Beruflich Dokumente

Kultur Dokumente

Break Even Point Analysis

Hochgeladen von

Chaya SeebaluckOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Break Even Point Analysis

Hochgeladen von

Chaya SeebaluckCopyright:

Verfügbare Formate

5.

l

l

=

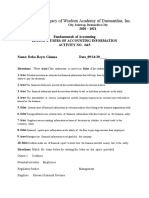

BREAK EVEN POINT ANALYSIS

11.5.1 Break Even Point in Units

Illustration 1:

Assume the selling price of product Rs.20/-per unit and variable cost per unit Rs.10/-

and the fixed cost Rs.1000/- Find out the break even point.

Sales

Variable Cost

Contribution

Fixed Cost

Profit

Rs.20/-

Rs.10/-

Rs 10/-

Rs.1000/-

(-) Rs. 990/-

If the firm produces only one unit, the amount of loss is Rs.990/-. To avoid the amount of

loss how many units are to be produced ?

As already highlighted, BEP is the point at which the firm neither earns profit nor incurs loss.

Profit/Loss is a resultant out of Contribution while meeting out the fixed cost volume of

the transaction. From the above example, the contribution per unit is Rs.10/ not sufficient

to meet out the fixed cost volume of Rs.1000/-. The purpose of finding out the BEP in

units is to identify the level of contribution which is not only equivalent as well as to meet

fixed cost of the transaction but also to avoid loss. To raise the volume of contribution at

par with the fixed cost volume, fixed cost has to be related to the contribution margin per

unit through the ratio given below

Fixed cost= "X" units x Contribution Margin Per Unit

"X" units can be found out from the following

"X" units =

Fixed Cost

Contribution Margin Per Unit

The total number of units "X" which equate the contribution volume of "X" units with the

total fixed cost is the Break Even Point (Units).

Break Even Point (Units) =

Fixed Cost

Contribution Margin Per Unit

Rs.1000/-

Rs.10/-

= 100 Units

The above illustration reveals that how many number of times the contribution margin

per unit should be equivalent to the total fixed cost volume. Hence the number of times

is nothing but the units required to have equivalent volume of contribution to the tune of

184

fixed cost.

(a)

(b)

= =

192

APPLICATIONS OF AR!INAL COSTIN!

ake or B"# $e%ision

The firms which are routinely in need of spares, accessories are bought from the outsiders

instead of any production or manufacturing, though the requirement is at regular intervals.

Most of the automobile manufacturers are usually buying the components from outside

instead of producing them on their own. The Maruthi Udyog ltd had given a contract to

the Nettur Technical Training Foundation, Bangalore to design the tool for the panel and

to manufacture regularly to the tune of the orders.

The leading four wheeler manufacture in India is buying the panel from the NTTF on

contract basis instead of manufacturing.

&'# (on)t t'e# *an"+a%t"re in s,ite o+ -"#in. t'e* +ro* t'e NTTF /

The main reason of buying is cheaper than the production of an article.

Illustration 8

The management of a company finds that while the cost of making a component part is

Rs. 20, the same is available in the market at Rs. 18 with an assurance of continuous

supply.

Give a suggestion whether to make or buy this part. Give also your views in case the

supplier reduces the price from Rs. 18 to Rs. 16.

The cost information is as follows

Marginal Costing

Material

Direct Labour

Other variable expenses

Fixed expenses

Total

Rs 7,00

Rs. 8.00

Rs. 2.00

Rs. 3.00

Rs.20.00

The first point to be found out that the contribution of the transaction. The cost of

manufacturing should be compared with the price of the product which is available in the

market.

To find out the worth of the transactions, first the cost of manufacturing should be found

out

Material

Direct Labour

Other variable expenses

Total

Rs. 7.00

Rs. 8.00

Rs. 2.00

Rs.17.00

The cost of manufacturing a component is Rs.17.00. While calculating the cost of

manufacturing a component, the fixed expenses was not considered. The fixed expenses

were not considered for computation. Why?

The costs will be incurred irrespective of the production status of the firm; for which the

expenses should not be added.

If the company manufactures the product/ component at Rs.17 which will facilitate to

book profit Rs. 1 from the price of Rs.18 which is available from the market.

The next stage is decision criteria.

11.0.1 &ort' o+ Pro("%tion

Cost of the production < Price of the product available in the market

The firm is better advised to take the course of production rather than purchase of the

product.

11.0.2 &ort' o+ P"r%'ase

Cost of the production > Price of the product available in the market

The product available in the market is dame cheaper than the manufacturing of a product.

The firm is better advised to buy the product rather than the manufacturing of a product

If the product price comes down to the price of Rs.16 facilitates the firm to save Re 1

from the cost of manufacturing.

193

=

Accounting and Finance for

Managers

Illustration 9

A refrigerator manufacturer purchases a certain component @ Rs.50 per unit. If he

manufactures the same product he has to incur a fixed cost of Rs.20,000 and variable

cost per unit is Rs. 40/- when can the manufacturer make on his own or when he can

buy from outside ?

&'en t'e re3"ire*ents is Rs. 54555 "nits4 6i77 #o" a(vise to *ake or -"#/

The very first point to be found that Break even point in units.

The break even point in units at which the cost of buying is equivalent to the cost of

manufacturing.

The cost of purchase per unit - Rs 50/-

If the same product is manufactured, what would be the total cost of manufacture ?

Total cost of manufacture= Total fixed cost + Variable cost

The cost of buying is felt that an exorbitant one than the cost of manufacturing. Having

observed, as a manufacturer undergoes for the manufacturer of a component. If he

manufactures a component, he could save Rs.10=( Rs.50Rs.40) Which in other words

known as contribution per unit

Before finding out the Break even point in units, the contribution of the product should be

found out.

Contribution margin per unit= Selling price in the market Cost of manufacture

Contribution margin per unit is nothing but the amount of savings to the manufacture.

Amount of savings out of the manufacture = Purchase price Variable cost

Though the firm enjoys savings, it is required to additionally incur fixed cost of operations

Rs.20,000

Break even point in units =

Fixed cost

Purchase price- Variable cost

Rs.20,000

Rs.50Rs.40

= 2,000 units

At 2,000 units, the firm considers both alternatives are incurring equivalent volume of

Cost in manufacturing.

Cost of buying for 2,000 units

=2,000 units Rs.50 per unit= Rs. 1,00,000

Cost of Buying Break even in Rupees

= Rs.20,000 + 2,000 units Rs.40 = Rs.1,00,000

From the above, it obviously understood that both are bearing equivalent amount of

costs. It means both are neither profitable nor non- profitable.

&'i%' one is -etter +or t'e +ir*/

No o+ Units

@ 2,001 units

an"+a%t"rin. %ost

Rs.20,000+ Rs.80,0040

=Rs.1,00,040

B"#in. %ost

2001 Rs.50

= Rs.1,00,050

$e%ision

Manufacturing

cost < Buying cost

Advisable to

manufacture

194

@1,999 units Rs.20,000+Rs.79,960

=Rs.99,960

1,999 Rs.50

Rs.99,950

Manufacturing

cost > Buying cost

Advisable to Buy

195

The next step is to identify the worth of either manufacturing the units or buying the units

at 5,000

If the manufacturer buys from the outsider= 5,000 Rs.50= Rs.2,50,000

If the same manufacturer produces the component instead of buying

=Rs.20,000+ Rs.2,00,000= Rs.2,20,000

From the above, the company is finally advised to manufacture the component due to

low cost of manufacture.

11.15 ACCEPTIN! T8E E9PORT OFFER

Illustration 10

The cost statement of a product is furnished below

Marginal Costing

Direct material

Direct wages

Factory overhead

Fixed Rs1.00

Rs.10.00

Rs.6.00

Variable

Administrative expenses

Selling or distribution overheads

Fixed

Variable

Selling price per unit Rs.24.00

Rs.1.00

Rs.0.50

Rs.1.00

Rs.2.00

Rs.1.50

Rs.1.50

Rs.21.00

The above figures are for an output of 50,000 units. The capacity for the firm is 65,000

units A foreign customer is desirous of buying 15,000 units a price of Rs.20 per unit.

Advise the manufacturer whether the order should be accepted, 6'at 6i77 -e #o"r

a(vise i+ t'e or(er 6ere +ro* t'e 7o%a7 *er%'ant/

The acceptance of the order is mainly based on the two important covenants viz Additional

cost and Additional revenue.

If the additional demand of the foreign buyer is able to generate the additional revenue

more than the additional cost of the operations, the firm should have to accept the foreign

order.

Decision criteria

Marginal/Additional cost for the additional order of 15,000 units

Per "nit :Rs; 154555 "nits

Selling price

Less:Marginal cost

Direct material

Direct wages

Variable overhead

Factory

Rs

10.00

6.00

1.00

20 3,00,000

Selling & Distribution 1.00 18

2

2,70,000

30,000

The acceptance of the order will generate marginal profit of Rs.30,000 which should be

accepted. The fixed portion of the factory and selling overheads were already met out

Accounting and Finance for

Managers

which should not be included again in the computation of the marginal or additional cost

of the foreign order placed by the business enterprise.

Instead, If the firm accepts the local order at the rate of Rs.20 which automatically will

spoil the relationship with the very good customers who regularly purchase at the rate of

Rs.24. This will lead to cannibalization of the existing pricing strategy.

11.11 KEY FACTOR

Key factor is nothing but a limiting factor or deterring factor on sales volume, production,

labour, materials and so on.

The limiting factor normally differs from one to another

Volume of sales- the limiting factor is that production of required number of articles

Volume of production- the limiting factors are as follows in adequate supply of raw

materials, labor, inability to sell the produced articles and so on

The limiting factors are studied in the lights of the contribution. The limiting factor is

bearing the inverse relationship with the volume of contribution. To study the worth of

the business proposals among the limiting factors, the contribution is considered as a

parameter to rank them one after another.

Illustration 11

From the following data, which product would you recommend to be manufactured in a

factory, time being the key factor?

Parti%"7ars

Direct Material

Direct Labor @ Re 1per hr

Variable overhead Rs.2 per hr

Selling price

Standard time to produce

Per "nit o+ Pro("%t A Rs

24

2

4

100

2 Hours

Per "nit o+ Pro("%t B Rs

14

3

6

110

3 Hours

(I.C.W.A.Inter)

The product is being chosen by the manufacturer based on the ability of generating

higher contribution. The higher the contribution leads to a better the position for the firm

The worth of the product is being selected on the basis of

Parti%"7ars

Selling price

Less :Direct Material

Direct Labor @ Re 1per hr

Per "nit o+ Pro("%t A Rs

100

24

2

Per "nit o+ Pro("%t B Rs

110

14

3

Variable overhead Rs.2 per hr 4 30 6 23

Contribution

Standard time to produce

Contribution per hour per product

70

2 Hours

Rs.70/2 Hrs= Rs.35

87

3 Hours

Rs.87/3 Hrs= Rs 29

From the above calculation, it is obviously understood that the firm is having higher

contribution margin per hour in the case of product A over the other one, portrays the

product A is better than B.

Illustration 12

The following particulars are obtained from costing records of a factory:

Parti%"7ars

Direct Material Rs.20 per Kg

Per "nit o+ Pro("%t A Rs

80

Per "nit o+ Pro("%t B Rs

320

196

Direct Labor @ Re 10per hr 100 200

Contd...

(a)

(b)

(a)

(b)

Variable overhead

Selling price

Total fixed overheads

40

400

Rs.30,000

80

1,000

Marginal Costing

Comment on the profitability of each product during the following conditions:

In adequate supply of raw material

Production capacity is limited

(c)

(d)

Sales quantity is limited

Sales value limited

The first step is to determine the Contribution per product.

According to the constraints given in the problem, contribution of two products should be

compared.

Parti%"7ars

Selling price

Direct Material Rs.20 per Kg

Direct Labor @ Re 10per hr

Per "nit o+ Pro("%t A Rs

400

80

100

Per "nit o+ Pro("%t B Rs

1,000

320

200

Variable overhead

Contribution margin per unit

40 220

180

80 600

400

Now the contribution per unit has found out with the help of above given information the

next step is to study the contribution margin per unit to the tune of given constraints of

the firm.

The first constraint is in adequate supply of the raw material: The raw materials

are considered to be precious due to insufficient supply to the requirement of the

firm. Having considered the scarcity of the raw material, the constraint in availing

the raw material is denominated in terms of ability of contribution generation.

Parti%"7ars

Contribution margin per unit

Consumption of raw material

per unit

Cost of raw material per unit

Cost of material per Kg

Contribution per Kg

Per "nit o+ Pro("%t A Rs

180

Rs 80 = 4 Kgs

Rs.20

Rs. 180 = Rs.45

4 Kgs

Per "nit o+ Pro("%t B Rs

400

Rs.320 = 16 Kgs

Rs20

Rs.400 = Rs.25

16 Kgs

It obviously understood that the firm enjoys greater contribution margin per k.g in

the case of Product A during the scarcity of raw material than the product B.

Then the production capacity of the firm is subject to the availability of the labour and

the hours normally consumed by them for the production of a single product. Due to

shortage of the labour, the firm should identify the product which requires lesser

labour hours as well as able to generate more contribution margin per labour hour.

In the next step, Contribution margin per hour should be calculated.

Parti%"7ars

Contribution margin per unit

Consumption of Labor Hrs

Cost of Labor per unit

Cost of Labor per Hour

Contribution per Hr of the

Per "nit o+ Pro("%t A Rs

180

Rs100 = 10 Hrs

Rs.10

Rs. 180 = Rs.18

Per "nit o+ Pro("%t B Rs

400

Rs.200 = 20 Hrs

Rs10

Rs.400 = Rs. 20

product

10 Hrs 20 Hrs

197

(c)

(d)

1.

2.

(c) (d)

1.

Accounting and Finance for

Managers

The contribution per hour is greater in the case of the product B, considered to be

as a better product among the given. It means that the firm has better opportunity

to earn greater contribution in the case of product B than A.

The next one is that sale of the quantities is the major limiting factor. It means that

the vendor finds some what difficulties in selling the articles. While considering the

difficulties in selling the quantities, the firm should identify the product which is able

to generate greater contribution.

From the earlier calculation, it is clearly understood that, the product B is bearing

greater value of contribution margin per unit than the product.

If the sales value is considered to be a limiting factor, to choose one among the

given products PV ratio is being applied as a measure. It means that the sales

value of the products are ignored for comparison in between them. To identify the

better product, irrespective of the price, PV ratio should be applied. The PV ratio

of the Product A & B are calculated as follows

Profit volume ratio =

Contribution

Sales

100

For A = 45%

For B = 40%

The PV ratio is greater in the case of product A than B. The product A has to be

chosen

C'e%k Yo"r Pro.ress

Which is the following factor equated to the Contribution at the level of Break Even

Point ?

(a)

(c)

Fixed cost

Variable cost

(b)

(d)

Sales

Semi-Variable cost

What is the change to be made on the BEP formula to find out the volume of sales at

the desired level of profit ?

(a) Desired profit

Desired profit with Fixed cost

(b) Fixed cost

Desired cost + Fixed profit

11.11 SELECTIN! T8E SUITABLE PRO$UCT I9

In the market, dealership is offered by the various companies to the individual intermediaries

in promoting the sale of products. Before reaching an agreement with the company to act

as a dealer, normally every individual consider the profitability of the product mix offered

by the firm. For e-g There are two different companies brought forth their advertisements

in offering the dealership to the individual trading firms viz HCL and IBM.

The profitability under the dealership banner should be appropriately considered prior to

take decision. To take rational decision, the firm should compare the profitability of both

different dealership of two different giant industrial brands. The greater the share of the

profitability in volume will be selected and vice versa.

C'e%k Yo"r Pro.ress

If the supply of the material is considered to be scared in the market for two different

units of production of ABC ltd. How the worth of the units of production could be

studied through Key factor analysis?

198

Contd...

(a)

2.

3.

(a)

(c)

(d)

(a)

Contribution per unit (b) Contribution per labour

Marginal Costing

(c) Contribution per hour (d) None of the above

While accepting export order, which component of influence should not be taken into

consideration?

(a)

(c)

Direct material

Direct labour

(b)

(d)

Direct expenses

Fixed cost

If Licon co ltd wants to induct a product B along with the existing product line, what

would be the deciding factor to undertake or reject?

(a)

(c)

Composite contribution

Contribution margin per unit

(b)

(d)

Fixed cost

None of the above

Illustration 13

From the following information has been extracted of EXCEL rubber products ltd

Direct materials A

Direct materials B

Direct wages A

Direct wages B

Variable overheads

Fixed overheads

Selling price A

Selling price B

Rs 16

Rs12

24 Hrs at 50 paise per hour

16 Hrs at 50 paise per hour

150% of wages

Rs. 1,500

Rs.50

Rs.40

The directors want to be acquainted with the desirability of adopting any one of the

following alternative sales mixes in the budget for the next period.

250 units of A and 250 units of B

(b) 400 units of B only

400 units of A and 100 units of B

150 units of A and 350 units of B

State 6'i%' o+ t'e a7ternative sa7es *i<es #o" 6o"7( re%o**en( to t'e *ana.e*ent/

The first step is to determine the contribution margin per unit of A and B.

The determination of the contribution of product A and B are through the preparation of

Marginal costing statement.

Parti%"7ars Pro("%t A Rs Pro("%t B Rs

Selling price

Less: Direct Materials

Direct wages

Variable overheads

Variable cost

Contribution

16

12

18

50

46

4

12

8

12

40

32

8

The next step is to determine the profit level of every mix.

250 units of A and 250 units of B

The first step is to determine the total contribution of the mix. Why the total

contribution has to be found out?

The main reason is to determine the profit level of the mix through the deduction of

the fixed overheads

199

(c)

(d)

200

Accounting and Finance for

Managers

Product of A

Product of B

250 units Rs.4=

250 units Rs.8=

Rs.1,000

Rs.2,000

Contribution

Fixed overheads

Profit

Rs.3,000

Rs.1,500

Rs.14555

(b) 400 units of B only

Product B Contribution

Fixed overheads

Profit

400 units Rs.8 =

Rs.3,200

Rs.1,500

Rs.14=55

400 units of A and 100 units of B

Product of A

Product of B

Contribution

Fixed overheads

Profit

400 units Rs.4

100 units Rs.8

Rs.1,600

Rs. 800

Rs.2,400

Rs.1,500

Rs.055

150 units of A and 350 units of B

Product A

Product B

Contribution

Fixed overheads

Profit

150 units Rs.4

350 units Rs.8

Rs.600

Rs.2,800

Rs.3,400

Rs.1,500

Rs.14055

Mix

Contribution

A

Rs.1,500

B

1,700

C

900

D

14055

The profit level among the given various mixes, the mix (d) is able to generate

highest volume of profit over the others

11.12 $ETERININ! OPTIU LEVEL OF

OPERATIONS

Under this method, the level has to be found out which is having lesser selling price, cost

of operations and greater profits known as optimum level of operations.

Illustration 14

A factory engaged in manufacturing plastic buckets is working at 40% capacity and

produces 10,000 buckets per annum.

The present cost break up for bucket is as under

Material

Labour

Overheads

Rs.10

Rs.3

Rs.5(60% fixed)

The selling price is Rs 20 per bucket

If it is decided to work the factory at 50% capacity, the selling price falls by 3%. At 90 %

capacity the selling price falls by 5% accompanied by a similar fall in the prices of material.

=

You are required to calculate the profit at 50% and 90% capacities and also calculate

Marginal Costing

break even point for the same capacity productions. (C.A.Inter May,1976)

The very first step is to compute number of units at every level of capacity i.e. 50% and

90%.

But in this problem, 40 % capacity utilization given which amounted 10,000 units.

For 50% =

10,000

40

units 50 = 12,500 units

For 90 % =

10,000 units

40

90 = 22,500 units

The important information is that the changes taken place in the selling price of the

product.

Selling price = Rs.20 @ 40% i.e., 10,000 units

Selling price @ 50% i.e. 12,500 units = Rs.203% on Rs.20 = Rs.19.40

Selling price @90% i.e. 22,500 units=Rs.205% on Rs.20 = Rs.19

While preparing the marginal costing statement, the fixed cost portion should not be

included for the computation of the contribution.

The next step is to prepare the marginal costing statement.

Parti%"7ars 55 > %a,a%it#:114555 Units; 05> %a,a%it# Rs:114555 "nits

Per "nit Rs Tota7 Rs Per "nitRs Tota7Rs

Selling price

Less: Direct Materials

Direct wages

Variable overheads

Variable cost

Contribution

Fixed costs

Profit

19.40

10

3

2

15

4.40

2,42,500

1,25,000

37,500

25,000

55,000

30,000

25,000

19.00

9.50

3

2

14.50

4.50

4,27,500

2,13,750

67,500

45,000

1,01,250

30,000

71,250

The last step is to determine that the break even point

Parti%"7ars

Break even point in units

Fixed cost

Contribution margin per unit

Break even point in value

BEP in units Selling price

55 > %a,a%it# 114555 "nits

Rs.30,000

Rs.4.40

=6,818 units

6,818 units Rs 19.40

=Rs.1,32,269.2

05> %a,a%it# 114555 "nits

Rs.30,000

Rs.4.50

=.6,667units

6,667units Rs.19

=Rs.1,26,673

11.1? ALTERNATIVE ET8O$ OF PRO$UCTION

It is a method to identify the best method of production to generate greater contribution

as well as profit. The method which is able to earn greater profit only will be considered,

known as limiting factor method.

Illustration 15

Product X can be produced either by machine A or machine B. Machine A can produce

100 units of X per hour and machine B 150 units per hour. Total machine hours available

during the year are 2,500. Taking into account the following data determine the method

of profitable manufacture.

201

1.

Accounting and Finance for

Managers

11.15 LET US SU UP

"Marginal cost is the amount at any given volume of output, by which aggregate costs

are charged, if the volume of output is increased or decreased by one unit." Marginal

Costing is defined as "the ascertainment of marginal cost and of the effect on profit of

changes in volume or type of output by differentiating between fixed and variable costs."

In marginal costing, the change in the level of cost of operation is equivalent to variable

cost due to fixed cost component which is fixed irrespective level of outputs. Break

Even Point is the point at which the Total Cost is equivalent to Total Revenue. At the

break even point the business neither earns profit nor incurs a loss. It means that the

firm's cost is recovered at the minimum level of production. PV ratio is Profit Volume

ratio which establishes the relationship in between the profit and volume of sales. It a

ratio normally expressed in terms of contribution towards volume of sales. It is expressed

in terms of percentage. Key factor is nothing but a limiting factor or deterring factor on

sales volume, production, labour, materials and so on.

The limiting factor normally differs from one to another

Volume of sales- the limiting factor is that production of required number of articles

In the market, dealership is offered by the various companies to the individual intermediaries

in promoting the sale of products. Before reaching an agreement with the company to act

as a dealer, normally every individual consider the profitability of the product mix offered

by the firm.

11.1@ LESSONAEN$ ACTIVITY

Should we evaluate a managers performance on the basis of controllable or non-

controllable costs? Why? Give your opinion.

11.1= KEY&OR$S

ar!inal cost: Change occurred in the cost of operations due to change in the level of

production.

" # $ %&nits': It is the level of units at which the firm neither incurs a loss nor earns

profit.

"#$ %(olume': It is the level of sales in Rupees at which the firm neither incurs a loss

nor earns profit.

)i*ed cost: It is a cost which is fixed or remains the same for irrespective level of

production.

(aria+le cost: It varies along with the level of production.

,ontri+ution: It is an amount of balance available after the deduction of variable cost

from the sales.

-ey factor: Factor of influence on the component of contribution.

$( ratio: Profit volume ration which is nothing but the ratio in between the contribution

and sales.

.esired profit: It is a profit level desired by the firm to earn at the given level of sales

volume.

11.1B CUESTIONS FOR $ISCUSSION

Define marginal cost.

202

2. Define marginal costing.

3.

4.

5.

6.

7.

8.

9.

What is Break Even Point Analysis?

Marginal Costing

Explain the Graphic approach of BEP analysis.

Briefly explain the profit volume ratio.

Explain the various kinds of managerial decisions.

Elucidate the key factor analysis.

List out the advantages of marginal costing.

Highlight the limitations of marginal costing.

11.10 SU!!ESTE$ REA$IN!S

R.L. Gupta and Radhaswamy, Advanced Accountancy.

V.K. Goyal, Financial Accounting, Excel Books, New Delhi.

Khan and Jain, Management Accounting.

S.N. Maheswari, Management Accounting.

S. Bhat, Financial Management, Excel Books, New Delhi.

Prasanna Chandra, Financial Management Theory and Practice, Tata McGraw

Hill, New Delhi (1994).

I.M. Pandey, Financial Management, Vikas Publishing, New Delhi.

Nitin Balwani, Accounting & Finance for Managers, Excel Books, New Delhi.

203

Das könnte Ihnen auch gefallen

- Cost & Managerial Accounting II EssentialsVon EverandCost & Managerial Accounting II EssentialsBewertung: 4 von 5 Sternen4/5 (1)

- Accounting and Finance Formulas: A Simple IntroductionVon EverandAccounting and Finance Formulas: A Simple IntroductionBewertung: 4 von 5 Sternen4/5 (8)

- Direct Costing AnalysisDokument6 SeitenDirect Costing AnalysisLaibaNoch keine Bewertungen

- Module 2 Marginal Cost and Decision Making & Methods of Calculationof Contribution or CostDokument12 SeitenModule 2 Marginal Cost and Decision Making & Methods of Calculationof Contribution or CostkedarambikarNoch keine Bewertungen

- Assignment of Cost Accounting 2Dokument9 SeitenAssignment of Cost Accounting 2Mrinal BishtNoch keine Bewertungen

- BEA Handouts 20Dokument8 SeitenBEA Handouts 20Suraj KumarNoch keine Bewertungen

- Break Even AnalysisDokument10 SeitenBreak Even AnalysisSai MalaNoch keine Bewertungen

- Unit 5Dokument15 SeitenUnit 5Ramesh Thangavel TNoch keine Bewertungen

- Variable Costing vs Absorption Costing: Key DifferencesDokument22 SeitenVariable Costing vs Absorption Costing: Key DifferencesVibhor AgarwalNoch keine Bewertungen

- Marginal costing techniques for profit planning and decision makingDokument18 SeitenMarginal costing techniques for profit planning and decision makingKishor Nag0% (1)

- Management AccountingDokument68 SeitenManagement AccountingNekibur DeepNoch keine Bewertungen

- Breakeven Analysis 0Dokument35 SeitenBreakeven Analysis 0Nistha Bisht100% (1)

- Costing 57189426Dokument10 SeitenCosting 57189426Zeeshan RahmanNoch keine Bewertungen

- CVP Analysis Break-Even Point CalculationDokument19 SeitenCVP Analysis Break-Even Point Calculationlaur33nNoch keine Bewertungen

- Marginal CostingDokument10 SeitenMarginal CostingNishant ModiNoch keine Bewertungen

- Material CostingDokument23 SeitenMaterial CostingGanesh somvanshiNoch keine Bewertungen

- Marginal CostingDokument9 SeitenMarginal CostingSam MishraNoch keine Bewertungen

- CVP Analysis-1Dokument40 SeitenCVP Analysis-1Gul Muhammad BalochNoch keine Bewertungen

- Marginal Costing and Its Application - ProblemsDokument5 SeitenMarginal Costing and Its Application - ProblemsAAKASH BAIDNoch keine Bewertungen

- Cost & Management AccountingDokument11 SeitenCost & Management AccountingSANJAY RATHINoch keine Bewertungen

- Contribution Margin Definition - InvestopediaDokument6 SeitenContribution Margin Definition - InvestopediaBob KaneNoch keine Bewertungen

- Chap1 Marginal Costing & Decision MakingDokument31 SeitenChap1 Marginal Costing & Decision Makingrajsingh15Noch keine Bewertungen

- Objectives of Cost-Volume-Profit AnalysisDokument7 SeitenObjectives of Cost-Volume-Profit AnalysisAnonNoch keine Bewertungen

- Cost - Direct Costing, CVP AnalysisDokument7 SeitenCost - Direct Costing, CVP AnalysisAriMurdiyantoNoch keine Bewertungen

- Session 4 Cost-Volume-Profit (CVP) AnalysisDokument46 SeitenSession 4 Cost-Volume-Profit (CVP) Analysischloe lamxdNoch keine Bewertungen

- Cost-Volume-Profit (CVP) Analysis SRMSDokument55 SeitenCost-Volume-Profit (CVP) Analysis SRMSSanchit MiglaniNoch keine Bewertungen

- Strategic Cost Management - Semester SummaryDokument15 SeitenStrategic Cost Management - Semester SummaryivandimaunahannnNoch keine Bewertungen

- Unit - 4 Marginal CostingDokument27 SeitenUnit - 4 Marginal CostingShreyash PardeshiNoch keine Bewertungen

- 03-04-2012Dokument62 Seiten03-04-2012Adeel AliNoch keine Bewertungen

- Break Even AnalysisDokument19 SeitenBreak Even AnalysissaadsaaidNoch keine Bewertungen

- Marginal Costing Is Very Helpful in Managerial Decision MakingDokument5 SeitenMarginal Costing Is Very Helpful in Managerial Decision MakingshankarinadarNoch keine Bewertungen

- Marginal Costing DecisionsDokument19 SeitenMarginal Costing Decisionsdivya8955Noch keine Bewertungen

- Absorption and Marginal CostingDokument58 SeitenAbsorption and Marginal CostingtokyadaluNoch keine Bewertungen

- Breakeven AnalysisDokument16 SeitenBreakeven AnalysisRahul Kaushal100% (1)

- Cost Volume Profit AnalysisDokument8 SeitenCost Volume Profit AnalysissachinremaNoch keine Bewertungen

- 202005272153381522au-Marginal Costing-2Dokument11 Seiten202005272153381522au-Marginal Costing-2GauravsNoch keine Bewertungen

- Relevant CostingDokument40 SeitenRelevant CostingUtsav ChoudhuryNoch keine Bewertungen

- Breakeven QuestionDokument14 SeitenBreakeven QuestionALI HAMEED0% (1)

- Pricing and Short Term Decision Making (Edited)Dokument58 SeitenPricing and Short Term Decision Making (Edited)Vaibhav SuchdevaNoch keine Bewertungen

- 38 Marginal CostingDokument9 Seiten38 Marginal CostingAbhishek SinhaNoch keine Bewertungen

- Cost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageDokument40 SeitenCost-Volume-Profit (CVP) Analysis: Understanding Break-Even Point, Margin of Safety and Operating LeverageJeejohn Sodusta0% (1)

- Marginal Costing Problems SolvedDokument29 SeitenMarginal Costing Problems SolvedUdaya ChoudaryNoch keine Bewertungen

- Calculate BEP, profit, sales and margin of safety from cost and revenue dataDokument3 SeitenCalculate BEP, profit, sales and margin of safety from cost and revenue dataNivedita Suresh KumarNoch keine Bewertungen

- Marginal Costing - NoteDokument18 SeitenMarginal Costing - NoteAnilNoch keine Bewertungen

- Cost accounting concepts and techniquesDokument12 SeitenCost accounting concepts and techniquessanjay sahooNoch keine Bewertungen

- Working Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadDokument26 SeitenWorking Capital, Pricing & Performance Management: Afzal Ahmed, Fca Finance Controller NagadsajedulNoch keine Bewertungen

- Relevant Costing-MBADokument33 SeitenRelevant Costing-MBAUtsav ChoudhuryNoch keine Bewertungen

- Session 12 CVP AnalysisDokument52 SeitenSession 12 CVP Analysismuskan mittalNoch keine Bewertungen

- Practice of Cost Volume Profit Breakeven AnalysisDokument4 SeitenPractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- Break-Even Analysis ExplainedDokument17 SeitenBreak-Even Analysis Explainedsana khanNoch keine Bewertungen

- Break-even Point Analysis: Determine When Profits BeginDokument29 SeitenBreak-even Point Analysis: Determine When Profits BeginDr. Yogesh Kumar SharmaNoch keine Bewertungen

- I Am Sharing 'Cost Accounting and Classification7280895122984483619' With YouDokument10 SeitenI Am Sharing 'Cost Accounting and Classification7280895122984483619' With Yousuraj banNoch keine Bewertungen

- 4) Relevant CostingDokument4 Seiten4) Relevant CostingAli IsaacNoch keine Bewertungen

- (At) 01 - Preface, Framework, EtcDokument8 Seiten(At) 01 - Preface, Framework, EtcCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Q1,2,3Dokument6 SeitenQ1,2,3Bhavika JoshiNoch keine Bewertungen

- 1 ++Marginal+CostingDokument71 Seiten1 ++Marginal+CostingB GANAPATHYNoch keine Bewertungen

- Method For Analyzing Cost BehaviorDokument6 SeitenMethod For Analyzing Cost BehaviorkashanpirzadaNoch keine Bewertungen

- ACC 2200 Milestone 1Dokument8 SeitenACC 2200 Milestone 1Akhuetie IsraelNoch keine Bewertungen

- Chapter On CVP 2015 - Acc 2Dokument16 SeitenChapter On CVP 2015 - Acc 2nur aqilah ridzuanNoch keine Bewertungen

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageVon EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageBewertung: 5 von 5 Sternen5/5 (1)

- SWOT AnalysisDokument1 SeiteSWOT AnalysisChaya SeebaluckNoch keine Bewertungen

- CSMDokument5 SeitenCSMChaya SeebaluckNoch keine Bewertungen

- Studies of Motivation Related To TeachersDokument1 SeiteStudies of Motivation Related To TeachersChaya SeebaluckNoch keine Bewertungen

- AccountingDokument33 SeitenAccountingChaya SeebaluckNoch keine Bewertungen

- Solutions Chapter 5Dokument13 SeitenSolutions Chapter 5Laila Al Suwaidi100% (2)

- Robin Sharma How To Be A Leader Without TitleDokument35 SeitenRobin Sharma How To Be A Leader Without Titleapi-19857048Noch keine Bewertungen

- Customer ServiceDokument3 SeitenCustomer ServiceChaya SeebaluckNoch keine Bewertungen

- Iso Quality MGTDokument1 SeiteIso Quality MGTChaya SeebaluckNoch keine Bewertungen

- Porter's FiveDokument2 SeitenPorter's FiveChaya SeebaluckNoch keine Bewertungen

- Six Sigma - Introduction To Analyze PhaseDokument1 SeiteSix Sigma - Introduction To Analyze PhaseChaya SeebaluckNoch keine Bewertungen

- Why Is Human Resource Management ImportantDokument4 SeitenWhy Is Human Resource Management ImportantChaya SeebaluckNoch keine Bewertungen

- Game TheoryDokument10 SeitenGame TheoryChaya SeebaluckNoch keine Bewertungen

- Yudhisthira PDFDokument6 SeitenYudhisthira PDFChaya SeebaluckNoch keine Bewertungen

- Yudhisthira PDFDokument6 SeitenYudhisthira PDFChaya SeebaluckNoch keine Bewertungen

- 7110 s02 QP 2Dokument6 Seiten7110 s02 QP 2Chaya SeebaluckNoch keine Bewertungen

- RecipesDokument40 SeitenRecipesChaya SeebaluckNoch keine Bewertungen

- What Is The Difference Between The Criminal and The Civil LawDokument4 SeitenWhat Is The Difference Between The Criminal and The Civil LawChaya SeebaluckNoch keine Bewertungen

- Programming FlowchartDokument105 SeitenProgramming FlowchartKinosraj Kumaran60% (5)

- General and Technical Interview QuestionsDokument28 SeitenGeneral and Technical Interview QuestionsAlka JosephNoch keine Bewertungen

- Vacancy Announcement 3 of 2023Dokument8 SeitenVacancy Announcement 3 of 2023gowoalistairNoch keine Bewertungen

- SAP FICO (Finance and Controlling) : SAP R/3 Systems Introduction To ERPDokument4 SeitenSAP FICO (Finance and Controlling) : SAP R/3 Systems Introduction To ERPibmangiNoch keine Bewertungen

- Accounting Equation and Double Entry BookkeepingDokument29 SeitenAccounting Equation and Double Entry BookkeepingArvin ToraldeNoch keine Bewertungen

- Regional Financial Accounting System AnalysisDokument12 SeitenRegional Financial Accounting System AnalysisMaia NahakNoch keine Bewertungen

- ACTG 360 Midterm Exam ReviewDokument3 SeitenACTG 360 Midterm Exam ReviewSubha ManNoch keine Bewertungen

- Accounting Equation and TransactionsDokument12 SeitenAccounting Equation and TransactionsAl Francis GuillermoNoch keine Bewertungen

- General Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementDokument15 SeitenGeneral Ledger Debits and Credits Normal Account Balances Journal Entries The Income StatementPriyashini RajasegaranNoch keine Bewertungen

- Legacy of Wisdom Academy of Dasmariñas, IncDokument2 SeitenLegacy of Wisdom Academy of Dasmariñas, InczavriaNoch keine Bewertungen

- Chapter 1 - The Importance O.doDokument17 SeitenChapter 1 - The Importance O.doMarielle GrengiaNoch keine Bewertungen

- Chart of AccountsDokument9 SeitenChart of AccountsMarius PaunNoch keine Bewertungen

- Accenture Professional Services IndustryDokument32 SeitenAccenture Professional Services IndustryEsayas DeguNoch keine Bewertungen

- Basic Accounting SyllabusDokument16 SeitenBasic Accounting SyllabusMerdzNoch keine Bewertungen

- WRD 26e - Se PPT - CH 01Dokument19 SeitenWRD 26e - Se PPT - CH 01Vĩnh TríNoch keine Bewertungen

- Book Keeping & Accounts/Series-3-2007 (Code2006)Dokument11 SeitenBook Keeping & Accounts/Series-3-2007 (Code2006)Hein Linn Kyaw100% (3)

- Cash and Accounts Receivable PDFDokument11 SeitenCash and Accounts Receivable PDFAndrew Benedict PardilloNoch keine Bewertungen

- Cash Inflow and OutflowDokument6 SeitenCash Inflow and OutflowMubeenNoch keine Bewertungen

- Trial Balance and Financial Statements for 31st Dec 2019Dokument10 SeitenTrial Balance and Financial Statements for 31st Dec 2019Designer CliqueNoch keine Bewertungen

- Introduction To AccountingDokument162 SeitenIntroduction To AccountingKunjunni MashNoch keine Bewertungen

- Management Syllabus For UPSC Main Examination: Paper-IDokument4 SeitenManagement Syllabus For UPSC Main Examination: Paper-IDeep DaveNoch keine Bewertungen

- Functions of AISDokument2 SeitenFunctions of AISHannah YnciertoNoch keine Bewertungen

- Wonder (Pvt) Ltd Company ACCN 101 Group AssignmentDokument37 SeitenWonder (Pvt) Ltd Company ACCN 101 Group AssignmentSimphiwe KarrenNoch keine Bewertungen

- AST LTCC ComputationDokument9 SeitenAST LTCC ComputationeiraNoch keine Bewertungen

- Journal Balance Sheet Activity PDFDokument1 SeiteJournal Balance Sheet Activity PDFIrish CanutoNoch keine Bewertungen

- Udoh, Emmanuel Billy: Personal StatementsDokument3 SeitenUdoh, Emmanuel Billy: Personal StatementsImmanuel Billie AllenNoch keine Bewertungen

- Non Profit Making OrganizationsDokument6 SeitenNon Profit Making OrganizationsangaNoch keine Bewertungen

- Standard Costing Journal EntriesDokument11 SeitenStandard Costing Journal EntriesRachel LeachonNoch keine Bewertungen

- Revenue Accounting and RecognitionDokument7 SeitenRevenue Accounting and RecognitionjsphdvdNoch keine Bewertungen

- Analyze Costs Using Marginal CostingDokument13 SeitenAnalyze Costs Using Marginal CostingmohitNoch keine Bewertungen

- Drill12 Drill13 Manufacturing BusinesDokument6 SeitenDrill12 Drill13 Manufacturing BusinesAngelo FelizardoNoch keine Bewertungen