use the average -(..(1 to account for the large fluctuations seen in Nike&s historic etas. 3e

felt that the D;7 eta was a reflection of current usiness practices, ut the goal of Nike Inc. was to look

forward and gain ack market share and increase revenues. $onse<uentl!, we felt the average eta

reflected the historical usiness practices of Nike Inc. etter.

From here, we calculated the cost of det and e<uit!. $ost of det was calculated ! finding the

!ield to maturit! on '(#!ear Nike Inc. det with a =.+0B coupon semi#annuall! -See %ppendi6 %1. 3e

assumed Nike Inc. to have a single cost of capital since its multiple usiness segments -shoes, apparel,

sports e<uipment, etc.1 are not ver! different and would e6perience similar risks and etas. ;he cost of

e<uit! was calculated as followsC

Cost of Debt Cost of Equity

(d) = !T" on #$ !ear Nike %nc& 'ond K-e1 > $%P/ Ef 0.+5B#$ !ear !ield on (S Treasuries

+.01B Ef @ 2etaF-/EP1 /EP 0.*(B)eo*etric "ean

1(.5=B 2eta (..+,erage Nike 'eta

Kenkel, Kerins, Kruse, Seifert :

%t this point, we calculated the 3%$$ of Nike Inc. using the weights and costs of det and e<uit!. ;he

formula used isC 3%$$ > wdkd-1#;1 @ weke.

WACC

-+CC = -d.d(/0T) 1 -ee

3dFKd-1#;1 3eKe

(.5=.'B *.5(.:B

9.!"#$

;he weighted average cost of capital for Nike Inc. is *..+=0 percent. ;he ne6t model that we used to

calculate the cost of capital was the dividend discount model. ;he assumption made with this model is that

the compan! pa!s a sustantial dividend, ut Nike Inc. does not. ;herefore, we reGected this model ecause

it does not reflect the true cost of capital. ;he calculation is as followsC

DDM

DD" = 2Do(/1g)3Po4 1 g

H(.5.-1@.(001?5'.(*I @ .(00

=.+(B

;he final model used to compute the cost of capital was the earning capitali)ation model. ;he prolem

with this model is that it does not take into consideration the growth of the compan!. ;herefore we chose

to reGect this calculation. ;he earnings capitali)ation model calculations were found this wa!C

ECM

EC" = E/3Po

'1=?5'.(*

0.:1B

III. %eco&&endation

Kimi Ford used a discount rate of 1( percent to find a share price of ,:=.15. ;his makes Nike Inc.

share price overvalued ! ,0.*0 as Nike is currentl! trading at ,5'.(*. 3e alread! estalished that we

found this discount rate to not reflect the true market value and solved for a discount rate that would e

more accurate. 3e found the weighted average cost of capital ! using $%P/, finding a discount rate of

*..+=0 percent. ;his discount rate results in a share price of ,:=.5*, meaning that Nike Inc. is overvalued

! ,0.=( per share.

4sing this data, we found that Nike Inc. should not e added to the NorthPoint "arge#$ap Fund at

this time ecause the stock is overvalued. 3hat Kimi Ford can do is wait for a etter u! period when this

stock is trading closer to the proper value. She should keep a close e!e on the compan! ecause Nike Inc.

has growth potential that would e eneficial to the fund. %long with this fact, management has goals for

the near future that could provide a great deal of profit for Nike Inc. %ll of the plans laid out at the

Kenkel, Kerins, Kruse, Seifert 5

e6ecutive meeting displa! that the compan! is taking steps to move toward the future, making this a stock

that could e attractive at a later date.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Chapter 13 Quick Overview of Correlation and Linear RegressionDokument17 SeitenChapter 13 Quick Overview of Correlation and Linear RegressionJayzie LiNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Microsoft Opens WindowDokument3 SeitenMicrosoft Opens WindowJayzie LiNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Chapter 14 An Introduction To Multiple Linear Regression: No. of Emails % Discount Sales Customer X X yDokument9 SeitenChapter 14 An Introduction To Multiple Linear Regression: No. of Emails % Discount Sales Customer X X yJayzie LiNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Summary of Listing RequirementsDokument3 SeitenSummary of Listing RequirementsJayzie LiNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Equity Securities: Qualifications For Listing PreliminaryDokument15 SeitenEquity Securities: Qualifications For Listing PreliminaryJayzie LiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Butler Lumber Case DiscussionDokument3 SeitenButler Lumber Case DiscussionJayzie Li100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Assignment1 OceanCarriersDokument6 SeitenAssignment1 OceanCarriersJayzie LiNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- OM Data MK-IVDokument12 SeitenOM Data MK-IVJayzie LiNoch keine Bewertungen

- Deluxe Corporation CaseDokument7 SeitenDeluxe Corporation Caseankur.mastNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- 1 - Nike Cost of CapitalDokument8 Seiten1 - Nike Cost of CapitalJayzie LiNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Chapter 7 - Problem SOlvingDokument26 SeitenChapter 7 - Problem SOlvingDesirre Transona100% (1)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Excel SolverDokument10 SeitenExcel SolverSumant SharmaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- FM QuizDokument4 SeitenFM QuizM Ahsan KhanNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- MBA LECTURE-lecture 1Dokument160 SeitenMBA LECTURE-lecture 1takawira chirimeNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Upstox AssignmentDokument5 SeitenUpstox AssignmentSwapnil NagareNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Assign 3 - Sem 2 11-12 - RevisedDokument5 SeitenAssign 3 - Sem 2 11-12 - RevisedNaly BergNoch keine Bewertungen

- Behavior of IR - QDokument10 SeitenBehavior of IR - QTrang NguyenNoch keine Bewertungen

- Ac Far Quiz6Dokument2 SeitenAc Far Quiz6Kristine Joy CutillarNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Equity Derivatives Trade SupportDokument2 SeitenEquity Derivatives Trade Supportapi-78985750Noch keine Bewertungen

- M & A Financial AspectsDokument27 SeitenM & A Financial AspectsMandip LuitelNoch keine Bewertungen

- Horizontal and VerticalDokument9 SeitenHorizontal and VerticalDianna EsmerayNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- SDM - Best Practices From FMCG IndDokument51 SeitenSDM - Best Practices From FMCG IndShubham Abrol100% (1)

- Investment ChecklistDokument3 SeitenInvestment ChecklistArpan chakrabortyNoch keine Bewertungen

- How To Price Swaps in Your Head An Interest Rate Swap & Asset Swap PrimerDokument96 SeitenHow To Price Swaps in Your Head An Interest Rate Swap & Asset Swap Primerswinki3Noch keine Bewertungen

- Guide To Investing: Warren BuffettDokument8 SeitenGuide To Investing: Warren BuffettAsh Max100% (1)

- Bargain Purchase Gain/ Gain On Acquisition: Books of AcquirerDokument2 SeitenBargain Purchase Gain/ Gain On Acquisition: Books of AcquirerNikki Coleen SantinNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Unclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019Dokument9 SeitenUnclaimed and Unpaid Dividend Pending With The Company As On 31.03.2019harsh bangurNoch keine Bewertungen

- Chapter 2 The Financial Market EnvironmentDokument35 SeitenChapter 2 The Financial Market EnvironmentJames Kok67% (3)

- SFA SFA04G05 Guidelines On Licensing Registration and Conduct of Business For FMCs 25 March 2019Dokument24 SeitenSFA SFA04G05 Guidelines On Licensing Registration and Conduct of Business For FMCs 25 March 2019Lei JianxinNoch keine Bewertungen

- Financial Statements of Electricity CompaniesDokument7 SeitenFinancial Statements of Electricity Companiesradhey3993Noch keine Bewertungen

- Upload 8Dokument3 SeitenUpload 8Meghna CmNoch keine Bewertungen

- Universa SpitznagelResearch 201501Dokument7 SeitenUniversa SpitznagelResearch 201501rafael100% (1)

- Investment ProcessDokument32 SeitenInvestment ProcessBirat Sharma100% (1)

- 05 Wms Green Fields RenaissanceDokument5 Seiten05 Wms Green Fields RenaissanceAllan DouglasNoch keine Bewertungen

- FrancisHunt - The Market Sniper - TraderProfileDokument4 SeitenFrancisHunt - The Market Sniper - TraderProfileAndrei Cojocaru100% (1)

- 3Q21 TME Investor PresentationDokument27 Seiten3Q21 TME Investor PresentationVincent ChanNoch keine Bewertungen

- Cash Flow DiagramDokument22 SeitenCash Flow DiagramDhena Rezqiah. S0% (1)

- Forex 1Dokument53 SeitenForex 1Irwan HeriyantoNoch keine Bewertungen

- IFRS 9 - Financial InstrumentsDokument14 SeitenIFRS 9 - Financial InstrumentsJayvie Dizon Salvador0% (1)

- Pitino Acquired 90 Percent of Brey's Outstanding SharesDokument40 SeitenPitino Acquired 90 Percent of Brey's Outstanding SharesKailash KumarNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)