Beruflich Dokumente

Kultur Dokumente

Problem 1:: Problems & Solutions

Hochgeladen von

Francisco MarvinOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Problem 1:: Problems & Solutions

Hochgeladen von

Francisco MarvinCopyright:

Verfügbare Formate

PROBLEMS & SOLUTIONS

Problem 1:

Accounting at MacCloud Winery

Mike MacCloud had worked in the operations side of a winery for several years.

Having built a strong knowledge of the art of making wine, he had decided to create his

own wine label (i.e., brand). For his label, he planned to grow all of his own grapes. He

had identified an ideal plot of five acres of land in northern California that had most

recently been used to grow soybeans. His initial plans were to lease a nearby building to

use as a winery (i.e., a place for processing grapes and fermenting and aging his wine).

However, Mike hoped someday to build his own winery and thus would only plant on

four acres of land. Mike agreed to lease the building for 10 years at $5,000 per year. It

was estimated that the building was worth $32,000 and had a 30-year economic life. The

lease contract Mike signed did not mention any bargain purchase option or that Mike

might assume ownership of the leased building. The interest rate Mike received on his

personal bank account was 5%. When Mike started the business, he opened a checking

and savings account for MacCloud Wines Inc. that paid 6% annual interest. The annual

interest rate the bank charged was 10%.

Mike purchased the five acres of land for $250,000. To finance the transaction,

Mike borrowed $180,000 from the bank to be repaid $10,000 annually and a lump sum at

the end of three years. In addition, Mike bought from Australia special grapevines at a

cost of $10,000 per acre. The transportation costs totaled $2,500. Once Mike had the

grapevines, he hired extra help to plant the vines at a cost of $2,000 per acre.

While vines might produce a limited amount of grapes during the first five

growing seasons, the young vine grapes could not be used for wine (or any other

commercial purpose). Although Mike would not use these grapes, he would need to

spend $1,000 per acre per each of the five years to fertilize and water the vines. If this

were not done, the vines would not produce high-quality grapes in the future.

Beginning in the sixth growing season the vines would bear a full crop of high-

quality grapes. Some vines continued to produce at this level until their 100

th

growing

season. However, generally production began to decline after the 75

th

growing season.

Once production declined, the land would be replanted with a new set of vines.

Interestingly, many experts believed that grapes from old growth vines (for the type of

vines Mike was planting, a vine was old growth after it had been planted 50 or more

growing seasons) made a higher-quality wine. Once the vines began to produce high-

quality grapes, Mike would need to spend $1,500 per acre per year for fertilizing and

water. If he did not provide these nutrients, the grapes produced that year would not be of

high enough quality to produce wine. However, this would not affect the ability of the

vines to produce high- quality grapes in the future.

Beginning with the first harvest, Mike planned to mature his wine in expensive

oak barrels imported from France, which he believed were required for the production of

above-average quality wine. Each barrel would be used for a period of up to five years to

mature the better-quality wine. Thereafter, the barrel would be used on a one-year-cycle

basis to mature the vineyards lower-quality wines. At the end of 15 years, the barrel

would be sold as raw material to a manufacturer of charcoal chips for outdoor grills.

Cheaper locally procured barrels with an average expected useful life of 10 years would

be used to mature lower-quality wines. At the end of their useful life these barrels would

also be sold to a charcoal-chip manufacturer.

Questions with Answers:

1. Should the leased building be accounted for as an asset? Should the agreement to

pay lease rentals be recorded as a liability? Justify your answers. Do not refer to

any FASB rules on this issue.

ANSWER:

No, the leased building should not be accounted as an asset

because the lease would be considered as an operating lease, on which the

expense would be accrued day by day as the asset (building) is used. To

determine this is in fact an operating lease, the life of the lease should be

less than 75% of the useful life of the asset being leased. For instance, this

is a ten-year lease, which is less than the economic life of a 30-year asset.

The rental payments would be expensed as incurred and offset by the asset

used to make the rental payments (i.e. cash), the lessor would still hold the

benefit of the ownership.

In addition, there are no stipulations to support that ownership will

be transferred to Mike. And then there is no bargain purchase option nor

the lease term is for the major part of the economic life of the asset even if

title is not transferred.

Yes, the agreement to pay lease rentals should be recorded as a

liability because the building rent qualifies as finance lease. Therefore, the

asset should be recorded as a liability.

Building $30,722.85

Lease Liability $30,722.85

2. Record the journal entries to account for the bank loan for all three years. Assume

the loan was made at the beginning of year one and repaid at the end of year three.

Assume all interest payments are made on an annual basis. The $10,000 per year

payment is to reduce the loans principal.

ANSWER:

Issuance of debt/loan

Cash $180,000

Notes Payable $180,000

Year One

Repayment of Loan

Notes Payable $10,000

Cash $10,000

Year Two

Repayment of Loan

Notes Payable $10,000

Cash $10,000

Year Three

Repayment of Loan

Notes Payable $160,000

Cash $160,000

To record the interest payments on existing loan/monthly 10% interest rate

Interest Expense $1,500

Interest Payable $1,500

To record interest payment annually

Interest Payable $18,000

Cash $18,000

(Principal: $180,000*10%=$18,000)

Present Value of Minimum Lease Payment

= (1-(1/(1+(.10)

10

)/.10)

= (1-(1/(1*.10)

10

)/.10)

= 6.14457 x $5,000

= $30,722.85, which is the 96% of the estimated cost of the

building ($32,000)

3. Applying the principles of accrual accounting, how should Mike treat the

expenditures for the land, vines, vine planting, fertilizing, and water? Be specific

regarding the treatment over time, including amounts, and the rationale for the

treatments.

ANSWER:

All expenditures should be assigned to cost centers like

fermentation, aging, and the like. Mike should treat the expenditures for

the vines, vine planting, fertilizing, and water as part of the cost of

producing wines since these are directly related in producing wines.

The costs associated with manufacturing/producing the wine

should be capitalized until the vine is sold, the costs should be

expensed (COGS) when selling transaction happens. For

example, the special grapevines brought from Australia at

$50,000.00 ($10,000.00 x5 acres) should be capitalized over the

time that is taking the vine to be ready for production

($50,000.00/5yrs= $10,000.00).

Labor, which is a direct inventoriable cost (the extra help hired to

plant the vines at $2,000.00 per acre x5= $10,000.00) should be

capitalized over 5 years.

Land should be capitalized over the useful life of the asset.

Fertilizer and water should be expensed as they are incurred.

Following the accrual accounting concepts: Conversation,

Realization, and Matching, Mike should treat the expenditures as follows:

Item

No.

Item Description Treatment

Over Time

Rationale

1 Building Lease

$5,000/year

Expense, be

amortized by

$5,000/year

Mike cannot control the

property as the lease

contract did not mention

about Mike might assume

ownership of the leased

building.

2 Purchase of land

$250,000

Asset, be

depreciated

according to its

lease term year

Mike owns the land after

purchase.

3 Bank loan $180,000

for land purchase

Loan payable in

liability

It is a source for the land.

4 Interest for land

purchase

Be capitalized

as part of land

asset

It is an amount related to

borrowing made to

finance the land and it is

identifiable.

5 Vines

$10,000*5=$50,000

Asset -

inventory

It is a kind of equipment

producing grapes.

6 Vines

Transportation cost

$2,500

It is an asset -

inventory and

could be

computed into

vines asset

It is cost that is necessary

to make the vines ready

for its intended use.

7 Vine planting

$2,000*5=$10,000

It is an asset -

inventory

computed into

vines. When

vines are

brewed and

sold, it becomes

as cost of goods

sold

Same as above, it is

necessary to make the

vine ready for its use.

8 Fertilizing and

water fee:

$1,000*5=$5,000

Outright

expense, part of

operating

expense of the

company

These works are to keep

the asset (land and vine)

in good operating

conditions and they did

not add capitalized cost

of the asset (land and

vine).

9 Labor directly

related in producing

wine (the extra help

hired to plant the

vines at $2,000.00

per acre x5=

$10,000.00)

Asset Labor is needed to

produce wine.

When the benefits of assets are used up or consumed, the

expenditures are eventually transformed into expenses.

4. Without changing your answers to the above questions, consider the following

facts:

Mikes greatest concern is that his vines will contract Phylloxera disease,

Black Goo syndrome, or Pierces disease. While these conditions do not kill the

vines immediately, they reduce production of quality grapes by approximately

50%. Further, the vines generally die approximately 10 years after contracting the

condition. While Mike will probably be able to avoid Phylloxera by planting

genetically treated vines, incidents of Black Goo and Pierce disease have been

increasing over the last several years and are most dangerous to vines that are less

than three years old.

How should the potential for vine disease be reflected in the financial

statements if the vines have not been diagnosed with any of the diseases? Does

this change if the vines are diagnosed with one of the diseases? Be specific

regarding any amounts and the rationale for these treatments.

ANSWER:

When vines have not been diagnosed with any of the disease such

as Phylloxera disease, Black Goo syndrome, or Pierces disease, it is in

good conditions and still keeps its value. It could be keep as asset with no

change. However, the incidents of Black Goo and Pierce disease have

been increasing over the last several years and are the most dangerous to

vines younger than three years old. Based on conservatism concept,

recognize the expenses of vine lost as soon as they are reasonably

possible. It is better to use declining depreciation method for the possible

vine loss due to the diseases in the first three years.

If vines are diagnosed with one of the diseases and it will lose half

of its annual value until they die 10 years after contracting the condition.

Thereafter their service life will be shortened and the residual value could

be written off as obsolete expense in 10 years.

5. How should Mike account for the oak barrels?

ANSWER:

Oak barrels are equipments containing wines and therefore it is an

asset. It has 15 years of service life. Its book value will be depreciated

over its service life using straight-line depreciation method. The

depreciation will be accumulated as a contra-asset account for the oak

barrels.

The value of residual value for 10 years could be based on the

purchase price for cheaper local procured barrels that used to mature

lower-quality life. The revenue of recycling is only recognized when it is

sold to make charcoal chips after 15 years.

Thus, the oak barrel should be accounted as part of the property,

plant, and equipment (fixed assets) basing from IAS 16.

6. How would the transactions in Question 3 and the bank loan be recorded in the

winerys indirect statement of cash flows?

ANSWER:

The outflows paid as interest on loan are considered part of the

operating activities. The issuance of the $180,000 loan would be an inflow

of cash used to purchase land. Therefore, it is a financing activity. The

repayment of the loan (principal only) is considered an outflow of cash in

the financing section of the statements of cash flows. The land is an

outflow of cash on the investing activities section of the statement of cash

flows. The purchase of the vine is an outflow of cash on the operating

activities. Vine planting is an outflow of cash and therefore recorded as

operating activities. Water & fertilizer is an outflow of cash on accounts

payable, which is also part of the operating activities.

Problem 2:

Financial Performance Reporting

The Financial Accounting Standards Boards (FASB) Financial Performance

Reporting by Business Enterprises project may change the form and content,

classifications and aggregations, and display of specified items and summarized amounts

on the face of all basic financial statements. An important result of this project may be

that net income would be eliminated as an income statement item. It would be replaced

by comprehensive income. Currently, comprehensive income plays little, if any, role in

equity valuations.

The projects goal is to

Improve the quality of information displayed in financial statements so that

statement users can better evaluate an enterprises performance.

Ensure that sufficient information is contained in financial statements to permit

calculation of key financial measures used by investors and creditors.

In the interest of global convergence of accounting principles, the FASB is

working closely on this project with the International Accounting Standards

Board (IASB), which has a similar project underway with the United Kingdoms

Accounting Standards Board. The FASB and IASB have tentatively decided on a

similar objective for the new statementto enhance the predictive feedback value

of the information that is presented in a statement of comprehensive income.

Comprehensive Income

The FASBs Concept Statement No. 6 defines comprehensive income. It states:

Comprehensive income is the change in equity of a business enterprise during a period

from transactions and other events and circumstances from nonowner sources. It includes

all changes in equity during a period except those resulting from investments by owners

and distributions to owners.

The FASB in SFAS 130, Comprehensive Income, required companies to

display in their financial statements total comprehensive income and its components in

either an income statement-type format (Table A) or in a changes-in-equity format

(Table B). Most companies have elected to use the changes in equity format.

SFAS 130s operational definition of comprehensive income is net income plus

other comprehensive income. Other comprehensive income consists of those accounting

items that are direct debits or credits to owners equity that do not involve transactions

with owners, such as foreign currency translation gains and losses and unrealized gains or

losses on marketable securities classified as available-for-sale.

IASB

The IASB is ahead of the FASB in its financial performance reporting project. To

guide its deliberations, the IASB has tentatively agreed on the following five principles:

Principle 1 A performance statement should be able to distinguish the return on

total capital employed from the return on equity.

Principle 2 Components of gains and losses should be reported gross unless they

give little information with respect to future income.

Principle 3 Income and expenses resulting from the remeasurement of an asset or

liability should be reported separately. (Remeasurement refers to gains and expenses

arising from the revision of estimates embedded in the carrying values of assets and

liabilities.)

Principle 4 A performance statement should identify gains and losses where the

change in economic value does not arise in the period in which it is reported.

Principle 5 Within the prescribed format and without the use of proscribed

subtotals, the performance statement should allow reporting in the form of:

i. Information on the entity as a whole, analyzed by nature or function;

ii. The activities in (i) disaggregated by business segments (geographic or

product- based);

iii. Additional distinctions according to managerial discretion.

The IASBs proposed format for the financial performance statement reporting

comprehensive income is shown in Table C. It is based on Principle 3.

To illustrate further the IASBs approach and Principle 3, the components of financial

performance relating to pension costs would be reported using the Table C format as

follows:

(i) Operating, Column 1service cost

(ii) Operating, Column 2actuarial gains and losses relating to changes in

assumptions about future cash outflows

(iii) Financing, Column 1interest cost, expected return on assets

(iv) Financing, Column 2actuarial gains and losses relating to return on assets

and changes in discount rate assumptions

Other Possible Approaches

The FASB is studying the IASBs tentative comprehensive income statement

format for possible adoption. In addition to the separation by functional classification, the

FASB has directed its staff to explore the possibility of further separating the information

in the statement of comprehensive income. Several possible approaches for separation

being explored are:

a. Separating transactions with third parties from all other transactions and

events.

b. Separating cash measurements, accrual measurements, and fair-value

measurements.

c. Separating transactions and events driven by historical cost principles from

transactions and events driven by fair value or remeasurement principles.

d. Separating income and expenses resulting from the remeasurement of an

asset or liability from all other income and expenses (the current IASB

approach).

e. Some other approach.

Timetable

The FASBs objective is to issue in 2003 an Exposure Draft relating to the

reporting of items of revenue, expense, gains, and losses in a statement of comprehensive

income.

Questions with Answers:

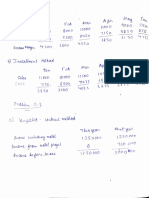

1. Where in the IASBs proposed Statement of Financial Performance would you

display the following?

o Tangible fixed assetsdepreciation, impairments, gains or losses on

disposal and revaluations (permitted under International Financial

Reporting Standards)

o Investment propertiesrent and revaluations

o Goodwillimpairments

o Inventorysales and impairments

o Investments in equity securitiestotal value change

o Financial assets and liabilities held for tradingtotal value changes

o Foreign exchangegains and losses

o Nonequity financial assets and liabilitiesinterest income and expenses

o Provisionsinitial recognition, subsequent interest costs, remeasurements

due to changes in the original estimates

o Extraordinary itemsinfrequent and unusual items

ANSWER:

The table below shows the placement of the enumerations above in

the IASBs proposed Statement of Financial Performance.

Normal Other Comprehensive

Income

To be reported

separately

1. Depreciation

2. Gains and losses

on disposal

Investing

3. Investment

properties rent

investing

4. Nonequity

financial assets and

1. Revaluation

(Tangible fixed

assets)

2. Goodwill

impairment

3. Investment

revaluation

4. Investment in equity

securities total

1. Extraordin

ary items

infrequent

and

unusual

items

liability

5. Provisions (Initial

recognition,

subsequent interest

costs)

value change

5. Foreign exchange

gains and losses

6. Provisions -

remeasurements

*These activities pertain to cash flows only. Therefore, there are

activities wherein cash is not involved like depreciation.

2. What is your appraisal of the IASBs Statement?

ANSWER:

The IASBs statement presents the comprehensive income by

separating the information according to activities (i.e. operating, financing,

tax). It also presents the income flows along side by its valuation

adjustments, which is aligned with FASBs and IASBs objective for the

new statement to enhance the predictive feedback value of the

information. With this regard, faithful representation is being observed.

However, the principle on uniformity may be compromised as valuation

adjustments were included as part of the statement. Therefore, it may not

be observing the principle of comparability. Moreover, the statement is

structured combining the normal composition of net income plus the

income and expense not found in the normal income statement. It can also

be seen that the discontinued operations account is reported as part of the

operating activity. This is incorrect since discontinued operation is not part

of the regular operation of a business. It must be reported separately in the

income statement.

3. Does the Statement satisfy the FASB projects goals?

ANSWER:

Yes. FASB projects goals are to improve the quality of

information in the financial statements that will eventually lead to better

evaluation of its performance; and to permit calculations of key financial

measures used by investors and creditors. By doing so, Statement

satisfies the FASB projects goals.

In the IASB statement it can be implied that the information

pertaining to different entities were consolidated into one statement. In

line with this, it would misrepresent the actual performance of each entity.

4. How might equity investors use this Statement?

ANSWER:

Investors (whether potential or existing) use this Statement to aid

them in making economic decisions and for assessing the effectiveness of

the entitys management easier or lighter. They are concerned with the risk

inherent in, and return provided by, their investments. They need

information to help them determine whether they should buy, hold, or sell.

Using the information stated in the financial performance report,

investors should be able to gauge whether or not management is using

funds wisely and primarily how profitable is the company.

5. What changes to the Statement would you propose?

ANSWER:

Separating the normal income from the other comprehensive

income that is not recognized in the traditional profit or loss statement

may be presented in the Statement. This way, the information supplied

will be more relevant to common users. The purpose of presenting the

statement of performance is to give internal and external users awareness

on how the company executed its plan for the year and whether or not they

have achieved their goals set at the beginning of the year. In addition,

information material to the company (i.e. associates, discontinued

operations) must be reported separately in order to observe prudence and

comparability.

Das könnte Ihnen auch gefallen

- Acctg ProbDokument7 SeitenAcctg ProbFrancisco MarvinNoch keine Bewertungen

- Case 14-4 Accounting at MacCloud WineryDokument4 SeitenCase 14-4 Accounting at MacCloud WineryPriya Darshini50% (2)

- Answer To The Question No: 1: Accounting at Maccloud WineryDokument5 SeitenAnswer To The Question No: 1: Accounting at Maccloud WineryAmmer Yaser MehetanNoch keine Bewertungen

- Accounting at MacCloud and Financial ReportingDokument3 SeitenAccounting at MacCloud and Financial Reportingvivek1119100% (1)

- Accounting at MacCloud and Financial ReportingDokument3 SeitenAccounting at MacCloud and Financial Reporting0p00Noch keine Bewertungen

- Maccloud WineryDokument3 SeitenMaccloud WineryFrancisco MarvinNoch keine Bewertungen

- Case 14-1 MacCloudDokument2 SeitenCase 14-1 MacCloudvivek1119100% (2)

- Arnab Roy-BUS 505 - Class AssignmentDokument5 SeitenArnab Roy-BUS 505 - Class AssignmentAmmer Yaser MehetanNoch keine Bewertungen

- Fiat Mio: Prototype Created With Open Innovation and CrowdsourcingDokument5 SeitenFiat Mio: Prototype Created With Open Innovation and CrowdsourcingsherNoch keine Bewertungen

- ACT201 Case StudyDokument6 SeitenACT201 Case StudyShimulAhmedNoch keine Bewertungen

- WineryDokument12 SeitenWineryRaam PrakashNoch keine Bewertungen

- Gitman CH 14 15 QnsDokument3 SeitenGitman CH 14 15 QnsFrancisCop100% (1)

- CASE 8 - Norman Corporation (A) (Final)Dokument3 SeitenCASE 8 - Norman Corporation (A) (Final)Katrizia FauniNoch keine Bewertungen

- Case 2-3 Lone Pine Café (A)Dokument15 SeitenCase 2-3 Lone Pine Café (A)Cynthia Anggi Maulina100% (1)

- AMAZON FRESH-case AnalysisDokument1 SeiteAMAZON FRESH-case AnalysisAkanksha SinhaNoch keine Bewertungen

- PC DepotDokument2 SeitenPC DepotJohn Carlos WeeNoch keine Bewertungen

- Accounting DecissionsDokument20 SeitenAccounting Decissionsjcabrera87Noch keine Bewertungen

- Amazon Fresh 5Dokument7 SeitenAmazon Fresh 5Hammad Ali100% (1)

- On June 1 You Begin An Ocean Tour Business For PDFDokument1 SeiteOn June 1 You Begin An Ocean Tour Business For PDFhassan taimourNoch keine Bewertungen

- M&M PizzaDokument1 SeiteM&M Pizzasusana3gamito0% (4)

- Case 8-1 Norman Corp, Patrick AnalysisDokument2 SeitenCase 8-1 Norman Corp, Patrick AnalysisPatrick HariramaniNoch keine Bewertungen

- Problem 13-1 - Chapter 13 - SolutionDokument6 SeitenProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- AkuntansiDokument3 SeitenAkuntansier4sallNoch keine Bewertungen

- Starbucks SWOT AnalysisDokument2 SeitenStarbucks SWOT AnalysisRubayath Namibur RazzakNoch keine Bewertungen

- 07 Time Value of Money - BE ExercisesDokument26 Seiten07 Time Value of Money - BE ExercisesMUNDADA VENKATESH SURESH PGP 2019-21 BatchNoch keine Bewertungen

- Quick Lunch CASE 14-1Dokument2 SeitenQuick Lunch CASE 14-1sheeraveal0% (1)

- Chapter 5 ProblemsDokument7 SeitenChapter 5 Problemsanu balakrishnanNoch keine Bewertungen

- Medieval Case SolutionDokument7 SeitenMedieval Case SolutionTarry BerryNoch keine Bewertungen

- Revenue and Expense RecognitionDokument27 SeitenRevenue and Expense RecognitioncskNoch keine Bewertungen

- Kieso 6Dokument54 SeitenKieso 6noortiaNoch keine Bewertungen

- (Case 6-7) 5-1 Stern CorporationDokument1 Seite(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Example of Investment Analysis Paper PDFDokument24 SeitenExample of Investment Analysis Paper PDFYoga Nurrahman AchfahaniNoch keine Bewertungen

- Case 26 An Introduction To Debt Policy ADokument5 SeitenCase 26 An Introduction To Debt Policy Amy VinayNoch keine Bewertungen

- New Heritage Doll Company Case StudyDokument10 SeitenNew Heritage Doll Company Case StudyRAJATH JNoch keine Bewertungen

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDokument19 SeitenBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNoch keine Bewertungen

- Henri BoulangerieDokument7 SeitenHenri BoulangerievietNoch keine Bewertungen

- CH 06Dokument8 SeitenCH 06Tien Thanh DangNoch keine Bewertungen

- anthonyIM 06Dokument18 SeitenanthonyIM 06Jigar ShahNoch keine Bewertungen

- Quick LunchDokument3 SeitenQuick LunchDV Villan100% (1)

- The Production and Operations Operations Management in NOKIA FirmDokument2 SeitenThe Production and Operations Operations Management in NOKIA FirmAkshath Mavinkurve0% (1)

- Chapter 12: Corporate Valuation and Financial Planning: Page 1Dokument33 SeitenChapter 12: Corporate Valuation and Financial Planning: Page 1nouraNoch keine Bewertungen

- GROUP ASSIGNMENT (Chapter 3, Case 3-62)Dokument6 SeitenGROUP ASSIGNMENT (Chapter 3, Case 3-62)T Yoges Thiru MoorthyNoch keine Bewertungen

- Chapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyDokument1 SeiteChapter 14-Ch. 14-Cash Flow Estimation 11-13.El-Bigbee Bottling CompanyRajib DahalNoch keine Bewertungen

- Can One Size Fits AllDokument8 SeitenCan One Size Fits AllAngelica B. PatagNoch keine Bewertungen

- Managerial Accounting ExamDokument10 SeitenManagerial Accounting ExamJeremy Linn100% (1)

- WCM QuestionsDokument5 SeitenWCM QuestionsBhavin BaxiNoch keine Bewertungen

- 7001 Assignment #3Dokument9 Seiten7001 Assignment #3南玖Noch keine Bewertungen

- BA 141 THU Case 2 PaperDokument10 SeitenBA 141 THU Case 2 PaperLance EstopenNoch keine Bewertungen

- Surecut Shears, Inc.: AssetsDokument8 SeitenSurecut Shears, Inc.: Assetsshravan76Noch keine Bewertungen

- McGraw Hill Connect Question Bank Assignment 3Dokument2 SeitenMcGraw Hill Connect Question Bank Assignment 3Jayann Danielle MadrazoNoch keine Bewertungen

- Case 01a Growing Pains SolutionDokument7 SeitenCase 01a Growing Pains Solution01dynamic33% (3)

- Harlan Foundation: Company BackgroundDokument4 SeitenHarlan Foundation: Company BackgroundPrachiNoch keine Bewertungen

- Capital Budgeting Case StudyDokument2 SeitenCapital Budgeting Case StudyAnand Prakash Sharma100% (1)

- Use The Following Information For Questions 63 andDokument2 SeitenUse The Following Information For Questions 63 andjbsantos09100% (1)

- Amerbran Company A Final1Dokument6 SeitenAmerbran Company A Final1Rio TanNoch keine Bewertungen

- Accounting Principles 2: Mr. Mohammed AliDokument43 SeitenAccounting Principles 2: Mr. Mohammed AliramiNoch keine Bewertungen

- 1758-Minta Yuwana-Soal Kumpulan 1Dokument5 Seiten1758-Minta Yuwana-Soal Kumpulan 1AuliaMukadisNoch keine Bewertungen

- Problem Set #2-Solutions PDFDokument4 SeitenProblem Set #2-Solutions PDFLhorene Hope DueñasNoch keine Bewertungen

- Problem Set Math Day 12 EDITEDDokument21 SeitenProblem Set Math Day 12 EDITED2018-103863Noch keine Bewertungen

- Economics Sample ProblemDokument6 SeitenEconomics Sample ProblemanthonyNoch keine Bewertungen

- Increased by Percentage 19.8% 26.8% 30.45%Dokument1 SeiteIncreased by Percentage 19.8% 26.8% 30.45%Francisco MarvinNoch keine Bewertungen

- Southern Cross Cement Corporation VDokument1 SeiteSouthern Cross Cement Corporation VFrancisco MarvinNoch keine Bewertungen

- Cir V Mobil (Francisco) DoctrineDokument3 SeitenCir V Mobil (Francisco) DoctrineFrancisco MarvinNoch keine Bewertungen

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsDokument1 SeiteYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinNoch keine Bewertungen

- MIAA v. Court of Appeals IssueDokument3 SeitenMIAA v. Court of Appeals IssueFrancisco MarvinNoch keine Bewertungen

- NaagDokument6 SeitenNaagFrancisco MarvinNoch keine Bewertungen

- Filipina Sy V. Ca and Fernando Sy - FranciscoDokument5 SeitenFilipina Sy V. Ca and Fernando Sy - FranciscoFrancisco MarvinNoch keine Bewertungen

- Ylarde vs. Aquino Case Digest 163 SCRA 697 FactsDokument1 SeiteYlarde vs. Aquino Case Digest 163 SCRA 697 FactsFrancisco MarvinNoch keine Bewertungen

- G.R. No. 85279Dokument13 SeitenG.R. No. 85279JP TolNoch keine Bewertungen

- Case Doctrines in Labor Relations: Kiok Loy v. NLRCDokument24 SeitenCase Doctrines in Labor Relations: Kiok Loy v. NLRCFrancisco MarvinNoch keine Bewertungen

- Case 17-3, Powerpoint Presentation SHELTER PARTNERSHIPDokument33 SeitenCase 17-3, Powerpoint Presentation SHELTER PARTNERSHIPFrancisco MarvinNoch keine Bewertungen

- Manpri Case07 GilletteDokument7 SeitenManpri Case07 GilletteFrancisco MarvinNoch keine Bewertungen

- Indivisibility & Indivisible Obligation Solidarity & Solidarity ObligationDokument2 SeitenIndivisibility & Indivisible Obligation Solidarity & Solidarity ObligationFrancisco MarvinNoch keine Bewertungen

- MPDokument7 SeitenMPFrancisco MarvinNoch keine Bewertungen

- North-South Airline Group 5-1Dokument13 SeitenNorth-South Airline Group 5-1Francisco Marvin100% (1)

- Manpri CaseDokument6 SeitenManpri CaseFrancisco MarvinNoch keine Bewertungen

- People Vs Lase 219 SCRA 584 DigestDokument7 SeitenPeople Vs Lase 219 SCRA 584 DigestFrancisco MarvinNoch keine Bewertungen

- CMI, Inc., Manufactures Small Electrical Appliances and Has Recently Introduced AnDokument5 SeitenCMI, Inc., Manufactures Small Electrical Appliances and Has Recently Introduced AnFrancisco MarvinNoch keine Bewertungen

- Group 5 (Reporter) - San Miguel CaseDokument8 SeitenGroup 5 (Reporter) - San Miguel CaseFrancisco Marvin100% (1)

- Case Doctrines in Labor Relations: Kiok Loy v. NLRCDokument24 SeitenCase Doctrines in Labor Relations: Kiok Loy v. NLRCFrancisco MarvinNoch keine Bewertungen

- Cano18 To 20Dokument11 SeitenCano18 To 20Francisco MarvinNoch keine Bewertungen

- Manpri Case01 ConsolidatedAutomobileCaseAnalysisDokument3 SeitenManpri Case01 ConsolidatedAutomobileCaseAnalysisFrancisco Marvin100% (1)

- 16-1 Hospital Supply IncDokument4 Seiten16-1 Hospital Supply IncFrancisco Marvin100% (1)

- PDFDokument2 SeitenPDFEm JayNoch keine Bewertungen

- Oracle Projects CostingDokument17 SeitenOracle Projects CostingredroNoch keine Bewertungen

- Generally Accepted Cost Accounting Principles (GACAP)Dokument72 SeitenGenerally Accepted Cost Accounting Principles (GACAP)Gaurav Jain100% (1)

- MBA Finance ProjectDokument246 SeitenMBA Finance ProjectAshwin80% (5)

- Compilation Notes Financial Statement AnalysisDokument8 SeitenCompilation Notes Financial Statement AnalysisAB12P1 Sanchez Krisly AngelNoch keine Bewertungen

- Advanced Taxation Cpa PDFDokument292 SeitenAdvanced Taxation Cpa PDFJustin MUNYAMAHORONoch keine Bewertungen

- WorksheetsDokument2 SeitenWorksheetsSarifeMacawadibSaid100% (5)

- 5A Review of Accounting Process PDFDokument7 Seiten5A Review of Accounting Process PDFAldrin Jay SalcedoNoch keine Bewertungen

- HARD ROCK COMPANY Statement of Financial PositionDokument3 SeitenHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNoch keine Bewertungen

- Tcode Favorites Sap AaDokument10 SeitenTcode Favorites Sap AaKrali MarkoNoch keine Bewertungen

- MCQs For AuditingDokument10 SeitenMCQs For AuditingSajid AliNoch keine Bewertungen

- Start A Disposable Syringes Manufacturing Business PDFDokument7 SeitenStart A Disposable Syringes Manufacturing Business PDFIndia Heals-2020100% (2)

- CH 5 TAXATION OF CORPORATIONSDokument16 SeitenCH 5 TAXATION OF CORPORATIONSCasandra Nicole AldecoaNoch keine Bewertungen

- Malaysian Tax System and AdministrationDokument75 SeitenMalaysian Tax System and AdministrationfazrinbusirinNoch keine Bewertungen

- Muhammad Nabil Izzuddin Bin Musa Ba247 2DDokument10 SeitenMuhammad Nabil Izzuddin Bin Musa Ba247 2D2022898118Noch keine Bewertungen

- Accounting For Non AccountantsDokument66 SeitenAccounting For Non Accountantsআম্লান দত্ত100% (1)

- Revision 2 - With Answers - 2011Dokument26 SeitenRevision 2 - With Answers - 2011trang vũ lê huyềnNoch keine Bewertungen

- ACCA MA Course NotesDokument380 SeitenACCA MA Course NotesIsaac HermidaNoch keine Bewertungen

- Nonprofit AccountingDokument19 SeitenNonprofit AccountingMayari de AmanteNoch keine Bewertungen

- 02 FM Chapter-2Dokument85 Seiten02 FM Chapter-2Tarekegn DemiseNoch keine Bewertungen

- JXDGDokument12 SeitenJXDGAhsan IqbalNoch keine Bewertungen

- Accounting MCQ On BasicDokument7 SeitenAccounting MCQ On BasicSiji Varghese100% (1)

- Mark Scheme (Results) January 2008: GCE Accounting (6002) Paper 1Dokument20 SeitenMark Scheme (Results) January 2008: GCE Accounting (6002) Paper 1Shah RahiNoch keine Bewertungen

- QUIZ CHAPTER-16 NPOsDokument6 SeitenQUIZ CHAPTER-16 NPOsJennifer TabancuraNoch keine Bewertungen

- Fundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1Dokument36 SeitenFundamentals of Corporate Finance Canadian 6th Edition Brealey Solutions Manual 1jillhernandezqortfpmndz100% (23)

- Initiating Coverage-Engineers India LimitedDokument15 SeitenInitiating Coverage-Engineers India LimitedAdeshNoch keine Bewertungen

- Balance SheetDokument37 SeitenBalance Sheetecell_iimkNoch keine Bewertungen

- INS 21 Chapters 3-Insurer Financial PerformanceDokument27 SeitenINS 21 Chapters 3-Insurer Financial Performancevenki_hinfotechNoch keine Bewertungen

- Lesson 2 - Transactions and Accounting EquetionDokument5 SeitenLesson 2 - Transactions and Accounting EquetionMazumder SumanNoch keine Bewertungen

- All Sections of Income Tax Act 1961Dokument37 SeitenAll Sections of Income Tax Act 1961Prasad IyengarNoch keine Bewertungen