Beruflich Dokumente

Kultur Dokumente

Assess Two Doll Projects' NPV, IRR for Recommendation

Hochgeladen von

Tushar Gupta100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

478 Ansichten4 SeitenCAT

Originaltitel

319972_1_Assignment-1

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCAT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

478 Ansichten4 SeitenAssess Two Doll Projects' NPV, IRR for Recommendation

Hochgeladen von

Tushar GuptaCAT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

IRCO 421B Finance IRPS, UC San Diego

Spring 2013 Krislert Samphantharak

Assignment 1

Due April 19, 11.59 pm, by email (Finance B Turnin on FirstClass)

This assignment serves three main objectives. First, it allows you to review various present value and

discounting concepts and how to compute them using relevant functions in Excel. Second, it helps you

review some crucial concepts in nancial accounting that you studied in the last quarter. Finally, it guides

you through the calculation of NPV and other investment criteria we discuss in class. Although the case

is from a privately-owned company in the US, it serves as an illustrative example on how we compute

NPV, IRR, payback period, and protability index in practice. This procedure could be applied (with

appropriate adjustments) to other investment decision making by other forms of organizations, including

households, publicly-traded companies, not-for-prot organizations, or governments, both in the US and

elsewhere.

Instruction

1. Read New Heritage Doll Company: Capital Budgeting case. The case can be purchased from

Harvard Business School Press at https://cb.hbsp.harvard.edu/cbmp/access/19276442 You need to

register on the site to create a user name if you do not already have one. After you register, you can

get to the coursepack at any time by doing the following:

1. Visit hbsp.harvard.edu and log in.

2. Click My Coursepacks, and then click Finance B.

2. Excel le consisting of spreadsheets for Exhibits from the case is also available for download.

3. You should try to think about how to get the answer for each question below before diving to the hints

provided in the study guide.

4. The study guide is mainly numerical nancial analysis and do not contain all of the analysis you need

in order to solve the case. In other words, going through the guideline is not sufcient for addressing

all the issues raised in the questions.

5. Remember that the study guide provides just one of the many ways to analyze the case. You are not

required to follow it. Alternative sensible nancial analysis is perfectly acceptable.

6. Again, do not forget to address other issues listed in the questions that are not analyzed in the study

guide.

7. Turn in your assignment by emailing the following two les to Finance B Turnin on FirstClass:

a. A memo that addresses the questions below. The memo should be structure as if it were an

executive summary submitted to your boss or your client. For this assignment, the memo cannot

be longer than one page. Refer to the numbers your compute in Excel spreadsheets when

necessary, but no detailed calculation is needed in the memo.

1

b. An Excel le that contains all calculations that give you the nal numbers. The le must be self-

contained and understandable to general readers outside your group.

How to Solve Case Study?

I assume that you are somewhat familiar with case solving. Most of the suggestions for general case

study apply to this course as well. However, cases in nance have some distinct features. My additional

suggestions are as follows:

1. Details matter here. A lot. Exhibits are extremely important and the heart of your nancial analysis lies

somewhere in those exhibits. Make sure to spend time studying them carefully.

2. Use macro-micro-macro approach. Start the case by reading it carefully, preferably twice. Grab the

macro context of the casethe settings, the development, and the current issues. Then, try to dive

into the pool of numbers. Perform relevant nancial analysis in detail. Finally, put the results from your

analysis back into the macro picture of the case. Provide strategy and policy suggestions.

3. Stay within the case. Use all information you can get from the case, both in the text and in the

exhibits. I sometimes provide additional information for you. However, do not use information from

other sources, especially in retrospect. If you feel that the information provided by the case is not

sufcient, feel free to make additional assumptions. Note that the assumptions you make should be

justiable and should be based on the information in the case. Ambiguous cases give you an

opportunity to practice making necessary assumptions and making nal decisions under the

imperfect information environment.

Questions

1. Compare the business cases for each of the two projections under considerations by Emily Harris.

Qualitatively, which one do you regard as more compelling?

2. Use the operating projections to compute a net present value (NPV) for each project. Which project

creates more value?

3. Compute the internal rate of return (IRR) and payback period for each project. How should these

metrics affect Harriss deliberations? How do they compare to NPV as tools for evaluating projects?

When and how would you use each?

4. What additional information does Harris need to complete her analyses and compare the two

projects? What specic questions should she ask each of the project sponsors?

5. If Harris is forced to recommend only one project over the other, which should she recommend?

Why?

Study Guide for New Heritage Doll

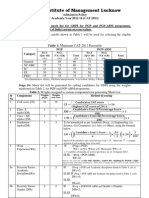

The company has two project proposals: Match My Doll Clothing expansion (MMDC) and Design Your

Own Doll (DYOD) initiative. The case analyzes various investment criteria for New Heritage Doll. We will

start with NPV, and then move on to other criteria.

2

A. NPV for MMDC

We start by focusing on MMDC. In order to compute NPV for MMDC, we need two ingredients: discount

rate and cash ow forecasts

1. Discount rate: From the case, what is the discount rate you should use for MMDC? Why?

2. Expected cash ows:

a. In class, we know that free cash ow (FCF) = EBITDA*(1 t) + Depreciation*t - Change in NWC -

CAPEX. Show that we can rewrite this expression and compute FCF from FCF = EBIT*(1-t) +

Depreciation - Change in Net Working Capital - Capital Expenditure.

b. Compute EBIT for each year from 2010 to 2020. Compute after-tax EBIT, i.e. EBIT*(1-t), for each

of those years. (Hint: Get the tax rate, t, from the case.)

c. Working capital in this case consists of four components: (1) cash, (2) account receivables, (3)

inventories, and (4) account payables. Compute each of these four items of working capital. (Hint:

You may need to review your Accounting lecture on how each of the working capital is related to

turnover ratio etc.)

Once you get the amount of cash, account receivables, inventories, and account payables for

each year, compute net working capital (NWC), which is dened as cash + account receivables +

inventories - account payables. (Also, try to think what NWC means in our context.) Finally,

compute changes in NWC from year to year.

d. Finally, compute free cash ow (FCF) for each year from 2010 to 2020.

e. In principle, we need to forecast future cash ows through the end of the project. What is left at

the end of the project could be sold and recorded as a cash inow at the end of the project. This

inow is called a salvage value. In this case, however, the project is assumed to last forever, i.e.

there is no end date. This is very common when we value any innitely-lived projects. In order to

deal with this situation, we make an additional assumption that after some point in the future (say,

2020 for MMDC in this case), the project will become mature and it will grow at a constant rate

forever. With this assumption, we can calculate the value of the MMDC project in 2020. This is

called the terminal value. In other words, the terminal value represents the value, at the end of the

explicit forecast period, of all cash ows occurring after that point.

Assume that from 2020 onward, FCF for MMDC will grow at 3% per year. (Justify my

assumption of this growth rate. Do you agree or disagree with this assumption? Why?) The

terminal value, i.e. the present value of future (growing) FCF from 2020 onward can be

computed as a growing perpetuity. (Why?) Compute this terminal value of MMDC in 2020.

3. Net Present Value: With the discount rate and expected FCF we get, compute NPV of MMDC. (Also,

review Excel function NPV.)

B. NPV for DYOD

Repeat steps 1-3 above and compute NPV for DYOD.

3

C. Other Investment Criteria

1. IRR: Internal Rate of Return is the discount rate for which NPV = 0. Compute and compare IRRs for

MMDC and DYOD. (You should think also what the intuition behind IRR is. Also, review Excel function

IRR)

2. Payback Period: Payback is the period at which cumulative cash ow becomes positive. Compute

and compare paybacks for MMDC and DYOD.

3. Protability Index: Compute and compare protability indices for MMDC and DYOD. It is dened as

NVP/Initial Outlay.

D. Putting Everything Together

Consider NPV, IRR, payback, and protability index you get from above, what investment project(s)

should Emily Harris recommend if New Heritage Doll does not have limited resource. What if the

company has resource to invest in only one project, what should be her recommendation?

4

Das könnte Ihnen auch gefallen

- The Vault Guide To ConsultingDokument185 SeitenThe Vault Guide To ConsultingMahesh Balan100% (4)

- Successful Sales and Marketing Letters by Dianna BooherDokument554 SeitenSuccessful Sales and Marketing Letters by Dianna Boohersungmin83% (6)

- Finance - WK 4 Assignment TemplateDokument31 SeitenFinance - WK 4 Assignment TemplateIsfandyar Junaid50% (2)

- DYOD Financial AnalysisDokument13 SeitenDYOD Financial AnalysisSabyasachi Sahu100% (1)

- New Heritage Doll CompanyDokument4 SeitenNew Heritage Doll Companyvenom_ftwNoch keine Bewertungen

- Interview Questions: Always Find A Link Between The StepsDokument9 SeitenInterview Questions: Always Find A Link Between The StepsKarimNoch keine Bewertungen

- Boeing's New 7E7 AircraftDokument10 SeitenBoeing's New 7E7 AircraftTommy Suryo100% (1)

- 4214-XLS-ENG New Herritage Doll Case SpreadsheetDokument4 Seiten4214-XLS-ENG New Herritage Doll Case SpreadsheetAlex HuesingNoch keine Bewertungen

- Case AnalysisDokument11 SeitenCase AnalysisSagar Bansal50% (2)

- Mercury Athletic CaseDokument3 SeitenMercury Athletic Casekrishnakumar rNoch keine Bewertungen

- Cost Behavior: Analysis and UseDokument36 SeitenCost Behavior: Analysis and Userachim04100% (1)

- Betas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Dokument21 SeitenBetas: Prof. H. Pirotte - SBS/ULB Ó Nov 2003Elias del CampoNoch keine Bewertungen

- Shipping Bill of LadingDokument1 SeiteShipping Bill of LadingdonsterthemonsterNoch keine Bewertungen

- NPV Analysis of Sampa Video Online ExpansionDokument13 SeitenNPV Analysis of Sampa Video Online ExpansionAnirudh KowthaNoch keine Bewertungen

- Group Ariel StudentsDokument8 SeitenGroup Ariel Studentsbaashii4Noch keine Bewertungen

- HP Case Competition PresentationDokument17 SeitenHP Case Competition PresentationNatalia HernandezNoch keine Bewertungen

- Critical Financial Review: Understanding Corporate Financial InformationVon EverandCritical Financial Review: Understanding Corporate Financial InformationNoch keine Bewertungen

- New Heritage DoolDokument9 SeitenNew Heritage DoolVidya Sagar KonaNoch keine Bewertungen

- Nike Case AnalysisDokument9 SeitenNike Case AnalysisFami FamzNoch keine Bewertungen

- Marketing PlanDokument17 SeitenMarketing PlanSteve WeberNoch keine Bewertungen

- New Heritage Doll CompanyDokument5 SeitenNew Heritage Doll CompanyChris ChanonaNoch keine Bewertungen

- SLFI610-Project Appraisal & FinanceDokument2 SeitenSLFI610-Project Appraisal & FinanceVivek GujralNoch keine Bewertungen

- UltraTech Cement Fundamental Report with Financial AnalysisDokument6 SeitenUltraTech Cement Fundamental Report with Financial AnalysisMohd HussainNoch keine Bewertungen

- Final AssignmentDokument15 SeitenFinal AssignmentUttam DwaNoch keine Bewertungen

- Product DiffrentiationDokument26 SeitenProduct Diffrentiationoptimistic07100% (1)

- This Study Resource Was: 1 Hill Country Snack Foods CoDokument9 SeitenThis Study Resource Was: 1 Hill Country Snack Foods CoPavithra TamilNoch keine Bewertungen

- Nishat Mill IbfDokument18 SeitenNishat Mill IbfU100% (1)

- New Heritage Doll Company Financial AnalysisDokument31 SeitenNew Heritage Doll Company Financial AnalysisSoundarya AbiramiNoch keine Bewertungen

- New Heritage Doll Company Case StudyDokument10 SeitenNew Heritage Doll Company Case StudyRAJATH JNoch keine Bewertungen

- Hyatt Regency Dallas Floor PlanDokument4 SeitenHyatt Regency Dallas Floor PlanTushar GuptaNoch keine Bewertungen

- The Risk-Based Approach To Audit: Audit JudgementDokument18 SeitenThe Risk-Based Approach To Audit: Audit JudgementWiratama SusetiyoNoch keine Bewertungen

- Concept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023Von EverandConcept Based Practice Questions for Tableau Desktop Specialist Certification Latest Edition 2023Noch keine Bewertungen

- New Heritage Doll Company Capital BudgetDokument5 SeitenNew Heritage Doll Company Capital BudgetCarlosNoch keine Bewertungen

- Difference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Dokument8 SeitenDifference Between Basel 1 2 and 3 - Basel 1 Vs 2 Vs 3Sonaal GuptaNoch keine Bewertungen

- Ow To LAY: Finance Simulation: Capital BudgetingDokument10 SeitenOw To LAY: Finance Simulation: Capital BudgetingApoorv GuptaNoch keine Bewertungen

- Product Portfolio AnalysisDokument30 SeitenProduct Portfolio AnalysisShakti Dash25% (4)

- Valuing Teuer Furniture Using DCF and Multiples MethodsDokument5 SeitenValuing Teuer Furniture Using DCF and Multiples MethodsFaria CHNoch keine Bewertungen

- Managerial Finance Case Write UpDokument3 SeitenManagerial Finance Case Write Upvalsworld100% (1)

- New Heritage Capital SimulationDokument2 SeitenNew Heritage Capital Simulationdanvle11Noch keine Bewertungen

- Finanacial Management: Group Assignment Group No. A04 Simulation Questions For Project SubmissionDokument6 SeitenFinanacial Management: Group Assignment Group No. A04 Simulation Questions For Project SubmissionrahiimnuNoch keine Bewertungen

- Finance Simulation - Capital BudgetingDokument1 SeiteFinance Simulation - Capital BudgetingKarthi KeyanNoch keine Bewertungen

- Case Nobody Ever DisagreesDokument4 SeitenCase Nobody Ever DisagreesChinmay PrustyNoch keine Bewertungen

- Does IT Payoff Strategies of Two Banking GiantsDokument10 SeitenDoes IT Payoff Strategies of Two Banking GiantsScyfer_16031991Noch keine Bewertungen

- Case Study - GMDokument8 SeitenCase Study - GMAustin Bray100% (1)

- Deluxe Corporation Case StudyDokument3 SeitenDeluxe Corporation Case StudyHEM BANSALNoch keine Bewertungen

- Michael McClintock Case1Dokument2 SeitenMichael McClintock Case1Mike MCNoch keine Bewertungen

- Cash Conversion CycleDokument7 SeitenCash Conversion Cyclebarakkat72Noch keine Bewertungen

- FBE 529 Lecture 1 PDFDokument26 SeitenFBE 529 Lecture 1 PDFJIAYUN SHENNoch keine Bewertungen

- Caso TeuerDokument46 SeitenCaso Teuerjoaquin bullNoch keine Bewertungen

- Ejercicio 7.5Dokument6 SeitenEjercicio 7.5Enrique M.Noch keine Bewertungen

- Pacific Grove Spice CompanyDokument1 SeitePacific Grove Spice CompanyLauren KlaassenNoch keine Bewertungen

- What Dividend Policy Would Be Appropriate For TelusDokument4 SeitenWhat Dividend Policy Would Be Appropriate For Telusmalaika12Noch keine Bewertungen

- PHT and KooistraDokument4 SeitenPHT and KooistraNilesh PrajapatiNoch keine Bewertungen

- Gainesville Machine Tools Corp financial projections and analysisDokument2 SeitenGainesville Machine Tools Corp financial projections and analysisAbhinav Singh100% (1)

- Case 5 Midland Energy Case ProjectDokument7 SeitenCase 5 Midland Energy Case ProjectCourse HeroNoch keine Bewertungen

- M&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun KoDokument2 SeitenM&A and Corporate Restructuring) - Prof. Ercos Valdivieso: Jung Keun Kim, Yoon Ho Hur, Soo Hyun Ahn, Jee Hyun Ko고지현Noch keine Bewertungen

- Hill Country Snack Foods CompanyDokument14 SeitenHill Country Snack Foods CompanyVeni GuptaNoch keine Bewertungen

- Sneaker Excel Sheet For Risk AnalysisDokument11 SeitenSneaker Excel Sheet For Risk AnalysisSuperGuyNoch keine Bewertungen

- CM FinanceforUndergradsDokument5 SeitenCM FinanceforUndergradsChaucer19Noch keine Bewertungen

- Valuing and Acquiring A Business: Hawawini & Viallet 1Dokument53 SeitenValuing and Acquiring A Business: Hawawini & Viallet 1Kishore ReddyNoch keine Bewertungen

- TM ACC ABCandABM1Dokument7 SeitenTM ACC ABCandABM1anamikarblNoch keine Bewertungen

- Mercury Athletic QuestionsDokument1 SeiteMercury Athletic QuestionsRazi UllahNoch keine Bewertungen

- Real Options ExcercisesDokument3 SeitenReal Options ExcercisesSudhakar Joshi0% (1)

- AMERICAN HOME PRODUCTS CORPORATION Group1.4Dokument11 SeitenAMERICAN HOME PRODUCTS CORPORATION Group1.4imawoodpusherNoch keine Bewertungen

- ACC to Acquire AirThread for $7.5 BillionDokument16 SeitenACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- Mercury Athletic FootwearDokument4 SeitenMercury Athletic FootwearAbhishek KumarNoch keine Bewertungen

- Alice PortafolioDokument17 SeitenAlice PortafoliofannnyNoch keine Bewertungen

- Capsim UserGuideDokument13 SeitenCapsim UserGuiden589454fNoch keine Bewertungen

- Post-merger integration A Complete Guide - 2019 EditionVon EverandPost-merger integration A Complete Guide - 2019 EditionNoch keine Bewertungen

- AOL.com (Review and Analysis of Swisher's Book)Von EverandAOL.com (Review and Analysis of Swisher's Book)Noch keine Bewertungen

- Gamification in Consumer Research A Clear and Concise ReferenceVon EverandGamification in Consumer Research A Clear and Concise ReferenceNoch keine Bewertungen

- Computer ArchitectureDokument2 SeitenComputer ArchitectureAnkit BaruaNoch keine Bewertungen

- DirectionsDokument1 SeiteDirectionsTushar GuptaNoch keine Bewertungen

- Ebay Final ShortlistDokument1 SeiteEbay Final ShortlistTushar GuptaNoch keine Bewertungen

- Assess Two Doll Projects' NPV, IRR for RecommendationDokument4 SeitenAssess Two Doll Projects' NPV, IRR for RecommendationTushar Gupta100% (1)

- GK NuggetsDokument0 SeitenGK NuggetsTushar GuptaNoch keine Bewertungen

- Intro FormulationDokument79 SeitenIntro FormulationTushar GuptaNoch keine Bewertungen

- Intro FormulationDokument79 SeitenIntro FormulationTushar GuptaNoch keine Bewertungen

- FirefoxDokument1 SeiteFirefoxTushar GuptaNoch keine Bewertungen

- FirefoxDokument1 SeiteFirefoxTushar GuptaNoch keine Bewertungen

- BINARY SEARCH IMPLEMENTATIONDokument18 SeitenBINARY SEARCH IMPLEMENTATIONTushar GuptaNoch keine Bewertungen

- Redox, Group 2 and Group 7 ExtraDokument8 SeitenRedox, Group 2 and Group 7 ExtraShabnam ShahNoch keine Bewertungen

- Economic Structure of Tourism and Hospitality in AustraliaDokument6 SeitenEconomic Structure of Tourism and Hospitality in AustraliaAnjali DudarajNoch keine Bewertungen

- JFET and MOSFET quiz questionsDokument4 SeitenJFET and MOSFET quiz questionsfGNoch keine Bewertungen

- Chapter 5Dokument37 SeitenChapter 5Ahmed ElbazNoch keine Bewertungen

- Chapter 5 (Audit)Dokument2 SeitenChapter 5 (Audit)arnel gallarteNoch keine Bewertungen

- The Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Dokument40 SeitenThe Copperbelt University BS 361: Entrepreneurship Skills: Lecture 2C: Business Startups K. Mulenga June, 2020Nkole MukukaNoch keine Bewertungen

- Your Electronic Ticket Receipt-32Dokument2 SeitenYour Electronic Ticket Receipt-32LuluNoch keine Bewertungen

- Lion Air ETicket (IIZKUK) - NataliaDokument2 SeitenLion Air ETicket (IIZKUK) - NataliaNatalia LeeNoch keine Bewertungen

- Best Practice Guidance For Hybrid Concrete ConstructionDokument3 SeitenBest Practice Guidance For Hybrid Concrete ConstructionTanveer Ahmad50% (2)

- Swanand Co-Op. Housing Society LTDDokument2 SeitenSwanand Co-Op. Housing Society LTDskumarsrNoch keine Bewertungen

- Intermediate Accounting Exam 2 SolutionsDokument5 SeitenIntermediate Accounting Exam 2 SolutionsAlex SchuldinerNoch keine Bewertungen

- Dissolution RegulationsDokument15 SeitenDissolution Regulationsbhavk20Noch keine Bewertungen

- Cost Functions Defined in EconomicsDokument26 SeitenCost Functions Defined in EconomicsSoumya Ranjan SwainNoch keine Bewertungen

- BMW Case StudyDokument3 SeitenBMW Case StudyPrerna GoelNoch keine Bewertungen

- Ecbwp 1507Dokument55 SeitenEcbwp 1507Anonymous KkhWPL3Noch keine Bewertungen

- Founders Pie Calculator FinalDokument3 SeitenFounders Pie Calculator FinalAbbas AliNoch keine Bewertungen

- Acounting Aacounting Aacounting Aacounting ADokument8 SeitenAcounting Aacounting Aacounting Aacounting AFrankyLimNoch keine Bewertungen

- Macro CH 11Dokument48 SeitenMacro CH 11maria37066100% (3)

- Bicol Region As One of The Hot Spot For Cacao IndustryDokument10 SeitenBicol Region As One of The Hot Spot For Cacao IndustryPlantacion de Sikwate0% (1)

- CAP Timetable 2016-2017Dokument2 SeitenCAP Timetable 2016-2017Trung NguyenNoch keine Bewertungen