Beruflich Dokumente

Kultur Dokumente

2 ERM Approach

Hochgeladen von

carwadevilisbackCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2 ERM Approach

Hochgeladen von

carwadevilisbackCopyright:

Verfügbare Formate

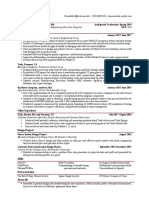

MOHAMAD HASSAN, MAFIS, QIA, CRMP, CRMA

APAKAH RISIKO?

ISO 31000:2009

Pengaruh ketidakpastian terhadap tujuan

Penyimpangan dari

yang diharapkan -

positif atau negatif

Kekurangan informasi yang terkait

dengan suatu peristiwa,

dampaknya, atau

kemungkinannya

Berbagai aspek, misal

keuangan, keselamatan,

lingkungan

Berbagai level: strategi,

projek, divisi

3

How to explain Risks

Register Risiko

Sumber risiko

(hazard)

Peristiwa

(kapan & dimana?)

Outcome

(konsekuensi)

Penyebab

(bagaimana,

mengapa)

Api

(kebakaran)

Kebakaran di kantor

pusat

Kerugian Rp. 500

juta

Arus pendek

Virus

Wabah H1N1 Gangguan operasi

Pegawai

terkena kontak

4

JENIS

RISIKO

SUMBER

RISIKO

PERISTIWA

ATAU

EKSPOSURE

KONSEKUENSI SEBAB RISK FACTOR

Safety

Bekerja di

ketinggian

Jatuh

Luka atau

meninggal

Disain yang

jelek

Ketinggian

(dari tanah)

Kesehatan Chemical Kontak Cancer

Tidak

memahami

bahan kimia

Jumlah bahan

kimia

Keuangan

Suku

bunga

Naik lebih dari

2% dalam satu

tahun

Penurunan

profit

Tekanan

inflasi

Besarnya

pinjaman

Proyek

Sumber

pasokan

Pengiriman

spare part

terlambat

Projek delay

Kebakaran di

gudang

pemasok

Ada tidaknya

pemasok

alternatif

Understanding of Risks ..

ENTERPRISE RISK MANAGEMENT APPROACH

SILO APPROACH HOLISTIC APPROACH

DEPT A

DEPT B

DEPT C

DEPT D

EWRM

EWRM

DEPT A DEPT C

DEPT B DEPT D

ENTERPRISE RISK MANAGEMENT APPROACHES

INTEGRATED SYSTEM & PROCESS SCATTERED SYSTEM & PROCESS

HOLISTIC APPROACH SILO APPROACH

CENTRALIZED RISK

MANAGEMENT STRUCTURE AND

SYSTEM

DECENTRALIZED RISK

MANAGEMENT STRUCTURE AND

SYSTEM

DEPARTMENTAL BASED BUSINESS PROCESSES BASED

RELATIVELY HOMOGEN RISK

MANAGEMENT ACTIVITIES

HETEROGEN RISK MANAGEMENT

ACTIVITIES

ENTERPRISE RISK MANAGEMENT APPROACHES

HOLISTIC APPROACH SILO APPROACH

SINGLE RISK LIBRARY (USE OF A

COMMON LANGUAGE)

ASSURED CONSISTENCY

MULTIPLE RISK LIBRARY

SCATTERED ACROSS DEPTS

INCONSISTENCIES POSSIBLY

OCCURED

RISK MANAGEMENT OPINION

AGGREGATION ISSUES

RISK MANAGEMENT OPINION

DIRECTLY CATCHES FROM THE

RISK REGISTERS

RISK MANAGEMENT OPINION

AGGREGATION ISSUES

ENTERPRISE RISK MANAGEMENT MODEL

CONTROL PROCESS MODEL MEASUREMENT MODEL

FOCUS ON CONTROL OVER

IMPORTANT BUSINESS

PROCESSES

FOCUS ON SIGNIFICANT

MEASURABLE RISKS IN TERMS

OF IMPACT MATERIALITY &

LIKELIHOOD OF OCCURENCE

Traditional RM vs. ERM: Essential Differences

Traditional risk management ERM

Risk as individual hazards Risk in the context of business

strategy

Risk identification and assessment Risk portfolio development

Focus on discrete risks Focus on critical risks

Risk mitigation Risk optimization

Risk limits Risk strategy

Risks with no owners Defined risk responsibilities

Haphazard risk quantification Monitoring and measuring of risks

Risk is not my responsibility Risk is everyones responsibility

Source: KPMG LLP.

Integrated versus silo

EWRM should

provide a strategic

and consolidated

picture from two

perspectives:

individual risk

classes across

business lines

all key risk classes

across the

organization

Executive Management

SENIOR

MGMT.

CRO

credit

risk

market

risk

ops

risk

liquidity

risk

liquidity

risk

ops

risk

market

risk

credit

risk

LOB 1

liquidity

risk

ops

risk

market

risk

credit

risk

LOB 2

liquidity

risk

ops

risk

market

risk

credit

risk

LOB 3

credit

risk

ops

risk

market

risk

liquidity

risk

LOB 4

Risk Management as a Process

Establish Business Risk

Management Process

Goals and Objectives

Common Language

Oversight Structure

Information

for Decision-

Making

Develop Business Risk

Management Strategies

Avoid

Transfer

Retain

Exploit

Reduce

Assess Business Risks

Identify

Source

Measure

Continuously Improve

Risk Management

Capabilities

Design/Implement

Risk Management

Capabilities

Monitor Risk

Management

Performance

Source: Enterprise-wide Risk Management: Strategies for linking risk and opportunity

1. Mantapkan kelembagaan & oversight:

a. Common language dan standards

b. Organisasi (oversight)

c. Tetapkan kebijakan (limit)

2. Process yang seragam

a. Tetapkan risk owners

b. Integrasi dengan strategi perusahaan

Lesson Learned

1. Kembangkan RM capabilities

2. Lakukan selangkah demi selangkah

3. Fokus pada semua sumber value

4. Kembangkan (latih) fasilitator

5. Tetapkan strategi manajemen risiko yang jelas

Lesson Learned

Development of Risk Management Capability

Capabilities

are

characteristic

of individuals,

not of the

organization

Process

established

and

repeating;

reliance

on people is

reduced

Policies,

processes and

standards

defined and

formalized

across the

company

Risks

measured and

managed

quantitatively

and aggregated

on an

enterprise-wide

basis

Organization

focused

on continuous

improvement of

business risk

management

Initial Repeatable Defined Managed Optimizing

Source: Derived from Carnegie Mellon model for inclusion in Enterprise-wide Risk Management: Strategies for linking risk and opportunity

Systematically Build and Improve Risk Management Capabilities

Risk Identification

Improved ERM Capabilities:

Initial Repeatable Defined

Managed/

Optimizing

Defined process

EWRM responsibilities

Policy guidelines

followed across the

organization

Risk measurement

Consistent risk

reporting

Enterprise-wide limits

Common language

Dedicated resources

Risk management

policy

Risk sourcing

Enterprise-wide risk

strategies

Risk diversification

exploited competitively

Quantification of risk

versus tolerances

Integrated risk

measurement systems

Risk measures applied

to business

performance goals

Source: Enterprise-wide Risk Management: Strategies for linking risk and opportunity

Initial Repeatable Defined Managed Optimizing

L

e

v

e

l

o

f

R

i

s

k

M

a

n

a

g

e

m

e

n

t

C

a

p

a

b

i

l

i

t

y

Desired level

Current level

STAGE 1

STAGE 2

Operations

Finance

Technology

Human resources

Competition

Regulatory

Environmental

Global expansion

Reputation

From:

Finance function

To:

Entire enterprise

Financial risks

Risk insurance

Treasury risk

Foreign exchange

Source:

FutureBrand

Source: Enterprise-wide Risk Management: Strategies for linking risk and opportunity

Systems

and data

Methodologies

Management

reports

People

Business

and Risk

Management

processes

Business

strategies

and policies

Risk if component is deficient:

Process does

not achieve

strategy

People cannot

perform

process

Reports do not

provide

information for

effective

management

Methodologies

do not

adequately

analyze

information

Information is

not available

for analysis

and reporting

Governance Oversight Roles Highlight Key Questions

Relating to Risk Management

Make

Policy Execution

Policy

Strategy Reporting

Is there a process for

reporting risk and

performance?

Does the organization

structure support risk

reporting?

All key uncertainties

being managed?

Are there assurances

that our capabilities

are effective?

Is risk-sensitive

culture in place?

Is there a process

for assessing risk

and capabilities?

Is Board advising on

mission-critical

risks?

Is opportunity-

seeking behavior

balanced with risk-

taking?

Are boundaries and

limits adequately

defined ?

12 Top ERM Implementation Challenges

Defining Risk

Terminology

Selecting a

Framework

Articulating ERM

Benefits/Impacts

Identifying Risk

Assessing Risk

Evaluating Risk Treating Risk

Monitoring Risk

Creating a Risk-

aware Culture

Deploying

Technology

Effectively

Integrating

Strategy & HR

into ERM

Successfully

Leveraging the

Impact of

Sarbanes-Oxley

Das könnte Ihnen auch gefallen

- 4 Risk ManagementDokument6 Seiten4 Risk ManagementYoseph NdiayeNoch keine Bewertungen

- Internal Auditing & RBIA 1 Rumah SakitDokument58 SeitenInternal Auditing & RBIA 1 Rumah SakitSiti Fatimah DNoch keine Bewertungen

- (TEMPLATE) - HS017 Risk Assessment Form StickersbadgesandpencilcaseDokument4 Seiten(TEMPLATE) - HS017 Risk Assessment Form StickersbadgesandpencilcaseAli ClarkeNoch keine Bewertungen

- FF0291 01 Free Mind Map Powerpoint Diagram 16x9Dokument6 SeitenFF0291 01 Free Mind Map Powerpoint Diagram 16x9licantNoch keine Bewertungen

- FF0203 01 Free Pdca Lego BlockDokument7 SeitenFF0203 01 Free Pdca Lego BlockingronaldNoch keine Bewertungen

- Intosai Gov 9150 eDokument13 SeitenIntosai Gov 9150 emirjana75Noch keine Bewertungen

- Kerangka Kerja Imtermal AuditDokument5 SeitenKerangka Kerja Imtermal AuditkaranziaNoch keine Bewertungen

- BQMS Template Procedure 8.2.1 Internal Audit v3.0Dokument4 SeitenBQMS Template Procedure 8.2.1 Internal Audit v3.0Tria Meildha GustinNoch keine Bewertungen

- Risk Culture - PPM Manajemen PDFDokument29 SeitenRisk Culture - PPM Manajemen PDFnadzorNoch keine Bewertungen

- Sarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitDokument28 SeitenSarbanes-Oxley Act: Will It Close The GAAP Between Economic and Accounting ProfitRakesh KumarNoch keine Bewertungen

- BPKP - Risk Management EssentialDokument22 SeitenBPKP - Risk Management Essentialfm3602100% (1)

- INTOSAI Internal Control StandardsDokument210 SeitenINTOSAI Internal Control StandardsfriedricNoch keine Bewertungen

- Brasil Shipyards SWOT AnalysisDokument2 SeitenBrasil Shipyards SWOT AnalysisAlexandru Florin BadeaNoch keine Bewertungen

- Using The COSO Framework For Sustainability ReportingDokument31 SeitenUsing The COSO Framework For Sustainability ReportingSelim HANNoch keine Bewertungen

- Audit Internal Chapter 4 Risk ManagementDokument25 SeitenAudit Internal Chapter 4 Risk ManagementFitri NoviaNoch keine Bewertungen

- Draft SLAuS For Non SBE Audits - 29-08-2018Dokument20 SeitenDraft SLAuS For Non SBE Audits - 29-08-2018Sanath FernandoNoch keine Bewertungen

- Fraud and Corruption Risk Assessments: WhitepaperDokument6 SeitenFraud and Corruption Risk Assessments: WhitepaperShafiullahNoch keine Bewertungen

- The Iia Global Internal Audit Competency Framework 2013 1Dokument16 SeitenThe Iia Global Internal Audit Competency Framework 2013 1marocNoch keine Bewertungen

- Risk Based Delivery Performance Standards AuditDokument176 SeitenRisk Based Delivery Performance Standards AuditJosh MartinNoch keine Bewertungen

- Risk Appetite For ScribdDokument2 SeitenRisk Appetite For ScribdjerkymiahNoch keine Bewertungen

- Annual Risk Management Report SampleDokument16 SeitenAnnual Risk Management Report SampleSuman khadkaNoch keine Bewertungen

- Agricultural Policies in Costa Rica: OECD Food and Agricultural ReviewsDokument193 SeitenAgricultural Policies in Costa Rica: OECD Food and Agricultural ReviewsJosé Almeida100% (1)

- Risk Register FormatDokument24 SeitenRisk Register FormatShyam_Nair_9667Noch keine Bewertungen

- Fox Solutions: M-9, MIDC, AMBAD, NASHIK 422 010 Maharashtra, IndiaDokument11 SeitenFox Solutions: M-9, MIDC, AMBAD, NASHIK 422 010 Maharashtra, IndiaPranoti JoshiNoch keine Bewertungen

- The Inherent Risk of Garuda Indonesia Around 2013 Until 2015Dokument14 SeitenThe Inherent Risk of Garuda Indonesia Around 2013 Until 2015arlindaNoch keine Bewertungen

- Risk Metrics Risk Manager 3.7 RMClient Batch ApplicationDokument397 SeitenRisk Metrics Risk Manager 3.7 RMClient Batch Applicationckcalvin888Noch keine Bewertungen

- CAA SMS Evaluation Tool Rev5Dokument28 SeitenCAA SMS Evaluation Tool Rev5RickyNoch keine Bewertungen

- Change Management Briefing Report TemplateDokument3 SeitenChange Management Briefing Report TemplateSuraj Singh50% (2)

- Coso Assesment 1Dokument30 SeitenCoso Assesment 1masBangunNoch keine Bewertungen

- 6 Stages Diagram Design: Step 6Dokument3 Seiten6 Stages Diagram Design: Step 6JOHNNoch keine Bewertungen

- INTOSAI GOV 9100 - Guidelines For Internal Control Standards For The Public SectorDokument83 SeitenINTOSAI GOV 9100 - Guidelines For Internal Control Standards For The Public Sectorbudimah100% (2)

- Operations Risk Management - RCSA Management and AnalysisDokument10 SeitenOperations Risk Management - RCSA Management and AnalysisShanKumarNoch keine Bewertungen

- Auditing Fair Value Measurements and DisclosuresDokument93 SeitenAuditing Fair Value Measurements and DisclosuresddeliuNoch keine Bewertungen

- Hospital Strategic Risk Management PDFDokument5 SeitenHospital Strategic Risk Management PDFTwistiesFifie FafauNoch keine Bewertungen

- 8 - Tatakelola Risiko - 1Dokument100 Seiten8 - Tatakelola Risiko - 1Haggai Pesakh PercivalNoch keine Bewertungen

- Sustainability Report 2016 PT Bank Mandiri Persero TBKDokument254 SeitenSustainability Report 2016 PT Bank Mandiri Persero TBKlucky.amirullahNoch keine Bewertungen

- Risk Maturity IndexDokument1 SeiteRisk Maturity IndexhazopmanNoch keine Bewertungen

- Sample Audit Trail For LabDokument2 SeitenSample Audit Trail For LabbawcockNoch keine Bewertungen

- Enterprise Risk Management SolutionDokument43 SeitenEnterprise Risk Management Solutionapi-25888878Noch keine Bewertungen

- IAA Risk Book Chapter 4 - Operational Risk Peter Boller Caroline Grégoire Toshihiro Kawano Executive SummaryDokument17 SeitenIAA Risk Book Chapter 4 - Operational Risk Peter Boller Caroline Grégoire Toshihiro Kawano Executive SummaryAlexanderHFFNoch keine Bewertungen

- COSO Framework BANKDokument15 SeitenCOSO Framework BANKFahmi Nur AlfiyanNoch keine Bewertungen

- Policy Review of Sectoral Laws - For Disaster Risk GovernanceDokument26 SeitenPolicy Review of Sectoral Laws - For Disaster Risk GovernanceMorito FranciscoNoch keine Bewertungen

- 08 Risk Management QuestionnaireDokument7 Seiten08 Risk Management QuestionnaireBhupendra ThakurNoch keine Bewertungen

- Audit Berbasis Risiko Untuk Auditor InternDokument65 SeitenAudit Berbasis Risiko Untuk Auditor InternFitriansyah MonasfalyNoch keine Bewertungen

- Understanding IC and COSO 2013Dokument37 SeitenUnderstanding IC and COSO 2013fred_barillo09100% (1)

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDokument4 SeitenPost Graduate Diploma in Management: Narsee Monjee Institute of Management Studiesprachi100% (1)

- Auditing in Times of Social Distancing: The e Ffect of COVID-19 On Auditing QualityDokument10 SeitenAuditing in Times of Social Distancing: The e Ffect of COVID-19 On Auditing Qualitymuhammad umerNoch keine Bewertungen

- Risk Appetite PresentationDokument10 SeitenRisk Appetite PresentationAntonyNoch keine Bewertungen

- Proper 2021 Lca 3Dokument38 SeitenProper 2021 Lca 3wahyu pribadi oetomoNoch keine Bewertungen

- Auditor Perceptions of Audit Workloads Audit Quality and Job SasticfationDokument43 SeitenAuditor Perceptions of Audit Workloads Audit Quality and Job SasticfationKevin PhạmNoch keine Bewertungen

- 357 1227 1 PBDokument13 Seiten357 1227 1 PBEngki J. KendekNoch keine Bewertungen

- Kuliah 11 Audit Dan Tata Kelola TIDokument90 SeitenKuliah 11 Audit Dan Tata Kelola TIRonn SaguntaNoch keine Bewertungen

- Risk MGT Training SlidesDokument32 SeitenRisk MGT Training SlideskapsicumadNoch keine Bewertungen

- CRMP Assessment FinalDokument163 SeitenCRMP Assessment FinalBanu Adi Seputra100% (1)

- Aon Risk Maturity Index Report 041813Dokument28 SeitenAon Risk Maturity Index Report 041813Dewa BumiNoch keine Bewertungen

- Enterprise Risk ManagementDokument11 SeitenEnterprise Risk ManagementDave CNoch keine Bewertungen

- CRMP TemplateDokument9 SeitenCRMP TemplateIonut NeacsuNoch keine Bewertungen

- HM Treasury Risk Management Assessment FrameworkDokument22 SeitenHM Treasury Risk Management Assessment FrameworkAndy TrederNoch keine Bewertungen

- SPS Diagnostic Mapping Report Uganda UAA FinalDokument56 SeitenSPS Diagnostic Mapping Report Uganda UAA FinalSteve Hodges100% (1)

- Short Guide To Procurement Risk Ch1Dokument19 SeitenShort Guide To Procurement Risk Ch1carwadevilisbackNoch keine Bewertungen

- Coso, New Coso, Iso 31000Dokument21 SeitenCoso, New Coso, Iso 31000carwadevilisback0% (1)

- 1 Overview ERMDokument20 Seiten1 Overview ERMcarwadevilisbackNoch keine Bewertungen

- Business Risk Assessment - ERM ProcessDokument26 SeitenBusiness Risk Assessment - ERM ProcesscarwadevilisbackNoch keine Bewertungen

- The Price of Corruption, An Institutional Analysis of The Impacts of Corruption On Economic LevelDokument170 SeitenThe Price of Corruption, An Institutional Analysis of The Impacts of Corruption On Economic LevelcarwadevilisbackNoch keine Bewertungen

- Informasi Dengan Cobit 4 1 Dan Is Risk Assessment Studi Kasus Bagian Pusat Pengolahan Data Pts XyzDokument6 SeitenInformasi Dengan Cobit 4 1 Dan Is Risk Assessment Studi Kasus Bagian Pusat Pengolahan Data Pts XyzcarwadevilisbackNoch keine Bewertungen

- Magaya Cargo System OperationsDokument17 SeitenMagaya Cargo System OperationsMohammed Al-GhannamNoch keine Bewertungen

- CUEGISDokument2 SeitenCUEGISAuryn Astrawita HendroSaputri100% (1)

- Case Study No.2 Analysis On Toyota's Operations ManagementDokument3 SeitenCase Study No.2 Analysis On Toyota's Operations Managementzarah mae aday50% (2)

- Chapter 3 Fundamentals of Organization StructureDokument21 SeitenChapter 3 Fundamentals of Organization StructureKaye Adriana GoNoch keine Bewertungen

- Endowment vs. GrantDokument6 SeitenEndowment vs. GrantamalekhNoch keine Bewertungen

- 11 Business Studies Notes Ch01 Nature and Purpose of BusinessDokument8 Seiten11 Business Studies Notes Ch01 Nature and Purpose of BusinessAyush Srivastava100% (1)

- PAS 36 Impairment of AssetsDokument8 SeitenPAS 36 Impairment of AssetswalsondevNoch keine Bewertungen

- Chapter 2 AnswersDokument3 SeitenChapter 2 Answersapi-479802605Noch keine Bewertungen

- Responsibility CentresDokument30 SeitenResponsibility CentresRafiq TamboliNoch keine Bewertungen

- Outsourcing SpeechDokument7 SeitenOutsourcing SpeechBrad HogenmillerNoch keine Bewertungen

- Ratio FormulasDokument1 SeiteRatio FormulasPiyush SoniNoch keine Bewertungen

- Stacey Rosenfeld Resume 2018Dokument1 SeiteStacey Rosenfeld Resume 2018api-333865833Noch keine Bewertungen

- Hotel Master Critical PathDokument14 SeitenHotel Master Critical Pathtaola80% (25)

- Utb Programmes 2021-2022Dokument3 SeitenUtb Programmes 2021-2022labid.mccNoch keine Bewertungen

- Fundamentals of Corporate Finance Canadian 9th Edition Ross Solutions Manual 1Dokument36 SeitenFundamentals of Corporate Finance Canadian 9th Edition Ross Solutions Manual 1jillhernandezqortfpmndz100% (23)

- British African F&I Terms and Fees 2021Dokument1 SeiteBritish African F&I Terms and Fees 2021EdidiongNoch keine Bewertungen

- Job EvaluationDokument34 SeitenJob EvaluationRakshit BhargavaNoch keine Bewertungen

- Chap01-Operation As Competitive WeaponDokument45 SeitenChap01-Operation As Competitive WeaponIwan NovaNoch keine Bewertungen

- Summer Internship ReportDokument3 SeitenSummer Internship ReportDeepak RanaNoch keine Bewertungen

- Middle Managers Role in Strategy ImplementationDokument20 SeitenMiddle Managers Role in Strategy Implementationrajivsharma79Noch keine Bewertungen

- The Audit Process: Principles, Practice and Cases Seventh EditionDokument28 SeitenThe Audit Process: Principles, Practice and Cases Seventh EditionSyifa FebrianiNoch keine Bewertungen

- 167 Sep2019 PDFDokument13 Seiten167 Sep2019 PDFShah KhanNoch keine Bewertungen

- Audit Chapter 7 SlidesDokument46 SeitenAudit Chapter 7 Slidessandra0104sNoch keine Bewertungen

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDokument34 SeitenIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNoch keine Bewertungen

- BT Group - Wikipedia, The Free EncyclopediaDokument14 SeitenBT Group - Wikipedia, The Free Encyclopediabachtiar 119Noch keine Bewertungen

- Manufacturing Accounts FormatDokument6 SeitenManufacturing Accounts Formatkerwinm6894% (16)

- AD PR SyllabusDokument26 SeitenAD PR SyllabusYogesh KamraNoch keine Bewertungen

- CARO 2020 by Ankit OberoiDokument38 SeitenCARO 2020 by Ankit Oberoiraja kumarNoch keine Bewertungen

- Agency: Effect of Death - 1919, 1930 and 1931Dokument25 SeitenAgency: Effect of Death - 1919, 1930 and 1931johnkyleNoch keine Bewertungen

- Fact Sheet 29Dokument2 SeitenFact Sheet 29Alan Cheng0% (1)