Beruflich Dokumente

Kultur Dokumente

June 23 Weekly Economic Update

Hochgeladen von

Doug Potash0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten3 Seiten6/23/2014

Originaltitel

June 23 weekly economic update

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden6/23/2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten3 SeitenJune 23 Weekly Economic Update

Hochgeladen von

Doug Potash6/23/2014

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

Doug Potash Presents:

WEEKLY ECONOMIC UPDATE

WEEKLY QUOTE

Great works are

performed not by

strength, but

perseverance.

- Samuel Johnson

WEEKLY TIP

A mental trick to help

you build your

emergency fund:

treat it like a bill that

you have to pay each

month, and make a

corresponding

monthly payment

to it.

WEEKLY RIDDLE

Three playing cards

lie face down on a

table. A jack is to the

left of a queen. To the

left of a spade is a

diamond. A king is

left of a heart. A

spade is right of a

king. What are the

three cards?

Last weeks riddle:

When I change my

jacket, I make a loud

noise and become

larger, but I weigh less.

What am I?

Last weeks answer:

Popcorn.

June 23, 2014

INFLATION PICKS UP

The Consumer Price Index increased 0.4% in May the biggest monthly rise in over

a year, with food prices up 0.5%. Labor Department data showed the core CPI

(minus energy and food prices) up 0.3% for May; that was its largest monthly

advance since August 2011. All this put the annualized gain in the headline CPI at

2.1% and the yearly gain in core CPI at 2.0%. Analysts polled by Reuters thought the

overall CPI would increase 0.2% last month. The turmoil in Iraq could help to drive

consumer prices higher this summer.

1

MAY SEES LESS NEW RESIDENTIAL CONSTRUCTION

Reduced home buying eventually means reduced groundbreaking. Mays housing

numbers from the Census Bureau reflected that housing starts slipped 6.5% last

month while building permits fell 6.4%. Housing starts are still maintaining a

million-unit seasonally adjusted annual pace.

1

OIL SETTLES AT A 9-MONTH HIGH

$107.26 a barrel that was where NYMEX crude for July delivery closed at Friday.

Even so, prices leveled off last week as ISIS insurgents in Iraq remained far away

from Basra, that countrys hub for oil exports.

2

WILL THE DOW REACH 17,000 THIS WEEK?

At Fridays close, the blue chips stood at 16,947.08. The Dow rose another 1.02% last

week, and its 5-day gain was surpassed by the advances of the Nasdaq (+1.33% to

4,368.04) and the S&P 500 (1.37% to 1,962.87). Investors were encouraged by the

Federal Reserve: the Federal Open Market Committee predictably elected to make

another $10 billion cut to QE3 for July and expressed confidence that the economy

was improving in its Wednesday policy statement, even as it cut its projections for

2014 growth slightly to 2.1%.

3,4,5

THIS WEEK: The NAR releases its May existing home sales report Monday. On

Tuesday, the Conference Boards June consumer confidence index, the Census

Bureaus May new home sales report and the April S&P/Case-Shiller home price

index all arrive, along with quarterly results from Walgreens. The last federal

government estimate of Q1 GDP appears Wednesday, plus the Census Bureaus May

report on durable goods orders and earnings from Bed Bath & Beyond, Lennar,

General Mills and Monsanto. Thursday brings May consumer spending data from

the Commerce Department, the latest initial jobless claims figures and earnings

announcements from Nike, ConAgra Foods and Accenture. Friday sees the release of

the University of Michigans final June consumer sentiment index.

% CHANGE Y-T-D 1-YR CHG 5-YR AVG 10-YR AVG

DJIA +2.23 +14.83 +19.69 +6.34

NASDAQ +4.58 +29.82 +27.80 +12.12

S&P 500 +6.20 +23.59 +22.61 +7.37

REAL YIELD 6/20 RATE 1 YR AGO 5 YRS AGO 10 YRS AGO

10 YR TIPS 0.35% 0.46% 1.91% 2.16%

Sources: USATODAY.com, bigcharts.com, treasury.gov - 6/20/14

5,6,7,8

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly.

These returns do not include dividends.

Please feel free to forward this article to family, friends or colleagues.

If you would like us to add them to our distribution list, please reply with their address.

We will contact them first and request their permission to add them to our list.

Doug Potash, CRPC

Vice President & Wealth Advisor

Legacy Financial Group, LLC

888 Bestgate Road, Suite 205

Annapolis, MD 21401

410-897-9401

Fax- 443-292-5119

Cell- 443-994-1897

www.legacyfinancialgroup.com

Securities offered through Cambridge Investment Research, Inc., a Broker/Dealer, Member FINRA/SIPC

Advisory services offered through Cambridge Investment Research Advisors, Inc. A Registered Investment Advisor

Legacy Financial is an independent firm and is not affiliated with Cambridge Investment Research

Doug Potash Disclosure

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their

affiliates. This information has been derived from sources believed to be accurate. Please note - investing involves risk, and past

performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services.

If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be

construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither

a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as

such. All indices are unmanaged and are not illustrative of any particular investment. The Dow Jones Industrial Average is a price-

weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is an unmanaged, market-weighted index of all

over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard

& Poor's 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general. It is not

possible to invest directly in an index. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange

(the NYSE) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx, and the Pacific Exchange). NYSE Group is a

leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX)

is the world's largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with

trading conducted through two divisions the NYMEX Division, home to the energy, platinum, and palladium markets, and the

COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency

fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the

market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. Past

performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when

originally invested. All economic and performance data is historical and not indicative of future results. Market indices discussed are

unmanaged. Investors cannot invest in unmanaged indices. The publisher is not engaged in rendering legal, accounting or other

professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 - tinyurl.com/pkdpugh [6/17/14]

2 - marketwatch.com/story/brent-slips-below-115-as-iraq-worries-simmer-2014-06-20 [6/20/14]

3 - google.com/finance?q=INDEXDJX%3A.DJI&ei=Aa-kU7C5O6SxsgezkIHQDA [6/20/14]

4 - cbsnews.com/news/federal-reserve-tapers-by-another-10-billion/ [6/18/14]

5 - usatoday.com/money/markets/overview/ [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F20%2F13&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F20%2F13&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F20%2F13&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F19%2F09&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F19%2F09&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F19%2F09&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F21%2F04&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F21%2F04&x=0&y=0 [6/20/14]

6 - bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F21%2F04&x=0&y=0 [6/20/14]

7 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/20/14]

8 - treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/20/14]

Das könnte Ihnen auch gefallen

- Classic Investing Mistakes: How Many Can You Prevent Yourself From Making?Dokument3 SeitenClassic Investing Mistakes: How Many Can You Prevent Yourself From Making?Doug PotashNoch keine Bewertungen

- Retirement in SightDokument2 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- Eekly Conomic Pdate: Doug Potash PresentsDokument2 SeitenEekly Conomic Pdate: Doug Potash PresentsDoug PotashNoch keine Bewertungen

- Retirement in SightDokument2 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- China, Ukraine and The MarketsDokument3 SeitenChina, Ukraine and The MarketsDoug PotashNoch keine Bewertungen

- Annapolis Film Festival ProgramDokument45 SeitenAnnapolis Film Festival ProgramDoug PotashNoch keine Bewertungen

- Weekly Economic UpdateDokument2 SeitenWeekly Economic UpdateDoug PotashNoch keine Bewertungen

- Retirement in SightDokument3 SeitenRetirement in SightDoug PotashNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Icici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Dokument21 SeitenIcici Prudential Asset Management Company LTD.: Revision and Practice Test Kit Version 3Neeraj KumarNoch keine Bewertungen

- Final Exam QANT630 Fall 2019 (Part-2)Dokument14 SeitenFinal Exam QANT630 Fall 2019 (Part-2)Simran SachdevaNoch keine Bewertungen

- Classification of Housing Units in The MarketDokument3 SeitenClassification of Housing Units in The MarketAron Stephen PlanNoch keine Bewertungen

- Retail Business Plan: Get Bagged .. .Tag A Bag..!Dokument13 SeitenRetail Business Plan: Get Bagged .. .Tag A Bag..!gurpreet gillNoch keine Bewertungen

- Global Distribution SystemDokument3 SeitenGlobal Distribution SystemAnonymous gUySMcpSqNoch keine Bewertungen

- NEWTHESISDokument64 SeitenNEWTHESISReivalf DueNoch keine Bewertungen

- Crown, Cork and Seal in 1989Dokument21 SeitenCrown, Cork and Seal in 1989Shweta GuptaNoch keine Bewertungen

- Mas Chapter 4 PDFDokument11 SeitenMas Chapter 4 PDFAldrin LiwanagNoch keine Bewertungen

- In Each Case, Justify Your AnswerDokument3 SeitenIn Each Case, Justify Your AnswerManzar Hussain100% (1)

- Production Planning LPP CaseDokument2 SeitenProduction Planning LPP Caserinkirola7576Noch keine Bewertungen

- Strategies Using ETFsDokument16 SeitenStrategies Using ETFscmms88Noch keine Bewertungen

- Spare Parts Management - Intro Levels Notes PDFDokument6 SeitenSpare Parts Management - Intro Levels Notes PDFEslam MansourNoch keine Bewertungen

- KPTL Annual Report 2017 18Dokument252 SeitenKPTL Annual Report 2017 18Saurabh PatelNoch keine Bewertungen

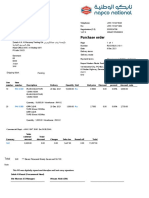

- Purchase Order: Napco Modern Plastic Products Co. - Sack DivisionDokument1 SeitePurchase Order: Napco Modern Plastic Products Co. - Sack Divisionمحمد اصدNoch keine Bewertungen

- AAA StrategyDokument6 SeitenAAA StrategysiddharthNoch keine Bewertungen

- Dwnload Full Anatomical Basis of Dentistry 3rd Edition Liebgott Test Bank PDFDokument35 SeitenDwnload Full Anatomical Basis of Dentistry 3rd Edition Liebgott Test Bank PDFleo7mco100% (15)

- Industrial Trip Report CIPLA PDFDokument36 SeitenIndustrial Trip Report CIPLA PDFAbhishek JhaNoch keine Bewertungen

- Fibo ScamDokument15 SeitenFibo ScamBerhampore Zone FinanceNoch keine Bewertungen

- Paper5 PDFDokument221 SeitenPaper5 PDFRoop Chandu JPNoch keine Bewertungen

- Inventory Strategy For Processing Independent Demand A Study On AmulDokument101 SeitenInventory Strategy For Processing Independent Demand A Study On AmulSagardwip Dey100% (4)

- Descriptive SituationsDokument9 SeitenDescriptive SituationsRiya PandeyNoch keine Bewertungen

- Theory of Production in EconomicsDokument47 SeitenTheory of Production in EconomicsHopeMwaromeNoch keine Bewertungen

- Screening With The Big, Safe Dividend FormulaDokument5 SeitenScreening With The Big, Safe Dividend FormulaJimKNoch keine Bewertungen

- Cadbury Sales PromotionDokument47 SeitenCadbury Sales PromotionVinodDubeyNoch keine Bewertungen

- 12 Business Combination Pt2Dokument1 Seite12 Business Combination Pt2Mel paloma0% (1)

- Domestic WiringDokument41 SeitenDomestic Wiringsowmya G J100% (1)

- The Cornell Company: Presented byDokument20 SeitenThe Cornell Company: Presented bySwapnil MotewarNoch keine Bewertungen

- Questionnaire: D) Above 20 LacksDokument5 SeitenQuestionnaire: D) Above 20 LacksShinchan NoharaNoch keine Bewertungen

- Heather EvansDokument35 SeitenHeather Evansmizhar7863173100% (1)

- Community Organisation EoI Application Form 29 JuneDokument3 SeitenCommunity Organisation EoI Application Form 29 JuneifyjoslynNoch keine Bewertungen