Beruflich Dokumente

Kultur Dokumente

UHY Government Contractor Insider - April 2014

Hochgeladen von

UHYColumbiaMDCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

UHY Government Contractor Insider - April 2014

Hochgeladen von

UHYColumbiaMDCopyright:

Verfügbare Formate

8601 Robert Fulton Drive l Suite 210 l Columbia, MD 21046 l 410-423-4800 l Fax 410-381-5538 l www.uhy-us.

com

Goodwill

Impairment

By Marlon Bernal, Principal

T

he Financial

Accounting

S t a n d a r d s

Board (FASB)

has issued an

update to U.S.

generally ac-

cepted account-

ing principles

(GAAP) that provide an alternative

for private companies on the sub-

sequent accounting for goodwill.

The update is a consensus of the

Private Company Council (PCC)

that was endorsed by the FASB.

FASB Accounting Standards Up-

date No. 2014-02, Intangibles

Goodwill and Other (Topic 350):

Accounting for Goodwill, allows a

private company to subsequently

amortize goodwill on a straight-

line basis over a period of ten

years, or less if the company can

demonstrate that another useful

life is more appropriate. It also al-

lows a private company to apply a

simplified impairment model to

goodwill. Goodwill is the residual

asset recognized in a business

combination after recognizing all

continued on page 2

the next level of service

For more information,

please contact Jim Peacock

at jpeacock@uhy-us.com

Government

Contractor

Insider

UHY LLP

Mid-Atlantic

April 2014 Vol. 5 No. 3

UHY L L P pr ov i de s s ol ut i ons t o gov er nme nt

c ont r a c t or s i n ac c ount i ng, t a x and c ons ul t i ng.

accounting rules on what to capital-

ize and what to expense.

Website devel-

opment costs

can generally

be divided

into various

stages. The

f o l l o wi ng

table summa-

rizes the ac-

counting treatment

for the most common activities in

each stage. The table is based on

FASB ASC 350-50 IntangiblesGood-

will and Other: Website Develop-

ment Costs. It is intended as an

overview and exceptions may apply.

Ask your website development con-

sultant to provide a breakdown of

their fees based on this table (see

page 2). Imagine the delight of your

auditors when they see the spectac-

ular job youve done of properly ac-

counting for your website develop-

ment costs!

continued on page 2

Website Development Costs

A detailed look at what to

expense and what to capitalize

By Cindy McGiffin, Senior Accountant

A

n area of con-

fusion I see

frequently on au-

dits is the treat-

ment of website

d e v e l o p m e n t

costs. Clients tend

to place their en-

tire website devel-

opment costs in one bucket, either

expensingor capitalizingevery-

thing. The correct treatment is some-

where in the middle, and knowing

which activities are which is impor-

tant. Fortunately, there are detailed

Imagine the delight of your

auditors when they see

the spectacular job

youve done of properly

accounting for your

website development costs!

Our firm provides the information in this newsletter as tax information and general business or economic information or analysis for educational purposes, and none of the information contained herein is intended to serve as a so-

licitation of any service or product. This information does not constitute the provision of legal advice, tax advice, accounting services, investment advice, or professional consulting of any kind. The information provided herein should

not be used as a substitute for consultation with professional tax, accounting, legal, or other competent advisors. Before making any decision or taking any action, you should consult a professional advisor who has been provided

with all pertinent facts relevant to your particular situation. Tax articles in this newsletter are not intended to be used, and cannot be used by any taxpayer, for the purpose of avoiding accuracy-related penalties that may be imposed

on the taxpayer. The information is provided as is, with no assurance or guarantee of completeness, accuracy, or timeliness of the information, and without warranty of any kind, express or implied, including but not limited to war-

ranties of performance, merchantability, and fitness for a particular purpose.

UHY Advisors, Inc. provides tax and business consulting services through wholly owned subsidiary entities that operate under the name of UHY Advisors. UHY Advisors, Inc. and its subsidiary entities are not licensed CPA firms.

UHY LLP is a licensed independent CPA firm that performs attest services in an alternative practice structure with UHY Advisors, Inc. and its subsidiary entities. UHY Advisors, Inc. and UHY LLP are U.S. members of Urbach Hacker

Young International Limited, a UK company, and form part of the international UHY network of legally independent accounting and consulting firms. UHY is the brand name for the UHY international network. Any services de-

scribed herein are provided by UHY Advisors and/or UHY LLP (as the case may be) and not by UHY or any other member firm of UHY. Neither UHY nor any member of UHY has any liability for services provided by other members.

the next level of service

Goodwill Impairment

continued from page 1

other identifiable assets acquired

and liabilities assumed.

For years, private company stake-

holders have made the goodwill

impairment issue a priority given

its onerous and costly compliance

efforts. The new standard ad-

dresses private company stake-

holder concerns by reducing the

cost and complexity of compliance,

while still providing decision-useful

information for users of private

company financial statements.

Under the accounting alternative,

goodwill is tested for impairment

when a triggering event occurs

that indicates that the fair value

of a company (or a reporting unit)

is lower than its carrying value. A

private company that elects the

accounting alternative is further

required to make an accounting

policy election to test goodwill for

impairment at either the company

level or the reporting-unit level.

The combination of the amortiza-

tion method and the relief from

the requirement to test goodwill

for impairment at least annually is

expected to result in significant

cost savings for many private com-

panies that carry goodwill on

their balance sheets. This is be-

cause amortization should reduce

the likelihood of impairments,

and private companies generally

will test goodwill for impairment

less frequently.

We at UHY LLP are here to help

you implement the accounting al-

ternative for goodwill.

Stage Activities Treatment

Planning IDeveloping the Expense

business/project plan

IDetermining functionalities

IIdentifying hardware and

web applications/software

IConceptual formation of

graphics and content

ISelection of vendor(s)

Application and IAcquiring or developing hardware Capitalize

Infrastructure and software needed to operate

Development the website

IObtaining domain name

IDeveloping or acquiring the software

for website operations, database

and applications

IPurchasing the hardware

IInstalling the hardware/software

ITesting the hardware/software

Graphics IOverall design of web pages Capitalize

Development (design, layout, color, images)

Content IData entry and data conversion Expense

Development of content

ISoftware used to integrate a Capitalize

database with the website

Operating Stage ITraining employees on the new website Expense

IRegistering the website with internet

search engines

IUser administration activities

IBackups

IOn-going maintenance

IUpgrades and enhancements that Capitalize

increase functionality

Website Development Costs, continued from page 1

Das könnte Ihnen auch gefallen

- UHY Not-for-Profit Newsletter - August 2013Dokument2 SeitenUHY Not-for-Profit Newsletter - August 2013UHYColumbiaMDNoch keine Bewertungen

- Nonprofit Insider: Plan Sponsors, Are You Ready For The New Regulations?Dokument2 SeitenNonprofit Insider: Plan Sponsors, Are You Ready For The New Regulations?UHYColumbiaMDNoch keine Bewertungen

- Nonprofit Insider: What Is Your Form 990 Telling The IRS?Dokument2 SeitenNonprofit Insider: What Is Your Form 990 Telling The IRS?UHYColumbiaMDNoch keine Bewertungen

- UHY Not-For-Profit Newsletter - August 2012Dokument2 SeitenUHY Not-For-Profit Newsletter - August 2012UHYColumbiaMDNoch keine Bewertungen

- Insider: Plan Sponsors, Are You Ready For The New Regulations?Dokument2 SeitenInsider: Plan Sponsors, Are You Ready For The New Regulations?UHYColumbiaMDNoch keine Bewertungen

- UHY Government Contractor Newsletter - September 2011Dokument2 SeitenUHY Government Contractor Newsletter - September 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Government Contractor Newsletter - November 2011Dokument2 SeitenUHY Government Contractor Newsletter - November 2011UHYColumbiaMD100% (1)

- UHY Not-For-Profit Newsletter - March 2012Dokument2 SeitenUHY Not-For-Profit Newsletter - March 2012UHYColumbiaMDNoch keine Bewertungen

- UHY Not-for-Profit Newsletter - November 2011Dokument2 SeitenUHY Not-for-Profit Newsletter - November 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Not-for-Profit Newsletter - August 2011Dokument2 SeitenUHY Not-for-Profit Newsletter - August 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Government Contractor Newsletter - January 2011Dokument2 SeitenUHY Government Contractor Newsletter - January 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Government Contractor Newsletter - February 2011Dokument2 SeitenUHY Government Contractor Newsletter - February 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Not-for-Profit Newsletter - March 2011Dokument2 SeitenUHY Not-for-Profit Newsletter - March 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Financial Managment Newsletter - February 2011Dokument2 SeitenUHY Financial Managment Newsletter - February 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Construction Newsletter - February 2011Dokument2 SeitenUHY Construction Newsletter - February 2011UHYColumbiaMDNoch keine Bewertungen

- UHY Not-for-Profit Newsletter - December 2010Dokument2 SeitenUHY Not-for-Profit Newsletter - December 2010UHYColumbiaMDNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Passing Off and InfringmentDokument24 SeitenPassing Off and Infringmentswa291100% (2)

- SEO Proposal For AidanDokument4 SeitenSEO Proposal For AidanRitu BansalNoch keine Bewertungen

- Design Diagram Solution - CD & DFDDokument6 SeitenDesign Diagram Solution - CD & DFDjasper100% (1)

- Customizing F4 Help in WebDokument12 SeitenCustomizing F4 Help in WebpriyankguptasapNoch keine Bewertungen

- Costco Privacy TermsDokument2 SeitenCostco Privacy TermsGK SKNoch keine Bewertungen

- UntitledDokument25 SeitenUntitledDumitru Dana MariaNoch keine Bewertungen

- Naruto - NagareboshiDokument2 SeitenNaruto - NagareboshiOle HansenNoch keine Bewertungen

- Radha Hemmige Resume SmreDokument3 SeitenRadha Hemmige Resume Smreapi-265064612Noch keine Bewertungen

- ShahSoap Project Documentation (BSC)Dokument244 SeitenShahSoap Project Documentation (BSC)Ovee Maidul IslamNoch keine Bewertungen

- Patent Forms 1 To 5Dokument5 SeitenPatent Forms 1 To 5Anupam DubeyNoch keine Bewertungen

- The MarketerDokument8 SeitenThe MarketerHemant ChaudharyNoch keine Bewertungen

- Revenue Recognition 1Dokument5 SeitenRevenue Recognition 1V S Krishna AchantaNoch keine Bewertungen

- Comunicación y Protocolo Empresarial en Los Países de La Zona Euro PARTE 1 PDFDokument100 SeitenComunicación y Protocolo Empresarial en Los Países de La Zona Euro PARTE 1 PDFCamilo Ernesto Rojas Figueredo100% (1)

- Progressive CAse AnalysisDokument7 SeitenProgressive CAse AnalysisPiyush Pandey100% (1)

- Foxit PhantomPDF Business v9.0.0Dokument5 SeitenFoxit PhantomPDF Business v9.0.0Anonymous L4GY7kqNoch keine Bewertungen

- 32 Key Performance Indicators (KPIs) For Ecommerce - KPI ExamplesDokument16 Seiten32 Key Performance Indicators (KPIs) For Ecommerce - KPI ExamplesGanesh Pajwe100% (1)

- Cadbury Crisis in IndiaDokument6 SeitenCadbury Crisis in IndiaKushagra VarmaNoch keine Bewertungen

- Metric Stream Case StudyDokument2 SeitenMetric Stream Case Studyashfaque1987Noch keine Bewertungen

- Information Systems StrategyDokument5 SeitenInformation Systems StrategyAmiani 'Amio' David100% (1)

- Top 50 Management Consulting Firms Guide PDFDokument165 SeitenTop 50 Management Consulting Firms Guide PDFSunny Naresh ManchandaNoch keine Bewertungen

- SWOT JioDokument3 SeitenSWOT JioAmal Raj SinghNoch keine Bewertungen

- Axa PDFDokument5 SeitenAxa PDFCris SuyamNoch keine Bewertungen

- PHILAMLIFE Vs CA GR SP 31283, April 25,1995Dokument1 SeitePHILAMLIFE Vs CA GR SP 31283, April 25,1995Francise Mae Montilla Mordeno100% (1)

- Prakhar Shukla Summer Training Project OnDokument99 SeitenPrakhar Shukla Summer Training Project OnAnkush JhaNoch keine Bewertungen

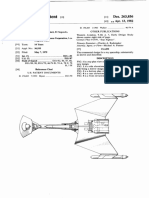

- USD263856 Klingon D-7 Design PatentDokument3 SeitenUSD263856 Klingon D-7 Design PatentfuccioniNoch keine Bewertungen

- Anand Gupta - Resume GREETING...................................Dokument4 SeitenAnand Gupta - Resume GREETING...................................Anand GuptaNoch keine Bewertungen

- Isms Internal AuditDokument10 SeitenIsms Internal AuditGayathri RachakondaNoch keine Bewertungen

- BBP-FICO (Organisation Structure)Dokument16 SeitenBBP-FICO (Organisation Structure)Ashok Kumar100% (3)

- Fert Mark Code of PracticeDokument104 SeitenFert Mark Code of PracticedbedadaNoch keine Bewertungen

- 18 x12 ABC ADokument12 Seiten18 x12 ABC AKM MacatangayNoch keine Bewertungen