Beruflich Dokumente

Kultur Dokumente

Policy Write Up GMC200 Great Eastern

Hochgeladen von

Prakash Vellayan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

438 Ansichten15 SeitenThis write up is about GMC200 stand alone medical card sale by Great Eastern Malaysia. updated as per 24.06.14

Originaltitel

Policy Write Up GMC200 great Eastern

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis write up is about GMC200 stand alone medical card sale by Great Eastern Malaysia. updated as per 24.06.14

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

438 Ansichten15 SeitenPolicy Write Up GMC200 Great Eastern

Hochgeladen von

Prakash VellayanThis write up is about GMC200 stand alone medical card sale by Great Eastern Malaysia. updated as per 24.06.14

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 15

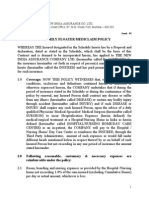

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 1 of 15

PRODUCT WRITE-UP

PLAN NAME: GREAT MEDICARE 2

PLAN CODES: H209 (for GMC2150)

H210 (for GMC2200)

H211 (for GMC2300)

H212 (for GMC2400)

LAUNCH DATE: 2

nd

JUNE 2009

PLAN DESCRIPTION

This is an individual non-participating, stand-alone comprehensive medical insurance policy.

Premium may be renewable up to the age of 79 years next birthday, subject to portfolio withdrawal. Annual

premium chargeable in any policy year depends on the attained age next birthday of the life assured at

renewal.

Benefits provided are subjected to individual annual and life time limits, as stated in the Schedule of

Benefits.

PLAN BENEFITS

In the event of medical expenses incurred on the life assured due to accident or illness (subject to

exclusions) or any other covered eventuality, the policy will reimburse such expenses based on the relevant

co-insurance percentages and minimum co-insurance amounts, up to the limits and sub-limits according to

the plan purchased as stated in the Schedule of Benefits.

Whilst, in the event of expenses incurred on the insured where the expenses is claimed from other medical

plans from other companies or within Great Eastern (the Company), the co-insurance and/or deductible of

other medical plans from other companies or within the Company which to be imposed on the Life Assured

can be claimed from this plan, up to the limits and sub-limits according to the plan purchased as stated in

the Schedule of Benefits. The reimbursement of the co-insurance and/or deductible of other medical plans

from other Companies or within the Company is subject to Great MediCare 2 co-insurance.

Compensation may be claimed from the start of a course of the covered treatment until the time it is

confirmed by the medical opinion acceptable to the Company that such treatment is no longer necessary.

Medical reimbursements provided under the policy shall commence for:

1. Illness occurring after 30 days from the effective date of the policy; or

2. Accidental injury occurring on or after the effective date of the policy.

Four types of plans available:

1. GMC2-150 for Room & Board RM150

2. GMC2-200 for Room & Board RM200

3. GMC2-300 for Room & Board RM300

4. GMC2-400 for Room & Board RM400

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 2 of 15

SCHEDULE OF BENEFITS

No.

Insured Benefits

(H209)

GMC2-150

(RM)

(H210)

GMC2-200

(RM)

(H211)

GMC2-300

(RM)

(H212)

GMC2-400

(RM)

1 Hospital Room and Board (R&B)

(Limit per Day subject to a maximum of

180 days for Insured Benefits (1) and (2)

in aggregate)

150

200

300

400

2 Intensive Care Unit (ICU)

(Limit per Day subject to a maximum of

180 days for Insured Benefits (1) and (2)

in aggregate)

As charged subject to Overall Annual Limit and Overall

Lifetime Limit.

3 Hospital Supplies and Services

As charged subject to Overall Annual Limit and Overall

Lifetime Limit.

Reimbursement of Reasonable and Customary Charges

which is consistent with those usually charged to a ward or

Room & Board accommodation which is approximate to and

within the daily limit of the amount stated in Hospital Room

and Board benefit under the plan insured.

Subject to 10% co-insurance, up to a maximum of RM500.

20% co-insurance and no maximum capping if upgradeRoom

& Board.

4 Surgical Fees

5 Operating Theatre

6 Anaesthetist Fees

7 In Hospital Physician Visit

(2 visits per day)

8 Pre-Hospitalisation Diagnostic Tests

(Within 60 days before hospitalisation)

9 Pre-Hospitalisation Specialist

Consultation

(Within 60 days before hospitalisation)

10 Post-Hospitalisation Treatment

(Within 90 days after hospital discharge)

11 Organ Transplant

12 Ambulance Fees

13 Day Surgery

14 Outpatient Cancer Treatment

As charged subject to Overall Annual Limit and Overall

Lifetime Limit.

Subject to 10% co-insurance.

15 Outpatient Kidney Dialysis Treatment

16 Emergency Accidental Outpatient

Treatment

(Maximum 30 days from date of accident)

3,000

4,000

6,000

8,000

17 Daily-Cash Allowance at Malaysian

Government Hospital

(Maximum 120 days)

50 per day

18 Overall Annual Limit for Items (1) to (17)

(Based on Paid Amount)

90,000 120,000 160,000 200,000

19 Overall Lifetime Limit for items (1) to (17)

(Based on Paid Amount)

360,000 4

80,000

640,000 800,000

20 Executive Second Opinion (ESO) In accordance with benefit provisions in

Executive Second Opinion

21 Supreme Assist

(Emergency Medical Assistance Services)

In accordance with benefit provisions in

Supreme Assist agreement

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 3 of 15

DESCRIPTION OF BENEFITS

(1) Hospital Room and Board (R&B)

Reimbursement of the Reasonable and Customary Charges incurred for Medically Necessary room

accommodation and meals. The amount payable for this benefit shall be equal to the actual

charges made by the Hospital during Hospitalisation of the Life Assured, subject to the daily rate of

Hospital Room and Board, the maximum number of days and the limits stated in item (1) of the

Schedule of Benefits. A Life Assured will only be entitled to this benefit while confined to a Hospital

as an Inpatient.

(2) Intensive Care Unit (ICU)

Reimbursement of the Reasonable and Customary Charges for Medically Necessary actual room

and board incurred during confinement of a Life Assured as an Inpatient in the Intensive Care Unit

of a Hospital. The amount payable for this benefit shall be equal to the actual charges made by the

Hospital, subject to the maximum number of days and the limits stated in item (2) of the Schedule

of Benefits. No Hospital Room and Board benefit and Intensive Care Unit benefit shall be paid

concomitantly.

For the avoidance of doubt, if Intensive Care Unit benefit is payable for a confinement period, no

Hospital Room and Board benefit shall be payable for the same confinement period.

(3) Hospital Supplies and Services

Reimbursement of the Reasonable and Customary Charges actually incurred for:

(a) General nursing;

(b) Prescribed and consumed drugs and medicines;

(c) Dressings, splints and plaster casts;

(d) X-ray;

(e) Laboratory examinations;

(f) Electrocardiograms;

(g) Physiotherapy;

(h) Basal metabolism tests;

(i) Intravenous injections and solutions; or

(j) Administration of blood and blood plasma but excluding the cost of blood and plasma while

the Life Assured is confined as an Inpatient in a Hospital.

which is Medically Necessary, subject to the limits stated in the Schedule of Benefits.

(4) Surgical Fees

Reimbursement of the Reasonable and Customary Charges incurred for Medically Necessary

surgery by the Specialists, including Pre-Hospitalisation Specialist Consultation and Post-

Hospitalisation Treatment, subject to the limits stated in the Schedule of Benefits. If more than one

surgery is performed for Any One Disability, the total payments for all the surgeries performed shall

not exceed the limits stated in the Schedule of Benefits.

(5) Operating Theatre

Reimbursement of the Reasonable and Customary Charges incurred for operating room incidental to

Medically Necessary surgical procedure, subject to the limits stated in the Schedule of Benefits.

(6) Anaesthetist Fees

Reimbursement of the Reasonable and Customary Charges incurred for Medically Necessary

administration of anaesthesia by the anaesthetist, subject to the limits stated in the Schedule of

Benefits.

(7) In-Hospital Physician Visit

Reimbursement of the Reasonable and Customary Charges incurred for Medically Necessary

Physicians visit to an Inpatient who is confined for Disability, subject to a maximum of two (2) visits

per day and the limits stated in the Schedule of Benefits.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 4 of 15

(8) Pre-Hospitalisation Diagnostic Tests

Reimbursement of the Reasonable and Customary Charges incurred within sixty (60) days

preceding Hospitalisation, for Medically Necessary ECG, X-ray and laboratory tests, which are

recommended by a qualified medical practitioner and performed for diagnostic purposes on account

of an Injury or Illness and in connection with a Disability, subject to the limits stated in the Schedule

of Benefits. No payment shall be made if the Life Assured does not result in Hospitalisation for the

treatment of the medical condition diagnosed upon such diagnostic services. In addition,

medications and consultation charged by the medical practitioner shall not be payable.

(9) Pre-Hospitalisation Specialist Consultation

Reimbursement of the Reasonable and Customary Charges incurred within sixty (60) days

preceding Hospitalisation, for Medically Necessary first time consultation by a Specialist in

connection with a Disability provided that such consultation has been recommended in writing by

the attending general practitioner, subject to the limits stated in the Schedule of Benefits.

No payment shall be made for clinical treatment (including medications and subsequent consultation

after the Illness is diagnosed) or where the Life Assured does not result in Hospitalisation for the

treatment of the medical condition diagnosed.

(10) Post-Hospitalisation Treatment

Reimbursement of the Reasonable and Customary Charges incurred within ninety (90) days

immediately following discharge from Hospital for a Disability, for Medically Necessary follow-up

treatment by the same attending Physician, subject to the limits stated in the Schedule of Benefits.

This shall include Prescribed Medicines during the follow-up treatment but shall not exceed the

supply needed for the maximum of ninety (90) days from the date of discharge.

(11) Organ Transplant

Reimbursement of the Reasonable and Customary Charges incurred on transplantation surgery for

the Life Assured being the recipient of the transplant of a kidney, heart, lung, liver or bone marrow.

This benefit is applicable only once per lifetime while this Policy is in force and shall be subject to

the limits stated in the Schedule of Benefits. The costs of acquisition of the organ and all costs

incurred by the donors are not covered under this Policy.

(12) Ambulance Fees

Reimbursement of the Reasonable and Customary Charges incurred for Medically Necessary

domestic ambulance services (inclusive of attendant) to and/or from the Hospital, subject to the

limits stated in the Schedule of Benefits. No payment shall be made if the Life Assured is not

hospitalised.

(13) Day Surgery

Reimbursement of the Reasonable and Customary Charges incurred for a Medically Necessary

Day Surgery. This shall be limited to the following surgical procedures, which are commonly

performed safely as Day Surgery:

(a) Cataract removal;

(b) Colonoscopy;

(c) Extra corporeal Shock Wave Lithotripsy;

(d) Laparoscopy;

(e) Laryngoscopy;

(f) Reduction of Bone Fracture(s);

(g) Release of Carpal Tunnel Syndrome (Carpal Tunnel Decompression);

(h) Adenoidectomy

(i) Bone Marrow Aspiration and Biopsy

(j) Cystourethroscopy

(k) Endolaser Venous Surgery

(l) Endoscopic Retrograde Cholangiopancreatography

(m) Excision of Bunions

(n) Excision of Ganglion, Fibroma(s) and Breast Lump(s)

(o) Excision of Pterygium

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 5 of 15

(p) Herniotomy / Herniorapphy

(q) Insertion or Removal of Ureteric J-Stent

(r) Laparoscopic Endometrial Ablation

(s) Marsupialisation and drainage of Bartholin's Cysts

(t) Myringotomy or Myringoplasty

(u) Release of Dupuytren's contractur

(v) Removal of Cervical Polyps

(w) Removal of Nasal Polyps

(x) Removal of Plate and Screw/implants

(y) Laser Photocoagulation treatment for Retinal Detachment

(z) Rubber Banding of Haemorrhoids

If any such surgical procedure is performed while the Life Assured is an Inpatient, only the

equivalent benefit of Day Surgery shall be paid, unless the Companys appointed medical

practitioner has given prior approval.

(14) Outpatient Cancer Treatment

If a Life Assured is diagnosed with Cancer as defined below, the Company shall reimburse the

Reasonable and Customary Charges incurred for the Medically Necessary cancer treatment

performed at a legally registered cancer treatment center, subject to the limits stated in item (14) of

the Schedule of Benefits.

Such treatment (radiotherapy or chemotherapy excluding consultation, examination tests and take

home drugs) must be received at the Outpatient department of a Hospital or a registered cancer

treatment center immediately following discharge from Hospital.

Cancer is defined as the uncontrollable growth and spread of malignant cells and the invasion and

destruction of normal tissue for which major interventionist treatment or surgery (excluding

endoscopic procedures alone) is considered necessary. The cancer must be confirmed by

histological evidence of malignancy. The following conditions are excluded:

(a) Carcinorma in situ including of the cervix;

(b) Ductal Carcinorma in situ of the breast;

(c) Papillary Carcinorma of the bladder & Stage 1 Prostate Cancer;

(d) All skin cancers except malignant melanoma;

(e) Stage 1 Hodgkin's disease;

(f) Tumours manifesting as complications of AIDS.

In addition to the exclusion of Pre-existing Illness, this benefit shall not be payable for any Life

Assured who had been diagnosed as a cancer patient and/or is receiving cancer treatment prior to

the Risk Commencement Date.

(15) Outpatient Kidney Dialysis Treatment

If a Life Assured is diagnosed with Kidney Failure as defined below, the Company shall reimburse

the Reasonable and Customary Charges incurred for the Medically Necessary kidney dialysis

treatment performed at a legally registered dialysis center, subject to the limits stated in item (15) of

the Schedule of Benefits.

Such treatment (dialysis excluding consultation, examination tests and take home drugs) must be

received at the Outpatient department of a Hospital or a registered dialysis treatment center

immediately following discharge from Hospital.

Kidney Failure means end stage renal failure presenting as chronic and irreversible failure of both

kidneys to function as a result of which renal dialysis is initiated.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 6 of 15

In addition to the exclusion of Pre-existing Illness, this benefit shall not be payable for any Life

Assured who has developed chronic renal diseases and/or is receiving dialysis treatment prior to

the Risk Commencement Date.

(16) Emergency Accidental Outpatient Treatment

Reimbursement of the Reasonable and Customary Charges incurred for Medical Necessary

treatment as an Outpatient at any registered Clinic or Hospital as a result of a covered bodily injury

arising from an Accident, within 24 hours of such Accident and subject to the maximum amount and

the limits stated in item (16) of the Schedule of Benefits. Follow-up treatment by the same Doctor or

same registered Clinic or Hospital for the same covered bodily injury shall be provided up to a

maximum of thirty (30) days from date of Accident, subject to the maximum amount and the limits

stated in item (16) of the Schedule of Benefits.

(17) Daily-Cash Allowance at Malaysian Government Hospital

Pays a daily allowance for each day of confinement for a covered Disability in a Malaysian

Government Hospital, provided that the Life Assured shall confine to a Hospital Room and Board

rate that does not exceed the amount stated in item (17) of the Schedule of Benefits. Contractual

change to cover and pay for the benefit even if the Life Assured is transferred to or from any private

Hospital and Malaysian Government Hospital for the covered Disability.

(18) Overall Annual Limit

The maximum of Eligible Expenses with respect to coverage of the Life Assured within any specific

Policy Year of all the Insured Benefits listed under items (1) to (17) of the Schedule of Benefits and

the said limit is specified in item (18) of the Schedule of Benefits.

(19) Overall Lifetime Limit

The limit applying to the total benefit payable, in aggregate, with respect to coverage of the Life

Assured since Risk Commencement Date and the said limit is specified in item (19) of the Schedule

of Benefits.

(20) Executive Second Opinion (ESO)

A second opinion can be obtained from an approved medical institution for any covered conditions.

The ESO services inclusive of a report which summarises the documentation of review data,

findings and observations, other treatment alternatives, recommendation for the medical

necessity of a treatment plan, procedure, length of stay, level of care, future discharge plan,

second surgical opinion issues and followed by telephone consultation from specialist, subject

to terms & conditions. This benefit is limited to one consultation per covered condition per year;

maximum entitled three consultations per lifetime.

(a) File Review

The Panel will prepare a report, which will summarize the documentation of review data,

findings and observations and other treatment alternatives. In addition, the File Review will

include a recommendation for the medical necessity of a treatment plan, procedure, length of

stay, level of care, discharge plan of future or ongoing services. Second surgical opinion issues

may also be addressed in the report.

(b) Tele-Consultation of Medical Opinion

After the receipt of the medical File Review as described in (i) above, the Life Assured shall be

entitled for a free telephone medical consultation with the Panel for a period not exceeding one

(1) hour. The telephone medical consultation refers to a medical/surgical, psychiatric or allied

health telephonic discussion on a specific case with the Panel. Issues to be addressed include

medical necessity of treatment, appropriateness of site of treatment, proper length of stay and

discharge planning which are in addition to the requirements stated in the File Review above.

The Company reserves the right to amend the provision of this benefit at any time, by giving 30-day

notice, subject to the availability of this benefit at reasonable costs from the Service Provider.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 7 of 15

Note:

Please refer to Appendix on page 14 - 15 for the List of Covered Conditions.

(21) Supreme Assist (Emergency Medical Assistance Services)

The company has arranged with Supreme Assist to provide Overseas and Domestic Emergency

Medical Assistance Services. The membership card will be issued to the Life Assured, which shall

be used as means of verification of eligibility for the Emergency Medical Assistance Services.

(a) Overseas Emergency Medical Assistance

The Life Assured may call Supreme Assist from anywhere in the world to obtain the

assistance or services. The following services are applicable to the Life Assured who is

traveling outside Malaysia for a period not exceeding 120 consecutive days on any one trip.

(i) Travel Assistance

Visa Information Services, Inoculation Information Services, Weather Information

Services, Foreign Exchange Information Services, Interpreter Assistance, Legal

Referral, Embassy Referral, Lost Luggage Assistance and Lost Passport

Assistance.

(ii) International Medical Assistance

Emergency Message Transmission, Telephone Medical Advice, Medical Service

Provider Referral, Arrangement of Appointments with Doctors, Arrangement for

Hospital Admission, Arrangement of Hotel Accommodation, Arrangement and

Payment of Emergency Medical Evacuation, Arrangement and Payment of

Emergency Medical Repatriation, Arrangement and Payment of Repatriation of

Mortal Remains, Arrangement and Payment of Compassionate Visit for a relative

or friend, Arrangement and Payment of Return of up to three minor children, if such

child or children is/are left unattended.

(b) Domestic Emergency Medical Assistance

(i) The following services are applicable to the Life Assured within Malaysia but

outside his state of residence in Malaysia:

Emergency Message Transmission

Medical Service Provider Referral

(ii) The following services are applicable to the Life Assured traveling outside his state

of residence in Malaysia for a period not exceeding 120 consecutive days for any

one trip:

Arrangement and Payment of Emergency Medical Evacuation

Arrangement and Payment of Emergency Medical Repatriation

Arrangement for Hospital Admission

The Company reserves the right to amend the provision of this benefit at any time, by giving a 30-

day notice, subject to the availability of this benefit at reasonable costs from the Service Provider.

The maximum amount payable by the Company in respect of this benefit on the same Life Assured

is limited to RM500,000.

UNDERWRITING GUIDELINES

1. Minimum / Maximum Age at Entry

Minimum : 30 days old attained age

Maximum : 60 years next birthday

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 8 of 15

2. Policy Term

80 minus entry age next birthday (Only one term is allowed)

3. Underwriting for Substandard Life

The treatment for underwriting substandard lives will be to impose an extra premium loading and/or

exclusions, if any.

4. Non-Medical Limits

In general, Medical Examination is not required. However, the Company reserves the absolute right

to call for a medical examination, if necessary.

PREMIUM

1. Premium Payment Mode and Modal Factors

This is an annual premium plan but it can also be purchased with half-yearly, quarterly or monthly

premium installments.

In case where premium payments are made other than annual premium, the following factors are to

be applied to the annual premium to arrive at the installment premium:

Mode of premium payments Factors

Half-yearly 0.5100

Quarterly 0.2575

Monthly 0.0875

2. Premium Payment

Premium can be paid by cash, cheque, or credit card for all modes of payments. Cash / cheque is

not applicable for monthly premium payment mode.

3. Premium Payment Term

Premiums are payable until the age of 79 years next birthday or upon termination of the policys

contract, whichever occurs earlier.

4. Female Rates

Separate rates applicable to males and females.

5. Occupational Rates

The standard male and female rates are applicable to Occupation Classes 1 and 2.

Separate premium rates are chargeable for Occupation Classes 3 and 4.

6. Renewal / Change in Occupation

Upon notification of change in occupation (class) during any policy year, revision of premium rates

will be affected upon next premium due date. There will be no premium refund or collection during

the policy year.

7. Backdating

Not allowed.

Note:

Kindly refer to page 12 - 13 for the indicative premium rates.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 9 of 15

DISCOUNTS

1. Non-smoker Discount

Not applicable.

2. Group Special Discount

A family discount for 5% of office premium is given, if 2 or more family members are being insured

under medical policy.

ATTACHABLE RIDERS AND SUPPLEMENTARY BENEFITS

No riders or supplementary benefit is allowed to be attached to the policy.

Note:

Except for attachment of Premier Comprehensive Accident Benefits Exclusive Rider (P-CABE) from 02

June 2009 to 13 July 2009.

OTHER FEATURES

1. Surrender Values

This plan has no surrender value. However, upon cancellation of the policy by policyowner and

provided that no claims have been made during the policy year, the policyowner shall be entitled to

a refund of the proportionate premium paid as follows:

Period Not Exceeding

Refund of

Annual

Premium

Refund of

Semi-Annual

Premium

Refund of

Quarterly

Premium

Refund of

Monthly

Premium

15 days 90% 80% 70% No refund

1 month 80% 70% 50% No refund

2 months 70% 50% 20% No refund

3 months 60% 30% No refund No refund

4 months 50% 20% 50% No refund

5 months 40% 10% 20% No refund

6 months 30% No refund No refund No refund

7 months 25% 70% 50% No refund

8 months 20% 50% 20% No refund

9 months 15% 30% No refund No refund

10 months 10% 20% 50% No refund

11 months 5% 10% 20% No refund

Period exceeding 11 months No refund No refund No refund No refund

Note: Under such circumstance the commissions payable will be clawed-back accordingly.

2. Free-look Period

Policyowner is allowed to cancel the policy within 15 days. Under such circumstance, total premium

paid minus the expenses incurred for medical examination (if any) will be refunded and

commissions will be clawed back accordingly.

3. Assignment / Nomination

Not allowed.

4. Third-Party Policy

Allowed.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 10 of 15

5. Reinstatement

With effective from 3 September 2012, the reinstatement period for all standalone medical plans or

medical riders (including Hospitalisation Benefits riders) have been extended from 6 months to 12

months. This enhancement is applicable to all still-selling and withdrawn standalone medical plans

and riders. Other existing terms and conditions of reinstatement still apply.

FORMS REQUIRED FOR NEW BUSINESS SUBMISSION

1. Proposal for Assurance

EXCLUSIONS

The Company will not pay any benefit under this Policy as a result of, including of any of the following whether

directly or indirectly:

1. Pre-existing Illness;

2. Specified Illnesses occurring within the first 120 days from the Risk Commencement Date;

3. Any medical or physical conditions arising within the first thirty (30) days from the Risk

Commencement Date except for Injury;

4. Plastic/cosmetic surgery, circumcision, eye examination, glasses, lens and refraction or surgical

correction of nearsightedness and farsightedness (Radial Keratotomy or Lasik) and the use or

acquisition of external prosthetic appliances or devices such as artificial limbs, hearing aids, implanted

pacemakers and prescriptions thereof;

5. Dental conditions including dental treatment or oral surgery; except as necessitated due to Injury to

sound natural teeth occurring in any Policy Year and performed by Dentist. In addition, expenses

arising from placement of denture and prosthetic services such as bridges, implants and crowns or

their replacement will not be payable;

6. Private nursing, rest cures or sanitaria care, illegal drugs, intoxication (including but not limited to

alcohol and drugs), sterilization, venereal disease and its sequelae, AIDS (Acquired Immune

Deficiency Syndrome) or ARC (AIDS Related Complex) and HIV related diseases, and any

communicable diseases required quarantine by law;

7. Any treatment or surgical operation for Congenital Conditions or deformities including hereditary

conditions;

8. Pregnancy, childbirth (including surgical delivery and any surgical or non surgical procedure of the

female reproductive system during surgical delivery), miscarriage, abortion and prenatal or postnatal

care and surgical, mechanical or chemical contraceptive methods of birth control or treatment

pertaining to infertility. Erectile dysfunction and tests or treatment related to impotence or sterilization;

9. Hospitalisation primarily for investigatory purposes, diagnosis, x-ray examination, general physical or

medical examinations, not incidental to treatment or diagnosis of a covered Disability or any treatment

which is not Medically Necessary and any preventive treatments, preventive medicines or

examinations carried out by a Physician, and treatments specifically for weight reduction or gain;

10. Suicide, attempted suicide or intentionally self-inflicted injury while sane or insane;

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 11 of 15

11. War or any act of war, declared or undeclared, criminal or terrorist activities, active duty in any armed

forces, direct participation in strikes, riots and civil commotion or insurrection;

12. Ionising radiation or contamination by radioactivity from any nuclear fuel or nuclear waste from

process of nuclear fission or from any nuclear weapons material;

13. Expenses incurred for donation of any body organ by an Life Assured and cost of acquisition of the

organ including all costs incurred by the donor during organ transplant and its complications;

14. Investigations and treatment of sleep and snoring disorders, hyperhidrosis treatment, hormone

replacement therapy, stem cell therapy, PET scan and alternative therapy such as treatment,

medical service or supplies, including but not limited to chiropractic services, acupuncture,

acupressure, reflexology, bone setting, herbalist treatment, massage, hyperbaric oxygen therapy or

aromatherapy or other alternative treatment;

15. Care or treatment for which payment is not required or to the extent which is payable by any other

insurance or indemnity covering the Life Assured and disabilities arising out of duties of

employment or profession that is covered under a Workmans Compensation Insurance Contract or

from either sources in respect of Injury or Illness or Disease for which the claim is made;

16. Psychotic, mental or nervous disorders, (including any neuroses and their physiological or

psychosomatic manifestations);

17. Costs/expenses of services of a non-medical nature, such as television, telephones, telex services,

broadband services, electricity bills for hand phone charging, radios or similar facilities, admission

kit/pack and other ineligible non-medical items;

18. Sickness or Injury arising from racing of any kind (except foot racing), hazardous sports such as but

not limited to parachuting, sky-diving, water skiing, underwater activities requiring breathing apparatus,

winter sports, professional sports and illegal activities;

19. Engaging in aerial flights other than as a crew member or as a fare-paying passenger of an

International Airline operating on a regular scheduled route;

20. Expenses incurred for sex change;

21. Any Outpatient treatment not related to Inpatient treatment, except as provided under this Policy;

22. Any Accident caused by mosquito bites, worm infestations such as Hookworms and allergic

reaction to insect bites during the first thirty (30) days from the Risk Commencement Date;

23. Charges which are not Reasonable and Customary Charges, or any surgery or treatment which is

not Medically Necessary, or charges in excess of Reasonable and Customary Charges, or charges

which are incurred for hospitalisation, pre-hospitalisation and/or post-hospitalisation after the Expiry

Date;

24. Any medical treatment received by the Life Assured outside Malaysia, if the Life Assured resides or

travel outside Malaysia for more than ninety (90) consecutive days.

Note:

Kindly refer to individual policy contract for details of exclusions.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 12 of 15

ANNUAL PREMIUM RATES

1. Occupation Classes 1 & 2

MALE FEMALE

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

1-5 846 1,008 1,360 1,768 1-5 616 730 981 1,275

6-10 609 726 980 1,274 6-10 533 633 850 1,105

11-15 515 615 829 1,078 11-15 450 535 718 933

16-20 526 627 847 1,101 16-20 460 546 733 953

21-25 521 622 842 1,095 21-25 536 639 868 1,128

26-30 521 621 840 1,092 26-30 539 644 876 1,139

31-35 523 624 847 1,101 31-35 541 648 883 1,148

36-40 657 787 1,070 1,391 36-40 678 815 1,116 1,451

41-45 849 1,018 1,391 1,808 41-45 842 1,015 1,394 1,812

46-50 1,080 1,298 1,778 2,311 46-50 1,104 1,333 1,837 2,388

51-55 1,215 1,462 2,006 2,608 51-55 1,367 1,653 2,284 2,969

56-60 1,675 2,021 2,779 3,613 56-60 1,689 2,047 2,833 3,683

61-65* 2,513 3,032 4,169 5,420 61-65* 2,534 3,071 4,250 5,525

66-70* 3,770 4,548 6,254 8,130 66-70* 3,801 4,607 6,375 8,288

71-75* 5,655 6,822 9,381 12,195 71-75*

5,702

6,911

9,563

12,432

76-79* 8,483 10,233 14,072 18,293 76-79* 8,553 10,367 14,345 18,648

*

For renewal only.

2. Occupation Class 3

MALE FEMALE

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

1-5 1,058 1,260 1,700 2,210 1-5 770 913 1,226 1,594

6-10 761 908 1,225 1,593 6-10 666 791 1,063 1,381

11-15 644 769 1,036 1,348 11-15 563 669 898 1,166

16-20 658 784 1,059 1,376 16-20 575 683 916 1,191

21-25 651 778 1,053 1,369 21-25 670 799 1,085 1,410

26-30 651 776 1,050 1,365 26-30 674 805 1,095 1,424

31-35 654 780 1,059 1,376 31-35 676 810 1,104 1,435

36-40 821 984 1,338 1,739 36-40 848 1,019 1,395 1,814

41-45 1,061 1,273 1,739 2,260 41-45 1,053 1,269 1,743 2,265

46-50 1,350 1,623 2,223 2,889 46-50 1,380 1,666 2,296 2,985

51-55 1,519 1,828 2,508 3,260 51-55 1,709 2,066 2,855 3,711

56-60 2,094 2,526 3,474 4,516 56-60 2,111 2,559 3,541 4,604

61-65* 3,141 3,790 5,211 6,775 61-65* 3,168 3,839 5,313 6,906

66-70* 4,713 5,685 7,818 10,163 66-70* 4,751 5,759 7,969 10,360

71-75* 7,069 8,528 11,726 15,244 71-75* 7,128 8,639 11,954 15,540

76-79* 10,604 12,791 17,590 22,866 76-79* 10,691 12,959 17,931 23,310

*

For renewal only.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 13 of 15

3. Occupation Class 4

MALE FEMALE

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

ANB

GMC2-

150

(H209)

GMC2-

200

(H210)

GMC2-

300

(H211)

GMC2-

400

(H212)

1-5 1,269 1,512 2,040 2,652 1-5 924 1,095 1,472 1,913

6-10 914 1,089 1,470 1,911 6-10 800 950 1,275 1,658

11-15 773 923 1,244 1,617 11-15 675 803 1,077 1,400

16-20 789 941 1,271 1,652 16-20 690 819 1,100 1,430

21-25 782 933 1,263 1,643 21-25 804 959 1,302 1,692

26-30 782 932 1,260 1,638 26-30 809 966 1,314 1,709

31-35 785 936 1,271 1,652 31-35 812 972 1,325 1,722

36-40 986 1,181 1,605 2,087 36-40 1,017 1,223 1,674 2,177

41-45 1,274 1,527 2,087 2,712 41-45 1,263 1,523 2,091 2,718

46-50 1,620 1,947 2,667 3,467 46-50 1,656 2,000 2,756 3,582

51-55 1,823 2,193 3,009 3,912 51-55 2,051 2,480 3,426 4,454

56-60 2,513 3,032 4,169 5,420 56-60 2,534 3,071 4,250 5,525

61-65* 3,770 4,548 6,254 8,130 61-65* 3,801 4,607 6,375 8,288

66-70* 5,655 6,822 9,381 12,195 66-70* 5,702 6,911 9,563 12,432

71-75* 8,483 10,233 14,072 18,293 71-75* 8,553 10,367 14,345 18,648

76-79* 12,725 15,350 21,108 27,440 76-79* 12,830 15,551 21,518 27,972

*

For renewal only.

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 14 of 15

Appendix:

(A) List of Covered Conditions:

1) Heart Attack

2) Stroke

3) Coronary Artery Disease Requiring Surgery

4) Cancer

5) Kidney Failure

6) Fulminant Viral Hepatitis

7) Major Organ Transplant

8) Paralysis / Paraplegia

9) Multiple Sclerosis

10) Primary Pulmonary Arterial Hypertension

11) Blindness

12) Heart Valve Replacement

13) Loss Of Hearing / Deafness

14) Surgery To Aorta

15) Loss of Speech

16) Alzheimers Disease / Irreversible Organic Degenerative Brain Disorders

17) Major Burns

18) Coma

19) Terminal Illness

20) Motor Neuron Disease

21) AIDS Due To Blood Transfusion

22) Parkinsons Disease

23) Chronic Liver Disease

24) Chronic Lung Disease

25) Major Head Trauma

26) Aplastic Anaemia

27) Muscular Dystrophy

28) Benign Brain Tumour

29) Encephalitis

30) Poliomyelitis

31) Brain Surgery

32) Bacterial Meningitis

33) Other Serious Coronary Artery Disease

34) Apallic Syndrome

35) AIDS Cover of Medical Staff

36) Full Blown AIDS

37) Angioplasty

38) Medullary Cystic Kidney

39) Cardiomyopathy

40) Systemic Lupus Erythematosus with Lupus Nephritis (SLE)

ESO Service will be arranged for a Covered Condition under (41) to (49) if the Life Assured is diagnosed of

any such Covered Conditions after the Waiting Period and before he attains the age of twenty-one (21)

years next birthday. If the evidence or opinion of a consultant paediatrician is required for any of the

Covered Conditions (41) to (49) on a Life Assured over the age of fourteen (14) years next birthday, the

requirement for evidence or opinion of a consultant paediatrician may be substituted by that of an

appropriate attending medical practitioner at the sole discretion of the Company or Supreme Assist.

41) Bone Marrow Transplant

42) Glomerulonephritis with Nephrotic Syndrome

43) Insulin Dependent Diabetes Mellitus

44) Intellectual Impairment due to Accident or Sickness

FOR INTERNAL REFERENCE ONLY

CFE/PWU/GREAT MEDICARE 2 (H209, H210, H211, H212)/12.10.12 Page 15 of 15

45) Kawasaki Disease with Heart Complications

46) Leukaemia

47) Rheumatic Fever with Valvular Impairment

48) Severe Asthma

49) Severe Juvenile Rheumatoid Arthritis (including Stills Disease)

(B) Definition:

Specified Illnesses means the following disabilities and its related complications, occurring within the

first 120 days from the Risk Commencement Date. However, if there is a break in coverage prior to the

expiry of the said 120 days, a fresh period of 120 days shall apply again from the date of reinstatement:

(a) Hypertension, diabetes mellitus and Cardiovascular disease;

(b) All tumours, cancers, cysts, nodules, polyps, stones of the urinary system and biliary system;

(c) All ear, nose (including sinuses) and throat conditions, excluding flu and sore-throat;

(d) Hernias, haemorrhoids, fistulae, hydrocele, varicocele;

(e) Endometriosis including disease of the Reproduction system;

(f) Vertebro-spinal disorders (including disc) and knee conditions.

-End-

Das könnte Ihnen auch gefallen

- PHM Medisavers 2015 Insurance Policy SampleDokument24 SeitenPHM Medisavers 2015 Insurance Policy SampleNazim Saleh100% (1)

- Brochure (PRU@Work)Dokument36 SeitenBrochure (PRU@Work)aviro259156Noch keine Bewertungen

- 11037Dokument4 Seiten11037api-309082881Noch keine Bewertungen

- SOW Dedicated TeamDokument6 SeitenSOW Dedicated TeamНаталия ТкаченкоNoch keine Bewertungen

- AIA SOLITAIRE PERSONAL ACCIDENTDokument16 SeitenAIA SOLITAIRE PERSONAL ACCIDENTmailer68650% (2)

- Birads PosterDokument1 SeiteBirads PosterGopalarathnam BalachandranNoch keine Bewertungen

- 1.2.1 Log 1Dokument3 Seiten1.2.1 Log 1linuspauling101100% (6)

- PRUcash premier: 15-Year Endowment PlanDokument14 SeitenPRUcash premier: 15-Year Endowment PlanJaboh LabohNoch keine Bewertungen

- Motion Picture Health Plan Appeals - NoticeDokument6 SeitenMotion Picture Health Plan Appeals - Noticeravip3366Noch keine Bewertungen

- Scope of Appointment FormDokument2 SeitenScope of Appointment Formapi-260208821Noch keine Bewertungen

- Medical Cards Comparison in MalaysiaDokument5 SeitenMedical Cards Comparison in MalaysiaZulkifli Abdul MajidNoch keine Bewertungen

- Singlife Cancer Cover Plus PDT Summary - Hospital Reimbursement PlanDokument6 SeitenSinglife Cancer Cover Plus PDT Summary - Hospital Reimbursement PlanTulip TyNoch keine Bewertungen

- Policy - Co-2-034 Independent Double Check High Alert MedicationsDokument8 SeitenPolicy - Co-2-034 Independent Double Check High Alert MedicationsTravel JunkyNoch keine Bewertungen

- Evolution of Health Plans and Managed Care ModelsDokument119 SeitenEvolution of Health Plans and Managed Care ModelsMonyNaguNoch keine Bewertungen

- PRUWith You Boost Campaign GuideDokument4 SeitenPRUWith You Boost Campaign GuideMurugan AnathanNoch keine Bewertungen

- University of San Francisco Student Health Insurance Plan For 2020 To 2021Dokument34 SeitenUniversity of San Francisco Student Health Insurance Plan For 2020 To 2021The College FixNoch keine Bewertungen

- Optimize Working Capital with Strategic Current Asset ManagementDokument69 SeitenOptimize Working Capital with Strategic Current Asset ManagementShoniqua Johnson100% (2)

- Bom Sample NP AgreementDokument7 SeitenBom Sample NP Agreementsfox8792Noch keine Bewertungen

- International Finance AnalysisDokument20 SeitenInternational Finance AnalysisPARTH KHANNANoch keine Bewertungen

- Brosur Suction Pro 72Dokument4 SeitenBrosur Suction Pro 72Anonymous tbJ24554Noch keine Bewertungen

- HLA MediShield ENG - Updated AUG 18Dokument16 SeitenHLA MediShield ENG - Updated AUG 18Chan SCNoch keine Bewertungen

- Great Cash Wonder (Launch) Write-UpDokument8 SeitenGreat Cash Wonder (Launch) Write-UpAlex GeorgeNoch keine Bewertungen

- Ihealth Benefits TableDokument4 SeitenIhealth Benefits TablebelrayNoch keine Bewertungen

- Man Guard protects male healthDokument4 SeitenMan Guard protects male healthidayu9779Noch keine Bewertungen

- Medical Cards ComparisonDokument4 SeitenMedical Cards ComparisonZulkifli Abdul MajidNoch keine Bewertungen

- Allianz Life Insurance Policy Sustainability QuoteDokument4 SeitenAllianz Life Insurance Policy Sustainability Quotechang muiyunNoch keine Bewertungen

- SampleDokument5 SeitenSamplenadiaNoch keine Bewertungen

- AMA - State Patient Compensation FundsDokument4 SeitenAMA - State Patient Compensation FundsjojobagginsNoch keine Bewertungen

- Mycare - Mycare Plus: An Eldershield Supplement With Higher Payouts For Long-Term CareDokument12 SeitenMycare - Mycare Plus: An Eldershield Supplement With Higher Payouts For Long-Term CareKH LaiNoch keine Bewertungen

- Canara Mediclaim BrochureDokument5 SeitenCanara Mediclaim Brochurepankarvi6Noch keine Bewertungen

- Local Drug Testing ProgramDokument7 SeitenLocal Drug Testing ProgramIBEWBrotherhoodNoch keine Bewertungen

- Andhra Pradesh Social Welfare SchemesDokument8 SeitenAndhra Pradesh Social Welfare SchemesranganadhaNoch keine Bewertungen

- Annual LeaveDokument3 SeitenAnnual LeaveDzul Azhar SalimNoch keine Bewertungen

- New India Asha Kiran Policy Celebrates WomenDokument2 SeitenNew India Asha Kiran Policy Celebrates Womenranjitha satheeNoch keine Bewertungen

- What are medical services not covered by insurance known asDokument10 SeitenWhat are medical services not covered by insurance known asCybu BrainNoch keine Bewertungen

- Free - Senior Manager New York State Employment Contract - by CompactLawDokument9 SeitenFree - Senior Manager New York State Employment Contract - by CompactLawCompactLaw USNoch keine Bewertungen

- Ahm250 l19 PDFDokument14 SeitenAhm250 l19 PDFVinayaka KumarNoch keine Bewertungen

- Drug Development Process - Part 1Dokument19 SeitenDrug Development Process - Part 1thang nguyen100% (1)

- Diet Charges in Govt Hospitals Go 146 DT 07-06-2011Dokument14 SeitenDiet Charges in Govt Hospitals Go 146 DT 07-06-2011Narasimha SastryNoch keine Bewertungen

- CLP - Oneassist - TNC 1013099876 - 1Dokument21 SeitenCLP - Oneassist - TNC 1013099876 - 1Aarav LakheraNoch keine Bewertungen

- PRUMillion Med BoosterPRUValue Med Booster FAQ v11 1655688313Dokument67 SeitenPRUMillion Med BoosterPRUValue Med Booster FAQ v11 1655688313Amanda PJYNoch keine Bewertungen

- MCO Pass Through LTR 8.14.18Dokument3 SeitenMCO Pass Through LTR 8.14.18Karen KaslerNoch keine Bewertungen

- Catalogo Uro Nuevo PDFDokument294 SeitenCatalogo Uro Nuevo PDFMei Córdova PinkasNoch keine Bewertungen

- Allianz Care Individual BrochureDokument20 SeitenAllianz Care Individual BrochureLeonard YangNoch keine Bewertungen

- U740046133Dokument32 SeitenU740046133Daniel CopelandNoch keine Bewertungen

- Group Insurance Scheme, 1985Dokument18 SeitenGroup Insurance Scheme, 1985dharamthakur50% (2)

- Charter of Demand 10 Bps Prepared by National Union of Bank EmployeesDokument96 SeitenCharter of Demand 10 Bps Prepared by National Union of Bank Employeeshimadri_bhattacharje100% (1)

- Is your insurance complaint unheard? Contact IRDA for helpDokument10 SeitenIs your insurance complaint unheard? Contact IRDA for helpvinaysekharNoch keine Bewertungen

- Pacific Cross BC-Flexi-Access-a42023-11-november-24Dokument16 SeitenPacific Cross BC-Flexi-Access-a42023-11-november-24Ramil Montealto100% (1)

- PruBSN Takaful Malaysia Medical CardDokument9 SeitenPruBSN Takaful Malaysia Medical CardNisa AzizNoch keine Bewertungen

- Employment Contract TemplateDokument11 SeitenEmployment Contract Templatetaha_shakir52Noch keine Bewertungen

- Licensing & Registration: Sindh Food Authority, Official Website: Https://sfa - Gos.pkDokument5 SeitenLicensing & Registration: Sindh Food Authority, Official Website: Https://sfa - Gos.pkFilza MaryamNoch keine Bewertungen

- Privacy PolicyDokument3 SeitenPrivacy Policymerengue100Noch keine Bewertungen

- Max Age 28 Is Insured Under An Individual Medical ExpenseDokument1 SeiteMax Age 28 Is Insured Under An Individual Medical ExpenseAmit PandeyNoch keine Bewertungen

- Better Buy Energy T and C DocumentDokument8 SeitenBetter Buy Energy T and C DocumentjdscribdNoch keine Bewertungen

- AFDS Circular To Shareholders - Dec 16Dokument1 SeiteAFDS Circular To Shareholders - Dec 16Business Daily ZimbabweNoch keine Bewertungen

- ContentDokument3 SeitenContentகோபிநாத் சுப்ரமணியம்Noch keine Bewertungen

- Great Medicare 2 Product Write-UpDokument15 SeitenGreat Medicare 2 Product Write-UpVerodoxNoch keine Bewertungen

- Nota Medik XtraDokument10 SeitenNota Medik Xtralyna deenNoch keine Bewertungen

- Product Info I-Great Medimax (Plan Codes: 0718 - 0720) : ArketingDokument18 SeitenProduct Info I-Great Medimax (Plan Codes: 0718 - 0720) : ArketingApakElBuheiriGetbNoch keine Bewertungen

- Prospectus Yuva Bharat Health PolicyDokument28 SeitenProspectus Yuva Bharat Health PolicyS PNoch keine Bewertungen

- NEW INDIA Family Flaoter Mediclaim PolicyDokument14 SeitenNEW INDIA Family Flaoter Mediclaim Policyjoydeep_d3232Noch keine Bewertungen

- Oriental Insurance-Happy Family Floater Policy-ProspectusDokument12 SeitenOriental Insurance-Happy Family Floater Policy-Prospectusdpsharma1978Noch keine Bewertungen

- Everett Association of School Administrators (EASA) Administrative HandbookDokument46 SeitenEverett Association of School Administrators (EASA) Administrative HandbookJessica OlsonNoch keine Bewertungen

- IFUk en 310250 07 PDFDokument14 SeitenIFUk en 310250 07 PDFKhaled AlkhawaldehNoch keine Bewertungen

- VetcareDokument18 SeitenVetcareMy binNoch keine Bewertungen

- Snap Glass CleanerDokument7 SeitenSnap Glass Cleanerlovenan02Noch keine Bewertungen

- Undulating Periodization For BodybuildingDokument24 SeitenUndulating Periodization For BodybuildingPete Puza89% (9)

- 11 Foods That Lower Cholesterol: Foods That Make Up A Low Cholesterol Diet Can Help Reduce High LevelsDokument3 Seiten11 Foods That Lower Cholesterol: Foods That Make Up A Low Cholesterol Diet Can Help Reduce High Levelsaj dancel marcosNoch keine Bewertungen

- Methodology Tapping Methodology of WaterlineDokument15 SeitenMethodology Tapping Methodology of WaterlineBryNoch keine Bewertungen

- Stericon Plus BioindicatorDokument4 SeitenStericon Plus Bioindicatorupt labkeswanbaliNoch keine Bewertungen

- Effect of Ointment Base Type on Percutaneous Drug AbsorptionDokument4 SeitenEffect of Ointment Base Type on Percutaneous Drug AbsorptionINDAHNoch keine Bewertungen

- Stetler Model EBP PosterDokument1 SeiteStetler Model EBP PosterEmily MNoch keine Bewertungen

- Healy Professional DeviceDokument1 SeiteHealy Professional DeviceBramarish KadakuntlaNoch keine Bewertungen

- PIDSR Other DiseasesDokument45 SeitenPIDSR Other DiseasesMichelle TuraNoch keine Bewertungen

- Reviews of Two Works by Dr. Amy Baker.Dokument9 SeitenReviews of Two Works by Dr. Amy Baker.Talia SchwartzNoch keine Bewertungen

- Things of Boundaries. Andrew AbbottDokument27 SeitenThings of Boundaries. Andrew AbbottDaniel SotoNoch keine Bewertungen

- GENETIC DISORDERS AND CYTOGENETICSDokument7 SeitenGENETIC DISORDERS AND CYTOGENETICSsmilechance8Noch keine Bewertungen

- PORNOGRAPHICDokument13 SeitenPORNOGRAPHICcarlos ortizNoch keine Bewertungen

- Human Sexual Response Physiology PhasesDokument2 SeitenHuman Sexual Response Physiology PhasesLovely HerreraNoch keine Bewertungen

- Talisay Leaf Extract Cures Betta Fish in Less Time than Methylene BlueDokument8 SeitenTalisay Leaf Extract Cures Betta Fish in Less Time than Methylene BlueMuhammad Rehan Said100% (1)

- S.P.P.M. MasterDokument126 SeitenS.P.P.M. MasterwahyuNoch keine Bewertungen

- NCP Gastric CancerDokument7 SeitenNCP Gastric CancerAnonymous XvwKtnSrMR100% (4)

- Spesifikasi Cardio 7Dokument2 SeitenSpesifikasi Cardio 7Ali RidwanNoch keine Bewertungen

- Survival of The Sickest PresentationDokument24 SeitenSurvival of The Sickest Presentationapi-255985788Noch keine Bewertungen

- Enemies of BeerDokument24 SeitenEnemies of Beerpana0048100% (1)

- Michael DeLong V Oklahoma Mental Health: PetitionDokument30 SeitenMichael DeLong V Oklahoma Mental Health: PetitionTony OrtegaNoch keine Bewertungen

- A Medical Outreach Elective CourseDokument11 SeitenA Medical Outreach Elective CourseRobert SmithNoch keine Bewertungen

- Symbols On PackegingDokument3 SeitenSymbols On PackegingsakibarsNoch keine Bewertungen

- Hahnemann Advance MethodDokument2 SeitenHahnemann Advance MethodRehan AnisNoch keine Bewertungen