Beruflich Dokumente

Kultur Dokumente

Aa

Hochgeladen von

shamim22Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Aa

Hochgeladen von

shamim22Copyright:

Verfügbare Formate

Circular No.

07/2014

F. No. 275/27/2013-IT(B)

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

New Delhi, the 4

th

March, 2014

All Chief Commissioners of Income-tax

All Directors General of Income-tax

Sub: Ex-post facto extension of due date for filing TDS/TCS statements for FYs 2012-13 and

2013-14 regarding

The Central Board of Direct Taxes (the Board) has received several petitions from

deductors/collectors, being an office of the Government (Government deductors), regarding

delay in filing of TDS/TCS statements due to late furnishing of the Book Identification Number

(BIN) by the Principal Accounts Officers (PAO) / District Treasury Office (DTO) / Cheque

Drawing and Disbursing Office (CDDO). This has resulted in consequential levy of fees under

section 234E of the Income-Tax Act, 1961( the Act).

2. The matter has been examined. In case of Government deductors, if TDS/TCS is paid

without production of challan, TDS/TCS quarterly statement is to be filed after obtaining the

BIN from the PAOs / DTOs / CDDOs who are required to file Form 24G (TDS/TCS Book

Adjustment Statement) and intimate the BIN generated to each of the Government deductors in

respect of whom the sum deducted has been credited. The mandatory quoting of BIN in the

TDS/TCS statements, in the case of Government deductors was applicable from 01-04-2010.

However, the allotment of Accounts Officers Identification Numbers (AIN) to the PAOs/

DTOs/CDDOs (a pre-requisite for filing Form 24G and generation of BIN) was completed in

F.Y. 2012-13. This has resulted in delay in filing of TDS/TCS statements by a large number of

Government deductors.

3. In exercise of the powers conferred under section 119 of the Act, the Board has decided

to, ex-post facto, extend the due date of filing of the TDS/TCS statement prescribed under sub-

section (3) of section 200 /proviso to sub-section (3) of section 206C of the Act read with rule

31A/31AA of the Income-tax Rules, 1962. The due date is hereby extended to 31.03.2014 for a

Government deductor and mapped to a valid AIN for -

(i) FY 2012-13 - 2

nd

to 4

th

Quarter

(ii) FY 2013-14 - 1

st

to 3

rd

Quarter

4. However, any fee under section 234E of the Act already paid by a Government deductor

shall not be refunded.

5. Timely filing of TDS/TCS statements is essential to ensure timely reconciliation of

Government accounts and for providing tax credit to the assessees while processing their

Income-tax Returns. Therefore, it is clarified that the above extension is a one time exception in

view of the special circumstances referred to above. Since the Government deductor and the

associated PAO/ DTO/ CDDO belong to the same administrative setup that regulates the

clearance of expenditure, the deductors/collectors may be advised to co-ordinate with the

respective PAO/DTO/CDDO to ensure timely receipt of BIN/filing of TDS/TCS statements.

6. This circular may be brought to the notice of all officers for compliance.

7. Hindi version shall follow.

(Sandeep Singh)

Under Secretary to Government of India

Copy to:

1. The Comptroller and Auditor General of India (40 copies)

2. All Secretaries of Government of India

3. Chief Secretaries/ Administrators of all the States and Union Territories of India

4. The DGIT (Systems) New Delhi for necessary action

5. The Director General of Income-tax, NADT, Nagpur

6. The Director (PR, PP & OL), Mayur Bhawan, New Delhi for printing in the quarterly tax

bulletin and for circulation as per usual mailing list (100 copies)

7. DIT (Systems-II), Commissioner of Income-tax, (CPC) TDS, Vaishali

8. All Commissioners of Income-tax (TDS)

9. Guard file

Das könnte Ihnen auch gefallen

- This Sheet Have Hidden Data Please Do Not Try To Alter This FileDokument1 SeiteThis Sheet Have Hidden Data Please Do Not Try To Alter This Fileshamim22Noch keine Bewertungen

- As - Is Feedback FormDokument1 SeiteAs - Is Feedback Formshamim22Noch keine Bewertungen

- Exit Mangement Plan-ITDokument1 SeiteExit Mangement Plan-ITshamim22Noch keine Bewertungen

- Government of Jammu and Kashmir Commercial Taxes Department Excise and Taxation Complex Rail Head JammuDokument2 SeitenGovernment of Jammu and Kashmir Commercial Taxes Department Excise and Taxation Complex Rail Head Jammushamim22Noch keine Bewertungen

- Quick Guide To Using This Utility For Ereturns: Color CodesDokument18 SeitenQuick Guide To Using This Utility For Ereturns: Color Codesshamim22Noch keine Bewertungen

- Mediclaim FormDokument1 SeiteMediclaim Formshamim22Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Innoprint Inti Perkasa, PT - PO00122117Dokument1 SeiteInnoprint Inti Perkasa, PT - PO00122117mario gultomNoch keine Bewertungen

- Versus - Case: de C I S I 0 NDokument16 SeitenVersus - Case: de C I S I 0 NRandy LorenzanaNoch keine Bewertungen

- Negotiable Instruments (3) - ChavezDokument22 SeitenNegotiable Instruments (3) - ChavezGian Reynold C. ParinaNoch keine Bewertungen

- Practical Auditing - C2 and C3 Suggested AnswersDokument4 SeitenPractical Auditing - C2 and C3 Suggested AnswersTammy Yeban100% (1)

- Ageasfederal: February 18, 2021Dokument3 SeitenAgeasfederal: February 18, 2021Jayanth RNoch keine Bewertungen

- Arthakranti BTT Budget Proposal - Advertorial PDFDokument1 SeiteArthakranti BTT Budget Proposal - Advertorial PDFAryann GuptaNoch keine Bewertungen

- Issuer On-Behalf ServicesDokument820 SeitenIssuer On-Behalf ServicesMunkhtsogt Tsogbadrakh100% (2)

- Spaze TowerDokument1 SeiteSpaze TowerShubhamvnsNoch keine Bewertungen

- Boat Airdopes 141 PDFDokument1 SeiteBoat Airdopes 141 PDFSantosh SharmaNoch keine Bewertungen

- Form16 W0000000 GS186523X 2021 20211Dokument1 SeiteForm16 W0000000 GS186523X 2021 20211Raman OjhaNoch keine Bewertungen

- Postpaid Monthly Statement: This Month's SummaryDokument4 SeitenPostpaid Monthly Statement: This Month's SummaryJinesh JadavNoch keine Bewertungen

- Bir Form No. 2304Dokument2 SeitenBir Form No. 2304mijareschabelita2Noch keine Bewertungen

- Definition of TaxDokument3 SeitenDefinition of TaxAbdullah Al Asem0% (1)

- General Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshDokument47 SeitenGeneral Banking Activities of Mutual Trust Bank LTD.: A Comparative Study On Five Commercial Banks in BangladeshMoyan HossainNoch keine Bewertungen

- Swiggy Order 58514422563Dokument2 SeitenSwiggy Order 58514422563SakshamNoch keine Bewertungen

- StrataxDokument40 SeitenStrataxAsh PadillaNoch keine Bewertungen

- Bhagya Viva ProjectDokument13 SeitenBhagya Viva ProjectBhagya sNoch keine Bewertungen

- Tax Final (Taxation 1) As at 5th October 2004Dokument275 SeitenTax Final (Taxation 1) As at 5th October 2004Victor J Odongo50% (4)

- DocumentDokument6 SeitenDocumentBala RajuNoch keine Bewertungen

- Fee Structure PDFDokument2 SeitenFee Structure PDFNarinderNoch keine Bewertungen

- MITC CCDokument12 SeitenMITC CCDeepak SinghNoch keine Bewertungen

- Sol. Man. - Chapter 13 - Acctg For Bot - 2020 EditionDokument4 SeitenSol. Man. - Chapter 13 - Acctg For Bot - 2020 EditionKathleen Rose BambicoNoch keine Bewertungen

- IFRS Chapter 10 The Consolidated Income StatementDokument34 SeitenIFRS Chapter 10 The Consolidated Income StatementJuBin DeliwalaNoch keine Bewertungen

- FinnairVisa Hinnasto Fi - Fi.enDokument2 SeitenFinnairVisa Hinnasto Fi - Fi.enbengaltigerNoch keine Bewertungen

- GST Kolhapur 1Dokument6 SeitenGST Kolhapur 1MukeshNoch keine Bewertungen

- Capital Gains - An Overview: Ca Ameet PatelDokument51 SeitenCapital Gains - An Overview: Ca Ameet PatelPrasun TiwariNoch keine Bewertungen

- Centrifuge Machine - InvoiceDokument1 SeiteCentrifuge Machine - InvoiceArindam HaldarNoch keine Bewertungen

- 252289600057294Dokument1 Seite252289600057294Pricila MercyNoch keine Bewertungen

- FESCO N Type Nov 2023Dokument1 SeiteFESCO N Type Nov 2023tanveerNoch keine Bewertungen

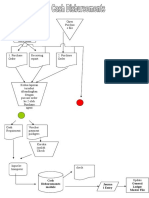

- Flowchart Account Payable & Cash DisbursementsDokument4 SeitenFlowchart Account Payable & Cash DisbursementsAlif Nur IrvanNoch keine Bewertungen