Beruflich Dokumente

Kultur Dokumente

6Ps Brand Growth Model One Pager

Hochgeladen von

Arun S BharadwajCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6Ps Brand Growth Model One Pager

Hochgeladen von

Arun S BharadwajCopyright:

Verfügbare Formate

6Ps Brand Growth Model 6Ps Brand Growth Model

Market Dynamics and Financial Return Market Dynamics and Financial Return

10 Second summary 10 Second summary

The 6Ps Brand Growth model links:

financial measures to market share

market share to consumer buyer behaviour

consumer buyer behaviour to 6 levers for

brand growth

We can drill down the model to diagnose

changes in brand share, or build up to

demonstrate how pulling one or more of the 6Ps

brand growth levers grows the brand. We can

use the model qualitatively to understand the

factors, or quantitatively to measure their effects.

Consumer Buyer Behaviour Consumer Buyer Behaviour

6 Ps (Brand Growth Levers) 6 Ps (Brand Growth Levers)

The top layer of the model relates Finance metrics to

market size, growth & brand share. There are clear

mathematical relationships between these metrics.

TO Volume

Price

TO Value

Volume Mkt Size Volume Share

Value Mkt Size Value Share

Market growth

Profit

Choice:

Loyalty

Consumption:

Category

frequency

Consumption:

purchase size

How much they buy

Penetration

How many people buy

Penetration: How many consumers buy the brand

Loyalty: How likely they are to choose the brand within

their repertoire

Category Purchase Frequency: How often they shop

for the category

Average Trip Size: How much volume they buy per trip

The second layer of the model relates volume share to key metrics for consumer buyer behaviour:

Again, there are mathematical relationships that link volume share to these metrics which help us understand how

brands & categories grow. We can use the Dirichlet model to predict the patterns of buyer behaviour in a

particular country & category. These are the rules of buyer behaviour within which we work.

Pack Product Proposition Promotion Price Place

The third layer of the model relates consumer buyer behaviour to the 6Ps brand growth levers:

Proposition: the brand that consumers have in their heads - what it stands for, its values, benefits & reasons to believe. The strength

of the proposition is measured by the Brand Equity Score. This links Strength of Proposition to the brands performance of attributes

that are important to consumers. Proposition includes the strategic price positioning.

Promotion: promoting the brand wherever the consumer is. 1. Getting consumers attention in a world where they are bombarded

with messages, and getting our message across in a clear, creative way, more likely to be remembered. The key questions are is

our advertising good enough? and are we investing enough behind it?.

Place: what happens wherever consumers buy the brand. Can shoppers find the brand in store? and What does the brand look

like in store?. There are serious opportunities to increase share by increasing distribution. We can leverage our knowledge of

shopper behaviour to optimise the in-store environment and grow share.

Pack is the in-store hero. It has to stand out to create awareness, be unquestionably for the brand, and communicate the

proposition. The brands visual triggers (colours, shapes & icons) do much of this work in store.

Price: what the consumer pays regularly, or on promotion. Most consumers are not conscious of the price they pay for our

products, so it is perceived price that is important, and this is traded off against perceived quality.

Product: how well our products perform against the expectations set by the proposition, determines repeat purchase (loyalty) and

therefore long-term success. The challenge is when product performance is average, if propositions cue better than average, we

will not meet our consumers expectations.

1

Contacts Contacts

The 6Ps Detective Tool The 6Ps Detective Tool

Applications of the 6P Brand Growth Model Applications of the 6P Brand Growth Model

For more information, visit the Market

Information pages on m@u or the CMI

Portal or email:

marketing.academy@unilever.com

The 6Ps Detective Tool uses the structure of the 6P Brand Growth Model to explain what things to look

for when diagnosing brand performance and getting to Root Issues.

This document may only be distributed within the Unilever group of companies ("Unilever") and its agencies, to persons who need to be aware of the contents to carry out

specific tasks requested by Unilever. This document must not be copied in total or partially, or distributed outside of Unilever without prior agreement with the copyright

owners. Any unauthorised use may lead to legal action. Unilever 2010.

Marketing Marketing

thinking thinking

CMI CMI

thinking thinking

Tracking Tracking

Tools Tools

-Understand which levers to pull to grow brands

-A consistent language for talking about brand

performance

-Qualitative diagnosis of brand share changes

-How buyers behave

-Translate buyer behaviour norms into insights

-Setting realistic growth targets

-Brand Audit

-Brand Quarterly Trackers

-Launch Monitor

-Standard Business Case

-6Ps Finance

Calculator

-6Ps Analysis of

Brand Performance

The 6Ps do reinforce each other:

The 6Ps act at three points of contact with the consumer:

Relationships between the 6Ps Relationships between the 6Ps

Using the 6Ps model Using the 6Ps model

2

BB and BD should use the model during any brand audits, or

when investigating any brand issue or exploring for opportunities

use data and insight to understand root issues and explore the

best relevant levers to pull.

Das könnte Ihnen auch gefallen

- PDF 6ps Brand Growth Model One Pager DLDokument2 SeitenPDF 6ps Brand Growth Model One Pager DLPham Thanh HatNoch keine Bewertungen

- Deepak Parth Vidya Harish Neha WinstonDokument42 SeitenDeepak Parth Vidya Harish Neha WinstonParth PatelNoch keine Bewertungen

- Google Merchandise Store Digital Marketing AnalysisDokument9 SeitenGoogle Merchandise Store Digital Marketing AnalysisWilliamArugaNoch keine Bewertungen

- Primark Edition 16 FullDokument4 SeitenPrimark Edition 16 FullYasmin FarhanNoch keine Bewertungen

- Assignment of Brand ManagementDokument9 SeitenAssignment of Brand ManagementMuhammad Taqi AdnanNoch keine Bewertungen

- FIGURE 1: Porter's Value Chain FIGUR E 3: Apple SWOT AnalysisDokument11 SeitenFIGURE 1: Porter's Value Chain FIGUR E 3: Apple SWOT AnalysisIreri MwanikiNoch keine Bewertungen

- PepsiCo Sales and Distribution Strategies AnalysisDokument13 SeitenPepsiCo Sales and Distribution Strategies AnalysisMicah ThomasNoch keine Bewertungen

- Sales Management PlanningDokument15 SeitenSales Management PlanningpadchdNoch keine Bewertungen

- Sample Marketing PlanDokument19 SeitenSample Marketing Planmr.mrs_jones8990100% (11)

- Nesta Sales Plan 2021Dokument15 SeitenNesta Sales Plan 2021Ernest HauleNoch keine Bewertungen

- Product StrategyDokument18 SeitenProduct StrategyMonica AbreaNoch keine Bewertungen

- By-Vaibhav Raj Dixit Roll No .36 MBA Gen (Sec A)Dokument28 SeitenBy-Vaibhav Raj Dixit Roll No .36 MBA Gen (Sec A)RAMARAJ2506Noch keine Bewertungen

- Marketing Strategy Notes Prof Kalim KhanDokument94 SeitenMarketing Strategy Notes Prof Kalim KhanPraveen PraveennNoch keine Bewertungen

- Integrated Marketing Plan PDFDokument14 SeitenIntegrated Marketing Plan PDFimcharles100% (1)

- Pepsi Brand Valuation - FinalDokument19 SeitenPepsi Brand Valuation - FinalManoj Iyer100% (5)

- Brand Equity Kevin Lane KellerDokument136 SeitenBrand Equity Kevin Lane KellersanjayagalsNoch keine Bewertungen

- How Do I Develop A Strategic Marketing Plan?Dokument42 SeitenHow Do I Develop A Strategic Marketing Plan?KanishkaweeNoch keine Bewertungen

- Co BrandingDokument28 SeitenCo BrandingPratibha Khemchandani100% (1)

- Retail Strategic PlanningDokument56 SeitenRetail Strategic Planningsumitpanwar007100% (1)

- Ai FMCG BusinessDokument12 SeitenAi FMCG BusinessMayank SinghalNoch keine Bewertungen

- Competitor AnalysisDokument4 SeitenCompetitor Analysisalhad86Noch keine Bewertungen

- Assortment PlanningDokument12 SeitenAssortment Planningarunimishra02100% (1)

- Sheng SiongDokument63 SeitenSheng SiongHoa Mai NguyễnNoch keine Bewertungen

- Strategic Product Launch PlanDokument14 SeitenStrategic Product Launch PlanEmon Ishtiak100% (1)

- Acid-Test Ratio: Average InventoryDokument8 SeitenAcid-Test Ratio: Average InventorymohsinnaveesNoch keine Bewertungen

- Retail Fashion Lifestyle Store Operation Induction ReportDokument9 SeitenRetail Fashion Lifestyle Store Operation Induction Reportsufiroshan0% (1)

- Strategic Marketing Plan for Bernadini's Gelato ShopDokument10 SeitenStrategic Marketing Plan for Bernadini's Gelato Shopkunwar showvhaNoch keine Bewertungen

- Category Management and Private LabelsDokument4 SeitenCategory Management and Private LabelsAditi ChauhanNoch keine Bewertungen

- Customer Driven Marketing Strategy For NokiaDokument26 SeitenCustomer Driven Marketing Strategy For NokiaMd Mehedi Hasan75% (4)

- What Is A Business Model - 24 Types of Business Models - Feedough PDFDokument9 SeitenWhat Is A Business Model - 24 Types of Business Models - Feedough PDFChristian LlerandiNoch keine Bewertungen

- E-Commerce Business ModelsDokument20 SeitenE-Commerce Business ModelsAmbreen AtaNoch keine Bewertungen

- Retail MGTDokument29 SeitenRetail MGTKasiraman RamanujamNoch keine Bewertungen

- Marketing the 3-in-1 coffee category in IndiaDokument7 SeitenMarketing the 3-in-1 coffee category in IndiaYash AgarwalNoch keine Bewertungen

- Customer Retention & Customer Loyalty - MFSDokument26 SeitenCustomer Retention & Customer Loyalty - MFSPankaj KumarNoch keine Bewertungen

- Strategic Marketing Plan: Develop A Strategic Marketing Plan To Successfully Grow Your Business and Increase ProfitsDokument30 SeitenStrategic Marketing Plan: Develop A Strategic Marketing Plan To Successfully Grow Your Business and Increase ProfitsMalik Mohamed100% (1)

- LifebuoyDokument10 SeitenLifebuoyPradeep BandiNoch keine Bewertungen

- Integrated Marketing Communications Plan For Red Bull Energy DrinkDokument41 SeitenIntegrated Marketing Communications Plan For Red Bull Energy DrinkCharles Johnston99% (186)

- CRM Process: Submitted byDokument15 SeitenCRM Process: Submitted bySwati JaretNoch keine Bewertungen

- Marketing Plan NikeDokument33 SeitenMarketing Plan NikeTrần Ngọc Mai100% (2)

- Category ManagementDokument8 SeitenCategory ManagementAditi JindalNoch keine Bewertungen

- Competitive Analysis of Food Delivery AppsDokument6 SeitenCompetitive Analysis of Food Delivery Appsanon_930444039Noch keine Bewertungen

- Five Tools To Close Customer Experience Strategy Gaps 06092014Dokument9 SeitenFive Tools To Close Customer Experience Strategy Gaps 06092014tpat1Noch keine Bewertungen

- BI Retail Industry v1.1Dokument23 SeitenBI Retail Industry v1.1vivek5110100% (1)

- Product Assortment Strategies: Written ReportDokument10 SeitenProduct Assortment Strategies: Written ReportMiguel FloresNoch keine Bewertungen

- Market AnalysisDokument10 SeitenMarket AnalysisAkshay VijayvergiyaNoch keine Bewertungen

- Boost Technology: Athleisure CultureDokument11 SeitenBoost Technology: Athleisure CultureCharlie WangNoch keine Bewertungen

- Rebranding RedbullDokument33 SeitenRebranding Redbullanushka binaniNoch keine Bewertungen

- Strategic Experiential ModulesDokument5 SeitenStrategic Experiential ModulesSimran singhNoch keine Bewertungen

- Branding AssignmentDokument7 SeitenBranding Assignmentpritom sarkerNoch keine Bewertungen

- Pricing StrategiesDokument28 SeitenPricing StrategiesRajesh SharmaNoch keine Bewertungen

- Sample Marketing Strategy DocumentDokument3 SeitenSample Marketing Strategy Documenttinoyan100% (7)

- Merchandise Planning for Fashionable MerchandiseDokument14 SeitenMerchandise Planning for Fashionable MerchandiseMitu RanaNoch keine Bewertungen

- Sales Promotion Course Outline Dec 2015Dokument4 SeitenSales Promotion Course Outline Dec 2015aparnaskiniNoch keine Bewertungen

- Merchandise Planning and Pricing - FINALDokument34 SeitenMerchandise Planning and Pricing - FINALrohitr6Noch keine Bewertungen

- Marketing MenagementDokument36 SeitenMarketing MenagementRajaKeraNoch keine Bewertungen

- Sales and Go-to-Market A Clear and Concise ReferenceVon EverandSales and Go-to-Market A Clear and Concise ReferenceNoch keine Bewertungen

- LD SBDokument5 SeitenLD SBArun S BharadwajNoch keine Bewertungen

- Little Mermaid ProjectDokument1 SeiteLittle Mermaid ProjectArun S BharadwajNoch keine Bewertungen

- VW's German-US Culture ClashDokument3 SeitenVW's German-US Culture ClashArun S BharadwajNoch keine Bewertungen

- 6P Analysis - CompetitorsDokument3 Seiten6P Analysis - CompetitorsArun S BharadwajNoch keine Bewertungen

- Auto Liquids CaseDokument3 SeitenAuto Liquids CaseArun S BharadwajNoch keine Bewertungen

- Mahindra Grp7 SecB SM1Dokument25 SeitenMahindra Grp7 SecB SM1Arun S BharadwajNoch keine Bewertungen

- PV Problem Set With AnswersDokument2 SeitenPV Problem Set With AnswersArun S BharadwajNoch keine Bewertungen

- Pharmaceutical (Allopathic) IndustryDokument5 SeitenPharmaceutical (Allopathic) IndustryArun S BharadwajNoch keine Bewertungen

- Project Appraisal Criteria Key Investment MetricsDokument49 SeitenProject Appraisal Criteria Key Investment MetricsArun S BharadwajNoch keine Bewertungen

- Nike & MarriottDokument1 SeiteNike & MarriottArun S BharadwajNoch keine Bewertungen

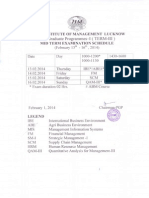

- PGP-I Term III Mid Term Exam Schedule February 13-16, 2014Dokument1 SeitePGP-I Term III Mid Term Exam Schedule February 13-16, 2014Arun S BharadwajNoch keine Bewertungen

- Beta Unlevering & ReleveringDokument4 SeitenBeta Unlevering & ReleveringArun S BharadwajNoch keine Bewertungen

- FM Objective - PPT - Compatibility ModeDokument20 SeitenFM Objective - PPT - Compatibility ModeArun S BharadwajNoch keine Bewertungen

- CFM - Sports.200words v2 - Edit 1Dokument2 SeitenCFM - Sports.200words v2 - Edit 1Arun S BharadwajNoch keine Bewertungen

- Arun S BharadwajDokument1 SeiteArun S BharadwajArun S BharadwajNoch keine Bewertungen

- Welfare Economics Seminar Focuses on Ethics of StateDokument22 SeitenWelfare Economics Seminar Focuses on Ethics of StateRieger TamásNoch keine Bewertungen

- SYBCom CBCS Sem III 100001-110050Dokument1.544 SeitenSYBCom CBCS Sem III 100001-110050maheshNoch keine Bewertungen

- ToA - Lecture 9 - Inty PPE & BiologicalDokument11 SeitenToA - Lecture 9 - Inty PPE & BiologicalRachel LeachonNoch keine Bewertungen

- Business Cycles: Causes and CharacteristicsDokument108 SeitenBusiness Cycles: Causes and CharacteristicsBai Alleha MusaNoch keine Bewertungen

- Econ 442 Problem Set 2 (Umuc)Dokument2 SeitenEcon 442 Problem Set 2 (Umuc)OmarNiemczykNoch keine Bewertungen

- Understanding Unemployment and Labor Force ConceptsDokument6 SeitenUnderstanding Unemployment and Labor Force ConceptsVu Thao NguyenNoch keine Bewertungen

- Labour shortage threatens Indian agricultureDokument60 SeitenLabour shortage threatens Indian agricultureadishNoch keine Bewertungen

- Year10 - Eco - 2.factors Affecting PEDDokument15 SeitenYear10 - Eco - 2.factors Affecting PEDcutekookieoppaNoch keine Bewertungen

- Indifference CurveDokument63 SeitenIndifference CurveManish Vijay100% (1)

- Lec 18-19 How Markets Determine IncomesDokument14 SeitenLec 18-19 How Markets Determine IncomesJutt TheMagicianNoch keine Bewertungen

- Macro and Micro Factors Affect SOEsDokument9 SeitenMacro and Micro Factors Affect SOEsIlham JefriNoch keine Bewertungen

- Learning OutcomesDokument3 SeitenLearning Outcomesmaelyn calindongNoch keine Bewertungen

- Colombian Economic History Ec0262 English 2020 1 JDokument11 SeitenColombian Economic History Ec0262 English 2020 1 JYeison LondoñoNoch keine Bewertungen

- Final Economics Presentation 1213465465146Dokument28 SeitenFinal Economics Presentation 1213465465146Kalpesh BhansaliNoch keine Bewertungen

- Econ 1010 NotesDokument11 SeitenEcon 1010 NotesDonnyNoch keine Bewertungen

- Corporate Finance (Ross) ChaptersDokument1 SeiteCorporate Finance (Ross) ChaptersJayedNoch keine Bewertungen

- Economics NSC P1 Memo Nov 2022 EngDokument22 SeitenEconomics NSC P1 Memo Nov 2022 Engxhanti classenNoch keine Bewertungen

- 1 s2.0 S0264837722001508 MainDokument15 Seiten1 s2.0 S0264837722001508 Mainsulhi_08Noch keine Bewertungen

- 10 Emh (FM)Dokument4 Seiten10 Emh (FM)Dayaan ANoch keine Bewertungen

- Planning Theories SUMMARYDokument23 SeitenPlanning Theories SUMMARYCharms QueensNoch keine Bewertungen

- TM 1 - Introduction To Microeconomics 1Dokument15 SeitenTM 1 - Introduction To Microeconomics 1Muhammad naufal FadhilNoch keine Bewertungen

- 45 Journals Used in FT Research RankDokument2 Seiten45 Journals Used in FT Research RankSzymon KaczmarekNoch keine Bewertungen

- Accn102 Tutorial Sheet 2Dokument4 SeitenAccn102 Tutorial Sheet 2BARNABAS MUFAROWASHENoch keine Bewertungen

- Cfa Ques AnswerDokument542 SeitenCfa Ques AnswerAbid Waheed100% (4)

- 2022 Fall Courses Taught in English (NEW)Dokument4 Seiten2022 Fall Courses Taught in English (NEW)Mariana MartínezNoch keine Bewertungen

- Veer Narmad South Gujarat University, Surat Managerial EconomicsDokument2 SeitenVeer Narmad South Gujarat University, Surat Managerial EconomicsGaurav VaghasiyaNoch keine Bewertungen

- Defining EntrepreneurshipDokument15 SeitenDefining EntrepreneurshipJoseph KingNoch keine Bewertungen

- Africa and GlobalisationDokument24 SeitenAfrica and GlobalisationAmeraly AliNoch keine Bewertungen

- Principles in MKTG Module 1 and 2Dokument3 SeitenPrinciples in MKTG Module 1 and 2faye pgrnNoch keine Bewertungen

- Symphony CoolersDokument9 SeitenSymphony Coolersakirocks71Noch keine Bewertungen