Beruflich Dokumente

Kultur Dokumente

HSBC Swift For Corporates Questions Answered

Hochgeladen von

Ganesh ShankarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HSBC Swift For Corporates Questions Answered

Hochgeladen von

Ganesh ShankarCopyright:

Verfügbare Formate

SWIFT for Corporates Questions Answered

142 HSBCs Guide to Cash, Supply Chain and Treasury Management in Asia Pacific 2010

T

e

c

h

n

o

l

o

g

y

a

n

d

C

o

n

n

e

c

t

i

v

i

t

y

C

orporates considering using SWIFT want to know the

answers to several questions. What are the benefits?

What if a company already has a single cash management

banking partner? Is SWIFT only an option in a multi-banked

environment? Is there an ideal shape and size of company that

fts the SWIFT offering?

Fierce lobbying persuaded a reluctant bank-owned SWIFT

to open its door to corporates in 2001, and since 2007 it has been

attracting corporate participation as a result of its standardised

corporate environment (SCORE). To date, approximately 500

corporates have migrated to SWIFT.

The implementation of SWIFT for corporates is not as

difficult as one might think and the opportunities provided

considerably outweigh the investment and effort required. This

article sets out the key factors that will lead corporate treasurers

to the optimal answers for their business.

What Does SWIFT Actually Offer Companies?

There is a common misconception that SWIFT is only for

corporates with large transaction volumes. Rather, SWIFTs

offering can be tailored to suit a variety of needs (see Figure 1).

The preceding article looked at

how businesses are focusing

more than ever on liquidity

management with SWIFT as

part of their solution. This article

covers answers to questions

that companies might ask when

considering using SWIFT.

The decision to use SWIFT

depends on a companys

individual circumstances and

business requirements.

Arguably, the first factor to

consider is the visibility of funds

as businesses want to keep

track of their cash at all times

and be fully aware of how much

remains unused.

Migrating to SWIFT naturally

requires a business case. There

is a one size fits all offering

whereby the cost depends on

the transaction volume and type

of connectivity required.

SWIFT for Corporates

Questions Answered

Nigel Raymont, Senior Vice President, Regional Sales, Global Payments and Cash Management,

Asia Pacific, HSBC, Hong Kong and Caroline Lacocque, Head, Corporate Connectivity, Asia Pacific,

SWIFT, Hong Kong

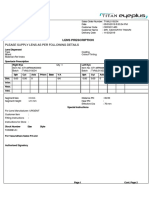

SWIFT connection

Volume of message

types

Comment

Alliance Lite

web-based

Up to 4,000 messages

per month

Target new companies with lower volumes

SWIFTNet

direct access

Unlimited Global companies that prefer to maintain the SWIFT

connection in-house

Service bureau Unlimited SWIFT connection is hosted and maintained by a third party

Member

concentrator

(indirect access)

Unlimited A SWIFT member that will offer a broader remit of services,

such as registration and receiving SWIFT invoices, including

administration of the SWIFT contract

FIGURE 1: SWIFTs Offerings are Tailored to a Companys Needs

Source: SWIFT

SWIFT for Corporates Questions Answered

HSBCs Guide to Cash, Supply Chain and Treasury Management in Asia Pacific 2010 143

T

e

c

h

n

o

l

o

g

y

a

n

d

C

o

n

n

e

c

t

i

v

i

t

y

Benefits for Companies

Deciding whether to connect to SWIFT and whether it is the optimal solution depends on the companys

individual circumstances and business requirements. The benefits of SWIFT for corporates include the

following.

Lower Costs and Straight-Through Processing

Corporates have found that the disciplines set out by SWIFT such as presenting standardised payment fles

and receiving standardised bank statements have resulted in higher straight-through processing (STP) rates.

SWIFT creates a single communication channel allowing for transaction instructions to be transmitted

effciently between a corporate and its banks. The more banking relationships, the higher the savings.

In addition, standards used by SWIFT for payment fles, bank balances and deal confrmations allow

increased STP, thus improving staff productivity by reducing manual input. Banks also beneft from high STP

rates since no manual intervention is required, and, to that end, they will be more disposed to offering a tariff

that refects the automation level.

That said, it is important to be cautious when dealing with regulated countries since banks will require

supporting documentation for cross-border payments in accordance with local regulations. While the

underlying fee can be lower due to the clean nature of the payment data presented, there will be charges to

cover the costs of validating and processing the supporting documentation. However, SWIFTs fle transfer

mechanism, which is content-agnostic, can be utilised to process this documentation, as well as SWIFTs

new ISO 20022 XML standards

1

.

The fip side to this is that a company with established cash management banking partners should already

have ironed out the creases.

Network Availability, Security and Reliability

Leonard Schrank, former chief executive officer of SWIFT, commented that airline passengers require

100% uptime when flying 99% is simply not acceptable. The same is true for SWIFT, which boasts

99.999% availability, a reliability rate that is hard to top. It is important to remember that though some of

the leading international banks may have highly robust infrastructures because of the size and scale of their

own networks, the same may not be true at the local bank level where companies may suffer from regular

breakdowns of their electronic banking systems.

Visibility of Funds

Arguably, this should be the frst factor to consider. Although the sharing of e-statements has been available

for at least three decades (based on the exchange of SWIFT messages) the process of aggregating through a

leading cash management banks delivery channel takes time to set up and, indeed, maintain. SWIFT is bank

agnostic allowing data to be received directly, thus facilitating the process of collation. A company only

needs to inform its banks to report balances and transactions to its own SWIFT address.

Information is key as businesses are focusing more than ever on effective liquidity management. They

want to keep track of their cash at all times and be fully aware of how much remains unused. SWIFT offers

a simplifed retrieval process allowing the company to receive electronic bank statements directly from all

counterparty banks, and has the fexibility to be extended to receive interim and intra-day statements.

1. ISO 20022 is the standard set by the International Organization for Standardization (ISO) to provide the fnancial industry

with a common platform for the development of messages in a standardised Extended Markup Language (XML) syntax.

For more information, see www.iso20022.org. For other defnitions and concepts relating to SWIFT not included in this

article, see the preceding article or consult the SWIFT website, www.swift.com.

SWIFT for Corporates Questions Answered

144 HSBCs Guide to Cash, Supply Chain and Treasury Management in Asia Pacific 2010

T

e

c

h

n

o

l

o

g

y

a

n

d

C

o

n

n

e

c

t

i

v

i

t

y

Compliance

Although Sarbanes-Oxley (SOX) is a piece of legislation aimed at reforming the accounting and fnancial

practice and governance in the US, its infuence is nevertheless felt in every corner of the globe, so becoming

close to an international standard. In the context of SOX, supporting a number of bank interfaces requires

the application of stringent controls. It is easier then to have a single interface, which, as company users

comment, signifcantly reduces the administrative effort in maintaining accurate records and maintaining up-

to-date bank communication processes.

Despite the potential advantages for companies considering SWIFT, one nagging doubt may still linger:

Whats in it for the banks? For decades they have been espousing the benefits of their own electronic

channels. Is there any beneft to them in ditching these treasured platforms?

Benefits for Banks

There is a risk that a companys bank is not supportive of the SWIFT channel approach. However, there are

benefts for banks as outlined below.

Role as Innovator

Banks are embracing corporates that use SWIFT. Remember that SWIFT is owned by banks, and therefore it

was the banks that voted to allow companies access. SWIFT alters the dialogue between banks and corporate

customers, shifting the focus to be less on proprietary technology and more on strategic management. Banks

are keen to present themselves as innovators, encouraging their clients to migrate to SWIFT and showcasing

SWIFT as a viable alternative to their own channels. Even with a standards backbone set up, there is still

plenty of opportunity for a bank to differentiate itself and compete effciently.

Enhanced Value-Added Services

Where a corporate customer has decided to migrate to SWIFT as its primary channel, the bank is free to

focus on its unique selling points and, indeed, enhancing them. Instead of spending money on the core

information technology infrastructure, investment in future will be on value-added differentiation. This is

already happening. Take, for example, receivables management. Accounts receivable in a country, region or

regions has always been considered too diffcult to do, yet that has been proven wrong.

Opportunity for Additional Flows

A bank that leads the dialogue with a company has a clear advantage in capturing additional flows. A

corporate can truly appoint a global bank for its accounts payable processing. As previously mentioned, the

increase in STP rates is good news for banks that are keen to control their costs.

Response to Company Demand

The danger for the banking community in ignoring the demand for SWIFT is tantamount to burying its head

in the sand. If banks dont take the lead in forwarding the agenda, a competitor will. Remember, banks are

keen to present themselves as innovators for example, by linking SWIFT connectivity to payment fle

formatting. After looking at the risks, SWIFT concluded that all companies could join, and that there were

benefts in doing so for companies and banks alike.

How Broad is the Business Case?

Having examined the relative benefts to corporates, and indeed for banks, the fnal consideration is the key

elements of a business case for the corporate to advance SWIFT for corporates. Here we have drawn on the

SWIFT for Corporates Questions Answered

HSBCs Guide to Cash, Supply Chain and Treasury Management in Asia Pacific 2010 145

T

e

c

h

n

o

l

o

g

y

a

n

d

C

o

n

n

e

c

t

i

v

i

t

y

success of others companies that have successfully implemented SWIFT.

Is joining SWIFT so challenging that the project is unrealistic because of the amount of spending on IT?

There are costs, of course, to cover:

Joining SWIFT;

Integration of systems;

Process re-engineering; and

Project management (internal or external).

Migrating to SWIFT naturally requires a business case. Common drivers follow the benefts to companies

as mentioned above. Yet in and of themselves they dont stand up in isolation. Following are some of the

key drivers.

Multi-bank management: Does a company have to be multi-banked to move to SWIFT? The answer

is no. But how many companies keep all their eggs in one basket? None. Since the challenge for the

treasurer is keeping many mouths fed, core lending banks are keen for asset-light ancillary business,

hence most companies have more than one banking partner. Furthermore, coordinating fows of data is,

as mentioned earlier, a challenge using the traditional approach.

Optimising return on investment: Specifcally investment in enterprise resource planning (ERP) systems.

SWIFT connectivity now further enhances the ERP business case: the more instances of integration that

can be achieved, the better the usage. One company admittedly a large multinational has estimated

the return on investment of switching to SWIFTNet at 406%, resulting from a marked reduction in

connection failures, simplifcation of the number of interfaces from 40 to one, and fnally, an increased

volume of activity through working with a single channel.

Format standardisation: As previously suggested, combining SWIFT connectivity with a broader

project can result in significant benefits. For the past two decades, a number of formats have been

available SWIFT emulation, EDIFACT (e.g. PAYMUL)

2

and ERP proprietary formats yet none have

really worked. All have spawned different quests by the various users to try to fnd a common group

where integration can be simplifed and uniform. The XML ISO 20022 standard provides the frst real

opportunity to achieve this.

SWIFT has a one size fits all offering whereby the cost depends on the transaction volume and type of

connectivity required. There are three ways of connecting:

Direct connection;

Through a service bureau

Using Alliance Lite (the newest, low-cost web-based connection)

Conclusions

Single bank or multi-bank? It doesnt really matter. Better questions to ask are: What is the strategic direction

of the company? and, to achieve that, how would SWIFT help? A number of key issues have been examined

above the benefts to the company, the benefts to the bank, the business case for SWIFT and a checklist

for implementation. Does it all add up? If so, maybe its time for your company to call its leading cash

management banking partner and SWIFT to invite them over for coffee and a chat.

2. EDIFACT is the electronic data interchange standard for administration, commerce and transport. The standard has been

adopted by the United Nations for business messages, and is managed by SWIFT. PAYMUL is the multiple payment order

message type used in EDIFACT.

Das könnte Ihnen auch gefallen

- Swiftnet PDFDokument7 SeitenSwiftnet PDFCarlos AlexandreNoch keine Bewertungen

- SWIFT Report On WCMDokument25 SeitenSWIFT Report On WCMMohammad Ilyas AfridiNoch keine Bewertungen

- Swift Report Nostrodlt Public ReleaseDokument28 SeitenSwift Report Nostrodlt Public Releasepenta100% (1)

- Swift Block Info and FormatDokument5 SeitenSwift Block Info and FormatnishantvshahNoch keine Bewertungen

- SWIFT Joining Process: List of DocumentsDokument35 SeitenSWIFT Joining Process: List of DocumentsJohn SamboNoch keine Bewertungen

- SWIFT Procurement Compliance PDFDokument18 SeitenSWIFT Procurement Compliance PDFMasoud DastgerdiNoch keine Bewertungen

- ISO20022 MDRPart2 PaymentsInitiation 2019 2020 v1 1Dokument287 SeitenISO20022 MDRPart2 PaymentsInitiation 2019 2020 v1 1kafihNoch keine Bewertungen

- SWIFT - PresentationVisit Us at Management - Umakant.infoDokument50 SeitenSWIFT - PresentationVisit Us at Management - Umakant.infowelcome2jungleNoch keine Bewertungen

- Webinar Swiftgpi 20181004Dokument28 SeitenWebinar Swiftgpi 20181004andres torresNoch keine Bewertungen

- Swift 4Dokument86 SeitenSwift 4Freeman JacksonNoch keine Bewertungen

- Standing Order FormDokument3 SeitenStanding Order FormMaissa Hassan100% (1)

- Swiftready Label - For Corproates Cash ManagementDokument17 SeitenSwiftready Label - For Corproates Cash ManagementFreeman JacksonNoch keine Bewertungen

- Swift Iso20022 Thirdpartytoolkit FinalDokument16 SeitenSwift Iso20022 Thirdpartytoolkit Finalanurag jadhav100% (1)

- ReportDokument4 SeitenReportredwanNoch keine Bewertungen

- Financial Perspective: Doing Business in IndiaDokument21 SeitenFinancial Perspective: Doing Business in India26702741Noch keine Bewertungen

- Blockchain Money London 2016 ProgramDokument28 SeitenBlockchain Money London 2016 ProgramKeynote_DocsNoch keine Bewertungen

- Volante Technologies Simplifying Messaging ConnectivityDokument20 SeitenVolante Technologies Simplifying Messaging ConnectivityLuis YañezNoch keine Bewertungen

- Global Payments Guide 2018Dokument79 SeitenGlobal Payments Guide 2018annmj170% (1)

- Naseer SwiftDokument67 SeitenNaseer SwiftNaseeruddin MohdNoch keine Bewertungen

- DBFX Trading Station User GuideDokument28 SeitenDBFX Trading Station User GuideSiddharth DurbhaNoch keine Bewertungen

- Swift 1Dokument31 SeitenSwift 1Freeman JacksonNoch keine Bewertungen

- File Transfer SWIFTNet Fact SheetDokument2 SeitenFile Transfer SWIFTNet Fact SheetaNoch keine Bewertungen

- Global Server Load Balancing GSLB 101Dokument7 SeitenGlobal Server Load Balancing GSLB 101terabitsystemsNoch keine Bewertungen

- Financial Services Authority: Final NoticeDokument44 SeitenFinancial Services Authority: Final Noticeannawitkowski88Noch keine Bewertungen

- 2 - Terminal - Tech Procedure For Extraction and Downloading of Funds - ELGSB - 20july2022Dokument2 Seiten2 - Terminal - Tech Procedure For Extraction and Downloading of Funds - ELGSB - 20july2022uink wowNoch keine Bewertungen

- SWIFT Gpi For Financial Institution Application Profile: Incoming Messages Outgoing MessagesDokument2 SeitenSWIFT Gpi For Financial Institution Application Profile: Incoming Messages Outgoing MessagesSushma V KumarNoch keine Bewertungen

- SWIFT Concepts 101 1685270376Dokument11 SeitenSWIFT Concepts 101 1685270376Mandar mahadikNoch keine Bewertungen

- Swift Global Vendor Webinar June 2021Dokument34 SeitenSwift Global Vendor Webinar June 2021Beniamin KohanNoch keine Bewertungen

- Payment and Settlement Systems in India PDFDokument436 SeitenPayment and Settlement Systems in India PDFSanju ThakurNoch keine Bewertungen

- Camt 054 001 08Dokument1 SeiteCamt 054 001 08Abdulwahab AhmedNoch keine Bewertungen

- ICBC SOP For RMB BT Settlement (Engilish) Template 20211216Dokument14 SeitenICBC SOP For RMB BT Settlement (Engilish) Template 20211216Kathrine TDNoch keine Bewertungen

- SWIFT Certified Application: Label Criteria 2019Dokument24 SeitenSWIFT Certified Application: Label Criteria 2019Rimpa SenapatiNoch keine Bewertungen

- Barc CMB 49MDokument2 SeitenBarc CMB 49MLo PediaNoch keine Bewertungen

- Swift Partners Certifiedapplication S Cert App TRD FNC LBL Crtria 2017Dokument21 SeitenSwift Partners Certifiedapplication S Cert App TRD FNC LBL Crtria 2017Tannistha ChakrabortyNoch keine Bewertungen

- SWIFT-gpi Final JAnuary-2018 PDFDokument30 SeitenSWIFT-gpi Final JAnuary-2018 PDFxyNoch keine Bewertungen

- 20b Avan New Update MP2112Dokument5 Seiten20b Avan New Update MP2112pezhmanbayat924Noch keine Bewertungen

- Formaatbeschrijving MT103 SWIFT FIN PDFDokument9 SeitenFormaatbeschrijving MT103 SWIFT FIN PDFAnonymous 9NgJRDVHMMNoch keine Bewertungen

- Swift Connectivity Brochure CommunitycloudleafletDokument7 SeitenSwift Connectivity Brochure CommunitycloudleafletObilious90Noch keine Bewertungen

- Ymrtc LogDokument8 SeitenYmrtc LogDzikrul Maulana100% (1)

- L2LDokument2 SeitenL2LJacquet JeanNoch keine Bewertungen

- University of Central Punjab: To: Prof. Nauman DaarDokument45 SeitenUniversity of Central Punjab: To: Prof. Nauman DaarUsman ShakoorNoch keine Bewertungen

- PMPG Structured Customer Data MPGDokument21 SeitenPMPG Structured Customer Data MPGJaya100% (1)

- Payments System - Swift Network - MessagesDokument19 SeitenPayments System - Swift Network - MessagesPranay SahuNoch keine Bewertungen

- Addressing The Domestic Market Needs of Indias Financial Industry ALLIANCE LITE 2Dokument17 SeitenAddressing The Domestic Market Needs of Indias Financial Industry ALLIANCE LITE 2Daya nandaNoch keine Bewertungen

- SWIFT Gpi: Delivering The Future of Cross-Border PaymentsDokument24 SeitenSWIFT Gpi: Delivering The Future of Cross-Border PaymentsInggrita Emanuelin100% (1)

- CEO's Message: June HighlightsDokument6 SeitenCEO's Message: June Highlightsapi-26047937Noch keine Bewertungen

- UBSAG GF 10B Remittance AdviceDokument1 SeiteUBSAG GF 10B Remittance AdviceВячеслав БуйныйNoch keine Bewertungen

- CrvswiDokument588 SeitenCrvswiPrasad NayakNoch keine Bewertungen

- Swift Reports Informationpaper Phiso20022mar16Dokument12 SeitenSwift Reports Informationpaper Phiso20022mar16XRP SharinganNoch keine Bewertungen

- Server To Server TransferDokument1 SeiteServer To Server TransferMelis Yes HNoch keine Bewertungen

- SWIFT FIN Payment Format Guide For European AcctsDokument19 SeitenSWIFT FIN Payment Format Guide For European AcctsShivaji ManeNoch keine Bewertungen

- SWIFT SR2021 MT BusinessHighlightsDokument13 SeitenSWIFT SR2021 MT BusinessHighlightsmelol40458Noch keine Bewertungen

- Get Ready For: Universal Payment ConfirmationsDokument4 SeitenGet Ready For: Universal Payment Confirmationsswift adminNoch keine Bewertungen

- MT 103202Dokument5 SeitenMT 103202uink wow100% (1)

- Electronic Financial Services: Technology and ManagementVon EverandElectronic Financial Services: Technology and ManagementBewertung: 5 von 5 Sternen5/5 (1)

- Swift 6Dokument4 SeitenSwift 6Freeman JacksonNoch keine Bewertungen

- SWIFT For Corporates 1642357509Dokument2 SeitenSWIFT For Corporates 1642357509pratapNoch keine Bewertungen

- SWIFT For Corp Orates Brochure 200903Dokument42 SeitenSWIFT For Corp Orates Brochure 200903Bruno NevesNoch keine Bewertungen

- Treasury Management Presentation: Banking To The PeopleDokument28 SeitenTreasury Management Presentation: Banking To The PeopleArvind ChaudharyNoch keine Bewertungen

- Achieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli KyribaDokument3 SeitenAchieving Treasury Visibility by Leveraging SWIFT: Scott Montigelli Kyribabeevant100% (1)

- Year Total Tyre Market Annual Target Actual AchievementDokument4 SeitenYear Total Tyre Market Annual Target Actual AchievementGanesh ShankarNoch keine Bewertungen

- Print FriendlyDokument2 SeitenPrint FriendlyGanesh ShankarNoch keine Bewertungen

- Dell Case AnalysisDokument77 SeitenDell Case AnalysisGanesh Shankar57% (7)

- Payment SystemsDokument7 SeitenPayment SystemsGanesh ShankarNoch keine Bewertungen

- Quiz Master: Ganesh ShankarDokument19 SeitenQuiz Master: Ganesh ShankarGanesh ShankarNoch keine Bewertungen

- Name: Ganesh Shankar Write Up For Action Plans For Quiz ClubDokument1 SeiteName: Ganesh Shankar Write Up For Action Plans For Quiz ClubGanesh ShankarNoch keine Bewertungen

- CAPSIM ExamDokument46 SeitenCAPSIM ExamGanesh Shankar90% (10)

- Wal-Mart's Supply Chain Management PracticesDokument5 SeitenWal-Mart's Supply Chain Management PracticesGanesh ShankarNoch keine Bewertungen

- Activity Analysis, Cost Behavior, and Cost Estimation: Answers To Review QuestionsDokument60 SeitenActivity Analysis, Cost Behavior, and Cost Estimation: Answers To Review QuestionsGanesh ShankarNoch keine Bewertungen

- Indian Institute of Management Kashipur Time Table: Batch Term Class Room: CR-03 PGP (2013-15) SectionDokument2 SeitenIndian Institute of Management Kashipur Time Table: Batch Term Class Room: CR-03 PGP (2013-15) SectionGanesh ShankarNoch keine Bewertungen

- LanguageDokument6 SeitenLanguageGanesh ShankarNoch keine Bewertungen

- Units Sold 200,000 Price ($) 100 Variable Cost ($) 20 Translation Cost 5000000 Percentage 20% (Assuming 0 % Increase Initially)Dokument5 SeitenUnits Sold 200,000 Price ($) 100 Variable Cost ($) 20 Translation Cost 5000000 Percentage 20% (Assuming 0 % Increase Initially)Ganesh ShankarNoch keine Bewertungen

- Campus Levers Guest Lecture TopicsDokument2 SeitenCampus Levers Guest Lecture TopicsGanesh ShankarNoch keine Bewertungen

- C&S Wholesale GrocersDokument15 SeitenC&S Wholesale GrocersGanesh Shankar0% (2)

- Anthony SpeechDokument6 SeitenAnthony SpeechGanesh ShankarNoch keine Bewertungen

- NESTLEDokument4 SeitenNESTLERobin Reji100% (2)

- Project Management ConceptsDokument19 SeitenProject Management ConceptsarunlaldsNoch keine Bewertungen

- AftaDokument6 SeitenAftanurnoliNoch keine Bewertungen

- Sony ProjectDokument12 SeitenSony ProjectfkkfoxNoch keine Bewertungen

- Oracle Fusion Financials General Ledger Essentials Q & ADokument32 SeitenOracle Fusion Financials General Ledger Essentials Q & AC NuNoch keine Bewertungen

- SL No Candidate Name DOB (Mm/dd/yy) Campus Basic Qualification MBA Specialisation MajorDokument9 SeitenSL No Candidate Name DOB (Mm/dd/yy) Campus Basic Qualification MBA Specialisation MajorSonali GroverNoch keine Bewertungen

- TVML019234 PDFDokument2 SeitenTVML019234 PDFSIDHARTH TiwariNoch keine Bewertungen

- Manpower Planning FormDokument1 SeiteManpower Planning FormMohammad Abd Alrahim ShaarNoch keine Bewertungen

- Marketing SystemDokument20 SeitenMarketing SystemAldrich BunyiNoch keine Bewertungen

- Assignment ON Steel Authority of India (SAIL)Dokument32 SeitenAssignment ON Steel Authority of India (SAIL)Bhupender MehtoNoch keine Bewertungen

- Problemson CVPanalysisDokument11 SeitenProblemson CVPanalysisMark RevarezNoch keine Bewertungen

- Industry 4.0 Engages CustomersDokument24 SeitenIndustry 4.0 Engages CustomersAries SantosoNoch keine Bewertungen

- NeemDokument9 SeitenNeemdineshmarineNoch keine Bewertungen

- Chapter 16 Extra Problem and SolutionDokument3 SeitenChapter 16 Extra Problem and SolutionVincent PhamNoch keine Bewertungen

- Master of Business Administration: Submitted in Partial Fulfilment of The Requirements For The Award ofDokument54 SeitenMaster of Business Administration: Submitted in Partial Fulfilment of The Requirements For The Award ofKannan CNoch keine Bewertungen

- Chapter 4 Reviewer Law 2 7Dokument6 SeitenChapter 4 Reviewer Law 2 7Hannamae Baygan100% (1)

- Group 5.scrum MethodologyDokument11 SeitenGroup 5.scrum Methodologysimon MureithiNoch keine Bewertungen

- Freight Forwarding SoftwareDokument10 SeitenFreight Forwarding SoftwareShuklendu BajiNoch keine Bewertungen

- Methods of Fit Gap Analysis in SAP ERP ProjectsDokument0 SeitenMethods of Fit Gap Analysis in SAP ERP ProjectsVasco Monteiro100% (2)

- Art Centre Contractors & Supplies LTD P.O Box 165, KAGADI Tel: 0772530672/0752530672Dokument1 SeiteArt Centre Contractors & Supplies LTD P.O Box 165, KAGADI Tel: 0772530672/0752530672kitderoger_391648570Noch keine Bewertungen

- Chapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinDokument13 SeitenChapter # 15 Solutions - Engineering Economy, 7 TH Editionleland Blank and Anthony TarquinMusa'b100% (1)

- Employment Law For BusinessDokument18 SeitenEmployment Law For Businesssocimedia300Noch keine Bewertungen

- Siebel Systems Anatomy of A Sale-Deepak Kumar Sood 34BM17Dokument8 SeitenSiebel Systems Anatomy of A Sale-Deepak Kumar Sood 34BM17Deepak SoodNoch keine Bewertungen

- Labor NotesDokument36 SeitenLabor NotesJay TabuzoNoch keine Bewertungen

- UofMaryland Smith Finance Assoc Resume Book (1Y)Dokument46 SeitenUofMaryland Smith Finance Assoc Resume Book (1Y)Jon CannNoch keine Bewertungen

- Memorandum of AssociationDokument8 SeitenMemorandum of AssociationSohail AnjumNoch keine Bewertungen

- Bizbox Emr Training Invitation - March 2, Region3Dokument2 SeitenBizbox Emr Training Invitation - March 2, Region3Thor StarkNoch keine Bewertungen

- CARO 2020 by Ankit OberoiDokument38 SeitenCARO 2020 by Ankit Oberoiraja kumarNoch keine Bewertungen

- INVESTMENT IN DEBT SECURITIES DiscussionDokument12 SeitenINVESTMENT IN DEBT SECURITIES DiscussionKristine Kyle AgneNoch keine Bewertungen

- Global Marketing Management: Chapter 7 Segmentation, Targeting and PositioningDokument19 SeitenGlobal Marketing Management: Chapter 7 Segmentation, Targeting and PositioningrameshmbaNoch keine Bewertungen