Beruflich Dokumente

Kultur Dokumente

Banking Law Cases

Hochgeladen von

Rowena Mae Mencias0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

36 Ansichten4 SeitenCase Digest

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCase Digest

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

36 Ansichten4 SeitenBanking Law Cases

Hochgeladen von

Rowena Mae MenciasCase Digest

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

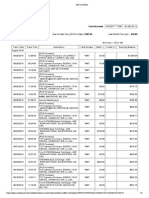

Sie sind auf Seite 1von 4

1

SIMEX INTERNATIONAL (MANILA) INC. VS. COURT OF APPEALS

A bank may be held liable for damages by reason of its unjustified dishonor of a check, which

caused damage to its clients credit standing. The bank must record every single transaction

accurately, down to the last centavo, and as promptly as possible. This has to be done if the

account is to reflect at any given time the amount of money the depositor can dispose of as he

sees fit, confident that the bank will deliver it as and to whomever he directs. The bank is a

fiduciary of the depositors money.

FACTS: Simex International is a private corporation engaged in the exportation of food

products. It buys these products from various local suppliers and then sells them abroad to the

Middle East and the United States. Most of its exports are purchased by the petitioner on credit.

Simex was a depositor of the Far East Savings Bank and maintained a checking account in its

branch in Cubao, Quezon City which issued several checks against its deposit but was surprised

to learn later that they had been dishonored for insufficient funds. As a consequence, several

suppliers sent a letter of demand to the petitioner, threatening prosecution if the dishonored

check issued to it was not made good and also withheld delivery of the order made by the

petitioner. One supplier also cancelled the petitioners credit line and demanded that future

payments be made by it in cash or certified check. The petitioner complained to the respondent

bank. Investigation disclosed that the sum of P100,000.00 deposited by the petitioner on May 25,

1981, had not been credited to it. The error was rectified only a month after, and the dishonored

checks were paid after they were re-deposited. The petitioner then filed a complaint in the then

Court of First Instance of Rizal against the bank for its gross and wanton negligence.

ISSUE: Whether or not the bank can be held liable for negligence by reason of its unjustified

dishonor of a check

HELD: The depositor expects the bank to treat his account with the utmost fidelity whether

such account consists only of a few hundred pesos or of millions. The bank must record every

single transaction accurately, down to the last centavo, and as promptly as possible. This has to

be done if the account is to reflect at any given time the amount of money the depositor can

dispose of as he sees fit, confident that the bank will deliver it as and to whomever he directs. A

blunder on the part of the bank, such as the dishonour of a check without good reason, can cause

the depositor not a little embarrassment if not also financial loss and perhaps even civil and

criminal litigation.

METROPOLITAN BANK AND TRUST CO. v CABILZO

Banking is a business affected with public interest. The degree of diligence required of a bank

must be a high degree of diligence.

FACTS: Renato Cabilzo was one of Metrobanks clients who maintained a current account with

the banks Pasong Tamo Branch. On Nov. 12, 1994, he issued a check payable to cash and

postdated on Nov.24, 1994 for the amount of P1,000. The check was presented to Westmont

Bank for payment and the latter indorsed it to Metrobank. Metrobank cleared the check and

debited Cabilzos account. It was found out later by Cabilzo that the checks amount was altered

to P91,000 and the date changed to Nov. 14. Cabilzo demanded that Metrobank re-credit the

90,000 to his account. Metrobank refused. Cabilzo filed a civil action for damages against

Metrobank. In its defense, Metrobank said that it exercised due diligence in examining the

genuineness of the signature and the technical entries including the amount in figures and in

2

words to see if there were alterations and found that there was none. It further stated that Cabilzo

was partly responsible for leaving spaces on the check which made the fraudulent insertion

possible. TheRTC and the Court of Appeals ruled in favor of Cabilzo saying that Metrobank was

liable

ISSUE: Whether or not Metrobank should be held liable for damages for its negligence

HELD: YES. The degree of diligence required of a reasonable man in the exercise of his tasks

and the performance of his duties has been faithfully complied with by Cabilzo. In fact, he was

wary enough that he filled with asterisks the space between and after the amounts, not only those

stated in words but also those in numerical figures in order to prevent any fraudulent insertion.

Metrobank cannot rely on the doctrine of equitable estoppel which states that when one of the

two innocent persons, each guiltless of any intentional or moral wrong, must suffer a loss, it must

be borne by the one whose erroneous conduct, either by omission or commission, was the cause

of injury. Metrobank did not prove that Cabilzo was negligent or that this negligence was the

proximate cause of the loss. Negligence is not presumed but it must be proven by the one who

alleges it. Banking is a business affected with public interest and because of the nature of its

functions, the bank is under obligation to treat the accounts of its depositors with meticulous

care, always having in mind the fiduciary nature of their relationship. The appropriate degree of

diligence required of a bank must be a high degree of diligence, if not the utmost diligence. Here,

the alterations on the check are visible to the naked eye but Metrobank failed to detect the

alterations which could not escape the attention of even an ordinary person. This negligence is

further exacerbated by the fact that it was the cash custodian who examined the check when his

functions do not involve the examining of checks. Obviously, the custodian was not versed and

competent in handling such duty. Banks are expected to exercise the highest degree of diligence

in the selection and supervision of employees.

SERRANO VS. CENTRAL BANK

"Bank deposits are in the nature of irregular deposits. They are really loans because they earn

interest. The petitioner here in making time deposits that earn interests with respondent

Overseas Bank of Manila was in reality a creditor of the respondent Bank and not a depositor.

The respondent Bank was in turn a debtor of petitioner. Failure of the respondent Bank to honor

the time deposit is failure to pay its obligation as a debtor and not a breach of trust arising from

a depositary's failure to return the subject matter of the deposit."

FACTS: Manuel Serrano made a time deposit, for one year with 6%interest of One Hundred

Fifty Thousand Pesos with the Respondent Overseas Bank of Manila. Concepcion Maneja also

made a time deposit, for one year with 6 1/2% interest, of Two Hundred Thousand Pesos on the

same respondent Overseas Bank of Manila. Concepcion Maneja, then married, assigned and

conveyed to petitioner Manuel Serrano, her time deposit of Php200,000.00. Notwithstanding

series of demands for encashment of the aforementioned time deposit from the respondent

Overseas Bank of Manila, not a single one of the time deposit certificates was honored by

respondent Overseas Bank of Manila. Respondent Central Bank dissolved and liquidated the

Overseas Bank of Manila. The former denied that it is a guarantor of the permanent solvency of

any banking institution as claimed by the petitioner. Respondent Central Bank avers no

knowledge of petitioners claim that the properties given by the respondent Overseas Bank of

Manila as additional collaterals to the respondent Central Bank of the Philippines for the

formers overdrafts and emergency loans were acquired from the depositors money including

the time deposits of the petitioner.

3

ISSUE: Whether or not the respondents (Central Bank of the Philippines Overseas Bank of

Manila and its Stockholders) are jointly and solidary liable for damages due to breach of trust

RULING: Both parties overlooked the fundamental principle in the nature of bank deposits

when the petitioner claimed that there should be created a constructive trust in his favor when the

respondent Overseas Bank of Manila increased the collaterals in favor of the respondent Central

Bank of the Philippines for the formers overdrafts and emergency loans, since these collaterals

were acquired by the use of depositors money. Bank deposits are in nature of irregular deposits.

They are really loans because they earn interest. All kinds of bank deposits, whether fixed,

savings or current are to be treated as loans and are to be covered by the loans. Current and

savings deposits are loans to a bank because it can use the same. The petitioner here in the

making time deposits that earn interests with respondent Overseas Bank of Manila was in reality

a creditor of the respondent bank and not a depositor. The respondent bank was in turn a debtor

of petitioner. Failure of the respondent bank to honor the time deposit is failure to pay obligation

as a debtor and not a breach of trust arising from depositorys failure to return the subject matter

of the deposit.

CONSOLIDATED BANK AND TRUST CORPORATION VS. CA

FACTS: Private respondent L.C. Diaz instructed his employee, Calapre, to deposit in his

savings account in petitioner bank. Calapre left the passbook of L.C. Diaz to the teller of the

petitioner bank because it was taking time to accomplish the transaction and he had to go to

another bank. When he returned, the teller told him that somebody got it. The following day, an

impostor succeeded in withdrawing P300,000.00 by using said passbook and a falsified

withdrawal slip. Private respondent sued the bank for the amount withdrawn by the impostor.

ISSUE: Whether or not petitioner bank is liable solely for the amount withdrawn by the

impostor

HELD: No. The bank is liable for breach of contract due to negligence or culpa contractual. The

contract between the bank and its depositor is governed by the provisions of the Civil Code on

simple loan. Article 1172 of the Civil Code provides that responsibility arising from negligence

in the performance of every kind of obligation is demandable. The bank is liable to its depositor

for breach of the savings deposit agreement due to negligence or culpa contractual. The bank is

under obligation to treat the accounts of its depositors with meticulous care, always having in

mind the fiduciary nature of their relationship (Simex International vs. CA).

The tellers know, or should know, that the rules on savings account provide that any person in

possession of the passbook is presumptively its owner. If the tellers give the passbook to the

wrong person, they would be clothing that person presumptive ownership of the passbook,

facilitating unauthorized withdrawals by that person.

The doctrine of last clear chance states that where both parties are negligent but the negligent act

of one is appreciably later than that of the other, or where it is impossible to determine whose

fault or negligence caused the loss, the one who had the last clear opportunity to avoid the loss

but failed to do so, is chargeable with the loss. This doctrine is not applicable to the present case.

The contributory negligence of the private respondent or his last clear chance to avoid the loss

would not exonerate the petitioner from liability. However, it serves to reduce the recovery of

damages by the private respondent. Under Article 1172, the liability may be regulated by the

courts, according to the circumstances. In this case, respondent L.C. Diaz was guilty of

contributory negligence in allowing a withdrawal slip signed by its authorized signatories to fall

into the hands of an impostor. Thus, the liability of petitioner bank should be reduced. The

4

Supreme Court allocated the damages between the depositor who is guilty of contributory

negligence and the bank on a 40-60 ratio. Petitioner bank must pay only 60% of the actual

damages.

Das könnte Ihnen auch gefallen

- Certificate of Transfer Business, RelatoDokument1 SeiteCertificate of Transfer Business, RelatoRowena Mae MenciasNoch keine Bewertungen

- Affidavit of ClosureDokument1 SeiteAffidavit of ClosureRowena Mae MenciasNoch keine Bewertungen

- Affidavit of ConformityDokument1 SeiteAffidavit of ConformityRowena Mae Mencias100% (2)

- Affidavit of Two Disinterested PersonsDokument2 SeitenAffidavit of Two Disinterested PersonsRowena Mae MenciasNoch keine Bewertungen

- Deed of Adjudication With Real Estate MortgageDokument2 SeitenDeed of Adjudication With Real Estate MortgageRowena Mae MenciasNoch keine Bewertungen

- Waiver of RightsDokument2 SeitenWaiver of RightsRowena Mae MenciasNoch keine Bewertungen

- Affidavit of Two Disinterested PersonsDokument2 SeitenAffidavit of Two Disinterested PersonsRowena Mae MenciasNoch keine Bewertungen

- Affidavit of DiscrepancyDokument1 SeiteAffidavit of DiscrepancyRowena Mae MenciasNoch keine Bewertungen

- Affidavit of Loss-Fatima de JuanDokument1 SeiteAffidavit of Loss-Fatima de JuanRowena Mae MenciasNoch keine Bewertungen

- Affidavit of Building A SidecarDokument1 SeiteAffidavit of Building A SidecarRowena Mae MenciasNoch keine Bewertungen

- GENERAL POWER OF ATTORNEY - Diosdado Rose - For MergeDokument1 SeiteGENERAL POWER OF ATTORNEY - Diosdado Rose - For MergeRowena Mae MenciasNoch keine Bewertungen

- Letter FELCONTECH DSWD MacapobreDokument6 SeitenLetter FELCONTECH DSWD MacapobreRowena Mae MenciasNoch keine Bewertungen

- Affidavit of DiscrepancyDokument1 SeiteAffidavit of DiscrepancyRowena Mae MenciasNoch keine Bewertungen

- Business AgreementDokument2 SeitenBusiness AgreementRowena Mae Mencias100% (1)

- Waiver, Release and Quitclaim: Doc. No. Page No. Book No. V Series of 2019Dokument2 SeitenWaiver, Release and Quitclaim: Doc. No. Page No. Book No. V Series of 2019Rowena Mae MenciasNoch keine Bewertungen

- Contract To Sell - Yolanda QuiambaoDokument2 SeitenContract To Sell - Yolanda QuiambaoRowena Mae MenciasNoch keine Bewertungen

- Affidavit of Desistance - LimstonDokument1 SeiteAffidavit of Desistance - LimstonRowena Mae MenciasNoch keine Bewertungen

- Contract To Sell - Yolanda QuiambaoDokument2 SeitenContract To Sell - Yolanda QuiambaoRowena Mae MenciasNoch keine Bewertungen

- Motion For BailDokument2 SeitenMotion For BailRowena Mae Mencias50% (2)

- Contract of LeaseDokument2 SeitenContract of LeaseRowena Mae MenciasNoch keine Bewertungen

- Stat Con QuestionsDokument1 SeiteStat Con QuestionsRowena Mae MenciasNoch keine Bewertungen

- Waiver Rights DaughterDokument2 SeitenWaiver Rights DaughterRowena Mae MenciasNoch keine Bewertungen

- Reply Position Paper Tayao LatestDokument13 SeitenReply Position Paper Tayao LatestRowena Mae Mencias100% (1)

- Referral To ProsecutorDokument1 SeiteReferral To ProsecutorRowena Mae MenciasNoch keine Bewertungen

- 30 Rules For Godly WomenDokument3 Seiten30 Rules For Godly WomenRowena Mae MenciasNoch keine Bewertungen

- Promissory NoteDokument1 SeitePromissory NoteRowena Mae Mencias100% (2)

- Agreement To Sever Marital Obligations and RightsDokument1 SeiteAgreement To Sever Marital Obligations and RightsRowena Mae MenciasNoch keine Bewertungen

- ASU Student Seeks Legal Recourse After Being Wrongly Denied Cum Laude HonorsDokument6 SeitenASU Student Seeks Legal Recourse After Being Wrongly Denied Cum Laude HonorsRowena Mae MenciasNoch keine Bewertungen

- Intercountry AdoptionDokument2 SeitenIntercountry AdoptionRowena Mae MenciasNoch keine Bewertungen

- Requirements and Supporting Documents For Prospective Adoptive ParentsDokument3 SeitenRequirements and Supporting Documents For Prospective Adoptive ParentsRowena Mae MenciasNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- My Card Place PDFDokument3 SeitenMy Card Place PDFDIGITAL PATRIOTSNoch keine Bewertungen

- Opcom: February 2013 Monthly Market ReportDokument4 SeitenOpcom: February 2013 Monthly Market ReportioanitescumihaiNoch keine Bewertungen

- Barings - A Case Study For Risk ManagementDokument5 SeitenBarings - A Case Study For Risk ManagementGyanendra Mishra100% (1)

- Davao Del Sur Electric Cooperative, Inc. (Dasureco) Cogon, Digos City, Davao Del SurDokument1 SeiteDavao Del Sur Electric Cooperative, Inc. (Dasureco) Cogon, Digos City, Davao Del SurDASURECOWebTeamNoch keine Bewertungen

- Struktur OrganisasiDokument1 SeiteStruktur OrganisasiRoudaNoch keine Bewertungen

- Daftar Penerbit Kartu Debet (En)Dokument1 SeiteDaftar Penerbit Kartu Debet (En)Dzochra Miltaz YaoumielNoch keine Bewertungen

- OpTransactionHistoryUX524 08 2023Dokument2 SeitenOpTransactionHistoryUX524 08 2023Praveen SainiNoch keine Bewertungen

- Novy ChargesDokument41 SeitenNovy ChargesGavin RozziNoch keine Bewertungen

- Change of OwnershipDokument11 SeitenChange of OwnershipGlenn JamesNoch keine Bewertungen

- 397 SCRA 651 - Producers Bank of The Philippines Vs Hon. Court of AppealsDokument3 Seiten397 SCRA 651 - Producers Bank of The Philippines Vs Hon. Court of AppealsRengie GaloNoch keine Bewertungen

- A.J. Frost Robert Prechter Elliott Wave PrincipleDokument3 SeitenA.J. Frost Robert Prechter Elliott Wave PrincipleingenierohannerNoch keine Bewertungen

- Gaisano Cagayan, Inc Vs Insurance Company of North America DigestDokument2 SeitenGaisano Cagayan, Inc Vs Insurance Company of North America DigestAbilene Joy Dela Cruz100% (1)

- Comprehensive ProblemDokument11 SeitenComprehensive Problemapi-295660192Noch keine Bewertungen

- Why Hayek Was Wrong On Concurrent CurrenciesDokument12 SeitenWhy Hayek Was Wrong On Concurrent CurrenciesKrzysiek RembiaszNoch keine Bewertungen

- Dela Cruz Vs Capital Insurance & Surety CoDokument1 SeiteDela Cruz Vs Capital Insurance & Surety CoKelsey Olivar MendozaNoch keine Bewertungen

- Bol PDFDokument9 SeitenBol PDFSiddhartha ChakrabartiNoch keine Bewertungen

- NAFSCOB-Branch OperationsDokument379 SeitenNAFSCOB-Branch OperationsAshoak VarmaNoch keine Bewertungen

- Mr. Potlacheru Naveen Kumar bank account statementDokument14 SeitenMr. Potlacheru Naveen Kumar bank account statementP NAVEEN KUMARNoch keine Bewertungen

- 1 - BPI V CADokument5 Seiten1 - BPI V CADanielle Palestroque SantosNoch keine Bewertungen

- 300 Saw Pa Accounting ManualDokument52 Seiten300 Saw Pa Accounting ManualKaren Robinson WilliamsNoch keine Bewertungen

- MB6 871 PDFDokument24 SeitenMB6 871 PDFrudhra02Noch keine Bewertungen

- Service Tax: Aiaims Mms-ADokument31 SeitenService Tax: Aiaims Mms-AAbbas Haider NaqviNoch keine Bewertungen

- 3.2 Credit and Debt ManagementDokument35 Seiten3.2 Credit and Debt Managementsuhada asriNoch keine Bewertungen

- Shedule of ChargessDokument13 SeitenShedule of ChargessalirezaNoch keine Bewertungen

- ObjectionBACHomeLoansClaim 11 12Dokument3 SeitenObjectionBACHomeLoansClaim 11 12GrammaWendyNoch keine Bewertungen

- The Role of Micro Loans in The Mordern Financial Industry-Dessertation 1st DraftDokument37 SeitenThe Role of Micro Loans in The Mordern Financial Industry-Dessertation 1st DraftManika Gupta100% (1)

- Resume - Edmundo H Perez-1Dokument2 SeitenResume - Edmundo H Perez-1Mon PerezNoch keine Bewertungen

- Self Employed DocumentDokument11 SeitenSelf Employed DocumentapproachdirectNoch keine Bewertungen

- Philippine Interpretations Committee Operating ProceduresDokument5 SeitenPhilippine Interpretations Committee Operating ProceduresJere Mae Bertuso TaganasNoch keine Bewertungen

- An Internship Report On Risk Management of Exim Bank BangladeshDokument64 SeitenAn Internship Report On Risk Management of Exim Bank BangladeshSumantra Barai25% (4)