Beruflich Dokumente

Kultur Dokumente

Forfaiting: Dr. Prashanta K. Banerjee

Hochgeladen von

nurul0000 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten4 SeitenForfaiting

Originaltitel

Forfaiting New

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenForfaiting

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

35 Ansichten4 SeitenForfaiting: Dr. Prashanta K. Banerjee

Hochgeladen von

nurul000Forfaiting

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Forfaiting

Dr. Prashanta K. Banerjee

1. The term forfait is a French word, which means to give something or give up

ones right. Forfaiting refers to non-recourse financing of receivabes simiar to

factoring. !hie a factor norma" purchases a compan"s short-term receivabes,

a forfait ban# $ financia institution purchases trade bis$ promissor" notes that

are ong-term receivabes with ma%imum maturities of eight "ears. &t is on"

pertaining to internationa trade. Forfaiting had origina" deveoped in

'wit(erand after word war && in response to fet need for financing e%ports to the

)astern )urope for which financing was not avaiabe through the norma ban#ing

channes. *ow, goba", forfaiting voume stands at around +' , -. biion. &t

accounts for / 0. per cent of the tota internationa trade.

2. Forfaiting is we compared to e%port factoring with the difference that the

former finances notes$ bis arising out of deferred credit transactions for capita

goods spread over 1-2 "ears whereas factoring is essentia" a short-term

financing dea reating to the e%port of consumer goods. The forfaiting is a

hundred per cent financing arrangement on non-recourse basis. But the e%tent of

advance against receivabes with a factoring arrangement is on" partia, ranging

between 3.-2. per cent on recourse or without recourse basis. The forfaiters

decision to provide financing depends upon the financia standing of the avaiing

ban# whereas factors decision, particuar" in non-recourse, depends on the

credit standing of the e%porter. 4oreover, cost of forfaiting is eventua" borne b"

the overseas bu"er whereas in case of factoring it is usua" borne b" the seer.

---------------------------------------------------------------------------------------------------

5ssociate Professor, Bangadesh &nstitute of Ban# 4anagement

182

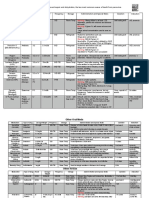

3. The mechanics of operation of forfaiting are presented in the following

Chart .

Mechanics of Forfaiting Transactions

Exporter 1 Importer

3

4 5 6 8 7 4

2

Exporters Bank Importer Bank

8 7

4 6

Forfaiter 8

5 7

4

Source: 4asarguppi, 5runa 6788/9, :5dvantage of Forfaiting, ;hartered

Financia 5na"st, *ovember, P.7. 6'ight" changed9.

79 ;ommercia contract between the e%porter and the importer.

-9 ;ommitment to forfait bis of e%change $ promissor" notes 6Debt instruments9.

19 Deiver" of goods b" the e%porter to the importer.

/9 Deiver" of debt instruments.

.9 )ndorsement of debt instruments without recourse in favour of the forfaiter.

<9 ;ash pa"ment of discounted debt instruments.

39 Presentation of debt instruments on maturit".

29 Pa"ment of debt instruments on maturit".

183

4. The benefits accruing to the e%porter are numerous. The e%porter receives the

fu e%port vaue minus the cost of forfaiting for credit transactions from the

forfaiter. !ith forfaiting, the e%porter can easi" avai credit periods of /-3 "ears .

The finance is provided without recourse. This means that the fuctuations in

interest rates and e%change rates do not matter during the commitment period.

The e%porter has, therefore, an assurance of receiving pa"ment notwithstanding

the ris#s regarding the bu"er, the bu"ers ban# and the bu"ers countr". The

e%porters botherations about administering the saes edger and coection of

pa"ments are aso ta#en over b" the forfaiter. This gives considerabe reief to

e%porters. 4oreover, the forfaiter does not insist on getting credit insurance from

officia agencies.

.. Forfaiting concudes the dea for the medium and arge e%port contract. The

internationa forfaiting agencies do not accept contracts to forfait bis ess than

=.. miion +' doars on a singe dea. &t is most" imited to capita goods. &t is

estimated that 2= to 2. per cent of the forfaiting mar#et toda" invoves the capita

goods e%porting . >owever, with growing e%ports, products i#e commodities,

eather, d"es, etc. are aso coming under the forfaiting umbrea. Forfaiting can be

used when ?overnment e%port credits or credit guarantees are not avaiabe. &t

aso hepfu for the sma si(ed companies because it enabes them to negotiate

transactions that norma" e%ceed their financia capabiities

<. Forfaiters are @uite active in Paris, ?eneva, Aienna, Brusses, etc . &n &ndia,

the )B&4 ban# has aread" received green signa from the CB& to faciitate e%port

financing through forfaiting. 4oreover, >ong Kong Ban#, 4eghraj Financia

'ervices, *atwest Ban#, &ndo 5va and 5B* 54CD Ban# offer forfaiting services

. 5ccording to their annua reports, the" have aread" faciitated forfaiting

services for commercia vehices, printed cotton fabrics, mechanica power

transmission, gems, etc. &n Bangadesh, forfaiting is "et to catch up. The main

reasons ma" be ac# of awareness among the e%porting communit", and itte

184

voume and ow amount of capita goods e%port. 4oreover, neither ?overnment

nor ban#s have ta#en an" step to aunch this e%port-promoting too.

3. For forfaiting to be successfu, e%istence of the secondar" mar#et is an

essentia condition. 5 forfaiter ma" not be incined to hod the discounted bis $

notes upto maturit" because of its own cash fow consideration. &n the secondar"

mar#et, forfaiters bu" and se these bis in the usua manner in which the

traditiona securities are traded. >owever, ever" transaction in the secondar"

mar#et is done on without recourse basis. &n that case, the hoder of the paper

6forfaited bi9 can go on" to the origina guarantor 6the ban#9 and not to the

previous forfait owner, or to the e%porter.

185

Das könnte Ihnen auch gefallen

- BNK601 Short Notes Banking Laws & PracticesDokument7 SeitenBNK601 Short Notes Banking Laws & PracticesNasir MuhammadNoch keine Bewertungen

- Unctad - Marine Cargo Claims Adjustment and Recoveries - Old But GoldDokument17 SeitenUnctad - Marine Cargo Claims Adjustment and Recoveries - Old But GoldRafa da PiliNoch keine Bewertungen

- Loans & Advances Basic Bank LTDDokument19 SeitenLoans & Advances Basic Bank LTDZubair RazaNoch keine Bewertungen

- Deficit-Solution-Lies-In-Exports/ Text - 103644.html: C. GoldDokument17 SeitenDeficit-Solution-Lies-In-Exports/ Text - 103644.html: C. GoldNikita NamaNoch keine Bewertungen

- F Exchange OkDokument22 SeitenF Exchange OkZubair RazaNoch keine Bewertungen

- Explanation of SecuritizationDokument15 SeitenExplanation of SecuritizationForeclosure Fraud100% (15)

- Basic Training Manual-For Retail Sales PersonnelDokument21 SeitenBasic Training Manual-For Retail Sales Personnelmnasir_virgo14Noch keine Bewertungen

- BFS L0 Ques464Dokument360 SeitenBFS L0 Ques464Aayush AgrawalNoch keine Bewertungen

- Indian Banking SystemDokument8 SeitenIndian Banking SystemAnonymous kwi5IqtWJNoch keine Bewertungen

- BANKING AND INSURANCE SERVICES OVERVIEWDokument68 SeitenBANKING AND INSURANCE SERVICES OVERVIEWPowerCutPuneethNoch keine Bewertungen

- BFS L0 QuesDokument360 SeitenBFS L0 QuesShubhamKaseraNoch keine Bewertungen

- 15 Cebu Contractors v. CADokument4 Seiten15 Cebu Contractors v. CAJon SantosNoch keine Bewertungen

- Financial DerivativesDokument5 SeitenFinancial Derivativessushant1903Noch keine Bewertungen

- Guide To For Fa It IngDokument21 SeitenGuide To For Fa It IngcristiansaitariuNoch keine Bewertungen

- Insurance Law: Sunlife Assurance, GR No. 158085, October 14, 2005)Dokument2 SeitenInsurance Law: Sunlife Assurance, GR No. 158085, October 14, 2005)Sharmen Dizon GalleneroNoch keine Bewertungen

- PrepartionDokument31 SeitenPrepartionbaapanil100% (1)

- Chapter Twenty-One Managing Liquidity Risk On The Balance SheetDokument15 SeitenChapter Twenty-One Managing Liquidity Risk On The Balance SheetBiloni KadakiaNoch keine Bewertungen

- Bank Guarantee Types and UsesDokument12 SeitenBank Guarantee Types and UsesmydeanzNoch keine Bewertungen

- Report On FranchisingDokument3 SeitenReport On Franchisingjimmyfunk56Noch keine Bewertungen

- Bonds and CourtsDokument2 SeitenBonds and CourtsfiremanswifeNoch keine Bewertungen

- An Introduction To Contract AdministrationDokument3 SeitenAn Introduction To Contract AdministrationjaffnaNoch keine Bewertungen

- Module 2.11 ForfaitingDokument33 SeitenModule 2.11 ForfaitingdiviprabhuNoch keine Bewertungen

- Chapter 7 Revenue Recognition: Learning ObjectivesDokument16 SeitenChapter 7 Revenue Recognition: Learning Objectivessamuel_dwumfourNoch keine Bewertungen

- Truth in Lending (RA 3765)Dokument2 SeitenTruth in Lending (RA 3765)Solomon Malinias BugatanNoch keine Bewertungen

- CIMA P3 Notes - Performance Strategy - Chapter 13Dokument8 SeitenCIMA P3 Notes - Performance Strategy - Chapter 13Suresh Madhusanka Rodrigo50% (2)

- Exposure and Risk in International FinanceDokument25 SeitenExposure and Risk in International Financeravi_nyseNoch keine Bewertungen

- BanksandbankingDokument6 SeitenBanksandbankingRene SmithNoch keine Bewertungen

- Le Fax D'adamowiczDokument16 SeitenLe Fax D'adamowiczLaurent MAUDUITNoch keine Bewertungen

- Lending Risk ManagementDokument54 SeitenLending Risk ManagementFaraz Ahmed FarooqiNoch keine Bewertungen

- What Is Securitization2Dokument14 SeitenWhat Is Securitization2John Foster100% (2)

- Credit Management BasicDokument8 SeitenCredit Management BasicShohid ZamanNoch keine Bewertungen

- SECURED TRANSACTIONS REMEDIESDokument33 SeitenSECURED TRANSACTIONS REMEDIESLisa Williams-McCallum100% (2)

- 15fighting ForeclosureDokument19 Seiten15fighting ForeclosureKeith Muhammad: Bey83% (6)

- Treatment of Securitized Transactions in Bankruptcy: April 2001Dokument6 SeitenTreatment of Securitized Transactions in Bankruptcy: April 2001Harpott GhantaNoch keine Bewertungen

- Collateral Support For DerivativesDokument2 SeitenCollateral Support For DerivativesitreasurerNoch keine Bewertungen

- NOTESDokument8 SeitenNOTESShruthi sNoch keine Bewertungen

- Credit Policy GuidelinesDokument4 SeitenCredit Policy Guidelinesnazmul099Noch keine Bewertungen

- Leach TB Chap12 Ed3Dokument7 SeitenLeach TB Chap12 Ed3bia070386Noch keine Bewertungen

- Project Finance SchemeDokument7 SeitenProject Finance SchemeLeilani JohnsonNoch keine Bewertungen

- 4) Net Working Capital:: Finance JargonsDokument4 Seiten4) Net Working Capital:: Finance JargonsnavyaekkiralaNoch keine Bewertungen

- Factoring in IndiaDokument16 SeitenFactoring in IndiadaveferalNoch keine Bewertungen

- Cat Telehandler Tl642 TBK Operation Parts and Maintenance ManualDokument22 SeitenCat Telehandler Tl642 TBK Operation Parts and Maintenance Manualrodneyjohnson111103faz100% (25)

- MBTC V BA Finance CorpDokument21 SeitenMBTC V BA Finance CorpHeidiNoch keine Bewertungen

- BNK601 Short Notes: Consortium FinanceDokument7 SeitenBNK601 Short Notes: Consortium FinanceRimsha TariqNoch keine Bewertungen

- Debt Instruments - FAQ: Personal FinanceDokument12 SeitenDebt Instruments - FAQ: Personal FinanceparulshinyNoch keine Bewertungen

- BC Tel Case - Article v2Dokument29 SeitenBC Tel Case - Article v2chinua_azubikeNoch keine Bewertungen

- Loss-Share Questions and AnswersDokument3 SeitenLoss-Share Questions and Answersdbush2778Noch keine Bewertungen

- SME financing through alternative productsDokument3 SeitenSME financing through alternative productsrajmirakshanNoch keine Bewertungen

- MBNA Credit Card ABSDokument6 SeitenMBNA Credit Card ABSOUSSAMA NASRNoch keine Bewertungen

- CF Assignment - Group 2Dokument11 SeitenCF Assignment - Group 2Poova RaghavanNoch keine Bewertungen

- OTC Derivatives General Paper 112010 AaaaDokument5 SeitenOTC Derivatives General Paper 112010 Aaaaredearth2929Noch keine Bewertungen

- Bunty BLCK BookDokument9 SeitenBunty BLCK BookSBI103 PranayNoch keine Bewertungen

- ForfaitingDokument14 SeitenForfaitingArun SharmaNoch keine Bewertungen

- Tenielle Appanna - The Two Important Doctrines Underlying Documentary Letters of Credit and The Fraud ExceptionDokument12 SeitenTenielle Appanna - The Two Important Doctrines Underlying Documentary Letters of Credit and The Fraud ExceptionRoy BhardwajNoch keine Bewertungen

- LC Basics: Intro to Letters of CreditDokument4 SeitenLC Basics: Intro to Letters of CreditNahid Ali Mosleh JituNoch keine Bewertungen

- Trade financing services for imports, exports, and inland tradeDokument4 SeitenTrade financing services for imports, exports, and inland tradeHabib KhanNoch keine Bewertungen

- G.R. No. 161135. April 8, 2005 Swagman Hotels and Travel, Inc., Petitioners, Hon. Court of Appeals, and Neal B. Christian, RespondentsDokument6 SeitenG.R. No. 161135. April 8, 2005 Swagman Hotels and Travel, Inc., Petitioners, Hon. Court of Appeals, and Neal B. Christian, RespondentsJenMarkNoch keine Bewertungen

- Stamp RequisitionDokument20 SeitenStamp Requisitionnurul000Noch keine Bewertungen

- Fixing Rate of Interest On Credit Card - Sep242020brpdl47Dokument1 SeiteFixing Rate of Interest On Credit Card - Sep242020brpdl47nurul000Noch keine Bewertungen

- Feb 232022 BR PDL 07Dokument1 SeiteFeb 232022 BR PDL 07amirentezamNoch keine Bewertungen

- Appointment of External Auditors in Financial Institutions - Apr302015dfim04eDokument3 SeitenAppointment of External Auditors in Financial Institutions - Apr302015dfim04enurul000Noch keine Bewertungen

- Name Change - Feb032019dfiml01Dokument1 SeiteName Change - Feb032019dfiml01nurul000Noch keine Bewertungen

- Driving Digital Innovation For A Sustainable Inclusive GrowthDokument209 SeitenDriving Digital Innovation For A Sustainable Inclusive Growthnurul000100% (1)

- E Vswks Cöwewa I BXWZ Wefvm: Evsjv 'K E VSK Cöavb KVH©VJQ XVKVDokument11 SeitenE Vswks Cöwewa I BXWZ Wefvm: Evsjv 'K E VSK Cöavb KVH©VJQ XVKVkhan knitwareNoch keine Bewertungen

- Write Off - Apr082015fid03Dokument1 SeiteWrite Off - Apr082015fid03nurul000Noch keine Bewertungen

- Application - Form of BkmeaDokument3 SeitenApplication - Form of Bkmeanurul000Noch keine Bewertungen

- Cheque Clearing FeeDokument1 SeiteCheque Clearing Feenurul000Noch keine Bewertungen

- Tolet or Lease of Floor Space - Aug052019dfiml13Dokument1 SeiteTolet or Lease of Floor Space - Aug052019dfiml13nurul000Noch keine Bewertungen

- Gross Cheque CalculationDokument1 SeiteGross Cheque Calculationnurul000Noch keine Bewertungen

- Avoidance of High Expenses For Luxurious Vehicles and Decoration - Nov182015dfim12eDokument1 SeiteAvoidance of High Expenses For Luxurious Vehicles and Decoration - Nov182015dfim12enurul000Noch keine Bewertungen

- Sep182018dfim03Dokument4 SeitenSep182018dfim03nurul000Noch keine Bewertungen

- A Xkvibvgv 'WJJ: 'WJJ Möwnzvi BVG I WVKVBV T BVG T GVT Avt Iv VK Dwki QweDokument6 SeitenA Xkvibvgv 'WJJ: 'WJJ Möwnzvi BVG I WVKVBV T BVG T GVT Avt Iv VK Dwki Qwenurul000Noch keine Bewertungen

- Application For Leave of AbsenceDokument1 SeiteApplication For Leave of Absencenurul000Noch keine Bewertungen

- K Xcyi Mve Iwrwó Awdm: GVQVT BVWQGV - Vgxi BVG T GVT LVKVDokument8 SeitenK Xcyi Mve Iwrwó Awdm: GVQVT BVWQGV - Vgxi BVG T GVT LVKVMohammad Kawsar HowladerNoch keine Bewertungen

- Accounting Job FunctionDokument1 SeiteAccounting Job Functionnurul000Noch keine Bewertungen

- ALM Maturity Profile 1Dokument8 SeitenALM Maturity Profile 1nurul000Noch keine Bewertungen

- Table-A: CAF (For Asset-Side Products) : Description of Loan/Lease FacilityDokument4 SeitenTable-A: CAF (For Asset-Side Products) : Description of Loan/Lease Facilitynurul000Noch keine Bewertungen

- Basel IIIDokument4 SeitenBasel IIInurul000Noch keine Bewertungen

- An Overview of ITPFDokument3 SeitenAn Overview of ITPFnurul000Noch keine Bewertungen

- Central BankDokument57 SeitenCentral Banknurul000Noch keine Bewertungen

- Bank Asia ATM LocationsDokument4 SeitenBank Asia ATM Locationsnurul000Noch keine Bewertungen

- Basel IIIDokument4 SeitenBasel IIInurul000Noch keine Bewertungen

- Payment Settlements R 2009Dokument8 SeitenPayment Settlements R 2009nurul000Noch keine Bewertungen

- ALM Maturity Profile 1Dokument8 SeitenALM Maturity Profile 1nurul000Noch keine Bewertungen

- Know Your Marketability Know Your Marketability Know Your Marketability Know Your MarketabilityDokument22 SeitenKnow Your Marketability Know Your Marketability Know Your Marketability Know Your Marketabilitynurul000Noch keine Bewertungen

- The Bankers' Book Evidence Act, 1891Dokument4 SeitenThe Bankers' Book Evidence Act, 1891nurul000Noch keine Bewertungen

- Kelayakan Kasiterit Dalam Tailing Pada Disposal TK 4.218 PT Timah TBK Desa Paku Kabupaten Bangka SelatanDokument4 SeitenKelayakan Kasiterit Dalam Tailing Pada Disposal TK 4.218 PT Timah TBK Desa Paku Kabupaten Bangka SelatanSusi Mariana SihombingNoch keine Bewertungen

- Apple Brochure Becky PimentelDokument2 SeitenApple Brochure Becky PimentelLeslieNoch keine Bewertungen

- Testing and inspection of electronic productsDokument22 SeitenTesting and inspection of electronic productsLyle Isaac L. IllagaNoch keine Bewertungen

- Rigor in Qualitative Research: The Assessment of TrustworthinessDokument9 SeitenRigor in Qualitative Research: The Assessment of TrustworthinessSyed Junaid AhmadNoch keine Bewertungen

- Two Brain MetricsDokument27 SeitenTwo Brain MetricsJay MikeNoch keine Bewertungen

- D 0116491 F Audibase 5 Operating ManualDokument76 SeitenD 0116491 F Audibase 5 Operating ManualRoa DanielNoch keine Bewertungen

- TPDokument2 SeitenTPbatuhanizmirli2Noch keine Bewertungen

- Scan0002 PDFDokument1 SeiteScan0002 PDFFranklin BanisterNoch keine Bewertungen

- Jeevani Research CorrectedDokument8 SeitenJeevani Research CorrectedRhyson 2009Noch keine Bewertungen

- Antibiotics - FosfomycinDokument2 SeitenAntibiotics - FosfomycinSsNoch keine Bewertungen

- BRCDokument237 SeitenBRCHitachiNoch keine Bewertungen

- Agarwood Oil-Grade S Sample-Chemical CompositionDokument6 SeitenAgarwood Oil-Grade S Sample-Chemical CompositionDinh xuan BaNoch keine Bewertungen

- Solutions To Session 6 Practice ProblemsDokument3 SeitenSolutions To Session 6 Practice ProblemsKeshav soodNoch keine Bewertungen

- Guidelines on safety devices for MEWPsDokument3 SeitenGuidelines on safety devices for MEWPsSamson Rajan BabuNoch keine Bewertungen

- XPol Panel iRCU 698–894 65° 16dBi 0°–10Dokument2 SeitenXPol Panel iRCU 698–894 65° 16dBi 0°–10Romina VargasNoch keine Bewertungen

- The Use of Systematic Desensitization in Psychotherapy: (A) Trigeminal Neuralgia (B) Glossopharyngeal NeuralgiaDokument4 SeitenThe Use of Systematic Desensitization in Psychotherapy: (A) Trigeminal Neuralgia (B) Glossopharyngeal NeuralgiaRaluca ElenaNoch keine Bewertungen

- Chapter 03 The Eye and RetinaDokument10 SeitenChapter 03 The Eye and RetinaSimrat WNoch keine Bewertungen

- Forms For AthleticsDokument12 SeitenForms For Athleticsneoclint100% (1)

- Cogbill Construction - Wear Pads BrochureDokument1 SeiteCogbill Construction - Wear Pads BrochureCogbillConstructionNoch keine Bewertungen

- Inlet Cooling SystemsDokument4 SeitenInlet Cooling SystemsMohamed RashidNoch keine Bewertungen

- Luce X: Type FST 3Dokument44 SeitenLuce X: Type FST 3Gabriel Montoya CorreaNoch keine Bewertungen

- Ethical Concerns in Family Therapy: Paulette M. Hines and Rachel T. Hare-MustinDokument7 SeitenEthical Concerns in Family Therapy: Paulette M. Hines and Rachel T. Hare-MustinPaula CelsieNoch keine Bewertungen

- 0222 Al Rajhi Takaful 21052011Dokument7 Seiten0222 Al Rajhi Takaful 21052011Abo Yaser60% (10)

- Northern Bottlenose WhaleDokument2 SeitenNorthern Bottlenose WhaleMaryam ShakirNoch keine Bewertungen

- 2019 - Parvo Med Chart Updated 2018Dokument2 Seiten2019 - Parvo Med Chart Updated 2018Joni KNoch keine Bewertungen

- 1990 4588 Pilothouse MotoyachtDokument32 Seiten1990 4588 Pilothouse MotoyachtDavid MortonNoch keine Bewertungen

- EMRO Newsletter #5 - What's Up EMRO?!Dokument17 SeitenEMRO Newsletter #5 - What's Up EMRO?!International Pharmaceutical Students' Federation (IPSF)Noch keine Bewertungen

- MPE080VG (A287) MPE060VG (A292) Parts Manual: Yale Materials Handling CorporationDokument182 SeitenMPE080VG (A287) MPE060VG (A292) Parts Manual: Yale Materials Handling CorporationАлександр ФедоровNoch keine Bewertungen

- Attachment 1, Conformed Technical Provision - Amendment 0002Dokument224 SeitenAttachment 1, Conformed Technical Provision - Amendment 0002bhavithavinaynNoch keine Bewertungen