Beruflich Dokumente

Kultur Dokumente

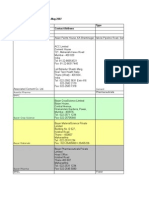

FICCI Gems & Jewellery

Hochgeladen von

kavenindiaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FICCI Gems & Jewellery

Hochgeladen von

kavenindiaCopyright:

Verfügbare Formate

Unlocking the Potential

of Indias

Gems & Jewellery Sector

A Knowledge Report

3 Unlocking the Potential of Indias Gems & Jewellery Sector |

Executive Summary 06

Introduction 09

Market Structure and Potential 11

Growth Drivers, Opportunities &

Challenges 13

Growth Drivers and Opportunities 13

Challenges 18

The Export Market 25

Recommendations 27

Recommendations for the Industry 27

Recommendations to the Government 30

About FICCI 33

About Technopak 34

Cont ent s

4 | Unlocking the Potential of Indias Gems & Jewellery Sector

Foreword

Welcome to the first edition of the Indian Gem and Jewellery industry Knowledge report prepared jointly

by FICC and Technopak. It is being brought out on the occasion of FICCIs International Conference for

the Indian Gem and Jewellery industry focusing on Opportunities Led Growth. We take this opportunity

to thank Technopak Advisors our Knowledge Partners, who have devoted their valuable time, resources

and expertise to prepare this document on our behest

The Indian gem and jewellery industry is at a very significant point in its development. During the last few

decades, the export side has developed, modernized and grown immensely and has been catering to

the global markets, particularly the USA. Meanwhile the much larger domestic industry continued with its

traditional structures and practices.

Since 2000, the export players began to get involved in the domestic industry, even as some of the larger

domestic jewellers began to adopt more contemporary business practices. In the context of the slowdown

in the US market over the last few years, and the global financial crisis that we experienced last year, this

process has further accelerated to a great extent.

The Indian domestic market has shown very promising signs, and there has been a stupendous growth

and increase in penetration of the brands and organized retail across the categories namely FMCG,

Durables, Apparels, and Home Improvement etc. There is a great potential for the gem and jewellery sector

to achieve similar growth.

While exports will continue to play an important role in earning foreign exchange and providing employment

to large numbers, we have to ensure that the domestic industry marches in step with the transformation

sweeping through other lifestyle segments, and modernizes itself in terms of products, outlook and business

practices. The socio-economic conditions are ripe for this change with the large youthful population that is

integrating with a global culture having significant disposable incomes.

Mehul Choksi, Chairman, Gems & Jewellery Committee, FICCI

5 Unlocking the Potential of Indias Gems & Jewellery Sector |

The large organized players within the industry have an important role to play in this process as they can

catalyse the growth of the industry, set higher standards and create more value across the value chain.

This FICCI-Technopak report looks at all these factors in detail and provides many relevant pointers for the

direction of change.

But a forward looking industry is not enough, a business environment conducive to growth is equally

essential. The industry has been interacting with the government, voicing our concerns and indicating the

direction of the changes we desire. Many of these areas have been summarized in the report. Bodies like

FICCI and other industry associations have to work together and with the government to hasten the pace

of policy change.

We thank Technopak for their effort at integrating their expertise with information and inputs gathered from

the stake holders in the industry to prepare this report that is both comprehensive and concise. It will surely

be appreciated widely throughout the industry and among policy makers.

FICCI would also like to acknowledge the efforts made by the members and stakeholders of the Gem &

Jewellery industry in various initiatives including this report and the Conference and hope that they will

provide a vigorous push to the growth of the industry in the years ahead.

Mehul Choksi

Chairman, Gems & Jewellery Committee

FICCI

6 | Unlocking the Potential of Indias Gems & Jewellery Sector

Executive Summary

Traditionally the focus of the gems and jewellery manufacturers has been on the large global markets.

Indeed for years, barring the last year or so, these international markets have given large and growing

business to the Indian exporters and have contributed in creation of significant jobs in the country. The

Indian players, duly supported by the Government of India are placed highly competitively in the market.

Hopefully with the revival of the international markets, the Indian players would again stand to gain.

We believe that the domestic market holds similar or even brighter potential for gems & jewellery sector.

The industry can be put on accelerated growth path provided the industry, the government and other

stakeholders plan and act on the initiatives required by the transforming market. In the process the industry

shall continue to generate large amounts of foreign exchange and employment to the Indian socio-

economic fabric.

The key drivers and growth opportunities for this sector are:-

Growing spending power: There is a great opportunity to capitalise on the growing spending power of

the Indians with increased discretionary spending such as that on Gems & Jewellery.

Organised players acting as catalysts: The organised players (includes current players who are

becoming more organised) would act as a catalyst in this transformation. Although the current proportion

of the organised sector is small at present, the available potential and growing momentum is very

encouraging.

Rationalised cost structures: One good aspect of the slowdown is that it has also controlled the

rampant rise in key input costs such as manpower and real estate and this should accelerate the recovery

and growth.

While the opportunities and drivers are strong we need to also surmount some of the key challenges: -

Changing share of wallet: While the share of wallet is changing for the Indian consumer towards

discretionary spending, other categories such as travel, entertainment, electronics etc are growing their

share at a faster rate. Thus, we need to position Gems & Jewellery as a sought after lifestyle product

especially amongst todays youth.

Mindset & Manpower: With the changing consumer and business environment there is also a need to

transform the mindset & manpower in the industry. The human resources and leaders in the industry will

need to adopt a more modern and professional approach towards work and management while they also

retain the best practices that our rich tradition in Gems & Jewellery has enabled us to cultivate. Bringing

in outside professionals in this sector will help accelerate the change.

Upgradation & Modernisation : Besides modernising manpower and mindset; the technology, systems

and processes also need to be upgraded and modernised. This would help not only to achieve the next

leap in growth but also to compete with rising international competition.

7 Unlocking the Potential of Indias Gems & Jewellery Sector |

Financing: To enable all this growth and transformation the flow of finances to this sector would also

need to be ramped up, especially to the unorganised retail.

To make the most of the opportunities and overcome the challenges we have identified a set of

recommendations for the industry and government. These should serve as a good starting point to kick-

start this proposed journey of higher growth and excellence.

Recommendations for the Industry

(a) Potential Assessment and Strengthening Consumer Understanding

There is dire need for the industry to first understand the various segments of the consumers and their

purchasing and shopping needs. The proposition, design and brands can be created around these

needs.

(b) Invest in Retailing and Brands

The organised retail and brands can provide impetus to the sector. Appropriate investments can potentially

put the category on a higher priority in the consumer basket and can generate the higher margins. An

overall investment of US $ 2 billion is required by for branded jewellery to achieve 15% share of the market.

A possible solution here is to create highly active Industry Co-ordination to bring together the outside

investors and industry stars.

(c) Improve skill sets & quality of people

The Gems & Jewellery industry needs to systematically and collectively invest in up gradation of the skill

sets of its workforce through increased training and manpower development programs. A joint effort by the

Industry to invest in the development of vocational training institutes could be a way forward with Industry

captains leading the efforts to underwrite recruitment of graduates and participate in syllabus design &

development.

(d) Enhance Product Design & Manufacturing Quality Standards

A National Institute of Jewellery Design & Development would go a long way in providing the platform for

development of a pipeline of innovative high quality designers that can serve the industry as a whole. If

Industry captains come together to invest in setting up the institute or expanding existing ones, efforts can

be made to lobby to obtain Government support and create national centres of excellence like NIFT with

multiple campuses and courses.

(e) Promote adoption of Industry wide standards for gaining consumer trust

Enhancement of product quality standards and incentives for increasing adoption of the standards will go

a long way in improving consumer trust and enable the industry to gain share of wallet of the consumer in

the long run. Eventually it will also help in the spread of e-selling in India which has seen a lot of success

in western markets.

(f) Co-operative use of resources

To bring down cost of operation and investments in the sector, industry players should adopt co-operative

use of technology and marketing. Even retail space can be hired by co-operatives when foraying into

international markets.

8 | Unlocking the Potential of Indias Gems & Jewellery Sector

Recommendations to the Government

Government and Apex bodies could act as facilitators in broadening the outlook of the exporters /players

and help them in familiarizing with the changing scenario both in the domestic and international fronts,

where moving up the value chain and adoption of modern practices has become compelling imperatives.

(a) Provide Industry status to Gems & Jewellery Sector

Special cell to look into specific needs of Industry- At ~US $15 bn, the domestic Gems & Jewellery industry

deserves the same attention and interest as a number of other industries such as Textiles & Steel. The

domestic Gems & Jewellery Retail sector could especially benefit a lot from Industry status. Creating

Technology Upgradation Fund (TUF) for facilitating the modernization of the manufacturing and design

facilities is another important initiative.

(b) Creation of Design Centers /Studios, Holding Fairs

The importance of design has been highlighted by us in this report. This can help significantly in moving

the industry from commoditized selling to design based selling.

(c) Asset (Gold) based leverage

This could help individual investors mortgage their gold and jewellery for credit. Perhaps RBI can think and

act on this suggestion which can potentially unlock significant value.

(d) Regulatory Laws & Taxation

There are some regulations which are restricting the growth of the industry such as search & seizure laws.

Perhaps there is case of rationalizing /removing these restrictive laws. At the same time there is dire need

to standardization in the industry, which can restore the credibility of the industry. In terms of taxation there

should be a continuation and further enhancements of tax benefits, notably deduction under section 10A /

10B / 10AA of the Income tax Act. Removal of Octroi from Mumbai will also go be a big help as the city is

a major hub of Gems & Jewellery.

(e) Modernize Labor Laws

This will enable Indian manufacturers to improve efficiencies, serve Indian consumers better and also grow

exports from India by allowing manufacturers to adopt more flexible labor practices.

(f) Increase the setting up of export focused SEZs

This would help to meet and the growing needs of exporters and create the infrastructure for even faster

export growth. The policy could also help to promote the spread of industry across India besides the

current pockets in western & southern India.

(g) Gold exchange

A physical or internet based exchange to trade precious metals could help the Indian population to

rediscover their age old investment preference for precious metals and jewellery which have time and

again proved to be safe instrument with good returns.

Unlocking the Potential of Indias Gems & Jewellery Sector | 9

01

Gems & Jewellery has had an important place in the Indian society and economy ever since civilization

dawned on the Indian soil. Exhibit 1 explains the traditional value served by Gems & Jewellery to us

In the last few decades the Gems & Jewellery sector has evolved far beyond its traditional roles. Today it

has become a major item of export leading to valuable foreign exchange earnings. The rapid growth in

domestic and export markets have lead also to employment growth and overall economic growth in the

country.

The sector is very people intensive and skilled

manpower is required throughout the value chain

for retailing, designing, jewellery manufacturing,

raw material processing and mining. The sector

has been one of the biggest employers to the

economically weaker sections of the society which

especially dominate the skill-based diamond cutting

& polishing and jewellery crafting (Karigar) trades.

India has used its abundant supply of manpower to

generate cost and skill advantages.

Traditionally the focus of the gems and jewellery

manufacturers has been on the large global markets.

Indeed for years, barring the last year or so, these

international markets have given large and growing

business to the Indian exporters and have contributed in creation of significant jobs in the country. The

Indian players, duly supported by the Government of India are placed highly competitively in this market.

Hopefully with the revival of the international markets, the Indian players would again stand to gain.

In the last few years, on the other hand, the Indian domestic market has shown very promising signs,

evident from the stupendous growth and increase in penetration of the brands and organized retail across

the categories namely FMCG, Durables, Apparels, and Home Improvement etc.

We believe that the Indian market holds similar or even brighter potential for gems & jewellery sector.

The industry can be put on an accelerated growth path provided the industry, the government and other

stakeholders plan and act on the initiatives required by the transforming market. In the process the industry

shall continue to generate large amounts of foreign exchange and employment to the Indian socio-

economic fabric.

Introduction

Precious

metals, gems

& even

jewellery

serve as an

economic

store of value

for investment

and trade

For the

traditional

Indian woman

jewellery is

still the most

important

fashion and

style

accessory

Gems and

precious metal

objects have a

great

astrological

and religious

significance

Gems &

jewellery are

an integral gift

and purchase

items for

special

occasions

such as

weddings and

ceremonies

Traditional Role of Gems & Jewellery

in Indian Society

Exhibit 1

10 | Unlocking the Potential of Indias Gems & Jewellery Sector

At this juncture when we prepare ourselves to take the higher growth trajectory for this sector we are

confronted with some pertinent questions: -

How can we take the industry to an accelerated path?

How can we ensure that the exports retain their competitiveness and leadership in dynamic world

economy?

How can we improve the quantity and quality of supply of manpower to this sector to support rapid

growth?

How can we move up the value chain to improve returns in this sector besides the revenues?

How can we improve financing for smoother operations (working capital) and rapid growth (long-term

debt, investment)? What role can the government play in this endeavor?

We have attempted to to answer some of these questions in this report. This document is based on the

extensive research, interaction with the various stakeholders and Technopak body of knowledge, attempts

to assess the enormous untapped opportunities and presents some known (still the need of the hour)

initiatives and some new initiatives which can perhaps be the starting point in the future journey.

Unlocking the Potential of Indias Gems & Jewellery Sector | 11

02

Through the ages, Gems & Jewellery has played a very pivotal role in weaving the social fabric of India.

Besides the ornamental value, jewellery remains an important savings and investment vehicle for most

Indians.

The two major sub-segments within jewellery are

gold (22kt and above) and diamonds, with the former

constituting 80% of the jewellery market, the balance

comprising diamonds and gemstone jewellery.

A major chunk of gold jewellery manufactured in

India is for domestic consumption, whereas a major

portion of polished diamonds or finished diamond

jewellery is exported.

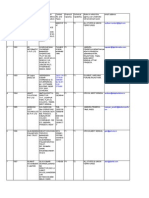

Overall Size: The Gems & Jewellery sector in India is currently pegged around US $ 44 billion of which US

$ 25 billion is exports.

Employment: The sector currently provides employment around 1.8 million people which is a significant

number. Majority of people employed in the sector are semi skilled and belong to economically weaker

sections of the society. The Gems & Jewellery sector is capable of creating additional employment for

around 1.1 million people in the next 5 years.

Domestic Market: Though the government has been proactive in promoting exports in Gems & Jewellery

sector, it now needs to take concrete steps to boost the domestic consumption as well. Even though

India is the largest consumer of gold in the world, the per capita consumption is almost 1/10th that of any

matured market.

The domestic market of Gems & Jewellery is

estimated to be in the US $ 18-20 billion range.

Given the fragmented nature of the industry it is

difficult to put a finger on the exact size. The industry

is expected to grow at around 13% annually and at

this rate it could reach US $ 35-40 billion by 2015.

Currently the domestic Gems & Jewellery market

is fragmented across the value chain. There are

more than 300,000 players across the Gems &

Jewellery sector, with majority of them being small

unorganised players who are operating on wafer thin

Market Structure and

Potential

Gems & Jewellery Sector pegged between US $43-45 billion

Exports (2009): US $ 25 billion

Domestic Industry (2009): US $ 18-20 billion

Employs 1.8 million people

Share of Organised Retail in Jewellery Retail: 4%-6%

Snapshot of the Industry

Domestic Market Size

(US $ Billion)

Exhibit 2

2009 2015

35

40

20

18

E

s

t

i

m

a

t

e

d

s

i

z

e

(

R

a

n

g

e

)

Source : Technopak Anaylsis

80

60

40

20

0

12 | Unlocking the Potential of Indias Gems & Jewellery Sector

margins. Organised retail of jewellery thus presents

a significant opportunity to create additional value

through higher margins, which would be possible

through differentiation and branding. .

With the onset of organised retail in the last decade,

lots of new players have entered the space. Currently

modern retail players in jewellery space have only

5%-7% share of the total jewellery market, but this

number would increase considerably in the near

future.

The major national players are Tanishq, Gitanjali,

Intergold and Rajesh Exports. Besides these there

are a lot of large regional players as well, such as B. C. Sen in East, P.P. Jewellers, Mehra Sons, Bhola Sons

in North, TBZ, Chintamani in West and Ganjam, C Krishniah Chetty & Sons in South.

Apart from the specialty retail players, lots of retail chains like Shoppers Stop, Lifestyle and Big Bazaar

now have jewellery counters from branded chains. Reliance Retail has entered the market with its chain

Reliance Jewels. The last few years has also seen the entry of international luxury jewellery brands in India

such as Cartier and Tiffanys. Besides the above mentioned brands, lots of jewellery exporters are also

actively looking at the domestic market and plan to open their retail outlets.

Most of the organised retail players, especially

Tanishq, have grown significantly in the last decade,

driven primarily by their value proposition, marketing

investments and by their easy to roll out formats.

The good part is that India is now beginning to move

towards branded jewellery and the consumers have

accepted the modern retail formats. Opportunities

for jewellery chains rely in the proposition of

differentiated styles at good prices.

Though, in spite of the confident march of organised

jewellery chains we strongly believe that the traditional

players would coexist with the modern players this

is in fact the trend in international markets where the

independents still hold significant share of the market as is evident from Exhibit 4 which depicts the retail

scenario in U.S.

Organised Retail in Different

Sectors

Exhibit 3

Apparel

20%

7% 6%

35%

11%

CDIT &

Mobiles

Jewellery

Footwear Books and

Music

Retail Market Organised Market

Source : Technopak Anaylsis

US Retail Scenario Exhibit 4

1987 1992 2004

Independents Discount store Jewellery chain

store

Non store

retailers

53%

23%

20%

4%

49%

24%

20%

7%

49%

22%

20%

9%

Source Tanishq Corporate Presentation

Unlocking the Potential of Indias Gems & Jewellery Sector | 13

03

Growth Drivers and Opportunities

Growing Spending Power

Despite recent slowdown, the move from a

Pyramid to a Diamond shaped structure of

the Indian consumer segments is well and truly

underway. Robust income growth particularly in the

service sector accompanied with improvements in

infrastructure are enlarging consumer markets and

accelerating the convergence of consumer tastes.

With a real GDP of ~US$ 1.0 trillion, Globals,

Strivers & Seekers are projected to grow at 11%,

9% and 18% respectively, over the next 10 years.

With this, Indias affluent & rich will number more

than the adult populations of many large countries.

By 2025 Indian Middle class will reach 41% of the

population from 5% in 2005, creating a sizeable

urban middle class. This will create fast paced and

exciting opportunities for firms in the consumer &

retail space.

Indias current per capita annual disposable income

is expected to grow by 8-13% from the current level

of Rs. 32,299 in the next 5 years. Rising income

levels with population increase will lead to an

overall increase in consumer spending and shift in

consumption basket of consumers from the basic

products to more aspirational ones. As wealth

grows spend is added to discretionary categories,

aspiration products and ultimately luxury products.

Need based consumption categories to become

low-involvement items for the core consuming classes. New, rapidly growing consumption categories

would take a larger share of larger share of consumers household spending. Consumers will optimize their

purchases largely on simple attributes of price & convenience (time efficiency) in order to release more

resources (money, time, mental involvement) for the aspiration/lifestyle based consumption categories.

Gems and Jewellery falls in the aspirational based category and can therefore hold good potential.

Growth Drivers,

Opportunities & Challenges

Over the next 10 years Indias affluent & rich will number more

than the adult populations of many large countries

By 2025 Indian Middle class will reach 41% of the population

Indias current per capital annual disposable income is expected

to grow by 8-13%

There will be a shift in consumption basket of consumers from

the basic products to more aspirational ones such as Gems &

Jewellery

Growing Spending Power

1.2 40

32

60

228

108

434

418

612

274

52

126

76

304

293

76

2.4

10.9

91.3

101.1

3.3

5.1

55.1

106

74.1

9.5

33.1

94.9

93.1

49.9

Number of

housholds

Houshold income

brackets

Aggregate

disposable income

Million US $ US $ bn

Globals(> 20,000)

Strives(10,000-20,000)

Seekers (4,000-10,000)

Aspirers( 1,800 4,000)

Deprived(<1,800)

Globals(> 20,000)

Strives(10,000-20,000)

Seekers (4,000-10,000)

Aspirers( 1,800 4,000)

Deprived(<1,800)

Globals(> 20,000)

Strives(10,000-20,000)

Seekers (4,000-10,000)

Aspirers( 1,800 4,000)

Deprived(<1,800)

2

0

0

5

2

0

1

6

P

2

0

2

5

P

The Indian Consumer Spectrum Exhibit 5

Source Industry Reports

14 | Unlocking the Potential of Indias Gems & Jewellery Sector

Share of food and grocery in the consumers wallet will

continue to drop releasing money for discretionary

expenditure. Gems and Jewellery forms a part of

discretionary expenditure

India also has a rich base of young consumers

compared to other economies which have a different

set of needs and are more amenable to branded

products and services. Currently, the population in

the working age group (16-60) stands at 700 mn

representing about 64% of the total population.

Changing lifestyle orientation, exposure to

international travel and the internet combined to

make this new customer more astute and awareness

levels about trends and quality in jewellery have

increased. This new Indian consumers demands

greater transparency, better service and a more compelling value proposition driven by brand and fashion.

At the same time they are also willing to pay justified premium for the right proposition and design. Market

is expected to witness significant changes because of the changing preferences of the todays youth who

will be tomorrows middle class. The youth of India cannot be ignored as half our population is below 25

years of age.

The industry needs to focus on tapping successfully the needs of this growing Indian middle class working

population and creating more fashionable products and products wearable on all occasions. Retailers

need to spend time and resources to understand consumer needs and expectations very carefully, and

continue to evolve with the consumers.

Organized Players Acting as Catalysts

Introduction of organized retail in a sector gives a boost to the industry in terms of improved practices,

better customer service and after sales service as it puts a lot of emphasis on customer satisfaction and

assurance. Retail chains are able to provide better deals to customers; this gives the industry a competitive

edge with local retailers and retail chains trying to maximize their market share, putting the industry on the

path of growth and expansion.

The Changing Share of Wallet of the Indian Consumer Spectrum Exhibit 6

Food and Grocery

Rent, Utilites & Education

Fuel, Transport & Communication

Savings & Investments

Discretionary Expenditure

(Includes Gems and Jewellery)

40%

20% 9%

4%

27%

2003

20% 10%

4%

30%

36%

2008

20%

11%

5%

32% 32%

2013

Source : Technopak Anaylsis

Exhibit 7

Source Technopak Analysis

Consumption Classification

Need based merchandise

and services

Aspiration based merchandise

and services

Food & Grocery

Prepared food / food services

Textiles and apparel

Footwear

Medicine & healthcare

services

Air travel

Consumer durables (white and

brown goods)

Consumer electronics (select

categories e.g. DVD players)

Kitchen appliances

Mobile telephone handsets

Home& Home dcor

Personal transport vehicle

Jewellery & wrist-wear (both

for women and men)

Accessories (handbags, pens,

others)

Grooming

Well-being

Education (including Coaching

& Learning)

Leisure & recreation

Socializing & other lifestyle

15 Unlocking the Potential of Indias Gems & Jewellery Sector |

Organized retail in the jewellery segment is a fairly new

concept. Currently organized retail has a penetration

between 5-7% but this is expected to grow in the

next few years. The expansion of organized retail

and brands can provide impetus to this sector.

Already major retail chains like Big Bazaar, Shoppers

Stop, Pantaloons, Lifestyle etc have started having

jewellery section or Shop-in-Shops in their stores.

Branded jewellery in India can now be seen as a

developing phenomenon. The impact of these

modern formats will be felt most in Urban India. We

anticipate that large investments of about US $ 1

billion in the coming years would be made by large

retailers/brands which would catalyze the growth of

the industry, set higher standards and create value

addition across the industry. As is evident from

exhibit 8 below, retailing of gems and jewellery could

be very lucrative once the startup phase is over.

The entry of leading brands like Gili (Gitanjali Group,

1994), Tanishq (Tata Group, 1995), Sangini (JV of

Sanghavi Exports and Gitanjali Group, 2004), Ishis (Suhashish Diamonds, 2003) Scintillating (Dhanraj

Dhadda Group, 2003), Orra (Rosy Blue Group, 2004), Shubh, Laabh (Rajesh Exports, 2006) amongst

many others into the organized jewellery segment characterised the expansion phase. Tanishq (Tata group)

has been a pioneer and contributes now to the maximum share of the organized retail jewellery market.

These brands promised great quality and the best designs both traditional and contemporary.

The major brands pulling the organized market have now reached a critical point and are looking for more

opportunities to grow. They are already well established in all the top tier cities and state capitals in India

and are now looking to concentrate on their existing base and extend to other categories. Also there are

major plans of expansion in tier 2 and tier 3 cities with the opening of new stores. For instance, Tanishq

is planning to triple its turnover in the next five years timeframe by opening new stores and improving

revenues in the existing ones.

Food &

Grocery

CDIT

Footwear

Books & Music

Pharma & Wellness

Home

Apparel

Jewellery

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-2% 2% 4% 6% 8% 10% 12% 14%

R

O

C

E

ROCE vs EBITDA

EBITDA

Exhibit 8

Source : Technopak Anaylsis

Company

Turnover 2009

(Rs. Crores)

Number of Outlets Announced Plans

Tanishq 2370 117

Tanishq plans to triple its turnover by opening new stores and focusing on

improving the revenues per store of the existing ones

Gitanjali Group 1275

1246 outlets including

shop in shops

Announced plans for 100 stores in May 2009 of which 30-40 were to be

lifestyle stores

Goldplus 390 30

The retail brand plans to reach Tier-IV and Tier-V cities representing the

smaller towns and rural India with over 25 Goldplus stores across in six

states

Reliance Jewels NA 15 Plan to open 85 more in next three years

Big Bazaar (Navras) NA 60 Shop-in-shops Plan to go to 150 by 2011

Rajesh Exports 100 30 Expansion after consolidating current turnover

Exhibit 9

Source Company Announcements & Official Websites

Snapshot of a Few Organised Retail Players

Expansion of organized retail improves competitiveness and

ultimately customer satisfaction

Currently organized retail has a penetration between 5-7% but

this is expected to grow in the next few years

Branded jewellery in India can now be seen as a developing

phenomenon

Compared to other categories jewellery is quite lucrative in terms

of financial returns

Organized Players Acting as Catalysts

16 | Unlocking the Potential of Indias Gems & Jewellery Sector

The last few years have seen the entry of a number of luxury brands in India such as Jimmy Choo, Gucci,

Christian Dior, Louis Vuitton, Cartier, Piaget, Tiffany, Moschino and others. Many of them such as Cartier

and Tiffanys are well known for their jewellery ranges.

Better designs, new ranges and innovative marketing are the factors in the success of these brands in

the past few years. Retail chains focusing on these aspects are well positioned to rise since the customer

wants to see variety in his purchases and the brand providing the same takes the cake. Latest ways of

segmentation, targeting various consumer segments with specific designs and exclusive range and new

usage styles has attracted a new set of consumers and created new occasions.

Thus it is very important to gain the momentum in this direction and focus on consumer research &

innovation in design. Players are also required to focus more on marketing and branding efforts and create

innovative campaigns to attract the new set of customers and increase the frequency of their purchase

occasions. Globally there are examples of very successful campaigns that have been launched and have

translated into a steep increase in the sales and revenue.

Real Estate and Other Costs are Now Under Manageable Limits

Last years slowdown has pushed the real estate prices southwards with substantial drop in the value

accompanied far better lease terms. The malls & the main markets across the country saw a drop of 25%

to 30% in footfalls and 10% to 15% dip in sales. There have been corrections of rentals in the range of 25%

to 40% across major cities and markets over the last 2 to 3 quarters in 2009. The market is taking a U turn

from being landlord/developer driven market to being retailer driven. Developers are also experiencing low

occupancy rates, (10-15% on an average) and have low negotiation power for charging high rental rates

due to sluggish demand from retailers for new space booking. This is a good sign for the jewellery retailers

looking for expansion opportunities.

Case Studies - Marketing Success

WGC Akshay Trithiya DTC Nakshatra De Beers

Till some years ago, not many knew what

the Akshaya Trithiya day stood for. It was a

day largely celebrated in parts of Tamil Nadu

& Maharashtra. People considered it to be an

auspicious day to make purchases, as they

believed it would be protected by Lord Vishnu.

But it was after a massive campaign run by

World Gold Council (WGC), an international

organisation funded by leading gold mining

companies, that the day assumed importance

as an occasion to buy gold. Adding to the

frenzy, jewellery stores and goldsmiths lured

customers with discounts, 24-hour sales and

latest designs. In 2006 Akshaya Trithiya sales

jumped 14% in terms of value and in 2007 they

jumped 55% in volume terms over the previous

year.

De Beers success with marketing of Diamonds

in the west is well known, especially their A

Diamond is Forever campaign. DTC which

is also closely associated with De Beers

pulled another masterstroke in India through

the Nakshatra campaign. Based on sound

research, excellent marketing communication

and perfectly cast celebrity endorsement an

age old Indian Jewellery design was used to

capture the imagination of the Indian buyer.

The initiative was so successful that Nakshatra

has subsequently become a top brand while

it was originally meant to be only a vehicle to

arouse cravings for diamonds amongst Indian

consumers. In the past few years diamond

jewellery has recorded growth rates of above

25%.

De Beers: The Right Hand Ring Campaign

brings out the success story of De Beers

by tracing its growth over a period of time.

Realizing that the non-bridal market for diamond

rings had an immense potential, De Beers then

launched a campaign in 2003 targeted at

independent and accomplished women, who

wanted to buy or receive diamond rings for

non-traditional reasons. The novel concept they

promoted was the Women of the world, raise

your right hand. Which created a huge impact,

according to industry sources, had become a

$5 billion category by 2004. Right hand rings

such as modern vintage, contemporary, floral

and romantic brought about a psychological

change in the attitude of women consumers.

The key learning is that occasion based buying

of jewellery in India is strong. An effective

marketing connect of occasions with jewellery

can work wonders

The key learning is that a professional approach

towards marketing can be very effective and

yield high returns through creation of high-

margin brands

The key learning is creating new non traditional

ways of motivating consumers to make the

purchase by realizing the need gaps in the

market and establishing an effective marketing

connect

Noteworthy Marketing Campaigns

17 Unlocking the Potential of Indias Gems & Jewellery Sector |

The Jewellery market is big and growing and the pricing situation has become more comfortable now than it

ever was. Retailers can get hold of new space at more favorable terms than before. New operating models

such as daily rental model, revenue sharing arrangements and minimum guarantee amount have now

been worked upon by mall owners to lure retailers towards their malls. Market is also expected to witness

more quality space as developers are placing increasing importance to mall planning and management

than just creating mall based on euphoria and hype, which the market saw in 2006-07. The markets are

also witnessing revival in customer demand and confidence. The slowdown has helped in maintaining a

good supply demand equation, especially for markets which were staring at an oversupply situation.

Similarly the other costs such as manpower have shown stability, which would favorably impact the industry.

Employment scenario becoming gloomy on the wake of slowdown coupled with decline in terms of salary

increments and incentives in 2009 has helped the companies in controlling their payroll cost structures.

Job instability in the market also reduced the attrition rates of employees in the industry. The share of

manpower costs in the total operational expenses have reduced in 2009, they had increased substantially

in 2007-08.

Exhibit 10 State of the Retail Real Estate Market

City Micro Market Rental Values (INR/Month/sqft) % Change from 1 year ago

Mumbai

Goregaon

Vashi

Ghatkopar

290

185

215

-24%

-38%

-36%

NCR

Noida

South Delhi

Gurgaon

310

490

250

-35%

-26%

-35%

Bangalore

Koramangala

Cunninghum Road

Magrath Road

400

210

350

-18%

-7%

-5%

Chennai Chennai Central 220 -14%

Hyderabad

NTR Garden

Himayatnagar

Banjara Hill No 1

100

90

130

-9%

-28%

-42%

Pune

Bund garden Road/ Koregaon Park

Ganesh Khind Road

Nagar Road

240

140

170

-31%

-36%

-6%

Kolkata

Rajarhat

Salt Lake

Elgin Road

120

425

315

-1%

-15%

-22%

Ahmedabad

Kankaria Lake

SG Highway

Drive in Road

45

90

70

-55%

-41%

-33%

Source Cushman and wakefield Research * Rentals mentioned are for ground floor premises on carpet area, for vanilla retailers

18 | Unlocking the Potential of Indias Gems & Jewellery Sector

Challenges

Competing for Share of Wallet Expenditure and Investments

The inaction in the past by the industry has lead to

gems and jewellery taking lower share of growing

wallet of the Indian consumers. The increased

activities and vibrant industry in other categories like

Telecom, Apparel, CDIT, Entertainment, Watches,

Vacations and other lifestyle products have possibly

taken away some money from the gems & jewellery

brands /retailers. This is especially true for younger

consumers.

The approach so far has been one size fit all

(barring few) -traditional designs being served to all

sections of the society. The new segments which are

emerging like the BPO /Service oriented young middle

class require a) Affordable , b)Fashionable c)

which can be purchased Frequently d) Available

off the shelve with e) Certification for providing the

much desired assurance . There has been a shift in

consumer preference from heavy gold jewellery to

a well made, light and more trendy jewellery such

as indo western fashions with high quality and good

designs. These kinds of products are by and large

missing from the market. As a result the industry is

losing traction relative to other emerging categories

like watches, mobile phones and other lifestyle

products. Players in the industry need to look at

ways and means bridging the gulf between what is

in demand and what is being offered by constantly

innovating and coming up with new products,

designs and indigenous formats. Opportunities for

jewellery chains rely in the proposition of differentiated styles at good prices, creating product standards

and generating trust and offering products beyond traditional jewellery into lifestyle products.

Similarly there is a business case for catering to the consumers in the upper tier of bottom of the pyramid.

The reason is that unlike others segments they do not have any avenues but jewellery to invest their money.

Innovative measure such as gold exchanges, making affordable branded /certified products, and gold

asset monetization possibilities could really help in unlock the potential for this large segment.

Indian consumer space is getting slowly but surely better defined, more experimenting and ever more

discerning. The desire to own a unique or signature piece does not exist just among the upper echelons of

society but is also permeating the middle and upper middle class. The customer wants something new and

different all the time. The older generation preferred to look at jewellery as an investment but the younger

generation sees it more from fashion than investment standpoint.

Exhibit 11

Source Technopak Analysis

Sectoral Rankings by Market Size

Ranking 2009 Retail Categories

1 Food & Grocery

2 Healthcare

3 Apparel & Home Textiles

4 Education (K-12, Higher Ed. & Vocational)

5 Telecom

6 Jewellery

7 Personal Transport (Vehicles+Fuel+Repairs)

8 Travel and Leisure

9 CDIT

10 Home - Furniture, Furnishing etc

11 Personal Care

12 Eating out

13 Footwear

14 Health & Beauty Services

Competing for Share of Wallet Expenditure and Investments

Various sections of society differ in their needs and jewellery

preferences.

Shift in consumer preference from heavy gold jewellery to a

well made, light and more trendy jewellery of good quality and

designs

Opportunities for jewellery chains in terms of understanding

different customer segments and creating customized

propositions and differentiated styles at good prices

Creating more options for individuals to get credit using gold as a

mortgage to make it a lucrative investment option

19 Unlocking the Potential of Indias Gems & Jewellery Sector |

Brands and Retailers also need to keep in mind

the regional differences while creating their product

proposition. India has great geographical diversity

and cultural differences for jewellery. While northern

and southern Indian jewellery is made from the purest

of gold, Rajasthan delights in silver, precious stones,

shells and mirror work. Likewise, Kashmiris are fond

of silver ornaments set with semi- precious Ferozas.

The imperative for brands and retailers is to

understand the various consumer segments and

make customized propositions and suitable designs

which have been missing, resulting in its lower

preference in comparison with other emerging

categories. In this regards, the industry can draw

significant learnings from other similar industries like

watches, which has very successfully positioned itself

as s lifestyle accessory and a fashion statement ( as

opposed to functional positioning), thereby creating

significant value. As exhibit 13 depicts, the maximum

value addition typically happens at the retail end.

In the last two decades several alterative investment

options such a stocks and real estate have emerged.

Gold as an investment option is facing competition

here as well. As per The World Wealth Report

the investment in gold is less than 10% of the total

investments for HNIs. Options have to be created for

individuals to get credit using gold as a mortgage to

make it a lucrative investment option.

Watch Industry A Case Study

India is an under-penetrated market for watches,

with only 27% of Indians owning a watch, and more

than 80% of the market by volume is below INR

500 per watch. Exhibit 14 gives an idea about the

segmentation of the market:

Given the price sensitive Indian, watches as a segment has taken its time to penetrate the market. HMT was

the first major watch manufacturer in the country, and undisputedly the market leader in this category for a

lot of years. The watch-maker offered sturdiness and reliability at a low price. The focus was not so much

on the design and brand as much as affordability for the average Indian.

However, with the entry of Titan in 1984 as a Joint Venture between the Tata group and Tamil Nadu Industrial

Development Corporation, rules of the industry changed drastically. Designing, Branding and Precision at

120%

100%

80%

60%

40%

20%

0%

% Value Addition

72.3%

Retail-Diamond Jewellery

Value of diamond content in

retail

Value of polished from local

production

Net rough used in local

production

Rough sales to cutting

centre

Rough production value

Rough production

Mine sales

Exhibit 13

Source International Diamond Exchange, 2007

International Diamond Jewellery

Value Chain

Shift in Consumer Behavior Exhibit 12

Source Geetanjali Group Presentation

Urbranded from family

jeweller

Branded

Plain metal

jewellery

Gems studded

jewellery

Jewellery for

investment

Jewellery for

fashion

Traditional ethnic and

chunky designs

Fashionable lightweight &

innovative designs

Marriage and festival

season as peak seasons

Wearability & gifts

spreading the demand

throught the year

jewellery sold on

commodity basis with

labor charges

jewellery being sold

on a per piece bais

Yesterday Topday

20 | Unlocking the Potential of Indias Gems & Jewellery Sector

a reasonable price was the USP of Titan, which has

made it the worlds sixth largest watch manufacturer

in the world, and the largest in India. Today, it has

more than 50% share in the organized watch market

in the country. It offers brands such as: Steel, Edge,

Raga, Sonata, Fasttrack, Regalia, Bandhan, Sonata,

Nebula, Flip.

Titan has been christened as the most admired

consumer durable company (A&M magazine),

Superbrand 2003, Brand Equity Award (PHDCCI),

and Images Fashion Award to name a few. Titan was

able to achieve this distinction for itself in the market,

while making it still reasonably priced, and supporting

this with a vast network and efficient operations. In

short it created a great brand extracted a more value

out of the Indian consumer than HMT.

A number of premium and luxury brands have entered

India in the recent past, such as Rado, Tommy

Hilfiger, Evidenza (from Longines) and Rolex, which

are trying to catch the upmarket, urban, western

minded youth. These brands further offer a sense of

exclusivity and style as their products are distributed

through some select outlets, and use high society

and style icons such as Shahrukh Khan, Aishwarya

Rai, Yana Gupta and Lisa Ray. Exhibit 15 gives an

overview of the brands in the market today:

The mindset in the Gems & Jewellery sector has been that of cost plus markup (adding making charge

to the material, along with a margin), which is not very different from what was in watches until several

years back, When it was sort of a commoditized product. Today however, watches are sold basis on more

intangible factors. Thus, Gems & Jewellery sector can also think of breaking away from the traditional

markup model and increasingly focus on innovative products driven by designing & branding.

Share Segmentation Price bracket (INR) Brand

11% Mass <400 Grey Market, Chinese

13% Premium >5000

Swiss brands: Tissot, Omega,

Rolex Fashion brands: Fossil,

Calvin Klein, Giordano, Esprit

33% Mid-Upper 1000-5000

Titan, Citizen, Timex, Swatch,

Espirit

43% Low End 400-1000 Sonata, HMT, Maxima

Exhibit 14

Source Titan Corporate Presentation

Watch Market Segmentation

Exhibit 15

Source Titan Corporate Presentation

Brand Spread in Watches

Sonata, HMT

Maxima

Raynold, Well,

Tissot

Nebula

XYLYS

Omega, Rado,

Longines

Espirit, Swatch,

Fossil Giordano, DKNY,

Carrera, Tommy Hilfiger,

Accent

Tag Heuer,

Hugo Boss,

C Dior

Formal/ Classic

Fashion/ Sporty

Price

500 1000 2000

Titan Citizen

Timex

4000 5000 10000 20000+

Fastrack

21 Unlocking the Potential of Indias Gems & Jewellery Sector |

Mindset and Manpower

The Jewellery industry has traditionally been a

very closely guarded industry, where skills of the

trade have been passed on within a family from

one generation to the other and restricted entry of

outsiders. Although this has its own advantages, this

structure of the industry has not allowed it to gain the

scale benefits, and in professionalizing it to remove

inefficiencies.

In order to tap the growing opportunity, the sector needs to attract and groom professionals at all levels

Managerial and Skilled workers. The sector so far has not caught the attention of the managerial resources

be at senior level or at entry level unlike other consumer product segments like FMCG, Durables or Retail

for that matter. The issue perhaps also stems from the fact that the majority of players operating in the

sector have still not adopted the best practices from the corporate culture.

The sector currently employs close to 1.8 million people and in the next 6 years a further 1.1 million people

will be needed. As a large section of the workforce is employed in skill-based jobs such as diamond

cutting, jewellery making, retail selling etc we need a large number of vocational training institutes spread

all across the country.

We can look at the apparel industry for solutions. It grew tremendously due to combined effort of favorable

government policies, investment in capacities, entry of multinationals, and the introduction of Fashion

designers through a vast network of educational infrastructure. Thus, institutes like NIFT which have done

exceedingly well for their respective sectors, are more than just a need of the hour for the Gems & Jewellery

industry today.

National Institute of Fashion Technology was

set up in 1986 under the aegis of the Ministry of

Textiles, Government of India. It has emerged

as the premier Institute of Design, Management

and Technology, developing professionals

for taking up leadership positions in fashion

business in the emerging global scenario. NIFT

has been granted statutory status under the act

of Parliament of India in 2006, empowering the Institute to award degrees

and other academic distinctions

The number of stores a Jeweller

has in India is equal to the number

of sons - An industry leader

requesting anonymity

22 | Unlocking the Potential of Indias Gems & Jewellery Sector

There needs to be wholesome change, with the development of every skill set at every level of the industry,

such as designing, marketing and management, apart from technical skills of workers. Government and

Apex bodies could act as facilitators in broadening the outlook of the exporters /players and help them in

familiarizing with the changing scenario both in the domestic and international fronts, where moving up the

value chain and adoption of modern practices has become compelling imperatives.

Financing

In the Gems & Jewellery sector the government does not provide many innovative financing options for

the retailers and the wholesalers (refer Exhibit 17). Even though there are vanilla financing products for the

jewellery retail sector, most of the retailers cant avail the facility since they are unorganised.

The need of the hour is to develop some innovative solutions such as those available to the non-retail

players and ensure access of the same to small unorganised retailers.

Apparel Gems & Jewellery

Both are sizeable sectors with a large export component

Both largely dominated by unorganized sectors

Both employ large chunks of the Indian population

Excellent educational infrastructure:

India textile and apparel education sector is largest in the world with

36 degree level engineering colleges, 56 diploma level institutes

imparting education in textile technology dealing with yarn and fabric

manufacture, and more than 100 institutes offering education related

to garment and fashion design and technology. The shining star in this

gallery is National Institute of Fashion Technology (NIFT); in May 2006 it

was recognized by an act of Parliament as an Institute of Excellence of

Design, Management and Technology in India.

Good educational infrastructure is limited

There is a need for a National Institute

of Gems & Jewellery and numerous

vocational training institutes

Exhibit 16

Source NIFT Website, Various Internet Sources

Learnings for Gems & Jewellery from the Textile & Apparel Sector

Exhibit 17

Source FICCI

Financing Options in Gems & Jewellery

Financing Options

Raw Material

Sourcing

Raw Material

Processing

Raw Material

Trading

Jewellery

Manufacturing

Wholesaling Retailing

Packing Credit (for diamond exports

only)

Available for 180 days pre-shipment

and 180 days post-shipment

Gold Loan

Available against bank guarantee

Upto 90 days pre-shipment and 180

days post-shipment

LC on gold is also available for 90

days though nominated agencies

Cash Credit for Domestic Consumption

Working Capital demand Loan

LC 180 to 364 days

23 Unlocking the Potential of Indias Gems & Jewellery Sector |

Also, since the sector lacks an industry status it

does not qualify for obtaining friendly-terms financial

assistance or any external financial aid in the

domestic market from banks or International funding

bodies.

An important requirement would be to make

the unorganised players more professional and

transparent in their dealings.

Upgradation /Modernization

As mentioned earlier, the industry needs to modernize itself. This is in light of the fact the industry is also

highly fragmented with minimal benefits of economies of scale, latest production techniques or design

centers. All of them are critical for the industry to grow rapily and move towards the higher ends of the

value chain.

In such a scenario the government could help with the creation of a Technology Upgradation Fund (TUF)

for this sector. Such schemes have worked well in other sectors such as Textile & Apparel. Highlights of the

Textile & Apparel TUF are given below: -

At the end of the last decade the apparel sector was in dire need of up gradation of technology to remain

competitive internationally.

However, the player specifically the small scale industries lacked both the funds as well as intent.

TUFS was introducted with the intention of upgradation of technology.

Under this scheme a capital subsidy of 10% and interest subsidy of 5% was provided for technology

upgradation initiatives.

It was a grand success since during the period the ministry has disbursed INR 66,275 crore under the

scheme, while it propelled investment of more than Rs. 1,16,981 crore.

The Indian industry can perhaps learn significantly from Turkey where the industralization of the jewlery

segment has transformed it into one representing the modern flexible production techniques, supreme

craftsmenship, excellent quality and immense variety.

An example of the benefits of focused structural support is the

domestic Film industry, which after the grant of Industry status in

2000 has grown at a CAGR of 18% in the last 9 years, driven by

greater organization of the industry and better access to organized

sources of financing. IDBI Bank alone raised its film financing from

zero in 2000 to INR 500 crore in 2009. The government decision

to grant Bollywood the industry status has also helped in stemming

the flow of legitimate and appropriate funding to the sector.

Case Study Indian Film Industry

Turkey Gold Jewellery A Case Study

Turkeys Gold exports have been on a strong vertical growth trajectory

for the past 10 years reaching almost US $ 1.6 billion in 2008. Turkey

is expected to dethrone Italy as the largest exporter of Gold Jewellery,

as it continues to grow strongly while Italy falls behind.

The Turkish jewellery sector traditionally was beset with problems,

such as low usage of technology, high fragmentation, poor emphasis

on design etc. These problems were similar to the ones plaguing the

current Indian industry. During the 90s, the sector finally opened up

financially due to several reasons, most notably technology, design,

investment in production capacities, and government initiatives to

liberalize the gold market. Since then the jewellery sector has charted

a blazing path which has borne great fruit in the last decade.

Exhibit 18 Turkey Gems & Jewellery

Exports (US $ Million)

0

500

1000

1500

2000

207

285

284

431

568

708

932

1127

1095 1490

1585

1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008

Source Undersecretariat of Foreign trade (Turkey)

24 | Unlocking the Potential of Indias Gems & Jewellery Sector

Key Drivers of Turkeys Growth

Technology Centric Large Scale Manufacturing In the 90s

Turkeys organised sector only had a couple of workshops with

100-200 workers. Today there are at least 15 factories with

1000 plus workers. Total production capacity in Turkey for Gold

Jewellery is 400 tons per annum. The machine park of the industry

has upgraded to adopt the highest level of technology. Allowing

it to meet the international customers requirements for intricate

designs, quality and reliability of supply.

Focus on Designs In the mid 90s jewellery companies also started

employing designers in a big way and now most of the worlds largest

design teams work in Turkey. To promote jewellery designing Wold

Gold Council has been organising design competitions since 1994

and there is a plethora of courses from universities to vocational

institutes for churning out well-trained designers. Use of Computer

Aided Design (CAD) is now omnipresent.

Leveraging Tradition Like India Turkey too has a rich heritage of indigenous designs and craftsmanship. Well-known techniques include filigree,

niello & wickerwork. So while Turkey made a name for itself by excelling in international designs it then used the respect and attention it gained

to propagate its unique heritage and strengths as well. Sales to tourists and luggage traders account for a whopping 70% of the total produce.

Besides, international style jewellery many tourists refer to buy the intricate local designs for their uniqueness and as souvenirs.

Infrastructure in 1995 a gold exchange was started by the Turkish Government. Today it has 62 members comprising of banks, precious metal

companies, currency offices etc. A state of the art Istanbul Gold Refinery commenced operations in 2002 augmenting supply of quality gold.

It has the technology to produce 9999 purity gold and convert scrap or Dore bullion into 9999 purity in four hours. Istanbuls famous Grand

Bazaar which has been a historical centre for gold trade has been developed and positioned to attract buyers and tourists from the world over

in a distinct yet friendly retail and wholesale environment. Istanbul boasts of the worlds largest integrated jewellery centre Kuyumcukent. The

construction was started in 1996 and it has 328,000 square metres of built-up area with 2800 production units and shops. Besides designers,

traders, retailers and manufacturers there is also a gold refinery branch and a branch of the gold exchange is expected soon.

Fairs & Journals Four large scale jewellery fairs are organised in Turkey every year. The well-known Istanbul Jewellery Show takes place twice

a year. Gold News is a widely circulated periodical which is published 6 times a year by Istanbul Chamber of Jewellery. Besides this the industry

players, industry associations and Turkish Government regularly organise events and road-shows across the world to promote Turkish gold

jewellery.

Exhibit 19 Kuyumcukent

Unlocking the Potential of Indias Gems & Jewellery Sector | 25

04

Gems & Jewellery exports are the back-bone of the

sector and also of our overall exports. The sector is

expected to grow at a CAGR of 15% to reach a size

of US $ 58 billion by 2015 from the current US $ 25

billion.

In the export market, India has gained a competitive

advantage because of its ability to deliver good

quality at low cost. For example, cost of cutting a

diamond in India is 7% of that in Belgium and 60% of

that in China. Highly skilled and low cost manpower,

along with strong government support in the form

of incentives and establishment of SEZs have been

the major drivers for the rapid growth of Indian gems

and jewellery exports. The industry thus plays a vital

role in the Indian economy as it is the top 5 foreign

exchange earner in the country surpassing even

the US $ 22 billion earned by the textile and apparel

sector.

The current global economic crisis came as rude

interruption to the exports growth story. Exporters

were doubly hit by falling demand and fluctuating

exchange rates. The Fiscal Year 2008-09 saw Gems

& Jewellery exports decline by 1.5% in dollar terms

and 13.5% in Rupee terms. However, the exports

have already bounced back in recent months and

are expected to resume a near vertical march to double its foreign exchange earnings in the next 5 years.

If we study the recent export data we find that our core strength continues to be cut and polished diamonds

but gold jewellery is also now a sizeable share and indicates that we are diversifying expanding our offerings

to the world.

Moving Up the Value Chain

With regards to Exhibit 22 India currently lies on the 2nd level in the value addition ladder of the gems and

jewellery sector. This position has cushioned India a bit during the economic crisis as compared to other

exporters like Italy. This is because the higher value Gems & Jewellery products were hit much harder than

the mass low value products

Te Export Market

Gems & Jewellery Exports

(US $ Billion)

Exhibit 20

Source GJEPC, Technopak Analysis

2009

25

58

2015

0

10

20

30

40

50

60

Apr-Nov 2009 Exports (%)

Exhibit 21

Source GJEPC Statistics

Cut & Pol Diamond

Gold Jewellery

Rough Diamond

60%

34%

3% 2%

Others

26 | Unlocking the Potential of Indias Gems & Jewellery Sector

Being on this position also shows that India has a great opportunity to move up and be present across all

the points in the value addition chain. Doing so can generate the next wave of growth and profitability as

we consolidate our position in low-value gem processing and capture a greater share of high-value gem

processing and Jewellery making .This move is also important as other low cost countries like China are

striving hard to wrest share from India in our current areas of strength.

However, the industry needs to modernize itself to move up the export value chain. As stated earlier, it is

highly fragmented with minimal benefits of economies of scale, latest production techniques or design

centers. All of them are critical for the industry to move towards the high end of the value additions ladder.

There is also a significant opportunity to create additional value through higher margins which are possible

through differentiation and branding.

New Markets

In terms of finding new markets for export, one could look at SE Asia, Latin America and China which are

becoming significant consumption centres due to 7% plus growth.

In fact, GJEPC is already exploring markets like China, West Asia and Russia for exports of diamonds and

diamond jewellery from the country. China is currently the worlds second-biggest gold-consuming country,

the worlds fourth-largest diamond-consuming country and Asias largest jade, jadeite and pearl consumer.

Buoyed by the continuing improvements in income, Chinas domestic jewellery market is expected to see

solid and sustained growth presenting a lucrative market for us.

Key Enablers of Growth

In order to sustain high growth in exports, what India necessarily needs is

Strengthened export incentives, policies and schemes. This is targeted especially at the tax and duty

benefits.

In addition to this, there is a requirement of skilled manpower, especially jewellery designers and

manufacturing technologists.

The requirement for infrastructure, such as more export SEZs, is also essential in order to compete with

China and meet the growing needs of the exporters

Gems & Jewellery Value Addition Ladder

Exhibit 22

Raw

Materials

Processed Raw

Materials- Low value

Processed Raw

Materials- High

Value

Mass

Jewellery

Designer

Jewellery

Branded

Jewellery

Indias Current Dominant Position

Unlocking the Potential of Indias Gems & Jewellery Sector | 27

05

Recommendations

Recommendations for the Industry

Potential Assessment and Strengthening Consumer Understanding

Unlike other consumer goods sectors such as FMCG, Apparel & Consumer Electronics there have been no

comprehensive studies done so far with regards to gaining insights into the gems & jewellery consumer.

The domestic market holds a significant opportunity and its potential needs to be fully explored.

The consumers have evolved rapidly and the traditional ways of segmentation & usage have failed to provide

any meaningful results to the brands and retailers. There is dire need for the industry to first understand the

various segments of the consumers so that the transformations shown in Exhibit 5a can take place

Thus we recommend a comprehensive consumer-insight study to be commissioned by the various industry

bodies with the objective of facilitating above transformations. The collaboration of all industry bodies is

important so that no sections of the industry are left out.

Invest in Retailing and Brands

The organised retail and brands can provide impetus to the sector. Appropriate investments can potentially

put the category on a higher priority in the consumer basket and can generate the higher margins. An

overall investment of US $ 2 billion is required by the branded jewellery players to achieve 15% share of

the market.

This is not a huge amount if you consider the investing power of Indian corporate houses and international

players. However the investors often perceive this sector to be secretive, closed and tough. We need to

overcome these doubts and fears to promote a more rapid flow of investment.

While investment from outside the industry is welcome and needed there is great opportunity for the high-

performing industry players as well. There are scores of leading family-run jewelers with highly profitable

enterprises. Currently the surplus is invested back into inventory or in other investment avenues such as real

estate and equities. We need to give these rising stars confidence and direction to invest in expansion.

Thus a possible solution here is to create highly active Industry Co-ordination Cells by the industry promotion

bodies such as FICCI, GJEPC, GJF, WGC etc. This would help bring together the outside investors and

industry stars to create high-potential, low-risk joint-ventures and partnerships.

28 | Unlocking the Potential of Indias Gems & Jewellery Sector

Improve Skill Sets & Quality of People

While we have a large pool of skilled manpower

in the industry, the high growth rate that we aim

both in domestic and export markets means that

skilled manpower will be in great demand. In such

a scenario the traditional father-to-son tutelage and

on-the-job training provided by organizations may

not be sufficient, especially as we try to modernize

and professionalise the industry.

The Gems & Jewellery industry needs to

systematically and collectively invest in up gradation

of the skill sets of its workforce through increased training and manpower development programs. A joint

effort by the Industry to invest in the development of vocational training institutes could be the solution with

Industry captains showing the way forward by leading efforts to underwrite recruitment of graduates and

participate in syllabus design & development. Some key proposed areas for vocational training are shown

in Exhibit 23: -

Enhance Product Design & Manufacturing Quality Standards

A National Institute of Jewellery Design & Development would go a long way in providing the platform

for development of a pipeline of innovative high quality designers that can serve the industry as a whole.

The Institute can play a role similar to NIFT which

ultimately proved to be a fertile ground that gave

birth to a number of marquee design apparel brands

in the country and improved product design and

manufacturing quality. Indian Institute of Gems &

Jewellery (IIGJ) is a step in the right direction but the

scale and reach needs to be even greater to meet

the huge demand. If Industry captains come together

to invest in setting up the institute or expanding

existing ones, efforts can be made to lobby to obtain

Government support and create national centres of

excellence like NIFT with multiple campuses and

courses.

Besides designing there are other high-end education areas which the institute can offer. The proposed

areas are shown in Exhibit 24

Area Rationale

Processing of

Gems

Export of Gems will continue to grow in double

digits

Jewellery

Manufacturing

This is the next area of growth both for exports

as well as the domestic market

Retail Selling

This is a key requirement for Organised

Retailing to prosper

Quality Testing &

Assurance

Quality is a must to improve margins and to

move up the value chain

Exhibit 23 Vocational Training Areas

Area Rationale

Jewellery

Designing

Important for our exports and domestic market

to move up the value chain and improve

margins

Manufacturing

Technology

We will need more hi-tech manufacturing

expertise to excel in the jewellery space

especially with regards to exports

Merchandising &

Retail Management

This is a key requirement for the growth and

profitability of retail

Marketing & Brand

Building

This would be key to transform the domestic

market especially in the minds of the consumer

Exhibit 24 Specialised Education Areas

29 Unlocking the Potential of Indias Gems & Jewellery Sector |

Promote Adoption of Industry Wide Standards for Gaining Consumer Trust

Enhancement of product quality standards and incentives for increasing adoption of the standards will

go a long way in enhancement of consumer trust and enable the industry to gain share of wallet of the

consumer, in the long run.

Currently various material purity and value certifications are already present in the Indian market such as

Gold Hallmarking, Diamond Certification, Pt950 Certification for Platinum etc. We now need the industry to

widely adopt the certifications as a best practice. We thus need the industry bodies to organize workshops

for educating and motivating the industry. Next there should also be consumer campaigns to improve