Beruflich Dokumente

Kultur Dokumente

709 Form 2005 Sample

Hochgeladen von

123pratusCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

709 Form 2005 Sample

Hochgeladen von

123pratusCopyright:

Verfügbare Formate

I.R.S.

SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT

TLS, have you

transmitted all R

text files for this

cycle update?

Date

Revised proofs

requested

Date Signature

O.K. to print

INSTRUCTIONS TO PRINTERS

FORM 709, PAGE 1 of 4

MARGINS: TOP 13mm (

1

2 "), CENTER SIDES. PRINTS: HEAD TO FOOT

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 216mm (8

1

2 ") x 559mm (22") FOLD TO 216mm (8

1

2 ") x 279mm (11")

PERFORATE: ON HORIZONTAL FOLD

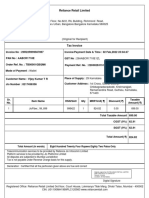

United States Gift (and Generation-Skipping Transfer) Tax Return

Form 709

(For gifts made during calendar year 2005)

OMB No. 1545-0020

Department of the Treasury

Internal Revenue Service

See separate instructions.

1 2 Donors last name Donors first name and middle initial Donors social security number 3

Address (number, street, and apartment number) 4 5 Legal residence (domicile) (county and state)

6 City, state, and ZIP code Citizenship 7

No Yes

If the donor died during the year, check here

and enter date of death , . 8

9 If you extended the time to file this Form 709, check here

Enter the total number of donees listed on Schedule A. Count each person only once.

10

11a Have you (the donor) previously filed a Form 709 (or 709-A) for any other year? If "No," skip line 11b

12 Gifts by husband or wife to third parties. Do you consent to have the gifts (including generation-skipping transfers) made

by you and by your spouse to third parties during the calendar year considered as made one-half by each of you? (See

instructions.) (If the answer is Yes, the following information must be furnished and your spouse must sign the consent

shown below. If the answer is No, skip lines 1318 and go to Schedule A. )

13 Name of consenting spouse 14 SSN

15 Were you married to one another during the entire calendar year? (see instructions) P

a

r

t

1

G

e

n

e

r

a

l

I

n

f

o

r

m

a

t

i

o

n

16 If 15 is No, check whether

Will a gift tax return for this year be filed by your spouse? (If Yes, mail both returns in the same envelope.) 17

Consent of Spouse. I consent to have the gifts (and generation-skipping transfers) made by me and by my spouse to third parties during the calendar year

considered as made one-half by each of us. We are both aware of the joint and several liability for tax created by the execution of this consent.

18

Date

Consenting spouses signature

1

1 Enter the amount from Schedule A, Part 4, line 11

2

2 Enter the amount from Schedule B, line 3

3

3 Total taxable gifts. Add lines 1 and 2

4

4 Tax computed on amount on line 3 (see Table for Computing Gift Tax in separate instructions)

5

5 Tax computed on amount on line 2 (see Table for Computing Gift Tax in separate instructions)

6

6 Balance. Subtract line 5 from line 4

345,800 00 7

7 Maximum unified credit (nonresident aliens, see instructions)

8

8 Enter the unified credit against tax allowable for all prior periods (from Sch. B, line 1, col. C)

9

9 Balance. Subtract line 8 from line 7

10 Enter 20% (.20) of the amount allowed as a specific exemption for gifts made after September 8,

1976, and before January 1, 1977 (see instructions)

10

11

11 Balance. Subtract line 10 from line 9

12

12 Unified credit. Enter the smaller of line 6 or line 11

13

13 Credit for foreign gift taxes (see instructions)

14

14 Total credits. Add lines 12 and 13

15

P

a

r

t

2

T

a

x

C

o

m

p

u

t

a

t

i

o

n

15 Balance. Subtract line 14 from line 6. Do not enter less than zero

16

16 Generation-skipping transfer taxes (from Schedule C, Part 3, col. H, Total)

17

17 Total tax. Add lines 15 and 16

18

18 Gift and generation-skipping transfer taxes prepaid with extension of time to file

19

19 If line 18 is less than line 17, enter balance due (see instructions)

If line 18 is greater than line 17, enter amount to be refunded 20 20

A

t

t

a

c

h

c

h

e

c

k

o

r

m

o

n

e

y

o

r

d

e

r

h

e

r

e

.

Form 709 (2005) For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see page 12 of the separate instructions for this form. Cat. No. 16783M

If the answer to line 11a is "Yes," has your address changed since you last filed Form 709 (or 709-A)? 11b

divorced or widowed/deceased, and give date (see instructions)

married

Under penalties of perjury, I declare that I have examined this return, including any accompanying schedules and statements, and to the best of my

knowledge and belief, it is true, correct, and complete. Declaration of preparer (other than donor) is based on all information of which preparer has

any knowledge.

Sign

Here

Date Signature of donor

Date

Preparers

signature

Check if

self-employed

Paid

Preparers

Use Only

Firms name (or

yours if self-employed),

address, and ZIP code

Phone no. ( )

3

05

RANDY J. SMITH 111 22 3333

1234 SMITH LANE KING, WASHINGTON

SEATTLE, WA 98123 U.S.

1

5,000 00

0

5,000 00

1,100 00

0

1,100 00

0

345,800 00

0

345,800 00

1,100 00

0

1,100 00

0

0

0

1,000 00

1,000 00

SCHEDULE A

INSTRUCTIONS TO PRINTERS

FORM 709, PAGE 2 of 4

MARGINS: TOP 13mm (

1

2 "), CENTER SIDES. PRINTS: HEAD TO FOOT

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 216mm (8

1

2 ") x 559mm (22") FOLD TO 216mm (8

1

2 ") x 279mm (11")

PERFORATE: ON HORIZONTAL FOLD

Page 2 Form 709 (2005)

Computation of Taxable Gifts (Including transfers in trust) (see instructions)

Part 1Gifts Subject Only to Gift Tax. Gifts less political organization, medical, and educational exclusions. See instructions.

F

Value at

date of gift

E

Date

of gift

D

Donors adjusted

basis of gift

A

Item

number

1

Part 2Direct Skips. Gifts that are direct skips and are subject to both gift tax and generation-skipping transfer tax. You must list the gifts

in chronological order.

F

Value at

date of gift

E

Date

of gift

D

Donors adjusted

basis of gift

A

Item

number

1

(If more space is needed, attach additional sheets of same size.)

B

B

Donees name and address

Relationship to donor (if any)

Description of gift

If the gift was of securities, give CUSIP no.

If closely held entity, give EIN

3

I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT

Does the value of any item listed on Schedule A reflect any valuation discount? If Yes, attach explanation Yes No

Gifts made by spousecomplete only if you are splitting gifts with your spouse and he/she also made gifts.

Total of Part 2. Add amounts from Part 2, column H

Check here if you elect under section 529(c)(2)(B) to treat any transfers made this year to a qualified tuition program as made

ratably over a 5-year period beginning this year. See instructions. Attach explanation.

B

A

Form 709 (2005)

C

H

Net transfer

(subtract

col. G from

col. F)

G

For split

gifts, enter

1

2 of

column F

Total of Part 1. Add amounts from Part 1, column H

Donees name and address

Relationship to donor (if any)

Description of gift

If the gift was of securities, give CUSIP no.

If closely held entity, give EIN

G

For split

gifts, enter

1

2 of

column F

C

2632(b)

election

out

Part 3Indirect Skips. Gifts to trusts that are currently subject to gift tax and may later be subject to generation-skipping transfer tax. You

must list these gifts in chronological order.

F

Value at

date of gift

E

Date

of gift

D

Donors adjusted

basis of gift

A

Item

number

1

B

Donees name and address

Relationship to donor (if any)

Description of gift

If the gift was of securities, give CUSIP no.

If closely held entity, give EIN

G

For split

gifts, enter

1

2 of

column F

C

2632(c)

election

H

Net transfer

(subtract

col. G from

col. F)

H

Net transfer

(subtract

col. G from

col. F)

Gifts made by spousecomplete only if you are splitting gifts with your spouse and he/she also made gifts.

Gifts made by spousecomplete only if you are splitting gifts with your spouse and he/she also made gifts.

Total of Part 3. Add amounts from Part 3, column H

Randy James Smith 16,000.00 12-31- 16,000.00 16,000.00

1234 Smith Lane, Seattle, Washington 2005

[98123], Beneficiary, Compensation for

Labor

16,000.00

SCHEDULE B

INSTRUCTIONS TO PRINTERS

FORM 709, PAGE 3 of 4

MARGINS: TOP 13mm (

1

2 "), CENTER SIDES. PRINTS: HEAD TO FOOT

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 216mm (8

1

2 ") x 559mm (22") FOLD TO 216mm (8

1

2 ") x 279mm (11")

PERFORATE: ON HORIZONTAL FOLD

Page 3 Form 709 (2005)

12 Terminable Interest (QTIP) Marital Deduction. (See instructions for Schedule A, Part 4, line 4.)

13 Election Out of QTIP Treatment of Annuities

Check here if you elect under section 2523(f)(6) not to treat as qualified terminable interest property any joint and survivor annuities that are

reported on Schedule A and would otherwise be treated as qualified terminable interest property under section 2523(f). See instructions. Enter

the item numbers from Schedule A for the annuities for which you are making this election

Gifts From Prior Periods

D

Amount of specific

exemption for prior

periods ending before

January 1, 1977

C

Amount of unified

credit against gift tax

for periods after

December 31, 1976

A

Calendar year or

calendar quarter

(see instructions)

E

Amount of

taxable gifts

B

Internal Revenue office

where prior return was filed

1

Totals for prior periods 1

2

Amount, if any, by which total specific exemption, line 1, column D, is more than $30,000 2

Total amount of taxable gifts for prior periods. Add amount on line 1, column E and amount, if any, on

line 2. Enter here and on line 2 of the Tax Computation on page 1

3

3

(If more space is needed, attach additional sheets of same size.)

If a trust (or other property) meets the requirements of qualified terminable interest property under section 2523(f), and:

a. The trust (or other property) is listed on Schedule A, and

b. The value of the trust (or other property) is entered in whole or in part as a deduction on Schedule A, Part 4, line 4, then the donor

shall be deemed to have made an election to have such trust (or other property) treated as qualified terminable interest property under section

2523(f).

If less than the entire value of the trust (or other property) that the donor has included in Parts 1 and 3 of Schedule A is entered as a deduction

on line 4, the donor shall be considered to have made an election only as to a fraction of the trust (or other property). The numerator of this

fraction is equal to the amount of the trust (or other property) deducted on Schedule A, Part 4, line 6. The denominator is equal to the total value

of the trust (or other property) listed in Parts 1 and 3 of Schedule A.

If you answered Yes on line 11a of page 1, Part 1, see the instructions for completing Schedule B. If you answered No, skip to the Tax

Computation on page 1 (or Schedule C, if applicable).

If you make the QTIP election, the terminable interest property involved will be included in your spouses gross estate upon his or her death

(section 2044). See instructions for line 4 of Schedule A. If your spouse disposes (by gift or otherwise) of all or part of the qualifying life income

interest, he or she will be considered to have made a transfer of the entire property that is subject to the gift tax. See Transfer of Certain Life

Estates Received From Spouse on page 4 of the instructions.

3

I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT

Form 709 (2005)

Part 4Taxable Gift Reconciliation

1

Total value of gifts of donor. Add totals from column H of Parts 1, 2, and 3 1

3

4

5

2

Total annual exclusions for gifts listed on line 1 (see instructions)

6

3

Total included amount of gifts. Subtract line 2 from line 1

7

Deductions (see instructions)

Gifts of interests to spouse for which a marital deduction will be claimed, based

on items of Schedule A

8

4

5

Exclusions attributable to gifts on line 4

9

6

Marital deduction. Subtract line 5 from line 4

10

7

Charitable deduction, based on items less exclusions

11

8

Total deductions. Add lines 6 and 7

9

Subtract line 8 from line 3

10 Generation-skipping transfer taxes payable with this Form 709 (from Schedule C, Part 3, col. H, Total)

Taxable gifts. Add lines 9 and 10. Enter here and on line 1 of the Tax Computation on page 1 11

2

16,000 00

11,000 00

5,000 00

5,000 00

INSTRUCTIONS TO PRINTERS

FORM 709, PAGE 4 of 4

MARGINS: TOP 13mm (

1

2 "), CENTER SIDES. PRINTS: HEAD TO FOOT

PAPER: WHITE, WRITING, SUB. 20 INK: BLACK

FLAT SIZE: 216mm (8

1

2 ") x 559mm (22") FOLD TO 216mm (8

1

2 ") x 279mm (11")

PERFORATE: ON HORIZONTAL FOLD

Form 709 (2005) Page 4

Part 2GST Exemption Reconciliation (Section 2631) and Section 2652(a)(3) Election

Check box

if you are making a section 2652(a)(3) (special QTIP) election (see instructions)

Enter the item numbers from Schedule A of the gifts for which you are making this election

1

Maximum allowable exemption (see instructions) 1

2

2 Total exemption used for periods before filing this return

3

3 Exemption available for this return. Subtract line 2 from line 1

4

4 Exemption claimed on this return from Part 3, col. C total, below

6 Exemption allocated to transfers not shown on line 4 or 5, above. You must attach a Notice of Allocation.

(see instructions)

6

7

Add lines 4, 5, and 6 7

8 8 Exemption available for future transfers. Subtract line 7 from line 3

Part 3Tax Computation

H

Generation-Skipping

Transfer Tax

(multiply col. B by col. G)

G

Applicable Rate

(multiply col. E

by col. F)

F

Maximum Estate

Tax Rate

E

Inclusion Ratio

(subtract col. D

from 1.000)

D

Divide col. C

by col. B

B

Net transfer

(from Schedule C,

Part 1, col. D)

C

GST Exemption

Allocated

A

Item No.

(from Schedule

C, Part 1)

1 47% (.47)

2

3

4

5

6

Total exemption claimed. Enter

here and on line 4, Part 2,

above. May not exceed line 3,

Part 2, above

Total generation-skipping transfer tax. Enter here; on Schedule

A, Part 4, line 10; and on line 16 of the Tax Computation on page

1

(If more space is needed, attach additional sheets of same size.)

SCHEDULE C Computation of Generation-Skipping Transfer Tax

Note: Inter vivos direct skips that are completely excluded by the GST exemption must still be fully reported

(including value and exemptions claimed) on Schedule C.

Part 1Generation-Skipping Transfers

D

Net Transfer (subtract

col. C from col. B)

B

Value (from Schedule A,

Part 2, col. H)

A

Item No.

(from Schedule A,

Part 2, col. A)

C

Nontaxable

portion of transfer

1

47% (.47)

47% (.47)

47% (.47)

47% (.47)

47% (.47)

47% (.47)

47% (.47)

47% (.47)

47% (.47)

3

I.R.S. SPECIFICATIONS TO BE REMOVED BEFORE PRINTING

DO NOT PRINT DO NOT PRINT DO NOT PRINT DO NOT PRINT

Form 709 (2005)

Gifts made by spouse (for gift splitting only)

5

5 Automatic allocation of exemption to transfers reported on Schedule A, Part 3 (see instructions)

47% (.47)

47% (.47)

Das könnte Ihnen auch gefallen

- 2011 1040NR-EZ Form - SampleDokument2 Seiten2011 1040NR-EZ Form - Samplefrankvanhaste100% (1)

- Form 1041Dokument4 SeitenForm 1041topsytables50% (4)

- IRS Publication Form 706Dokument4 SeitenIRS Publication Form 706Francis Wolfgang UrbanNoch keine Bewertungen

- Request Sample Ltr2CFO - Trustee For OIDs 11 - 2017Dokument2 SeitenRequest Sample Ltr2CFO - Trustee For OIDs 11 - 2017ricetech92% (13)

- Corporate Dissolution FormDokument2 SeitenCorporate Dissolution FormDUTCH55140089% (9)

- Harry Thomas JR IRS Form 3949aDokument2 SeitenHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- CT 706 709bookDokument23 SeitenCT 706 709bookPatricia Dillon100% (1)

- Report Tax Violations Form 3949-ADokument3 SeitenReport Tax Violations Form 3949-Aiamsomedude100% (3)

- IRS 3949-A American Bankers AssociationDokument2 SeitenIRS 3949-A American Bankers Associationrodclassteam100% (4)

- 1199 A 1 PDFDokument4 Seiten1199 A 1 PDFGerry Ruff100% (1)

- OID Tax Diagram 3Dokument2 SeitenOID Tax Diagram 3ricetech100% (14)

- 1099a Example For 1041Dokument1 Seite1099a Example For 1041jigger manNoch keine Bewertungen

- 33 - NOTICE of 1099A - Gov - Uscourts.ord.124749.33.0, NOTICE OF 1099ADokument3 Seiten33 - NOTICE of 1099A - Gov - Uscourts.ord.124749.33.0, NOTICE OF 1099AFreeman Lawyer83% (6)

- Fax Irs Fiduciary Breitkreuz 21211 ConsentDokument15 SeitenFax Irs Fiduciary Breitkreuz 21211 Consent:Nanya-Ahk:Heru-El(R)(C)TMNoch keine Bewertungen

- Nonprofit Law for Religious Organizations: Essential Questions & AnswersVon EverandNonprofit Law for Religious Organizations: Essential Questions & AnswersBewertung: 5 von 5 Sternen5/5 (1)

- 1041 Tax Return Walk-ThroughDokument66 Seiten1041 Tax Return Walk-Throughdsfewr100% (4)

- ADR 1041 2010cDokument83 SeitenADR 1041 2010cPeggy W Satterfield100% (1)

- WHFIT Transition GuidanceDokument12 SeitenWHFIT Transition GuidancejpesNoch keine Bewertungen

- Request Ltr2Bank For OIDsDokument2 SeitenRequest Ltr2Bank For OIDsricetech96% (48)

- Irs Form 56 Douglas Schulman 8-14-08Dokument2 SeitenIrs Form 56 Douglas Schulman 8-14-08Wb Warnabrother Hatchet100% (4)

- Judicial. IRS Form56Dokument66 SeitenJudicial. IRS Form56Shane Christopher Family of Buczek94% (17)

- f13909 (Completed) PDFDokument2 Seitenf13909 (Completed) PDFAnonymous HCUEwQNG5100% (2)

- UCC3 Assign BondDokument2 SeitenUCC3 Assign BondMichael Kovach86% (7)

- Information Return For Publicly Offered Original Issue Discount InstrumentsDokument4 SeitenInformation Return For Publicly Offered Original Issue Discount InstrumentsShawn60% (5)

- 2011 Form 1041 K 1 InstructionsDokument37 Seiten2011 Form 1041 K 1 InstructionsEltech911100% (1)

- 1099 Oid'sDokument8 Seiten1099 Oid'sNikki Cofield81% (16)

- IRS Form 706Dokument43 SeitenIRS Form 706Tiggle Madalene100% (2)

- IRS Decoding Manual 6209-2003Dokument674 SeitenIRS Decoding Manual 6209-2003Julie Hatcher-Julie Munoz Jackson100% (5)

- Form 1041-V Payment InstructionsDokument2 SeitenForm 1041-V Payment InstructionsPnut Hallman100% (1)

- IRS Form 1099-B Filing InstructionsDokument6 SeitenIRS Form 1099-B Filing InstructionsYarod EL100% (4)

- Your Massachusetts Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for Massachusetts ResidentsVon EverandYour Massachusetts Wills, Trusts, & Estates Explained Simply: Important Information You Need to Know for Massachusetts ResidentsNoch keine Bewertungen

- A4V Procedure - Trvth's Presentation of SFsDokument22 SeitenA4V Procedure - Trvth's Presentation of SFsBob Hurt100% (7)

- 2848 - Arnold Part 2Dokument2 Seiten2848 - Arnold Part 2Arnissia Dior100% (5)

- Sample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020Dokument3 SeitenSample Ltr2 FudiciaryTrustee4 OIDs 3 - 2020ricetech100% (22)

- 1099 Oid Puzzle by Myron 7-4-2019Dokument2 Seiten1099 Oid Puzzle by Myron 7-4-2019ricetech100% (20)

- OID Tax Diagram-1 - 2019 UpdateDokument3 SeitenOID Tax Diagram-1 - 2019 Updatericetech100% (29)

- Request Ltr2Bank For OIDsDokument2 SeitenRequest Ltr2Bank For OIDsricetech100% (15)

- 2 - Oid MethodDokument2 Seiten2 - Oid MethodSovereign62996% (49)

- US Internal Revenue Service: p1212 - 1997Dokument15 SeitenUS Internal Revenue Service: p1212 - 1997IRSNoch keine Bewertungen

- Instructions For Form 2848 (02 - 2020) - Internal Revenue ServiceDokument30 SeitenInstructions For Form 2848 (02 - 2020) - Internal Revenue ServiceBIGBOY80% (5)

- BC InfoDokument6 SeitenBC InfoBrad Greene100% (4)

- USE OF THE 1099-A Plus RadioDokument1 SeiteUSE OF THE 1099-A Plus Radioapi-19731109100% (1)

- The Constitutional Case for Religious Exemptions from Federal Vaccine MandatesVon EverandThe Constitutional Case for Religious Exemptions from Federal Vaccine MandatesNoch keine Bewertungen

- Money Order Keating Style ExampleDokument2 SeitenMoney Order Keating Style Examplekbarn389100% (77)

- Orders For SSA Treasury IRS SOS and All Public Servants That PatrickDokument1 SeiteOrders For SSA Treasury IRS SOS and All Public Servants That PatrickPatrick Long100% (1)

- SIKANU Form 56Dokument4 SeitenSIKANU Form 56sikanubeyel100% (3)

- Request 1099-OID On Court CaseDokument2 SeitenRequest 1099-OID On Court CaseJeromeKmt100% (31)

- Case 2:09-cv-07017-GHK-RC Document 36 Filed 03/08/10 1 of 8Dokument5 SeitenCase 2:09-cv-07017-GHK-RC Document 36 Filed 03/08/10 1 of 8Nat WilliamsNoch keine Bewertungen

- IRS EFTPS InstructionsDokument12 SeitenIRS EFTPS InstructionsLeon Hormel100% (2)

- 2 Letter To Secretary Paulson BC BondDokument2 Seiten2 Letter To Secretary Paulson BC BondKonan Snowden100% (8)

- IRS Form 1040es 2016Dokument12 SeitenIRS Form 1040es 2016Freeman Lawyer100% (1)

- Non DecedentDokument1 SeiteNon DecedentNotarys To Go100% (1)

- Operating Circular 1 AppendicesDokument6 SeitenOperating Circular 1 Appendicespurpel100% (1)

- The Fiduciary Formula: 6 Essential Elements to Create the Perfect Corporate Retirement PlanVon EverandThe Fiduciary Formula: 6 Essential Elements to Create the Perfect Corporate Retirement PlanNoch keine Bewertungen

- Basic Understanding of Bond Investments: Book 5 for Teens and Young AdultsVon EverandBasic Understanding of Bond Investments: Book 5 for Teens and Young AdultsBewertung: 4.5 von 5 Sternen4.5/5 (2)

- Your New Jersey Will, Trusts & Estates Explained Simply: Important Information You Need to Know for New Jersey ResidentsVon EverandYour New Jersey Will, Trusts & Estates Explained Simply: Important Information You Need to Know for New Jersey ResidentsNoch keine Bewertungen

- Navigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaVon EverandNavigating Failure: Bankruptcy and Commercial Society in Antebellum AmericaBewertung: 2 von 5 Sternen2/5 (3)

- Form 709 Gift Tax Return GuideDokument5 SeitenForm 709 Gift Tax Return GuidepdizypdizyNoch keine Bewertungen

- Form 709 United States Gift Tax ReturnDokument5 SeitenForm 709 United States Gift Tax ReturnBogdan PraščevićNoch keine Bewertungen

- Affidavit of Fact IRSDokument13 SeitenAffidavit of Fact IRS123pratus89% (9)

- 'Safe Passage' Docs - Support For The DAVID CLARENCE Executor Letter at The Turiya Files PDFDokument1 Seite'Safe Passage' Docs - Support For The DAVID CLARENCE Executor Letter at The Turiya Files PDF123pratus100% (14)

- Evidentiary Hearing RequestDokument13 SeitenEvidentiary Hearing Request123pratus50% (2)

- Received An IRS 2645c LetterDokument1 SeiteReceived An IRS 2645c Letter123pratus100% (1)

- Executors Manual of Rights Privileges Duties Liabilities 18731Dokument424 SeitenExecutors Manual of Rights Privileges Duties Liabilities 18731Ian Rossiter100% (2)

- MORTGAGE - Responses To DiscoveryDokument7 SeitenMORTGAGE - Responses To Discovery123pratusNoch keine Bewertungen

- MORTGAGE FRAUD - Notary Presentment SampleDokument2 SeitenMORTGAGE FRAUD - Notary Presentment Sample123pratus100% (5)

- Determining Interest RatesDokument53 SeitenDetermining Interest Rates123pratus100% (2)

- Declaration of Nominee TrustDokument4 SeitenDeclaration of Nominee Trust123pratus50% (2)

- Citizenship Affidavit Clarifies Voter Registration StatusDokument2 SeitenCitizenship Affidavit Clarifies Voter Registration Statusjester7100% (5)

- Executor LetterDokument4 SeitenExecutor Letter123pratus96% (23)

- Jerman v. Carlisle Et Als - 1Dokument18 SeitenJerman v. Carlisle Et Als - 1123pratusNoch keine Bewertungen

- SF 25a 98 Payment BondDokument2 SeitenSF 25a 98 Payment Bond123pratus100% (3)

- SF - 25-96 - Performance BondDokument2 SeitenSF - 25-96 - Performance Bond123pratus100% (1)

- Oath of Office AffidavitDokument1 SeiteOath of Office AffidavitnevdullNoch keine Bewertungen

- BIR Form 1702 (November 2011)Dokument18 SeitenBIR Form 1702 (November 2011)Jecon BonsucanNoch keine Bewertungen

- Calculate income from house propertyDokument5 SeitenCalculate income from house propertyYash JainNoch keine Bewertungen

- Income Tax Calculator for Govt EmployeesDokument11 SeitenIncome Tax Calculator for Govt Employeeschandu3060Noch keine Bewertungen

- Digital Order: Feb. 26 2022: Details For Order # D01-7940294-2662636Dokument1 SeiteDigital Order: Feb. 26 2022: Details For Order # D01-7940294-2662636AssignmentHelp OnlineNoch keine Bewertungen

- Income Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Dokument2 SeitenIncome Tax Account Statement of Account: MR Brock W Johnson 177 Barrabool RD Highton Vic 3216Annie LamNoch keine Bewertungen

- ABS CBN V CTA Exception To The Rule On Erroneous Executive ConstructionDokument2 SeitenABS CBN V CTA Exception To The Rule On Erroneous Executive ConstructionprincessmagpatocNoch keine Bewertungen

- Lmurillo Benefit LetterDokument2 SeitenLmurillo Benefit Letterloretta005Noch keine Bewertungen

- My - Invoice - Feb 2022Dokument2 SeitenMy - Invoice - Feb 2022VijayNoch keine Bewertungen

- CHAPTER 11 Compensation IncomeDokument15 SeitenCHAPTER 11 Compensation IncomeGIRLNoch keine Bewertungen

- Excel Form16 Ay 2017 18Dokument6 SeitenExcel Form16 Ay 2017 18Tulsiram KumawatNoch keine Bewertungen

- Registration Under GSTDokument8 SeitenRegistration Under GSTMahesh PawarNoch keine Bewertungen

- Form 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-VDokument2 SeitenForm 1040-V: What Is Form 1040-V and Do You Have To Use It? How To Send in Your 2009 Tax Return, Payment, and Form 1040-Vapi-26236657Noch keine Bewertungen

- New Era University College of Accountancy Income Taxation Finals QuizDokument2 SeitenNew Era University College of Accountancy Income Taxation Finals QuizAllen GabrielNoch keine Bewertungen

- Daily Cash Flow Template v.1.1Dokument2 SeitenDaily Cash Flow Template v.1.1jose miguel baezNoch keine Bewertungen

- US Internal Revenue Service: I2555ez - 2001Dokument3 SeitenUS Internal Revenue Service: I2555ez - 2001IRSNoch keine Bewertungen

- Sept To NovDokument21 SeitenSept To NovdevNoch keine Bewertungen

- GST Working May 2022Dokument20 SeitenGST Working May 2022Chandrashekar BNoch keine Bewertungen

- California Real Estate Principles, 10e - PowerPoint - CH 14Dokument23 SeitenCalifornia Real Estate Principles, 10e - PowerPoint - CH 14tommy58Noch keine Bewertungen

- Wa0016Dokument3 SeitenWa0016Vinay DahiyaNoch keine Bewertungen

- Invoice details for medical suppliesDokument2 SeitenInvoice details for medical suppliesVicky KumarNoch keine Bewertungen

- Irs - 2553 FormDokument4 SeitenIrs - 2553 FormmeikaizenNoch keine Bewertungen

- Estate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeDokument29 SeitenEstate Tax: Sec. 84 To Sec. 97 National Internal Revenue CodeJoie Tarroza-LabuguenNoch keine Bewertungen

- RedmiNote5ProInvoice PDFDokument1 SeiteRedmiNote5ProInvoice PDFRavi BadriNoch keine Bewertungen

- Salary statement July 2021Dokument1 SeiteSalary statement July 2021Chiranjibi BiswalNoch keine Bewertungen

- Chapter 8 - Business TransactionsDokument4 SeitenChapter 8 - Business TransactionsRose CastilloNoch keine Bewertungen

- GSTDokument20 SeitenGSTSanjaygowda55k100% (2)

- Government of TamilNadu Treasury BillDokument2 SeitenGovernment of TamilNadu Treasury BillMani Vannan JNoch keine Bewertungen

- 3 Cir VS PinedaDokument2 Seiten3 Cir VS PinedaJoshua Erik MadriaNoch keine Bewertungen

- Tax Free Wealth 2019 Companion FileDokument27 SeitenTax Free Wealth 2019 Companion FiledrodduqueNoch keine Bewertungen

- Principles of Taxation - 2019Dokument2 SeitenPrinciples of Taxation - 2019Anushka SinghNoch keine Bewertungen