Beruflich Dokumente

Kultur Dokumente

Patel

Hochgeladen von

MD AbdulMoid MukarramCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Patel

Hochgeladen von

MD AbdulMoid MukarramCopyright:

Verfügbare Formate

To give a brief idea about the benefits available from Mutual Fund investment.

To give a brief idea about the benefits available from Mutual Fund investment.

Te. To discuss about the market trends of Mutual Fund investment. > To study som

e of the mutual fund schemes.

3. To study some mutual fund companies and their funds. > Observe the fund manag

ement process of mutual funds.

Explore the recent developments in the mutual funds in India. Se. To give an ide

a about the regulations of mutual funds.

The main purpose of doing this project was to know about mutual fund and its fun

ctioning. This helps to know in details about mutual fund industry right from it

s inception stage, growth and future prospects.

It also helps in understanding different schemes of mutual funds. Because my stu

dy depends upon prominent funds in India and their schemes like equity, income,

balance as well as the returns ass.iated with ihose schemes.

T. proj.t study was done to ascertain the asset allocation, entry load, exit loa

d, ass.iated with the mutual funds. Ultimately this would help in undetstanding

the benefits of mutual funds to investors.

Literature Review on Mutual Funds

A study was conducted by Grinblatt and Titman (1989) to examine the superior sto

ck selection abilities of mutual fund managers through which researcher generate

d abnormal returns. For this purpose a sample of 274 funds was taken from 1974 t

o1984. Study applied Jensen Measure and compared the abnormal returns of active

and passive investment strategies both with and without transaction costs, fees,

and expenses. The results showed that the actual returns of these funds do not

exhibit abnormal performance indicating that investors cannot take advantage of

the superior abilities of these portfolio managers by purchasing shares in the m

utual funds.

A company that collected money from a group of people with common investment obj

ectives to buy different securities is called mutual fund. The collected holding

of these securities was known as its portfolio Mark (2007). According to Teri (

2007) mutual fund is a professional investment company which managed collection

of stocks, bonds, or other securities owned by a group of investor. Each mutual

fund had a fund manager who purchased and sold the funds investment according to

the fund goals. Fund managers were responsible to analyze the economic condition

s, industry trends, government regulations and the impact on stocks before selec

ting the securities for investment.

Mutual funds provided investment facility to the small investors who cannot affo

rd to invest the large sums of money Teri (2007). Basically these small investor

s invested money into a common fund and handover the investment decision to fund

manager. Many people often regard the beginning of Foreign and Colonial Governm

ent Trust as the beginning of modern day mutual funds. But the beginning of mutu

al funds dates back to Seventeenth century when the first "pooling of money" for

investments was done in 1774. Following the financial crisis of 1772-1773 a Dut

ch merchant Ketwich invited investors to come together to form an investment tru

st under the name of Eendragt Maakt Magt David (2007). The purpose of the trust

was to provide diversification at low cost to the small investors.

In order to spread risk, the fund invested in various countries such as Austria,

Denmark, German States, Spain, Sweden, Russia etc. In 18th century Amsterdam St

ock Exchange had only a small number of listed equities due to which the trust i

nvested only in bonds. However after war with England many colonial bonds defaul

ted due to which there was sharp decline in the investments. As a result, share

redemption was suspended in 1782 and later the interest payments were decreased

too. The fund was no longer attractive for investors and vanished. These early m

utual funds before heading to the United States took root in England and France

in the 1890s. On the other hand Massachusetts Investors' Trust of Boston was the f

irst open-end fund Formed in 1924. The growth of pooled investments was hampered

by stock market crash of 1929 and the Great Depression but Securities Act of 19

33 and Company Act of 1940 restored investors confidence and industry witnessed s

teady growth after that.

Several measures are used in the literature on mutual fund performance evaluatio

n but there is (still) a large controversy around them. Some of the important ri

sk-adjusted techniques include the Sharpe (1966) measure, the Treynor (1965) mea

sure and the Jensen (1968) measure. These measures were frequently called tradit

ional measures of performance evaluation and were based on the idea that the com

bination of any portfolio with the risk-free asset is located in the expected re

turn or beta space. The Jensen measure has been the most commonly used performan

ce measure in academic and non-academic empirical studies. On the other hand Sha

rpes reward-to-variability ratio was also very popular and was frequently used by

the researchers. Some of the empirical work on the performance of mutual funds

was given below.

Sharpe (1966) introduced the measure to evaluate the mutual funds risk-adjusted p

erformance. The measure was known as reward-to-variability ratio (Currently Shar

pe Ratio). With the help of this ratio he evaluated the return of 34 open-end mu

tual funds in the period 1945-1963. The results showed the capital market was ex

tremely efficient due to which majority of the sample had lower performance as c

ompared to the Dow Jones Index. Sharpe (1966) found that from 1954 to 1963 only

11 funds outperformed the Dow-Jones Industrial Average (DJIA) while 23 funds wer

e outperformed by the DJIA. Study concluded that the mutual funds were inferior

investments during the period.

Previously two- and three-moment analyses were used to analyze the mutual fund p

erformance relative to market performance. But Joy and Porter (1974) applied fir

st-, second-, and third-degree stochastic dominance principles to investigate th

e same question. Study suggested that the proper test of mutual fund performance

relative to the market (DJIA) is a test employing stochastic dominance principl

es. Such a test necessitates a pair wise comparison between each fund and the DJ

IA. Therefore Joy and Porter (1974) collected the performance data for the 34 fu

nds analyzed by both Sharpe (1966) and Arditti (1971) for the ten-year period 19

54-1963. Price and dividend data were also collected for the DJIA over the same

period. Study supported the earlier Sharpe (1966) study and opposed the Arditti

(1971) work and concluded that mutual fund performance was inferior to market pe

rformance over the period 1954-1963.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Form-6A-Application For Inclusion of Name in Electoral Roll by An Overseas Indian Elector. (English)Dokument2 SeitenForm-6A-Application For Inclusion of Name in Electoral Roll by An Overseas Indian Elector. (English)MD AbdulMoid MukarramNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Form-6A-Application For Inclusion of Name in Electoral Roll by An Overseas Indian Elector. (English)Dokument4 SeitenForm-6A-Application For Inclusion of Name in Electoral Roll by An Overseas Indian Elector. (English)Ilamaran HemalathaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Multiple Regression AnalysisDokument14 SeitenMultiple Regression AnalysisMD AbdulMoid MukarramNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- M.B.a. I Sem Exam Result Nov-Dec 2013, Bangalore University, Karnataka - IndiaResultsDokument1 SeiteM.B.a. I Sem Exam Result Nov-Dec 2013, Bangalore University, Karnataka - IndiaResultsMD AbdulMoid MukarramNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- CAIT Whitepaper On FDI in RetailDokument28 SeitenCAIT Whitepaper On FDI in RetailMD AbdulMoid MukarramNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

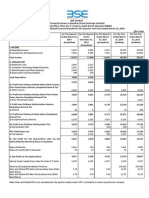

- Standalone Financial ResultsDokument4 SeitenStandalone Financial ResultsMD AbdulMoid MukarramNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Airtel 140323032138 Phpapp01Dokument14 SeitenAirtel 140323032138 Phpapp01MD AbdulMoid MukarramNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Roles of Entrepreneurs: Spotting Opportunities and Creating WealthDokument2 SeitenRoles of Entrepreneurs: Spotting Opportunities and Creating WealthMD AbdulMoid MukarramNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Admission ListingDokument2 SeitenAdmission ListingMD AbdulMoid MukarramNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- Master of Business AdministrationDokument7 SeitenMaster of Business AdministrationMD AbdulMoid MukarramNoch keine Bewertungen

- Agriculture Sector Group - 3Dokument49 SeitenAgriculture Sector Group - 3MD AbdulMoid MukarramNoch keine Bewertungen

- T TestDokument4 SeitenT TestMD AbdulMoid MukarramNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Battle Between BSE NSEDokument39 SeitenBattle Between BSE NSERamesh LaishettyNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Consolidated FinancialDokument4 SeitenConsolidated FinancialMD AbdulMoid MukarramNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Preparing a Synopsis for a DissertationDokument2 SeitenPreparing a Synopsis for a DissertationMashum AliNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Brand Equity Mba Dissertation George RossolatosDokument111 SeitenBrand Equity Mba Dissertation George RossolatosgrossolattosNoch keine Bewertungen

- 058 - Slide 77 728Dokument1 Seite058 - Slide 77 728MD AbdulMoid MukarramNoch keine Bewertungen

- Faris Al SaidDokument380 SeitenFaris Al SaidMD AbdulMoid MukarramNoch keine Bewertungen

- ING ZIP Application FormDokument2 SeitenING ZIP Application FormMD AbdulMoid MukarramNoch keine Bewertungen

- Comparative Analysis of Indian Stock Market With2258Dokument33 SeitenComparative Analysis of Indian Stock Market With2258Subrat SarNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Fees StructureDokument1 SeiteFees StructureMD AbdulMoid MukarramNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- B.A III Yr Result 2014Dokument242 SeitenB.A III Yr Result 2014MD AbdulMoid MukarramNoch keine Bewertungen

- ReferencesDokument1 SeiteReferencesMD AbdulMoid MukarramNoch keine Bewertungen

- KCET 2014 Seat Matrix - Engineering - Hyd-Kar QuotaDokument6 SeitenKCET 2014 Seat Matrix - Engineering - Hyd-Kar QuotaAnweshaBoseNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Farm Science Courses (B.SC (Ag), BVSC, BTech (Food), BTech (Ag) )Dokument1 SeiteFarm Science Courses (B.SC (Ag), BVSC, BTech (Food), BTech (Ag) )AnweshaBoseNoch keine Bewertungen

- Ranjana Project Report On Inventory ManagementDokument93 SeitenRanjana Project Report On Inventory Managementranjanachoubey90% (10)

- Architecture - Hyd-Kar QuotaDokument1 SeiteArchitecture - Hyd-Kar QuotaAnweshaBoseNoch keine Bewertungen

- List of Bollywood movies from 2011-2014Dokument9 SeitenList of Bollywood movies from 2011-2014MD AbdulMoid MukarramNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- User GuideDokument109 SeitenUser GuideMD AbdulMoid MukarramNoch keine Bewertungen

- Departures From StandardsDokument3 SeitenDepartures From StandardsDiana GarciaNoch keine Bewertungen

- Group 8 - ASSIGNMENT CASE SPORTS OBERMEYERDokument11 SeitenGroup 8 - ASSIGNMENT CASE SPORTS OBERMEYERkanishk khandelwalNoch keine Bewertungen

- Jan 24Dokument2 SeitenJan 24charnold miolNoch keine Bewertungen

- Reporting and Analyzing Operating IncomeDokument59 SeitenReporting and Analyzing Operating IncomeHazim AbualolaNoch keine Bewertungen

- Week 2 QuestionsDokument2 SeitenWeek 2 Questionskailu sunNoch keine Bewertungen

- Dan Loeb Sony LetterDokument4 SeitenDan Loeb Sony LetterZerohedge100% (1)

- Measuring Effectiveness of Airtel's CRM StrategyDokument82 SeitenMeasuring Effectiveness of Airtel's CRM StrategyChandini SehgalNoch keine Bewertungen

- Logistics Provider Profiles and ServicesDokument20 SeitenLogistics Provider Profiles and ServicesPAUL GUEVARANoch keine Bewertungen

- 6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDokument2 Seiten6) What Are The Allowable Deductions From Gross Income?: Personal ExemptionsDeopito BarrettNoch keine Bewertungen

- Private & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeDokument1 SeitePrivate & Confidential: NET 8,052,724 25 April 2019 Payroll OfficeIrfhaenmahmoedChildOfstandaloneNoch keine Bewertungen

- Tax Invoice Details for Mobile Phone PurchaseDokument1 SeiteTax Invoice Details for Mobile Phone PurchaseNiraj kumarNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Occupational Safety and Health: Lecture NotesDokument7 SeitenOccupational Safety and Health: Lecture NotesJonathan TungalNoch keine Bewertungen

- L2M2-Slide-deck V2Dokument48 SeitenL2M2-Slide-deck V2deepak0% (1)

- Permission MarketingDokument35 SeitenPermission Marketingtattid67% (3)

- Production Planning and ControlDokument26 SeitenProduction Planning and ControlravichandraNoch keine Bewertungen

- Umw 2015 PDFDokument253 SeitenUmw 2015 PDFsuhaimiNoch keine Bewertungen

- Chapter 5 Internal Enviroment Analysis PDFDokument31 SeitenChapter 5 Internal Enviroment Analysis PDFsithandokuhleNoch keine Bewertungen

- Mexican Corp Accounts Receivable AdjustmentsDokument4 SeitenMexican Corp Accounts Receivable AdjustmentsA.B AmpuanNoch keine Bewertungen

- CSR Partners - Navya Disha Trust: TH TH THDokument2 SeitenCSR Partners - Navya Disha Trust: TH TH THNakul ArunNoch keine Bewertungen

- Foreign ExchangeDokument25 SeitenForeign ExchangeAngelica AllanicNoch keine Bewertungen

- 2012 - ALTO - ALTO - Annual Report PDFDokument120 Seiten2012 - ALTO - ALTO - Annual Report PDFNuvita Puji KriswantiNoch keine Bewertungen

- Introduction and Company Profile: Retail in IndiaDokument60 SeitenIntroduction and Company Profile: Retail in IndiaAbhinav Bansal0% (1)

- Business Plan of Electronic BicycleDokument9 SeitenBusiness Plan of Electronic BicycleSabdi AhmedNoch keine Bewertungen

- PARTNERSHIP ACCOUNTING EXAM REVIEWDokument26 SeitenPARTNERSHIP ACCOUNTING EXAM REVIEWIts meh Sushi50% (2)

- Aizenman y Marion - 1999Dokument23 SeitenAizenman y Marion - 1999Esteban LeguizamónNoch keine Bewertungen

- 403Dokument12 Seiten403al hikmahNoch keine Bewertungen

- CRM Case StudyDokument13 SeitenCRM Case StudyJijo FrancisNoch keine Bewertungen

- k4 Form PDFDokument2 Seitenk4 Form PDFHarshavardhanReddyKNoch keine Bewertungen

- Axial DCF Business Valuation Calculator GuideDokument4 SeitenAxial DCF Business Valuation Calculator GuideUdit AgrawalNoch keine Bewertungen

- Tax Invoice for Designing & Adaptation ChargesDokument1 SeiteTax Invoice for Designing & Adaptation ChargesPrem Kumar YadavalliNoch keine Bewertungen