Beruflich Dokumente

Kultur Dokumente

Mrs Aye Mali

Hochgeladen von

FazalWahabOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Mrs Aye Mali

Hochgeladen von

FazalWahabCopyright:

Verfügbare Formate

Energy crisis in Pakistan

2

TheDiagnosis

Keyreasonsbehindcurrentandpreviousenergy

crises:

1. Lackoflongtermintegratedplanningand

implementationforlast40years

2. Ignoredindigenousresources

3. Dependenceonimportedfurnaceoil

4. Lackofpoliticalwilltoreform/deregulate

3

.Lackoflongtermintegratedplanning

1994PowerPolicyalateresponsetochronicshortages

1994Policyadded6,000MWofmostlyimportedthermalbetween

19972001

Thermalshareincreasedfrom30%to70%

Ledtoexpensivesurpluscapacitybyearly2000s

Surplusbredcomplacency;

Politicalwitchhuntinlate90sdroveawayinvestors

Electricitydemandjumpedto10%p.a.between200407

Asalate,kneejerkresponse,anewwaveofIPPsapproved

between200407

4

Lackoflongtermintegratedplanning(contd)

3,700MWnewcapacitycameonlinein200711

Again,basedonfurnaceoil

Orgasthatwasnotavailable

RentalPowerPlantsfiascoduetoshorttermmeasures

100MWbeingproducedvs.2,000+MWplanned

OneofthefewRPPsonlinechargingRs.43/kWh

Asaresult,inthelastfiveyears

Tariffhasalmostdoubled

Rs.1trillionspentonsubsidies

Andthereisstillnosolutioninsight

5

Ignoredindigenousresources

StalledOilandgasexplorationaftermajordiscoveriesinSindhin

the90s

Complacencyandlackoffocusonresolvingsimmering

Balochistanissue

Majorinternationalcompaniesdrivenawaybyunattractive

policyincentives(2001PetroleumPolicy)

Hydellargelyignoredafter1970s,sidetrackedbypolitics

Only6,600MWoftotal50,000MWpotentialdeveloped

TharCoalstillapipedream

NolongtermThardevelopmentplan

Ongoingprojectsheldupbyfederal/provincialissues

Circular Debt choking the cash flows of energy supply chain

Circular debt understanding the complexity of the problem

owerdeficitmayrisetoover11,000MWinnextfive

earswithbusinessasusual

8

12,000

16,000

20,000

24,000

28,000

32,000

2010-11 2011-12 2012-13 2013-14 2014-15 2015-16 2016-17

Peak Demand Peak Generation

Projected peak demand

at 6% p.a. growth

About 2,500 MW of ongoing,

funded projects should come

online between FY11-15

Few sizable projects

due to circular debt

Neelum Jhelum likely

to be delayed further

(11,400 MW)

(8,600 MW)

(6,400

MW)

(5,700

MW)

Source: NTDC National Power System Expansion Plan 2011, NEPRA State of Industry Report 2011, PPIB, WAPDA public documents

9

heGasCrisis

-

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

2

0

1

1

-

1

2

2

0

1

2

-

1

3

2

0

1

3

-

1

4

2

0

1

4

-

1

5

2

0

1

5

-

1

6

2

0

1

6

-

1

7

2

0

1

7

-

1

8

2

0

1

8

-

1

9

2

0

1

9

-

2

0

2

0

2

0

-

2

1

(3.5 bcfd)

(5.2

bcfd

Projected gas supply

from domestic sources

Source: Petroleum Institute of Pakistan projections updated for actuals

Projected gas demand

(1.6 bcfd)

GDP growth has declined to 3.1% FY08-13; from 5.7% previous 5y

-4

-2

0

2

4

6

8

10

F

Y

0

0

F

Y

0

1

F

Y

0

2

F

Y

0

3

F

Y

0

4

F

Y

0

5

F

Y

0

6

F

Y

0

7

F

Y

0

8

F

Y

0

9

F

Y

1

0

F

Y

1

1

F

Y

1

2

F

Agriculture Industry Services Real GDP

Real GDP growth % y/y

Investment spending has collapsed lowest in history

Investment & saving as % of GDP

nsustainable fiscal deficits lead to macroeconomic instability

Source: SBP Annual Report 2012

Fiscal deficit widens to record 8.6% of GDP in FY12 (SBP)

arge external debt payments USD 6bn payment in FY14

Repayments to IMF 2012 2014 USD million

BP FX reserves fall below USD 6bn (1.8 months of import) J une 2013

Recommendations - Energy Mix

E & P - Recommendations

Petroleum Policies announced in 2001, 2007 and 2009 failed to

attract investment in the E&P sector. It is therefore

recommended that the well head gas pricing should be based

on 70% of a basket of imported crude price. This is in line with

the 1997 Petroleum Policy price which gave great impetus to

investment in oil and gas exploration. The pricing of this policy

was later rescinded by later Governments.

The GOP should engage a world class consultant to evaluate

the unconventional gas reserves in Pakistan and make the

study available to potential investors

To have a formula of making the local population as

shareholders

E& P The Unconventional Gas Potential in Pakistan

The demand supply gap has

changed dramatically with the

addition of unconventional

gas potential in Pakistan.

The decline in conventional

natural gas predicted is

reversed somewhat through

commencement of Tight Gas

production in 2015 16. Shale

Gas production is expected to

commence production from

2018 19.

Deficit in supply of natural

gas will still need to be met

through transnational

pipelines, LNG imports and

through fuel substitution

Pakistan Current Natura

Gas

Conventional Reserves 2

TCF

Daily Supply

4.2 BCF

Unconventional:

-Tight Gas 50 TCF

- Shale Gas

50 TCF

Pakistan Current Natura

Gas

Conventional Reserves 2

TCF

Daily Supply

4.2 BCF

Unconventional:

-Tight Gas 50 TCF

- Shale Gas

50 TCF

2.5 3.5

Source: Pakistan Petroleum Limited

Implications of business as usual

Unless there is a political will and

resolve to implement an integrated

energy plan the country will face

growing crisis on the energy front

With nominal GDP growth

projections of 2.5 4% the energy

consumption by the year 2025 would

be 142 mmtoe which translates to a

Power Requirement of 38,000 MW.

Oil Requirement will be 40 MMTOE,

Gas Requirement 67 MMTOE

The total energy import bill in 2025 at

US$ 100/ bbl will be

US$ 90 billion

19

Renewable

1%

Gas

Import

37%

LPG

2%

Gas Local

10%

Oil 28%

Hydel

13%

Coal 8%

Nuclea

1%

2022 Energy Mix Outlook

Business As Usual

2025

Das könnte Ihnen auch gefallen

- Pep Final PepDokument30 SeitenPep Final PepAshoni KumarNoch keine Bewertungen

- Power Policies, Planning and Bottlenecks - FinalDokument60 SeitenPower Policies, Planning and Bottlenecks - Finalsabeeh FaruquiNoch keine Bewertungen

- PTI Energy PolicyDokument52 SeitenPTI Energy PolicyPTI Official100% (9)

- Check For Answers. Hope You Will Find ItDokument11 SeitenCheck For Answers. Hope You Will Find ItMohammad Nazmul IslamNoch keine Bewertungen

- Unit 7 Intro To Natural Gas MarketingDokument9 SeitenUnit 7 Intro To Natural Gas MarketingJay JaniNoch keine Bewertungen

- Presentation 2Dokument21 SeitenPresentation 2Ayesha KousarNoch keine Bewertungen

- Case Study PhilippinesDokument4 SeitenCase Study PhilippinesNelbert SumalpongNoch keine Bewertungen

- Presentation On State of Power Crisis in BangladeshDokument10 SeitenPresentation On State of Power Crisis in BangladeshrifatNoch keine Bewertungen

- Bangladesh Fuel Additional InformationDokument14 SeitenBangladesh Fuel Additional InformationdpmgumtiNoch keine Bewertungen

- Why Pakistan's Power Woes Will Get Worse: Problems That Need To Be AddressedDokument11 SeitenWhy Pakistan's Power Woes Will Get Worse: Problems That Need To Be AddressedAimen JahangirNoch keine Bewertungen

- Energy Sector in Pakistan: MembersDokument25 SeitenEnergy Sector in Pakistan: MembersHassan AhmedNoch keine Bewertungen

- Energy Security and AffordabilityDokument12 SeitenEnergy Security and AffordabilityhonestscarryNoch keine Bewertungen

- Energy Crisis of PakistanDokument12 SeitenEnergy Crisis of PakistanM.Tauqeer90% (10)

- PEO 2020 Executive SummaryDokument3 SeitenPEO 2020 Executive SummaryUsman AbbasiNoch keine Bewertungen

- Power Policies of PakistanDokument29 SeitenPower Policies of PakistanRao ARSLANNoch keine Bewertungen

- Transformation of The Gas Sector Transformation of The Gas SectorDokument23 SeitenTransformation of The Gas Sector Transformation of The Gas SectorAmine ChabchoubNoch keine Bewertungen

- Introduction To Infrastructure ManagementDokument40 SeitenIntroduction To Infrastructure ManagementAbhaSinghNoch keine Bewertungen

- Ga - EnergyDokument20 SeitenGa - EnergyPranks9827653878Noch keine Bewertungen

- Water and PowerDokument25 SeitenWater and PowerJamal JalalaniNoch keine Bewertungen

- Engy Scenario 15 16Dokument25 SeitenEngy Scenario 15 16Hydrosys InnovationNoch keine Bewertungen

- Energy Crisis of Pakistan: Causes & Remedy: M. Nadeem JahangirDokument16 SeitenEnergy Crisis of Pakistan: Causes & Remedy: M. Nadeem JahangirFizza JamalNoch keine Bewertungen

- Energy: Performance Review 2014-15Dokument19 SeitenEnergy: Performance Review 2014-15Muhammad SaqibNoch keine Bewertungen

- Energy ScrenarioDokument54 SeitenEnergy ScrenarioViki PrasadNoch keine Bewertungen

- SPE-189176-MS Gas Development in An Emerging Economy: Nigerian Case StudyDokument12 SeitenSPE-189176-MS Gas Development in An Emerging Economy: Nigerian Case StudyIbrahim SalahudinNoch keine Bewertungen

- Oil and Gas Sector: 1) OverviewDokument9 SeitenOil and Gas Sector: 1) OverviewShital Parakh100% (1)

- Aftab - Husain Challenges of The Oil Refining Sector in PakistanDokument31 SeitenAftab - Husain Challenges of The Oil Refining Sector in PakistanMustafaNoch keine Bewertungen

- Group - II: Adnan Ali Zainab Rauf Abdul Rehman Abdul Samad Muhammad Kashif Tauqeer RazaDokument38 SeitenGroup - II: Adnan Ali Zainab Rauf Abdul Rehman Abdul Samad Muhammad Kashif Tauqeer RazaAbdul RehmanNoch keine Bewertungen

- Prepared By: Sanjeev Kumar Apurva Mittal Riya Giri Manish BhadeDokument10 SeitenPrepared By: Sanjeev Kumar Apurva Mittal Riya Giri Manish BhadeSanjeev SharmaNoch keine Bewertungen

- Energy Sector in IndiaDokument34 SeitenEnergy Sector in IndiaDilse RamjeeNoch keine Bewertungen

- Petroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesDokument54 SeitenPetroleum Exploration & Production POLICY 2011: Government of Pakistan Ministry of Petroleum & Natural ResourcesShaista IshaqNoch keine Bewertungen

- Study On Regulatory FrameworkDokument27 SeitenStudy On Regulatory FrameworkRave Christian Pangilinan ParasNoch keine Bewertungen

- Energy Crisis of Pakistan Causes & RemedyDokument16 SeitenEnergy Crisis of Pakistan Causes & Remedyamirq4Noch keine Bewertungen

- Cobp Phi 2013 2015 Ssa 02 PDFDokument6 SeitenCobp Phi 2013 2015 Ssa 02 PDFMhay VelascoNoch keine Bewertungen

- Nigerias Energy Transition Oil An Gas UpdateDokument20 SeitenNigerias Energy Transition Oil An Gas UpdateAmanu EkiyeNoch keine Bewertungen

- UNIT 4 - Natural Gas BusinessDokument11 SeitenUNIT 4 - Natural Gas BusinessJay JaniNoch keine Bewertungen

- Strategy - For - New - India - 0 ExportDokument49 SeitenStrategy - For - New - India - 0 Exportanil200110110Noch keine Bewertungen

- The History of Private Power in PakistanDokument17 SeitenThe History of Private Power in PakistansalmanNoch keine Bewertungen

- Philippine Cobp Phi 2014 2016 Ssa 02Dokument6 SeitenPhilippine Cobp Phi 2014 2016 Ssa 02LuthfieSangKaptenNoch keine Bewertungen

- Rising LNG Dependence in Pakistan - June 2022 - 3Dokument43 SeitenRising LNG Dependence in Pakistan - June 2022 - 3jalees23Noch keine Bewertungen

- 1 Introductio1Dokument3 Seiten1 Introductio1Faisal Ur Rahman AwanNoch keine Bewertungen

- NLCDokument51 SeitenNLCPrasant Prasad100% (1)

- Oil & Gas Pipeline Opportunities 2020-22Dokument21 SeitenOil & Gas Pipeline Opportunities 2020-22NORTECH TRINITYNoch keine Bewertungen

- Investment Opportunities in Nigeria Oil and Gas Value ChainDokument17 SeitenInvestment Opportunities in Nigeria Oil and Gas Value ChainMichael OlorunninwoNoch keine Bewertungen

- Africa Latin America Asia CEE India Mediterrannean Countries OECD CountriesDokument6 SeitenAfrica Latin America Asia CEE India Mediterrannean Countries OECD CountriesTulika ShreeNoch keine Bewertungen

- Energy Crisis Eassy OutlineDokument1 SeiteEnergy Crisis Eassy Outlineali zainNoch keine Bewertungen

- AR 2013 14 Infra-ReviewDokument12 SeitenAR 2013 14 Infra-ReviewHarshal PhuseNoch keine Bewertungen

- Energy Crisis in PakistanDokument10 SeitenEnergy Crisis in Pakistansabir17100% (2)

- Coal and Power Related Issues SummaryDokument3 SeitenCoal and Power Related Issues SummaryRahul MathurNoch keine Bewertungen

- 3 233 PBDokument14 Seiten3 233 PBAyesha kazmiNoch keine Bewertungen

- Lcoy - Energy Input DocumentDokument5 SeitenLcoy - Energy Input DocumentHammad AbbasiNoch keine Bewertungen

- Energy PDFDokument22 SeitenEnergy PDFSultan AhmedNoch keine Bewertungen

- No Guaranteed Future For Imported Gas in The Philippines - May 2021Dokument35 SeitenNo Guaranteed Future For Imported Gas in The Philippines - May 2021BernardNoch keine Bewertungen

- Metis Coal Report Brochure Full May 1Dokument8 SeitenMetis Coal Report Brochure Full May 1arorakgarima100% (1)

- Chapter 1Dokument6 SeitenChapter 1mohshin06009Noch keine Bewertungen

- Energy Crises in PakistanDokument9 SeitenEnergy Crises in PakistanHamza MunirNoch keine Bewertungen

- Policy For Power Generation Projects: Year 2002 vs. Year 1994Dokument15 SeitenPolicy For Power Generation Projects: Year 2002 vs. Year 1994Hamza KhalidNoch keine Bewertungen

- Oversees Coal in IndiaDokument13 SeitenOversees Coal in IndiaNaman RawatNoch keine Bewertungen

- Pathways to Low-Carbon Development for the PhilippinesVon EverandPathways to Low-Carbon Development for the PhilippinesNoch keine Bewertungen

- Energy Storage: Legal and Regulatory Challenges and OpportunitiesVon EverandEnergy Storage: Legal and Regulatory Challenges and OpportunitiesNoch keine Bewertungen

- Transforming the energy systemVon EverandTransforming the energy systemNoch keine Bewertungen

- Activity 1 - GlobalizationDokument4 SeitenActivity 1 - GlobalizationIris leavesNoch keine Bewertungen

- Presentation NGODokument6 SeitenPresentation NGODulani PinkyNoch keine Bewertungen

- Appendix 14 - Instructions - BURSDokument1 SeiteAppendix 14 - Instructions - BURSthessa_starNoch keine Bewertungen

- Procedure For Making Location DecisionsDokument7 SeitenProcedure For Making Location DecisionsFitz JaminitNoch keine Bewertungen

- 386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Dokument46 Seiten386 - 33 - Powerpoint - Slides - Lipsey - PPT - ch07 (Autosaved)Ayush KumarNoch keine Bewertungen

- Metropolitan Transport Corporation Guindy Estate JJ Nagar WestDokument5 SeitenMetropolitan Transport Corporation Guindy Estate JJ Nagar WestbiindduuNoch keine Bewertungen

- Latihan Soal PT CahayaDokument20 SeitenLatihan Soal PT CahayaAisyah Sakinah PutriNoch keine Bewertungen

- Business Economics - Question BankDokument4 SeitenBusiness Economics - Question BankKinnari SinghNoch keine Bewertungen

- Microsoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDokument8 SeitenMicrosoft Word - CHAPTER - 05 - DEPOSITS - IN - BANKSDuy Trần TấnNoch keine Bewertungen

- Mechanizing Philippine Agriculture For Food SufficiencyDokument21 SeitenMechanizing Philippine Agriculture For Food SufficiencyViverly Joy De GuzmanNoch keine Bewertungen

- Flex Parts BookDokument16 SeitenFlex Parts BookrodolfoNoch keine Bewertungen

- © 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenDokument62 Seiten© 2015 Mcgraw-Hill Education Garrison, Noreen, Brewer, Cheng & YuenHIỀN LÊ THỊNoch keine Bewertungen

- Company ProfileDokument13 SeitenCompany ProfileDauda AdijatNoch keine Bewertungen

- Fiscal Deficit UPSCDokument3 SeitenFiscal Deficit UPSCSubbareddyNoch keine Bewertungen

- Democracy Perception Index 2021 - Topline ResultsDokument62 SeitenDemocracy Perception Index 2021 - Topline ResultsMatias CarpignanoNoch keine Bewertungen

- CMACGM Service Description ReportDokument58 SeitenCMACGM Service Description ReportMarius MoraruNoch keine Bewertungen

- Buku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiaDokument17 SeitenBuku Petunjuk Tata Cara Berlalu Lintas Highwaycode Di IndonesiadianNoch keine Bewertungen

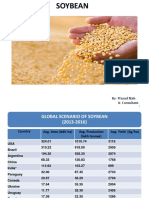

- Soybean Scenario - LaturDokument18 SeitenSoybean Scenario - LaturPrasad NaleNoch keine Bewertungen

- Evolution of Taxation in The PhilippinesDokument16 SeitenEvolution of Taxation in The Philippineshadji montanoNoch keine Bewertungen

- Posting Journal - 1-5 - 1-5Dokument5 SeitenPosting Journal - 1-5 - 1-5Shagi FastNoch keine Bewertungen

- TCW Act #4 EdoraDokument5 SeitenTCW Act #4 EdoraMon RamNoch keine Bewertungen

- Chapter Five: Perfect CompetitionDokument6 SeitenChapter Five: Perfect CompetitionAbrha636Noch keine Bewertungen

- Module 2Dokument7 SeitenModule 2Joris YapNoch keine Bewertungen

- P1 Ii2005Dokument3 SeitenP1 Ii2005Boris YanguezNoch keine Bewertungen

- ENG Merchant 4275Dokument7 SeitenENG Merchant 4275thirdNoch keine Bewertungen

- Vtiger Software For CRMDokument14 SeitenVtiger Software For CRMmentolNoch keine Bewertungen

- BS Irronmongry 2Dokument32 SeitenBS Irronmongry 2Peter MohabNoch keine Bewertungen

- (Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesDokument20 Seiten(Paper) Intellectual Capital Performance in The Case of Romanian Public CompaniesishelNoch keine Bewertungen

- RM AllowanceDokument2 SeitenRM AllowancekapsicumadNoch keine Bewertungen

- What Is InflationDokument222 SeitenWhat Is InflationAhim Raj JoshiNoch keine Bewertungen