Beruflich Dokumente

Kultur Dokumente

Ecogreen 2003

Hochgeladen von

misterbe0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten73 SeitenEcogreen 2003 annual report. Hong Kong listed company

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenEcogreen 2003 annual report. Hong Kong listed company

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten73 SeitenEcogreen 2003

Hochgeladen von

misterbeEcogreen 2003 annual report. Hong Kong listed company

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 73

EcoGreen Fine Chemicals Group Limited

E

c

o

G

r

e

e

n

F

i

n

e

C

h

e

m

i

c

a

l

s

G

r

o

u

p

L

i

m

i

t

e

d

A

n

n

u

a

l

R

e

p

o

r

t

2

0

0

3

*

*

*

EcoGreen Fine Chemicals Group Limited

(incorporated in the Cayman Islands with limited liability)

*

ANNUAL REPORT 2003

*For identification purposes only

2 Corporate Information

3 Financial Highlights

4 Chairmans Statement

6 Management Discussion and Analysis

14 Directors and Senior Managements Profile

18 Directors Report

26 Auditors Report to the Shareholders

27 Balance Sheet

28 Notes to the Accounts

31 Auditors Report to the Directors

33 Proforma Consolidated Profit and Loss Account

34 Proforma Consolidated Balance Sheet

35 Proforma Consolidated Cash Flow Statement

36 Proforma Consolidated

Statement of Changes in Equity

37 Notes to the Proforma Consolidated Accounts

72 Financial Summary

C O N T E N T S

EcoGreen Fine Chemicals Group Limited 2

Corporate Information

Auditors

PricewaterhouseCoopers

Certified Public Accountants

Legal advisers

Chiu & Partners

Principal bankers

The Hongkong and Shanghai Banking

Corporation Limited

China Construction Bank, Xiamen Branch

Principal share registrar and transfer office

Bank of Bermuda (Cayman) Limited

36C Bermuda House, 3rd Floor

P.O. Box 513GT

Dr. Roys Drive

George Town

Grand Cayman

Cayman Islands

British West Indies

Hong Kong branch share registrar and transfer office

Tengis Limited

Ground Floor

Bank of East Asia Harbour View Centre

56 Gloucester Road

Wanchai

Hong Kong

Internet addresses

http://www.ecogreen.com

http://www.doingcom.com

Stock Code

2341

Key Dates

Closure of register of members:

18th May 2004 to 21st May 2004

(both days inclusive)

Date of annual general meeting:

21st May 2004

Executive Directors

Mr. Yang Yirong (Chairman & President)

Mr. Gong Xionghui

Ms. Lu Jiahua

Mr. Lin Zhigang

Mr. Ho Wan Ming

Non-executive Director

Mr. Yang Chiming#

Independent Non-executive Directors

Dr. Zheng Lansun

*

#

Mr. Yau Fook Chuen

*

#

Mr. Wong Yik Chung, John

*

#

*

Audit committee members

# Renumeration committee members

Company secretary

Mr. Lam Kwok Kin ACCA, AHKSA

Registered office

Century Yard

Cricket Square

Hutchins Drive

P.O. Box 2681 GT

George Town

Grand Cayman

Cayman Islands

British West Indies

Head office and principal place of

business in Hong Kong

Unit No. 508

5th Floor, Tower 2

Lippo Centre

89 Queensway

Hong Kong

3 Annual Report 2003

Financial Highlights

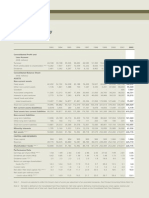

TURNOVER BY GEOGRAPHICAL LOCATION

Year ended 31st December

2003 2002 % of change

RMB000 RMB000

Turnover 223,152 146,761 +52.1%

Profit attributable to shareholders 54,680 33,926 +61.2%

Earnings per share basic (RMB cents) 18 11 +63.6%

Return on total assets 19.3% 17.4% +1.9%

Total assets 283,850 194,535 +45.9%

Shareholders equity 85,888 42,272 +103.2%

Gross profit margin 38.8% 38.0% +0.8%

Net profit margin 24.5% 23.1% +1.4%

TURNOVER

PROFIT ATTRIBUTABLE TO SHAREHOLDERS

PRC

Hong Kong

Others

2003

2002

250,000

200,000

150,000

100,000

50,000

0

2002 2003 2000 2001

75,261

114,259

146,761

223,152

RMB 000

Compound Annual Growth Rate (CAGR):+43.7%

2002 2003 2000 2001

15,520

20,805

33,926

54,680

60,000

50,000

40,000

30,000

20,000

10,000

0

RMB 000

CAGR:+52.2%

9.2%

6.3%

84.5%

10.1%

8.7%

81.2%

EcoGreen Fine Chemicals Group Limited 4

Chairmans Statement

I am pleased to present to shareholders our first annual report since the listing of the Companys Shares on the

Main Board of The Stock Exchange of Hong Kong Limited (the Stock Exchange) on 9th March 2004.

The year of 2003 was significant to the Group in terms of growth and corporate development. During the year,

the Group devoted to the preparation for the listing and fulfilled the stringent requirements of the international

equity market and successfully enhanced its management standard through the listing exercise. With the

dedication of all our staff, the Group successfully listed on the Stock Exchange on 9th March 2004. The listing

has laid down a new milestone to the Group. It was well received among institutional and public investors. The

public offer was over subscribed by 391.8 times and the net proceeds raised amounted to approximately

RMB149.2 million (equivalent of HK$140.8 million), a token of the confidence of the investors towards the

prospects of the fine chemical products industry in the Peoples Republic of China (the PRC) and the Group.

In addition, the Group was awarded the Leading Enterprise in the Forestry Industry in Fujian Province

() by the Forestry Bureau of Fujian Province () and Finance Bureau

of Fujian Province () in 2003. Also, the Group was recognised as a New High Technology

Enterprise () by the Department of Science and Technology of Xiamen ().

The leading position of the Group in terms of operation scale and level of technology is widely recognised in

the PRC.

BUSINESS REVIEW

In 2003, the Group achieved a remarkable growth. Turnover reached RMB223.2 million, representing an increase

of 52.1% over 2002. Profit for the year increased by 61.2% to approximately RMB54.7 million. Basic earnings per

share was approximately RMB18 cents.

The products of the Group are extensively applied in pharmaceutical, healthcare, beauty and cosmetics, personal

care, household and sanitary industries. With the increasing health consciousness of the public, together with

the wide recognition of the effectiveness of chiral pharmaceutical products, the demand of the three major

product groups of the Group, namely (i) chiral pharmaceuticals raw materials and pharmaceutical intermediates,

(ii) natural pharmaceutical raw materials, and (iii) aroma chemicals, is surging. As a result, the Group has benefited

from such continuously growing market demand.

Moreover, since the completion of the enhancement project on the Groups production facilities in the second

half of 2002, the annual processing capacity of botanic essential oils increased by 1,500 metric tonnes to 9,500

metric tonnes, which led to an increase in production output and consequently sales. As to the production

capability, the Group had increased the product types from 9 to over 30 types of products and product

diversification was achieved. Through further development of high value-added fine chemical products, gross

profit margin was improved. The percentage of the Groups turnover generated by the high value-added chiral

pharmaceuticals raw materials and pharmaceutical intermediates increased to 10% in 2003 as compared to 5%

in 2002. As a result, gross profit margin and net profit margin increased by 0.8% and 1.4% respectively.

5 Annual Report 2003

Chairmans Statement

BUSINESS OUTLOOK

Looking ahead, Business specialisation and product diversification remains to be the development direction

of the Group. Leveraging on the existing business model, the Group will enhance its core technological edge

to expediate product diversification and tap into downstream products.

After the completion of the expansion of the Groups production facilities, the Groups annual processing capacity

of botanic essential oils will further increase to 11,000 metric tonnes and four new high value-added chiral

pharmaceuticals raw materials and pharmaceutical intermediates will be launched to the market. Meanwhile,

the construction of a new multi-purpose plant with a total floor area of 16,000 sq.m. will commence in the

second half of 2004 and is expected to be completed by 2005. The Group will also actively expand its overseas

business by establishing a logistic support centre in Rotterdam, Europe.

For research and development, apart from the joint investment with Xiaman University in an enterprise for the

research and development of biological and chemical medicines, the Group will continue the collaboration

with other academics and research institutions through Industry University Research Partnership ()

to develop new products and production technologies, so as to maintain our leading position. On the other

hand, the Group will continually employ additional professionals and acquire sophisticated equipments to lay

down a solid foundation for future development.

On behalf of the Board , I would like to express my sincere gratitude to our shareholders, clients, suppliers and

staff for their trust and support towards the Group since their effort and hard work are essential to our growth

and success. I would like to invite all shareholders to witness our future remarkable development in the years to

come, and we look forward to achieve an impressive performance in the year 2004.

Yang Yirong

Chairman

Hong Kong, 20th April 2004

EcoGreen Fine Chemicals Group Limited 6

Management Discussion and Analysis

EcoGreen Fine Chemical Group Limited (the Company) and its subsidiaries (the Group) is the leading

natural fine chemicals company in the PRC and is principally engaged in the research and development,

production and sales of fine chemical products. Using botanic essential oils as raw material, the fine chemical

products are extensively applied in pharmaceutical industry, healthcare industry and personal care industry.

The Groups fine chemical products are broadly categorised into three main product groups, namely (i) chiral

pharmaceuticals raw materials and pharmaceutical intermediates which are principally used in the production

of chiral pharmaceuticals, (ii)

natural pharmaceutical raw

materials which are used as

functional ingredients in the

production of healthcare

products, and (iii) aroma

chemicals which are broadly

used as ingredients in flavor

and fragrance products to be

applied in a wide range of

personal care products,

cosmetics and household

products.

BUSINESS REVIEW

Riding on the impressive performance in previous years, the Group continued to record a remarkable business

growth for the year ended 31st December 2003. Turnover and profit attributable to shareholders reached

RMB223.2 million and RMB54.7 million, respectively, representing a year-on-year increase of 52.0% and 61.4%

as compared to RMB146.8 million and RMB33.9 million in 2002. For the four years ended 31st December 2003,

the compound annual growth rates for the Groups turnover and net profit amounted to approximately 43.7%

and 52.2% respectively. Earnings per share also increased from RMB11 cents in 2002 to RMB18 cents in 2003.

The notable growth in turnover was mainly attributable to the launching of two new chiral pharmaceuticals raw

materials and pharmaceutical intermediates and one new aroma chemical products during the year and the

impact of a full years operation of the enhancement of the Groups production facilities which was completed

in June 2002, the annual processing capacity of botanic essential oils was increased from 8,000 metric tonnes to

9,500 metric tonnes. With the expansion of the Groups sales volume, together with the benefits brought forth

by economies of scale and improvement of operational efficiency, the Group successfully adopted a competitive

pricing policy for its products.

Management Discussion and Analysis

7 Annual Report 2003

Management Discussion and Analysis

In addition, the Group has continued to enlarge its customer base through expansion of sales and distribution

network to overseas market. In 2003, overseas sales of the Groups fine chemical products surged significantly

by 85% as compared to that of 2002.

During the year of 2003, the gross profit margin of the Group increased from 38.0% in 2002 to 38.8% in 2003.

The improvement was attributable to the improvement of operational efficiency, economies of scale of

production and the change in sales mix towards higher gross profit margin products.

OPERATIONAL REVIEW

Product Diversification

Leveraged on its advanced production technologies and techniques, the Group is well positioned to develop

new products in a timely manner and swiftly adjust the product mix in accordance with the market demand.

During the year under review, approximately 30 types of fine chemical products were produced. An analysis of

the Groups turnover by product types and the gross profit margin of the Groups products for the year ended

31st December 2003 and 31st December 2002 is as follows:

Gross profit Gross profit

Turnover margin Turnover margin

2003 2003 2002 2002

RMB000 % RMB000 %

Chiral pharmaceuticals raw materials

and pharmaceutical intermediates 21,374 78.5 6,727 68.5

Natural pharmaceutical raw materials 59,253 38.2 42,712 37.9

Aroma chemicals 142,525 34.6 97,322 36.1

223,152 38.8 146,761 38.0

With the Groups emphasis on the development of fine chemical products that are mainly applied as functional

ingredients or intermediates for a wide range of downstream applications, the growing demand for downstream

products in the PRC and the international market lead to an overall increase in the demand for the Group

products. Above all, the growth in turnover of chiral pharmaceuticals raw materials and pharmaceutical

intermediates was faster than other products of the Group, contributing to a change of sales mix. With the

increase of turnover of the high-margin chiral pharmaceuticals raw materials and pharmaceutical intermediates,

its contribution to the Groups gross profit becomes more predominant.

EcoGreen Fine Chemicals Group Limited 8

Management Discussion and Analysis

TURNOVER BY PRODUCT TYPES

GROSS PROFIT BY PRODUCT TYPES

Chiral pharmaceuticals raw materials

and pharmaceutical intermediates

Natural pharmaceutical raw materials

Aroma chemicals

2003 2002

2003 2002

Chiral pharmaceuticals raw materials

and pharmaceutical intermediates

Natural pharmaceutical raw materials

Aroma chemicals

26.5%

9.6%

63.9%

4.6%

29.1%

66.3%

54.9%

19.2%

25.9%

64.5%

28.1%

7.4%

9 Annual Report 2003

Management Discussion and Analysis

The sales of chiral pharmaceuticals raw materials and pharmaceutical

intermediates increased by 217.7% to RMB21.4 million in the year ended 31st

December 2003, from RMB6.7 million in the previous year. It accounted for

9.6% (2002: 4.6%) of the Groups turnover. The market launch of new products,

comprising intermediary polysaccharides and resveratrol which are of higher

profit margins and the cessation of selling lower profit margin pseudo ionone

contributed to the impressive increase of the gross profit margin of this

product group.

The sales of natural pharmaceutical intermediates increased by 38.7% to

RMB59.3 million in the year ended 31st December 2003, from RMB42.7 million

in the previous year. It accounted for 26.6% (2002: 29.1%) of the Groups

turnover. The progressive growth in the sales of the Groups natural

pharmaceutical raw materials was the result of an increasing demand for

downstream products in the PRC. The Groups economies of scale, continuous

refining of production technology and the reduction in unit production cost

of the Groups natural pharmaceutical raw materials improved the gross profit

margin of this product group for the year.

The sales of aroma chemicals increased by 46.4% to RMB142.5 million in the

year ended 31st December 2003, from RMB97.3 million in the previous year.

It accounted for 63.9% (2002: 66.3%) of the Groups turnover. The prominent

overseas sales of the Groups products and the enhancement of the Groups

processing capacity of botanic essential oils were the driving force of the

remarkable increase in the sales of aroma chemicals. With a view of satisfying

the needs of some of the Groups largest customers and utilising redundant

production capacity in the production plant, the Group received orders of

some new aroma chemicals with lower gross profit margin, which caused the

decrease in the overall gross profit margin of the Groups aroma chemicals in

2003.

Extensive Clientele Base

The Group has established a solid and extensive customer base with over

100 customers, including trading companies and industrial companies that

are the major multinational manufacturers of pharmaceuticals, flavour and

fragrance products. During the year 2003, turnover generated from the Groups

five largest customers reduced from 26.0% to 20.7%. The Groups extensive customer base minimises the adverse

impact of any over-exposure to a particular customer, industry or any significant seasonal fluctuation in sales

pertaining to any particular industry.

Production Facilities

The Groups existing production facilities have a site area of

approximately 27,000 sq. m. and an aggregate gross floor area of

approximately 8,400 sq. m. located in Xiamen, Fujian Province, PRC.

The Groups facilities enjoy close proximity to Xiamens container port

and extensive transportation network, ensuring efficient delivery and

reduction of transportation costs. After the enhancement project on

the existing production facilities which was completed in 2002, the

annual processing capacity of botanic essential oils of the Group

increased from 8,000 metric tonnes to 9,500 metric tonnes. Based on

optimal product mix, the average annual utilisation rate of the existing

production facilities is approximately 91%.

EcoGreen Fine Chemicals Group Limited 10

Management Discussion and Analysis

Research and Development

For the year ended 31st December 2003, product development

costs incurred and capitalised by the Group amounted to

approximately RMB6.2 million (2002: RMB1.5 million) whereas

the Groups amortisation of product development costs

amounted to RMB2.2 million (2002: RMB2.1 million), representing

2.8% (2002: 1.0%) and 1.0% (2002: 1.4%), respectively, of the

Groups turnover.

With the availability of sophisticated ancillary facilities and the

abundant resources provided by a number of PRC academic and

research institutes, the Group bolstered its research and

development capability through the collaborations with some

leading academic and research institutes in the PRC, including

Xiamen University, Nanjing University, The Shanghai Institute of

Organic Chemistry of Chinese Academy of Sciences and The

Guangzhou Institute of Chemistry of Chinese Academy of

Sciences.

During the year, the Group has cooperated with Xiamen

University Assets Operations Co., Ltd. to invest in Xiamen Xiada

Taigu Pharmaceutical Co., Ltd., a domestic enterprise established

in the PRC which is principally engaged in the research and

development of biological and chemical pharmaceutical

products. As at 31st December 2003, the Group had 10% (2002:

Nil) interest in this company.

RECOGNITIONS

In December 2003, Xiamen Doingcom Chemical Co., Ltd., one of the subsidiaries of the Company, was accredited

with a ISO9001: 2000 certificate for its Quality Management System for its unparalleled management of the

research and development, manufacture and service of flavor and fragrance, botanic aroma essential oils and

their derivants.

Chemical wastes discharged by the Groups production facilities were kept under the statutory level and complied

with the requirements of the environmental authority under the local government. In addition, Xiamen Doingcom

Chemical Co., Ltd. was accredited ISO14001: 1996 certificate in December 2003 for its eminent Environmental

Management System implement on the research and development, manufacture and service of aroma flavour

and fragrance, botanic aroma essential oils and their derivants as well as the associated environmental

management activities.

11 Annual Report 2003

Management Discussion and Analysis

EMPLOYEES AND REMUNERATION POLICY

As at 31st December 2003, the Group has 218 full-time employees of which 215 are based in the PRC and 3 in

the Hong Kong office. The Group has always maintained a good relationship with its employees and training is

provided to its staff on business knowledge including information on the application of the Groups products

and to maintain clients relationship. Remuneration packages offered to the staff are in line with the prevailing

market terms and reviewed on a regular basis. Discretionary bonuses may be rewarded to employees after

assessment of the Groups and the individuals performance.

The Group participates in state-sponsored retirement plans which are administered by the local government in

the PRC for its PRC based employees. The Group has also set up a retirement scheme in accordance with the

mandatory provident fund requirements prescribed by the Mandatory Provident Fund Schemes Ordinance for

all its Hong Kong based employees.

The Group has also adopted a share option scheme on 16th February 2004 for the purpose of providing incentives

and rewards to eligible participants who contribute to the success of the Groups operations. The Directors

may, at their discretion, invite any employees or Directors of the Group and other selected participants as set

out in the scheme, to subscribe for shares in the Company. For the period up to the date of this report, no

share options had been granted under the share option scheme.

FINANCIAL REVIEW

Liquidity, Financial Resources and Capital Structure

During the year under review, the Groups primary source of funding included cash generated from operating

activities and credit facilities provided by its principal banks in the PRC. Net cash inflow from operating activities

amounting to approximately RMB22.7 million (2002: RMB22.8 million) which was resulted from the Groups

capability in working capital management to develop and strengthen a net cash surplus from operation. As at

31st December 2003, the Group had cash and bank deposits of approximately RMB65.9 million (2002: RMB11.7

million).

The Groups financial position remains healthy. As at 31st December 2003, the net current assets and the current

ratio of the Group were approximately RMB40.9 million (2002: RMB23.0 million) and 1.32 (2002: 1.31), respectively.

As at 31st December 2003, the Group had total assets of approximately RMB283.9 million (2002: RMB194.5

million), bank borrowings of approximately RMB90.6 million (2002: RMB59.0 million), government loans from

State Development and Reform Commission, Xiamen Development Planning Commission and other PRC

government bureaus to finance the Groups product development activities and expansion of production facilities

of approximately RMB36.2 million (2002: RMB31.0 million), convertible bonds of RMB37.2 million (2002: RMB37.2

million), trade and other payables of approximately RMB34.0 million (2002: RMB25.1 million) and shareholders

equity of approximately RMB85.9 million (2002: RMB42.3 million).

The Groups gearing ratio as at 31st December 2003, which is represented by the ratio of total debts to total

assets, was approximately 57.7% (2002: 65.9%). Moreover, the Groups return on assets was about 19.3% (2002:

17.4%), which indicated that the Groups assets were employed and utilised efficiently and effectively.

EcoGreen Fine Chemicals Group Limited 12

Management Discussion and Analysis

With the positive cash inflow from operations, its available banking facilities and the proceeds from the

Companys issue of new shares and the exercise of over-allotment option at the time of listing on the Stock

Exchange on 9th March 2004, which, after deduction of related issuance expenses, amounted to approximately

RMB149.2 million (equivalent of HK$140.8 million), the Group has sufficient financial resources to meet its

commitments, working capital requirements and future investments for expansion.

Charges on assets

The Groups bank borrowings were secured by pledge of certain of the Groups land and buildings of

approximately RMB37.2 million (2002: RMB38.3 million), corporate guarantees provided by certain unrelated

third parties of approximately RMB25.5 million (2002: RMB19.5 million) and pledge of input value-added tax

recoverable of approximately RMB3.1 million (2002: nil).

Contingent Liabilities

As at 31st December 2003, corporate guarantees in the amount of RMB1.5 million (2002: RMB1.0 million) were

provided by the Group for bank loans of an unrelated third party. Subsequent to 31st December 2003, such

guarantees were released.

Capital Commitment

As at 31st December 2003, the Group had capital commitments of approximately RMB21.0 million (2002: RMB9.1

million) in respect of purchases of property, plant and equipment and construction-in-progress, capital injection

to a subsidiary and product development projects.

Treasury Policies and Exposure to Fluctuations in Exchange Rates

The Groups transactions are mainly denominated in Renminbi, United States dollars and Hong Kong dollars

with operation mainly in the PRC. As at 31st December 2003, the Groups bank borrowings were denominated

in Renminbi and bearing interest at rates ranging from 5.6% to 6.6% per annum whereas the Groups cash and

cash equivalents denominated in Renminbi amounted to 97.2% of the total balance with the remaining balance

denominated in United States dollars and Hong Kong dollars. The Groups exposure to the foreign exchange

fluctuations was minimal and has not experienced any material difficulties or affects the operations or liquidity

as a result of fluctuations in currency exchange rates during the year. Nevertheless, the Group will conduct

periodic review of its exposure to foreign exchange risk and may use financial instrument for hedging purpose

when considered appropriate.

13 Annual Report 2003

Management Discussion and Analysis

Business Outlook

Looking ahead, the Group will capitalise on the surging market demand for chiral drugs, natural pharmaceuticals

and personal care product, with the view of propelling business growth. Business specialisation and product

diversification has been, and will continue to be, the goal for the Groups long-term development.

Leveraging its solid foundation for aroma chemicals products, the Group will further strengthen and expand

this market, while diversifying its existing product portfolio to other fine chemicals products. The Group

endeavors to utilise botanic essential oils as the principal raw material and develop new products with high

growth potential. High value-added products, comprising mainly chiral pharmaceuticals raw materials and

pharmaceutical intermediates and natural pharmaceutical raw materials, will further be developed in order to

increase the Groups market share and the sales of the abovementioned products.

The Group will complete the expansion of the existing production facilities by 2004 and the construction of a

new plant by 2005. The expansion will enhance the Groups processing capacity of botanic essential oils to

11,000 metric tonnes and to 16,000 metric tonnes in 2004 and 2005, respectively, and strengthen its plan for

business expansion.

With the objective of maintaining intimate customer relationship and creating customer values, the Group will

actively establish direct communication channels with product users to thoroughly understand customers needs

and adopt a more effective control over distribution channels, so as to respond to market changes and customers

needs. The setting up of a representative office in Guangzhou enables the Group to have direct access to

potential users, which motivates further expansion of the extensive customer base in the PRC. To increase

direct exports to overseas market, the Group endeavors to provide comprehensive and quality services and

establish a strong foothold in the European and the US market by setting up logistics support centre in Rotterdam,

the Netherlands, the transportation and logistics hub of Europe, as well as a representative office in New York,

the US in 2005.

Amidst the backdrop of the promising market, the

Group will continue to seek for appropriate

opportunities to acquire advanced research and

development facilities and recruit high caliber

professionals for speeding up the effective

commercialisation of its research and development

results. Leverage on its unique market insight,

unrivalled research and development competence

and sound fi nanci al posi ti on, the Group i s

conf i dent of capt ur i ng any cooper at i on

opportunities with renowned local and overseas

research institutes and further enhancing its long-

term competitiveness.

EcoGreen Fine Chemicals Group Limited 14

Directors and Senior Managements Profile Directors and Senior Managements Profile

DIRECTORS

Mr. YANG Yirong

Executive Director

Mr. Yang Yirong (), aged 42, is the Chairman

and President of the Group. Mr.Yang is responsible

for strategic planning and formulation of overall

corporate development policy for the Group. Mr.

Yang holds a bachelor degree in science, majoring in

chemistry from Huaqiao University () in 1982.

Prior to founding the Group in 1994, Mr. Yang has

extensi ve experi ence i n the f i ne chemi cal s

manufacturing and trading and has more than 10

years of experience in natural organic chemistry

research.

Ms. LU Jiahua

Executive Director

Ms. Lu Jiahua (), aged 37, is the Vice President

of corporate control of the Group. Ms. Lu oversees

the finance and accounting and human resources

functions for the Group in the PRC. Prior to joining

the Group in April 2002, Ms. Lu has 14 years of

experience in accounting, financial management,

administration management and internal auditing in

a number of pharmaceutical and fine chemical

manufacturing enterprises. Ms. Lu holds a bachelor

degree and a master degree in economics and

corporate management from Xiamen University (

).

Mr. GONG Xionghui

Executive Director

Mr. Gong Xionghui (), aged 40, is the Vice

President of operations of the Group, responsible for

general manufacturing operations and research and

development functions for the Group. Mr. Gong

oversees the research and development department

and other operational departments including the

producti on department, qual i ty management

department and logistic centre of the Group. Mr.

Gong holds a master degree in chemical engineering

from Xi amen Uni versi ty ( ) and has

accumulated over 16 years of experience in fine

chemicals industry and qualified as an ISO 9000

auditor in the PRC in 1998. He joined the Group in

September 1999.

Mr. LIN Zhigang

Executive Director

Mr. Lin Zhigang (), aged 33, is the head of Sales

and Marketing Department and is responsible for

overseas and domestic sales and the marketing

management of the Group. Mr. Lin holds a bachelor

degree i n economi cs obtai ned from Xi amen

University (). Prior to joining the Group in

June 1996, he worked in a foreign investment

enterprise and has concrete experience in sales and

marketing management, business development and

production management.

15 Annual Report 2003

Directors and Senior Managements Profile

DIRECTORS (Continued)

Mr. HO Wan Ming

Executive Director

Mr. Ho Wan Ming (), aged 44, is responsible

for the overseas affairs of the Group. Mr. Ho

graduated from Huaqiao University ()

majoring in chemistry and chemical engineering. He

accumulated over 20 years of extensive experience

i n i nternati onal tradi ng, pl ant management,

corporate management and publ i c rel ati ons

management from a various types of sectors including

petrochemicals, cosmetic and beverage. Mr. Ho

joined the Group in June 2002.

Dr. ZHENG Lansun

Independent Non-executive Director

Dr. Zheng Lansun (), aged 49, is a member of

the National Committee of the 10th Chinese Peoples

Political Consultative Conference (

), representi ng the

technology sector. He is also a qualified academician

() of the Chinese Academy of Sciences (

). Dr. Zheng received a doctoral degree in

philosophy from Rice University in the United States

of America and has engaged in chemistry related

research activities at Xiamen University. He was

appointed as an independent non-executive Director

in February 2004.

Mr. WONG Yik Chung, John

Independent Non-executive Director

Mr. Wong Yik Chung, John (), aged 37, is a

qualified accountant and has over 12 years of public

accounting and financial consulting experience in the

PRC, Hong Kong, Australia and Southeast Asia. Mr.

Wong is a member of Australian Society of Certified

Practising Accountants and the Hong Kong Society

of Accountants. Mr. Wong graduated from the

Flinders University of South Australia with a master

degree in applied finance and is currently engaging

in a range of financial consulting services stationing

in Shanghai, the PRC. He was appointed as an

independent non-executive Director in February

2004.

Mr. YANG Chiming

Non-executive Director

Mr. Yang Chi mi ng ( ) , aged 52, i s an

entrepreneur who stations in Taiwan and is the cousin

of Mr.Yang Yirong. Mr. Yang has extensive experience

i n busi ness management and manufacturi ng

operation at manufacturing industries. He also

assisted the Group in providing opinions with respect

to management of i nvestments proj ects and

operations. Mr. Yang joined the Group in May 2002

and was appointed as a Director is October 2003 and

was then appointed as a non-executive Director in

February 2004.

Mr. YAU Fook Chuen

Independent Non-executive Director

Mr. Yau Fook Chuen (), aged 46, is a practising

accountant and has over 14 years of experience in

public accountancy practice which covers company

secretarial service, accountancy, auditing and

taxation. Mr. Yau is a member of the Association of

Chartered Certified Accountants and the Hong Kong

Society of Accountants. Mr. Yau is currently the

propri etor of Yau & Wong, Certi fi ed Publ i c

Accountants in Hong Kong. He was appointed as an

independent non-executive Director in February

2004.

EcoGreen Fine Chemicals Group Limited 16

Directors and Senior Managements Profile

SENIOR MANAGEMENT

Ms. Chen Hua (), aged 32, oversees the

I nvestment Management Department and i s

responsible for coordinating and monitoring the

execution of investment projects of the Group. Ms.

Chen graduated from the University of Shanghai for

Science and Technology (formerly known as Shanghai

Institute of Mechanics ()) and has more

than eight years of experience in sales and marketing,

publ i c rel ati on admi ni strati on and corporate

management. She joined the Group in March 1995.

Mr. Shi Jinlei (), aged 32, is a senior consultant

of the Group. Mr. Shi is a qualified accountant and

lawyer in the PRC and is responsible for advising the

management on corporate development strategy in

legal and financial aspect. Mr. Shi holds a bachelor

degree of science major in chemistry from Sichuan

University (), a master degree of law and a

doctorate degree of economics from Xiamen

University (). Prior to joining the Group in

2001, Mr. Shi has extensive experience in investment

banking business.

Mr. Yin Xiande (), aged 63, is the head of

Research & Devel opment Department and i s

directing the research and development projects in

products and technologies. Mr. Yin graduated from

the Wuhan University () with a chemistry

degree major in organic synthesis. He has served at

the Chinese Academy of Sciences () for

research projects in the areas of organic chemistry,

fine chemistry, catalytic science and material science

for more than 20 years and obtained senior engineer

qualification specialised in fine chemicals. He has

been entitled to receive an extraordinary grant from

the State Council () of the PRC Government.

Mr. Yin joined the Group in July 2001.

Mr. Lin Weiqing (), aged 33, is the head of

Accounting Department. Mr. Lin is responsible for

managing the accounting functions of the Group in

the PRC. Mr. Lin holds an economics degree major

in accountancy from Xiamen University ()

and was qualified as an accountant specialises in

corporate accounts by the Ministry of Finance in

China. Mr. Lin has more than 10 years of working

experience in finance and accounting. Mr. Lin joined

the Group in March 2002.

Mr. Zheng Jinzhuan (), aged 33, is the head of

the Logistics Center and is responsible for procuring,

inventory and logistics management of the Group.

Mr. Zheng graduated in chemical engineering faculty

from Fuzhou University () and he is a

qualified chemical engineer. Prior to joining the

Group in January 2000, Mr. Zheng worked in a number

of multinational fine chemicals companies and has

extensive experience in fine chemicals industry.

Mr. Li Xiaoliang (), aged 29, is the head of

Corporate Devel opment Department. Mr. Li

graduated from Jiangxi University of Traditional

Chinese Medicine () in pharmacy and

holds a master degree of business administration

from Xiamen University (). Mr. Li joined the

Group in March 2001.

17 Annual Report 2003

Directors and Senior Managements Profile

SENIOR MANAGEMENT (Continued)

Mr. Zhang Yonglai (), aged 61, is the head of

Production Department and is responsible for the

Groups production functions. Mr. Zhang graduated

from the Chemical Engineering Academy of Beijing

( presently known as Beijing University

of Chemical Technology ()) with an

organic chemistry degree major in organic synthesis.

Mr. Zhang has extensive experience in constructing

as well as managing large-scale chemical production

facilities and he also received chemical engineering

awards for achievements in development of new

advance coal gas production technology. Mr. Zhang

joined the Group in March 1999.

Mr. Jiang Yuming (), aged 37, is the head of

Quality Management Department and is responsible

for establishing and supervising the quality control

system for the Group. Mr. Jiang holds a post-

graduate study in analytical chemistry from Hebei

University (). Prior to joining the Group in

September 2003, Mr. Jiang worked in a chemical plant

and is a qualified chemical engineer.

Lam Kwok Kin (), aged 30, is the financial

controller and company secretary of the Company.

Mr. Lam holds a bachelor degree in accountancy and

is an associate member of the Association of

Chartered Certified Accountants and the Hong Kong

Society of Accountants. Prior to joining the Group in

October 2003. He worked with an international

accounting firm and was the financial controller and

company secretary of a company listed on the Stock

Exchange. Mr. Lam has accumulated extensive

experience in auditing, accounting, budgeting and

company secretarial works.

EcoGreen Fine Chemicals Group Limited 18

Directors Report Directors Report

The directors of EcoGreen Fine Chemicals Group Limited (the Company) (the Directors) are pleased to

present their first report together with the audited accounts of the Company for the period ended 31st December

2003 and the audited proforma consolidated accounts of the Company and its subsidiaries (the Group) for

the year ended 31st December 2003.

GROUP REORGANISATION

The Company was incorporated in the Cayman Islands on 3rd March 2003 as an exempted company with

limited liability under the Companies Law of the Cayman Islands. On 16th February 2004, the Company acquired

the entire issued share capital of EcoGreen Fine Chemicals Limited, a company incorporated in the British

Virgin Islands, through a share exchange (the Reorganisation) and consequently became the holding company

of the subsidiaries as set out in Note 33 to the proforma consolidated accounts. Details of the Reorganisation

and the basis of presentation of the accounts of the Company and the proforma consolidated accounts of the

Group are set out in Note 1 to the accounts.

Shares of HK$0.10 each in the share capital of the Company (Shares, each a Share) have been listed on the

Main Board of The Stock Exchange of Hong Kong Limited (the Stock Exchange) since 9th March 2004 (the

Listing Date).

PRINCIPAL ACTIVITIES AND GEOGRAPHICAL ANALYSIS OF OPERATIONS

The Company is an investment holding company. The principal activities of the subsidiaries are the research

and development, production and sale of fine chemicals products from natural resources for use in aroma

chemicals and pharmaceutical products.

An analysis of the Groups performance for the year by business and geographical segments is set out in Note

3 to the proforma consolidated accounts.

RESULTS AND DIVIDENDS

Apart from the change in share capital of the Company as set out in Note 3 to the Companys accounts, no

other transactions were carried out by the Company during the period from 3rd March 2003 (date of

incorporation) to 31st December 2003.

The results of the Group for the year are set out in the proforma consolidated accounts on page 33.

No dividend has been paid or declared by the Company since its incorporation. The directors do not recommend

the payment of a final dividend by the Company for the period.

During the year, dividends of RMB7,600,000 (2002: RMB23,750,000) were paid by a subsidiary of the Company

out of the subsidiarys retained earnings which were attributable to the Group.

Directors Report

19 Annual Report 2003

RESERVES

There was no movement in the reserve of the Company during the period from 3rd March 2003 (date of

incorporation) to 31st December 2003. As at 31st December 2003, the Group had no reserves available for

distribution to its shareholders.

Movements in reserves of the Group during the year are set out in Note 28 to the proforma consolidated

accounts.

PROPERTY, PLANT AND EQUIPMENT

Details of movements in property, plant and equipment during the year are set out in Note 12 to the proforma

consolidated accounts.

SHARE CAPITAL

Details of movements in share capital of the Company are set out in Note 26 to the proforma consolidated

accounts.

PRE-EMPTIVE RIGHTS

There are no provision for pre-emptive rights under the Companys articles of association or the laws of the

Cayman Islands, which would oblige the Company to offer new shares on a pro-rata basis to existing shareholders.

FINANCIAL SUMMARY

A summary of the results and of the assets and liabilities of the Group for the last four financial years is set out

on page 72.

SHARE OPTIONS

Pursuant to a written resolution of the shareholders of the Company passed on 16th February 2004, a share

option scheme (the Share Option Scheme) was approved and adopted.

The purpose of the Share Option Scheme is to enable the Group to grant options to selected participants as

incentives or rewards for their contributions to the Group. All directors, employees, suppliers of goods or

services, customers, persons or entities that provide research, development or other technological support to

the Group, shareholders and advisers or consultants of the Group are eligible to participate in the Share Option

Scheme.

The total number of Shares which may be allotted and issued upon exercise of all options to be granted under

the Share Option Scheme and any other share option scheme adopted by the Company must not in aggregate

exceed 10% of the Shares of the Company in issue on the Listing Date.

EcoGreen Fine Chemicals Group Limited 20

Directors Report

SHARE OPTIONS (Continued)

The Company may renew this 10% limit with shareholders approval provided that each such renewal may not

exceed 10% of the Shares in the Company in issue as at the date of the shareholders approval.

The maximum number of Shares which may be issued upon exercise of all outstanding options granted and yet

to be exercised under the Share Option Scheme and any other share option scheme adopted by the Company

must not in aggregate exceed 30% of the Shares in issue from time to time.

Unless approved by shareholders of the Company, the total number of Shares issued and to be issued upon

the exercise of the options granted to each participant (including both exercised and outstanding options)

under the Share Option Scheme or any other share option scheme adopted by the Company in any 12-month

period must not exceed 1% of the Shares in issue.

An option must be exercised in accordance with the terms of the Share Option Scheme at any time during a

period to be determined and notified by the Directors to each grantee, which period may commence from the

date of the offer for the grant of option is made, but shall end in any event not later than 10 years from the date

on which the offer for the grant of the option is made, subject to the provisions for early termination thereof.

An option may be accepted by a participant within 21 days from the date of the offer for the grant of the option

and the amount payable on acceptance of the grant of an option is HK$1.

Unless otherwise determined by the Directors and stated in the offer for the grant of options to a grantee,

there is no minimum period required under the Share Option Scheme for the holding of an option before it can

be exercised.

The subscription price for the Shares under the Share Option Scheme shall be a price determined by the

Directors but shall not be less than the highest of:

(a) the closing price of the Shares as stated in the daily quotation sheet of the Stock Exchange for trade in

one or more board lots of the Shares on the date of the offer for the grant;

(b) the average closing price of the Shares as stated in the daily quotation sheets of the Stock Exchange for

the five business days immediately preceding the date of the offer for the grant; and

(c) the nominal value of a Share.

The Share Option Scheme will remain in force for a period of 10 years commencing on the date on which the

Share Option Scheme is adopted.

As at the date of approval of the accounts, no options had been granted under the Share Option Scheme.

Directors Report

21 Annual Report 2003

DIRECTORS

The Directors who held office during the year and up to the date of this report are:

Executive Directors

Mr. Yang Yirong (Chairman & President) (appointed on 24th March 2003)

Mr. Gong Xionghui (appointed on 28th October 2003)

Ms. Lu Jiahua (appointed on 28th October 2003)

Mr. Ho Wan Ming (appointed on 28th October 2003)

Mr. Lin Zhigang (appointed on 12th February 2004)

Non-executive Director

Mr. Yang Chiming (appointed on 28th October 2003)

Independent Non-executive Directors

Dr. Zheng Lansun (appointed on 12th February 2004)

Mr. Yau Fook Chuen (appointed on 12th February 2004)

Mr. Wong Yik Chung, John (appointed on 12th February 2004)

In accordance with articles 108(A) of the Companys articles of association, Mr. Gong Xionghui and Ms. Lu

Jiahua will retire from office by rotation and, being eligible, offers themselves for re-election at the forthcoming

annual general meeting.

The independent non-executive Directors were appointed for an initial term of one year and will be renewable

automatically for successive term of one year until terminated by not less than three months notice in writing

served by either party or the other.

DIRECTORS SERVICE CONTRACTS

Each of Mr. Yang Yirong, Mr. Gong Xionghui, Ms. Lu Jiahua, Mr. Lin Zhigang and Mr. Ho Wan Ming, all being

executive Directors, has entered into a service contract with the Company for an initial term of three years

commencing from 1st January 2004, and will continue thereafter for successive terms of one year until terminated

by not less than three months notice in writing served by either party on the other.

DIRECTORS INTERESTS IN CONTRACTS

Save as disclosed in this annual report and other than in connection with the Groups reorganisation in preparation

for the listing of the Shares on the Main Board of The Stock Exchange, no contracts of significance in relation to

the Groups business to which the Company, its subsidiaries was a party and in which a Director of the Company

had a material interest, whether directly or indirectly, subsisted at the end of the period or at any time during

the period.

EcoGreen Fine Chemicals Group Limited 22

Directors Report

BIOGRAPHICAL DETAILS OF DIRECTORS AND SENIOR MANAGEMENT

Biographical details of Directors and senior management are set out on page 14 of the annual report.

DIRECTORS AND CHIEF EXECUTIVES INTERESTS AND SHORT POSITIONS IN SHARES

The Company became a listed company on 9th March 2004. The interests and short positions of the Directors

and chief executives in the Shares, underlying shares or debentures of the Company and its associated

corporations (within the meaning of Part XV of the Securities and Futures Ordinance (SFO), as recorded in

the register maintained by the Company under Section 352 of the SFO; or as notified to the Company and the

Stock Exchange pursuant to the Divisions 7 and 8 of Part XV of the SFO (including interests or short positions

which the Directors or the chief executives were taken or deemed to have under such provisions of the SFO)

and the Model Code for Securities Transactions by Directors of Listed Companies contained in the Listing

Rules as at the date of this report, were as follows:

Interests in ordinary Shares:

Percentage of

Number of the Companys

Name of directors Nature of interest ordinary Shares held issued share capital

Mr. Yang Yirong Interest of a controlled 193,263,158 46.57%

corporation (Note a)

Mr. Yang Chiming Interest of a controlled 14,210,526 3.42%

corporation (Note b)

Mr. Gong Xionghui Interest of a controlled 11,368,421 2.74%

corporation (Note c)

Ms. Lu Jiahua Interest of a controlled 8,526,316 2.05%

corporation (Note d)

Mr. Ho Wan Ming Interest of a controlled 7,105,263 1.71%

corporation (Note e)

Mr. Lin Zhigang Interest of a controlled 5,684,211 1.37%

corporation (Note f)

Notes:

(a) These Shares are registered in the name of and beneficially owned by Marietta Limited, the entire issued share

capital of which is registered in the name of and beneficially owned by Mr. Yang Yirong. Under the SFO, Mr. Yang

Yirong is deemed to be interested in all the Shares held by Marietta Limited.

(b) These Shares are registered in the name of and beneficially owned by Rowe Investments Ltd., the entire issued share

capital of which is registered in the name of and beneficially owned by Mr. Yang Chiming. Under the SFO, Mr. Yang

Chiming is deemed to be interested in all the Shares held by Rowe Investments Ltd.

Directors Report

23 Annual Report 2003

DIRECTORS AND CHIEF EXECUTIVES INTERESTS AND SHORT POSITIONS IN SHARES

(Continued)

Notes: (Continued)

(c) These Shares are registered in the name of and beneficially owned by Dragon Kingdom Investment Limited, the

entire issued share capital of which is registered in the name of and beneficially owned by Mr. Gong Xionghui. Under

the SFO, Mr. Gong Xionghui is deemed to be interested in all the Shares held by Dragon Kingdom Investment

Limited.

(d) These Shares are registered in the name of and beneficially owned by Sunwill Investments Limited, the entire issued

share capital of which is registered in the name of and beneficially owned by Ms. Lu Jiahua. Under the SFO, Ms. Lu

Jiahua is deemed to be interested in all the Shares held by Sunwill Investments Limited.

(e) These Shares are registered in the name of and beneficially owned by Veazey Finance Corp., the entire issued share

capital of which is registered in the name of and beneficially owned by Mr. Ho Wan Ming. Under the SFO, Mr. Ho

Wan Ming is deemed to be interested in all the Shares held by Veazey Finance Corp.

(f) These Shares are registered in the name of and beneficially owned by Active Wealth Limited, the entire issued share

capital of which is registered in the name of and beneficially owned by Mr. Lin Zhigang. Under the SFO, Mr. Lin

Zhigang is deemed to be interested in all the Shares held by Active Wealth Limited.

Save as disclosed above, as at the date of this report, to the knowledge of the Company, none of the Directors

and chief executives of the Company had or was deemed to have any interests or short positions in the Shares

or the underlying shares or debentures of the Company and any of its associated corporations (within the

meaning of Part XV of the SFO) that was required to be recorded pursuant to section 352 of the SFO, or as

otherwise notified to the Company and the Stock Exchange pursuant to the Divisions 7 and 8 of Part XV of the

SFO and the Model Code for Securities Transactions by Directors of Listed Companies contained in the Listing

Rules.

SUBSTANTIAL SHAREHOLDERS INTERESTS AND SHORT POSITIONS IN SHARES

The Company became a listed company on 9th March 2004. The interests and short positions of the persons,

other than Directors and chief executives of the Company, in the Shares and underlying Shares and debentures

of the Company, as notified to the Company pursuant to Division 2 and 3 of Part XV of the SFO; or as recorded

in the register required to be kept by the Company pursuant to Section 336 of the SFO as at the date of this

report, were as follows:

Interests in ordinary Shares:

Number of ordinary Shares

Corporate

Personal interests Percentage of

interests (interest of the Companys

(held as controlled issued

Name beneficial owner) corporation) Total shares capital

New Margin Venture Capital Co. Ltd. 21,315,789 21,315,789 5.14%

Sino-Alliance International, Ltd. (Note) 21,315,789 21,315,789 5.14%

Shanghai Alliance Investment, Ltd. (Note) 21,315,789 21,315,789 5.14%

EcoGreen Fine Chemicals Group Limited 24

Directors Report

SUBSTANTIAL SHAREHOLDERS INTERESTS AND SHORT POSITIONS IN SHARES (Continued)

Note: These Shares are registered in the name of New Margin Venture Capital Co. Ltd., the entire issued share capital of

which is beneficially owned by Sino-Alliance International, Ltd. which is wholly owned by Shanghai Alliance Investment,

Ltd., an investment vehicle of Shanghai Municipal Government. Under the SFO, Sino-Alliance International, Ltd. and

Shanghai Alliance Investment, Ltd. are deemed to be interested in all the Shares held by New Margin Venture Capital

Co. Ltd.

Save as disclosed above, no person, other than the Directors and chief executives of the Company, whose

interests are set out in the section DIRECTORS AND CHIEF EXECUTIVES INTERESTS AND SHORT POSITIONS

IN SHARES above, had registered an interest or short position in the Shares or underlying shares and debentures

of the Company that was required to be recorded pursuant to section 336 of the SFO and the Company had

not been notified of any persons interests and short positions in the Shares or underlying shares or debentures

of the Company which fall to be disclosed to the Company under Divisions 2 and 3 of Part XV of the SFO as at

the date of this report.

ARRANGEMENTS TO PURCHASE SHARES OR DEBENTURES

At no time during the period was the Company, or any of its subsidiaries, a party to any arrangements to

enable the Directors of the Company to acquire benefits by means of the acquisition of Shares in, or debentures

of, the Company or any other body corporate and neither the Directors or the chief executives, nor any of their

spouses or children under the age of 18, had any right to subscribe for the securities of the Company, or had

exercised any such right.

MANAGEMENT CONTRACTS

No contracts concerning the management and administration of the whole or any substantial part of the business

of the Company were entered into or existed during the period.

MAJOR CUSTOMERS AND SUPPLIERS

The percentage of sales and purchases for the year attributable to the Groups major customers and suppliers

are as follows:

Sales

the largest customer 5%

five largest customers combined 21%

Purchases

the largest supplier 13%

five largest suppliers combined 42%

None of the Directors, their associates or any shareholder of the Company which, to the knowledge of the

Directors, owned more than 5% of the Companys issued share capital, had any interest in the share capital of

the Groups five largest customers and five largest suppliers.

Directors Report

25 Annual Report 2003

CONNECTED TRANSACTIONS

Significant related party transactions entered into by the Group during the year ended 31st December 2003,

which do not constitute connected transactions under the Listing Rules, are disclosed in Note 32 to the proforma

consolidated accounts.

In the opinion of the Directors, there were no other related party transactions, which also constitute connected

transactions under the Listing Rules, entered into by the Group the year ended 31st December 2003.

CODE OF BEST PRACTICE

In the opinion of the Directors, the Company has complied with the Code of Best Practice (the Code) as set

out in Appendix 14 of the Listing Rules in the period between the Listing Date and the date of this report.

AUDIT COMMITTEE

The Companys audit committee, comprising three independent non-executive Directors, was formed on 16th

February 2004 with written terms of reference in compliance with the Code. The primary duties of the audit

committee are to review and supervise the financial reporting process and internal control system of the Group

and to provide comments and advice to the Board. The audit committee has reviewed the audited accounts of

the Company and audited proforma consolidated accounts of the Group for the year ended 31st December

2003.

PURCHASE, SALE OR REDEMPTION OF THE COMPANYS LISTED SHARES

There were no purchases, sales or redemptions of the Companys listed securities by the Company or any

of its subsidiaries during the period.

SUBSEQUENT EVENTS

Saved as disclosed in the notes to the proforma consolidated accounts, no other significant event has taken

place subsequent to 31st December 2003.

AUDITORS

The accompanying accounts have been audited by PricewaterhouseCoopers who retire and, being eligible,

offer themselves for re-appointment.

On behalf of the Directors

YANG YIRONG

Chairman & President

Hong Kong, 20th April 2004

EcoGreen Fine Chemicals Group Limited 26

Auditors Report Auditors Report

PricewaterhouseCoopers

22nd Floor Princes Building

Central Hong Kong

AUDITORS REPORT TO THE SHAREHOLDERS OF

ECOGREEN FINE CHEMICALS GROUP LIMITED

(incorporated in the Cayman Islands with limited liability)

We have audited the accounts of EcoGreen Fine Chemicals Group Limited (the Company) on pages 27 to 30

which have been prepared in accordance with accounting principles generally accepted in Hong Kong.

RESPECTIVE RESPONSIBILITIES OF DIRECTORS AND AUDITORS

The Companys directors are responsible for the preparation of accounts which give a true and fair view. In

preparing accounts which give a true and fair view it is fundamental that appropriate accounting policies are

selected and applied consistently.

It is our responsibility to form an independent opinion, based on our audit, on those accounts and to report our

opinion solely to you, as a body, and for no other purpose. We do not assume responsibility towards or accept

liability to any other person for the contents of this report.

BASIS OF OPINION

We conducted our audit in accordance with Statements of Auditing Standards issued by the Hong Kong Society

of Accountants. An audit includes examination, on a test basis, of evidence relevant to the amounts and

disclosures in the accounts. It also includes an assessment of the significant estimates and judgements made

by the directors in the preparation of the accounts, and of whether the accounting policies are appropriate to

the circumstances of the Company, consistently applied and adequately disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered

necessary in order to provide us with sufficient evidence to give reasonable assurance as to whether the accounts

are free from material misstatement. In forming our opinion we also evaluated the overall adequacy of the

presentation of information in the accounts. We believe that our audit provides a reasonable basis for our

opinion.

OPINION

In our opinion the accounts give a true and fair view of the state of affairs of the Company as at 31st December

2003 and have been properly prepared in accordance with the disclosure requirements of the Hong Kong

Companies Ordinance.

PricewaterhouseCoopers

Certified Public Accountants

Hong Kong, 20th April 2004

As at 31st December 2003

Balance Sheet

27 Annual Report 2003

Balance Sheet

As at 31st December 2003

2003

Note RMB000

Share capital 3

YANG YIRONG LU JIAHUA

Director Director

EcoGreen Fine Chemicals Group Limited 28

Notes to the Accounts Notes to the Accounts

1. COMPANY BACKGROUND, GROUP REORGANISATION AND BASIS OF PRESENTATION

EcoGreen Fine Chemicals Group Limited (the Company) was incorporated in the Cayman Islands on

3rd March 2003 as an exempted company with limited liability under the Companies Law of the Cayman

Islands. Its shares have been listed on the Main Board of The Stock Exchange of Hong Kong Limited

since 9th March 2004.

Upon incorporation on 3rd March 2003, the Company had an authorised share capital of HK$100,000,

divided into 1,000,000 shares of HK$0.1 each. It allotted and issued as nil paid a total of 450,000 ordinary

shares during the period ended 31st December 2003. Apart from the foregoing, no other transactions

were carried out by the Company during the period from 3rd March 2003 (date of incorporation) to 31st

December 2003.

Subsequent to 31st December 2003 (period end), on 16th February 2004, the Company acquired the

entire issued share capital of EcoGreen Fine Chemicals Limited, a company incorporated in the British

Virgin Islands, through a share exchange (the Reorganisation) and consequently became the holding

company of the subsidiaries as set out in Note 33 to the accompanying proforma consolidated accounts.

As the Reorganisation took place on 16th February 2004, the current group structure resulting from the

Reorganisation did not exist at any day during the period ended 31st December 2003. The Companys

accounts as at and for the period from 3rd March 2003 (date of incorporation) to 31st December 2003

have not reflected the effect of the Reorganisation in accordance with Statement of Standard Accounting

Practice No. 27 Accounting for group reconstructions (SSAP 27) issued by the Hong Kong Society

of Accountants because SSAP 27 specifies that accounts should not incorporate a combination which

occurs after the date of the most recent balance sheet included in the accounts even though the

reorganisation occurred after such date meets the definition of a group reconstruction.

The Companys Directors consider that it will provide additional information by presenting proforma

consolidated accounts of the Group using merger accounting by treating the Group as a continuing

entity. On this basis, the accompanying proforma consolidated accounts as at and for the year ended

31st December 2003 have presented the state of affairs, results of operations and cash flows of the

companies now comprising the Group as if the structure of the Group resulting from the Reorganisation

had been in existence throughout the year and the share capital of the Company outstanding immediately

after the share exchange in connection with the Reorganisation and the related subsequent capitalisation

issue as described in Note 4, totalling 300,000,000 shares of HK$0.1 each, had been in existence

throughout the year.

29 Annual Report 2003

Notes to the Accounts

2. PRINCIPAL ACCOUNTING POLICIES

The accounts have been prepared under the historical cost convention and in accordance with accounting

principles generally accepted in Hong Kong and comply with accounting standards issued by the Hong

Kong Society of Accountants.

3. SHARE CAPITAL

Number Nominal

of shares value

Note RMB000

Ordinary shares of HK$0.1 each

Authorised:

Upon incorporation on 3rd March 2003 (i) 1,000,000 106

Issued:

Allotted and issued nil paid (ii)

on 24th March 2003 1

on 28th October 2003 449,999

At 31st December 2003 450,000

Notes:

(i) On 3rd March 2003 (date of incorporation), the authorised share capital of the Company was RMB106,000

(equivalent of HK$100,000), divided into 1,000,000 ordinary shares of HK$0.1 each.

(ii) On 24th March 2003 and 28th October 2003, 1 share and 449,999 shares of the Company were allotted and

issued as nil paid, respectively.

EcoGreen Fine Chemicals Group Limited 30

Notes to the Accounts

4. SUBSEQUENT EVENTS

In addition to those disclosed elsewhere in the accounts, the following significant events have taken

place subsequent to 31st December 2003:

(i) On 10th February 2004, 25,000 shares of the Company were allotted and issued as nil paid.

(ii) On 16th February 2004, the authorised share capital of the Company was increased from

RMB106,000 (equivalent of HK$100,000) to RMB212,000,000 (equivalent of HK$200,000,000), by

the creation of additional 1,999,000,000 shares of HK$0.1 each.

(iii) On 16th February 2004, the Company:

(a) credited as fully paid at par value of HK$0.1 each 475,000 ordinary shares of the Company,

which were previously allotted and issued as nil paid; and

(b) further allotted and issued 475,000 ordinary shares of the Company, credited as fully paid

at par value of HK$0.1 each,

as consideration of and in exchange for the entire issued share capital of EcoGreen Fine Chemicals

Limited in connection with the Reorganisation (see Note 1).

(iv) On 16th February 2004, 299,050,000 ordinary shares of the Company were allotted and issued,

credited as fully paid at par value of HK$0.1 each to the then existing shareholders of the Company

in proportion to their respective shareholding, by the capitalisation of RMB31,699,300 (equivalent

of HK$29,905,000) from the share premium account. Such allotment and capitalisation were

conditional on the share premium account being credited as a result of the new shares issued in

connection with a listing of the Companys shares on The Stock Exchange of Hong Kong Limited

as described in (vi) below.

(v) On 16th February 2004, a share option scheme was approved and adopted. Details of the share

option scheme are set out in Note 27 to the accompanying proforma consolidated accounts.

(vi) On 8th March 2004, the Company issued 115,000,000 ordinary shares of HK$0.1 each at

approximately RMB1.46 (equivalent of HK$1.38) per share in connection with a listing of the

Companys shares on The Stock Exchange of Hong Kong Limited, and raised net proceeds of

approximately RMB149,245,000 (equivalent of HK$140,797,000).

5. APPROVAL OF ACCOUNTS

The accounts were approved by the Board of Directors on 20th April 2004.

31 Annual Report 2003

Auditors Report

PricewaterhouseCoopers

22nd Floor Princes Building

Central Hong Kong

AUDITORS REPORT TO THE DIRECTORS OF

ECOGREEN FINE CHEMICALS GROUP LIMITED

(incorporated in the Cayman Islands with limited liability)

We have audited the proforma consolidated accounts of EcoGreen Fine Chemicals Group Limited (the

Company) and its subsidiaries (together the Group) on pages 33 to 71 which have been prepared in

accordance with the accounting policies set out in Note 2 to the proforma consolidated accounts, which comply

with accounting principles generally accepted in Hong Kong, except that the effect of the group reorganisation

entered into after the balance sheet date has been accounted for using merger accounting, which is not in

accordance with the requirements of Statement of Standard Accounting Practice Number 27 Accounting for

group reconstructions (SSAP 27) issued by the Hong Kong Society of Accountants. Although the group

reorganisation meets the definition of a group reconstruction under SSAP 27, SSAP 27 specifies that the accounts

should not incorporate a combination which occurs after the date of the most recent balance sheet included in

the accounts.

RESPECTIVE RESPONSIBILITIES OF DIRECTORS AND AUDITORS

The Companys directors are responsible for the preparation of proforma consolidated accounts which are

properly prepared in accordance with the accounting policies set out in Note 2 to the proforma consolidated

accounts. In preparing such proforma consolidated accounts it is fundamental that appropriate accounting

policies are selected and applied consistently.

It is our responsibility to form an independent opinion, based on our audit, on those proforma consolidated

accounts and to report our opinion solely to you, as a body, in accordance with our agreed terms of engagement,

and for no other purpose. We do not assume responsibility towards or accept liability to any other person for

the contents of this report.

EcoGreen Fine Chemicals Group Limited 32

Auditors Report

BASIS OF OPINION

We conducted our audit in accordance with Statements of Auditing Standards issued by the Hong Kong Society

of Accountants. An audit includes examination, on a test basis, of evidence relevant to the amounts and

disclosures in the proforma consolidated accounts. It also includes an assessment of the significant estimates

and judgements made by the directors in the preparation of the proforma consolidated accounts, and of whether

the accounting policies are appropriate to the circumstances of the Group, consistently applied and adequately

disclosed.

We planned and performed our audit so as to obtain all the information and explanations which we considered

necessary in order to provide us with sufficient evidence to give reasonable assurance as to whether the proforma

consolidated accounts are free from material misstatement. In forming our opinion we also evaluated the overall

adequacy of the presentation of information in the proforma consolidated accounts. We believe that our audit

provides a reasonable basis for our opinion.

OPINION

In our opinion the proforma consolidated accounts as at and for the year ended 31st December 2003 have

been properly prepared in accordance with the accounting policies set out in Note 2 to the proforma consolidated

accounts and the disclosure requirements of the Hong Kong Companies Ordinance.

PricewaterhouseCoopers

Certified Public Accountants

Hong Kong, 20th April 2004

33 Annual Report 2003

For the year ended 31st December 2003

Proforma Consolidated Profit and Loss Account

2003 2002

Note RMB000 RMB000

Turnover 3 223,152 146,761

Cost of sales (136,593) (91,004)

Gross profit 86,559 55,757

Other revenues 3 691 5,183

Selling and distribution expenses (8,481) (4,534)

General and administrative expenses (16,915) (14,432)

Operating profit 4 61,854 41,974

Finance costs 5 (7,174) (5,244)

Profit before taxation 54,680 36,730

Taxation 6 (711)

Profit after taxation 54,680 36,019

Minority interests (2,093)

Profit attributable to shareholders 54,680 33,926

Dividends 7 7,600 23,750

Proforma earnings per share

Basic 9 RMB0.18 RMB0.11

EcoGreen Fine Chemicals Group Limited 34

Proforma Consolidated Balance Sheet

As at 31st December 2003

2003 2002

Note RMB000 RMB000

Non-current assets

Property, plant and equipment 12 99,440 85,295

Goodwill 13 258 543

Product development costs 14 15,597 11,619

Investment securities 15 400 200

Total non-current assets 115,695 97,657

Current assets

Inventories 16 21,485 16,174

Trade and bills receivables 17 70,618 24,432

Prepayments and other receivables 18 10,172 15,394

Loans receivable 10,000

Due from a director 32 19,160

Cash and bank deposits 19 65,880 11,718

Total current assets 168,155 96,878

Current liabilities

Due to a director 32 (2,136)

Short-term bank borrowings 20 (54,600) (18,000)

Long-term bank borrowings, current portion 24 (8,000)

Other borrowings, current portion 21 (30,900) (31,700)

Trade and bills payables 22 (12,842) (14,204)

Accruals and other payables 23 (18,701) (9,938)

Deferred income on government grants,

current portion (114)

Total current liabilities (127,293) (73,842)

Net current assets 40,862 23,036

Total assets less current liabilities 156,557 120,693

Non-current liabilities

Long-term bank borrowings 24 (28,000) (41,000)

Other borrowings 21 (5,270) (270)

Convertible bonds 25 (37,151) (37,151)

Deferred income on government grants (248)

Total non-current liabilities (70,669) (78,421)

Net assets 85,888 42,272

Representing