Beruflich Dokumente

Kultur Dokumente

L LE EG GA AL L D DE EC Ciis Siio ON NS S: Direct Taxes

Hochgeladen von

sumer_sen227883Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

L LE EG GA AL L D DE EC Ciis Siio ON NS S: Direct Taxes

Hochgeladen von

sumer_sen227883Copyright:

Verfügbare Formate

L AW

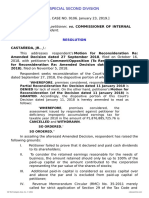

LEGAL DECISIONS

—Mukta Kathuria and Smita Mishra

DIRECT TAXES assessee to disclose fully and truly all material facts nec-

essary for Assessment) is satisfied.

1. Will an incorrect interpretation of accounts by the It was held that there was no failure on the part of the

Assessing Officer be taken as a valid ground to re- assessee to disclose fully and truly the material facts. The

open assessment after the expiry of four years from failure on the part of the Assessing Officer to correctly

the end of the relevant Assessment year? interpret the accounts of the assessee leading to exces-

sive relief cannot be a ground for re-opening the assess-

Amiya Sales and Industries and Another v. Assistant ment. The Assessing Officer who sought to re-open such

Commissioner of Income Tax and others (2005) 274 assessment was not permissible under section 147 of the

ITR 25 (Cal.-HC) Act to assume jurisdiction. The order under section 147

Decision: Once the assessee discloses all the material was quashed.

facts at the time of assessment, the failure on the part of Note: This case establishes the principle that once the

the Assessing officer to correctly interpret the accounts assessee discloses all the material facts at the time of

leading to excessive relief will not enable him to re-open assessment, the responsibility to scrutinize the books of

the assessment. account and other material in a proper manner shifts to

Due to incorrect interpretation of accounts by the the Assessing Officer. If due to his failure to verify the

Assessing Officer the assessee got a benefit of carry for- accounts properly, even if excessive relief is given to the

ward loss of approximately Rs. 34 Lakhs, which was assessee the assessment cannot be re-opened.

adjusted in the subsequent years. The above-mentioned 2. Whether the gratuity liability of the transferor of the

assessment was made under section 143(3). After the business related to the period of service under trans-

expiry of four years from the end of the relevant assess- feror, discharged by the transferee be considered as a

ment year such assessment was sought to be re-opened capital expenditure in the hands of the transferee?

under clause (c) of Explanation 2 to section 147 which

states that where an assessment has been made but income Sree Akilandeswari Mills Private Limited v. Deputy

chargeable to tax has been under assessed, such income Commissioner of Income-Tax [2005] 274 ITR 1 (Mad.-

shall be deemed to be income-escaping assessment. HC)

Proviso to section 147 states that where the assessment is Decision: Discharge of the gratuity liability, transferred

done under section 143(3) no action can be taken under to the purchaser of the business, as part of the consider-

section 147 after the expiry of four years from the end of ation is a capital expenditure.

relevant assessment year, unless income has escaped The appellant hereinafter referred to, as an “assessee”

assessment by the reason of failure on the part of the entered into an agreement with its holding company. As

assessee to disclose fully and truly the material facts nec- per the agreement a textile unit of the holding company

essary for his assessment for that assessment year. was transferred to the assessee. The services of the

Explanation 2 to section 147 of the Act, which contains employees working in the textile unit were continued and

the words “for the purpose of this section”, should be the agreement also protected the conditions of service of

read in conjunction with section 147. This reveals that workmen taken over by the assessee. The possession of

the conditions precedent for reopening assessment as the unit was given on November 22, 1982. During the

laid down in section 147 have to be complied with. This Assessment year 1988-89 the assessee company claimed

means that even if the income of the assessee is under a deduction of the gratuity payment made to the workers

assessed it will not be considered as income escaping who had retired during the previous year.

assessment unless one of the conditions under proviso to

section 147 (for example, failure on the part of the The Assessing Officer held that the liability towards the

payment of gratuity to the employees, related to the

period of service rendered by the employees to the trans-

The authors are Executive Officers in the Institute feror could not be claimed as business expenditure in the

THE CHARTERED ACCOUNTANT 1715 JUNE 2005

L AW

hands of the assessee company and that the assessee Income tax Officer accepted the contention of the assessee

company is entitled to claim deduction of part of the sum. that the compensation received was a capital receipt.

The Tribunal upheld the disallowances. The matter went However, the Commissioner (Appeals) was of the opinion

in an appeal to the High Court. that the compensation received was directly related to the

bottles, which were destroyed by the Coca Cola

The appeal was dismissed by the High Court. It was held

Corporation and thus the deduction of depreciation under

that the transferor had transferred the then gratuity liabil-

section 32 (1)(ii) should be set off against such compensa-

ity of the employees of the textile unit to the assessee.

tion and the balance should be allowed as a deduction. The

The sale consideration of such unit was calculated after

Tribunal held that the compensation received did not con-

taking into account such liability, as ascertained by the

stitute a revenue receipt and thus not taxable.

Actuarial valuation. Thus the said gratuity liability was a

part of the sale consideration, which was discharged later On Appeal to High Court it was held that the bottles and

by actual payment by the assessee to the employees in shells constituted plant and thus depreciation was admis-

subsequent years. Hence, it was a capital expenditure. sible under section 32 (1)(ii) of the Income Tax Act for

the Assessment year 1979-80. It was further held that the

Note: Payment of gratuity due to the employees consti-

assessee was doing business on behalf of the American

tutes part of the expenses towards remuneration of

Company in India and therefore the compensation

employees and hence constitutes revenue expenses in the

received by it was chargeable to income tax and was to be

hands of the employer. However, if the liability towards

treated as revenue receipt.

such gratuity is transferred to another person as a part of

sale consideration, the payment of such liability by the Note: This case establishes a principle that where an

purchaser will be capital expenditure. assessee purchases bottles and embosses the trademark

of the soft drink company on the bottles they constitute

3. Whether the compensation received by the bottling

plant and they cannot be utilized for any other purpose.

company for destruction of Coca Cola bottles conse-

Depreciation is allowable on the same and any compen-

quent upon bar by the Government be taxable as cap-

sation received on their destruction is chargeable under

ital receipt or revenue receipt?

section 28.

CIT v. Srikrishna Bottlers P. Ltd.[2005] 274 ITR 11

4. Whether the notice for assessment served at the reg-

(A.P.-HC)

istered office and not at the principal place of busi-

Decision: Bottles constitute plant in the hands of bottling ness is a valid notice?

companies and are entitled to depreciation. The com-

India Glycols Ltd. And another v. Commissioner of

pensation received on their destruction will constitute

Income Tax and others [2005] 274 ITR 137 (Cal.-HC)

revenue receipt.

Decision: The principal place of business to which

The Coca-Cola concentrate, which is used in the manu-

notice is to be sent under section 124 may or may not be

facture of the soft drinks, was imported by the assessee.

the registered place of business.

For this purpose the assessee procured bottles, which

bore the trademark embossed on them. In a particular As per section 124 of the Income Tax Act, 1961 an

year the Government prohibited the use of concentrates assessee cannot be compelled to file its return of income

manufactured by the Coca Cola concentrates. Due to this with the assessing Officer within whose jurisdiction the

all the embossed bottles lying in stock with the assessee assessee does not have its principle place of business.

became useless. In the meantime, the Coca Cola The place from where all the business activities are con-

Corporation made an offer to these bottling companies. trolled is treated as Principal place of business, which

According to this offer compensation was to be given may or may not be the registered place of business.

only in respect of those bottles lying with the bottlers,

The assessee had its principal place of business at

which were destroyed, under supervision of the Coca

Calcutta. The factory and the registered office of the

Cola Corporation after counting the bottles in the fac-

assessee were at Moradabad. Since inception assessee

tory. Compensation was to be paid on pro-rata basis on

filed its income tax return at Calcutta. The assessee

the sales reported during the last full year of operation in

received a notice at Moradabad office to file a return in

India. The assessee claimed that such amount i.e Rs.

Moradabad as it has registered office in Moradabad. The

5,46,000 was a capital receipt and thus not taxable. The

assessee filed a writ petition in Allahabad High Court

assessee also claimed depreciation under the then section

against this notice. The Allahabad High Court passed an

32 (1) (ii) of the Income tax Act, 1961.

order by which the Commissioner of Lucknow was

The Assessing Officer rejected the claim of assessee directed to decide the question of jurisdiction with regard

regarding depreciation but the Tribunal allowed it. The to filing of returns. The Commissioner of Lucknow held

THE CHARTERED ACCOUNTANT 1716 JUNE 2005

L AW

that the Assessing Officer at Moradabad had jurisdiction exchange through notary public and the assessee paid a

to assess the assessee. Even after such order the officials minimal amount of Rs. 30,000. The cargo was also cov-

at Moradabad did not take any follow up action to get the ered by an insurance policy. The Bank filed a claim for

return filed by the assessee. No action was taken up to payment of insurance money. The claim of the bank was

two years until a writ petition was filed in the Calcutta accepted by the Insurance Company and the amount

High court. specified in the Insurance policy was paid to the bank.

Due to devaluation of the rupee the Bank received Rs.

The Calcutta High Court held that the assessee stated that

8,60,217.88 as against the amount of Rs.4, 99,063.00 paid

the Income tax returns were filed in Calcutta, which is its

by the Bank to the supplier. When assessee came to know

principal place of business. The assessee had further stated

about this, he demanded the excess amount received by

that it had a registered office in Moradabad and also had

the Bank. After the bank refused the demand the assessee

branch offices at various places. The permanent Account

filed a suit against the bank in Delhi High Court. As per

number (PAN) was allotted to the assessee in Calcutta.

the order of the High Court the assessee received a sum of

The Court held that the findings of the Commissioner of

Rs. 1,35,000 from the Bank.

Lucknow were not legally tenable, as it had not taken into

account the facts stated by the assessee. The assessee had The amount received by the assessee from the bank was

its place of business within the meaning of section 124 in treated as business income under section 41(1) by the

Calcutta. The notice and order were not valid. Assessing Officer. The decision was confirmed by the

Appellate Assistant Commissioner but the Tribunal

Note: The words “ the principal place of business” have

deleted it.

many connotations. Even the word “address” given in

clause 17 of Form no. 3CD has to be construed appro- On a reference to the High Court it was held that the value

priately. This concept assumes importance in the context of goods lost was not claimed by the assessee and the

of jurisdiction of Assessing Officers to make assessment. Assessing Officer also did not make any allowance in

respect of lost goods in any assessment year. The

5. Whether the part of the excess money (received by the

amount, which represents the cost of goods, was paid by

bank from the Insurance Company on devaluation of

the bank, which was reimbursed by the Insurance

rupee) paid to the assessee by the bank, be considered

Company. The benefit of devaluation of rupee belonged

as business income or casual and non-recurring

to the bank and not to the assessee as the relationship of

receipt?

the assessee with the bank was only that of creditor and

CIT v. Swastika Metal Works [2005] 274 ITR 280 debtor. The amount received by the assessee as result of

(Punj. & Har. -HC) settlement between the parties was nothing more than a

casual receipt and not a trading receipt.

Decision: The portion of currency fluctuation gain

received by the assessee as a result of settlement between Note: In CIT v. Tata Locomotive and Engineering

the parties is a casual receipt and not a trading receipt if Company Ltd. (1966) 60 ITR 405 (SC) the Apex Court

the value of such lost goods is neither claimed by the laid down the principle that for bringing currency gains

assessee nor allowed in any assessment year. to tax, the intention with which the currency balance is

held by the assessee is the guiding factor.

The Assessee, being a registered firm was engaged in the

business of manufacturing and sale of brass, zinc and cop-

per sheets. The assessee placed an order for the purchase

of copper ingots with M/s Ore and Chemical Corporation,

Indirect Taxes

New York through an agent in Bombay. The payment

1. Can an appeal relating to demand of duty be sus-

was to be made in dollars. For the purpose of making pay-

tained when department did not file appeal against

ment in New York the assessee opened a letter of credit

an earlier order of the Tribunal which decided the

with a Mercantile Bank Ltd. in Delhi. The goods were dis-

same issue qua the parties for the same period?

patched and the payment was made by the Mercantile

Bank against the delivery of documents of title along with Supdt. of Central Excise v D.C.I. Pharmaceuticals Pvt.

the bill of exchange, which was drawn upon the assessee Ltd. 2005 (181) E.L.T. 189 (S.C.)

and endorsed in favour of the bank in the terms of the let-

Decision: An appellant cannot agitate an issue collater-

ter of credit. The bank presented the bill of exchange,

ally when he has not preferred an appeal from the deci-

which was payable after two months. In the meantime,

sion of the Tribunal in the related matter for the same

hostilities broke between India and Pakistan. The cargo of

period.

the steamer travelling from New York to India via

Karachi was confiscated by the Pakistan Government. In the instant case a demand was raised by the department

After the due date, the Bank presented the bill of denying the assessee the exemption under Notification

THE CHARTERED ACCOUNTANT 1717 JUNE 2005

L AW

175/86-C.E. Assistant Collector allowed the benefit of any illegal purpose. There was also no evidence to prove

exemption but the Commissioner (Appeals) denied the the conspiracy set up by the prosecution. The Apex Court

said exemption on an appeal by the department. held that though the articles were recovered from the

However, Tribunal finally upheld the order of Assistant truck, there was no evidence to show that the appellant

Collector, granting the exemption and quashing the had any control over the vehicle nor was he in possession

demand. The Department did not challenge this order by of those drugs. Therefore, the appeal was allowed and the

way of appeal. Meanwhile, another proceeding for the appellant was acquitted of all charges framed against

same period on the basis of classification list filed by the him.

assessee were initiated and benefit of said exemption was

Note: Section 108 of the Customs Act. It can be inferred

denied to the assessee. The matter was carried to the

from this decision of the Apex Court that the owner of a

High Court which held that the assessee was eligible to

vehicle carrying contraband goods cannot escape con-

excise exemption albeit for grounds which were inde-

viction on the plea that the vehicle is not registered in his

pendent of the decision of the Tribunal. The Department

name.

then approached the Supreme Court.

The Supreme Court held that since no appeal had been

3. Whether ‘Licel’ used for killing lice in human hair

preferred from the decision of the Tribunal in the related

will be classified as a medicament or an insecticide?

matter for the same period, it was not open to the appel-

lant to agitate the issue collaterally. Sujanil Chemo Industries v Commissioner of C.Ex., &

Cus., Pune 2005 (181) E.L.T. 206 (S.C.)

Note: In this case the Supreme Court has not gone in to

the actual facts of the issue involved but has decided in Decision: ‘Licel’ is used for therapeutic and prophylac-

favour of the assessee on the principle that an appeal tic purposes. It is thus a Medicament within the meaning

against the High Court cannot be sustained when the of the term “Medicament” in Note 2 of Chapter 30.

same issue decided by the Tribunal in another proceed-

The appellants manufactured a product known as

ing has not been appealed against.

‘LICEL” used for killing lice in human hair. The appel-

2. Whether the registered owner of a vehicle carrying lants claimed that their product was classifiable under

contraband goods can be convicted when he has tariff sub-heading 3808.10 as an insecticide. However,

transferred the vehicle to a third party but the vehi- according to the Department the product was classifiable

cle continued to be registered in his name? under tariff subheading 3003.10 as a medicament.

Balwinder Singh v. Asstt. Commissioner, Customs & The Appellants contended that as per the reports of

Central Excise 2005 (181) E.L.T. 203 (S.C.) chemical examiners and the Department of Dermatology

& Venereology product was an insecticide. The appel-

Decision: The registered owner cannot be convicted, as

lants claim was augmented by various statements of

there is no evidence to show that he has any control over

dealers stating that in the market the product was consid-

the vehicle nor is he in possession of the contraband

ered to be an insecticide.

goods.

Chapter Note 1(c) of Chapter 38 indicates that Chapter

Two trucks were intercepted by the Central Excise and

38 would not cover “Medicaments under Heading No.

Customs Department. The officers of the Customs

3003 or 3004”. Chapter Heading 2(i) of Chapter 30

Department conducted search of the vehicle in the pres-

defines “Medicament”, inter alia, as a product compris-

ence of witnesses and it was found that one of the trucks

ing of two or more constituents which have been mixed

had a secret compartment and 175 Kgs. of heroine and 39

or compounded together for therapeutic or prophylactic

Kgs. of Opium of foreign origin were concealed in that

use.

chamber. During the course of investigation, the state-

ment of the appellant (the registered owner of the vehi- The Supreme Court observed that even though, in nor-

cle) was taken under Section 108 of the Customs Act and mal parlance, a product might be considered to be an

15 witnesses had been examined. However, the appellant insecticide if that product had any therapeutic and pro-

completely denied his culpability in the crime. The phylactic use but for purposes of classification that prod-

appellant contended that he had sold the truck much uct could not fall under Chapter 38. In this case, the prod-

before the contraband goods were recovered therefrom uct was used only for killing lice in human hair. The

but the vehicle continued to be registered in his name. Apex Court clarified that any medicine or substance

The Supreme Court observed that the appellant was con- which treats disease or is a palliative or curative is thera-

victed solely for the reason that he was the registered peutic. Therefore, since. Licel cured the infection or

owner of the vehicle. There was no evidence to prove that infestation of lice in human hair, it was therapeutic.

he knowingly allowed any person to use the vehicle for Further, it was also prophylactic in as much as it pre-

THE CHARTERED ACCOUNTANT 1718 JUNE 2005

L AW

vented disease which would follow from infestation of It was also argued that provisions of Section 11B could

lice. Thus, The Apex Court held that ‘Licel’ was a prod- not be invoked for denial of the benefit of notifications as

uct which was used for therapeutic and prophylactic pur- section 11B was inserted in the Act by the Amendment

poses. It would thus be a Medicament within the mean- Act of 1978 (Act 25 of 1978) w.e.f. 17.11.1980 (after the

ing of the term “Medicament” in Note 2 of Chapter 30 refund claim was made). The section was further

and would be excluded from Chapter 38. amended by the Amendment Act of 1991 (Act 14 of

1991) w.e.f. 19.09.1991.

The Court pointed out that this view had also been taken

by the Supreme Court in the case of ICPA Health Supreme Court clarified that ‘Unjust enrichment’ means

Products (P) Ltd. v. Commissioner of C. Ex., Vadodara retention of a benefit by a person that is unjust or

2004 (167) E.L.T. 20 and Tribunal in Collector of C.Ex., inequitable and it occurs when a person retains money or

v. Pharmasia (P) Ltd. 1990 (47) E.L.T. 658 wherein in benefits which in justice, equity and good conscience,

respect of an identical product it had been set out that belong to someone else. The doctrine of ‘unjust enrich-

such product would fall under Chapter 30 under Tariff ment’, therefore, is that no person can be allowed to enrich

Heading 30.03. inequitably at the expense of another. A right of recovery

under the doctrine of ‘unjust enrichment’ arises where

Note: This decision is a pointer that while classifying

retention of a benefit is considered contrary to justice or

any particular product, reliance on trade parlance can

against equity. The juristic basis of the obligation is not

be sought only when one the Tariff does not provide a

founded upon any contract or tort but upon a third category

clear and direct answer to the question of classification.

of law, namely, quasi-contract or the doctrine of restitution.

The judgment has clarified that killing of lice in human

hair amounts to therapeutic or prophylactic use and that Supreme Court opined that irrespective of applicability

insecticides having any therapeutic and prophylactic use of Section 11B of the Act, the doctrine could be invoked

are not classifiable under Chapter 38 (Insecticides) of to deny the benefit to which a person was not otherwise

Central Excise Tariff. entitled. Section 11B of the Act or similar provision

merely gave legislative recognition to the doctrine. That,

4. Can a refund not governed by the amended section

however, did not mean that in absence of statutory provi-

11B of the Central Excise Act be hit by bar of unjust

sion, a person could claim or retain undue benefit. The

enrichment?

Court stated that before claiming a relief of refund, it was

Sahakari Khand Udyog Mandal Ltd. v. Commissioner necessary for the petitioner/appellant to show that he had

of C. Ex. & Cus. 2005 (181) E.L.T. 328 (S.C.) paid the amount for which relief was sought, he had not

passed on the burden on consumers and if such relief was

Decision: Irrespective of applicability of Section 11B of

not granted, he would suffer loss.

the Central Excise Act, the doctrine of unjust enrichment

can be invoked to deny the benefit to which a person is not It was observed by the Apex Court that all the lower

otherwise entitled. authorities had expressly recorded a finding that the

appellant had recovered the amount from consumers and

The appellant was engaged in the manufacture of sugar.

as such excise duty was passed on to consumers/cus-

In 1978 a refund was claimed by the appellant on the

tomers. In view of the specific finding, the Court held

basis of Notification No. 257/76, dated September 30,

that the appellant was not entitled to claim any amount.

1976. The Notification inter alia provided for exemption

Allowing exemption or refund of amount would have

from payment of excise duty leviable thereon in excess

resulted in ‘unjust enrichment’ by the appellant which

of average production of sugar of the corresponding

could not be permitted.

period of preceding three years. The production of the

appellant in the fourth year exceeded the average pro- Note: By this decision the judiciary has established that

duction of the sugar in the preceding three years by a cer- the principle of equity will always be recognised even

tain amount, the duty paid on which was claimed as though it may not be expressly spelt out in any part of the

refund by the appellant. However, Department invoked legislation. ■

the doctrine of unjust enrichment on such claim and

transferred the said amount to Consumer Welfare Fund. LIST OF ICAI PUBLICATIONS

It was the contention of the appellant that the rebate was This is for the information of the members that

in the nature of an incentive to the factories to encourage updated list (Committee wise and Subject wise) of the

them to produce more sugar and such rebate was not ICAI publications is available on the Institute's web-

intended to benefit the consumers. It was, therefore, not site at the link http://www.icai.org/publications/

open to the Authorities to take into account extraneous

ground for refusing relief to them

m_bkpub.html

THE CHARTERED ACCOUNTANT 1719 JUNE 2005

Das könnte Ihnen auch gefallen

- CIT V InsilcoDokument13 SeitenCIT V InsilcoRavi SrinivasanNoch keine Bewertungen

- DT CASE STUDY SERIES FOR FINAL STUDENTs - SET 1Dokument6 SeitenDT CASE STUDY SERIES FOR FINAL STUDENTs - SET 1tusharjaipur7Noch keine Bewertungen

- 1 Modul - Accounting IntermediateDokument30 Seiten1 Modul - Accounting IntermediatepastadishéNoch keine Bewertungen

- Direct Taxes Case Laws by CA Durgesh SinghDokument28 SeitenDirect Taxes Case Laws by CA Durgesh Singhpriyamvatha_c50% (2)

- Central Textile Mills, Inc. v. NWPC, 260 SCRA368 (1996)Dokument4 SeitenCentral Textile Mills, Inc. v. NWPC, 260 SCRA368 (1996)inno KalNoch keine Bewertungen

- C9 Audit Question BankDokument35 SeitenC9 Audit Question BankYash SharmaNoch keine Bewertungen

- Cyanamic V CA (Hernandez)Dokument3 SeitenCyanamic V CA (Hernandez)Jaerelle HernandezNoch keine Bewertungen

- (Chennai - Trib.) (30-11-2016)Dokument24 Seiten(Chennai - Trib.) (30-11-2016)harsh hgNoch keine Bewertungen

- Amalgamation Revision NotesDokument9 SeitenAmalgamation Revision NotesghsjgjNoch keine Bewertungen

- 1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeDokument5 Seiten1971 82 ITR 363 SC 17-08-1971 Kedarnath Jute MFG Co LTD Vs Commissioner of IncomeAnanya SNoch keine Bewertungen

- Payments On Account in Respect of Disputed SumsDokument3 SeitenPayments On Account in Respect of Disputed Sumsmarx0506Noch keine Bewertungen

- REMEDIES by J. DimaampaoDokument2 SeitenREMEDIES by J. DimaampaoJeninah Arriola CalimlimNoch keine Bewertungen

- Capital GainDokument6 SeitenCapital GainJohn FernendiceNoch keine Bewertungen

- DT PDFDokument8 SeitenDT PDFKanha KarwaNoch keine Bewertungen

- Audit of Insurance Business - 2Dokument5 SeitenAudit of Insurance Business - 2ANMOL GUMBERNoch keine Bewertungen

- Central Textile Mills v. National Wages CommissionDokument7 SeitenCentral Textile Mills v. National Wages CommissionMelissa AdajarNoch keine Bewertungen

- Central vs. National WagesDokument2 SeitenCentral vs. National WagesRPCO 4B PRDP IREAPNoch keine Bewertungen

- Case Law TaxDokument10 SeitenCase Law TaxAhmedAliNoch keine Bewertungen

- CH 5 Accounting For Disbursements and Related TransactionsDokument3 SeitenCH 5 Accounting For Disbursements and Related TransactionsGem Baguinon100% (1)

- CIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateDokument17 SeitenCIT v. HCL Technologies Limited (2018) 404 ITR 719 (SC) : Judicial UpdateHemanthNoch keine Bewertungen

- PC 16 OnlyRelevant MSO AE Volume 1 20210331152609Dokument21 SeitenPC 16 OnlyRelevant MSO AE Volume 1 20210331152609Works Accounts IrrigationNoch keine Bewertungen

- 1993 68 Taxman 45 SC 1993 201 ITR 800 SC 1993 112 CTR 61 SC 30 03 1993 UniversDokument10 Seiten1993 68 Taxman 45 SC 1993 201 ITR 800 SC 1993 112 CTR 61 SC 30 03 1993 UniversAnanya SNoch keine Bewertungen

- Company Audit0rDokument36 SeitenCompany Audit0rNarendra ReddyNoch keine Bewertungen

- SO Vol IDokument21 SeitenSO Vol IAsadZahidNoch keine Bewertungen

- Atlas Consolidated Mining & Dev. Corp. vs. Commissioner of Internal RevenueDokument20 SeitenAtlas Consolidated Mining & Dev. Corp. vs. Commissioner of Internal RevenueKristel HipolitoNoch keine Bewertungen

- Lecture 1 Buscom at Acquisition DateDokument7 SeitenLecture 1 Buscom at Acquisition DateKristine Joy SaavedraNoch keine Bewertungen

- Finance Policy ManualDokument16 SeitenFinance Policy ManualPearl DebbyNoch keine Bewertungen

- Judicial UpdateDokument10 SeitenJudicial UpdateRajbir SinghNoch keine Bewertungen

- IAET Case 1Dokument3 SeitenIAET Case 1HADTUGINoch keine Bewertungen

- P 2Dokument4 SeitenP 2Julious CaalimNoch keine Bewertungen

- Direct Tax-Chit FundDokument27 SeitenDirect Tax-Chit FundAbirami VasudevanNoch keine Bewertungen

- C NAMyzx Fue O6 V Scezem ZGDokument14 SeitenC NAMyzx Fue O6 V Scezem ZGDhruv ThakurNoch keine Bewertungen

- Commissioner of Income-Tax and Anr v. SV Gopala and Others (2017) 396 ITR 694 (SC)Dokument14 SeitenCommissioner of Income-Tax and Anr v. SV Gopala and Others (2017) 396 ITR 694 (SC)Rishabh GuptaNoch keine Bewertungen

- Tax Digest 10-27-22Dokument23 SeitenTax Digest 10-27-22angelicaNoch keine Bewertungen

- 4 DP Business Combination - Acquisition DateDokument6 Seiten4 DP Business Combination - Acquisition DateYapi BallersNoch keine Bewertungen

- CA Final May 24 Case LawsDokument4 SeitenCA Final May 24 Case Lawsnerises364Noch keine Bewertungen

- Lups-Central Textile Mills Vs National WageDokument4 SeitenLups-Central Textile Mills Vs National WageAllenMarkLuperaNoch keine Bewertungen

- When Assessee Reverses A Unilateral Write Back of Dues Payable To A Vendor To Its P & L Account, The Liability Is To Be Treated As Contingent Liability - Taxguru - inDokument3 SeitenWhen Assessee Reverses A Unilateral Write Back of Dues Payable To A Vendor To Its P & L Account, The Liability Is To Be Treated As Contingent Liability - Taxguru - inGaurav JainNoch keine Bewertungen

- Commissioner of Income Tax Vs Sun Engineering WorksDokument19 SeitenCommissioner of Income Tax Vs Sun Engineering WorksNishantNoch keine Bewertungen

- Paper XV Corporate Accounting: Kannur University School of Distance EducationDokument110 SeitenPaper XV Corporate Accounting: Kannur University School of Distance EducationUnni AmpadiNoch keine Bewertungen

- Kunezle & StreiffDokument3 SeitenKunezle & StreiffJanna Robles SantosNoch keine Bewertungen

- Groups 7 Changes in Group StructureDokument10 SeitenGroups 7 Changes in Group StructureSharmaine Rivera MiguelNoch keine Bewertungen

- Indian Income-Tax Act Ss. 10 (2) (XV) 33Dokument5 SeitenIndian Income-Tax Act Ss. 10 (2) (XV) 33keyur moriNoch keine Bewertungen

- Topic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Dokument2 SeitenTopic: Tax Refunds Commissioner of Internal Revenue V. Univation Motor Philippines, Inc. (Formerly Nissan Motor Philippines)Joshua Erik MadriaNoch keine Bewertungen

- CompiledDokument17 SeitenCompiledMeghna SinghNoch keine Bewertungen

- Central Textile Mills vs. NWPC (260 SCRA 368, 1996)Dokument1 SeiteCentral Textile Mills vs. NWPC (260 SCRA 368, 1996)eunice demaclidNoch keine Bewertungen

- Types of AssessmentDokument9 SeitenTypes of AssessmentRasel AshrafulNoch keine Bewertungen

- CORP - 54 - CENTRAL TEXTILE MILLS, INC., vs. NATIONAL WAGES AND PRODUCTIVITY COMMISSIONDokument3 SeitenCORP - 54 - CENTRAL TEXTILE MILLS, INC., vs. NATIONAL WAGES AND PRODUCTIVITY COMMISSIONAtty.Noch keine Bewertungen

- ACAI Chapter 17 PowerpointDokument28 SeitenACAI Chapter 17 PowerpointKathleenCusipagNoch keine Bewertungen

- Consolidation AccountingDokument3 SeitenConsolidation AccountingTauseef AbbasNoch keine Bewertungen

- CIR vs. OcierDokument9 SeitenCIR vs. OcierAdrian HughesNoch keine Bewertungen

- PWC News Alert 1 August 2017 No Tax Withholding Required On Reimbursement of ExpensesDokument3 SeitenPWC News Alert 1 August 2017 No Tax Withholding Required On Reimbursement of ExpensesNiileshNoch keine Bewertungen

- Session Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLDokument3 SeitenSession Paper - 6 (Questions & Answers), For Overall Discussion On Principles of Taxation of CLProgga MehnazNoch keine Bewertungen

- ACCT4011 - Lecture 2 - Business Combinations II (Revised) (Class)Dokument12 SeitenACCT4011 - Lecture 2 - Business Combinations II (Revised) (Class)DaveKwokNoch keine Bewertungen

- DT CASE STUDY SERIES FOR FINAL STUDENTs - SET 5Dokument10 SeitenDT CASE STUDY SERIES FOR FINAL STUDENTs - SET 5tusharjaipur7Noch keine Bewertungen

- 1) Cir Vs Pascor (Gallo)Dokument5 Seiten1) Cir Vs Pascor (Gallo)kaiaceegeesNoch keine Bewertungen

- Corporate Accounting: Assignment-3Dokument8 SeitenCorporate Accounting: Assignment-3sureshNoch keine Bewertungen

- Income TaxDokument57 SeitenIncome TaxDenis FernandesNoch keine Bewertungen

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeVon Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeBewertung: 1 von 5 Sternen1/5 (1)

- Fundamental & Technical Analysis: by Anup K. SuchakDokument53 SeitenFundamental & Technical Analysis: by Anup K. SuchakanupsuchakNoch keine Bewertungen

- 9 2023 1 06 27 AmDokument1 Seite9 2023 1 06 27 Amowei prosperNoch keine Bewertungen

- Iyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeDokument9 SeitenIyana Melgar Enterprise Chart of Account Assets Liabilities Account Name Account Name Account Code Account CodeJudy Silvestre BẹnóngNoch keine Bewertungen

- FM 415 Money MarketsDokument50 SeitenFM 415 Money MarketsMarc Charles UsonNoch keine Bewertungen

- Islamic Capital Markets: The Role of Sukuk: Executive SummaryDokument4 SeitenIslamic Capital Markets: The Role of Sukuk: Executive SummaryiisjafferNoch keine Bewertungen

- Sample Statement of AccountDokument1 SeiteSample Statement of AccountKipo JenefferNoch keine Bewertungen

- David M. Dodson Case Analysis: Financial Problems Related To The PurchaseDokument3 SeitenDavid M. Dodson Case Analysis: Financial Problems Related To The PurchaseAryanNoch keine Bewertungen

- FINS1612 Tutorial 2 - BanksDokument5 SeitenFINS1612 Tutorial 2 - BanksRuben CollinsNoch keine Bewertungen

- Simple, Compound Interest and Annuity Problems For Special ClassDokument2 SeitenSimple, Compound Interest and Annuity Problems For Special ClassPaolo PerezNoch keine Bewertungen

- INTERROGATIVES Depositions For DisclosureDokument6 SeitenINTERROGATIVES Depositions For Disclosureolboy92Noch keine Bewertungen

- Contingency Planning & Simulation Exercises Practical ApplicationsDokument11 SeitenContingency Planning & Simulation Exercises Practical ApplicationsMustafa Shafiq RazalliNoch keine Bewertungen

- CBI Holding Company, Inc. / Case 2.6Dokument3 SeitenCBI Holding Company, Inc. / Case 2.6octaevia50% (4)

- Acc 219 Notes Mhaka CDokument62 SeitenAcc 219 Notes Mhaka CfsavdNoch keine Bewertungen

- 19696ipcc Acc Vol2 Chapter14Dokument41 Seiten19696ipcc Acc Vol2 Chapter14Shivam TripathiNoch keine Bewertungen

- RY-Expected Optimal Exercise TimeDokument10 SeitenRY-Expected Optimal Exercise TimeryaksickNoch keine Bewertungen

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Dokument9 SeitenRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasNoch keine Bewertungen

- Cash Flow statement-AFMDokument27 SeitenCash Flow statement-AFMRishad kNoch keine Bewertungen

- Republic Vs CaguioaDokument6 SeitenRepublic Vs CaguioaKim Lorenzo CalatravaNoch keine Bewertungen

- PRE TEST - Gen MathDokument4 SeitenPRE TEST - Gen MathJe CelNoch keine Bewertungen

- Updated VAT Rate 2018 PDFDokument6 SeitenUpdated VAT Rate 2018 PDFAbdusSubhanNoch keine Bewertungen

- Integprac1 Quiz 1Dokument2 SeitenIntegprac1 Quiz 1AMARO, BABY LIZ ANDESNoch keine Bewertungen

- At January 2008 IssueDokument68 SeitenAt January 2008 IssuejimfiniNoch keine Bewertungen

- SWAT Guide PREVIEWDokument38 SeitenSWAT Guide PREVIEWChetan DeoNoch keine Bewertungen

- BA 323 Study GuideDokument7 SeitenBA 323 Study GuideTj UlianNoch keine Bewertungen

- UT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)Dokument5 SeitenUT Dallas Syllabus For Fin7310.001 05f Taught by Nina Baranchuk (nxb043000)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- FINA3080 Assignment 1 Q&ADokument4 SeitenFINA3080 Assignment 1 Q&AJason LeungNoch keine Bewertungen

- Customer Satisfaction in The Indian Banking SectorDokument70 SeitenCustomer Satisfaction in The Indian Banking SectorAbhishek Singh82% (22)

- Compliances For Small Company - Series - 40Dokument11 SeitenCompliances For Small Company - Series - 40Divesh GoyalNoch keine Bewertungen

- Ril Financing DecisionDokument2 SeitenRil Financing DecisionPravin Sagar ThapaNoch keine Bewertungen

- The Role of Monetary Policy in Zimbabwe's Hyperinflation EpisodeDokument36 SeitenThe Role of Monetary Policy in Zimbabwe's Hyperinflation EpisodeGerald kNoch keine Bewertungen