Beruflich Dokumente

Kultur Dokumente

GPinvestments 11396

Hochgeladen von

scottleeyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

GPinvestments 11396

Hochgeladen von

scottleeyCopyright:

Verfügbare Formate

GP Investments, Ltd.

(a Bermuda company)

US$40,000,000

10% Perpetual Notes

GP Investments, Ltd., or the Issuer, a Bermuda company, is offering US$40,000,000 aggregate

principal amount of its 10% Perpetual Notes. The notes offered by this offering memorandum are called

the new notes. The new notes are being offered as additional debt securities under an indenture dated

January 23, 2007, pursuant to which the Issuer previously issued $150,000,000 of 10% Secured

Perpetual Notes. The notes issued on January 23, 2007 are called the initial notes. The initial notes and

the new notes are fully fungible and will constitute a single series of debt securities under the indenture and

are called collectively the notes. After giving effect to this offering, an aggregate of US$190,000,000 of

notes of this series will be outstanding. The Issuer will pay interest on the notes on January 23, April 23,

July 23 and October 23 of each year. The first interest payment on the new notes will be made on

October 23, 2007. The notes will be perpetual notes with no fixed final maturity date and will be repaid only

in the event that the Issuer redeems the notes or upon acceleration due to an event of default, as described

under Description of Notes. The notes will be general unsubordinated obligations of the Issuer and will

rank pari passu with the Issuers unsubordinated indebtedness. The obligations of the Issuer under the

initial notes were secured by a first priority pledge by the Issuer of shares representing 100% of the issued

and outstanding shares of GP Private Equity Ltd., or GPPE. The pledge was released following the

occurrence, on April 27, 2007, of the pledge release condition set forth in the indenture and the share

pledge agreement. The new notes will be issued only in denominations of US$100,000 and in integral

multiples of US$1,000 in excess thereof.

Application has been made to the Irish Financial Services Regulatory Authority, as competent authority

under Directive 2003/71/EC for the Offering Memorandum to be approved. Application has been made to

the Irish Stock Exchange for the new notes to be admitted to the Official List and trading on its regulated

market. Such approval relates only to the new notes which are to be admitted to trading on the regulated

market of Irish Stock Exchange or other regulated markets for the purposes of Directive 93/22/EEC or

which are to be offered to the public in any Member State of the European Economic Area.

Investing in the new notes involves risks. See Risk Factors beginning on page 23.

We have not registered the new notes under the U.S. Securities Act of 1933, as amended, or the

Securities Act, or under any state securities laws. Therefore, we may not offer or sell the new notes

within the United States or to, or for the account or benefit of, any U.S. person unless the offer or

sale would qualify for a registration exemption from the Securities Act and applicable state securities

laws. Accordingly, we are only offering the new notes (1) to qualified institutional buyers (as defined

in Rule 144A under the Securities Act) that are also qualified purchasers (as defined in the

Investment Company Act of 1940, as amended) and (2) to non-U.S. persons outside the United

States in compliance with Regulation S under the Securities Act. See Transfer Restrictions for

additional information about eligible offerees and transfer restrictions. None of the United States

Securities and Exchange Commission, or the SEC, the Irish Stock Exchange, the Bermuda Monetary

Authority, the Registrar of Companies in Bermuda, or any other securities authority has approved or

disapproved these securities or determined that this offering memorandum is accurate or complete.

Any representation to the contrary is a criminal offense.

The new notes have not been, and will not be, registered with the Brazilian Securities

Commission (Comisso de Valores Mobilirios), or CVM. Any public offering or distribution, as

defined under Brazilian laws and regulations, of the new notes in Brazil is not legal without such prior

registration under Law 6385/76.

The new notes will be delivered to purchasers in book-entry form through the facilities of

Euroclear Bank S.A./N.V., as the operator of the Euroclear System, or Euroclear, and Clearstream

Banking, socit anonyme, or Clearstream, on or about October 5, 2007.

Credit Suisse

The date of this offering memorandum is October 3, 2007.

TABLE OF CONTENTS

Page

PRESENTATION OF FINANCIAL AND OTHER

INFORMATION. . . . . . . . . . . . . . . . . . . . . . . . . . . 3

GLOSSARY. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

FORWARD-LOOKING STATEMENTS. . . . . . . . . . . 8

SUMMARY . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

THE OFFERING . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

SUMMARY FINANCIAL INFORMATION . . . . . . . . 20

RISK FACTORS . . . . . . . . . . . . . . . . . . . . . . . . . . . . 23

USE OF PROCEEDS . . . . . . . . . . . . . . . . . . . . . . . . . 34

TRACK RECORD . . . . . . . . . . . . . . . . . . . . . . . . . . . 35

CAPITALIZATION . . . . . . . . . . . . . . . . . . . . . . . . . . 38

EXCHANGE RATES . . . . . . . . . . . . . . . . . . . . . . . . . 39

SELECTED FINANCIAL AND OTHER

INFORMATION. . . . . . . . . . . . . . . . . . . . . . . . . . . 40

MANAGEMENTS DISCUSSION AND ANALYSIS

OF FINANCIAL CONDITION AND RESULTS OF

OPERATIONS . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

INDUSTRY OVERVIEW. . . . . . . . . . . . . . . . . . . . . . 65

Page

BUSINESS . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 69

MANAGEMENT . . . . . . . . . . . . . . . . . . . . . . . . . . . . 109

PRINCIPAL SHAREHOLDERS . . . . . . . . . . . . . . . . . 116

RELATED PARTY TRANSACTIONS . . . . . . . . . . . . 117

DESCRIPTION OF NEW NOTES . . . . . . . . . . . . . . . 119

SETTLEMENT AND CLEARANCE. . . . . . . . . . . . . . 138

DESCRIPTION OF SHARE CAPITAL. . . . . . . . . . . . 140

DIVIDENDS AND DIVIDEND POLICY . . . . . . . . . . 146

TAX CONSIDERATIONS . . . . . . . . . . . . . . . . . . . . . 147

PLAN OF DISTRIBUTION . . . . . . . . . . . . . . . . . . . . 153

NOTICE TO CANADIAN RESIDENTS. . . . . . . . . . . 157

TRANSFER RESTRICTIONS. . . . . . . . . . . . . . . . . . . 158

ERISA CONSIDERATIONS. . . . . . . . . . . . . . . . . . . . 160

LISTING AND GENERAL INFORMATION . . . . . . . 162

LEGAL MATTERS . . . . . . . . . . . . . . . . . . . . . . . . . . 163

INDEPENDENT AUDITORS . . . . . . . . . . . . . . . . . . . 163

INDEX TO FINANCIAL STATEMENTS . . . . . . . . . . F-1

APPENDIX AU.S. PURCHASERS LETTER . . . A-1

You should rely only on the information contained in this offering memorandum. We and the initial

purchasers have not authorized anyone to provide you with information that is different. If anyone

provides you with different or additional information, you should not rely on it. This offering

memorandum may only be used where it is legal to sell these securities. The information contained in this

offering memorandum may only be accurate on the date hereof regardless of the time of delivery of this

offering memorandum or of any sale of the new notes. Neither the delivery of this offering memorandum

nor any sale made hereunder shall under any circumstances imply that there has been no change in our

affairs or in the affairs of our subsidiaries or that the information set forth herein is correct as of any date

subsequent to the date hereof.

In this offering memorandum, the terms GP Investments, Issuer, we, us, our and our company

mean, unless otherwise indicated, GP Investments, Ltd.

The term GP Group refers to GP Investimentos S.A. and its affiliates through which the GP Partners or

the Founders, as the case may be, have been conducting their activities under the brand name GP. This offering

memorandum is being furnished by us in connection with an offering exempt from registration under the

Securities Act and applicable state securities laws solely for the purpose of enabling a prospective investor to

consider the purchase of the new notes. Delivery of this offering memorandum to any person or any reproduction

of this offering memorandum, in whole or in part, without our and the initial purchasers prior consent, is

prohibited. The information contained in this offering memorandum has been provided by us and other sources

believed by us to be reliable. The initial purchasers make no representation or warranty, express or implied, as to

the accuracy or completeness of the information contained in this offering memorandum. Nothing contained in

this offering memorandum is, or shall be relied upon as, a promise or representation by the initial purchasers as

to the past or future.

i

This offering memorandum has been prepared solely for use in connection with the proposed offering of the

new notes described herein and does not purport to summarize all of the terms, conditions, covenants and other

provisions contained in the indenture, the new notes or other transaction documents. The information provided is

not all-inclusive and may not contain all the information that may be relevant to you. This offering memorandum

is personal to each offeree and does not constitute an offer to any other person or to the public generally to

subscribe for or otherwise to acquire such securities.

We are relying on an exemption from registration under the Securities Act for offers and sales of securities

that do not involve a public offering. Our new notes offered through this offering memorandum are subject to

restrictions on transferability and resale, and may not be transferred or resold in the United States except as

permitted under the Securities Act and applicable U.S. state securities laws pursuant to registration or exemption

from them. The new notes offered hereby have not been recommended by the United States Securities and

Exchange Commission, or the SEC, or any state or foreign securities commission or any regulatory authority.

The foregoing authorities have not confirmed the accuracy or determined the adequacy of this offering

memorandum. Any representation to the contrary is a criminal offense.

By purchasing these securities, you are required to make certain acknowledgements, representations and

warranties and agreements described under the heading Transfer Restrictions in this offering memorandum

(see also ERISA Considerations).

You should be aware that you may be required to bear the financial risks of this investment for an indefinite

period of time. In making an investment decision, you must rely on your own examination of our business and

the terms of this offering, including the merits and risks involved.

You must comply with all applicable laws and regulations in force in any jurisdiction in which you

purchase, offer or sell our new notes or possess or distribute this offering memorandum and must obtain any

consent, approval or permission required for your purchase, offer or sale of our new notes under the laws and

regulations in force in any jurisdiction to which you are subject or in which you make such purchases, offers or

sales, and neither we nor the initial purchasers will have any responsibility therefor. This offering does not

constitute an offer to sell or a solicitation of an offer to buy the new notes to any person in any jurisdiction where

it is unlawful to make such an offer or solicitation.

We reserve the right to withdraw this offering at any time and we and the initial purchasers reserve the right

to reject any commitment to subscribe for the new notes, in whole or in part, and for any reason, and to allot to

you less than all of the new notes offered to you.

This offering is being made solely on the basis of the information contained in this offering memorandum.

Investors should take this into account when making investment decisions.

In connection with the issue of the new notes, Credit Suisse Securities (USA) LLC (or persons acting on its

behalf) may over-allot new notes or effect transactions with a view to supporting the market price of the new

notes at a level higher than that which might otherwise prevail. However, there is no assurance that Credit Suisse

Securities (USA) LLC (or persons acting on its behalf) will undertake stabilization action. Such stabilizing, if

commenced, may be discontinued at any time, and must be brought to an end after a limited period.

This communication is directed only at persons who (i) are outside the United Kingdom, or (ii) are

investment professionals falling within Article 19(5) of the Financial Services and Markets Act of 2000

(Financial Promotion) Order 2001 (the Order) or (iii) are persons falling within Article 49(2)(a) to (d) (high

net worth companies, incorporated associations etc.) of the Order (all such persons together are being referred to

as relevant persons). This communication must not be acted on or relied on by persons who are not relevant

persons. Any investment or investment activity to which this communication relates is available only to relevant

persons and will be engaged in only with relevant persons.

1

This offering memorandum constitutes a prospectus for the purposes of the Directive 2003/71/EC of the

European Parliament and of the Council of 4 November 2003 on the prospectus to be published when securities

are offered to the public or admitted to trading, or the Prospectus Directive.

We and the initial purchasers are not making any representation to any purchaser of the securities regarding

the legality of an investment in the securities by such purchaser under any legal investment or similar laws or

regulations. You should not consider any information in this offering memorandum to be legal, business or tax

advice. You should consult your own attorney, business advisor and tax advisor for legal, business and tax advice

regarding an investment in the securities.

This offering memorandum contains summaries intended to be accurate with respect to certain terms of

certain documents, but reference is made to the actual documents, all of which will be made available to you

upon request to us, for complete information with respect thereto, and all such summaries are qualified in their

entirety by such reference.

You hereby acknowledge that (i) you have been afforded an opportunity to request from us and to review,

and have received, all additional public information considered by you to be necessary to verify the accuracy of,

or to supplement, the information contained herein, (ii) you have had the opportunity to review all of the

documents described herein, (iii) you have not relied on the initial purchasers or any person affiliated with the

initial purchasers in connection with any investigation of the accuracy of such information or the investment

decision and (iv) no person has been authorized to give any information or to make any representations

concerning us or the new notes (other than those contained in this offering memorandum and information given

by our duly authorized officers and employees in connection with your examination of us and the terms of this

offering) and, if given or made, you should not rely upon any such other information or representation as having

been authorized by us or the initial purchasers.

Consent under the Exchange Control Act 1972 (and its related regulations) has been obtained from the

Bermuda Monetary Authority for the issue and transfer of our securities, including the new notes, to and between

non-residents of Bermuda for exchange control purposes provided our shares remain listed on an appointed stock

exchange, which includes the Luxembourg Stock Exchange and Irish Stock Exchange. This offering

memorandum will be filed with the Registrar of Companies in Bermuda in accordance with Bermuda law. In

granting such consent and in accepting this offering memorandum for filing, neither the Bermuda Monetary

Authority nor the Registrar of Companies in Bermuda accepts any responsibility for our financial soundness or

the correctness of any of the statements made or opinions expressed in this offering memorandum.

NOTICE TO NEW HAMPSHIRE RESIDENTS

NEITHER THE FACT THAT A REGISTRATION STATEMENT OR AN APPLICATION FOR A

LICENSE HAS BEEN FILED UNDER RSA 421-B WITH THE STATE OF NEW HAMPSHIRE NOR

THE FACT THAT A SECURITY IS EFFECTIVELY REGISTERED OR A PERSON IS LICENSED IN

THE STATE OF NEW HAMPSHIRE IMPLIES THAT ANY DOCUMENT FILED UNDER RSA 421-B

IS TRUE, COMPLETE AND NOT MISLEADING. NEITHER ANY SUCH FACT NOR THE FACT

THAN AN EXEMPTION OR EXCEPTION IS AVAILABLE FOR A SECURITY OR A TRANSACTION

MEANS THAT THE SECRETARY OF STATE OF THE STATE OF NEW HAMPSHIRE HAS PASSED

IN ANY WAY UPON THE MERITS OR QUALIFICATIONS OF, OR RECOMMENDED OR GIVEN

APPROVAL TO, ANY PERSON, SECURITY OR TRANSACTION. IT IS UNLAWFUL TO MAKE, OR

CAUSE TO BE MADE, TO ANY PROSPECTIVE PURCHASER, CUSTOMER OR CLIENT ANY

REPRESENTATION INCONSISTENT WITH THE PROVISIONS OF THIS PARAGRAPH.

2

PRESENTATION OF FINANCIAL AND OTHER INFORMATION

All references herein to U.S. dollars, dollars, US$ or $ are to U.S. dollars. All references to the

real, reais or R$ are to the Brazilian real, the official currency of Brazil. All references herein to Euros

or are to the euro, the official currency of the European Union.

On June 29, 2007, the exchange rate for reais into U.S. dollars was R$1.926 to $1.00, and on December 31,

2006, the exchange rate for reais into U.S. dollars was R$2.138 to $1.00, based on the exchange rate as reported

by the Central Bank of Brazil, or Central Bank. The real/dollar exchange rate may fluctuate widely, and the

exchange rate as of the above dates may not be indicative of future exchange rates. See Exchange Rates for

information regarding exchange rates for the Brazilian currency.

Certain figures included in this offering memorandum have been subject to rounding adjustments.

Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that

precede them.

Financial Statements

Through March 15, 2006 we were domiciled in the British Virgin Islands and maintained our books and

records in the British Virgin Islands and in U.S. dollars, in accordance with applicable law. We prepare our

consolidated financial statements in accordance with accounting principles generally accepted in the

United States of America, or U.S. GAAP. We do not prepare and publish unconsolidated financial statements in

U.S. dollars; however, we do prepare unaudited unconsolidated financial statements in reais in U.S. GAAP, with

reconciliation to the accounting practices adopted in Brazil, which we refer to hereinafter as Brazilian GAAP,

which are based on Brazilian Law No. 6,404/76, as amended, and the accounting standards issued by the

Brazilian Institute of Independent Accountants (Instituto dos Auditores Independentes do Brasil), and the

Brazilian Federal Accounting Council (Conselho Federal de Contabilidade), for filing with the Brazilian

Securities Commission (Comisso de Valores Mobilirios), or the CVM. Our audited consolidated financial

statements as of December 31, 2006, 2005 and 2004, prepared in accordance with U.S. GAAP, are included in

this offering. Our unaudited condensed consolidated interim financial information as of June 30, 2007 and for the

six-month periods ended June 30, 2007 and 2006 are also included in this offering.

The preparation of financial information requires management to make estimates and assumptions that

affect the reported amounts of assets, liabilities, revenue and expenses and related disclosures in the financial

information. Actual results could differ from those estimates.

The condensed consolidated interim financial information as at June 30, 2007 and for the six-month periods

ended June 30, 2007 and 2006 are unaudited. This condensed consolidated interim financial information includes

all adjustments consisting of normal recurring adjustments which, in the opinion of our management, are

necessary for a fair presentation of our consolidated financial position, results of operations and cash flows for

the interim periods presented.

The unaudited condensed consolidated interim financial information should be read in conjunction with our

financial statements prepared for the year ended December 31, 2006. Our results for the six-month period ended

June 30, 2007 are not necessarily indicative of the results reported by us for the entire year ending December 31,

2007.

The accounting policies adopted in preparing this unaudited interim financial information are consistent

with those used by us in the preparation of our audited financial statements for the year ended December 31,

2006.

Certain of our subsidiaries prepare their financial statements in accordance with Brazilian GAAP. All assets

and liabilities of the foreign subsidiaries which do not use U.S. dollars as their reporting currency are translated

3

into U.S. dollars at the exchange rate prevailing at the date of the balance sheet, while statements of income and

of cash flow accounts are translated at the average rates of exchange in effect during the applicable periods. The

related translation adjustments are recorded directly to the cumulative translation adjustment account in

shareholders equity.

In December 2005, we effected a corporate reorganization whereby certain activities that were formerly

conducted by the GP Group, including the ownership of certain assets and liabilities, were distributed as a

dividend in kind to our controlling shareholder, Partners Holdings. These assets and liabilities include the general

partner of GPCP1 (which had, as of that date, a net book value of $4.0 million) and the general partner of GPCP2

(which had, as of that date, net book value of $8.8 million). During 2005 and 2004, certain other payments of

dividends in kind were effected to compensate shareholders withdrawing from our company.

On April 20, 2006, we completed the sale of our stake in GPRE, which contained our real estate business.

In addition, on May 10, 2006, we completed the transfer of the rights and obligations arising from the

management of GP Tecnologia to GP Tecnologia Administradora de Ativos Ltda., a subsidiary of Partners

Holdings, which also acquired from us our interest in that fund for $2 million; no gain or loss was recorded from

those transactions.

As of and for the six-month period ended June 30, 2007, as well as for the year ended December 31, 2006,

the application of EITF 04-5 (see Managements Discussion and Analysis of Financial Condition and Results of

Operations) caused us to consolidate the line items of GPCP3 in the financial statements of GP3, which in turn

are consolidated with our financial statements. The remaining 53.14% equity interest in GPCP3, held by the

limited partners of GPCP3, are classified as minority interest. Therefore, since January 1, 2006, all assets and

liabilities, as well as the revenues and expenses, of GPCP3 are reported on our consolidated balance sheet and

income statement, respectively, and the assets and liabilities not held by us, as well as the corresponding

revenues and expenses, are presented as minority interest in a single line item. In principle, the same accounting

treatment will be given regarding GPCP4.

In June 2007, the American Institute of Certified Public Accountants (AICPA) issued Statement of

Position 07-1, Clarification of the Scope of the Audit and Accounting Guide Investment Companies and

Accounting by Parent Companies and Equity Method Investors for Investments in Investment Companies,

(SOP 07-1). The new guidance clarifies which entities are within the scope of the AICPA Audit and

Accounting Guide, Investment Companies (the Guide). Prior to the release of SOP 07-1, the definition of an

investment company was unclear, which led to inconsistent application of the Guide. SOP 07-1 also addresses

whether companies that own or have significant stakes in an investment company should retain the specialized

financial-statement accounting that the Guide prescribes for the investment company industry. The provisions of

the SOP are effective for fiscal years beginning on or after December 15, 2007, although earlier application is

encouraged. As of December 31, 2006 and June 30, 2007, the Company accounted at fair value the investments

owned by GPCP3 in accordance with the Guide. If in future periods, GPCP3 does not meet the definition of an

investment company as defined in SOP 07-1, GPCP3 will need to review the accounting treatment adopted for its

investments and conclude if the investments should be accounted for using the cost method, the equity method or

the consolidation instead of using the fair value accounting. The Company is also addressing the impacts on the

other entities included in the consolidated financial statements (including GPCP4).

Market Share and Other Information

We obtained the market and competitive position data, including market forecasts, used throughout this

offering memorandum from internal surveys, market research, publicly available information and industry

publications. We have made these statements on the basis of information from third-party sources that we believe

are reliable, such as the Venture Equity Latin Americas 2005 Year-End Report, or VE-LA, the Brazilian

Institute of Geography and Statistics, or IBGE, and the Central Bank, among others. Industry and government

4

publications, including those referenced here, generally state that the information presented therein has been

obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not

guaranteed. Although we have no reason to believe that any of this information or these reports are inaccurate in

any material respect, we have not independently verified the competitive position, market share, market size,

market growth or other data provided by third parties or by industry or other publications. Neither we nor the

initial purchasers make any representation as to the accuracy of such information.

The performance measurement technique EVA referenced in this offering memorandum is a registered

trademark of Stern Stewart & Co.

5

GLOSSARY

BOVESPA . . . . . . . . . . . . . . . . . . . . . . . . . . So Paulo Stock Exchange (Bolsa de Valores de So Paulo)

Central Bank. . . . . . . . . . . . . . . . . . . . . . . . . Central Bank of Brazil

CMN . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Brazilian National Monetary Council (Conselho Monetrio Nacional)

Code. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . U.S. Internal Revenue Code of 1986, as amended

Companies Act. . . . . . . . . . . . . . . . . . . . . . . Bermuda Companies Act 1981, as amended

CVM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Brazilian Securities Commission (Comisso de Valores Mobilirios)

EBITDA . . . . . . . . . . . . . . . . . . . . . . . . . . . . earnings before interest, taxes, depreciation and amortization

EVCA . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . European Venture Capital Association

Exchange Act . . . . . . . . . . . . . . . . . . . . . . . . U.S. Securities Exchange Act of 1934, as amended

Fair Value . . . . . . . . . . . . . . . . . . . . . . . . . . . Our board of directors estimate of fair value

Founders . . . . . . . . . . . . . . . . . . . . . . . . . . . . Jorge Paulo Lemann, Carlos Alberto Sicupira, Marcel Hermann

Telles and Roberto Thompson Motta

GP Asset . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Administrao de Recursos S.A.

GP Group . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investimentos S.A. and its affiliates through which the GP

Partners or the Founders, as the case may be, have been conducting

their activities under the brand name GP

GP Partners or Partners . . . . . . . . . . . . . . . Antonio Bonchristiano, Fersen Lamas Lambranho, Carlos Medeiros,

Octavio Lopes, Eduardo Alcalay, Marcio Trigueiro and Danilo

Gamboa

GP1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investments I, Ltd., the general partner of GPCP1

GP2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investments II, Ltd. the general partner of GPCP2

GP3 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investments III (Cayman) Ltd., the general partner of GPCP3

GP4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investments IV, Ltd., the general partner of GPCP4

GPCP1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Capital Partners, L.P.

GPCP2. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Capital Partners II, L.P.

GPCP3. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Capital Partners III, L.P.

GPCP3 Partnership Agreement. . . . . . . . . GPCP3 limited partnership agreement, as amended

GPCP4. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Capital Partners IV, L.P.

6

GPCP4 Partnership Agreement. . . . . . . . . GPCP4 limited partnership agreement, as amended

GPCM . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Cash Management, Ltd.

GPPE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Private Equity Ltd.

GPRE. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Prosperitas Investimentos S.A. (formerly named GP Investimentos

Imobilirios S.A.)

GP Tecnologia . . . . . . . . . . . . . . . . . . . . . . . GP Tecnologia Multimercado Fundo de Investimento em Quotas de

Fundos de Investimento em Ttulos e Valores Mobilirios

IBGE . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Brazilian Institute of Geography and Statistics (Instituto Brasileiro de

Geografia e Estatstica)

Investment Company Act. . . . . . . . . . . . . . U.S. Investment Company Act of 1940, as amended, and the related

rules

Irish Listing Agent . . . . . . . . . . . . . . . . . . . NCB Stockbrokers Limited

Irish Paying Agent. . . . . . . . . . . . . . . . . . . . HSBC Institutional Trust Services (Ireland) Limited

IRR. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . internal rate of return

Legal Representative. . . . . . . . . . . . . . . . . . Antonio Bonchristiano, as legal representative in Brazil

Partners Holdings . . . . . . . . . . . . . . . . . . . . Partners Holdings, Inc.

PFIC. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Passive foreign investment company

Principal Paying Agent, Transfer Agent,

Registrar . . . . . . . . . . . . . . . . . . . . . . . . . . HSBC Bank plc

Prospectus Directive . . . . . . . . . . . . . . . . . . Directive 2003/71/EC of the European Parliament and of the Council

of 4 November 2003 on the prospectus to be published when

securities are offered to the public or admitted to trading

SEC . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . U.S. Securities and Exchange Commission

Securities Act . . . . . . . . . . . . . . . . . . . . . . . . U.S. Securities Act of 1933, as amended

Similar Laws . . . . . . . . . . . . . . . . . . . . . . . . laws or regulations that are similar to the fiduciary responsibility or

prohibited transaction provisions contained in Title I of ERISA or

Section 4975 of the U.S. Internal Revenue Code

Trustee, Paying Agent, Escrow Agent

and Collateral Agent. . . . . . . . . . . . . . . . HSBC Bank USA, National Association

U.S. GAAP. . . . . . . . . . . . . . . . . . . . . . . . . . accounting principles generally accepted in the United States

VE-LA. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Venture Equity Latin Americas 2005 Year-End Report

7

FORWARD-LOOKING STATEMENTS

This offering memorandum contains estimates and forward-looking statements, principally in Risk

Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations and

Business. Some of the matters discussed concerning our business operations and financial performance include

estimates and forward-looking statements within the meaning of the Securities Act and the Securities Exchange

Act of 1934, as amended, or the Exchange Act.

Our estimates and forward-looking statements are mainly based on our current expectations and estimates

on future events and trends, which affect or may affect our businesses and results of operations. Although we

believe that these estimates and forward-looking statements are based upon reasonable assumptions, they are

subject to several risks and uncertainties and are made in light of information currently available to us.

Our estimates and forward-looking statements may be influenced by the following factors, among others:

our ability to find suitable assets for investment;

our ability to arrange financing and implement our expansion plan;

our ability to compete and conduct our businesses in the future;

changes in our businesses;

inflation, interest rate fluctuations and other macroeconomic factors in the regions where we or our

investments operate;

changes in the laws and regulations applicable to the private investment market;

government interventions, resulting in changes in the economy, taxes, rates or regulatory environment;

other factors that may affect our financial condition, liquidity and results of our operations; and

other risks factors discussed under Risk Factors.

Investors should understand that the following important factors, in addition to those discussed elsewhere in

this offering memorandum, among others, could affect our future results and could cause results to differ

materially from those expressed in such forward-looking statements:

general economic conditions in Brazil, such as the rates of economic growth, fluctuations in exchange

rates or inflation;

general social and political conditions in Brazil; and

governmental intervention, resulting in changes to the economic, tax, tariff or regulatory environment in

Brazil or other countries in which we may operate.

The words believe, understand, may, will, estimate, continue, anticipate, intend, expect

and similar words are intended to identify estimates and forward-looking statements. Estimates and forward-

looking statements speak only as of the date they were made, and, except to the extent required by law, we

undertake no obligation to update or to review any estimate and/or forward-looking statement because of new

information, future events or other factors. Estimates and forward-looking statements involve risks and

uncertainties and are not guarantees of future performance. Our future results may differ materially from those

expressed in these estimates and forward-looking statements. In light of the risks and uncertainties described

above, the estimates and forward-looking statements discussed in this offering memorandum might not occur and

our future results and our performance may differ materially from those expressed in these forward-looking

statements due to, including, but not limited to, the factors mentioned above. Because of these uncertainties, you

should not make any investment decision based on these estimates and forward-looking statements.

8

SUMMARY

To understand the offering and the risks of investing in our new notes more fully, you should read this entire

offering memorandum carefully, especially the risks discussed under Risk Factors and the consolidated

financial statements and notes to those financial statements included elsewhere in this offering memorandum.

Overview

GP Investments

We are a Bermuda exempted company that consolidates certain of the activities of the GP Group, which is

generally considered a leader in private equity in Latin America. Our activities consist of our core private equity

business and our asset management business, and our mission is to generate higher than average returns for our

shareholders.

Our private equity business is conducted by us, either directly or by funds that we manage. In either case,

we will continue to seek to acquire privately negotiated control or joint-control equity positions in a number of

companies conducting businesses principally either located, or with significant business activities, in Brazil and,

to a lesser extent, in other Latin American countries.

We will continue to target investment opportunities that allow for enhancement of shareholder value

through improved management and operations, leveraging proven international business models adapted to the

Latin American marketplace.

Certain private equity activities that were formerly conducted by the GP Group, including the ownership of

certain assets and liabilities, have been spun-off from us prior to our initial public offering, concluded on

May 31, 2006. These include the general partner of GP Capital Partners, L.P., or GPCP1, and GP Capital

Partners II, L.P. or GPCP2, and the interests in a Brazilian technology private equity fund, or GP Tecnologia,

each of which is already in its divestiture period. We will not benefit from revenues arising from these assets. At

the GP Tecnologia general members meeting held on April 27, 2006, the members of GP Tecnologia approved

our replacement as manager of the fund, and transferred all rights and duties related to the management of such

fund to GP Tecnologia Administradora de Ativos Ltda., a subsidiary of Partners Holdings. The transfer was

effective May 10, 2006. In addition, on April 20, 2006, we completed the sale of our stake in GPRE, which

contained our real estate business.

We are led by experienced professionals, including Antonio Bonchristiano, Fersen Lamas Lambranho,

Carlos Medeiros, Octavio Lopes, Eduardo Alcalay, Marcio Trigueiro, and Danilo Gamboa, or the GP Partners,

and Allan Hadid, our CFO. The GP Partners have been with the GP Group for a combined period of

approximately 45 years and have more than 100 years of experience in private equity, operations and corporate

finance. The GP Partners possess a common, disciplined investment philosophy, a complementary set of skills

and a deep understanding of the Brazilian marketplace.

We seek to invest at attractive valuations in established companies with one or more of the following

characteristics: (i) products with strong market positions, (ii) primarily dependent upon private sector orders,

(iii) potential for significant productivity or growth increases, (iv) global competitive advantage, (v) customer-

driven, (vi) low technological risk, (vii) high proportion of export revenues, (viii) high barriers to entry and

(ix) replicable buyout model.

In addition to our core private equity business, we also conduct asset management activities, focusing on the

local Brazilian market, through our majority-owned subsidiary, GP Administrao de Recursos S.A., or GP

9

Asset. GP Asset is led by Nelson Rozental, who has more than 30 years of investment experience in the private

and public sectors in Brazil and has been a partner of the GP Group since 1999, Marcus Martino, who has been

with the GP Group since 1997, Mariano Figueiredo, who has been with the GP Group since 2004, and Marcos

Falco, who joined GP Group in 2007.

GP Assets current product offerings include fixed income funds, equity funds and hedge funds, all of which

focus on different risk profiles and investor bases. We expect our asset management business to benefit from

growth in demand for alternative asset management products in the wake of decreasing interest rates in Brazil.

History of the GP Group

Jorge Paulo Lemann, Carlos Alberto Sicupira, Marcel Hermann Telles and Roberto Thompson Motta, or the

Founders, started the GP Group in 1993 with the goal of conducting private equity activities in Latin America. At

its foundation, the GP Group was conceived as a partnership, in which employees had the opportunity to become

partners. As a result, the Founders gradually transferred the management and control of the GP Group to some of

the GP Partners, as part of a natural succession plan. Since 2001, the GP Partners have managed the GP Group

and, since 2003, the GP Partners have held voting control of the GP Group.

The GP Group has since its inception raised more than $2.6 billion from Brazilian and international

investors. The GP Group has raised five private equity funds:

GPCP1, which was closed in 1994 with $500 million of committed capital;

GPCP2, which was closed in 1997 with $800 million of committed capital;

GP Tecnologia, which was closed in 2000 with R$122 million (equivalent to $63.3 million as of

June 29, 2007) of committed capital;

GPCP3, which was closed in June 2006, with $250 million of committed capital. GP Investments is the

largest investor in GPCP3, representing 46.86% of the committed capital; and

GPCP4, which was closed in July 2007, with $1.03 billion of committed capital. GP Investments is the

largest investor in GPCP4, representing 39.02% of the committed capital. Under the GPCP4 Partnership

Agreement, GP4 may hold additional closings at any time until the earlier of (i) the date when the

aggregate capital commitments of all the partners, together with the entire capital commitments of any

parallel funds, reach $1.3 billion and (ii) November 15, 2007.

In addition, the GP Group has also raised, through its subsidiaries, a number of local public equity, debt and

real estate funds.

From 1994, the GP Group has made investments, through the above mentioned private equity funds, in 42

companies, with 31 of these investments realized for total proceeds of approximately $2.05 billion, producing a

realized annual internal rate of return of 22.3% in U.S. dollar terms and of 32.4% in reais terms as of August 31,

2007.

Our History and Ownership Structure

In 2003, GP Investments was created under the name GP Global, Inc. as part of a corporate reorganization,

which culminated in 2004 when certain of the GP Partners acquired substantially all of our capital. The

GP Partners have reorganized their ownership in GP Investments prior to its initial public offering, contributing

all of their shares to an intermediary holding company, Partners Holdings Inc., or Partners Holdings. Currently,

Partners Holdings is our controlling shareholder. In 2006, we were redomiciled to Bermuda from the British

Virgin Islands. See BusinessCorporate Reorganization.

10

As a result of the various corporate reorganizations that we have conducted, our corporate structure includes

the following entities:

GP Capital Partners IV,

LP (Cayman)

GP Investments,

Ltd. (Bermuda)

Partners

Holdings

25.4%

Free Float

74.6%

38.86%

0.001%

GP Cash Management

(Bahamas)

100%

GP Capital Partners III,

LP (Cayman)

GP Investments III

Ltd. (Cayman)

GP Investimentos S.A.

99.97%

64.5%

8%

100%

39.03%

GP Investments IV

Ltd. (Cayman)

GP Private Equity

(Bermuda)

GP Holdings, Inc

(Cayman)

GP Participaes S.A.

GP Investimentos Ltda.

Offshore

Brazil

GP Asset

Management Inc

(Panama)

100%

99.99%

60% (indirectly)

GP Administrao de

Recursos S.A.

99.99%

100% 100%

Note: The participation in GP Participaes S.A. is held indirectly.

Our Competitive Strengths

We believe that our competitive strengths include the following:

Experienced Professionals. We have a group of highly talented professionals, with a strong reputation in the

private equity industry. Our investment team has solid academic credentials and significant expertise in the private

equity and financial industries, having successfully completed private equity investments and exits in many

industries throughout various economic cycles in Brazil. Many of our executive officers also have direct experience

in operations. The GP Group has meaningful transaction experience, having completed 42 investments and 31 exits.

In the past two years alone, we have been involved in investments in Equatorial Energia S.A. (or Equatorial

Energia), Cemars holding company, Lupatech S.A. (or Lupatech), Fogo de Cho Churrascaria (Holding), LLC (or

Fogo de Cho), BR Malls S.A. (formerly Ecisa Participaes S.A. and Ecisa Engenharia S.A.) (or BR Malls),

Tempo Participaes S.A. (formerly IHH/USS) (or Tempo), BR Properties S.A. (or BR Properties), Magnesita S.A.

(or Magnesita) and Pride Latam, and the IPOs of Amrica Latina Logstica S.A. (or ALL), Submarino S.A. (or

Submarino), Gafisa S.A. (or Gafisa), Equatorial Energia, Lupatech and BR Malls, and six block trades. Our group

of 14 professionals (including the GP Partners) is the largest private equity-dedicated team in Brazil.

Unique Investment and Management Philosophies. Our value and control-oriented investment philosophy

is well-suited to the potentially volatile environment of most Latin American countries, by reducing valuation

risk and the uncertainty relating to investment exits. In addition, our clearly defined management philosophy,

based on strict cost control, lean organizational structures, talent development, meritocracy and business ethics,

implemented through a set of management tools mastered by the GP Group, allows us to achieve maximum

11

impact on acquired companies in a very short timeframe. The key element in our management philosophy is the

alignment of interests with our shareholders, attained by motivating our operating executives through the use of

share option plans and variable results-based compensation.

Reputation and Credibility. We believe GP is the premier brand for control-oriented investment firms in Latin

America, and that it is synonymous in Brazil with integrity, entrepreneurship, meritocracy and professionalism. These

qualities have helped the GP Group attract and retain top talent, source transactions, successfully complete deals and

find co-investors for larger deals, which we believe will continue to help us in the future.

Ability to Source Transactions. The network of contacts and corporate relationships that the GP Partners

have developed over the past years are essential to us in identifying and developing investment opportunities.

Our deal sourcing network includes portfolio company managers, corporate executives, entrepreneurs, private

equity firms, financial intermediaries and professional advisors. In addition, our local presence in Brazil, coupled

with our strong brand and reputation, enables us to source transactions that may not be available to a majority of

our competitors.

Attractive Publicly Traded Model. Unlike traditional private equity funds, we are not subject to standard

periodic capital return requirements that typically stipulate that funds can only be invested once and must be

returned to investors after a previously agreed time period. These provisions often force private equity funds to

seek liquidity on their investments more quickly than they otherwise would, potentially resulting in both a lower

overall return to investors and an adverse impact on their portfolio companies. The flexibility to make

investments with a long-term view and without the capital return requirements of traditional private investment

vehicles should provide us with the opportunity to generate higher returns on invested capital and should enable

us to be a better long-term partner for our portfolio companies. Furthermore, GP Investments is the first public

private equity company in Latin America.

Synergies from Our Asset Management Business. GP Asset has developed asset origination capabilities by

leveraging the GP Groups reputation, network of contacts and portfolio companies to invest in assets unique to

the Brazilian financial markets. Moreover, it benefits from the GP Groups institutional and personal

relationships in its ongoing fundraising efforts. The success of this venture should strengthen our image with the

financial community as well as with prospective portfolio companies.

The Initial Public Offering

GP Investments is the first publicly traded private equity company in Latin America. The decision to

become a public company was based on the Partners firm conviction that as a public company we significantly

increase our ability to perpetuate our position as a leading private equity firm. The capital raised with our initial

public offering represents an important competitive advantage for GP Investments, as it increases our ability to

pursue new deals independently of the availability of funds for private equity investments in Brazil and provides

us with the ability to use such leverage to increase our investment capacity. As a public company we also benefit

from a broader and more diverse investor base and gain flexibility in the timing of investments in, and exits from,

our portfolio companies.

Brazilian Private Equity Environment

We believe that the Brazilian private equity environment is attractive for the following reasons:

Macroeconomic Conditions. We believe the Brazilian economy, and more importantly, the private equity

investment environment, is in a period of sustained growth. In particular, the prudent fiscal and monetary policies

12

undertaken by successive Brazilian governments over the last decade, together with the implementation of

political reforms, have improved Brazils economic fundamentals and should contribute to higher growth. The

control over inflation, substantial current account surpluses along with an appreciation of the real, falling interest

rates and unemployment, and an increase in purchasing power should reduce long-term investment risk and

create opportunities for us.

Capital Scarcity. High short-term interest rates in Brazil have historically kept local investors (such as

pension funds and large financial institutions) out of the private equity market due to its longer-term, less liquid

features. In addition, very few local firms have the capacity to raise funds internationally, while international

firms have in the past shown low commitment to the region. In this context, the GP Group has alone raised

approximately 25% of all private equity capital invested in Brazil, from 1993 to 2004, according to data included

in Modelo Brasileiro de PE-VC, a FEA-USP (Faculdade de Economia e Administrao da Universidade de So

Paulo) academic thesis. This lack of competition for deals has so far reduced entry valuations in private

investmentsprofitable, growing companies are available in Brazil at much lower valuation multiples when

compared to deals seen in India and China, although there is no assurance that this will continue to be the case.

Increased Openness of the Brazilian Economy. Increased involvement of the Brazilian economy in the

global trade, which has resulted from the export boom over the past few years, is a powerful incentive for local

companies to increase their competitiveness. Private equity groups are likely to benefit from this trend, as it

should increase demand for equity capital and professional management.

Vibrant Financial Markets. The recent liquidity in the Brazilian public equity markets, if sustained, will

substantially reduce the uncertainty associated with exits from private equity investments. As an illustration, the

GP Group has taken public six (ALL, Submarino, Gafisa, Equatorial Energia, Lupatech and BR Malls) of its

portfolio companies in the last 3 years, having subsequently divested a significant portion of its interests in those

companies. In addition, the breadth of the credit markets should also benefit the private equity industry, by

creating the possibility of leveraged buy-outs and enhanced returns for equity investors.

Our Strategy

Private Equity Business

We seek attractive returns by acquiring and actively managing established assets in a wide range of

industries either located, or with significant business activities, in Brazil and, to a lesser extent, in other Latin

American countries.

We target investment opportunities that allow for enhancement of shareholder value through improved

management and operating techniques, leveraging proven international business models adapted to the Latin

American marketplace. The GP Group has historically created value by: (i) recruiting outstanding management

teams; (ii) taking an active role in formulating the strategy of portfolio companies; (iii) identifying and

facilitating relationships with strategic and financial partners; (iv) negotiating and arranging financings;

(v) timing and executing opportunistic exits; and (vi) where necessary or desirable, actively managing companies

on a day-to-day basis.

We operate under an operations-oriented strategy. This strategy includes:

Pursuing Opportunistic Deal Types. We focus on leveraged acquisitions, recapitalizations and growth

financings of established businesses in a variety of industries. These types of transactions may arise as a result of

an opportunity for: (i) consolidation in fragmented industries; (ii) divestitures by larger companies of non-core

assets; (iii) acquisitions of family-owned businesses in need of growth capital or a highly skilled management

team; and (iv) restructurings of fundamentally sound but poorly managed companies or the recapitalization of

13

under-capitalized companies. We believe that these situations may generate opportunities to make interesting

investments at attractive entry valuations.

Focusing on Varied Sectors. Many companies in Brazil lack the financial resources and professional

management required to position them for the next stage of growth. Many of these target companies can

experience a rapid increase in value from the professional oversight, strategic guidance and capital resources that

we offer, regardless of their sector of activity. We believe it is important to be flexible so that we may capitalize

on opportunities as they arise. At the same time, our rigorous industry analyses and the adherence to our

philosophy of focusing on businesses in which we can improve operating performance will reduce risks to our

investors.

Focusing on Mature Companies and Business Models. We invest in companies of a certain size (typically

over R$100 million in revenues, which corresponded, on June 30, 2007, to $51.9 million) because they tend to

have a series of advantages over smaller businesses, including: (i) need for a larger equity investment, resulting

in a smaller number of companies in the portfolio, consistent with our operations-oriented strategy, (ii) smaller

competition for deals, given the capital scarcity observed in Brazil, (iii) easier attraction of management talent,

and (iv) broader exit prospects due to higher interest from strategic acquirers and access to the capital markets.

Reducing Risk Through a Disciplined Investment Process. We focus on the risk/reward profile of each

prospective portfolio company. We seek to reduce risks by: (i) focusing on companies with leading market positions

and strong cash flow, (ii) engaging in extensive due diligence from the perspective of a long-term investor,

(iii) investing at low price to cash flow multiples, (iv) acquiring control or joint control positions, (v) adopting

low-leverage capital structures, and (vi) devising likely exit alternatives still in the investment phase.

Implementing Management Philosophy in Portfolio Companies. We maintain and replicate at our portfolio

companies the successful management philosophy that the GP Group has refined in its over 30 years of investing.

This philosophy, based on the principles of strict cost control, lean organizational structures, talent development,

meritocracy, and business ethics, is a powerful framework that helps us maximize the operating performance of

each acquired asset, and reduce risks.

Seeking Return over Invested Capital on Exits. As a public company with an indefinite life rather than a

private equity fund, we are able to manage our businesses without the requirement to sell within a specified time

period. We retain, however, the flexibility to pursue refinancings and dispositions when we believe such actions

will maximize shareholder returns.

Despite our broad sector focus, we follow a very disciplined investment approach, initially abiding by the

investment guidelines below. These investment guidelines were approved by our board of directors and any

changes to them must be approved by the affirmative vote of not less than 80% of our board of directors then in

office.

We do not invest in situations without control or shared control of target companies;

We do not enter into any projects which have been determined in good faith by a majority of our board

of directors to be start-up or greenfield projects, nor do we enter into the technology and biotech sectors,

industries where we cannot fully leverage our management expertise;

We decline any investment opportunity which has been determined in good faith by a majority of our

board of directors to be related to weapons, tobacco or other industries that have negative social and

environmental implications;

We follow certain diversification limits, ensuring that a single company or sector will not represent

more than 25% or 35% of our assets, respectively; and

We do not contract leverage in our balance sheet higher than 50% of our assets.

14

Our investments are made either directly by GPPE or through private equity funds that we manage.

We are subject to certain investing restrictions because of GPCP4s existing arrangements.

The GPCP4 Partnership Agreement, prohibits us from investing in any opportunity presented to the general

partner of GPCP4 (GP Investments IV Ltd., or GP4) or to the sponsor (as defined in the GPCP 4 Partnership

Agreement), that is suitable for GPCP4 without first offering such opportunity to GPCP4, subject to certain

specific exceptions. This prohibition is effective until the earlier of the end of the commitment period or the date

at which 90% of the committed amounts have been invested or committed to investment. During this period, we

would only be able to invest in transactions that are suitable for GPCP4, indirectly as a holder of partnership

interests in GPCP4 to the pro-rata extent of our commitment in GPCP4, or if the advisory committee of GPCP4

refuses such transactions. See BusinessGPCP4.

In addition, the GPCP4 Partnership Agreement prohibits us from co-investing in a transaction unless the

co-investment has been first offered to the partners of GPCP4 (which may include us or any of our affiliates) on a

pro-rata basis.

Similar investing restrictions used to apply to GPCP3 but have become inapplicable considering that, as of

August 31, 2007, GPCP3 was fully invested in six different companies (Equatorial Energia, Fogo de Cho, BR

Malls, Tempo, BR Properties and Magnesita).

We also maintain the flexibility of raising and managing other private equity funds with investors. As is

typical for managers of such funds, we may commit to acquire a portion of the interest in any such funds through

GPPE. GP Investments, Ltd., directly or through one of its subsidiaries, will be the general partner of any other

fund that we may raise in the future and will benefit from management fees and performance fees that we will

charge those other funds.

Asset Management Businesses

Our asset management business provides investment management and advisory services to institutional

clients, financial intermediaries, private clients and investment vehicles. Our goal in this business is to produce

superior risk-adjusted investment returns and provide diverse investment solutions for our clients.

We expect our asset management business to benefit from expected growth in demand in the wake of

decreasing interest rates in Brazil. In addition, we expect this business to leverage our brand and network of

contacts to quickly grow its assets under management and to develop superior asset origination capabilities.

Our registered office is located at Clarendon House, 2 Church Street, Hamilton, HM 11, Bermuda. We also

have an office located at Suite 411, fourth floor of the International Centre Building, in the City of Hamilton,

Bermuda, and a Legal Representative in Brazil, located at Av. Brigadeiro Faria Lima, 3900, 7 andar, 04538-132,

So Paulo, SP, Brazil, and our general telephone number is +55 11 3556-5505. The telephone number of our

investor relations department is +55 11 3556-5505. Our website is www.gp-investments.com. Our website and

the contents therein are not part of this offering memorandum.

15

THE OFFERING

Issuer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . GP Investments, Ltd.

The New Notes . . . . . . . . . . . . . . . . . . . . . . US$40,000,000 aggregate principal amount of the Issuers 10%

Perpetual Notes.

Issue Price. . . . . . . . . . . . . . . . . . . . . . . . . . . 100% of the principal amount, plus accrued interest, if any, from

July 23, 2007.

The new notes are being offered as additional debt securities under an

indenture dated January 23, 2007, pursuant to which the Issuer

previously issued $150,000,000 of 10% Secured Perpetual Notes. The

initial notes and the new notes are fully fungible and will constitute a

single series of debt securities under the indenture. The initial notes

were secured by a first priority pledge on 100% of GPPEs issued and

outstanding shares. The share pledge agreement and the security

interests granted thereby were terminated following the occurrence,

on April 27, 2007, of the pledge release condition set forth in the

indenture and the share pledge agreement.

Issue Date . . . . . . . . . . . . . . . . . . . . . . . . . . . October 5, 2007.

Maturity Date . . . . . . . . . . . . . . . . . . . . . . . . The new notes are perpetual notes with no fixed maturity date.

Optional Redemption at the Option of

the Issuer. . . . . . . . . . . . . . . . . . . . . . . . . . The Issuer may, on any interest payment date on or after January 23,

2012, and by giving at least 30 but not more than 60 days notice to

the noteholders, redeem the new notes in whole, but not in part, at the

then outstanding principal amount of the new notes, together with

accrued but unpaid interest and additional amounts, if any, as further

described in this offering memorandum under Description of

NotesRedemptionOptional Redemption.

Tax Redemption. . . . . . . . . . . . . . . . . . . . . . The new notes will be redeemable in whole, but not in part, at their

principal amount, plus accrued but unpaid interest and additional

amounts, if any, to the date of redemption, at the Issuers option at

any time in the event of certain changes affecting taxation described

in this offering memorandum under Description of

NotesRedemptionTax Redemption.

Debt Service Reserve Account . . . . . . . . . The Trustee has established and maintains in the United States a U.S.

dollar-denominated account (the Debt Service Reserve Account)

over which the Trustee will have sole and exclusive control and

exclusive right of withdrawal. Subject to certain exceptions, the Debt

Service Reserve Account shall be deemed to be Fully Funded so

long as, at any time, the funds on deposit therein are in an amount

sufficient to provide for the payment in full of the amounts due on the

notes on the following six interest payment dates. The Issuer may,

under certain circumstances, by giving notice to the Trustee no later

than three business days prior to a given interest payment date, make

16

payments of interest and additional amounts, if any, due and payable

on the notes on such interest payment date with funds held in the Debt

Service Reserve Account. Under certain circumstances, the Issuer

will be entitled to substitute a letter of credit, financial guarantee

insurance policy or other form of liquidity support for the Debt

Service Reserve Account. See Description of NotesDebt Service

Reserve Account.

Use of Proceeds . . . . . . . . . . . . . . . . . . . . . . The net proceeds of the issuance of the new notes by the Issuer will

be used to make acquisitions in accordance with its investment

strategy, including making follow-on investments in businesses

acquired from time to time, and for general corporate purposes.

Indenture . . . . . . . . . . . . . . . . . . . . . . . . . . . . The new notes will be issued under an Indenture between the Issuer,

HSBC Bank USA, National Association, as trustee, HSBC Bank plc,

as registrar, principal paying agent and transfer agent, and HSBC

Institutional Trust Services (Ireland) Limited, as Irish paying agent.

Interest Payment Dates. . . . . . . . . . . . . . . . January 23, April 23, July 23 and October 23 of each year,

commencing on October 23, 2007 with respect to the new notes.

Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . The new notes will bear interest from July 23, 2007 at the annual rate

of 10%, payable quarterly in arrears on each interest payment date.

Ranking . . . . . . . . . . . . . . . . . . . . . . . . . . . . . The new notes constitute general unsubordinated obligations of the

Issuer and will at all times rank pari passu among themselves and

with all other unsubordinated indebtedness of the Issuer.

Listing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Application has been made to the Irish Stock Exchange for the new

notes to be admitted to the Official List and trading on its regulated

market.

Ratings. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . The new notes will be rated by Standard & Poors and Fitch.

Covenants . . . . . . . . . . . . . . . . . . . . . . . . . . . The Indenture contains covenants that will:

prevent the Issuer and certain of its subsidiaries, other than

GPPE, from making certain investments;

limit the ability of the Issuer to create certain liens without

securing the notes;

limit the ability of the Issuer to amalgamate or consolidate with

or merge with or into, or convey, transfer or lease all or

substantially all of its assets to another person, unless the Issuer

complies with certain specified requirements;

limit the ability of the Issuer and certain of its subsidiaries to

enter into certain transaction with their affiliates; and

require the Issuer to provide certain reports to the Trustee.

17

Events of Default . . . . . . . . . . . . . . . . . . . . . The notes and the Indenture contain certain events of default,

consisting of, among others, the following:

Failure to the pay interest (including any related additional

amounts) on the notes when the same becomes due and payable,

and such default continues for a period of 30 days;

Failure to pay the principal (including any related additional

amounts) of the notes when the same becomes due and payable

upon acceleration or redemption or otherwise;

Failure to maintain the minimum required level of funds in the

Debt Service Reserve Account;

Failure to perform or comply with any covenants or agreements

in the notes or the indenture (other than those referred to above),

and such failure continues for 60 days after the notice specified

in the indenture;

Certain debt or guarantees of the Issuer or certain of its

subsidiaries equal to or exceeding US$2.5 million are not paid

when due or are accelerated;

A final, unappealable judgment for an amount equal to or greater

than US$2.5 million is rendered against the Issuer or certain of its

subsidiaries and continues unsatisfied for a period of 60 days;

and

Specified events of bankruptcy, liquidation or insolvency of the

Issuer or certain of its subsidiaries.

For a full description of the events of default, see Description of

NotesEvents of Default.

Additional Amounts . . . . . . . . . . . . . . . . . . All payments by the Issuer in respect of the new notes will be made

without withholding or deduction for or on account of any present or

future taxes, duties, assessments, or other governmental charges of or

on behalf of Bermuda, unless the Issuer is compelled by law to deduct

or withhold such taxes, duties, assessments, or governmental charges.

In such event, the Issuer will make such deduction or withholding,

make payment of the amount so withheld to the appropriate

governmental authority and pay such additional amounts as may be

necessary to ensure that the net amounts receivable by noteholders

after such withholding or deduction shall equal the respective

amounts of principal and interest which would have been receivable

in respect of the new notes in the absence of such withholding or

deduction. See Description of NotesAdditional Amounts.

Change of Control . . . . . . . . . . . . . . . . . . . . Upon the occurrence of a Change of Control (as defined in the

Indenture), noteholders will be entitled to require the Issuer to

purchase all or a portion of their new notes at 100% of their principal

amount, plus accrued and unpaid interest. See Description of

NotesChange of Control.

18

Transfer Restrictions. . . . . . . . . . . . . . . . . . The new notes have not been registered under the Securities Act and

the Issuer has not registered under the Investment Company Act.

Accordingly, the new notes are subject to limitations on transfers and

resales, as described under Transfer Restrictions.

Governing Law . . . . . . . . . . . . . . . . . . . . . . The Indenture, the new notes and all other transaction documents will

be governed by, and construed in accordance with, the laws of the

State of New York.

Clearance and Settlement. . . . . . . . . . . . . . The new notes will be issued in book-entry form through the facilities

of Euroclear Bank S.A./N.V., as the operator of the Euroclear System,

and Clearstream Banking, socit anonyme. Beneficial interests in

new notes held in book-entry form will not be entitled to receive

physical delivery of certificated notes except in certain limited

circumstances. For a description of certain factors relating to

clearance and settlement, see Settlement and Clearance.

Form and Denomination. . . . . . . . . . . . . . . The new notes will be issued in the form of one or more global notes

in fully registered form without interest coupons only in

denominations of US$100,000 and integral multiples of US$1,000 in

excess thereof.

19

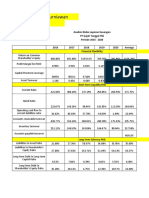

SUMMARY FINANCIAL INFORMATION

The following summary financial data has been derived from our consolidated financial statements. The

summary financial data as of and for the years ended December 31, 2006, 2005 and 2004 have been derived from

our audited consolidated financial statements included in this offering memorandum. The summary financial data

as of June 30, 2007, and for the six-month periods ended June 30, 2007 and 2006 has been derived from our

unaudited condensed consolidated interim financial information. Such condensed consolidated interim financial

information includes all recurring ordinary adjustments that, in the opinion of our management, are required for

the proper disclosure of our consolidated financial position, our results of operations and the cash flows in such

interim periods. The accounting policies applied in the preparation of this unaudited condensed consolidated

interim financial information are consistent with the policies applied in the preparation of our audited financial

statements for the annual period ended on December 31, 2006. Our consolidated financial statements are

prepared in accordance with U.S. GAAP.

This financial information should be read in conjunction with our consolidated financial statements and the

related notes and the sections entitled Presentation of Financial and Other Information, Selected Financial and

Other Information and Managements Discussion and Analysis of Financial Condition and Results of

Operations included elsewhere in this offering memorandum. The condensed consolidated interim financial

information should be read in conjunction with our consolidated financial statements prepared for the year ended

December 31, 2006. Our results for the six months ended June 30, 2007 are not necessarily indicative of the

results to be reported by us for the entire year ending December 31, 2007.

As of and for Six Months ended As of and for the Year ended

June 30,

2007(3)

June 30,

2006

December 31,

2006

December 31,

2005

December 31,

2004

(in thousands of US$, except per share data)

Consolidated Statement of Income Data

Revenues

Management and performance fees . . . . . . . . . . . . . . . . 8,567 12,112 15,519 1,565 713

Advisory fees and other services . . . . . . . . . . . . . . . . . . 487 487 1,453 478

Appreciation in fair value of trading securities . . . . . . 6,314 6,314 13,808

Realized gain . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11,806 3,464 4,385 12,908

Appreciation in fair value of investments of

consolidated Limited Partnerships . . . . . . . . . . . . . . 190,411 5,198 17,424

Equity in results of affiliated company . . . . . . . . . . . . . 28 146 10,314

Dividends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,025

Total Revenues. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 214,837 27,575 44,275 40,048 1,191

Expenses

General and administrative . . . . . . . . . . . . . . . . . . . . . . . (15,480) (7,766) (18,999) (2,720) (104)

Bonuses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,051) (3,637) (5,175) (5,440) (617)

Other, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 212 (27) (181)

Total Expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (18,319) (11,430) (24,355) (8,160) (721)

Financial income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15,526 12,303 23,732 858 189

Financial expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,340) (239) (456) (105)

Foreign exchange gain (loss) . . . . . . . . . . . . . . . . . . . . . . . . . . 31 (1,316) (1,321) (2,280) (1,493)

Financial income (expenses), net. . . . . . . . . . . . . . . . . . . . . . . 8,217 10,748 21,955 (1,527) (1,304)

Gain on sale of real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,546 2,546

Minority interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (110,018) (7,332) (16,778)

Income (loss) from continuing operations before

taxation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 94,717 22,107 27,643 30,361 (834)

Income tax and social contribution. . . . . . . . . . . . . . . . . . . . (403) (203) (1,168)