Beruflich Dokumente

Kultur Dokumente

Bir 2306

Hochgeladen von

RodnieGubaton0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

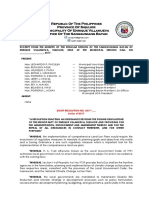

664 Ansichten6 SeitenThis document appears to be a Certificate of Final Tax Withheld at Source form from the Philippines. It contains information about income payments made and taxes withheld. The form includes sections for income recipient/payee information, withholding agent/payor information, details of income payments made and taxes withheld on those payments, and signatures from both the payee and payor certifying that the information provided is true and correct. It also contains a schedule of alphanumeric tax codes that correspond to the nature of income payments. The purpose of the form is to document income payments made and taxes withheld at the source to fulfill tax withholding and reporting requirements in the Philippines.

Originalbeschreibung:

BIR 2306

Originaltitel

BIR 2306

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document appears to be a Certificate of Final Tax Withheld at Source form from the Philippines. It contains information about income payments made and taxes withheld. The form includes sections for income recipient/payee information, withholding agent/payor information, details of income payments made and taxes withheld on those payments, and signatures from both the payee and payor certifying that the information provided is true and correct. It also contains a schedule of alphanumeric tax codes that correspond to the nature of income payments. The purpose of the form is to document income payments made and taxes withheld at the source to fulfill tax withholding and reporting requirements in the Philippines.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

664 Ansichten6 SeitenBir 2306

Hochgeladen von

RodnieGubatonThis document appears to be a Certificate of Final Tax Withheld at Source form from the Philippines. It contains information about income payments made and taxes withheld. The form includes sections for income recipient/payee information, withholding agent/payor information, details of income payments made and taxes withheld on those payments, and signatures from both the payee and payor certifying that the information provided is true and correct. It also contains a schedule of alphanumeric tax codes that correspond to the nature of income payments. The purpose of the form is to document income payments made and taxes withheld at the source to fulfill tax withholding and reporting requirements in the Philippines.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

1 For the Period

From (MM/DD/YY) To (MM/DD/YY)

Part I Income Recipient/Payee Information Withholding Agent/Payor Information

2 TIN 3 TIN

4 Payee's Name (For Non-Individuals ) 5 Payor's Name (For Non- Individuals)

6 Payee's Name (Last Name, First Name, Middle Name) For Individuals 7 Payor's Name (Last Name, First Name, Middle Name) For Individuals

8 Registered Address 9 Registered Address

8A Zip 9A Zip

Code Code

10 Foreign Address 10A Zip Code 10B ICR No. (For Alien Income Recipient Only)

Part II Details of Income Payment and Tax Withheld (Attach additional sheet if necessary)

Total

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

correct pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

CONFORME:

Payee/Payee's Authorized Representative/Accredited Tax Agent

I declare, under the penalties of perjury, that the information I declare under the penalties of perjury that I am qualified under substituted filing of Percentage

herein stated are reported under BIR Form No. 1600 which Tax/Value Added Tax Returns (BIR Form 2551M/2550M/Q), since I have only one payor from

have been filed with the Bureau of Internal Revenue. whom I earn my income; that, in accordance with RR 14-2003, I have availed of the Optional

Registration under the 3% Final Percentage Tax Wthholding/10% Final VAT Withholding in lieu

of the 3% Percentage Tax/10% VAT in order to be entitled to the privileges accorded by the

Substituted Percentage Tax Return/Substituted VAT Return System prescribed in the aforesaid

Payor/Payor's Authorized Representative/Accredited Tax Agent Regulations; that, this Declaration is sufficient authority of the withholding agent to withhold 3%

Final Percentage Tax/10% Final VAT from my sale of goods and/or services.

Payee/Payee's Authorized Representative/Accredited Tax Agent

Tax Agent Accreditation No./Attorney's Roll No. (if applicable) TIN of Signatory

Date of Expiry

Date Signed

Date of Issuance Date of Expiry

Tax Agent Accreditation No./Attorney's Roll No. (if applicable)

Date of Issuance Date of Expiry

Signature Over Printed Name

Date of Issuance

Signature Over Printed Name

Signature Over Printed Name

TIN of Signatory Title/Position of Signatory

To be accomplished for Value-Added Tax/Percentage Tax Withholding (substituted filing)

Title/Position of Signatory

Date of Issuance Date of Expiry

TIN of Signatory

Tax Agent Accreditation No./Attorney's Roll No. (if applicable)

Title/Position of Signatory

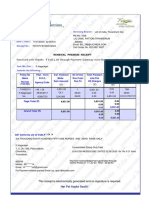

Nature of Income Payment A T C Amount of Payment Tax Withheld

Signature Over Printed Name

Tax Agent Accreditation No./Attorney's Roll No. (if applicable)

TIN of Signatory Title/Position of Signatory Date Signed Payor/Payor's Authorized Representative/Accredited Tax Agent

BIR Form No.

2306

September 2005 (ENCS)

Certificate of Final Tax

Withheld At Source

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

W I

Withholding Agent/Payor Information

Payor's Name (Last Name, First Name, Middle Name) For Individuals

Details of Income Payment and Tax Withheld (Attach additional sheet if necessary)

We declare, under the penalties of perjury, that this certificate has been made in good faith, verified by us, and to the best of our knowledge and belief, is true and

I declare under the penalties of perjury that I am qualified under substituted filing of Percentage

Tax/Value Added Tax Returns (BIR Form 2551M/2550M/Q), since I have only one payor from

Registration under the 3% Final Percentage Tax Wthholding/10% Final VAT Withholding in lieu

Substituted Percentage Tax Return/Substituted VAT Return System prescribed in the aforesaid

Regulations; that, this Declaration is sufficient authority of the withholding agent to withhold 3%

TIN of Signatory

Date of Expiry

To be accomplished for Value-Added Tax/Percentage Tax Withholding (substituted filing)

Title/Position of Signatory

Tax Withheld

2306

September 2005 (ENCS)

IND

Income Tax

Fringe Benefit

1 Alien individual employed by OBU's, Foreign Petroleum Service Contractors, & Subcontractors,

& by Regional or Area Headquarters & Regional Operating Headquarters of Multinational Co.,

including any of its Filipino employees occupying the same position

2 Payment of fringe benefits to Non-Resident Alien Not Engaged in Trade or Business (NRAETB) WF 330

3 Employees other than rank and file (Fringe Benefit Tax) WF 360

Interest/Yield from Bank Deposits/Deposit Substitutes/Government Securities

4 Saving Deposit WI 161

5 Time Deposit WI 161

6 Government Securities WI 162

7 Deposit Substitutes/Others WI 163

8 Foreign Currency Deposits WI 170

9 Preterminated Long Term Deposit/Investment

Less than three (3) years WI 440

Three (3) years to less than four (4) years WI 441

Four (4) years to less than five (5) years WI 442

All Others

10 Interest on foreign loans payable to NRFCs

11 Interest and other income payments on foreign currency transaction /loans payable to OBUs

12 Interest and other income payments on foreign currency transaction /loans payable to FCDUs

13 Cash dividend payment by domestic corporation to citizen & resident aliens/NRFC's WI 202

14 Property dividend payment by domestic corporation to citizens & resident aliens/NRFC's WI 203

15 Cash dividend payment by domestic corp. to NRFCs whose countries allowed tax deemed paid credit

16 Property dividend payment by domestic corp. to NRFCs whose countries allowed tax deemed paid credit

17 On other payments to NRFC

18 Cash dividend payment by domestic corporation to NRAETB WI 224

19 Property dividend payment by domestic corporation to NRAETB WI 225

20 Share of a NRAETB in the distributable net income after tax of a partnership (except General Professional

Partnership) of which he is a partner, or share in the net income after tax of an association,

a joint account or a joint venture taxable as a corp., of which he is a member or a co-venturer

21 Distributive share of individual partners in a taxable partnership, association,

a joint account or a joint venture or consortium

22 Other royalty payments to citizens, resident aliens and NRAETB

(other than WI380 and WI 341) /domestic and resident foreign corporation

23 On prizes exceeding P10,000 & other winnings paid to individuals WI 260

24 Branch profit remittances by all corporations except PEZA/SBMA/CDA registered

25 On the gross rentals, lease and charter fees derived by non-resident owner or lessor of foreign vessels

26 On the gross rentals, lease and charter fees derived by non-resident lessor of aircraft,

machineries and other equipment

27 Payment to Oil Exploration Service Contractors/Sub-Contractors WI 310

28 Payment to Filipinos or Alien individuals employed by Foreign Petroleum Service Contractors/

Subcontractors, Offshore Banking Units and Regional or Area Headquarters and Regional Operating

Headquarters of Multinational Companies occupying executive/managerial and technical positions

29 Payments to Non-Resident Alien Not Engaged in Trade or Business (NRAETB) except on sale of shares

in domestic corporation and real property

30 Payments to non-resident individual/foreign corporate cinematographic film owners, lessors or distributors WI 340

31 Royalties paid to NRAETB on cinematographic films and similar works WI 341

32 Final Tax on interest or other payments upon tax-free covenant bonds, mortgages, deeds of trust or

other obligations under Sec. 57C of the National Internal Revenue Code of 1997

33 Royalties paid to citizens, resident aliens & non-resident alien engaged in trade or business (NRAETB)

on books, other literary works & musical compositions

34 Payments to taxpayer enjoying Preferential Tax Rates/Tax Treaty Rates

35 Informer's cash reward to individuals/juridical person WI 410

36 Final Capital Gains Tax on Sale/Exchange or Other Disposition of Real Property WI 450

For Business Tax

37 VAT Withholding on Purchase of Goods - Govt. Withholding Agent

38 VAT Withholding on Purchase of Services - Govt. Withholding Agent

39 VAT Withholding on Purchase of Govenrment Public Work Contracts

40 VAT Withholding on Purchase of Goods (with waiver of privilege to claim input tax credits)

41 VAT Withholding on Purchase of Services (with waiver of privilege to claim input tax credits)

42 Person exempt from VAT under Sec. 109 (v)

43 Tax on Winnings and Prizes (Sec. 126) (double/forecast/quinella/trifecta bets) - Gov't. Withholding Agent (4%)

44 Tax on Winnings and Prizes on horse races/owners of winning racehorses (Sec. 126) - Gov't. Withholding Agent (10%)

45 Tax on Winnings and Prizes (Sec. 126 ) (double/forecast/quinella/trifecta bets) - Private Withholding Agent (4%)

46 Tax on Winnings and Prizes on horse races/owners of winning racehorses (Sec. 126 ) - Private Withholding Agent (10%)

47 VAT Withholding on Non-residents - Gov't. Withholding Agent

48 VAT Withholding on Non-residents - Private Withholding Agent

Legend:

NRAETB = Non-resident Alien Engaged in Trade or Business NRFC = Non- resident Foreign Corporation FCDU = Foreign Currency Deposit Unit

NRANETB = Non-resident Alien Not Engaged in Trade or Business OBU = Offshore Banking Unit PEZA = Philippine Export Zone Authority

SBMA = Subic Bay Metropolitan Authority CDA = Clark Development Authority

WV 020

WV 030

WI 240

WI 250

WI 350

SCHEDULES OF ALPHANUMERIC TAX CODES

A T C

WI 226

WF 320

Nature of Income Payment

WV 050

WB 191

WB 192

WB 193

WB 194

WV 040

WV 014

WV 024

WB 084

WI 380

WI 320

WV 010

WI 330

CORP

WC 161

WC 161

WC 162

WC 163

WC 170

WC 440

WC 180

WC 190

WC 191

WC 212

WC 213

WC 222

WC 223

WC 230

WC 280

WC 290

WC 310

WC 340

WC 390

WC 410

WC 450

NRAETB = Non-resident Alien Engaged in Trade or Business NRFC = Non- resident Foreign Corporation FCDU = Foreign Currency Deposit Unit

NRANETB = Non-resident Alien Not Engaged in Trade or Business OBU = Offshore Banking Unit PEZA = Philippine Export Zone Authority

WV 020

WV 030

SCHEDULES OF ALPHANUMERIC TAX CODES

A T C

WV 050

WB 191

WB 192

WB 193

WB 194

WV 040

WV 014

WV 024

WB 084

WC 250

WC 300

WV 010

Das könnte Ihnen auch gefallen

- 1600 Tax RatesDokument2 Seiten1600 Tax RatesmelizzeNoch keine Bewertungen

- Bir 2306Dokument2 SeitenBir 2306Caroline Sanchez90% (10)

- Form 2306 Witn Computation Electric BillDokument5 SeitenForm 2306 Witn Computation Electric BillLean IsidroNoch keine Bewertungen

- Ltom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentDokument2 SeitenLtom Book 1: Chapter 2: Qualifications and Appointmentof The Local Treasurer Andthe Assistant Treasurer Chapter AssessmentMarivic EspiaNoch keine Bewertungen

- Bir Form 2306 and 2307 MchsDokument3 SeitenBir Form 2306 and 2307 Mchschristopher labastidaNoch keine Bewertungen

- BIR Requirements newSSDokument1 SeiteBIR Requirements newSSKath ReignNoch keine Bewertungen

- Palapa KingDokument4 SeitenPalapa KingFRANCIS ZION JERUSALEMNoch keine Bewertungen

- Alquizola Vs OcolDokument2 SeitenAlquizola Vs OcolJapheth Cua100% (1)

- Kalahi-Cidss National Community Driven Development ProgramDokument6 SeitenKalahi-Cidss National Community Driven Development ProgramJohny Lou LuzaNoch keine Bewertungen

- BIR FORM 2307 SampleDokument6 SeitenBIR FORM 2307 SampleEasyHear Philippines by NuGen Hearing Devices, Inc.Noch keine Bewertungen

- Electronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchDokument1 SeiteElectronic Payment Payor Enrollment Form: Landbank of The Philippines - BranchKilikili East100% (1)

- DOLE CS Form No. 212 Attachment Work Experience Sheet 1Dokument2 SeitenDOLE CS Form No. 212 Attachment Work Experience Sheet 1Danilo PateñoNoch keine Bewertungen

- Sample Resolution PlebDokument1 SeiteSample Resolution PlebNorLaubanNoch keine Bewertungen

- Deed of DonationDokument3 SeitenDeed of DonationJerome BanaybanayNoch keine Bewertungen

- Motion For Reduction of Bail in Forms of Cashbond: AccusedDokument2 SeitenMotion For Reduction of Bail in Forms of Cashbond: AccusedAte GandaNoch keine Bewertungen

- Civil Service Form No.6 Revised 2020 Republic of The Philippines City Government of LucenaDokument2 SeitenCivil Service Form No.6 Revised 2020 Republic of The Philippines City Government of LucenaCriselda Cabangon DavidNoch keine Bewertungen

- 1702 NewDokument11 Seiten1702 NewDIVINE WAGTINGANNoch keine Bewertungen

- Transmittal Letter (TL) : Mecca Ella B. QuinzonDokument3 SeitenTransmittal Letter (TL) : Mecca Ella B. QuinzonedrizhNoch keine Bewertungen

- PERMIT To CAROL - 2016 (Rules and Guidelines)Dokument1 SeitePERMIT To CAROL - 2016 (Rules and Guidelines)Allan B. Melendez0% (1)

- Ord 9thCC 058Dokument8 SeitenOrd 9thCC 058SAMMY SARMIENTONoch keine Bewertungen

- Soce BskeDokument3 SeitenSoce BskeMae Ann Mendoza100% (1)

- GAM Forms 2016Dokument27 SeitenGAM Forms 2016Grace Dela CruzNoch keine Bewertungen

- Bac Resolution NewDokument2 SeitenBac Resolution Newbarangay obreroNoch keine Bewertungen

- Draft Resolution No. 55-2020 - Resolution Approving Barangay Eastern Looc Ordinance No. 1-2020Dokument1 SeiteDraft Resolution No. 55-2020 - Resolution Approving Barangay Eastern Looc Ordinance No. 1-2020Rica Carmel LanzaderasNoch keine Bewertungen

- Signature of Candidate or Other Approving Authority Title of Approving AuthorityDokument1 SeiteSignature of Candidate or Other Approving Authority Title of Approving AuthorityPatzAlzateParaguyaNoch keine Bewertungen

- Eo CdraDokument2 SeitenEo CdraKristelle Anne Mae GayamatNoch keine Bewertungen

- Annex 3C Interview and Evaluation Form PCPL PMSGDokument2 SeitenAnnex 3C Interview and Evaluation Form PCPL PMSGRecca Mae BiananNoch keine Bewertungen

- Agenda of The 110th Regular SessionDokument67 SeitenAgenda of The 110th Regular SessionCdeoCityCouncilNoch keine Bewertungen

- Individual Performance Commitment and Review (Ipcr)Dokument6 SeitenIndividual Performance Commitment and Review (Ipcr)Karla Mae BolañosNoch keine Bewertungen

- MMVHOA Board Resolution 2019-0419 Limit DogsDokument1 SeiteMMVHOA Board Resolution 2019-0419 Limit Dogsarthur aranasNoch keine Bewertungen

- Assumption To Office BarangayDokument1 SeiteAssumption To Office Barangaychichialonde.brgydelapazNoch keine Bewertungen

- Certificate To File Action Option 3Dokument2 SeitenCertificate To File Action Option 3Christine Angeli100% (1)

- Diversion Program of ArtachoDokument2 SeitenDiversion Program of ArtachojomarNoch keine Bewertungen

- Comelec Resolution 9640Dokument36 SeitenComelec Resolution 9640Ýel ÄcedilloNoch keine Bewertungen

- 02 FM SP Dilg 07 01 (CCSRF DBC)Dokument2 Seiten02 FM SP Dilg 07 01 (CCSRF DBC)Godece RosalNoch keine Bewertungen

- Leaves of AbsenceDokument2 SeitenLeaves of AbsenceRidzsr Dharhaidher100% (1)

- Municipal Zoning Ordinance 2017 - 1Dokument34 SeitenMunicipal Zoning Ordinance 2017 - 1ALLAN H. BALUCAN100% (1)

- Old Form 0605 PDFDokument2 SeitenOld Form 0605 PDFeugene badere50% (2)

- Jurisdiction and VenueDokument19 SeitenJurisdiction and VenueAlelie GarciaNoch keine Bewertungen

- Sample of Budget PreparationDokument14 SeitenSample of Budget PreparationCasey Del Gallego EnrileNoch keine Bewertungen

- Botika NG Lalawigan OrdinancesDokument2 SeitenBotika NG Lalawigan OrdinancesIra Dela RosaNoch keine Bewertungen

- Mariam Joji T. Grace A. de Vera Bunagan: ID NO.: 010167 ID NO.: 020963Dokument2 SeitenMariam Joji T. Grace A. de Vera Bunagan: ID NO.: 010167 ID NO.: 020963GahdhcmvoeiNoch keine Bewertungen

- BIR Form 1702-RT 2018Dokument8 SeitenBIR Form 1702-RT 2018Krisha Pioco TabanaoNoch keine Bewertungen

- SAOR 2015 Additional AOM DO ZDNDokument9 SeitenSAOR 2015 Additional AOM DO ZDNrussel1435Noch keine Bewertungen

- BIR Form 1604EDokument2 SeitenBIR Form 1604Ecld_tiger100% (2)

- Expanded Withholding TaxDokument3 SeitenExpanded Withholding TaxCordero TJNoch keine Bewertungen

- Executive Order For BPLKDokument1 SeiteExecutive Order For BPLKrafael ferolinoNoch keine Bewertungen

- Pop Edz LatestDokument66 SeitenPop Edz LatestMikhail ReyesNoch keine Bewertungen

- DEED OF ABSOLUTE SALE MotorcycleDokument2 SeitenDEED OF ABSOLUTE SALE MotorcycleSheryl Lea BatitaoNoch keine Bewertungen

- Bautista BTF Elcac Opcen EoDokument2 SeitenBautista BTF Elcac Opcen EojomarNoch keine Bewertungen

- Executive Order No. 05 - BacDokument2 SeitenExecutive Order No. 05 - Backesely esguerraNoch keine Bewertungen

- 2 Appointive Barangay Officials - EditedDokument23 Seiten2 Appointive Barangay Officials - EditedArt Robin NagpacanNoch keine Bewertungen

- Ordinance For SC's and PWD'sDokument5 SeitenOrdinance For SC's and PWD'sRandell Manjarres100% (1)

- Certificate To File ActionDokument1 SeiteCertificate To File ActionAnonymous qpUaTkNoch keine Bewertungen

- LAFMP Draft-Initao, Misamis Oriental - Region 10 As of 10-25-2022Dokument32 SeitenLAFMP Draft-Initao, Misamis Oriental - Region 10 As of 10-25-2022Steven Taleon MaghanoyNoch keine Bewertungen

- JJWC PDF Flowchart C1 Diversion KPambarangay PDFDokument1 SeiteJJWC PDF Flowchart C1 Diversion KPambarangay PDFRNJNoch keine Bewertungen

- Sample Ordinance Against Loan SharksDokument4 SeitenSample Ordinance Against Loan SharksMSSBNoch keine Bewertungen

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDokument2 SeitenCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasRb GutierrezNoch keine Bewertungen

- BIR Form 2306Dokument4 SeitenBIR Form 2306sedanzam80% (15)

- 2306 Manila WaterDokument6 Seiten2306 Manila WaterRegina Raymundo AlbayNoch keine Bewertungen

- Service Record: Orada Mayla PranuelasDokument2 SeitenService Record: Orada Mayla PranuelasRodnieGubatonNoch keine Bewertungen

- Service Record: Orcasitas Lewnyl DalisayDokument4 SeitenService Record: Orcasitas Lewnyl DalisayRodnieGubatonNoch keine Bewertungen

- School Based Management (SBM) Validation Form Name of School: Laguinbanwa EsDokument7 SeitenSchool Based Management (SBM) Validation Form Name of School: Laguinbanwa EsRodnieGubatonNoch keine Bewertungen

- Service Record: Hermogenes Realyn LachicaDokument4 SeitenService Record: Hermogenes Realyn LachicaRodnieGubatonNoch keine Bewertungen

- Willich, Isabella DDokument8 SeitenWillich, Isabella DRodnieGubatonNoch keine Bewertungen

- Service Record: Urquiola Vinelyn DalisayDokument4 SeitenService Record: Urquiola Vinelyn DalisayRodnieGubatonNoch keine Bewertungen

- Service Record: Villanueva Romelyn SalidoDokument4 SeitenService Record: Villanueva Romelyn SalidoRodnieGubatonNoch keine Bewertungen

- For Agency Remittance Advice: FORM A. List of Employees With Life and Retirement PremiumDokument2 SeitenFor Agency Remittance Advice: FORM A. List of Employees With Life and Retirement PremiumRodnieGubatonNoch keine Bewertungen

- Service Record: Ureta Ghia CrizaldoDokument4 SeitenService Record: Ureta Ghia CrizaldoRodnieGubatonNoch keine Bewertungen

- Service Record: Oliveros Mila GarciaDokument4 SeitenService Record: Oliveros Mila GarciaRodnieGubatonNoch keine Bewertungen

- Suggested Topics For InterviewDokument1 SeiteSuggested Topics For InterviewRodnieGubatonNoch keine Bewertungen

- Villeza, Ariane Mie MDokument2 SeitenVilleza, Ariane Mie MRodnieGubatonNoch keine Bewertungen

- Service Record: Tutol Elvira DalawisDokument4 SeitenService Record: Tutol Elvira DalawisRodnieGubatonNoch keine Bewertungen

- Batuan National School Inventory Building 2014Dokument23 SeitenBatuan National School Inventory Building 2014RodnieGubatonNoch keine Bewertungen

- From Comelec List of BeiDokument136 SeitenFrom Comelec List of BeiRodnieGubatonNoch keine Bewertungen

- Maloco NHS School Building Inventory Forms 10272014 TemplateDokument36 SeitenMaloco NHS School Building Inventory Forms 10272014 TemplateRodnieGubatonNoch keine Bewertungen

- For Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsDokument1 SeiteFor Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsRodnieGubatonNoch keine Bewertungen

- Time Book and Payroll CleaningDokument3 SeitenTime Book and Payroll CleaningRodnieGubatonNoch keine Bewertungen

- Action Research: Virgilio O. Dalisay Principal I Ondoy Elementary SchoolDokument1 SeiteAction Research: Virgilio O. Dalisay Principal I Ondoy Elementary SchoolRodnieGubatonNoch keine Bewertungen

- For Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsDokument4 SeitenFor Agency Remittance Advice: FORM C. List of Employees With Salary Adjustments For Confirmation AsRodnieGubatonNoch keine Bewertungen

- Ondoy ES Early Enrollment 14Dokument10 SeitenOndoy ES Early Enrollment 14RodnieGubatonNoch keine Bewertungen

- Permit July 2013Dokument1 SeitePermit July 2013RodnieGubatonNoch keine Bewertungen

- 2010 Division Executive CommitteeDokument4 Seiten2010 Division Executive CommitteeRodnieGubatonNoch keine Bewertungen

- Purchase Order of New Regional UniformDokument1 SeitePurchase Order of New Regional UniformRodnieGubatonNoch keine Bewertungen

- 1st Quarter TestDokument12 Seiten1st Quarter TestRodnieGubatonNoch keine Bewertungen

- S.O. Change of Name EdenDokument1 SeiteS.O. Change of Name EdenRodnieGubatonNoch keine Bewertungen

- The Schools Division SuperintendentDokument1 SeiteThe Schools Division SuperintendentRodnieGubatonNoch keine Bewertungen

- T Eacher (S) Service Durir:.g The V: RenderedDokument1 SeiteT Eacher (S) Service Durir:.g The V: RenderedRodnieGubatonNoch keine Bewertungen

- The Schools Division SuperintendentDokument1 SeiteThe Schools Division SuperintendentRodnieGubatonNoch keine Bewertungen

- Service Record: Bagac Randy DumalaogDokument3 SeitenService Record: Bagac Randy DumalaogRodnieGubatonNoch keine Bewertungen

- Taxation 1 Course Syllabus A. General Principles of Taxation I. TaxationDokument11 SeitenTaxation 1 Course Syllabus A. General Principles of Taxation I. TaxationAjay Ann De La CruzNoch keine Bewertungen

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument33 SeitenDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRahul RaoNoch keine Bewertungen

- HDFCDokument117 SeitenHDFCdNoch keine Bewertungen

- Binary Options FormatDokument8 SeitenBinary Options FormatEfosa Uk90% (31)

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Dokument6 SeitenFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNoch keine Bewertungen

- E-TDS Return Preparation SoftwareDokument37 SeitenE-TDS Return Preparation Softwareshabs4uroseNoch keine Bewertungen

- Electronic Contribution Collection List SummaryDokument2 SeitenElectronic Contribution Collection List SummaryVenice Leigh MallilinNoch keine Bewertungen

- IESCO ONLINE BILLL Atif SalehDokument1 SeiteIESCO ONLINE BILLL Atif SalehUmair SharifNoch keine Bewertungen

- Chapter 4Dokument19 SeitenChapter 4syahiir syauqiiNoch keine Bewertungen

- e-StatementBRImo 666201008493534 Jun2023 20230605 234408-1Dokument3 Seitene-StatementBRImo 666201008493534 Jun2023 20230605 234408-1Tri AriestaNoch keine Bewertungen

- Circular No. 355 - Mandatory Enrollment To and Remittance Through Accredited Electronic Payment and Collection Activities PDFDokument2 SeitenCircular No. 355 - Mandatory Enrollment To and Remittance Through Accredited Electronic Payment and Collection Activities PDFJunei Liza Intong - Sampani100% (1)

- RM RM RM: 7. Financial Plan 7.1 Financing 7.1.1 Project Implementation Cost ScheduleDokument4 SeitenRM RM RM: 7. Financial Plan 7.1 Financing 7.1.1 Project Implementation Cost ScheduletiraNoch keine Bewertungen

- What Are Notes ReceivableDokument2 SeitenWhat Are Notes ReceivableDarlene SarcinoNoch keine Bewertungen

- $RROKJIODokument6 Seiten$RROKJIOLily Gonzales FernandezNoch keine Bewertungen

- CIR v. LednickyDokument2 SeitenCIR v. LednickyBananaNoch keine Bewertungen

- Illustration 1Dokument9 SeitenIllustration 1Thanos The titanNoch keine Bewertungen

- Savings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationDokument2 SeitenSavings Account & Lockers : Terms & Conditions Apply. Kindly Contact Your Nearest Branch For Latest InformationVipin KumarNoch keine Bewertungen

- Clause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotDokument51 SeitenClause by Clause Analysis of Form 9C With Case Studies by CA. Swapnil MunotetgrgrfdNoch keine Bewertungen

- Statement 2020 06 25 090643681Dokument7 SeitenStatement 2020 06 25 090643681selfNoch keine Bewertungen

- 2015W8BEN AfinirderempliretsigneDokument2 Seiten2015W8BEN Afinirderempliretsigneneocortex92Noch keine Bewertungen

- PremiumpaymentReceipt 10751815Dokument1 SeitePremiumpaymentReceipt 10751815nithinNoch keine Bewertungen

- 04082020185610gubc0l8kevafd56qs2 Estatement 072020 309Dokument5 Seiten04082020185610gubc0l8kevafd56qs2 Estatement 072020 309Ankur ChauhanNoch keine Bewertungen

- Electronic Payment Systems: Bachu Vinay Chaithanya (1421408)Dokument12 SeitenElectronic Payment Systems: Bachu Vinay Chaithanya (1421408)Utkaljyoti JenasamantNoch keine Bewertungen

- 1604e 2018Dokument2 Seiten1604e 2018FedsNoch keine Bewertungen

- Phone BillDokument1 SeitePhone BillAbhishekSaurabhNoch keine Bewertungen

- Tax Law AssignmentDokument18 SeitenTax Law AssignmentAditya Pandey100% (1)

- Sysnova Cyber Security-1Dokument1 SeiteSysnova Cyber Security-1Isteak AhmedNoch keine Bewertungen

- Ccauth HotelsDokument1 SeiteCcauth HotelsJohn SabandoNoch keine Bewertungen

- AK GuptaDokument85 SeitenAK GuptaDhananjay Kumar100% (1)

- CPAR General Principles (Batch 92) - HandoutDokument12 SeitenCPAR General Principles (Batch 92) - HandoutNikkoNoch keine Bewertungen