Beruflich Dokumente

Kultur Dokumente

Platinum Card Benefits Features

Hochgeladen von

Jerry AfricaCopyright

Verfügbare Formate

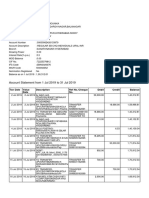

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Platinum Card Benefits Features

Hochgeladen von

Jerry AfricaCopyright:

Verfügbare Formate

Activating your PlatinumCredit Card

Remove your new Card from the folder and immediately sign the white signature

panel on the back. If you choose to have to have an embossed personalised card, you

can speak to the consultant.

This ensures that only you will be able to authorise a transaction on your Card.

You can activate your Credit Card at any African Bank branch or by calling our Card

Activation Service on 0861 000 444 and following the simple steps below:

Step 1

Follow the voice prompts to create your secret PIN code for your Credit Card.

Your PIN (Personal Identication Number) is a 4-digit code that you will use each

time you purchase or withdraw cash. You will need to remember this number.

Step 2

Please have your ID document and your new African Bank Credit Card available

when you phone, as you will need to conrmcertain details, as well as your 4 digit pin.

African Bank Credit Card Features

1. African Bank is your credit partner.

2. Your 16 digit Credit Card number.

3. Credit Card security features - chip and hologram.

4. Your Card expiry date.

5. Magnetic strip protect fromscratching and magnetic objects.

6. Your signature panel please sign immediately.

7. You can make purchases or withdraw cash wherever you see the Visa sign.

8. Client services and lost Card number.

Point of Sale Rewards

Your credit card pays you 1.5% every time you use your card when paying at the till

point. This saving is credited to the straight portion of your PlatinumCredit Card on

a monthly basis.

Card Benets

Convenience and safety as it eliminates the need to carry cash.

Added security: you need to input your PIN to transact.

Up to 60 days interest free credit on purchases, provided that you settle

your outstanding balance in full by the due date.

Monthly statements to help you monitor your account.

Demand Savings Account

Congratulations, your New African Bank PlatinumCredit Card qualies you to have a

savings account linked to it where you can deposit money and earn interest at a rate

of 5% per annum. To activate this benet you need to register and activate via Cell

Phone Services.

Cell Phone Services

Access your account information in seconds anytime, anywhere.

Simply register for Cellphone Services. You can:

View your balance or mini-statements.

(First 2 transactions are FREE, thereafter: R1.70 per transaction)

Buy airtime, sms and data bundles.

(Transactions are FREE)

Check if you qualify for a limit increase.

Immediately stop your lost or stolen Credit Card.

No need to wait in long ATM, branch or call centre queues.

How do I register?

Call 0861 000 351 or visit your nearest branch.

To activate:

Simply dial *130*49494# fromthe registered cellphone number.

Accept the Terms & Conditions.

Accept the PIN smsed to you upon registration or create a new one.

Insurance Benet

Credit Life insurance could be included on your Credit Card Account and is designed

to provide outstanding debt cover in the event of:

Death

Temporary disability

Permanent disability

Retrenchment, short time.

Crime Injury Insurance

As part of your Platinum Card you automatically become a member of the African

Bank Embedded Crime Injury and Personal Accident Group Insurance Schemes.

These schemes are death and disability schemes underwritten by

The Standard General Insurance Company Ltd a sister company of

African Bank. The schemes provide insurance cash benets at no additional cost if

you or your family are afected by crime-related incidents or other accidents.

What is Covered?

The Crime Injury Scheme insures your family against death or disability resulting

fromviolent crime events.

An R8000.00 beneft is paid for each assured life afected by either death or disability

as a direct result of the following criminal events your family maybe subjected to:

Death benefts:

- Murder

- Culpable homicide perpetrator killed accidentally or through negligence

Disability benefts:

Covers disability/ injury fromAssault as a broad category;

the sub-categories are:

Sexual Crimes (rape, sexual assault)

Attempted murder (perpetrator had intent to kill, but insured life survived eg.

gun-shot wound)

Assault with Grievous Bodily Harm(perpetrator intended to disable/injure or

induce insured life under submission eg. injury during hijacking AND injury is of

severe nature)

Product provides cash beneft to client if two thresholds are met:

Evidence of specied crime event AND

Evidence of disability/ injury/ death fromthat crime event

Note that if no injury occurred, no beneft is paid (eg. theft without

assault)

Only for Sexual Crimes, will psychological harmalso be considered where it

is possible that no bodily injury is objectively veriable, but there is evidence

of post-traumatic stress syndrome etc. (most often with adult female rape

cases)

Evidence in most instances obtained froma copy of J88 report (case number at

police station, medical examination, description of crime event etc)

For the Crime product, the cardholder &immediate family is insured

Who is Covered?

You, your spouse and two children (max of 4 family members)

Personal Accident Insurance

Covers all other forms of accidental death and accidental disability of a permanent

nature eg. car crash or injury froma accident occurring on the job, loss of eye-sight

in sport etc, not covered by CI.

What is Covered?

An R8000.00 beneft is also paid, provided the incident happened unexpectedly and

could not have been foreseen.

Who is Covered?

Only the cardholder is insured

To notify us of a claim:

Call: 0860 111 167 or Fax your claims to: 0872 328 976

Email : crimeinjuryclaims@africanbank.co.za

Dial *130*49494# or visit your local branch

Insurance lapsing

No premium is payable by you for this benet. If your credit card is in arrears, the

cover provided under this insurance benet may cease and no benets shall be

payable. You may be reinstated once if you bring your card account up to date, in

which event the benets under this policy will be reinstated with efect fromthe date

of payment.

Other terms &conditions apply, please consult policy document for details.

Never write down your PIN.

Sign the back of your Card upon receiving it.

Report a lost or stolen Card immediately to our Customer Service Centre

number 0861 465 322.

Keep a copy of African Banks Customer Service phone number, and your Visa

account number in a safe place. It is also on the back of the card as indicated in

8 on the previous page.

When using an ATM

Always be aware of your surroundings.

Have your Card ready before approaching an ATM.

Remember to remove your Card from an ATM after completing your

transaction.

Report irregular ATM activities to the bank.

The maximum amount that can be withdrawn is R4000.00 per day, but

different banks may assign different withdrawal limits for specific ATMs.

Never accept help from a stranger.

Purchases

Always check the amount you are paying for when making a purchase in a store.

Sign the slip and keep a copy. Remember to take your Card before you leave the till.

You can use your Credit Card at any point of sale or terminal with a PIN pad to

enter your PIN code.

Your Card cannot be used where an embossed Card is required, such as some

car rental agencies and certain sales points where a PIN Pad is not available,

e.g. toll roads and parking lots. If you choose not to have an embossed

personalised card

Lost Card

If youre in South Africa, immediately contact African Bank to report the loss or theft

of your Card and order a replacement Card.

You can do this by calling 0861 465 322 or via Cellphone Services facility by dialing:

*120*225#

PLATINUM CREDIT CARDFEATURES PLATINUM CREDIT CARDBENEFITS

SAFETY PRECAUTIONS WHENUSING

YOUR CARD

Standard Terms and Conditions

Credit Facility (Card)

In terms of section 93 of the National Credit Act 34 of 2005 (NCA)

Right to reasons for credit being refused

On my request, African Bank must, in writing, provide me with the dominant reason for refusing

to enter into a credit agreement, ofering me a lower credit limit than the one I applied for,

refusing a request fromme to increase the credit limit under an existing credit facility, or refusing

to renew an expiring credit facility.

Right to receive documents in ofcial language

I amentitled to request delivery of any particular document in the manner selected by me in an

ofcial language that I read and understand, to the extent permitted by section 63 of the NCA.

Where I elect to receive a document in person at a location other than the business premises of

African Bank, African Bank shall be entitled to recover the delivery costs fromme.

Cost of credit

African Bank will charge interest on the balance of the amount outstanding on my card

account from time to time, at a variable rate as refected in the Pre-Agreement Statement

and Quotation for Small and Intermediate Credit Agreements Credit Facility (Card)

(Pre-Agreement and Quote). Interest will be calculated on my daily balance and will be added

to the outstanding balance of my loan once a month (capitalised monthly in arrears.) African

Bank will charge fees, interest and charges in terms of the NCA, for the operation of the Card

Account. In addition I will be responsible for any statutory levies, taxes as well as any fees or

charges that may be charged for the utilisation of ATMor Point Of Sale services.

All fees, charges, statutory levies, and taxes will be debited to the Card Account. Interest or

fnance charges will accrue on the average daily balance of the Card Account from the date

on which cash advances or purchases are made. Where Dollars before being converted into

Rands it will attract a currency conversion fee. African Bank may at its sole discretion vary

any interest rate or amount of any charge or fee payable under this Agreement subject to the

appropriate legally prescribed notice period. Where any interest rates or amounts are subject

to amendment, African Bank will give me written notice no later than 30 (thirty) days after the

day on which the change in the variable rate takes efect, setting out the new rate payable under

the credit agreement, the new reference rate, as well as any further prescribed information. The

If youre travelling away fromhome, immediately contact the

Visa Global Customer Assistance Service on Call Collect.

USA (1) 410 581 3836

Client Services

If you experience any problems when using your Card, or simply need more

information, phone our PlatinumCustomer Service Call Centre 0861 465 322

Consumer Advocates Ofce

If you are unhappy with the service/response fromthe Bank, phone the African Bank

Consumer Advocates Ofce.

Tel: (011) 256 9284

Fax: (011) 207 4724

Email: consumeradvocate@africanbank.co.za

TERMS ANDCONDITIONS:

PLATINUM CREDIT CARDPRODUCT

African Bank Cellphone Services

1) Balance 2) Limit Increase 3) Prepaid 4) Credit Offer 5) Mini Statement 6) Stop Card 7) Change PIN 8) Exit

variable rate of interest charged by African Bank is calculated in terms of a formula that has a

fxed relationship to a reference rate and such reference rate is the ruling South African Reserve

Repurchase Rate (Repo rate).

Default and Acceleration

Any amount that is in default, arrears or overdue under this Agreement will bear interest at

the same rate agreed to and set out in the PRE-AGREEMENT AGREEMENTS FOR CREDIT

FACILITY (CARD) andsuch interest will be calculateddaily andcapitalisedmonthly. I understand

that if I die, commit any act of insolvency or fail to make at least the Minimum Payment as set

out in the Cost of Credit section of the Small & Intermediate Credit Agreement incorporating the

Pre-agreement Statement and Quotation, I will be in default with my Agreement and the full

amount outstanding will immediately become due, owing and payable and African Bank will

have the right to cancel this agreement. In such event I will be liable to pay African Bank default

administration charges in terms of the NCA.

Early Settlement & Right to Terminate my Credit Facility

I understand that I can settle the outstanding balance of my account, and or cancel this credit

facility at any time without giving notice to African Bank by paying the total of the unpaid capital

balance, together with any unpaid interest charges and all other fees and charges, calculated up

to the date of payment.

Repayment

On or before the due date, as refected on my monthly statement of account, I may either

settle the full amount outstanding (inclusive of all charges, fees and interest payable) on

my Card Account or pay the instalment as set out in this Agreement (where I have made an

arrangement to pay the instalment by way of a debit order authorisation African Bank will deduct

the instalment from my banking account). I understand that any payment(s) that I make into

my Card Account will not be refected as a credit until such payment(s) have been received and

processed by African Bank. I will not withhold any payments that I amobliged to make to African

Bank, in terms of this Agreement, on the basis that I may have another claimagainst African Bank.

I have the right, at any time, to repay African Bank an amount that is greater than the amount due.

If I fail to make at least the MinimumPayment as set out in the Cost of Credit section of the Small

& Intermediate Credit Agreement incorporating the Pre-agreement Statement and Quotation,

I will be in default with my Agreement and African Bank may suspend my card account which

will prevent me, as well as any associated card user(s), from using the Card Account and I will

immediately become liable to pay African Bank the full outstanding amount on my Card Account.

Any payment that I make will be used to frstly settle any due or unpaid interest (arrears interest),

secondly to satisfy any due or unpaid fees or charges (including legal costs, default administration

charges, collection costs, service fees, etc.) and thirdly to reduce the amount of the principal debt.

Termination by The Bank

African Bank will be entitled to terminate this Agreement if I amin default after notice has been

given to me advising me of my rights. In the event that I fail to make the Minimum Payment as

set out in the Cost of Credit section of the Small & Intermediate Credit Agreement incorporating

the Pre-agreement Statement and Quotation, I will be in default with my Agreement and African

Bank may institute legal action against me, which could result in a court judgment being granted

against me and I understand that my property could be sold and/or my salary could be attached

to recover the outstanding amount. This would mean that I have a bad credit record.

Termination of Card and Card Accounts

I may terminate this Agreement at any time as long as I give African Bank notice of my intention

to do so and provided that the unpaid balance of the principal debt, together with the unpaid

interest charges and all other fees and charges payable by me to African Bank, calculated up

to the date of termination are paid. Upon African Bank receiving written instructions from me,

African Bank will pay any funds available in the Card Account in accordance with such written

instructions. African Bank will be entitled to terminate this Agreement and close the Card

Account by giving me at least 10 (ten) business days written notice, I will be unable to use

my Card. African Bank has the right to continue debiting the Card Account with the monthly

deductions to settle any arrears interest and/or card transactions efected before or after the

closure or termination of the Card Account until my account has been settled in full. My liability

(and the liability of all other persons, if any, in whose name the Card Account is maintained) to

African Bank under this Agreement for any balance due to African Bank will continue, until it is

settled in full.

PLATINUM

CREDIT CARD

BENEFITS &FEATURES

Liability of Cardholders

African Bank may debit my Card Account with the amount of all authorised card transactions

and/or cash advances and associated fees. African Bank may also debit my Card Account for

unauthorised transactions where such transactions were concluded using my PIN or signature,

where I failed to cancel the Card in accordance with the procedure set out in this Agreement, or

where I failed to notify African Bank of the Card being lost and/or stolen.

Spending and/or Credit Limits

African Bank has set an overall credit limit in respect of the Card Account, which is set out in the

Pre-Agreement and Quote. I agree that I, together with any supplementary cardholder(s), will not

exceed the credit limit set by African Bank in respect of my Card Account.

Budget Facility

African Bank may, at its sole discretion, make a budget facility available to me. This facility will

allow me to pay for transactions over a fxed period of time, as stipulated by African Bank. If I

do choose to use the budget facility, the total amount outstanding and the monthly instalment

payable in terms of the budget facility will be refected on my statement of account. If I fail to pay

any instalment on the budget facility, I understand that African Bank may in its sole discretion,

demand that I repay the full amount outstanding on the budget facility and African Bank may

cancel or suspend the budget facility. Where any set of or consolidation undertaken by African

Bank involves the conversion of one currency prevailing currency exchange. Any losses that may

arise fromsuch conversion shall not be recoverable fromAfrican Bank.

Hold on Card Account

African Bank may set aside or place an amount on hold on my Card Account, in respect of any

transaction, either on the day the transaction is presented to African Bank for authorisation or

on the day African Bank receives notice of the transaction. I am not entitled to stop a payment

in respect of a transaction for which African Bank has set aside an amount or placed a hold on

my Card Account, nor am I entitled to use any funds that have been set aside for a transaction

by African Bank.

Transaction Involving Foreign Currency

Any references to Rands and R in this Agreement shall mean South African Rands. African

Bank may convert any transaction amount(s) on any Card Account into South African Rands

at the exchange rate that African Bank may determine. If the currency of any card transaction

is diferent from that which the Card Account is maintained, African Bank shall be entitled to

convert such transaction into the currency of the Card Account or any other currency at such

rate(s) of exchange as African Bank may determine; and debit the Card Account with the amount

of the card transaction. The currency conversion rate in efect on the processing date may difer

fromthe rate in efect on the transaction date or posting date.

Dispute with Merchants/Non-acceptance of Cards

African Bank will Not be Liable in Any Way:

Should the Card or Pin be rejected by a merchant or any terminal used to process card

transactions or if African Bank refuses for any reason to authorise any card transaction;

For any malfunction, defect or error in any terminal used to process card transactions, or other

machines or system of authorisation whether belonging to or operated by African Bank or

other persons; For any delay or inability on African Banks part to perform any of its obligations

under this Agreement because of any electronic, mechanical, system, data processing or

telecommunication defect or failure, Act of God, civil disturbance or any event outside African

Banks control or the control of any servants, agents or contractors or any fraud or forgery or; For

any damage to or loss or inability to retrieve any data or information that may be stored in the

Card or any microchip or circuit or device in the Card. African Bank may also refuse to authorise

any card transaction that I wish to efect even though such card transaction would not cause the

credit limit set to be exceeded.

Problems with Goods and Services

African Bank will not be liable in any way should I encounter any problems with the goods and

services that I obtain through the use of the Card, nor is African Bank responsible for any benefts,

discounts or programmes of any merchant that African Bank makes available to me. In spite of

the non-delivery or non-performance or defects in any such goods and services, I will pay African

Bank the full amount shown in the statement of account.

Conclusiveness of Documents and Certicates

Any of African Banks records relating to any card transactions with my signature and/or PIN

are conclusive evidence of their accuracy and authenticity and shall be binding on me for all

purposes, unless I prove otherwise.

Repayment Arrangement on Card Account Change

Should the Card Account be terminated and/or replaced with another Card Account, whether

through loss of the Card or otherwise, then any debit order, payroll deduction, cash repayment

or new arrangement, whether at regular intervals or otherwise shall continue in relation to the

new Card Account as from the date when the rst Statement with respect to the original Card

Account is sent to me.

Extent of the Banks Rights

African Bank shall be entitled at any time and without notice to me to combine or consolidate

the balances in any of my accounts maintained with African Bank and/or set of or transfer any

sums that my account is in credit, towards the repayment of sums owed by me to African Bank,

regardless of whether African Bank has terminated the use of my Card or Card Account and/or

whether the balance owed to African Bank has become due or payable

Additional Benets, Services and Programmes

African Bank may provide additional services, benefts or programmes in connection with the

use of the Card. Such additional services, where provided, do not form part of African Banks

legal relationship with me and African Bank may withdraw or change these services at any time

without notice to me. Those additional services, benefts or programmes may be subject to their

own terms and conditions, a copy of which will be supplied to me.

Password and Security

I amsolely responsible for maintaining the confdentiality of the PIN, Password, and Registration

Information and undertake to take all reasonable precautions to ensure that my PIN/Password,

including while I key-in the PIN/ Password at a computer or other machine, is not revealed to a

third party. I acknowledge that African Bank will not be liable for any loss or damage arising from

my failure to comply with these security measures and/or the duties set out below. My Card and

PIN/Password are reserved strictly for my own use. Where the Card is used by someone else, I will

be required to prove that I took all reasonable precautions to protect these items.

Duty to Prevent Loss/Theft/Fraud and Notication to African Bank

I agree to keep my Card secure and will ensure that the Card Account number and PIN are

not disclosed to any other person. Should I discover that my Card is lost, stolen or used in

an unauthorised way or retained by an ATM or another person has obtained the PIN, I will

immediately notify African Bank of the loss/theft or unauthorised use by calling African Banks

Platinum Card Services Centre at 0861465322 or Visa Global Services. At (USA) 410-581-

3836 and confrm any telephone call within 7 (seven) days by quoting my account number to

African Bank, Card Division, Private Bag X170, Midrand, 1685. African Bank will block the Card

Account against any potential misuse, as soon as reasonably possible after notifcation. In certain

circumstances, African Bank may also require that I report the incident to the police, and that

such report be accompanied by a written confrmation of the loss/theft/disclosure and any other

information that African Bank may require. I will obtain a reference number from African Bank

conrming the report. I consent to the disclosure to third parties of such information as is relevant

concerning the account in connection with such loss, theft or possible misuse of the Card. If the

Card is found after it has been reported to African Bank, as having been lost, or stolen or misused

then I will destroy it and any additional card by cutting it/them in half across the magnetic strip

and disposing of it/them.

Instalment and Deduction Due Dates

My frst instalment will become due, owing and payable 7 days after I activate my credit card and

all subsequent instalments will become due, owing and payable on the 1st day of each and every

month thereafter. (Instalment Due Date).

Addresses for Receiving of Documents

Any document that either party wishes to send to the other must be sent to the address set out

in the Pre-Agreement and Quote. If such document is:

Sent by ordinary mail in a correctly addressed envelope to the other partys chosen address,

it will be considered as received on the 7th (seventh) day after posting (unless the contrary is

proved); or delivered by hand to a responsible person during ordinary business hours at the other

partys chosen address, it will be considered as received on the day of delivery; or transmitted

by telefax to the chosen telefax number set out above or sent by electronic mail to the chosen

email address, it will be considered as received on the date of transmission (unless the contrary

is proved). Any document actually received by a party will be an adequate written notice or

communication to that party, even though it was not sent to or delivered at the chosen address.

Either party may change their address by delivering to the other party a written notice of the new

address by hand, registered mail, or electronic mail.

Condentiality

Unless African Bank is obliged to do so by law, it will not disclose any of my confdential

information without my express consent or instruction. I consent to African Bank disclosing,

reporting or releasing any fraudulent information or information relating to any unlawful activity

relating to me to the South African Fraud Prevention Services (SAFPS) and/or any similar

organisation or bureau, as well as reporting or releasing any credit information relating to me to

any credit bureau.

Certicate

A certifcate, signed by a manager employed by African Bank (whose appointment need not

be proved), refecting the outstanding amount that is due owing and payable by me to African

Bank will be sufcient proof of my indebtedness to African Bank for the purposes of provisional

sentence, summary judgement or any other proceedings, unless I amable to prove otherwise.

Assignment

African Bank will be entitled to cede, sell, assign, or transfer all or any of its rights under this

agreement, without your consent or prior notice to you. You may not cede, delegate, sell, assign,

or transfer any of your rights or obligations in terms of this agreement.

Legal costs

If African Bank has to institute any legal proceedings against me for the purposes of recovering

any debt that is due, owing and payable by me to African Bank, then I agree that I will pay all

African Banks legal costs, on an attorney and client scale including tracing fees, collection

commissions and all other costs that African Bank may incur.

Jurisdiction

I agree that any legal proceedings that African Bank intends bringing against me, as a result of

this agreement, may be brought in the Magistrates Court and I consent to the jurisdiction of the

Magistrates Court.

Miscellaneous

I understand that in order for African Bank to maintain and improve the quality of the services it

provides to its customers any telephone calls that are made by or to its customers are recorded.

I give my consent to African Bank to record any telephone call between us. I agree that I will

promptly notify African Bank, in writing, of any change in my address, telephone number,

employment or banking details. I also agree that I will immediately notify African Bank if I should

become insolvent, be placed under administration or have any other form of legal disability.

Although I amrequired to comply strictly with all the obligations in terms of this credit agreement,

African Bank shall have the right, in its absolute discretion, to defer or waive any amount payable

by me in terms of this agreement as contemplated in section 95 of the NCA.

Administration/Sequestration

My estate is not subject to debt review and is not under administration, nor am I an un-

rehabilitated insolvent. I further confrm that I am not aware and nor do I contemplate any

application to place my estate under debt review or administration during the repayment of this

Agreement.

1. Introduction

1.1 These terms and conditions are applicable to my Savings Account.

1.2 I know, understand and comply with these terms and conditions as they are a binding

agreement between you and me.

1.3 I acknowledge and agree that:

1.3.1 I have been given an adequate opportunity to read and understand all of these

terms and condition;

1.3.2 I ambound by these terms and conditions and

1.3.3 I may change, repeat, replace or add to any of these terms and conditions at any

time on reasonable notice to you. If I continue to use my account after receipt

of this notice, the new terms and conditions will apply.

2. Denitions

2.1 In these terms and conditions, the words on the left have the meanings set out on the

right:

2.1.1 Account: Means the Savings Account opened by us in your name;

2.1.2 Banks Act: Means the Banks Act 94 of 1990;

2.1.3 Card: Means a platinum credit card issued to you by us and linked to

your account;

2.1.4 Companies Act: Means the Companies Act 71 of 2008;

2.1.5 Operate: Means managing your account and transacting;

2.1.6 PIN: Means a confdential personal identifcation number used for

operating your account;

2.1.7 Savings product: Means the demand savings account product described in

clause 3;

2.1.8 Transaction: Means any debit or credit on your account made with or without

using any PIN or device. It includes any payment for goods or

services, deposit, withdrawal or transfer of money. Transact has a

similar meaning;

2.1.9 We/Our/Us: Means African Bank Ltd, a company with limited liability duly

incorporated in terms of the Companies Act and registered as a

bank in terms of the Banks Act;

2.1.10 I/You: Means the person in whose name an account is opened;

2.2 Reference to:

2.2.1 one gender includes all the genders;

2.2.2 the singular formof a word includes the plural;

2.2.3 the plural formof a word includes the singular; and

2.2.4 a law or regulation is a reference to that law or regulation on the date of these

terms and conditions;

3. Your Account

3.1 This account ofers fexibility and money on demand while also paying excellent

interest rates on all credit balances.

3.2 Your account will be linked to the Card we have issued to you and your Card PIN must be

utilised to operate your account .

3.3 Once linked, your account can be viewed or accessed through all ATMnetworks and/or

through Cellphone Services (should this service be activated by You).

4. Interest Rates

4.1 Interest is calculated daily and paid monthly at a rate of 5% p.a on the balance on your

account.

4.2 We are entitled, on reasonable prior written notice to you, to change the interest rate or

the method we use to calculate the interest rate which applies to your account from

time to time.

5. Fees

5.1 We will charge you transaction fees for this Savings Product as set out in the latest

pricing brochure which is included in the Card welcome pack or at any of our branches.

5.2 Any fees in respect of your account are payable immediately when they are chargedandwill be

debited to your account.

5.3 We are entitled to change or increase the fees or method we use to calculate these fees

from time to time, if there is any change in taxation or legislation, or any change in

market conditions, which may increase the costs we incur in making your account

available to you.

6. Statements

Astatement on your account shall be incorporated in your Card statement as a separate schedule

of transactions displayed in a table.

7. Deposits and Withdrawing the Money you Deposited

7.1 You can make a deposit into your account at any of our branches or you could make a

direct deposit into our bank account, the details which appear below:

Bank: Standard Bank

Account Name: Visa Settlement Account

Account number: 000054240

Account Type: Cheque

Branch Code: 051001

NCR Reg No. NCRCP5. African Bank is an Authorised Financial Services and

Credit Provider. Reg No. 1975/002526/06.

Ref: (Please insert your 16 digit Card number)

7.2 You may withdraw the money you deposited fromyour account via your Card.

7.3 We are not liable for any errors which we make because of incorrect information which

we rely on to process any payment which is deposited into your account, including but

not limited to incorrect account numbers given to us by you or by another person on

your behalf.

8. Set of and Realisation of Security

We may set of any amounts which you owe us against any credit balance on any account held by

you in our books, as may be permissible by law.

9. Closure of your account and cancellation of these terms and conditions

9.1 You may at any time ask us in writing to close your account, without penalty.

9.2 We are entitled to close your account or cancel these terms and conditions following the end

of 10 (ten) business days written notice to you informing you of a material failure in your part

to comply with these terms and conditions, unless you have remedied the failure within that

time.

9.3 We may close your account or refuse you access to your account without prior notication to

you if your account has been used to commit any fraud or we are compelled to do so by law.

9.4 If we close your account or cancel these terms and conditions you remain liable to us for any

amount you owe us under these terms and conditions, up to the date of this closure or

cancellation.

10. Address for Notices

10.1 Any document that either party wishes to sendto the other must be sent to the address set out

in the Card pre-agreement statement and quotation.

If such document is:

(a) Sent by ordinary mail in a correctly addressed envelope to the other partys chosen address,

it will be considered as received on the 7th (seventh) day after posting (unless the contrary

is proved); or

(b) Delivered by hand to a responsible person during ordinary business hours at the other

partys chosen address, it will be considered as received on the day of delivery; or

(c) Transmitted by telefax to the chosen telefax number set out above or sent by electronic

mail to the chosen email address, it will be consideredasreceivedon the date of transmission

(unless the contrary is proved).

10.2 Either party may change their address by delivering to the other party a written notice of the

new address by hand, registered mail, or electronic mail.

11. General

11.1 We may change these terms and conditions at any time by written notice to you. Achange will

not cancel this agreement.

11.2 You may not change any provision of these terms and conditions.

11.3 South African law governs these terms and conditions.

11.4 We may sue you in a Magistrates Court even if our claim against you is greater than would

otherwise be allowed.

11.5 Any favour or concession we may allow youwill not afect or substitute any of our rights against

you.

11.6 The invalidity, illegality or unenforceability of any of the clauses of these terms and conditions

shall not afect the validity, legality and enforceability of the remaining clauses of these terms

and conditions.

11.7 You may not transfer any of your rights and obligations under these terms and conditions to

anyone else without our prior written permission.

TERMS ANDCONDITIONS:

FOR SAVINGS ACCOUNT LINKEDTOTHE PLATINUM CREDIT CARD

AB/2013/09/PBF_V2

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- African Bank Silver Credit CardDokument1 SeiteAfrican Bank Silver Credit CardJerry AfricaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Credit Life Master PolicyDokument8 SeitenCredit Life Master PolicyJerry AfricaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Blue Credit Card Features and BenefitsDokument2 SeitenBlue Credit Card Features and BenefitsJerry AfricaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- African Bank Gold Credit CardDokument1 SeiteAfrican Bank Gold Credit CardJerry AfricaNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Blue Credit Card Features and BenefitsDokument2 SeitenBlue Credit Card Features and BenefitsJerry AfricaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Credit Facility Standard Terms and ConditionsDokument2 SeitenCredit Facility Standard Terms and ConditionsJerry AfricaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Personal Loan Terms and ConditionsDokument2 SeitenPersonal Loan Terms and ConditionsJerry AfricaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Long Term Personal LoansDokument2 SeitenLong Term Personal LoansJerry AfricaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Short Term Personal Loans From African BankDokument2 SeitenShort Term Personal Loans From African BankJerry AfricaNoch keine Bewertungen

- African Bank Information BrochureDokument3 SeitenAfrican Bank Information BrochureJerry AfricaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- African Bank Information BrochureDokument3 SeitenAfrican Bank Information BrochureJerry AfricaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- African Bank Gold Visa Credit Card Cellphone ServicesDokument2 SeitenAfrican Bank Gold Visa Credit Card Cellphone ServicesJerry AfricaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Get An African Bank Platinum Credit CardDokument2 SeitenGet An African Bank Platinum Credit CardJerry AfricaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Florida Quiet Title Complaint by Kathy Ann Garcia Lawson KAGLDokument77 SeitenFlorida Quiet Title Complaint by Kathy Ann Garcia Lawson KAGLMalcolm Walker100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Insight 021210 LowresDokument132 SeitenInsight 021210 LowresAbu LuhayyahNoch keine Bewertungen

- Elements of Accounting LectureDokument43 SeitenElements of Accounting LectureRaissa Mae100% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Caribbean Examinations Council: Application For Replacement Certificate or Diploma Declaration of LossDokument2 SeitenCaribbean Examinations Council: Application For Replacement Certificate or Diploma Declaration of LossMandy ThomasNoch keine Bewertungen

- Hire Purchase PDFDokument12 SeitenHire Purchase PDFliamNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Contoh Soal UN Bahasa Inggris SMAaaaaa N 1 NELLYDokument49 SeitenContoh Soal UN Bahasa Inggris SMAaaaaa N 1 NELLYsuherpanNoch keine Bewertungen

- Credtrans MidtermsDokument4 SeitenCredtrans MidtermsMarieNoch keine Bewertungen

- 25 Truths About MoneyDokument3 Seiten25 Truths About MoneyBarney CordovaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- An Introduction To Money and The Financial System: Chapter OverviewDokument13 SeitenAn Introduction To Money and The Financial System: Chapter Overviewmyungjin mjinNoch keine Bewertungen

- Balance Sep 2019Dokument3 SeitenBalance Sep 2019Kevis MartinezNoch keine Bewertungen

- Automated Teller MachineDokument21 SeitenAutomated Teller MachineAhmed SharifNoch keine Bewertungen

- Chapter 4 - Principles of Double EntryDokument30 SeitenChapter 4 - Principles of Double EntryMas Ayu100% (1)

- Demand LetterDokument2 SeitenDemand Letter1bruceman100% (2)

- Investment in Allied UndertakingsDokument4 SeitenInvestment in Allied Undertakingssop_pologNoch keine Bewertungen

- Cash Accounting SAPDokument0 SeitenCash Accounting SAPKauam SantosNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Cabuhat v. CADokument2 SeitenCabuhat v. CALiana AcubaNoch keine Bewertungen

- Fiqh For Economist 2: Name: Nor Farhain Binti Sarmin MATRIC NO: 1229128Dokument12 SeitenFiqh For Economist 2: Name: Nor Farhain Binti Sarmin MATRIC NO: 1229128Farhain SarminNoch keine Bewertungen

- 1566740571410uf5Ngn9Nm9H6neju PDFDokument2 Seiten1566740571410uf5Ngn9Nm9H6neju PDFChandu GoudNoch keine Bewertungen

- Patrimonio vs. GutierrezDokument1 SeitePatrimonio vs. GutierrezPatrice ThiamNoch keine Bewertungen

- Financial InstrumentsDokument15 SeitenFinancial InstrumentsSeo NguyenNoch keine Bewertungen

- E B BillDokument6 SeitenE B Billheaughfrds1Noch keine Bewertungen

- Velarde v. Court of AppealsDokument6 SeitenVelarde v. Court of Appealscmv mendozaNoch keine Bewertungen

- Mutual Fund Investments With Aadhaar Based Ekyc - FaqsDokument2 SeitenMutual Fund Investments With Aadhaar Based Ekyc - FaqsJnanam ShahNoch keine Bewertungen

- RL7-YONO-The One Digital Banking App of State Bank of IndiaDokument6 SeitenRL7-YONO-The One Digital Banking App of State Bank of IndiaSanam TNoch keine Bewertungen

- CAMSDokument39 SeitenCAMSSterling FincapNoch keine Bewertungen

- Ncnda BDG DiamondDokument6 SeitenNcnda BDG DiamondPenny100% (1)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Years 2019 Companies Net Income Market Value Total AssetDokument18 SeitenYears 2019 Companies Net Income Market Value Total AssetbilalNoch keine Bewertungen

- Hotel Details Check in Check Out Rooms: Guest Name: DateDokument1 SeiteHotel Details Check in Check Out Rooms: Guest Name: DateAARTI AHIRWARNoch keine Bewertungen

- Commercial Banking in IndiaDokument56 SeitenCommercial Banking in IndiaArunav Guha Roy0% (1)

- Text760 Bc-PmeDokument1 SeiteText760 Bc-PmeLosaNoch keine Bewertungen