Beruflich Dokumente

Kultur Dokumente

FX Factsheet

Hochgeladen von

abanso0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

91 Ansichten3 SeitenESignal produce a volume histogram with their FOREX data. The volume histogramme represents the number of transactions or ticks. A VSA indicator is based on relative volume compared to the previous bar.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenESignal produce a volume histogram with their FOREX data. The volume histogramme represents the number of transactions or ticks. A VSA indicator is based on relative volume compared to the previous bar.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

91 Ansichten3 SeitenFX Factsheet

Hochgeladen von

abansoESignal produce a volume histogram with their FOREX data. The volume histogramme represents the number of transactions or ticks. A VSA indicator is based on relative volume compared to the previous bar.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

An Explanation of How and Why TradeGuider Detects

Professional Activity in the FOREX Markets!!

Although many people think that there is no Volume in FOREX, eSignal produce a volume

histogram with their FOREX data. How is this done, well, you can find out a lot more by going to

the following eSignal page:

http://www.esignalcentral.com/support/faq/esignal/forex/default.asp .

Q: Where does eSignal get its FOREX data from?

A: Forex data from GTIS -- an affiliate of FT Interactive Data and sister company to eSignal and

the primary supplier, for more than 20 years, of foreign exchange information used by traders,

corporations and financial institutions:

Spot rates for more than 100 currencies, as well as precious metals

Cross rates

Forward rates

Nearly 200 global bank and broker contributions (Asia / Pacific Rim, Russia, Europe and North

America) -Check out the complete listing from the link below:

http://www.esignalcentral.com/support/symbol/forex2.htx?source=$(source)

Additional contributors: Garban Intercapital, the worlds leading derivatives, securities and

money broking business, and Tullett & Tokyo Liberty,

one of the largest inter-dealer brokers in the world.

Forex Market Depth with the ability to view the best bid / ask by Forex contributor.

Foreign Currency Options (FCO) from the Philadelphia Stock Exchange (PHLX), the first

organized stock exchange in the U.S. and one of North America's primary marketplaces.

Q: Im seeing the volume histogram update on FOREX issues in eSignal, what does that volume

represent?

A: The volume histogram for Forex issues represents the number of transactions or ticks and not

true "trade size" activity. It's much like most futures contracts, where the volume histogram

reflects the volume of transactions or updates during each given interval.

It is important to understand that TradeGuider does not need actual volume but relative volume

compared to the previous bar to give a VSA indicator. Volume in FOREX can be seen as

activity, and it is this activity that TradeGuider picks up extremely well when using the eSignal

datafeed.

Here is an explanation from Tom Williams, the creator of TradeGuider.

Q: How do the VSA principles work in Spot FOREX and TradeGuider?

A: First of all you have to realize that the Smart Money, or Professional money is very active

in the FOREX market. Professional Money as we shall refer to it here, can be trading

syndicates, individual traders with huge capital, large financial institutions, certain funds such as

The Quantum Fund operated by George Soros, and large institutional banks.

See further information in this letter from The Derivatives Study Center sent to The Commodity

Futures Trading Commission in August 2000 by clicking the link below:

http://www.financialpolicy.org/dsccftcletter.htm

These individuals or organizations are very secret in their dealings, as they do not want others to

know what they are doing. The result of this is no volume, however, tick volume works. Tick

volume is added to the price movement on every price tick up or down, because one may deal in

5M while the very next trader only deals 500k, but we get one tick each dealer. Bear in mind the

number one principle, that from the tick volume created, 90% will be from Professional Money

and their dealers.

When these very large orders go through, they have a following, the same as the futures pits;

this automatically creates more ticks, hence higher volume. So TradeGuider will analyze the tick

volume as if it were real volume, and will clearly show this Professional Money either

participating or just as importantly not participating in the movement of a currency. When we

hear of strength and weakness in a currency, this is nothing more than professional support or

lack of it, and can be clearly seen on the TradeGuider Chart.

Remember when in 1992 George Soros massively shorted the British Pound forcing the Bank Of

England to eventually withdraw from the European Exchange Rate Mechanism, well, this is one

very well known example of Professional Money having a dramatic effect on a currency. This

happens every day, you just need to know what to look for. Have a look at the chart and what

the volume did in that famous move by George Soros:

Here's a famous example...

BRITISH GOVERNMENT NO MATCH FOR GEORGE

SOROS

In 1992 the British pound fell so sharply that Britain was forced to leave the Exchange Rate

Mechanism (ERM). What do you think was behind this famous fall? Yes, you guessed it,

professional money! The money in question was the Quantum Fund, run by the renowned

speculator George Soros.

He and his analysts had spotted a potential weakness in the ERM. During the weeks before the

massive sell-off of the British pound, George Soros was busy exchanging seven billion US

dollars for German Deutschemarks.

When the time was right he moved in fast, selling the British pound. As the pound fell the

Deutschemark rose, creating huge profits for Soros. As soon as news of this got out the other

professionals followed suit. The onslaught was overwhelming and too much for Norman Lamont,

the then UK Chancellor of the Exchequer.

In an attempt to halt the slide Lamont resorted to selling some of Britain's gold reserves. He put

up interest rates three times during one day, but this was still no match for the professionals.

Now, if a government can't beat the professionals, what hope do individual traders have?

To find out more about TradeGuider and how we can teach you to follow the activity of the

Professional Money in FOREX, please email us at info@tradeguider.com

You can also call our offices:

Call United States (toll free) (877) 392 3896 (8:30am - 5pm CST)

UK(+44) 0845 075 1061 (8:30am - 5pm GMT)

Hong Kong (+852) 8120 6221

Australia (+61) 028 0114877

Good Trading,

Das könnte Ihnen auch gefallen

- How To Play Chess PDFDokument74 SeitenHow To Play Chess PDFMagnus Cycles PH100% (7)

- Calculating Frog Make Your Own Mechanical CalculaDokument6 SeitenCalculating Frog Make Your Own Mechanical Calculaabanso100% (1)

- Guide To Preventing Workplace FraudDokument60 SeitenGuide To Preventing Workplace FraudInam KhanNoch keine Bewertungen

- Proxxon Thermocut Manual PDFDokument5 SeitenProxxon Thermocut Manual PDFabansoNoch keine Bewertungen

- Instalar Polarizado AutosDokument2 SeitenInstalar Polarizado AutosabansoNoch keine Bewertungen

- Robert M Nideffer - Calming The MindDokument9 SeitenRobert M Nideffer - Calming The MindnpalemNoch keine Bewertungen

- Eddie The Wire-The Complete Guide To LockpickingDokument83 SeitenEddie The Wire-The Complete Guide To Lockpickingapi-3777781100% (5)

- Vsa Basics From MTMDokument32 SeitenVsa Basics From MTMabanso100% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Financial Institutions Management - Chap011Dokument21 SeitenFinancial Institutions Management - Chap011sk625218Noch keine Bewertungen

- Circular Flow of MoneyDokument10 SeitenCircular Flow of MoneyMadhumitha BalasubramanianNoch keine Bewertungen

- Review Exercises - Chapter 4Dokument2 SeitenReview Exercises - Chapter 4Jaskiràt NagraNoch keine Bewertungen

- Group 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileDokument44 SeitenGroup 1 Pranav Shukla Kunal Jha Navdeep Sangwan Mansi Bharadwaj Nainika Narula Company ProfileApoorv BajajNoch keine Bewertungen

- IPO Critical DisclosuresDokument93 SeitenIPO Critical DisclosuresFarhin MaldarNoch keine Bewertungen

- FIM Exercises 1Dokument15 SeitenFIM Exercises 1Hoang Hieu LyNoch keine Bewertungen

- MT103 522286795pdfDokument3 SeitenMT103 522286795pdfMasoud Dastgerdi100% (4)

- B.K. School of Business Management Gujarat UniversityDokument77 SeitenB.K. School of Business Management Gujarat UniversityMAHESHNoch keine Bewertungen

- Cba Sonia Ustinov 010318 - 260518Dokument3 SeitenCba Sonia Ustinov 010318 - 260518Ranji SoulNoch keine Bewertungen

- Financial Planning - Definition, Objectives and ImportanceDokument5 SeitenFinancial Planning - Definition, Objectives and ImportanceRuchi ChhabraNoch keine Bewertungen

- Net Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BDokument23 SeitenNet Cash Flows (CF) and Selected Evaluation Criteria For Projectsa and BNaila FaradilaNoch keine Bewertungen

- Financial Management HIntsDokument6 SeitenFinancial Management HIntsVignashNoch keine Bewertungen

- Entropia Universe GuideDokument164 SeitenEntropia Universe GuidePeter Paul Baldwin Panahon100% (1)

- National Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramDokument17 SeitenNational Finance Olympiad 2021: B-School Finance Competition Cum Learning ProgramManu BhikshamNoch keine Bewertungen

- Enriquez, Vixen Aaron M. - Assignment On Market-Based ValuationDokument3 SeitenEnriquez, Vixen Aaron M. - Assignment On Market-Based ValuationVixen Aaron EnriquezNoch keine Bewertungen

- Romona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingDokument15 SeitenRomona Taylor Williams & Anne-Sophie Gintzburger - Examining The Impact of Economic Exclusion On Low Wealth and Communities of Color in ST - Louis, MO: A Simulation of Pay LendingFondation Singer-PolignacNoch keine Bewertungen

- The Capital Asset Pricing Model: Investments (Asia Global Edition)Dokument24 SeitenThe Capital Asset Pricing Model: Investments (Asia Global Edition)Dương Quốc TuấnNoch keine Bewertungen

- Sprott Gold Report: The Gold Investment Thesis RevisitedDokument8 SeitenSprott Gold Report: The Gold Investment Thesis RevisitedOwm Close CorporationNoch keine Bewertungen

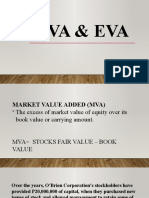

- Mva EvaDokument11 SeitenMva EvaRian ChiseiNoch keine Bewertungen

- International Portfolio Investment Q & ADokument7 SeitenInternational Portfolio Investment Q & AaasisranjanNoch keine Bewertungen

- Record Point of Sale (POS) Transaction in TallyPrimeDokument6 SeitenRecord Point of Sale (POS) Transaction in TallyPrimeSubham DuttaNoch keine Bewertungen

- Islamic Banking Topics Research Good For PHD ThesisDokument9 SeitenIslamic Banking Topics Research Good For PHD Thesisvotukezez1z2Noch keine Bewertungen

- Interest Rate Risk and Bond PricesDokument61 SeitenInterest Rate Risk and Bond PricesMarwa HassanNoch keine Bewertungen

- BFIn Honours Programme OverviewDokument17 SeitenBFIn Honours Programme OverviewIkonic Yiu YiuNoch keine Bewertungen

- New Business-Studies-Paper-2-Revision-BookletDokument108 SeitenNew Business-Studies-Paper-2-Revision-BookletRogue12layeNoch keine Bewertungen

- State Bank of India Welcomes You To Explore The World of Premier Bank in IndiaDokument4 SeitenState Bank of India Welcomes You To Explore The World of Premier Bank in Indiakishan kanojiaNoch keine Bewertungen

- Inventory QuesDokument1 SeiteInventory QuesYashi GuptaNoch keine Bewertungen

- Identify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetDokument1 SeiteIdentify The Following Statements Used in Front Office Services. Choose Your Answer On The Word Bank and Write It On Your Answer SheetTitser JeffNoch keine Bewertungen

- OFB TECH FINANCIALSDokument2 SeitenOFB TECH FINANCIALSamitsundarNoch keine Bewertungen

- RKG Class 11 Accounts Mock 2 SolDokument13 SeitenRKG Class 11 Accounts Mock 2 SolSangket MukherjeeNoch keine Bewertungen