Beruflich Dokumente

Kultur Dokumente

Basel II Implications For Structured Finance

Hochgeladen von

KofikoduahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Basel II Implications For Structured Finance

Hochgeladen von

KofikoduahCopyright:

Verfügbare Formate

Basel II Implications for Structured Finance

Basel II is the new regulatory framework that will apply to banks worldwide from 2007. The

Capital Requirements ire!ti"e is the legal te#t that will gi"e for!e to Basel II in the $% and on

whi!h dis!ussions should start "ery soon at the $uropean &arliament. Basel I was instrumental in

the de"elopment of se!uritisation and more generally of stru!tured finan!e. %nder Basel I'

se!uritisation had be!ome a !lassi! te!hnique that allowed banks to de!rease the amount of

regulatory !apital for some assets on their balan!e sheets' while not redu!ing the e!onomi!

!apital (designed to !apture the true e!onomi! risks asso!iated with those assets) to the same

e#tent. *s Basel II aims to better align regulatory !apital with e!onomi! !apital' one of the key

dri"ers of se!uritisation may disappear and one should legitimately question whether

se!uritisation and stru!tured finan!e still make sense in the !onte#t of Basel II.

Determining Regulatory Capital Charges

+ne ma,or !hange introdu!ed by Basel II !ompared with Basel I deals with the introdu!tion of

new approa!hes to determining regulatory !apital !harges. Capital !harges for market risk will not

!hange' whereas the !apital !harges for !redit risk and operational risk will. +perational risk is a

new type of risk that was not !onsidered under Basel I and refers to the risk of dire!t losses

resulting from fraud' te!hnology failures' legal risks or trade settlement errors' among other

things.

In !ontrast to the situation under Basel I' !redit risk !apital !harges will be!ome mu!h more risk-

sensiti"e as they will be linked to !redit ratings. Banks will either use publi! ratings published by

rating agen!ies under the simplest approa!h or the standardised approa!h or they will use their

own internal ratings under the more ad"an!ed internal ratings-based (IRB) approa!hes.

Credit !harges for se!uritisation e#posures are' howe"er' treated somewhat differently from

!orporate loans or bonds. rather more !onser"ati"ely' in fa!t. %nder the standardised approa!h'

risk weights are mu!h more !onser"ati"e for non-in"estment grade or unrated e#posures. /or

instan!e' a se!uritisation originator retaining a Ba2 tran!he should 0dedu!t0 the amount of the

tran!he from its regulatory !apital1 this is the 0one-for-one0 rule (one euro of !apital for one euro

of e#posure) whi!h !orresponds to a risk weight of 234 per !ent whi!h equals2250 per !ent. In

!omparison' a bank in"estor buying a Ba2 !orporate bond should apply a risk weight of 200 per

!ent' !orresponding to a !apital requirement of 4 per !ent of the amount of their in"estment.

IRB Approaches

The same differen!e in treatment for se!uritisation e#posures also applies to banks using the IRB

approa!hes. Indeed' Basel II does not re!ognise internal ratings determined by banks for

se!uritisation e#posures. Referring to the 0internal ratings-based0 approa!h in the !ase of

se!uritisation e#posures is therefore somewhat misleading. Instead of using internal ratings' IRB

banks may only use publi! ratings by rating agen!ies for rated tran!hes (ratings-based approa!h

- RB*)' or a regulatory formula (super"isory formula) for unrated tran!hes. 6owe"er' to be

perfe!tly fair' re!ognition of internal assessments does o!!ur in the "ery spe!ifi! !ase of liquidity

lines or !redit enhan!ements e#tended by sponsor banks to *BC& !onduits.

%nder the RB*' there are three different sets of risk weightings (linking risk weightings and publi!

ratings) that may be used depending on the granularity of the underlying pool of assets and the

seniority of the !onsidered tran!he. The lowest risk weights will be a!hie"ed for senior tran!hes

ba!ked by granular pools (residential mortgages or retail assets).

Implications of New Rules

7hat are the likely impli!ations of these new rules for se!uritisation issuers and in"estors8 Basel

II has in fa!t already had an impa!t on issuers' with banks ha"ing been a!ti"e in setting up

spe!ial task for!es to adapt their IT infrastru!tures and pro!esses. The implementation !osts of

Basel II ha"e been estimated at between 9200m and 9200m for ea!h large bank.

Beyond this transitional phase' the key benefi!iaries of Basel II will be those banks that hold a

ma,ority of high-grade or retail assets' while those banks that hold a ma,ority of low-grade assets

are likely to lose out as a result of the !hanges. *!!ording to the findings of the :uantitati"e

Impa!t ;tudy that the Basel Committee asked banks to !omplete in 200<' more !redit !apital will

be needed globally for banks= lending to so"ereigns' small banks and !orporates' or for

spe!ialised lending (pro,e!t finan!e) e#posures. >ess !redit !apital will be needed for portfolios of

;?$s' residential mortgages' retail assets and !redit !ards. Those banks that spe!ialise in

!onsumer lending are therefore more likely to benefit from Basel II than those with a different

fo!us.

To what use will the benefi!iaries of Basel II put their gain in regulatory !apital8 They may use the

e#tra !ushion to redu!e their !apital (through share buyba!ks' for instan!e)' boost loan

origination' de"elop new a!ti"ities' or e"en buy or merge with those entities that suffer from the

Basel II !hanges' depending on market !onditions. %ltimately' Basel II may well en!ourage

banking !onsolidation or e"en !ross-border mergers in $urope.

Coming ba!k to se!uritisation' it still seems to make sense for banks to se!uritise low-grade

assets to ensure that regulatory !apital remains at an a!!eptable le"el and to shift risks off their

balan!e sheets. @onetheless' banks may be less in!enti"ised to se!uritise high-grade or retail

assets as these assets will attra!t a lower le"el of regulatory !apital if they retain them on the

balan!e sheet. They may' howe"er' use them as !ollateral for on-balan!e-sheet finan!ings' su!h

as !o"ered bonds' stru!tured !o"ered bonds' or other types of !ollateralised issuan!es or

se!ured fundings.

Impact on Structured Finance Instruments

Basel II is likely to ha"e an impa!t on other stru!tured finan!e instruments' namely !redit

deri"ati"es and syntheti! se!uritisation' (stru!tured) !o"ered bonds or *BC& programmes. The

!urrent Basel II treatment for !redit deri"ati"es is somewhat !onser"ati"e. /or both single-name

and portfolio !redit deri"ati"es' Basel II !apital !harges are not determined by referen!e to a

double default of the underlying referen!e obligor or portfolio and the deri"ati"e !ounterparty' but

look solely to the !ounterparty.

In the !ase of syntheti! se!uritisation' spe!ial purpose "ehi!les (;&As) are generally not

re!ognised as eligible prote!tion pro"iders' e"en in a !ase where they are fully !ollateralised.

These !urrent !onser"ati"e rules for !redit deri"ati"es and syntheti! se!uritisation may for!e

issuers to restru!ture !urrent or future deals or e"en to stop issuan!e. @ote' howe"er' that the

Basel Committee and the International +rganisation of ;e!urities Commissions (I+;C+) are

,ointly working on refining these rules and other trading book issues. Current Basel II rules may

well !hange "ery soon.

Basel II may also impa!t !o"ered bonds' stru!tured or plain !o"ered bonds. ;tri!tly speaking'

their regulatory treatment is not dire!tly addressed within the Basel II a!!ord' but through the

Capital Requirements ire!ti"e in $urope. Basel II risk weights for (stru!tured) !o"ered bonds will

be determined by referen!e to the bank issuing the !o"ered bonds' rather than by referen!e to

the legal or stru!tural prote!tion of the !o"ered bonds themsel"es. These rules will on balan!e

benefit highly rated banks and may redu!e the in!enti"es to issue stru!tured !o"ered bonds with

dynami! stru!tural prote!tions.

Beyond that' some banks' espe!ially residential mortgage banks' will ha"e to de!ide whi!h way

to go for funding1 issue !o"ered bonds or se!uritise8 There seems to be no !lear ad"antage for

one solution or the other from a pure Basel II perspe!ti"e' although on a !ase-by-!ase basis one

may be preferred to another. The !hoi!e will !ertainly be dri"en by other !onsiderations1 spread

and !ost of funding of !o"ered bonds "ersus *aa ?B;. liquidity. and the need to maintain

different funding sour!es. Regulation may also influen!e the issuers= de!ision' for instan!e' the

/;* in the %B has adopted a soft rule asking %B banks to pro"ide ,ustifi!ation in the e"ent that

they issue !o"ered bonds for more than C per !ent of their assets.

ABCP Programmes

*BC& programmes are also likely to be impa!ted by Basel II' with potentially fewer bonds being

stored in *BC& !onduits. The margin deri"ed from this a!ti"ity will be squeeDed by the potentially

in!reasing !osts of liquidity lines e#tended by sponsor banks (more regulatory !apital will be

needed for those liquidity lines) and the potentially de!reasing spreads on the (in"estment-grade)

bonds stored in those !onduits (less regulatory !apital will be required for those bonds). In

addition' *BC& !onduits may pur!hase more trade re!ei"ables1 Basel II will somewhat in!rease

regulatory !apital for IRB banks lending to small and medium-siDed enterprises (;?$s)' whi!h

may translate into in!reased funding !osts for those ;?$s. ;e!uritising trade re!ei"ables through

*BC& programmes may therefore pro"e an attra!ti"e sour!e of funding for them.

Basel II will also lead to the restru!turing of liquidity lines pro"ided by *BC& sponsor banks. &ure

liquidity lines or alternati"e forms of liquidity lines relying on market me!hanism will be put in

pla!e to a!hie"e the lowest risk weights. In the e"ent that this pro"es impossible' liquidity lines

may !on"ersely be simplified to !o"er other risks than pure liquidity risk (typi!ally !redit risk of the

underlying assets). /inally' Basel II may well lead to more fully supported *BC& programmes.

Implications for Bank Inestors

Bank in"estors will also be impa!ted by Basel II and will ha"e to take a fresh look at their

in"estment strategies for se!uritisation. 7hi!h regulatory approa!h should they apply -

standardised or IRB8 *nd why8 7hi!h se!urities should they buy' hold and sell8 7hat will be the

!hanges in the in"estor base' the liquidity' the spreads8 ?any su!h questions need to be

addressed by bank in"estors.

+ne parti!ular issue' that of se!uritisation tran!hes rated Ba and below' is worth e#amining. ;u!h

tran!hes attra!t "ery high risk weightings for bank in"estors. *s a !onsequen!e' a bank in"estor

may well de!ide not to buy these tran!hes and they may end up being sold outside the Basel II

sphere. Con"ersely' a bank in"estor may well a!!umulate those tran!hes' repa!kage them as a

C+ of Ba-rated tran!hes' sell the senior C+ tran!he and keep the equity tran!he. This equity

tran!he will be dedu!ted from its !apital' but the e!onomi!s might turn to be highly profitable.

Regulatory arbitrages may well also de"elop for se!uritisation e#posures. Banks running the

standardised approa!h are in a stronger position than banks running the IRB approa!h when

holding Ba-rated tran!hes' while the !ontrary is the !ase when holding senior tran!hes. In this

!onte#t' why not !ontemplate 0regulatory swaps0 between an IRB bank and a standardised bank

whereby ea!h bank e#!hanges the total returns on the tran!hes they hold for the other bank8

6owe"er' it is not !rystal !lear how su!h swaps would be addressed by Basel II' if addressed at

all.

Conclusion

Basel II is a !omple# a!!ord that will undoubtedly reshape the stru!tured finan!e market in the

years to !ome. Elobally speaking' regulatory !apital arbitrage is unlikely to be a key dri"er of

stru!tured finan!e issuan!e' as may ha"e been the !ase under Basel I. +ther elements su!h as

the di"ersifi!ation of funding sour!es and' in!reasingly' the !ost of funding are more likely to

be!ome key stru!tured finan!e dri"ers. /inally' Basel II should be somewhat good news for

issuers' in"estors and other market parti!ipants. ;tru!tured finan!e and' abo"e all' those

stru!tured finan!e te!hniques whi!h allow issuers to a!hie"e *aa ratings appear to be here to

stay. Basel II should !reate new opportunities for all players' pro"ided they anti!ipate the !hanges

and adapt to them.

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Final Module in Human BehaviorDokument60 SeitenFinal Module in Human BehaviorNarag Krizza50% (2)

- Jaimini Astrology and MarriageDokument3 SeitenJaimini Astrology and MarriageTushar Kumar Bhowmik100% (1)

- Materials System SpecificationDokument14 SeitenMaterials System Specificationnadeem shaikhNoch keine Bewertungen

- Mathematics Into TypeDokument114 SeitenMathematics Into TypeSimosBeikosNoch keine Bewertungen

- Business Rescue PlanDokument21 SeitenBusiness Rescue PlanKofikoduahNoch keine Bewertungen

- SDT Model Trust Deed December2012 (Recovered)Dokument24 SeitenSDT Model Trust Deed December2012 (Recovered)KofikoduahNoch keine Bewertungen

- Asset SwapDokument1 SeiteAsset SwapKofikoduahNoch keine Bewertungen

- 60617-7 1996Dokument64 Seiten60617-7 1996SuperhypoNoch keine Bewertungen

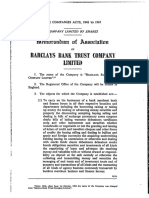

- Barclays Bank TrustDokument18 SeitenBarclays Bank TrustKofikoduahNoch keine Bewertungen

- Constant Capital Ghana Inflation Index UpdateDokument2 SeitenConstant Capital Ghana Inflation Index UpdateKofikoduahNoch keine Bewertungen

- The Rothschild FoundationDokument28 SeitenThe Rothschild FoundationKofikoduah100% (1)

- Cocktail Menus - GH NEWDokument5 SeitenCocktail Menus - GH NEWKofikoduahNoch keine Bewertungen

- Tullow Oil 2013 Investor Forum FINAL2Dokument22 SeitenTullow Oil 2013 Investor Forum FINAL2KofikoduahNoch keine Bewertungen

- Welcome IVRDokument1 SeiteWelcome IVRKofikoduahNoch keine Bewertungen

- JPM DCMDokument1 SeiteJPM DCMKofikoduahNoch keine Bewertungen

- Update On Series 7 ApplicabilityDokument1 SeiteUpdate On Series 7 ApplicabilityKofikoduahNoch keine Bewertungen

- Update On Series 7 ApplicabilityDokument1 SeiteUpdate On Series 7 ApplicabilityKofikoduahNoch keine Bewertungen

- For The Glencore MTN ProgramDokument1 SeiteFor The Glencore MTN ProgramKofikoduahNoch keine Bewertungen

- Scribd Definition of SubstantialDokument1 SeiteScribd Definition of SubstantialKofikoduahNoch keine Bewertungen

- Introduction To Exploration and ProductionDokument1 SeiteIntroduction To Exploration and ProductionKofikoduahNoch keine Bewertungen

- Structured NotesDokument20 SeitenStructured NotesjosecambaNoch keine Bewertungen

- How To Model RothschildDokument1 SeiteHow To Model RothschildKofikoduahNoch keine Bewertungen

- VDA ConnectDokument1 SeiteVDA ConnectKofikoduahNoch keine Bewertungen

- KKS CallingDokument1 SeiteKKS CallingKofikoduahNoch keine Bewertungen

- DCM OverviewDokument1 SeiteDCM OverviewKofikoduahNoch keine Bewertungen

- Wholesale Power Markets in The United StatesDokument60 SeitenWholesale Power Markets in The United StatesKofikoduahNoch keine Bewertungen

- EFGH File DLDokument1 SeiteEFGH File DLKofikoduahNoch keine Bewertungen

- Volans CDO PitchDokument1 SeiteVolans CDO PitchKofikoduahNoch keine Bewertungen

- Eqty RSRCHDokument1 SeiteEqty RSRCHKofikoduahNoch keine Bewertungen

- Stylistics and MeDokument1 SeiteStylistics and MeKofikoduahNoch keine Bewertungen

- Triangular ArbitrageDokument5 SeitenTriangular ArbitrageAnil BambuleNoch keine Bewertungen

- Kiddos FX Arb LinksDokument1 SeiteKiddos FX Arb LinksKofikoduahNoch keine Bewertungen

- World Bank Financing OpportunitiesDokument21 SeitenWorld Bank Financing OpportunitiesKofikoduahNoch keine Bewertungen

- Triangular ArbitrageDokument5 SeitenTriangular ArbitrageAnil BambuleNoch keine Bewertungen

- Calculadora MentalDokument3 SeitenCalculadora MentalAlex Garcia Ximenes QuintansNoch keine Bewertungen

- First Aid General PathologyDokument8 SeitenFirst Aid General PathologyHamza AshrafNoch keine Bewertungen

- Project Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantDokument40 SeitenProject Proposal On The Establishment of Plywood and MDF Medium Density Fiberboard (MDF) Production PlantTefera AsefaNoch keine Bewertungen

- Information Security Policies & Procedures: Slide 4Dokument33 SeitenInformation Security Policies & Procedures: Slide 4jeypopNoch keine Bewertungen

- ListeningDokument2 SeitenListeningAndresharo23Noch keine Bewertungen

- Intro To EthicsDokument4 SeitenIntro To EthicsChris Jay RamosNoch keine Bewertungen

- Introduction To Control SystemDokument9 SeitenIntroduction To Control SystemAbdulhakam Abubakar YusufNoch keine Bewertungen

- Formal Letter Format Sample To Whom It May ConcernDokument6 SeitenFormal Letter Format Sample To Whom It May Concernoyutlormd100% (1)

- Adverbs Before AdjectivesDokument2 SeitenAdverbs Before AdjectivesJuan Sanchez PrietoNoch keine Bewertungen

- S Jozsef Viata in DiosigDokument52 SeitenS Jozsef Viata in Diosigunoradean2Noch keine Bewertungen

- Curriculum Vitae: Personal InformationDokument3 SeitenCurriculum Vitae: Personal InformationMira ChenNoch keine Bewertungen

- Jurnal UlkusDokument6 SeitenJurnal UlkusIndri AnggraeniNoch keine Bewertungen

- Alice (Alice's Adventures in Wonderland)Dokument11 SeitenAlice (Alice's Adventures in Wonderland)Oğuz KarayemişNoch keine Bewertungen

- Water and Wastewater For Fruit JuiceDokument18 SeitenWater and Wastewater For Fruit JuiceJoyce Marian BelonguelNoch keine Bewertungen

- All Zone Road ListDokument46 SeitenAll Zone Road ListMegha ZalaNoch keine Bewertungen

- Chapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFDokument58 SeitenChapter 15 (Partnerships Formation, Operation and Ownership Changes) PDFAbdul Rahman SholehNoch keine Bewertungen

- Ruahsur Vangin Basket-Ball Court Lungrem ChimDokument4 SeitenRuahsur Vangin Basket-Ball Court Lungrem ChimchanmariansNoch keine Bewertungen

- The BreakupDokument22 SeitenThe BreakupAllison CreaghNoch keine Bewertungen

- International Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Dokument5 SeitenInternational Gustav-Bumcke-Competition Berlin / July 25th - August 1st 2021Raul CuarteroNoch keine Bewertungen

- Personal Training Program Design Using FITT PrincipleDokument1 SeitePersonal Training Program Design Using FITT PrincipleDan DanNoch keine Bewertungen

- BRAC BrochureDokument2 SeitenBRAC BrochureKristin SoukupNoch keine Bewertungen

- LiverDokument6 SeitenLiverMiguel Cuevas DolotNoch keine Bewertungen

- 23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncDokument2 Seiten23 East 4Th Street NEW YORK, NY 10003 Orchard Enterprises Ny, IncPamelaNoch keine Bewertungen

- Tangazo La Kazi October 29, 2013 PDFDokument32 SeitenTangazo La Kazi October 29, 2013 PDFRashid BumarwaNoch keine Bewertungen

- TestDokument56 SeitenTestFajri Love PeaceNoch keine Bewertungen

- Theo Hermans (Cáp. 3)Dokument3 SeitenTheo Hermans (Cáp. 3)cookinglike100% (1)