Beruflich Dokumente

Kultur Dokumente

When Moral Hazard Is Good

Hochgeladen von

DoofSad0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

68 Ansichten37 SeitenHealthcare and moral hazard in the US

Originaltitel

When Moral Hazard is Good

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenHealthcare and moral hazard in the US

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

68 Ansichten37 SeitenWhen Moral Hazard Is Good

Hochgeladen von

DoofSadHealthcare and moral hazard in the US

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 37

WHEN MORAL HAZARD IS GOOD:

A CRITIQUE OF THE UNITED STATES HEALTH

INSURANCE SYSTEM

Ashley Gray

Ecoo!"cs Se"or Thes"s

U"#ers"$y o% &'(e$ So')

S*r"(+ ,--.

TA/LE OF CONTENTS:

01 A2s$rac$ 3

,1 I$ro)'c$"o 3

31 Is'race Coce*$s a) De%""$"os 4

3.1 Moral Hazard

41 H"s$or"cal /ac5(ro') 6

4.1 History of Health Care in the United States

4.2 Types of Insurance

4.2.1 Pulicly !unded Health Insurance

4.2.1.1 Medicare

4.2.1.2. Medicaid

4.2.2 Pri"ate Insurance

4.3 Current State of Health Insurance in the U.S.

4.4 # Co$parison to %ther Industrialized Countries

71 Mo)els o% Heal$h Is'race 08

&.1 Social Health Insurance

&.2 #ctuarial Health Insurance

.1 The Co#e$"oal Moral Ha9ar) Cr"$":'e ,,

'.1 The Criti(ue

'.2 Policy Solution

'.2.1 )eductiles

'.2.2 Coinsurance

'.2.3 Co*pay$ents

'.2.4 Ter$s and +i$its

'.2.& Pree,istin- Conditions

'.2.' Health Sa"in-s #ccounts

;1 The Challe(e ,;

..1 /#0) Corporation Study

..2 The )istinction

..3 The 0e1 Theory

..4 Policy I$plications

61 Cocl's"os 34

2

01 A/STRACT

Health plays an immensely significant role in an individuals life; it can determine both

the quality and the length of a persons existence. It is therefore no surprise that health care is

such a prevalent and controversial topic in the world today. In contrast to the historically public

and non-exclusive health insurance in urope! the health care system in the "nited #tates is

exclusive and relies heavily on the private mar$et for financing %&eyman 2''(). *his +merican

preference toward consumer-directed health care is explained by the conventional ,moral

ha-ard. theory of health insurance. +ccording to this theory! full insurance encourages

individuals to overuse health services because they appear ,free. or highly subsidi-ed. /ew

theory! however! indicates that this dominant view of moral ha-ard is fundamentally flawed! that

full insurance is in fact effective and efficient.

,1 INTRODUCTION

*he dominance of the "nited #tates in health care research is clear. #ince 012(! the

/obel 3ri-e in medicine or physiology has been awarded to more +mericans than to researchers

in all other countries combined. +s of 2''2! eight of the ten top-selling drugs in the world were

produced by companies headquartered in the "nited #tates %+yres 0114). 5hile the ".#. health

care mar$et provides excellent incentives for innovation and technological progress! +merican

citi-ens! in general! have yet to receive good health care outcomes in comparison to citi-ens in

other industriali-ed nations. In fact! the health insurance system in the "nited #tates is often

discussed as an explanation for some of these negative effects on health care consumers.

6oncerns within public discourse regarding the fundamentals of the current health insurance

system are not new developments. *he ".#. ran$s 72

th

in a current 5orld Health 8rgani-ation

7

examination of the worlds health care systems %5orld Health 8rgani-ation 2'''). 9odifying

the health insurance system offers an especially attractive target for cost-saving reform.

#pecifically! reforms could be targeted to reduce the incentive to overuse health insurance as a

payment mechanism

0

. "nderstanding the economic forces at wor$ as well as the strengths and

wea$nesses of the health insurance system is central to developing policies that will lead to more

cost-effective health care and to greater access to health care for those underserved by the current

mar$et.

*his paper aims to analy-e the economic relevance of moral ha-ard in individual health

care decisions! investigating how pertinent the conventional moral ha-ard argument is to the

health insurance industry. :irst! this paper will examine the notion of health insurance and its

history within the "nited #tates. *his paper will further explore the models and theories

surrounding health care! critiquing the conventional theory of moral ha-ard and proposing a new

alternative theory. "ltimately! the purpose of this thesis is to contend that the conventional and

dominant theory of moral ha-ard is not entirely valid in the health insurance industry as it is in

other spheres due to the concept of good! efficient health care moral ha-ard.

31 INSURANCE CONCE&TS AND DEFINITIONS

Insurance is a significant and widely-discussed topic in modern economics. +utomobile

insurance provides financial security against the possibility of an accident! home insurance

provides financial security against the ris$ of a fire! flood or other ha-ards! and life insurance

provides financial security to loved ones in case of a death. In each of these examples! the basic

1

This overuse of health is referred to as moral hazard and will be discussed later in this

paper

;

principle is the same< in exchange for a fee

2

! the insurer guarantees that some financial benefit

will be supplied if one of these disastrous events occurs. Insurance is a valuable economic

commodity for consumers. =y giving up some income in the form of a premium! a consumer can

avoid the large loss in wealth associated with an unfortunate event. ven if the event does not

occur! a consumer still benefits from the reduced uncertainty provided by insurance.

Health insurance was designed with a purpose to pay the costs associated with health

care. Health insurance plans pay the bills from physicians! hospitals! and other providers of

medical services. =y doing so! health insurance protects people from financial hardship caused

by large or unexpected medical bills. :or example! the cost of a one-day stay in a hospital

7

can

exceed >0!''' in some parts of the "nited #tates. + hospital stay that includes the cost of

surgery and other physician services can easily produce bills exceeding >0'!'''. Health care

costs of this magnitude pose substantial ris$s to many families financial well-being.

=y combining! or ,pooling!. the ris$s of many people into a single group! insurance can

ma$e the financial ris$s associated with health care more manageable. *hrough insurance! each

person who buys coverage theoretically agrees to pay a share of the groups total losses in

exchange for a promise that the group will pay when he or she needs services. ssentially!

individuals ma$e regular payments to the plan rather than having to pay especially large sums at

any one time in the event of sudden illness or in?ury. In this way! the group as a whole funds

expensive treatments for those few who need them.

Insurance is generally not needed when there is little uncertainty or when financial ris$s

are small. :or example! insurance policies typically do not cover items such as groceries!

2

This fee is typically referred to as an insurance premium. A premium is the monthly payment

an individual policyholder makes in exchange for the financial assistance for medical cost. The

premium charged for the insurance reflects the value of the benefits received.

3

This cost of a one-day hospital stay is excluding the cost of all other health care services

(

clothing! gasoline! etc. :ew individuals would find such a policy cost-effective. #uppose! for

example! that an individual could purchase a grocery insurance policy with a ,coinsurance. rate

of 2( percent

;

. +n individual with such a policy would be expected to spend substantially more

on groceries with the 2( percent discount than he or she would at the full price. However! the

insurance company would need to charge a high premium to cover the 2( percent discount on the

groceries that the individual would have bought had he or she been paying real price of the

product. *his represents the inherent inefficiency in the use of insurance to pay for things that

have little intrinsic ris$ or uncertainty. *his example also illustrates the broader problem in

insurance mar$ets $nown as moral ha-ard.

310 MORAL HAZARD

In the past few decades an explanatory theory has developed among prominent +merican

economists! which has also served as a significant ?ustification for the lac$ of expansion of health

insurance. *his idea is $nown as ,moral ha-ard.. conomist 9ar$ 3auly was the first to argue in

014@ that moral ha-ard plays an enormous role in medicine. 9oral ha-ard refers to the notion

that individuals will ma$e different choices when they are covered by an insurance policy than

when they are not %3auly 012;). 9oral ha-ard is a result of asymmetric information; it exists

when a party with superior information alters his behavior in such a way that benefits him while

imposing costs on those with inferior information. #ince most insurance plans reduce the out-of

poc$et cost of medical care! the behavior of individuals is affected by those reduced pricesAthis

change in behavior is $nown as the moral ha-ard. In the same way that people treat water with

4

This means that after paying the insurance premium, the holder of the insurance policy would

only have to pay 25 cents on the dollar for all grocery purchases. Coinsurance will be discussed

in detail later within this paper.

4

little care when it is very inexpensive! the conventional theory of moral ha-ard claims that people

also tend to overuse medical care when the out-of poc$et costs are small.

*he fundamental problem is that the insured individual has far better information

regarding his or her health and behavior than the insurer. *herefore! after he has contracted for

insurance! the insured can use that informational superiority to alter his behavior in a way that

benefits him

(

. =ecause the insureds health care is theoretically being paid by a third party

4

! he

has an incentive to use health care less economically %Bothschild 0124). *here are two primary

and widely-discussed types of moral ha-ard resulting from consumers actions and behaviors.

:irst! insurance may discourage fully insured consumers to ta$e preventative measures. Insured

individuals have less motivation to ta$e care of themselves and lead healthy lifestyles in order to

prevent the need of future health care. *here is a cost involved in ta$ing precautions to avoid an

uncertain loss. However! fully insured persons have no reason to incur the costs of these

precautions since their insurance will fully cover the loss; these persons therefore may engage in

ris$y

2

behavior. 9oral ha-ard is the health care needed by an insured person because he did not

ta$e preventative actions to avoid the care. #econd! insurance may encourage consumers to

obtain medical care that is not necessary or crucial to his health. :or example! this moral ha-ard

occurs when an insured person spends an extra day in the hospital than is required or purchases

5

For this paper, assume that all parties are rational individuals and that, therefore, consumers

make health care decisions which are in their best interest. In other words, consumers do not

change their behavior after becoming insured by reason of coincidence. Prior to being insured,

consumers may not make good decisions regarding health care due to lack of information,

liquidity constraints, or discounting.

6

The transaction of medical care is directly between the consumer (the buyer) and the

physician/health care provider (the seller). The insurance company thus acts as a third party

within this transaction, receiving funds from the all consumers in the health insurance plan and

then transferring these funds to the physician/health care provider of the consumers who need the

care.

7

Risky behavior could include any number of things that would negatively affect ones health,

such as not exercising, having a poor diet, not brushing ones teeth regularly, smoking,

consuming excessive amounts of alcohol, etc.

2

some procedure that he would not otherwise have purchased. In both situations! health insurance

creates a moral ha-ard problem because insured consumers tend to overuse medical services that!

under uninsured circumstances! they would not have. Insurers generally disli$e moral ha-ard

because it often results in them paying more out in benefits than they had anticipated when

originally setting premiums %6utler 011@).

9oral ha-ard results from an asymmetry of information because the actions of the fully

insured persons cannot be observed by insurance companies. Insurers therefore do not have

complete information about the insured to $now why each consumer needs the health care

requested and what they intend to do with the care once they receive it. Coes the consumer need

the health care because he failed to ta$e preventative measures which would have prevented the

need for care or was the health situation a result of influences outside of the consumers controlD

*his information asymmetry prevents insurers from $nowing how financially responsible

consumers should be for their personal health care.

41 HISTORICAL /AC<GROUND

410 HISTORY OF HEALTH CARE IN THE UNITED STATES

*he historical bac$ground of health insurance coverage in the "nited #tates helps explain

why it is different from other types of insurance

@

. Health insurance in the "nited #tates is a

relatively new phenomenon! dating bac$ to the time of the 6ivil 5ar %0@40-0@4(). arly forms

of health insurance primarily offered coverage against accidents arising from travel! especially

by rail and steamboat %6utler 0111). *he success of accident insurance paved the way for the

first insurance plans covering illness and in?ury. *he first insurance against sic$ness was offered

by 9assachusetts Health Insurance of =oston in 0@;2. In the late nineteenth and early twentieth

8

Other types of insurance include automobile, home, and life insurance

@

century! health insurance tended to cover wage loss rather than payment for medical services

%+yres 0114). *his insurance is comparable to present-day disability insurance or wor$ers

compensation. 3atients were expected to pay all other health care costs out of their own poc$ets!

under what is $nown as the ,fee-for-service

1

. business model.

*he first modern health insurance policy originated in 0121 when a group of teachers in

Callas! *exas! contracted with =aylor "niversity Hospital for room! board! and medical services

as needed in exchange for a monthly fee. :or an annual premium of >4! the policy guaranteed up

to three wee$s of hospital coverage %ggleston 2'''). 3roviding insurance through employers!

rather than to individuals! lowered administrative costs for insurers. It also mitigated the problem

of adverse selection

0'

because the insured group was formed without regard to health status.

9any life insurance companies entered the health insurance field in the 017's and 01;'s! and the

popularity of health insurance grew quic$ly thereafter. In 0172! nonprofit organi-ations called

=lue 6ross and =lue #hield first began to offer policies of group health insurance

00

%6utler

9

Fee-for service health insurance is a private (commercial) health insurance plan that

reimburses health care providers on the basis of a fee for each health service provided to the

insured person. It allows the holder to make almost all health care decisions independentlyThe

patient may visit any health care provider. The patient or the medical provider then sends the bill

to the insurance company, which typically pays a certain percentage of the fee after the patient

meets the policys annual deductible.

10

Adverse selection, as analyzed in George Akerlofs Lemons Model (Akerlof 1970), occurs

in insurance markets when an insurance policy attracts certain types of people, and the insurer

cannot identify these people beforehand. Insurance companies argue that asymmetry of

information about a persons health and behavior is likely to lead to adverse selection. They

worry that those individuals who seek health insurance are likely to be those with existing

medical problems or those who are likely to have future medical problems. Adverse selection,

like moral hazard, exists when the consumer knows more about his or her characteristics than the

insurer. As a result, there is market inefficiency where some consumers may not purchase

insurance because the only policy available to them is priced for the most expensive consumer

(Brown 1992).

11

Originally, Blue Cross plans covered the cost of hospital care, whereas Blue Shield plans

covered doctors bills. Eventually, however, both Blue Cross and Blue Shield plans began

covering all health care services.

1

0111). *hese were the first programs that established contracts directly with health care

providers! who would then offer services to subscribers at reduced rates.

In both urope and the "nited #tates! the push for health insurance was led primarily by

organi-ed labor. In urope! the unions wor$ed through the political system! fighting for coverage

for all citi-ens. Health insurance in urope was public and universal from its origin. &ermany

introduced the first national health insurance program in 0@@7 and other industriali-ed countries

adopted government-funded health insurance systems in the early twentieth century %&eyman

2''(). In the "nited #tates! by contrast! the unions wor$ed through the collective-bargaining

system and! as a result! could win health benefits only for their own members. Health insurance

in the ".#. has therefore always been a private and selective system with an emphasis on

employer-based programs.

mployee benefit plans became a widespread source of health insurance in the 01;'s and

01('s. Increased union membership at ".#. factories enabled union leaders to bargain for better

benefit pac$ages! including tax-free! employer-sponsored health insurance. mployer-based

coverage was also encouraged in the "nited #tates by legal provisions during 5orld 5ar II

%0171-01;() which allowed employers to compete for employees by offering employee health

benefits during a period of wage free-ing and price controls %Cocteur 2''7). "nable by law to

attract scarce wor$ers by increasing wages! employers instead enhanced their benefit pac$ages to

include health care coverage. In addition! a 01;7 administrative tax court ruled that some

employers payments for group medical coverage on behalf of employees were not taxable as

employee income. xempting premiums paid on employer-provided insurance resulted in lower

tax receipts to the :ederal government.

02

&overnment programs to cover health care costs began

12

It has been estimated that, in 2001, Federal tax receipts were approximately $120 billion lower

as a result of the health care insurance tax exemption. Research on the inefficiencies from moral

hazard advocates that the tax preference for insurance induces people to buy more expansive

0'

to expand during the 01('s and 014's. 9edicare and 9edicaid programs were implemented in

014(. *hroughout most of the 01@'s and 011's the ma?ority of employer-sponsored group

insurance plans switched from fee-for-service plans to managed care plans %#teinmo 011().

41, TY&ES OF HEALTH CARE

F"('re 0: Ty*es o% Heal$h Is'race a) Co#era(e =US Ces's /'rea' ,--,>

41,10 &U/LICLY FUNDED HEALTH CARE

*he "nited #tates is the only industriali-ed nation that does not guarantee access to

health care as a right of citi-enship. *wenty-eight industriali-ed nations have single-payer

health insurance and policies that have low deductibles and co-insurance rates. (Ayres 1996)

00

universal health care systems

07

! while two have a multi-payer universal health care system

0;

%=ureau of Eabor ducation 2''0). &overnment-funded national health care in these countries

provides health insurance for all citi-ens. *he "nited #tates government operates some publicly

funded health insurance programs but access is limited to specific groups! such as the elderly and

disabled

0(

! the military veterans

04

! and the poor

02

.

41,1010 MEDICARE

&overnment-funded 9edicare programs help to insure the elderly

0@

! younger people with

disabilities

01

! and patients with nd #tage Benal Cisease

2'

in the "nited #tates; 9edicare

currently provides health care coverage for ;0 million +mericans %".#. 6ensus =ureau 2''2).

9edicare is primarily financed by payroll taxes

20

and monthly premiums paid by participants.

9edicare has several parts< Hospital Insurance! 9edical Insurance %helps cover doctors

services! outpatient hospital care! and some other medical services that Hospital Insurance does

13

Single-payer refers to a health care system in which only one entity is billed for all medical

costs, typically a government-run universal health care agency or department.

14

Germany and France both employ a multi-payer system in which health care is funded by

private and public contributions

15

Through Medicare

16

The Department of Veterans Affairs directly provides health care to U.S. military veterans

through a nationwide network of government hopsitals

17

Through Medicaid

18

People who are age 65 and over

19

People under 65 and disabled must be receiving disability benefits from either Social Security

or the Railroad Retirement Board for at least 24 months before automatic enrollment occurs.

20

Permanent kidney failure requiring dialysis or transplant

21

In the case of employees, the tax is equal to 2.9% (1.45% withheld from the worker and a

matching 1.45% paid by the employer) of the wages, salaries and other compensation in

connection with employment.

02

not cover)! 9edicare +dvantage 3lans

22

! and 3rescription Crug 3lans %2''; conomic Beport of

the 3resident). *he program utili-es premiums! deductibles! and co-payments.

41,101, MEDICAID

9edicaid in the "nited #tates is a program managed by the states and funded ?ointly by

the states and federal government to provide health insurance for individuals and families with

low incomes and resources. 9edicaid currently provides health insurance coverage for

approximately 00 percent of the ".#. 3opulation %".#. 6ensus =ureau). +s originally conceived!

any household that fell below the federal poverty level would qualify for 9edicaid benefits. In

practice! however! budget shortfalls have forced states to vary standards for eligibility! services!

and payment %=ureau of Eabor ducation). #tate participation in 9edicaid is voluntary;

however! all states have participated since 01@2. In some states 9edicaid pays private health

insurance companies that contract with the state 9edicaid program! while other states pay

providers %i.e.! doctors! clinics and hospitals) directly to ensure that individuals receive proper

medical attention.

41,1, &RI?ATE INSURANCE

In the "nited #tates! private organi-ations have traditionally provided the vast ma?ority of

health insurance coverage. +pproximately two-thirds of +mericans obtain private health

insurance coverage through employer-sponsored group plans %".#. 6ensus =ureau 2''2).

+mericans pay the cost of health insurance in a variety of ways. 5or$ers may pay for private

health insurance by authori-ing their employers to deduct a specified amount from their

22

The Federal government offers Medicare beneficiaries the option to receive the Medicare

benefit through private health insurance plans instead of receiving it from the Original

Medicare plans (Part A and Part B)

07

paychec$s. +lternatively! individuals may wor$ for employers who pay the direct cost of health

insurance. 3eople who do not receive health insurance through their employment or through

government programs can purchase private health insurance policies by paying premiums

directly to an insurance company. +lmost ten percent of +mericans purchase individual health

insurance policies to cover medical costs %".#. 6ensus =ureau 2''2).

413 CURRENT STATE OF HEALTH INSURANCE IN THE UNITED STATES

*he "nited #tates has a unique health insurance program. :irst! most health insurance is

provided through employers. +s shown in :igure 2! over 4' percent of all individuals in the

"nited #tates have employer-provided health insurance %".#. 6ensus =ureau 2''2). *he central

role of employer provision ma$es health insurance very different from other types of insurance!

such as home and automobile insurance programs.

F"('re ,: Heal$h Is'race o% A)'l$s U)er A(e .4 =US Ces's /'rea' ,--,>

Health Insurance Breakdown for Adults

Under Age 64

62%

14%

15%

9%

Employer

Health

Insurance

Uninsured

Government

Insurance

Other rivate

Insurance

#econdly! health insurance policies in the "nited #tates tend to cover many events that

have little uncertainty! such as routine dental care! annual medical exams! and vaccinations. :or

0;

these types of predictable expenses! health insurance plays the role of prepaid preventative care

rather than true insurance. If automobile insurance were structured li$e the typical health policy!

it would cover regular maintenance! such as tire replacements! car washes! etc.

*hird! health insurance tends to cover relatively low-expense items! such as doctor visits

for colds or sore throats. +lthough often unforeseeable! these expenses would not have a ma?or

financial impact on most people. *o continue the analogy! this would be similar to car insurance

covering relatively small expenses such as replacing worn bra$es.

414 A COM&ARISON TO OTHER INDUSTRIALIZED COUNTRIES

*he "nited #tates has the most expensive health care system in the world! as measured

by health expenditures per capita and total expenditures as a percentage of gross domestic

product %&C3). 6ountries that have national health insurance programs spend (.(F less on

health care as a percentage of their &C3 than the "nited #tates %2''; conomic Beport of the

3resident). +s shown in :igure 7! +mericans spend approximately >;!@@2 per capita on health

care every year! over twice the amount of the industriali-ed worlds median of >2!002 %=ureau of

Eabor ducation 2''0). *he reasons for the especially high cost of health care in the ".#. can be

attributed to a number of factors! including the rising costs of medical technology and

prescription drugs as well as the high administrative costs resulting from the complex multiple

player system in the "nited #tates. +dministrative costs comprise between 01.7 and 2;.0 percent

of total dollars spent on health care in the ".#. %5oolhandler 0110). In addition! the high

proportion of +mericans who are uninsured %0(.2 percent in 2''2) contributes to expensive

health care because conditions that could be either prevented or treated inexpensively in the early

stages often develop into health crises %+yres 0114). #tudies have also shown that the uninsured

0(

who are not at a point of serious illness still tend to use the most expensive solution for their

minor health care needsAthey will go to the emergency room when only a visit with a physician

is necessary. *his is an inefficient use of health care.

F"('re 3: &er Ca*"$a S*e)"( o Heal$h Care =/'rea' o% La2or E)'ca$"o ,--0>

+s shown in :igure ;! most industriali-ed countries have established systems in which

the public sector! which has the greater share of responsibility! wor$s alongside the private

sector! both in the funding of health care. *he "nited #tates is the only country in the developed

world that does not provide health care for all of its citi-ens %+yres 0114)

F"('re 4: The Ma" So'rce o% F"ac"( %or Heal$h Care a!o( I)'s$r"al"9e) Na$"os

=/'rea' o% La2or E)'ca$"o ,--0>

04

Instead! the ".#. has a confusing mixture of private insurance coverage based primarily

on employment! with only public insurance coverage for the elderly! the military veterans! the

poor and the disabled. *his system creates serious gaps in coverage. +mericans live fewer years

than people in other countries and have higher infant mortality levels %=ureau of Eabor

ducation 2''0). +ccording to the Institute of 9edicine! 0@!''' people die each year from

having a lac$ of heath insurance. +mericans have fewer doctors per capita! fewer hospital visits!

and are! overall! less satisfied with their health care than most other 5estern countries %&ladwell

2''(). *he 5orld Health 8rgani-ation %5H8) released a notable report in 2'''! with data on

the health systems of 010 member countries. *he 5H8 concluded that "nited #tates citi-ens

were less satisfied with their countrys health care system than citi-ens in most other

industriali-ed countries %5orld Health 8rgani-ation 2'''). 5hereas other countries in the

industriali-ed world insure all their citi-ens! despite those extra billions of dollars spent each

year in the "nited #tates! forty-five million +mericans are left without any form of insurance.

=oth the ".#. &eneral +ccounting 8ffice %&+8) and the 6ongressional =udgeting

8ffice %6=8) issued reports stating that a single payer system would more than pay for itself!

02

due to reduced administrative costs! as well as having universal access to health care! especially

preventative care %3hysicians for a /ational 3rogram 0111). In addition! recent surveys in the

".#. have documented the growing frustration with our health care system and an interest in

exploring a single payer plan for health insurance with universal coverage. +ccording to a

5ashington 3ost poll! +mericans would prefer a universal health insurance system which

provided health care coverage to all %:igure ( and 4).

F"('re 7: %Guestion 72). ,5hich of these do you thin$ is more important< providing health care

coverage for all +mericans! even if it means raising taxes; or holding down taxes! even if it

means some +mericans do not have health care coverageD. %Eester 2''7)

Which do you think is more important...?

!"%

1#%

4%

Provide Helath Care for All

Hold Down Taxes

No Opinion

F"('re .: %Guestion 7@). ,5hich would you preferAthe current health insurance system in the

"nited #tates! in which most people get their health insurance from private employers! but some

people have no insurance; or a universal health insurance program! in which everyone is covered

under a program li$e 9edicare thats run by the government and financed by taxpayersD. %Eester

2''7)

Which would you prefer...?

62%

$2%

5%

Universal %ystem

&urrent %ystem

'o Opinion

71 MODELS OF HEALTH INSURANCE

710 SOCIAL HEALTH INSURANCE

0@

Historically! health coverage was created to help balance financial ris$ between the

healthy and the sic$ %ggleston 2'''). *his model of coverage is $nown as social insurance

because those more li$ely to use health care %such as the old and sic$) do not pay substantially

more for coverage than the healthy and young. *his insurance model is utili-ed in the ma?ority of

countries in urope! where they refer to it as social health insurance %#HI). *hrough pooling

financial contributions from enterprises! households! and governments! #HI mechanisms

successfully finance and manage health care %/yman 2'';) *hese plans utili-e the social health

insurance model by ensuring that all people who ma$e contributions receive a pre-defined right

to health care! regardless of their income or social status. *he #HI schemes typically cover the

minimum health and financial ris$s

27

that! in the absence of insurance! would cause a financial

burden on the household as a result of the cost of health care.

+s with most forms of insurance! #HI is prospective financingAfunds are collected in

advance! mainly in the form of regular contributions %premiums)! without $nowing when or for

whom they will be needed. *hese contributions come from the insured households as well as

from employers and the government. #ocial Health Insurance is generally associated with

universal and mandatory membership of all people! i.e. because every household is covered

every citi-en must contribute

2;

. *his ensures the inclusion of underserved groups who are often

left out from the voluntary private health insurance schemes. *he fact that all varieties of ris$y

consumers receive coverage without regard to their health status in #HI schemes eliminates the

problem of adverse selection.

23

The minimum health and financial risks are the basic packages for health care and its

expenditure

24

Although every citizen is required to contribute, the government may do so for the poorest and

the unemployed.

01

+ll industriali-ed nations with universal health care are based on this social insurance

model. *he 9edicare program in the "nited #tates also follows the theory of #HI. =ecause of

this social aspect! +mericans with 9edicare plans reveal that they are much happier with their

insurance coverage than people with private insurance 2&ladwell 2''(). +lthough they are not

receiving better care! 9edicare consumers are receiving something ?ust as valuable< protection

and security against the financial threat of serious illness.

71, ACTUARIAL HEALTH INSURANCE

*he politics of +merican health insurance is a struggle over which vision of distributive

?ustice

2(

should govern< the social insurance principle or the logic of actuarial fairness. *he

second theory of insurance is this actuarial model. 6ar insurance! for instance! is actuarial

insurance< how much consumers pay is in large part a function of their individual situation and

history. *he new Health #avings +ccounts

24

%H#+s)! created in 9edicare legislation and signed

into law by 3resident =ush in 2''7! represent a ma?or step in the actuarial direction. "nder

H#+s! consumers pay for routine health care with their own money and then purchase a basic

health insurance pac$age for their catastrophic expenses %:letcher 2''(). H#+s represent a

massive retreat from the original purpose of insuranceAsharing the financial ris$ between

healthy and sic$ across a population.

+ctuarial fairness is central to +merican private health insurance. *here is a screening

process that health insurance companies engage in prior to allowing consumers to purchase

25

Distributive justice concerns what is just or right with respect to the allocation of goods in

society. It is justice dispensed in the community to confer maximum value to those in need

through the notions of fairness and consistency (Rawls 1971)

26

A Health Savings Account is a special account owned by an individual where contributions to

the account are to pay for current and future medical expenses. These will be discussed in more

detail later.

2'

private health insurance. Individuals are usually required to fill out a thorough medical history

form! which as$s an abundance of questions regarding the individuals health. *ypical queries

include whether the person smo$es! how much the person weighs! and has the person ever been

treated for any of a long list of diseases. In addition! discounts are frequently offered to those

people who live healthy lifestyles

22

. *his medical history form is primarily used as a screening

device to filter out persons with pre-existing medical conditions as well as persons with a high

li$elihood of developing future medical conditions.

In 2''2! the ".#. 6ensus =ureau reported that approximately ;7.4 million people in the

"nited #tates %0(.2 percent of the population) lac$ed health insurance coverage. +lthough

millions of +mericans lac$ health insurance because they cannot afford it or do not have access

to employer-sponsored group plans

2@

! many others cannot buy health insurance because insurers

consider them at especially high ris$ of needing expensive health care. Insurers assess the ris$s

posed by applicants for insurance and then group applicants into similar classes of ris$.

+mericans who are considered average or better-than average ris$s can usually purchase

insurance policies at a relatively affordable price. 5hen an applicant presents too much ris$!

however! private companies often refuse insurance coverage to that person. In fact! some

insurance companies have introduced clauses to their policies that are designed to $eep costs

down by denying insurance coverage for anyone who already suffers from significant medical

conditions. *he few companies willing to insure high-ris$ individuals will charge outrageous

premiums to compensate for that ris$. Increased premiums often ma$e the insurance policy

unaffordable to high-ris$ individuals.

27

People who live healthy lifestyles do not smoke, exercise regularly, and eat healthy diets

28

People who are self-employed, work part-time, or work in low-wage jobs

20

*he triumph of this actuarial model over the social insurance model in private health

insurance is the reason why! in many states! companies refuse to insure people suffering from

potentially high-cost medical conditions %ggleston 2'''). Industriali-ed countries with social

insurance argue that individuals whose genes predispose them to depression or cancer should not

bear a greater share of the costs of their health care than those who are fortunate enough to avoid

such misfortunes. *hey do not support this actuarial ,genetic lottery. method as an appropriate

way to organi-e health insurance.

.1 THE CON?ENTIONAL MORAL HAZARD CRITIQUE

.10 THE CRITIQUE

conomists have long held that people purchase health insurance to avoid ris$ %=rowne

0112). Health insurance allows individuals to have more income and resources available to

purchase health care in case they were to become ill. 6onventional theory holds that people buy

health insurance because they prefer a certain loss to an uncertain loss of a similar expected

magnitude %/yman 2'';). *hat is! consumers would rather pay >0'!''' for an insurance

premium than pay a >0''!''' medical bill that occurs with a 0 in 0' chance.

9ost health economists view moral ha-ard negatively because! under the conventional

theory! the additional health care spending generated by insurance represents a welfare loss to

society. 5hen consumers become insured! insurance pays for their care! essentially reducing the

price of health care for the consumer. =ut because consumers typically purchase more care when

the price drops than they would have at the normal mar$et price! economists conclude that the

value of care to consumers is less than the mar$et price %Holmstrom 0121). *he additional care!

22

however! is still ?ust as costly to produce

21

. *he difference between the high cost to produce this

care %reflected in the high mar$et price) and its low apparent value to insured consumers

%reflected in the reduced price for consumers) represents inefficiency in the mar$et for health

insurance %3auly 012;). *hus! health care spending increases with insurance

7'

! but the value of

this care is less than its cost! generating an inefficiency that economists refer to as a ,moral-

ha-ard welfare loss. %Hoc 2''(). 6onventional economists therefore consider all moral ha-ard to

be negative because it is caused by consumers who ta$e advantage of the insurance company and

receive care that is worth less to the consumer than the cost of producing it.

.1, &OLICY SOLUTION

In response to the information asymmetries and the moral ha-ard problem caused by

consumers! optimal insurance contracts attempt to balance the perceived value that consumers

place on reducing their exposure to ris$ against the inefficiency arising from moral ha-ard.

Insurance companies therefore have an incentive to increase the price of health care! recommend

marginally beneficial care

70

! or claim that certain medical procedures are not necessary. In the

01@'s and 011's economists also promoted utili-ation review! which is a process of assessing

the necessity! appropriateness! and efficiency of the use of medical services and facilities! as a

further way to reduce moral ha-ard %/yman 2'';). :urthermore! nearly all health insurance

policies in the "nited #tates share a few common features regardless of whether the policies are

purchased by individuals or through an employer. #tandard attributes of insurance contracts!

29

The actual price of the health care has not changed when a consumer becomes insuredthe

consumer just no longer pays for the real price of the care

30

Health care spending increases with insurance because consumers tend to utilize more care

when they are insured (the moral hazard theory)

31

Marginally beneficial care consists of incomplete care, care which may or may not fully

address the health care problem

27

such as deductibles! coinsurance rates! and co-payments! are attempts to mitigate the moral

ha-ard problem and the inefficient use of health insurance. *hese features force consumers to

pic$ up a larger share of health costs! theoretically ma$ing the health care system more efficient.

*hese policies assume that! unless patients pay something for the services they receive! they

place little value on those services. *he managed health care system in the "nited #tates today is

largely a product of this conventional theory.

.1,10 DEDUCTI/LES

Health insurance policyholders pay a specified amount of money each year for medical

services before the insurance policy pays anything at all %/yman 2'';). *his amount is called

the deductible. :or example! a person who selects a policy with a >('' deductible agrees to pay

the first >('' of medical costs in a given year. Ei$ewise! the insurance company agrees to pay

some or all costs that exceed >(''. 3olicies with a low deductible generally charge a relatively

high monthly fee! or premium.

.1,1, COINSURANCE

9any insurance policies also require policyholders to pay a certain portion of medical

costs that exceed the deductible %/yman 2'';). *his extra amount is called the coinsurance

payment. :or example! suppose an individual has already paid his policys deductible for the

year and then has a medical procedure that costs >0''. If that persons health insurance policy

states the terms of coinsurance at 2' percent! the insurance company must pay >@' of the bill and

the policyholder must pay >2'. 3olicies that do not require a coinsurance payment usually charge

subscribers a relatively high premium.

2;

.1,13 CO@&AYMENTS

9ost managed care policies require policyholders to ma$e a modest paymentAcalled a

co-paymentAtoward the cost of services for each visit to a health care provider. 6o-payments

are typically less than >0'. In the 012's many insurers adopted co-payments to reduce both

moral ha-ard and health care spending %3auly 012;). +lthough the amount of money collected

from co-payments may contribute little toward the actual cost of medical services! it does impose

some cost onto consumers in a way that successfully provides incentives against overusing the

health care system.

.1,14 TERMS AND LIMITS

9ost health insurance policies limit coverage to services that the insurance company

defines as both ,reasonable and necessary. %9anning 0114). *hese terms are helpful for

consumers in understanding the policys benefits because they define whether particular services

are within the scope of coverage. Insurance companies carefully determine what they consider to

be ,reasonable. costs of medical services by gathering statistics on what health care providers in

a particular area typically charge for identical or similar services. *hat information helps the

company determine the amounts it considers to be reasonable. Insurance companies also

determine what they consider to be ,necessary. medical treatments. Health insurance contracts

limit coverage to services that are considered important to maintaining sound health

72

.

.1,17 &REEAISTING CONDITIONS

32

This is a subjective termfor example, some health insurance companies refuse to provide

coverage for cosmetic surgeries.

2(

5hen a policyholder has medical conditions before being issued a health insurance

policy! these are referred to in the new policy as preexisting conditions. 9any newly issued

policies contain a clause that limits the amount the insurance company will pay for services

related to preexisting conditions. *he precise limit can be expressed in this clause as a dollar

amount! as a period of time for which benefits are limited! or as a permanent exclusion of

coverage for particular services related to the conditions %9anning 0114). *hese clauses protect

the company from the li$elihood of paying large medical bills associated with new

policyholders preexisting illnesses.

.1,1. HEALTH SA?INGS ACCOUNTS

Health #avings +ccounts %H#+s) are at the center of the =ush +dministrations plan to

address and minimi-e the problem of moral ha-ard. *he logic behind H#+s is that +mericans

have too much insurance< typical plans cover things that they shouldnt! creating the problem of

over consumption %conomic Beport of the 3resident 2'';). "nder the Health #avings +ccounts

system! consumers are as$ed to pay for routine health care out of their own poc$et. *o handle

their catastrophic expenses! they then purchase a basic health-insurance pac$age with a

deductible %#chreyogg 2'';). =ush claims that ,Health #avings +ccounts all aim at empowering

the people to ma$e decisions for themselves! owning their own health-care plan! and at the same

time bringing some demand control into the cost of health care. %:letcher 2''(). *he main effect

of putting more of the cost and responsibility on the consumer is to reduce the social

redistributive element of insurance.

;1 THE CHALLENGE

24

;10 RAND COR&ORATION STUDY

5hen you have to pay for your own health care! does your consumption really become

more efficientD *his is exactly the question the B+/C 6orporation

77

extensively studied in the

late 012's. It established an insurance company and insured (!2'7 individuals to health plans

with co-payment levels at -ero per cent! twenty-five per cent! fifty per cent! or ninety-five per

cent! up to six thousand dollars %+fifi 0122). +s expected! the study found higher co-payment

rates reduced spending because people did not see$ care as frequentlyAthe more that people

were as$ed to chip in for their health care! the less care they used. *he interesting aspect of the

study was that individuals cut bac$ equally on both frivolous

7;

care and useful

7(

care. 3oor

people in the high-deductible group with hypertension! for instance! did not control their blood

pressure as well as those in other groups! resulting in a ten per cent increase in the li$elihood of

death %Hoc 2''().

=ut how should the average consumer be expected to $now beforehand what care is

frivolous and what care is usefulD *he focus of the traditional moral ha-ard theory suggests that

the changes made in behavior when consumers become insured are nearly always wasteful. Iet!

when it comes to health care! the B+/C study found! many of the routine preventative actions

we ta$e only because we have insurance %li$e getting moles chec$ed! teeth cleaned!

mammograms) are anything but wasteful and inefficient. In fact! they are behaviors that could

33

The RAND Corporation is a think tank first formed to help improve policy and decision

making through research and analysis to the United States armed forces. It was incorporated as a

nonprofit organization to further promote scientific, educational, and charitable purposes, all for

the public welfare and security of the United States of America.

34

Frivolous care consists of care that results in negative moral hazard, i.e. care that was not

necessary for the consumer to obtain

35

Useful care consists of care that results in a positive moral hazard, i.e. care that was actually

beneficial to an individuals health

22

end up saving the health-care system a good deal of money

74

. *hese B+/C studies show that

cost sharing through deductibles! co-payments and coinsurance is effective in reducing all health

care costs! including the use of beneficial and valuable health care services %Hoc 2''().

;1, THE DISTINCTION

*here is a fundamental ambiguity concerning the moral ha-ard welfare loss of health

insurance. *hat is! the conventional theory only ma$es sense if individuals consume health care

in the same way that they consume other consumer goods. *o economists such as John /yman!

this assumption is absurd. He argues that people go to the doctor! reluctantly! only because they

are sic$. ,9oral ha-ard is overblownK3eople who are very well insured! who are very rich! do

you see them chec$ into the hospital because its freeD Co people really li$e to go to the doctorD

Co they chec$ into the hospital instead of playing golfD. %/yman 2'';).

*he conventional moral ha-ard argument may seem sensible for large health care

procedures such as cosmetic surgery! drugs to improve sexual functioning or designer-style

prescription sunglasses and for small habitual preventative health care such as doctor and dentist

visits! but not for serious treatments such as coronary bypass operations or organ transplants

72

.

6learly! insured people would purchase more of all these procedures than would uninsured

people! so they would all be considered moral ha-ard to insurers. 5hat is not clear is whether the

life-saving organ transplant an individual with organ failure purchases represents the same

36

Taking regular preventative measures on the part of the consumer to avoid needing serious

health care can save the health care system money

37

It is important to mention here that some serious treatments and illnesses may be due to a lack

of preventative actions taken on the part of the consumer. Recollect that the moral hazard theory

of insurance states that consumers have an incentive to ignore preventative actions which may

cause them to require medical care that they would not have otherwise needed. For this new

theory, assume that the serious illnesses referred to here are not a cause or result of the actions or

lack of actions by the consumer.

2@

welfare loss implications as the liposuction cosmetic surgery a healthy individual purchases

when both individuals are insured.

9ar$ 3auly! one of the founders of the conventional insurance theory! recogni-ed this

ambiguity in 01@7. He pointed out that the conventional theory of moral-ha-ard welfare loss was

intended to apply only to ,routine physicians visits! prescriptions! dental care! and the li$e. and

that ,the relevant theory! empirical evidence and policy analysis for moral ha-ard in the case of

serious illness has not been developed. *his is one of the most serious omissions in the current

literature. %3auly 011'). *his distinction! however! has been ignored by many health economists

and policy analysts who continue to use conventional theory to promote cost sharing and

managed care as a cure for high health costs in the "nited #tates.

;13 THE NEW THEORY

*here is a new theory that reconsiders the welfare implications of moral ha-ard in health

insurance. 3eople buy health insurance in order to obtain additional income if they become ill.

5hen a person purchases insurance! he pays a premium into an insurance pool in return for a

contract that obligates the insurer to pay for his care out of the same pool if he becomes ill. It is

un$nown by the insurance company who will become ill and who will remain healthy. =ecause

not all who pay into the pool become ill! however! the consumer who does become ill pays only

a fraction of his medical care costs. In essence! the contract obligates the insurance company to

transfer income from the many who pay into the pool and remain healthy to the few who become

ill enough to need medical care %/yman 2'';).

If insurers actually transferred income to an ill person in one lump-sum payment! the

welfare implications of moral ha-ard would be unambiguous. Health insurance policies in the

21

"nited #tates! however! generally pay off the ill consumer by paying for their medical care %as

shown in :igure 2 below). *he payment does not go directly to the patient! but instead to the

physician or the hospital. :or example! when the consumer pays >0'!''' for insurance! but then

becomes ill! and the insurance company pays the hospital >0''!'''! it is as if the consumer had

an increase in income of >1'!'''. *his extra >1'!''' represents a transfer of income from those

purchasers of insurance who paid into the pool! but remained healthy.

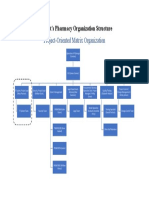

F"('re ;: A D"a(ra! o% $he c'rre$ U1S1 Heal$h Care Sys$e! =S$e"!o 0887>

*he welfare ambiguity arises because of this payoff mechanismAit is difficult to

distinguish whether this additional moral-ha-ard spending represents a welfare loss or a welfare

gain to society %/yman 2'';). *here are some patients who would respond to insurance paying

for their care in exactly the same way that they would respond to insurance paying the cost of

their care directly to them. In other words! consumers would purchase the same health care even

if the insurance company physically handed them the cash to pay for it themselves. :or these

patients! moral ha-ard is efficient and represents a welfare gain because it represents health care

that is of equal or greater value to the consumer than the cost of producing it. 9any of the more

7'

serious proceduresAorgan transplants! trauma care! many cancer treatments! and a large portion

of the costly! life-saving medical care that people could only afford to purchase with insuranceA

would now be considered welfare gains as opposed to welfare losses under this new theory.

However! there are those consumers who! if given the cash to spend on health care! would

choose to spend the money on some good or service other than health care. *hese patients clearly

value the money over the health care and would not have purchased the care without insurance.

*his is the true ,moral-ha-ard welfare loss. because there is inefficiency in the difference

between the unchanged cost of the care and the low value to the insured consumer. *his moral

ha-ard is inefficient and represents an actual welfare loss to society.

*he significance of this new theory is that not all moral ha-ard is inefficient. *here are

insured consumers who value the health care provided to them by insurance! but who would not

be able to afford to purchase this care without the additional income provided to them through

their health insurance plans. #ome of the moral ha-ard that was considered a welfare loss under

the conventional theory should therefore be reclassified as a welfare gain by reason of this new

theory %&eyman 2''(). Health insurance under the new theory is generally much more valuable

to consumers than economists originally have thought.

;14 &OLICY IM&LICATIONS

conomists have traditionally %using the conventional theory) insisted on cost sharing in

order to reduce moral ha-ard. *hey believed that all moral ha-ard was bad and inefficient and

therefore advocated for coinsurance and co-payment policies! which would reduce the welfare

loss problem caused by moral ha-ard. *he new theory suggests that cost-sharing policies have

70

been directed at problems that often do not exist. :urthermore! it proposes that coinsurance is too

blunt a policy instrument and that it should be applied sparingly! directed only on health care

spending that represents inefficient moral ha-ard %/yman 2'';). 9oral ha-ard that generates

welfare gains should be left alone or even encouraged. *he problem with implementing this

policy is that it is difficult to distinguish which consumers will act in ways that represent welfare

gains and which in ways that represent welfare losses due to the payoff mechanism of the ".#.

insurance system. It can be extrapolated! however! that those with serious illnesses

7@

! whose care

might also be associated with a great deal of pain and suffering anyway! will generate a welfare

gain. :or example! few people would frivolously choose to undergo chemotherapy treatment ?ust

because of the decreased price with insurance. *hus! it ma$es little sense to apply coinsurance

payments to procedures associated with serious illnesses and insurance contracts should be

redesigned so that this type of care is completely paid for.

*he new theory also has implications with regard to cost containment policy. "nder

conventional theory! high health care prices are not necessarily considered bad. In fact! a few

economists have argued that high prices should be encouraged because they reduce moral ha-ard

and any reduction of moral ha-ard is a welfare gain %6utler 011@). "nder the new theory!

however! the high prices that insurance providers charge because they have mar$et power are

considered harmful. 9any health care providers hold monopolies due to exclusive privileges that

have been given to them by law. :or example! only physicians are permitted to prescribe drugs!

to admit patients to hospitals! or to perform surgeries and drug firms have patents that give them

exclusive rights to sell the drugs they develop. *ypically! economists would weigh the benefits

38

That is, serious illnesses that are not a result of insured consumers ignoring preventative care

measures

72

of these laws against the costs

71

of the resulting high monopoly prices. =ut with the

preoccupation with moral ha-ard! many economists have decided that the high prices are good

precisely because of the reduction in use of health care that they produce for the insured. *his

,solution. causes an even greater problem for the uninsured; the high prices they face often

prevent any use at all. Instead of focusing public policy on reducing health care utili-ation in

order to reduce expenditures! the new theory suggests that policy should focus on reducing

excessively high monopoly prices held by health care providers! which would allow consumers

more access to health care. 8nly some utili-ationAthe ,bad. inefficient moral ha-ardAshould

be reduced.

9ore importantly! the new theory advocates a social! universal health insurance system.

"nder conventional theory! the voluntary purchase of full insurance coverage ma$es society

worse off due to the moral-ha-ard welfare loss of insurance. *herefore! a subsidy of insurance

premiums would not only encourage more people to be insured! but it would encourage them to

purchase insurance with inefficiently low cost-sharing provisions. *he new theory! on the other

hand! asserts that health insurance generally ma$es the consumer and society better off;

consequently! subsidies that encourage consumers to purchase insurance voluntarily! or a

national health insurance program for the entire ".#. population! would increase societys

welfare

;'

%Holmstrom 2''0). *his is especially true because we as a society do not li$e to see

those who are ill go without needed care

;0

. *hus! the new theory identifies efficiency %as well as

39

The costs of the high monopoly prices is represented through the lack of access by

consumers to the health care due to the expensive price of the care

40

Note that this paper is not actually advocating for the United States to adopt a universal health

insurance policy. There are indeed disadvantages and negative repercussions of implementing

such a policy that will not be discussed in this paper. This paper is solely arguing that the

primary reason for not adopting a universal, social insurance plan in the U.S. (the conventional

moral hazard theory) is flawed.

41

Refer back to Figure 5 and Figure 6

77

equity fairness arguments) as a new ?ustification for adopting some form of national health

insurance.

61 CONCLUSIONS

#ix timesAduring the :irst 5orld 5ar! the Cepression! the *ruman and Johnson

+dministrations! in the #enate in the 012's! and the 6linton yearsAefforts have been made to

initiate some $ind of universal health insurance! but each time the efforts have been re?ected

%&ladwell 2''(). *he fact that there have been six attempts in the last century! however! suggests

that there is some support for the idea. *he primary hindrance among +merican economists to

not implementing a social and universal health coverage plan has historically been the widely-

accepted conventional theory of moral ha-ard. *his obstacle is consequently irrelevant due to

recent assertions of a ,good. moral ha-ard theory.

*he new! ground-brea$ing approach to moral ha-ard claims that the additional health

expenditures generated by insurance are not always bad for society! and can in fact be good

because they often permit ill persons to obtain the care they need. :urthermore! the new theory

suggests that social health insurance provides an economy-wide redistribution of income from

those who remain healthy to those who become ill. =ecause people value the additional income

they receive from insurance when they become ill more than they value the income they lose

when they pay a premium and remain healthy! and because everyone in a social insurance system

has! in theory! an equal chance of becoming ill! this national redistribution of income from the

healthy to the ill is efficient and increases the welfare of society.

7;

REFERENCES:

+fifi! +.+. ,*houghts on the xperimental Cesign for the Health Insurance xperiment.. Band

6orporation %0122).

+$erlof! &eorge +. ,*he 9ar$et for LEemons< Guality "ncertainty and the 9ar$et

9echanism.. 3uarterly 4ournal of 5cono$ics. @; %7)< ;@@-(''.

+yres! #tephen 9.! 9.C. %0114). ,Health 6are in the "nited #tates< *he :acts and the 6hoices..

xii.

=rowne! 9ar$ J. %0112). ,vidence of +dverse #election in the Individual Health Insurance

9ar$et.. The 4ournal of /is6 and Insurance<0;-72.

=ureau of Eabor ducation! "niversity of 9aine %2''0). ,*he ".#. Health 6are #ystem< =est in

the 5orld! or Just the 9ost xpensive..

6utler! Cavid 9. and Bichard J. Mec$hauser %0111). ,*he +natomy of Health Insurance.

5or$ing 3aper. 0ational 7ureau of 5cono$ic /esearch.

6utler! Cavid 9. and #arah J. Beber %011@). ,3aying for Health Insurance< *he *rade-8ff

=etween 6ompetition and +dverse #election.. 3uarterly 4ournal of 5cono$ics< ;77-;44.

Cocteur! li-abeth %2''7). ,".#. Health #ystem 3erformance in an International 6ontext..

%5C).

Coherty! /eil and Eisa 3osey %011@). ,8n the Nalue of a 6hec$up< +dverse #election! 9oral

Ha-ard and the Nalue of Information.. The 4ournal of /is6 and Insurance< 0@1-200.

ggleston! Haren %2'''). ,Bis$ #election and 8ptimal Health Insurance-3rovider 3ayment

#ystems.. The 4ournal of /is6 and Insurance< 027-0@4.

hrlich! Isaac and &ary #. =ec$er %0122). ,9ar$et Insurance! #elf-Insurance! and #elf-

3rotection.. Uni"ersity of Chica-o Press 4ournal of Political 5cono$y. @' %;)< 427-4;@

:letcher! 9ichael +. %2''(). ,=ush 3romotes Health #avings +ccounts.. 8ashin-ton Post <

+'2.

:uchs! Nictor and Bichard Mec$hauser %01@2). ,Naluing HealthA+ L3riceless 6ommodity..

+merican conomic Beview< 247-24@.

&eyman! John %2''(). ,*he 6ommon Interest< Is it *ime for /ational Health InsuranceD. =oston

Beview.

&ladwell! 9alcolm %2''(). ,*he 9oral-Ha-ard 9yth.. The 0e1 9or6er.

7(

,Health 6are and Insurance.. conomic Beport of the 3resident %2'';)< 0@1-2'0.

Holmstrom! =engt %0121). ,9oral Ha-ard and 8bservability.. The /#0) Corporation 7ell

4ournal of 5cono$ics. 0' %0)< 2;-10

Hoc! 6agatay %2''(). ,Health-#pecific 9oral Ha-ard ffects.. Southern 5cono$ic 4ournal< 1@-

00@.

Eester! 5ill %2''7). ,3oll< 3ublic #upports Health 6are for +ll.. The 8ashin-ton Post.

9anning! 5& and 9# 9arquis %0114). ,Health insurance< the tradeoff between ris$ pooling and

moral ha-ard.. Uni"ersity of Minnesota School of Pulic Health.(< 4'1-471

,/ew *heory 6hanges How conomists valuate Health Insurance.. 5,press Healthcare

Mana-e$ent %2''7).

/i! Hanyu. ,*rends in Health Insurance 6overage by BaceO.thnicity +mong 3ersons "nder 4(

Iears of +ge< "nited #tates 0112-2''0. 0ational Center for Health Statistics.

/yman! John %2'';). ,+re the +dditional Health xpenditures &enerated by Insurance =ad for

#ocietyD. Minnesota Medical #ssociation.

/yman! John +. %2'';). ,Is L9oral Ha-ard InefficientD *he 3olicy Implications of a /ew

*heory.. Health #ffairs..

/yman! John and Boland 9aude-&riffin %2''0). ,*he 5elfare conomics of 9oral Ha-ard..

International 4ournal of Health Care !inance and 5cono$ics< 27-;2.

3auly! 9ar$ %012;). ,8verinsurance and 3ublic 3rovision of Insurance< *he Boles of 9oral

Ha-ard and +dverse #election.. 3uarterly 4ournal of 5cono$ics< ;;-42.

3auly! 9ar$ %011'). ,*he Bational /onpurchase of Eong-*erm-6are Insurance.. The 4ournal of

Political 5cono$y< 0(;-04@.

Bawls! John %0120). ,+ *heory of Justice..

Bothschild! 9ichael %0124). ,quilibrium in 6ompetitive Insurance 9ar$ets< +n ssay on the

conomics of Imperfect Information.. MIT Press 3uarterly 4ournal of 5cono$ics. 1' %;')< 47'-

4;1

#chreyogg! Jonas %2'';). ,Cemographic Cevelopment and 9oral ha-ard< Health Insurance with

9edical #avings +ccounts.. The :ene"a Papers on /is6 and Insurance< 4@1-2';.

#teinmo! #. and J. 5atts %011(). ,Its the institutions! stupidP 5hy comprehensive national

health insurance always fails in +merica..

74

Nera-Hernande-! 9arcos %2''7). ,#tructural stimation of a 3rincipal-+gent 9odel< 9oral

Ha-ard in 9edical Insurance.. The /and 4ournal of 5cono$ics< 42'-417.

".#. 6ensus =ureau< ".#. Cepartment of 6ommerce conomics and #tatistics +dministration.

,Health Insurance 6overage!. 6urrent 3opulation Beports 2''2.

5oolhander! #teffie! 9.C.! 9.3.H. and Cavid ". Himmelstein! 9.C. %0110). ,*he Ceteriorating

+dministrative fficiency of the ".#. Health 6are #ystem.. 0e1 5n-land 4ournal of Medicine<

02(7-02(@.

5orld Health 8rgani-ation. ,*he 5orld Health Beport 2'''AHealth #ystems< Improving

3erformance..

Mweifel! 3eter and 5illard &. 9anning %2'''). ,9oral ha-ard and consumer incentives in health

care.. Handboo$ of Health conomics< 6hapter @< ;'1-;(1

72

Das könnte Ihnen auch gefallen

- Basic Clinical Laboratory Techniques 6th Edition Estridge Solutions ManualDokument25 SeitenBasic Clinical Laboratory Techniques 6th Edition Estridge Solutions ManualJoshuaMartinezmqjp100% (55)

- Illinois Nursing Home RatingsDokument22 SeitenIllinois Nursing Home RatingsShannon McCarthy Antinori100% (2)

- Payslip: Employee Details Payment & Leave DetailsDokument2 SeitenPayslip: Employee Details Payment & Leave DetailsKushal Malhotra100% (3)

- Final Project On Health InsuranceDokument61 SeitenFinal Project On Health InsuranceYatriShah50% (14)

- Positive Discrimination in IndiaDokument38 SeitenPositive Discrimination in IndiaRohit Kumar Singh100% (2)

- Dream Job Essay EnglishDokument2 SeitenDream Job Essay Englishdltsweet28100% (2)

- ICD 10 Training For OptometryDokument48 SeitenICD 10 Training For OptometryctluvphdNoch keine Bewertungen

- The Anatomy of Health InsuranceDokument124 SeitenThe Anatomy of Health InsurancesimerjeetNoch keine Bewertungen

- Doctors, Hospitals, Insurers, Oh My! What You Need to know about Health Insurance and Health CareVon EverandDoctors, Hospitals, Insurers, Oh My! What You Need to know about Health Insurance and Health CareNoch keine Bewertungen

- Chapter 1: Introduction of The Project: Health InsuranceDokument62 SeitenChapter 1: Introduction of The Project: Health Insuranceapeksha bhoirNoch keine Bewertungen

- Health Economics 2Dokument4 SeitenHealth Economics 2Rira Fauziah INoch keine Bewertungen

- Medical Savings Accounts: Answering The Critics, Cato Policy AnalysisDokument12 SeitenMedical Savings Accounts: Answering The Critics, Cato Policy AnalysisCato InstituteNoch keine Bewertungen

- 11 Chapter 2Dokument37 Seiten11 Chapter 2Sairaj SankpalNoch keine Bewertungen

- Thesis Statement On Universal Health CareDokument8 SeitenThesis Statement On Universal Health Caretammylacyarlington100% (2)

- 2004 Mar 22 System Blocks Better Health CareDokument5 Seiten2004 Mar 22 System Blocks Better Health CareJoshua GansNoch keine Bewertungen

- Health InsuranceDokument2 SeitenHealth Insurancewilliam sunNoch keine Bewertungen

- Health-Status Insurance: How Markets Can Provide Health Security, Cato Policy Analysis No. 633Dokument12 SeitenHealth-Status Insurance: How Markets Can Provide Health Security, Cato Policy Analysis No. 633Cato Institute100% (1)

- Health InsuranceDokument54 SeitenHealth InsuranceMinal DalviNoch keine Bewertungen

- Aff Round 4 BlocksDokument5 SeitenAff Round 4 BlocksDaniela JovelNoch keine Bewertungen

- Health Insurance LawDokument16 SeitenHealth Insurance LawParul NayakNoch keine Bewertungen

- Ten Steps For A Market-Oriented Health Care SystemDokument2 SeitenTen Steps For A Market-Oriented Health Care SystemahmedNoch keine Bewertungen

- Hi 225 FinalpaperDokument11 SeitenHi 225 Finalpaperapi-708689221Noch keine Bewertungen

- Health Insurance Research PaperDokument7 SeitenHealth Insurance Research Paperxfeivdsif100% (1)

- If You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerVon EverandIf You Are Well: Health and Wellness Tips for the Empowered Health Care ConsumerNoch keine Bewertungen

- Running Head: Health Care Cost EconomicsDokument7 SeitenRunning Head: Health Care Cost EconomicsAlexandria SparksNoch keine Bewertungen

- Research Paper Topics On Health InsuranceDokument5 SeitenResearch Paper Topics On Health Insurancevguneqrhf100% (1)

- 2nd Shreet Report of KavyaDokument70 Seiten2nd Shreet Report of KavyaKavya NaikNoch keine Bewertungen

- A Closer Look Into Healthcare Systems 1 1Dokument10 SeitenA Closer Look Into Healthcare Systems 1 1api-511602646Noch keine Bewertungen

- Analysis of the healthcare systems in Australia and Germany and their approachesDokument2 SeitenAnalysis of the healthcare systems in Australia and Germany and their approachesSheikh Muhammad ShabbirNoch keine Bewertungen

- I Am Sharing 'Introdu 13' With YouDokument38 SeitenI Am Sharing 'Introdu 13' With Youbincybabuu87Noch keine Bewertungen

- Finalengcomppaper AndrewsDokument13 SeitenFinalengcomppaper Andrewsapi-583764833Noch keine Bewertungen

- The American Healthcare SystemDokument5 SeitenThe American Healthcare SystemRajendra NurukurthiNoch keine Bewertungen

- Running Head: Highs Deductible Healthcare Spending Accounts (Hsas)Dokument15 SeitenRunning Head: Highs Deductible Healthcare Spending Accounts (Hsas)Topher MatthewsNoch keine Bewertungen

- Is Healthcare A Right or A PrivilegeDokument6 SeitenIs Healthcare A Right or A Privilegearies usamaNoch keine Bewertungen

- Research Paper On Universal Health Care SystemDokument6 SeitenResearch Paper On Universal Health Care Systemaflbrpwan100% (1)

- Recovery: A Guide to Reforming the U.S. Health SectorVon EverandRecovery: A Guide to Reforming the U.S. Health SectorNoch keine Bewertungen

- Health Reform without Side Effects: Making Markets Work for Individual Health InsuranceVon EverandHealth Reform without Side Effects: Making Markets Work for Individual Health InsuranceNoch keine Bewertungen

- Does Australia's Health Insurance System Really Provide Insurance?Dokument9 SeitenDoes Australia's Health Insurance System Really Provide Insurance?Core Research100% (1)

- Medicliam Insurance (PRAVIN)Dokument66 SeitenMedicliam Insurance (PRAVIN)Aditya Sawant100% (1)

- AskinMoore Chp2Insurance 2014Dokument29 SeitenAskinMoore Chp2Insurance 2014Trent HardestyNoch keine Bewertungen

- 9.4 Ethical Issues in The Provision of Health CareDokument7 Seiten9.4 Ethical Issues in The Provision of Health CareAngelica NatanNoch keine Bewertungen

- Homeopathy funding debate; pros and cons discussedDokument5 SeitenHomeopathy funding debate; pros and cons discussedNadia ArviantiNoch keine Bewertungen

- MalaniDokument33 SeitenMalaniAdrian GuzmanNoch keine Bewertungen

- American Economic AssociationDokument17 SeitenAmerican Economic AssociationRotariu AlexandruNoch keine Bewertungen

- Talking PointsDokument1 SeiteTalking Pointszeke1999Noch keine Bewertungen

- Research Paper in Health EconomicsDokument6 SeitenResearch Paper in Health Economicscaqllprhf100% (1)

- Addressing Misinformation in the National Health Care DebateDokument8 SeitenAddressing Misinformation in the National Health Care DebateDan LucasNoch keine Bewertungen

- An Alternative Approach To Providing Universal CareDokument5 SeitenAn Alternative Approach To Providing Universal CareAnonymous yFIsD9kTCA100% (4)

- Hillary Clinton's Plan For Health CareDokument10 SeitenHillary Clinton's Plan For Health CareHashim Warren100% (2)

- Health Insurance CoverageDokument45 SeitenHealth Insurance CoverageAshok MaruthiNoch keine Bewertungen

- Advantageous Selection PaperDokument15 SeitenAdvantageous Selection Paperpaul_sangreyNoch keine Bewertungen

- Research Paper Health InsuranceDokument6 SeitenResearch Paper Health Insuranceyhclzxwgf100% (1)

- Opinion - Persuasive Essay (Yeison Izquierdo - Vanesa Martinez)Dokument2 SeitenOpinion - Persuasive Essay (Yeison Izquierdo - Vanesa Martinez)yeison david izquierdo estrellaNoch keine Bewertungen

- Systems of Health and Social Care and The Role of Incentives To Achieve Desired End-PointsDokument21 SeitenSystems of Health and Social Care and The Role of Incentives To Achieve Desired End-PointsiremNoch keine Bewertungen

- A Universal Health Care Plan For MissouriDokument20 SeitenA Universal Health Care Plan For MissouriPhysicians for a National Health ProgramNoch keine Bewertungen

- Final ProjectDokument9 SeitenFinal Projectapi-617745364Noch keine Bewertungen

- Project Report On Health Law: Limitations On Liabilities and MediclaimDokument17 SeitenProject Report On Health Law: Limitations On Liabilities and MediclaimDeepesh SinghNoch keine Bewertungen