Beruflich Dokumente

Kultur Dokumente

Stop Loss Requirements and The Pursuit of Self-Funding. A Fact-Based Analysis

Hochgeladen von

trninsgrp0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

78 Ansichten4 SeitenTernian Insurance Group offers a self-funded health insurance plan that requires only 25% participation for stop loss coverage, making it affordable for employers. Traditional stop loss requires 75-80% participation that many employers cannot meet. Ternian's plan gives credit for employees with other coverage and only requires offering coverage to 70% of employees in 2015. This can significantly reduce costs for employers struggling to provide affordable healthcare to lower-wage workers while remaining ACA compliant.

Originalbeschreibung:

Ternian Stop Loss White Paper

Originaltitel

Ternian White Paper StopLoss 05282014

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenTernian Insurance Group offers a self-funded health insurance plan that requires only 25% participation for stop loss coverage, making it affordable for employers. Traditional stop loss requires 75-80% participation that many employers cannot meet. Ternian's plan gives credit for employees with other coverage and only requires offering coverage to 70% of employees in 2015. This can significantly reduce costs for employers struggling to provide affordable healthcare to lower-wage workers while remaining ACA compliant.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

78 Ansichten4 SeitenStop Loss Requirements and The Pursuit of Self-Funding. A Fact-Based Analysis

Hochgeladen von

trninsgrpTernian Insurance Group offers a self-funded health insurance plan that requires only 25% participation for stop loss coverage, making it affordable for employers. Traditional stop loss requires 75-80% participation that many employers cannot meet. Ternian's plan gives credit for employees with other coverage and only requires offering coverage to 70% of employees in 2015. This can significantly reduce costs for employers struggling to provide affordable healthcare to lower-wage workers while remaining ACA compliant.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Timothy L.

Cook, Strategic Business Development, Ternian Insurance Group LLC

Ternian Insurance Group, LLC, 7310 N 16th St, Ste 100, Phoenix, Arizona 85020, 602.216.0006

www.ternian.com

Stop loss requirements

and the pursuit of self-

funding. A fact-based

analysis.

ternian

An unprecedented 25% participation requirement for stop loss within Ternians

plans will allow employers to offer this coverage to all classes of eligible employees.

Self-funded benets are emerging as an ideal approach for employers looking to offer

an affordable minimum essential value plan to eligible workers. In fact, a recent survey

of health insurance executives reveals that 82 percent have experienced a growing

level of interest among employers for self-funded group insurance.

1

Self-funded

benets offer a variety of advantages for mid-size and large employers, including:

Unlike fully-insured plans, these plans are not tied to community rating and are

not subject to state insurance laws or many ACA requirements such as the health

insurance industry fee. As a result of these requirements, many health insurance

carriers have predicted that premiums for fully-insured plans may increase in the

double digits for 2015.

Self-funded benefts are not subject to reviews by HHS for premium increases.

These plans can be customized to meet the needs of employees and an

employers budget.

The challenge for employers with lower-wage or hourly workers

Non-discrimination testing does require that the same ACA-compliant plan be offered

to all levels and classes of eligible employees, regardless of whether the benets are

self-funded or fully insured. This is a challenge for many employers who have

traditionally offered major medical coverage as a carve-out available only to managers

and home-ofce employees. Thats because low participation among hourly workers

(such as those employed in the retail, service and hospitality industries) will mean that

employers cannot meet the strict participation requirements of stop loss carriers.

Stop loss is a critical element of self-funded coverage, especially in light of the ACAs

elimination of certain benet restrictions such as lifetime maximums, which can

drive a large volume of high-cost, catastrophic claims. However, employers with low

participation rates (below 75 percent) are not generally considered candidates

for stop loss coverage. Some stop loss insurers have slightly higher or slightly lower

participation thresholds, but on average, anything below 80 percent will typically

not receive a bindable stop loss quote.

The self-funding dilemma: Traditional stop loss

participation requirements will prevent many

employers from pursuing self-funding as an

affordable solution for ACA-compliance.

ternian

Employers with low

participation rates

(below 75 percent)

are not generally

considered

candidates for

stop loss coverage

ternian

Ternians self-

funded plan option

requires as little as

25% participation

for stop loss

coverage to be

bindable, making

this is an extremely

affordable solution

for employers.

This level of participation will be impossible for many employers to meet, especially

those in industries mentioned above. Thats because younger, lower wage workers

have a signicant price sensitivity to benets, even when they are offered with a

sizable employer contribution. A recent research study demonstrated that among

full-time eligible employees with base pay between $15,000 and $20,000, only

37% elected health coverage.

2

In the small group who did elect health benets,

the employee contribution to premiums averaged just 5.7% of their total pay.

Age may also have an impact on participation rates. According to a recent Wall Street

Journal article, in 2014, young workers in the U.S. signed up for employer-sponsored

health plans at a lower rate than last year, in spite of the individual mandate.

THE SOLUTION: Ternians self-funding approach

allows for as little as 25% participation

Ternian has partnered with a forward-thinking stop loss carrier that is willing to adapt

its participation requirements to meet the changing needs of employers in light of the

ACA. Our self-funded plan option requires as little as 25% participation for stop loss

coverage to be bindable, making this is an extremely affordable solution for employers.

In addition, our solution gives full credit for coverage elsewhere waivers where an

employee has health insurance through a spouse or government exchangemeaning

that these individuals wont count toward participation rates. Census bureau studies

suggest that this number will be approximately 33%

5

of the eligible employees. In

addition, since only 70% of employees need to be offered coverage in 2015 according

to new rules issued for the employer mandate, the total number of enrollees can be

reduced even further.

6

The following chart illustrates the cost savings that can be achieved by employers

with lower participation through Ternians solution:

Total employees 1,500

Less part time employees and measurement

period employees (50%) -750

Less waivers for coverage elsewhere

(33% of new eligible employees)** -145

Full time eligible employees 605

Employees that must be offered coverage

(70% of full time eligible employees) * 424

Carrier required enrollment to meet

a 25% participation requirement 106

Less 90 employees currently enrolled

in a major medical carve out plan -90

Net new enrollees required 16

Estimated increase in monthly employer

cost at a $250 contribution level $3,969

If desired, Ternians self-funded plan can be aggressively priced with the lowest level

of ACA-compliant benets. The employer can then offer class dened supplemental

benets that dont coordinate with the major medical for higher-paid employees while

still avoiding discrimination issues.

Unless employers are willing to contribute to major medical plan premiums to

the extent that the employees costs reaches nearly zero, a traditional self-funded

approach will not be an option for many organizations. However, Ternians plans

will put self-funded benets within reach for many employers, regardless of the

age or income levels of their eligible employees.

To learn more about this solution, contact us today

at 602-216-0006.

1. Munich Health Survey. February, 2014. http://www.businesswire.com/news/home/20130415005132/en/

Health-Insurers-Anticipate-Increase-Self-Funding-U.S.-Employers#.U2JZwKV220u

2. ADP. How Income Impacts Employee Health Benefts Participation White Paper. https://www.adp.com/media/

press-releases/2013-press-releases/adp-research-institute-study-employee-income-is-a-determining-

factor-in-benets-participation.aspx

3. Francis, Theo. Wall Street Journal. Young Workers Fail to Flock to Employer Health Plans: Take-Up Rates

Among Those Under 30 Show Unexpected Decline. April 3, 2014. http://online.wsj.com/news/articles/

SB10001424052702303847804579479181342342704

4. Albert, LaRea. Stay the course. Benefts Pro. http://m.beneftspro.com/2013/08/05/stay-the-course

5. Hubert Janicki , US Census Bureau. Employer-based Health Insurance 2010. Issued February 2013.

https://www.census.gov/prod/2013pubs/p70-134.pdf

6. www.irs.gov/uac/Newsroom/Questions-and-Answers-on-Employer-Shared-Responsibility-Provisions-

Under-the-Affordable-Care-Act

ternian

Das könnte Ihnen auch gefallen

- Summary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareVon EverandSummary, Analysis & Review of Philip Moeller’s Get What’s Yours for MedicareNoch keine Bewertungen

- WP Insight HCR Impact On Rewards StrategiesDokument4 SeitenWP Insight HCR Impact On Rewards StrategiesGeorge B. BuckNoch keine Bewertungen

- Human Resources and Surviving Health Reform: by Mike TurpinDokument4 SeitenHuman Resources and Surviving Health Reform: by Mike TurpinMuhammad UsmanNoch keine Bewertungen

- Social Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionVon EverandSocial Security / Medicare Handbook for Federal Employees and Retirees: All-New 4th EditionNoch keine Bewertungen

- Financial Decision-Making Theory and The Small Employer Health Insurance Market in TexasDokument17 SeitenFinancial Decision-Making Theory and The Small Employer Health Insurance Market in TexasSajid AnothersonNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationVon EverandTextbook of Urgent Care Management: Chapter 21, Employment Contracts and CompensationNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 22, Health Plan ContractingVon EverandTextbook of Urgent Care Management: Chapter 22, Health Plan ContractingNoch keine Bewertungen

- Eow HC Aca Upheld 062812Dokument4 SeitenEow HC Aca Upheld 062812marshall_johnso6704Noch keine Bewertungen

- 2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015Von Everand2015 Trends and Predictions Guide for Small Business: Everything you need to know to run a successful business in 2015Noch keine Bewertungen

- The Great Cost ShiftDokument31 SeitenThe Great Cost ShiftCenter for American ProgressNoch keine Bewertungen

- Maximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsVon EverandMaximize Your Medicare (2019 Edition): Understanding Medicare, Protecting Your Health, and Minimizing CostsBewertung: 5 von 5 Sternen5/5 (1)

- DRC Oct 2012 Without CartoonsDokument21 SeitenDRC Oct 2012 Without CartoonsdallaschamberNoch keine Bewertungen

- Executive Perspectives: Hsas More Effective at Consumer Engagement Than HrasDokument4 SeitenExecutive Perspectives: Hsas More Effective at Consumer Engagement Than HrasAutomotive Wholesalers Association of New EnglandNoch keine Bewertungen

- Employee BenefitsDokument26 SeitenEmployee BenefitsSaad SaeedNoch keine Bewertungen

- VINCENT A ROCCHI - TheGuardianLifeInsuranceCompany - Fall2011Dokument30 SeitenVINCENT A ROCCHI - TheGuardianLifeInsuranceCompany - Fall2011studentATtempleNoch keine Bewertungen

- NFIB HealthcareDokument30 SeitenNFIB HealthcareworkitrichmondNoch keine Bewertungen

- Affordable Care Act Literature ReviewDokument4 SeitenAffordable Care Act Literature Reviewdkrnkirif100% (1)

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterVon EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNoch keine Bewertungen

- Health-Care Reform: Insurance Exchanges: Income Solutions Wealth ManangementDokument2 SeitenHealth-Care Reform: Insurance Exchanges: Income Solutions Wealth ManangementIncome Solutions Wealth ManagementNoch keine Bewertungen

- How To Create Effective Employee Benefit Programs: Step 1Dokument6 SeitenHow To Create Effective Employee Benefit Programs: Step 1Ana C. SobremonteNoch keine Bewertungen

- ACA White PaperDokument4 SeitenACA White PaperTom GaraNoch keine Bewertungen

- JP Griffin Group White Paper Small Business Self FundingDokument8 SeitenJP Griffin Group White Paper Small Business Self FundingVicente TorresNoch keine Bewertungen

- Retirement Breach in Defined Contribution Plans (From HelloWallet)Dokument27 SeitenRetirement Breach in Defined Contribution Plans (From HelloWallet)MarketplaceNoch keine Bewertungen

- Employee BenefitsDokument16 SeitenEmployee BenefitsCindy ConstantinoNoch keine Bewertungen

- Medicare Term PaperDokument4 SeitenMedicare Term Paperafdtzvbex100% (1)

- ObamacareintranetDokument3 SeitenObamacareintranetapi-157096525Noch keine Bewertungen

- U.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Dokument4 SeitenU.S. Employers Expect Health Care Costs To Rise 4% in 2015: SEPTEMBER 2014Automotive Wholesalers Association of New EnglandNoch keine Bewertungen

- Good Small Business Actionlist: Introducing A Cafeteria Benefits ProgramDokument5 SeitenGood Small Business Actionlist: Introducing A Cafeteria Benefits ProgramhdfcblgoaNoch keine Bewertungen

- Majority of Companies Taking Immediate Steps To Minimize Exposure To Excise TaxDokument4 SeitenMajority of Companies Taking Immediate Steps To Minimize Exposure To Excise TaxAutomotive Wholesalers Association of New EnglandNoch keine Bewertungen

- Trends in Healthcare Payments Annual Report 2015 PDFDokument38 SeitenTrends in Healthcare Payments Annual Report 2015 PDFAnonymous Feglbx5Noch keine Bewertungen

- According To The Small Business AdministrationDokument12 SeitenAccording To The Small Business AdministrationJulie Ann SisonNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 40, Implementing Occupational MedicineVon EverandTextbook of Urgent Care Management: Chapter 40, Implementing Occupational MedicineNoch keine Bewertungen

- Summary of Health Care Reform SeminarDokument8 SeitenSummary of Health Care Reform SeminarTheFedeliGroupNoch keine Bewertungen

- The Insider’s Guide to Obamacare’s Open Enrollment (2015-2016)Von EverandThe Insider’s Guide to Obamacare’s Open Enrollment (2015-2016)Noch keine Bewertungen

- Chapter 6 - Capitation in Provider ReimbursementDokument23 SeitenChapter 6 - Capitation in Provider ReimbursementAdityaNoch keine Bewertungen

- High Deductible Health PlansDokument6 SeitenHigh Deductible Health PlansiggybauNoch keine Bewertungen

- 13) Practices of Compensation and Benefits in 5Dokument30 Seiten13) Practices of Compensation and Benefits in 5thehrmaven2013Noch keine Bewertungen

- Healthcare Reform and You: Key ProvisionsDokument5 SeitenHealthcare Reform and You: Key Provisionsapi-252555369Noch keine Bewertungen

- Accenture Drowning in Bad DebtDokument4 SeitenAccenture Drowning in Bad DebtAnna NguyenNoch keine Bewertungen

- Perman 14rDokument17 SeitenPerman 14rVon J. MoreNoch keine Bewertungen

- Employee Group Benefit Insight: An Informal Reference GuideVon EverandEmployee Group Benefit Insight: An Informal Reference GuideNoch keine Bewertungen

- Assignment HRDokument6 SeitenAssignment HRAnuNoch keine Bewertungen

- 2020 Employer Toolkit V12 1Dokument22 Seiten2020 Employer Toolkit V12 1sachinitsmeNoch keine Bewertungen

- Vince Sisneros Project 2Dokument8 SeitenVince Sisneros Project 2api-279313843Noch keine Bewertungen

- Acahealthcare Update 4102014Dokument5 SeitenAcahealthcare Update 4102014api-250294225Noch keine Bewertungen

- Comparative Health Information Management 4th Edition Peden Solutions Manual 1Dokument13 SeitenComparative Health Information Management 4th Edition Peden Solutions Manual 1daisy100% (32)

- Textbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersVon EverandTextbook of Urgent Care Management: Chapter 34, Engaging Accountable Care Organizations in Urgent Care CentersNoch keine Bewertungen

- E-Portfolio Term Project - Provider Relations Manager Bret Gashler - FinalDokument9 SeitenE-Portfolio Term Project - Provider Relations Manager Bret Gashler - Finalapi-325641098Noch keine Bewertungen

- Affordable Care Act: Where Do We Go From Here?: Presented ToDokument55 SeitenAffordable Care Act: Where Do We Go From Here?: Presented TonketchumNoch keine Bewertungen

- Affordable Care Act: Where Do We Go From Here?: Presented ToDokument70 SeitenAffordable Care Act: Where Do We Go From Here?: Presented TonketchumNoch keine Bewertungen

- Characteristics of Traditional Group InsuranceDokument8 SeitenCharacteristics of Traditional Group Insurancechsureshkumar1985Noch keine Bewertungen

- FS PrivateInsuranceDokument2 SeitenFS PrivateInsuranceIndiana Family to FamilyNoch keine Bewertungen

- About FW TaylorDokument9 SeitenAbout FW TaylorGayaz SkNoch keine Bewertungen

- Parts Price ListDokument5.325 SeitenParts Price ListAlva100% (1)

- PDS Air CompressorDokument1 SeitePDS Air Compressordhavalesh1Noch keine Bewertungen

- MockboardexamDokument13 SeitenMockboardexamJayke TanNoch keine Bewertungen

- Autonics KRN1000 DatasheetDokument14 SeitenAutonics KRN1000 DatasheetAditia Dwi SaputraNoch keine Bewertungen

- Q2 Module 2 CESC WEEK 2Dokument17 SeitenQ2 Module 2 CESC WEEK 2rectojhon7100% (1)

- Standard Wiring Colors - Automation & Control Engineering ForumDokument1 SeiteStandard Wiring Colors - Automation & Control Engineering ForumHBNBILNoch keine Bewertungen

- Uploading, Sharing, and Image Hosting PlatformsDokument12 SeitenUploading, Sharing, and Image Hosting Platformsmarry janeNoch keine Bewertungen

- Arvind Textiles Internship ReportDokument107 SeitenArvind Textiles Internship ReportDipan SahooNoch keine Bewertungen

- Resume ObjectiveDokument2 SeitenResume Objectiveapi-12705072Noch keine Bewertungen

- Determination of The Amount of Hardness in Water Using Soap SolutionDokument3 SeitenDetermination of The Amount of Hardness in Water Using Soap SolutionlokeshjoshimjNoch keine Bewertungen

- Service Bulletin: Service Bulletin NUMBER: 8.8/134A Caterpillar: Confidential Green Page 1 of 8Dokument8 SeitenService Bulletin: Service Bulletin NUMBER: 8.8/134A Caterpillar: Confidential Green Page 1 of 8GutsavoNoch keine Bewertungen

- Pharmacology NCLEX QuestionsDokument128 SeitenPharmacology NCLEX QuestionsChristine Williams100% (2)

- 1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersDokument12 Seiten1962 BEECHCRAFT P35 Bonanza - Specifications, Performance, Operating Cost, Valuation, BrokersRichard LundNoch keine Bewertungen

- Engineer Noor Ahmad CVDokument5 SeitenEngineer Noor Ahmad CVSayed WafiNoch keine Bewertungen

- 2018 Master Piping Products Price ListDokument84 Seiten2018 Master Piping Products Price ListSuman DeyNoch keine Bewertungen

- DPS Ibak en PDFDokument9 SeitenDPS Ibak en PDFjsenadNoch keine Bewertungen

- Questions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcDokument8 SeitenQuestions - Mechanical Engineering Principle Lecture and Tutorial - Covering Basics On Distance, Velocity, Time, Pendulum, Hydrostatic Pressure, Fluids, Solids, EtcshanecarlNoch keine Bewertungen

- The 8051 Microcontroller & Embedded Systems: Muhammad Ali Mazidi, Janice Mazidi & Rolin MckinlayDokument15 SeitenThe 8051 Microcontroller & Embedded Systems: Muhammad Ali Mazidi, Janice Mazidi & Rolin MckinlayAkshwin KisoreNoch keine Bewertungen

- Role of SpeakerDokument11 SeitenRole of SpeakerSnehil AnandNoch keine Bewertungen

- Daily Price Monitoring: Retail Prices of Selected Agri-Fishery Commodities in Selected Markets in Metro ManilaDokument3 SeitenDaily Price Monitoring: Retail Prices of Selected Agri-Fishery Commodities in Selected Markets in Metro ManilaRio CorralNoch keine Bewertungen

- C.F.A.S. Hba1C: English System InformationDokument2 SeitenC.F.A.S. Hba1C: English System InformationtechlabNoch keine Bewertungen

- Toyota Auris Corolla 2007 2013 Electrical Wiring DiagramDokument22 SeitenToyota Auris Corolla 2007 2013 Electrical Wiring Diagrampriscillasalas040195ori100% (125)

- Fund For Local Cooperation (FLC) : Application FormDokument9 SeitenFund For Local Cooperation (FLC) : Application FormsimbiroNoch keine Bewertungen

- Branch CodeDokument3 SeitenBranch CodeAhir MukherjeeNoch keine Bewertungen

- Cassava Starch Granule Structure-Function Properties - Influence of Time and Conditions at Harvest On Four Cultivars of Cassava StarchDokument10 SeitenCassava Starch Granule Structure-Function Properties - Influence of Time and Conditions at Harvest On Four Cultivars of Cassava Starchwahyuthp43Noch keine Bewertungen

- SchlumbergerDokument29 SeitenSchlumbergerAitazaz Ahsan100% (5)

- AMAZONS StategiesDokument2 SeitenAMAZONS StategiesPrachi VermaNoch keine Bewertungen

- Anklet - Google SearchDokument1 SeiteAnklet - Google SearchManu KhannaNoch keine Bewertungen

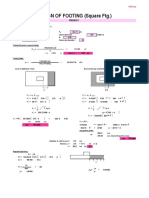

- Design of Footing (Square FTG.) : M Say, L 3.75Dokument2 SeitenDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNoch keine Bewertungen