Beruflich Dokumente

Kultur Dokumente

BPO Tolee

Hochgeladen von

Khan Majlis Reshad0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten16 SeitenBPO-Tolee

Originaltitel

BPO-Tolee

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBPO-Tolee

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten16 SeitenBPO Tolee

Hochgeladen von

Khan Majlis ReshadBPO-Tolee

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 16

Introduction to and Comments on

Bank Payment Obligation (BPO)

0

T. O. Lee Consultants Ltd.

10 Westbury Court

Richmond Hill, Ontario

L4S 2L1 Canada

www.tolee.com

Email: experts@tolee.com

1

Copyright 2013 All Rights Reserved

This handout is provided solely for your self-study.

Unauthorized uses, such as for sharing with others, training

courses, selling, renting and the like, whether for profits or

not, are strictly prohibited and such offences will be subject

to legal prosecution. No part of this handout may be

reproduced in any form, mimeograph, photocopying, scanning

or any other means, without written permission from:

T. O. Lee Consultants Ltd.

10 Westbury Court

Richmond Hill, Ontario

L4S 2L1 Canada

Telephone: 905 237 6465

Email: experts@tolee.com

Homepage: www.tolee.com

1

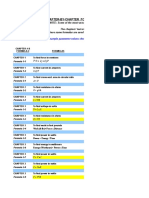

TABLE OF CONTENTS

Contents Page Nos.

Cover 0

Copyright Declaration 1

Table of Contents 2

The Objectives of Bank Payment Obligation (BPO) 3

Comparison of Open Account, BPO & Letter of Credit 4

BPO Builds on Electronic Data Matching 5

BPO Flows for Data, Documents & Goods 6

Contracts in BPO 7

Industry Standards for BPO 8

The Objectives of Bank Payment Obligation (BPO) 9 - 10

Comments on BPO 11 - 13

Conclusions 14

Q & A 15

2

The Objectives of Bank Payment Obligation (BPO)

1 To provide an electronic payment assurance tool to facilitate

open account operations and supply chain finance.

2 To save time and papers in trading procedures.

3 To target at SME that forms about 80% of the incorporations

in each developed or underdeveloped country.

4 To standardize product definitions in supply chain finance.

5 To link up banks representing and chosen by the

manufacturer, the supplier, the middleman, and the ultimate

buyer to reduce Know Your Customers (KYC) costs.

6 To provide end-to-end automation to limit processing time

and costs by eliminating propriety formats.

7 eUCP version 1.1 is the electronic version of UCP 600. Hence

BPO is NOT an electronic letter of credit as some LC

practitioners think.

8 Following slides are extracted from SWIFT BPO webinars.

3

Introduction to BPO Operations

1 BPO is governed by ICC Uniform Rules for Bank Payment

Obligations (URBPO) ICC Publication No. 750 effective

from 1 July 2013.

2 Buyer and seller exchange their key trading data derived

from the Purchase/Sales Order electronically through their

own banks for data matching purpose.

3 The buyers bank (Obligator Bank) sends the BPO to sellers

bank (Recipient Bank) who is also the Beneficiary.

4 Seller ships the goods and submits the electronic data through

the sellers bank to the buyers bank, claiming payment.

5 Buyers bank checks the data and pays the sellers bank if the

data is matching its own record.

6 In data mismatch, the buyers bank may contact buyer for a

waiver or may refuse the waiver from buyer and send

notice of refusal of payment.

4

7 BPO uses ISO 20022 Trade Services Management

messages for all parties and SWIFT TSU between banks.

8 Universal Time Coordinated (UTC) is used, a technical

equivalent of Greenwich Mean Time (GMT).

9 URBPO 750 is similar to UCP 600 in:

a Separate and independent from underlying contracts;

b Dealing with electronic data only, and not with paper

documents, goods, services or performances;

c Providing definitions of terms used;

d Duty to send notice without delay;

e Amendments;

f Force Majeure disclaimers (including computer software

defects) for banks; and

g Assignment of proceeds.

10 URBPO 750 mirrors ISP98 in extending data submission

period due to closing of bank before expiry and in

applicable law.

11 Other banks are Submission Bank & Involved Banks.

5

6

7

8

9

10

Comments on BPO

1 The Obligator Bank pays only to the Recipient Bank, the

sellers bank, as the Beneficiary, not the seller as in UCP

600.

2 Hence the seller cannot sue the Obligator Bank for

negligence, defaults and other obligations. Hence the

seller must make a separate contract with the Recipient Bank

to assign the right to sue the Obligator Bank.

3 Electronic Data Interface (EDI) introduced more than

twenty years ago was a total failure due to SMEs do not

have technical skills in electronic trade. They have to recruit

new staff and bear costs for on-going training. The same

remark may apply to BPO.

4 BPO has to compete with a similar product from ICC, the

eUCP 1.1 that the LC practitioners are more familiar with and

easier to grasp the essential features. In fact eUCP 1.1 is

getting more popular in 2013 in some countries, giving BPO a

threat in its infant stage.

11

5 The URBPO 750 introduces many new jargons unheard of in

the LC community, such as Established Baseline,

Transaction Matching Application (TMA), Trade Services

Management (TSMT) Message, Full Push Through

Report, Role & Baseline Acceptance/Rejection. SME may

not be able to familiarize with them in a short period.

6 BPO is completely new and never tested by time before.

There may be unpleasant surprises and loopholes for the

parties to overcome.

7 There is no precedent case on BPO to refer to in litigation

whereas there are plenty of legal cases in each country for

UCP 600. Litigants cannot estimate their chance in wining the

case.

8 BPO has no ICC Banking Commission official opinions as

in UCP 600 for parties to determine compliance.

9 BPO has no interpretation tool such as ISBP 745 for UCP

600 to end disputes by explaining the underlying intent and

clarification on grey areas, if any.

12

10 In DOCDEX, mediation and arbitration, the adjudicators have

to deal with the applicable law as specified in the BPO. This

will narrow the scope of available adjudicators.

11 The judges and panel of jurors are not familiar with URBPO

750. This may create unpleasant surprises for the parties.

Also litigation will be more time consuming and more

costly.

12 It needs time for DOCDEX experts to learn the skills in

understanding URBPO 750 in depth in order to resolve the

BPO disputes from parties.

13 In open account trade, the buyer is usually the dominating

party and it may not wish to lose the benefits in paper

based trading (e.g. delays in payment, simple

documentation and lower costs) now taken away by the

BPO.

14 Hence the BPO has the best opportunity to succeed in the

supply chain trading where it has no competition.

13

Conclusions

1 In open account trading and supply chain management,

the BPO has a good window of opportunity for success as

there is no tool in the market place available to compete with

BPO.

2 In letter of credit operations, the eUCP 1.1 will win over

URBPO 750 for reasons already elaborated above.

3 Unless extensive free seminars and training are provided

by SWIFT and ICC, and heavy promotions by banks

worldwide, the success of BPO is not easy.

4 The adjudicators in DOCDEX, mediation, arbitration have to

be trained for URBPO 750 to give faith to the parties to use

BPO.

5 The bad practice of some banks to fabricate

discrepancies in UCP 600 in order to increase revenue must

not be carried to URBPO 750. Otherwise the BPO will be

killed by them prematurely.

14

15

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Control and On-Off Valves GuideDokument87 SeitenControl and On-Off Valves Guidebaishakhi_b90100% (3)

- STS - (3000K 6000K) - H1 Smart Transformer Station Installation GuideDokument105 SeitenSTS - (3000K 6000K) - H1 Smart Transformer Station Installation GuideSav SashaNoch keine Bewertungen

- A Handbook of World Trade A Strategic Guide To Trading InternationallyDokument497 SeitenA Handbook of World Trade A Strategic Guide To Trading InternationallyDhulkifl Bey100% (1)

- Book Review-Drafting and Negotiating Int. Commercial ContractsDokument5 SeitenBook Review-Drafting and Negotiating Int. Commercial ContractsKhan Majlis ReshadNoch keine Bewertungen

- Eurox Cross Flow ScrubberDokument8 SeitenEurox Cross Flow ScrubberRobin LayogNoch keine Bewertungen

- Understand Centrifugal CompressorDokument16 SeitenUnderstand Centrifugal Compressorramanathan72-1100% (2)

- Skybox Security Sales&Tech OverviewDokument46 SeitenSkybox Security Sales&Tech Overviewerdem100% (1)

- SANY SSR180C 8 OM EN PreviewDokument31 SeitenSANY SSR180C 8 OM EN Previewzaploc.admNoch keine Bewertungen

- Bank Payment ObligationDokument8 SeitenBank Payment ObligationKhan Majlis ReshadNoch keine Bewertungen

- BPO - Draft 2 Mexico - With CommentsDokument28 SeitenBPO - Draft 2 Mexico - With CommentsKhan Majlis Reshad0% (1)

- Bangladesh Bank Order, 1972: (President's Order No. 127 of 1972)Dokument27 SeitenBangladesh Bank Order, 1972: (President's Order No. 127 of 1972)Shamsur RahmanNoch keine Bewertungen

- Managing Core Risks of Financial InstitutionsDokument45 SeitenManaging Core Risks of Financial InstitutionsKhan Majlis ReshadNoch keine Bewertungen

- Banks Policy DepositsDokument8 SeitenBanks Policy DepositsKhan Majlis ReshadNoch keine Bewertungen

- RMG Feb2012Dokument144 SeitenRMG Feb2012Saad48Noch keine Bewertungen

- FD I Survey Jan Jun 2011Dokument47 SeitenFD I Survey Jan Jun 2011shobu_iujNoch keine Bewertungen

- Facts Sheet BPODokument3 SeitenFacts Sheet BPOKhan Majlis ReshadNoch keine Bewertungen

- Market Disclousres Unde RBASEL-II 2009Dokument8 SeitenMarket Disclousres Unde RBASEL-II 2009Khan Majlis ReshadNoch keine Bewertungen

- Registration Order 1981Dokument8 SeitenRegistration Order 1981Khan Majlis ReshadNoch keine Bewertungen

- Trade Payment MethodsDokument6 SeitenTrade Payment MethodsKhan Majlis ReshadNoch keine Bewertungen

- FF Issues Payment Terms Export Financing ResourcesDokument6 SeitenFF Issues Payment Terms Export Financing Resourcesaiou687Noch keine Bewertungen

- National Budget Speech 2011-12Dokument194 SeitenNational Budget Speech 2011-12nhsajibNoch keine Bewertungen

- Registration Order 1981Dokument8 SeitenRegistration Order 1981Khan Majlis ReshadNoch keine Bewertungen

- Export Policy of BangladeshDokument19 SeitenExport Policy of BangladeshMir S. SauhridNoch keine Bewertungen

- Bangladesh Foreign Exchange Regulations Act 1947Dokument20 SeitenBangladesh Foreign Exchange Regulations Act 1947Dev Prosad DNoch keine Bewertungen

- International Trade GuidesDokument8 SeitenInternational Trade GuidesKhan Majlis ReshadNoch keine Bewertungen

- The CompaniesDokument184 SeitenThe CompaniesRalph JohnsonNoch keine Bewertungen

- International Trade Payment MethodsDokument2 SeitenInternational Trade Payment MethodsSCRIBD1868100% (1)

- TradeTutorials IntroductionDokument6 SeitenTradeTutorials IntroductionKhan Majlis ReshadNoch keine Bewertungen

- International Trade Payment MethodsDokument2 SeitenInternational Trade Payment MethodsSCRIBD1868100% (1)

- E Bankign TermsDokument19 SeitenE Bankign TermsKhan Majlis ReshadNoch keine Bewertungen

- The Resume WritingDokument3 SeitenThe Resume WritingKhan Majlis ReshadNoch keine Bewertungen

- IAS29Dokument2 SeitenIAS29Khan Majlis ReshadNoch keine Bewertungen

- Ifrs 7 Financial InstrumentsDokument7 SeitenIfrs 7 Financial InstrumentsKhan Majlis ReshadNoch keine Bewertungen

- E Bankign TermsDokument19 SeitenE Bankign TermsKhan Majlis ReshadNoch keine Bewertungen

- Microstructures and Mechanical Properties of Ultrafine Grained Pure Ti Produced by Severe Plastic DeformationDokument10 SeitenMicrostructures and Mechanical Properties of Ultrafine Grained Pure Ti Produced by Severe Plastic Deformationsoni180Noch keine Bewertungen

- LNMIIT Course Information Form: A. B. C. D. E. FDokument2 SeitenLNMIIT Course Information Form: A. B. C. D. E. FAayush JainNoch keine Bewertungen

- Geometric Design of Highways for EngineersDokument39 SeitenGeometric Design of Highways for EngineersZeleke TaimuNoch keine Bewertungen

- MPTK Medium Pressure Pump Performance SpecsDokument2 SeitenMPTK Medium Pressure Pump Performance SpecssaronandyNoch keine Bewertungen

- حل جميع المعادلات الكهربائيةDokument60 Seitenحل جميع المعادلات الكهربائيةGandhi HammoudNoch keine Bewertungen

- Plett DawsonDokument270 SeitenPlett DawsonRaghu0% (1)

- Pink Fun Doodles and Blobs Math Online Class Creative Presentation SlidesCarnivalDokument28 SeitenPink Fun Doodles and Blobs Math Online Class Creative Presentation SlidesCarnivalraine castorNoch keine Bewertungen

- Oracle Database Question Bank 1Dokument5 SeitenOracle Database Question Bank 1subbaraomca2010Noch keine Bewertungen

- RS-485 2X227 AWG SFUTP PVC - 9FY7F1V129 - V - 1 - R - 1Dokument2 SeitenRS-485 2X227 AWG SFUTP PVC - 9FY7F1V129 - V - 1 - R - 1jeffv65Noch keine Bewertungen

- Social Engineering: An Attack Vector Most Intricate To Handle!Dokument20 SeitenSocial Engineering: An Attack Vector Most Intricate To Handle!ishak8Noch keine Bewertungen

- D72140GC10 46777 UsDokument3 SeitenD72140GC10 46777 UsWilliam LeeNoch keine Bewertungen

- OceanPixel Abundo Marine Renewable Energy An Emerging OptionDokument96 SeitenOceanPixel Abundo Marine Renewable Energy An Emerging OptionjopaypagasNoch keine Bewertungen

- Slurry Flo BrochureDokument4 SeitenSlurry Flo BrochureChristian Andres Campa HernandezNoch keine Bewertungen

- Stereoscopic Restitution Instruments: Materi Kuliah GD3204 Fotogrametri I, Semester I-2009/2010Dokument50 SeitenStereoscopic Restitution Instruments: Materi Kuliah GD3204 Fotogrametri I, Semester I-2009/2010ththaalNoch keine Bewertungen

- Updated After 11th BoS Course Curriculum - B.tech CSEDokument120 SeitenUpdated After 11th BoS Course Curriculum - B.tech CSEAnonymous 9etQKwWNoch keine Bewertungen

- Project Vision DocumentDokument5 SeitenProject Vision DocumentorjuanNoch keine Bewertungen

- The Next 20 Billion Digital MarketDokument4 SeitenThe Next 20 Billion Digital MarketakuabataNoch keine Bewertungen

- Infantry WeaponsDokument61 SeitenInfantry WeaponsKaran SahotaNoch keine Bewertungen

- HoltacDokument8 SeitenHoltacdargil66Noch keine Bewertungen

- Smart Payment MeterDokument2 SeitenSmart Payment MeterJesus Castro OrozcoNoch keine Bewertungen

- A Polypropylene Film With Excellent Clarity Combined With Avery Dennison Clearcut™ Adhesive Technology and With A Glassine LinerDokument4 SeitenA Polypropylene Film With Excellent Clarity Combined With Avery Dennison Clearcut™ Adhesive Technology and With A Glassine LinerAhmad HaririNoch keine Bewertungen

- Alpema Standerd For Brazed Aluminium Plate-Fin Heat ExchDokument78 SeitenAlpema Standerd For Brazed Aluminium Plate-Fin Heat ExchBilal NazirNoch keine Bewertungen

- 01 U3 Ws 1 Force DiagramsDokument4 Seiten01 U3 Ws 1 Force Diagramsapi-197108354Noch keine Bewertungen