Beruflich Dokumente

Kultur Dokumente

EBS Introduction

Hochgeladen von

Shivaani Aggarwal0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

75 Ansichten7 SeitenThis is the document for EBS case study

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis is the document for EBS case study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

75 Ansichten7 SeitenEBS Introduction

Hochgeladen von

Shivaani AggarwalThis is the document for EBS case study

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

CIS 321 Case Study Employee Benefits System (EBS)

EBS Case Introduction

In this section you will learn the background information that will prepare you to understand and

complete each of the milestones of this case study. This information includes a history of the

business, a description of the businesss current facilities, and the descriptions of the problems

that triggered the project.

General Company Information

The Conover Insurance Company, Inc. serves nearly 10 million customers nationwide,

offering a variety of products and financial services, such as pension funds, annuities,

automobile insurance, homeowner insurance, and life insurance products. More than 800

companies entrust Conover Insurance Company to manage their life insurance and other

financial funds. Conover Insurance Company employs more than 4,100 people and

reported 2002 revenue of more than $40 million.

The Human Resources Department has become top priority in improvements for the

coming year. The projects objective was to significantly decrease processing time and

increase the functionality in our current employee information benefits and services. In

order to meet the new technology improvement addressing our current Human Resource

processing, other departments, systems and/or business will be impacted, from with our

company and outside of our company.

Note: See the organization charts at the end of this document for more details.

Case Background

Information Systems (IS) headquartered in Orlando, Florida, employs approximately

4,100 employees throughout the United States. IS provides leading edge technologies,

distributed computing, mainframe, micro, communication, and consulting services to its

parent company Corporation, headquartered in Bethesda, Maryland, as well as to external

customers including the U.S. government. In addition, IS is responsible for the

development and support of all the internal systems that support their day-to-day business

processes and operations.

IS currently operates in five sites across the nation and they are as follows:

CIS 321 Case Study Employee Benefits System (EBS)

Sunnyvale

CA

Orlando

FL

Denver

CO

Marietta

GA

Valley Forge

PA

Sunnyvale, CA - 725 employees

Denver, CO - 770 employees

Valley Forge, PA - 1,056 employees

Marietta, GA - 171 employees

Orlando, FL - 1,475 employees

Each site is responsible for servicing and supporting the customers in its region as well as

its internal employees. IS has experienced a 15 percent increase in employees over the

past two years, and long-range projections show that trend continuing for the next three

years.

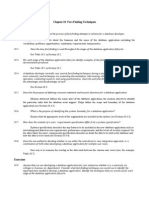

CIS 321 Case Study Employee Benefits System (EBS)

Organization Structure

The Conover Insurance Company contains the following departments on the organization

chart below. Each department is structured based on the five site discussed in the Case

Background section.

Conover Insurance Company (CIC)

CIC

Life Insurance Human Resources Sales & Marketing

Auto & Home

Insurance

Information

Systems

Payroll

Health Care

Services

Corporate

Management

New Product

Research &

Development

CIS 321 Case Study Employee Benefits System (EBS)

Information Systems

Joe Turner

President

Jane Crawley

Vice President

Sunnyvale

Operations

Deborah Sellars

Vice President

Orlando

Operations

Bill Henry

Vice President

Marietta

Operations

John Jones

Vice President

Denver

Operations

Robert Smith

Vice President

Valley Forge

Operations

Jack Mills

Vice President

Human

Resources

Peter Crane

Vice President

Business

Operations

Lori Simms

Vice President

Customer

Relations

Frank Biaz

Vice President

New Business

Development

Sharon Jennings

Administrative

Assistant

Human Resources

Jack Mills

Vice President

Paul Jenson

Director

Sunnyvale

Human

Resources

Gloria Peters

Director

Orlando

Human

Resources

Eva Jones

Director

Marietta

Human

Resources

Danny Smith

Director

Denver

Human

Resources

John Cole

Director

Valley Forge

Human

Resources

Jennifer Fiskus

Manager

Compensation

Don Harris

Manager

Benefits

Dotty Jones

Manager

Employee

Relations

June Lang

Manager

Staffing

Dorothy Miller

Administrative

Assistant

CIS 321 Case Study Employee Benefits System (EBS)

The Problem

Due to the tremendous growth the company has experienced in recent years, it has

recognized that to ensure the continued success of servicing internal as well as external

customers, it needed to develop a strategic plan and vision for the use and modernization

of its computing resources. The challenges of creating centralized systems across all five

IS sites to support business practices that are common if not identical across the sites

further emphasize the need.

In January 2003 a strategic plan to modernize the companys resources was presented to

executive management. This document included a plan to reengineer the current systems

to use state-of-the-art technology and provide a showcase of systems that eventually

could be delivered across the whole corporation.

The plan consisted of reengineering all systems related to Human Resources, which

included Employee Information, Time and Attendance, and Payroll. The first phase is the

development of the Employee Benefits System (EBS), a system that will house the

repository containing the employee master data, which is the foundation for providing a

common set of automated, integrated, platform-independent system solutions for Human

Resources. Several business processes/work flows, procedures and forms need to be

analyzed along with addressing new requirements.

The new employee benefits system should provide the capability for each employee to

maintain his or her own information regarding address and telephone number changes,

beneficiary changes, United Way deductions, and Savings Bond deductions. Current

practices now have each of these changes being processed by an extensive manual effort

in which Human Resource administrators fill out forms and input the data. This manual

effort often results in a time lag of several days between the time the employee submits

the forms and the online update. This delay caused several problems: employees were

unable to quickly locate other employees, company mailings were being sent to the

wrong addresses, payroll checks were unable to be delivered, paper-based company

telephone books were out of date almost as soon as they were printed, and United Way

and Savings Bonds contributions were less than ideal.

By providing the capability for an employee to update data themselves in real time, the

problems mentioned above can be reduced, if not eliminated.

CIS 321 Case Study Employee Benefits System (EBS)

The Objective

The new Employee Benefits System (EBS) should provide a single central repository of

employee information. The Staffing Department provides new employee profile

information and employee status changes. The Staffing Department needs staffing reports

on a weekly, monthly, and yearly basis. The employees provide employee profile

changes on selected information, as well as United Way and Savings Bonds contribution

activity. Although both are employee deductions, the Savings Bond option is part of the

employees retirement/investment plan information. We would like to offer other types

of contributions in the future, such as Hands on Atlanta, Aid Foundation, the Cancer

Research Society.

The EBS system should generate on request Employee Participation Reports for

management, and Savings Bonds and United Way Contribution reports for the Employee

Relations Department. The system must get the employees current salary from the

Payroll database in order to process contribution activity only, not the entire payroll

processing. Therefore, the employee contribution activity records (and/or any other

deductions) are sent to the Payroll System. In addition, some basic employee history

information on job performance, ratings, and departmental information will be collected

for this new EBS system. Finally, an employee telephone listing can be generated for any

employee who requests it. Some of the basic information on this report will consist of

Department, Job Description, Site, Room, Building and Company Mail Stop data (see

screen exhibit).

The new EBS systems must be able to handle additional benefits we would like to offer

our employees. As part of the retirement plan, employees can now sign up for the

investment plan (401K) and Company Stock Purchase Options and Saving Bond

deductions. In addition, the new EBS system will offer basic life insurance, and short-

term disability. Life insurance will be offered based on the one times the employees

annual salary, if the employee is new, and two times the employees annual salary, if the

employee has five years of service or more. For example, an employee with 7 years of

service, earning $25,000 annually can elect to buy $50,000 worth of life insurance. For

short-term disability, we need medical information/confirmation on pre-existing health

issues before we can determine the short-term disability approval or amount. Long-term

disability is not offered at this time.

We would also like new EBS system to know whether the employee has elected medical

coverage (health and dental), although the processing and maintenance of medical and

dental information isoutside of this new EBS system. The medical coverage information

will be sent to the Employee Health Care (EHC) System. If the employees do not elect

coverage with our company benefit package, they must have proof of basic medical

coverage some where. In addition to medical coverage selection information, the new

EBS system will be collecting basic spouse and dependent information to be sent to the

EHC system.

CIS 321 Case Study Employee Benefits System (EBS)

All employee benefit enrollments are the first of each year. If there is a change in marital

or dependent status during the year, the employee can update their benefit information

with proof of the status change, accordingly. If a new employee wants to purchase

automobile, home and/or renters insurance with our company, we want the new EBS to

submit a notice to the Auto & Home department to follow-up with that new employee

request for services.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- MyITLab Access Grader Northwind Traders Case SolutionDokument3 SeitenMyITLab Access Grader Northwind Traders Case SolutionShivaani AggarwalNoch keine Bewertungen

- MyITLab MS Access Morris Arboretum Case SolutionDokument3 SeitenMyITLab MS Access Morris Arboretum Case SolutionShivaani AggarwalNoch keine Bewertungen

- MyITLab Access Grader Bookstore Inventory Case SolutionDokument3 SeitenMyITLab Access Grader Bookstore Inventory Case SolutionShivaani AggarwalNoch keine Bewertungen

- MyITLab Access Grader Real Estate Case SolutionDokument3 SeitenMyITLab Access Grader Real Estate Case SolutionShivaani Aggarwal0% (1)

- All Tasks Solved Immediate Download: Requirements For Business Intelligence Capstone ProjectDokument8 SeitenAll Tasks Solved Immediate Download: Requirements For Business Intelligence Capstone ProjectShivaani AggarwalNoch keine Bewertungen

- MYH Manage Your Health Case StudyDokument3 SeitenMYH Manage Your Health Case StudyShivaani Aggarwal100% (1)

- Homework4DecisionTree Answers Vs1Dokument5 SeitenHomework4DecisionTree Answers Vs1Shivaani Aggarwal100% (1)

- UNIX Access ControlDokument2 SeitenUNIX Access ControlShivaani AggarwalNoch keine Bewertungen

- Graduate School of Management SolutionsDokument7 SeitenGraduate School of Management SolutionsShivaani AggarwalNoch keine Bewertungen

- Content Delivery NetworksDokument10 SeitenContent Delivery NetworksShivaani AggarwalNoch keine Bewertungen

- Unified Modelling LanguageDokument33 SeitenUnified Modelling LanguageShivaani Aggarwal71% (7)

- Assignment 3 and 4 - Comp 2364 - 2015 V1Dokument13 SeitenAssignment 3 and 4 - Comp 2364 - 2015 V1Shivaani AggarwalNoch keine Bewertungen

- VoIP Legal IssuesDokument2 SeitenVoIP Legal IssuesShivaani AggarwalNoch keine Bewertungen

- Pepe Jeans Case Study SolutionDokument8 SeitenPepe Jeans Case Study SolutionShivaani AggarwalNoch keine Bewertungen

- UMUC Case Study SolutionDokument10 SeitenUMUC Case Study SolutionShivaani AggarwalNoch keine Bewertungen

- Unified Modelling LanguageDokument33 SeitenUnified Modelling LanguageShivaani Aggarwal71% (7)

- Bitcoins Research PaperDokument4 SeitenBitcoins Research PaperShivaani AggarwalNoch keine Bewertungen

- MBA 595 Reflection Essay Solution PaperDokument5 SeitenMBA 595 Reflection Essay Solution PaperShivaani AggarwalNoch keine Bewertungen

- Firewall Selection ParametersDokument5 SeitenFirewall Selection ParametersShivaani AggarwalNoch keine Bewertungen

- Case Study of Chapter 14Dokument2 SeitenCase Study of Chapter 14Shivaani AggarwalNoch keine Bewertungen

- British Petroleum Marketing Strategy AnalysisDokument19 SeitenBritish Petroleum Marketing Strategy AnalysisShivaani Aggarwal0% (1)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hotel Industry HR PracticesDokument7 SeitenHotel Industry HR PracticesAyesha NadeemNoch keine Bewertungen

- Industria Auto 2012-2020 - Prezentare RezumativaDokument5 SeitenIndustria Auto 2012-2020 - Prezentare RezumativamanageranticrizaNoch keine Bewertungen

- Current Ethical Issues PaperDokument4 SeitenCurrent Ethical Issues PaperTangy GarrisonNoch keine Bewertungen

- Student Resource - Case StudiesDokument32 SeitenStudent Resource - Case StudiesGenie Soriano100% (1)

- I GATEDokument6 SeitenI GATESuthin Kosh ChackoNoch keine Bewertungen

- Chapter 5 Recruiting and Selecting Employees: Managing Human Resources, 8e, Global Edition (Gomez-Mejia Et Al.)Dokument40 SeitenChapter 5 Recruiting and Selecting Employees: Managing Human Resources, 8e, Global Edition (Gomez-Mejia Et Al.)Hana AlresainiNoch keine Bewertungen

- CARDIO Service Level Agreement 092021Dokument2 SeitenCARDIO Service Level Agreement 092021Julio Jose MercadoNoch keine Bewertungen

- Speaking 3 - Faculty of Language Foreign.: Unit 1: CompanyDokument26 SeitenSpeaking 3 - Faculty of Language Foreign.: Unit 1: CompanynhNoch keine Bewertungen

- SOFT3 HR & Payroll Software: ReportsDokument3 SeitenSOFT3 HR & Payroll Software: ReportsNuruzzaman TutulNoch keine Bewertungen

- Frustration of Employment Contracts and Wrongful DismissalDokument3 SeitenFrustration of Employment Contracts and Wrongful DismissalLooi Kok HuaNoch keine Bewertungen

- LIM V. CA Case DigestDokument79 SeitenLIM V. CA Case DigestWarren Codoy ApellidoNoch keine Bewertungen

- Manju Ko ThesisDokument54 SeitenManju Ko ThesisChetanath Gautam50% (2)

- Running Head: Corporate Communication in Companies 1Dokument3 SeitenRunning Head: Corporate Communication in Companies 1Leornard MukuruNoch keine Bewertungen

- Globalization: Globalization (Or Globalisation) Refers To The Increasing Global Relationships ofDokument38 SeitenGlobalization: Globalization (Or Globalisation) Refers To The Increasing Global Relationships oflinnwaiwarNoch keine Bewertungen

- Chapter 10-11-12 SolutionsDokument12 SeitenChapter 10-11-12 SolutionsAhmad M. KhalifiNoch keine Bewertungen

- Job Description Water Supply SupervisorDokument3 SeitenJob Description Water Supply SupervisorMohammad Reza DanishNoch keine Bewertungen

- MemoDokument3 SeitenMemoVictor AsagbaNoch keine Bewertungen

- Sales Executive Job DescriptionDokument8 SeitenSales Executive Job Descriptionsalesmanagement264Noch keine Bewertungen

- Toi Su20 Sat Epep ProposalDokument7 SeitenToi Su20 Sat Epep ProposalTalha SiddiquiNoch keine Bewertungen

- Stores Vol I ContractsDokument8 SeitenStores Vol I Contractsമിസ്റ്റർ പോഞ്ഞിക്കരNoch keine Bewertungen

- Why Study ServiceDokument40 SeitenWhy Study ServiceAry Setiyono100% (1)

- Ch. 1. HRMDokument7 SeitenCh. 1. HRMneway gobachewNoch keine Bewertungen

- First Report of The Monitor, Dated November 9, 2022Dokument124 SeitenFirst Report of The Monitor, Dated November 9, 2022Oleksandr StorcheusNoch keine Bewertungen

- Dird Companyprofile Draft6 1 18 Lores Spread PDFDokument9 SeitenDird Companyprofile Draft6 1 18 Lores Spread PDFAhasanul ArifNoch keine Bewertungen

- RUral Areas Problem and OppertunityDokument6 SeitenRUral Areas Problem and OppertunityDeva RanjanNoch keine Bewertungen

- Renee Massey Resume FinalDokument5 SeitenRenee Massey Resume Finalapi-396322710Noch keine Bewertungen

- Poverty and Inequality - Global Perspective IgcseDokument16 SeitenPoverty and Inequality - Global Perspective IgcsewqndrlvstNoch keine Bewertungen

- Primero Vs IACDokument6 SeitenPrimero Vs IACAngelReaNoch keine Bewertungen

- Deck-Hrd Corp TP Orientation 2022 and Hrd-TeeDokument49 SeitenDeck-Hrd Corp TP Orientation 2022 and Hrd-TeeZulqarnain RamliNoch keine Bewertungen

- Template - CSR MoUDokument13 SeitenTemplate - CSR MoUankitaNoch keine Bewertungen