Beruflich Dokumente

Kultur Dokumente

Brand Perception of Amulya Milk Powder

Hochgeladen von

Tonmoy Banerjee0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

87 Ansichten46 SeitenReport on Amul

Originaltitel

Amul report

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenReport on Amul

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

87 Ansichten46 SeitenBrand Perception of Amulya Milk Powder

Hochgeladen von

Tonmoy BanerjeeReport on Amul

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 46

BRAND PERCEPTION FOR AMULYA MILK POWDER

AT T.A. PAI MANAGEMENT INSTITUTE

Prepared for

Amul

Prepared by

Group Q2

Section 3

MNCN 2

T. A. Pai Management Institute - 576104

March 26, 2014

LETTER OF TRANSMITTAL

TO: AparnaBhat, Professor MNCN

FROM: Group Q2, PGP1

DATE: 26 March, 2014

SUBECT: MNCN report submission

The following report is a work of market research, done with the objective to conduct a

B2C market research for gaining the brand perception for Amulya to reach a wider

audience and newer consumers, connect better with its existing consumer base. The

research was done in Manipal, Udupi and Mangalore. The project included to find the

reasons for buying the Milk powder products like Amulya and Every day. The

elucidations of external validity confirm the acceptance of hypothesis in the report.

The team has tried to apply the MKRH concepts learned in class to the best of its

knowledge. Feedback for improving the effectiveness of the study will be highly valued.

Group Q2

ii

ACKNOWLEDGEMENTS

We sincerely thank Gujarat Co-operative Milk Marketing Federation-Amul for entrusting

us with such a challenging assignment. The experience was both demanding and

fulfilling.

We would like to thank the team from Amul for guiding us during the entire project.

We extend our gratitude to Dr. R.C. Natarajan, Director, Tapmi, for his support and

encouragement for this project.We take this opportunity to thank Prof. H.S. Srivatsa, the

faculty guide for the project for his continuous support and valuable insights.

We would like to thank Prof. AparnaBhat, for the valuable insights and motivation

provided throughout the course of the research study.

We would like to appreciate the support provided by all the other team members who

helped in conducting this research and who worked towards making the project a

success.

We thank all who have contributed to this project, directly or indirectly.

Group Q2

iii

EXECUTIVE SUMMARY

BRAND PERCEPTION FOR AMULYA MILK POWDER

AT T.A. PAI MANAGEMENT INSTITUTE

Group Q2

March 26, 2014

The objective of the project was to conduct a B2C market research for gaining the brand

perception for Amulya to reach a wider audience and newer consumers, connect better

with its existing consumer base. The research was done in Manipal, Udupi and

Mangalore. The project included to find the reasons for buying the Milk powder products

like Amulya and Every day.

The project has been broadly divided in three stages:

The first stage was to identify the factors that would help in preparing the questionnaires

for survey. In this stage secondary research was done followed by FGDs and in-depth

Interviews. 19 variables were identified in this process.

The second stage was a pilot study done with 35 respondents. The questionnaires

formed on the various variables here were taken for survey and reliability was tested

using Cronbachs Alpha method.

The third stage was an observation technique where a stall was setup in Udupi outside

Big Bazaar. The respondents were given tea/coffee using both Amulya and Every day

and noting their perception (taste, quality etc.) about the brand.

A total of 245 consumers firms have been interviewed across all the segments.

iv

The following were the major findings from the study:

1. AMUL is perceived to be a brand characterized by Quality, Purity, and Taste.

With Taste being synonymous with its logo Taste of India, hence it signifies the

recall of the brand. Also, it is considered to be offering products that are best

buy. But, Amulya as a product is not accepted that well by the customers.

2. AMUL was considered a Premium brand in comparison to the regional brands

and hence, is considered costly. Therefore, people prefer buying local brands in

spite of Amulya.

3. Decisions were mostly influenced by Quality/Taste and brand name of the

product (Amulya and not Amul) while packaging and price didnt play a significant

role.

4. Respondents expressed their desire to purchase healthy products of brands

purchased by them.

5. It was found that association of a brand with Social events/causes plays a driver

for respondents to purchase the products of that brand. The experiment done the

team to get the customer information, by giving them live demos, helped in

converting some respondents to buyers.

In final stage, a report will be submitted to Amul with all Analysis and Findings (Factorial

and Discriminant). There are few recommendations also that are suggested to Amul:

1. Amul should increase their visibility in Manipal/Udupi like cities by launching

some advertisements in local language and should them on local channels.

2. Amul should do promotional activities in Big Stores like Big Bazaars by giving

free tea/coffee made by Amulya Whitener. This might help them increase foot

falls.

v

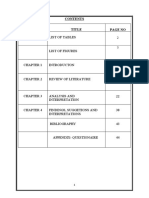

CONTENTS

LETTER OF TRANSMITTAL ii

ACKNOWLEDGEMENTS iii

EXECUTIVE SUMMARY iv

1.0 INTRODUCTION

1.1 Company Background 1

1.2 Problem Statement 3

1.3 Management Objective 3

1.4 Research Objectives 3

1.5 Coverage and scope 4

1.6 Limitations 4

2.0 RESEARCH METHODOLOGY

2.1Introduction 4

2.1.1Exploratory Research 5

2.1.2 Conclusive Research 6

2.1.3Data Analysis 7

3.0 FINDINGS

3.1 Analysis 7

3.1.1 Demographics and Psychographic findings 7

3.1.2 Internal Reliability testing 9

3.1.3 Factor Analysis 9

3.1.4 Discriminant Analysis 11

3.1.5 Conjoint Analysis 13

3.2 Findings 13

4.0 SUMMARY AND RECOMMENDATIONS

5.1 Summary of the Problem 15

5.2 Summary of the Findings 15

5.0RECOMMENDATIONS 15

6.0 APPENDIX

A. Questionnaire 17

7.0 REFERENC 25

LIST OF ILLUSTRATIONS

Figures

Fig.1. Gender of Respondents 25

Fig.1. Gender of Respondents 26

Fig.3 Profession of respondents 26

Fig.4. Tea/Coffee Usage Frequency 27

Fig.5 Overall Awareness Level of Amul Brand 27

Fig.6 Frequency of Awareness of Amulya Product 28

Fig.7. No. of cases processed for Cronbachs Alpha 28

Fig.8. Number of items and Cronbachs Alpha 28

Fig.9. Independent Variables Means and Standard Deviation 28

Fig.10. Brand Loyalty 29

Fig.11 Quality of Product 29

Fig.12. shows the acceptance of respondents for Amulya in Sweets, Cakes 29

Fig.13. shows the acceptance of respondents for Amulya in Tea/Coffee 30

Fig.14. shows the discountspreferences for Amulya 30

Fig.15. shows the taste preferences of customers 30

Fig.16. shows the purity preferences of customers 31

Fig.17. shows the freshness preferences of customers 31

Fig.18. shows the advertisements preferences of customers 31

Fig.19. shows the packaging preferences of customers 32

Fig.20. shows the price preferences of customers 32

Fig.21. shows the nutrition preferences of customers 32

Fig.22. shows the value for money preferences of customers 33

Fig.23. shows the convenience preferences of customers 33

Fig.24. shows the nature friendliness preferences of customers 33

Fig.25 Factor Analysis Communality Matrix 34

Fig.26. Total Variance Explained 34

Fig.27. Component Matrix 35

Fig.28 Rotated Component Matrix 35

Fig.29. Factor Analysis Variables Similarity 36

Fig.30 Factor 36

Fig.31 Scree Plot 36

Fig.32.All Case Analysis 37

Fig.33. Group Means 37

Fig.34.Retest on Group Means 37

Fig.35.Canonical Discriminant Function 38

Fig.36.Structure Matrix 38

Fig.37. Amulya Buyers vsAmulya Non Buyers 38

BRAND PERCEPTION FOR AMULYA MILK POWDER

AT T.A. PAI MANAGEMENT INSTITUTE

1.0 INTRODUCTION

1.1 Company Background

Gujarat Cooperative Milk Marketing Federation Ltd. (GCMMF) is India's largest food

product marketing organization with annual turnover (2011-12) US$ 2.5 billion. Its daily

milk procurement is approx 13 million liter (peak period) per day from 16,117 village milk

cooperative societies, 17 member unions covering 24 districts, and 3.18 million milk

producers.

AMULs origin was linked to the freedom movement in India. SardarVallabhbhai Patel,

one of Indias significant freedom fighters, encouraged the dairy farmers from the Kaira

district in Gujarat to form a cooperative to fight against the low prices offered for their

milk by the monopoly milk supplier of the area, Polson's Dairy. The dairy farmers met in

Samarkha (Kaira district, Gujarat) on the 4th of January 1946, and decided to set up a

milk producers' cooperative that would deal directly with the Bombay government, the

final buyer of their milk. This was the origin of the AMULs model.

GCMMF is the Apex organization of the Dairy Cooperatives of Gujarat, popularly known

as 'AMUL', which aims to provide remunerative returns to the farmers and also serve the

interest of consumers by providing quality products which are good value for money. Its

success has not only been emulated in India but serves as a model for rest of the World.

It operates through 47 Sales Offices and has a dealer network of 7000 dealers and 10

Lakh retailers, one of the largest such networks in India.

2

AMULs Model of dairy development is a three-tiered structure with the dairy cooperative

societies at the village level federated under a milk union at the district level and a

federation of member unions at the state level.

Establishment of a direct linkage between milk producers & consumers

Milk Producers (farmers) control procurement, processing and marketing

Professional management

It spurred the White Revolution of India, and has made India the largest producer of milk

and milk products in the world. On an average 10.6 million milk (peak figure of 14.5

million in 2012) is collected daily in 1, 28,799 dairy cooperative societies across the

country.

The milk is processed in 176 District Co-operative Unions and marketed by 22 State

Marketing Federations, ensuring a better life for millions.

AMUL initially started with milk, but now it operates in diversified product portfolio

comprising of milk, milk powder, health beverages, ghee, butter, cheese, Pizza cheese,

Ice-cream, Paneer, curd, cream, chocolates, and traditional Indian sweets etc. GCMMF

is India's largest exporter of Dairy Products. It has been accorded a "Trading House"

status. Many of its products are available in USA, Gulf Countries, Singapore,

Philippines, Japan, China and Australia.

GCMMF has received the APEDA award from Government of India for excellence in

dairy product exports for the last 13 years. For the year 2009-10, GCMMF was awarded

the "Golden Trophy' for its outstanding export performance and contribution in dairy

products sector by APEDA. For its consistent adherence to quality, customer focus and

dependability, GCMMF has received numerous awards and accolades over the years. It

received the Rajiv Gandhi National Quality Award in1999 in best of all Categories.

3

In 2002 GCMMF bagged India's most Respected Company award instituted by Business

World. In 2003, it was awarded the IMC Ramakrishna Bajaj National Quality Award -

2003 for adopting noteworthy quality management practices for logistics and

procurement. GCMMF is the first and only Indian organization to win topmost

International Dairy Federation Marketing Award for pro-biotic ice-cream launch in 2007.

1.2 Problem Statement

The problem statement provided by Amul:

Amul has 70% market share for Amulya in Udupi and Mangalore. Howto make the

balance 30% to shift over from Everyday to Amulya. A study needs to be carried out with

Everyday consumers (whose details have to be got from retailers) with a questionnaire

and finding out through analysis what is keeping them with Everyday and what will make

them shift.

1.3 Management Objective

The project was aimed at conducting a market research study to measure the

awareness levels of Amulya across Udupi and Mangalore.The Management objective

was to conduct a B2C market research for gaining the brand perception for Amulya to

reach a wider audience and newer consumers.

1.4 Research Objectives

The following research objectives have been defined to analyze and study the project

objective defined for the research process:

To assess the awareness level of Milk Powder products.

4

To find the area of usage.

To find the frequency of usage.

To identify the occasion of usage of Milk Powder.

To measure the level of satisfaction/dissatisfaction with various brands of Milk

Powder.

To find various milk powder brands used in last one year.

To measure the attitude for milk powder as the substitute for milk.

1.5 Coverage & Scope

The scope for the research process is as follows:

To capture the demographic and lifestyle characteristics

To find the buying behavior for the Amulya

To find the brand perception, brand recall and association of Amulya

To assess the impact of different initiatives undertaken by AMUL

To analyze the initiatives used by AMULs competitors

To devise strategies to enhance the connect of the AMUL brand

1.6 Limitations

The research study is limited to only Amulya milk powder which is one of the product

under Amul.

2.0 RESEARCH METHODOLOGY

2.1 Introduction

The research process was divided into 3 stages viz. Exploratory Research, Conclusive

Research and Data Analysis.

5

2.1.1Exploratory Research

The Exploratory research comprised of 4 stages:

a) Secondary Research: On the basis of secondary research, information was gained

about the the milk powder market in India for AMUL and its competitors. Sources

included various websites as well as previous BrandScan reports on AMUL. The

target segment was identified and categorized into 3 age-groups :

18-25 years

26-45 years

46 years and above

b) Exploratory Study: In this phase, we conducted FGDs and In-depth Interviews to

capture responses from the target segment.

FGDs

5 focus group discussions were conducted during the first phase of research.The FGDs

were conducted in various parts of Udupi and Manipal, such as, Manipal Institute of

Technology campus, cafeteria of Kasturba Medical College (KMC), TAPMI and public

places. A conscious effort was made to obtain an equitable distribution of respondents in

an age bracket of 18-60 (both young and middle aged people).The objective of the

FGDs was to identify variables which influence the purchase behaviour of customers

who are regular users of milk powder.

In depth Interviews

20 interviews were conducted with people in the age group of 18-60 years. The

discussion was aimed to gather insights from respondents about the milk products

consumed by them and the respective milk powder brands used. The campaigns and

6

initiatives taken by AMUL were discussed to find out the level of impact and awareness

among them. The objectives of the above stages were to gain insights on the following

parameters:

Factors that characterize the purchase of milk powder

List out the competitors of AMUL in the product portfolio offered

Awareness of advertisement initiatives taken by AMUL

Brand perception of AMUL and its competitors

c) Pilot questionnaire: An initial questionnaire was designed to assess target

respondents covering various age groups. These questionnaires were administered

online and the responses collected were used along with other responses to prepare the

final set of questions.

d) Final Questionnaire: After analyzing the additional insights gained from respondents

on different parameters, the initial questionnaire was further refined and a final

questionnaire (listed in Appendix-A) was prepared.

2.1.2 Conclusive Research

The final questionnaire was administered to people in the Manipal/Udupi and Mangalore

region. The sampling technique used was random convenience sampling. This research

was conducted in 3 phases :

Phase1: Mall Format(Mangalore)

Phase2: Big Bazaar Format(Udupi)

Phase3: Small Retail Shops Format (Manipal)

7

The aim of the conclusive research was to validate the data collected through the

exploratory research and get responses from a larger number of respondents on the

existing variables obtained in the exploratory research.

2.1.3Data Analysis

The final leg of the conclusive research was done post-data collection. The data

collected from the market surveywas analyzed and mapped to the research objectives.

The findings of the study helped to draw the conclusion and infer recommendations.

3.0 FINDINGS

3.1. Analysis

3.1.1. Demographic and Psychographic Findings

The total responses were taken in 4 formats, Mall format in Mangalore, Big Bazaars

(Class A) stores in Udupi, Small Retail shops(Class B) in Manipal and Experimental

Observation Format(Outside Manipal, Udupi and Tapmis Local Canteen(Gopi Annas

Caf). The total number of respondents was collected to be 245. The ratio of Male to

Female respondents was 64:36 with highest number of respondents in the group to be

of age group 26-35 yearsfollowed by 18-25 years and 36-45 years. This helped in

getting a mix of respondents in the target segment.The respondents were mostly

Students in their Higher Secondary, Graduate and Post Graduate degree while the rest

20% was split among the professionals in Private Sector, Public sector, Business

Executives and Others.

As the Amulya product is positioned for using during Tea/Coffee, we started our analysis

by asking people whether they drink Tea or Coffee. It was clearly observed that around

37.14% of people drink tea/coffee 4-5 times and 34.29% of people drink for 5-6 times(As

shown in Fig.4). Therefore, there is market potential for such a product.

8

The graph in Fig. 5 shows the awareness level of Amul brand with the sample size of

300 respondents. It was observed that only 6.12% people are not aware of Amul

products. We removed all those respondents who were not aware about the AMUL

brand.

Fig. 6 shows the awareness level of Amul brand with the sample size of 270

respondents. It was observed that only 11.13% people are not aware of Amulya

products. We removed all those respondents who were not aware about the Amulya

product. Finally, 254 respondents were left for final analysis.

The analysis for this report was initiated by identifying 19 variables from the combination

of Secondary Research, Focused Group Discussions and In-Depth Interviews. The

variables are listed as:

After finalizing the variables identified from the above mentioned mechanisms, a pilot

questionnaire was tried to test the internal reliability of questionnaire. A detailed

questionnaire is mentioned in APPENDIX A of this report.

It was found that taking all the variables into consideration, Cronbachs Alpha (a

parameter that judges the reliability of the questionnaire with standard value greater than

0.7) was coming to be 0.698. Therefore, few variables that had the negative impact on

the Cronbachs value were rejected. These included variables like Availability and

Brand Awareness Brand Recall

Product Usage Brand Satisfaction(Tea/Coffee)

Brand Satisfaction(Sweets /Cakes etc.) Brand Switching

Brand Loyalty Quality

Purity Availability

Packaging Taste

Price Freshness

Nutrition Nature Friendly

Value for Money Convenience

Advertisements

9

Product Usage. The rejection of these variables implies that they dont have any

considerable impact on the decision making for this research.

Final analysis included only 17 variables. This was the result of pilot study. The pilot

study included 35 respondents. The above highlighted variables were removed from the

study.

3.1.2.Internal Reliability Testing

As mentioned earlier about the internal reliability analysis done for Pilot study with 35

respondents, this analysis was targeted on all the variables (17) with the data of all 245

respondents.

The test done for this analysis was Cronbachs Alpha test. The expected value of

Cronbachs Alpha is above 0.7. The results are shown in Fig.7,Fig.8,Fig. 9. Fig.7, Fig.8

and Fig.9 clearly species that the research questions used are reliable and can be used

for future course of action. The data collected on these parameters should give expected

results. The value calculated of Cronbachs Alpha (0.7) in Fig.8. is the actual

identification of the reliability of this test.

3.1.3. Factor Analysis

Factor Analysis is a data reduction technique that helps in reducing the number of

variables to some common attributes. The logic behind this technique is that it clubs all

those variables into 1 factor that show similar properties or results. For getting the data

on Factor Analysis, there were few questions asked by the respondents. The summary

of the respondents analysis is shown below:

Level1: Variable Analysis

After asking questions and observations, we found that more than 50% of the

respondents preferred to be loyal to their brands. This data is taken in Manipal,

10

Udupiand Mangalore. It was observed that people are accustomed with their own

brands. Therefore, they usually dont try any new product. Also, this is an intermediate

product that doesnt have any taste of its own. Therefore, the team made by them would

be really easier than what we made.(Fig. 10)

After asking questions and observations, we found that more than 50% of the

respondents taste as one of the factors. This data is taken in Manipal, Udupi and

Mangalore. It was observed that people are accustomed with a specific taste of

product. Therefore, they usually dont like any new product with different taste until it

is really unique. Also, this is an intermediate product that doesnt have any taste of

its own. Therefore, the team made by them would be really easier than what we

made.(Fig. 11)

Similarly, for all the 17 variables, similar questions were asked and data was

collected. That data was used in SPSS tool to do the factor analysis.

The responses are shown in Fig.12-24

Level2: Factor Analysis

After identifying the variables from pilot study and check their reliability. We ran factor

analysis using SPSS tool. This helped us in reducing the number of variables and it

clubbed all the variables that gives same result into one factor.

Fig.25 shows the number of variables that are considered for performing the factor

analysis. The 2 columns shown in this figure specifies as how much percentage of data

will be processed correctly using that variable in making factors.

After performing all the necessary setting in SPSS for getting the factors, the result of

factors can be seen the Total Variance matrix (Fig.26). The factor having Total Eigen

11

Value above 1.0 is considered to be the major factors for calculations. Therefore, after

running this step, 17 variables are reduced on a scale of 5 factors.

Fig.27 and Fig.28 clearly explains the variables and their related variances. This matrix

is important as it clearly identifies as for Factor1 which variables are important. For

example, Component1 (Factor1), Taste/Value of Money/Advertisements/Freshness

holds the maximum representation.

Level 3: Factors Naming

Once all the factors are identified, all the variables are clubbed together based on the

above mentioned logic of Rotated Matrix. The variables that show similar properties are

shown in Fig. 29.

The five factors are now renamed so that it can logically signify as to what is wrapped

within these factors.(Fig.30)

The Scree plot these 5 factors is shown in Fig.31.

3.1.4. Discriminant Analysis

Discriminant Analysis is a technique that is used to identify the differences between

various attributes based on certain parameters. As this project was baselined to

differentiate between Amulya and Nestle, Discriminant Analysis was done to differentiate

based on the parameters value. For discriminant analysis entire data was used of 245

respondents. The aim of this test was to get an order of preferences of factors identified

above. These factors could then be considered for given recommendations to

clients.(Fig. 32)

12

While identifying the group means and discriminating between factors, we identified from

Fig.33. as highlighted is not significant(To consider any test as significant, significance

value should be less than 0.05).

Therefore, this discriminant test failed. Discriminant Analysis was not done again without

Brand Recall factor.

Now, all the factors are considered as significant. Also, after looking at the Wilks

Lambda, we can comment on the lowest value of Brand Satisfaction to be the best (As

Wilks Lambda looks for the minimum values).(Fig.34)

This classification clearly specifies the perception of respondents on the basis of

attributes. The order of preference is:

Brand Satisfaction->Convenience->Product Benfits->Health Related

Concerns(Order being most preferred to least preferred).

Fig.36 shows the preferences based on the factors identified, but if we attach these

factors with Amulya Buyers and Amulya Non-Buyers(Everyday Buyers), we can see the

preferences in Fig.37.

The preference for Amulya Buyers comes out to be:

Brand Satisfaction->Convenience->Product Benfits->Health Related

Concerns(Order being most preferred to least preferred).

This order is similar for Amulyas Non Buyers also. Additionally, this result is in line with

the general preferences without any brand value.

13

3.1.5.Conjoint Analysis

This analysis is done to have a final verification on the order of identified factors. The

final analysis was done on a sample of 35 people. This is considered as a pilot test as

very few people were considered as part of this.

3.2. Findings

The findings from the study are divided into following categories:

1) Brand perception, brand awareness.

AMUL is perceived to be a brand characterized by Quality, Purity, and Taste.

With Taste being synonymous with its logo Taste of India, hence it signifies the

recall of the brand. Also, it is considered to be offering products that are best

buy. But, Amulya as a product is not accepted that well by the customers.

Regional brands like Nandini and Ideal are big competitors to AMUL in their

respective product category. Here, Nandini is perceived to be a brand that is

easily available and best buy while Ideal is perceived to be a brand defined by

Taste. Competitors like Nestle are perceived to be premium brand and have

attractive product packaging.

AMUL as a brand that is mostly visible on Television and Newspaper but for

Amulya product, the recall of advertisements is very less. Customers are able to

recall the advertisements of Nestles Everyday but not of Amuls Amulya.

AMUL was considered a Premium brand in comparison to the regional brands

and hence, is considered costly. Therefore, people prefer buying local brands in

spite of Amulya.

14

2) Promotions and Connect

It was found that there was no significant recall of initiatives taken by AMUL due

to the lack of visibility. All the associations done with Amul are done at high level

at is targeted to bigger audience, but in a region like Manipal/Udupi, it failed to

promote the association among the consumers.

Television is considered to be the most impactful medium followed by Social

Media, Newspaper and Events/Causes while Internet and Billboards are

considered somewhat effective.

In region like Manipal and Udupi, the focus on the advertisement was on product

features, central idea and jingle/sound while tagline/logo was not given due

attention.

3) Key Drivers for Product Buy

Respondents were influenced by their family and friends in purchase of a product

and at times, through advertisements. Nestls Everyday is mostly used by the

world therefore; market penetration is expected to increase further.

Decisions were mostly influenced by Quality/Taste and brand name of the

product (Amulya and not Amul) while packaging and price didnt play a significant

role.

Respondents expressed their desire to purchase healthy products of brands

purchased by them.

4) Strategies to build and enhance connect

It was found that association of a brand with Social events/causes plays a driver

for respondents to purchase the products of that brand. The experiment done the

team to get the customer information, by giving them live demos, helped in

converting some respondents to buyers.

15

4.0 SUMMARY AND RECOMMENDATIONS

4.1 Summary of the Problem

The research was done to address the issues faced by Amul Company on Amulya. It

was stated that Amul had penetrated 70% of the market in Mangalore, Udupi and

Manipal. The study was done to address the remaining 30% of the customers in these

regions. The comparison was done with Nestls Everyday. The main problem was

identified as the awareness level amongst the consumers being very less.

4.2 Summary of the Findings

After analyzing the problem both qualitatively and quantitatively, 17 major variables were

identified. Out of these 17 variables, 4 factors (Brand Satisfaction->Convenience-

>Product Benfits->Health Related Concerns) were identified that addresses to buying

behavior.

The main findings were:

1. Brand perception, brand awareness of Amulya product was found low. People

are not aware about this product and its benefits.

2. Promotions and Connect amongst consumers for Amulya product is low. People

have not seen the advertisements and promotional campaigns for this product.

3. Key Drivers for Product Buy would be satisfaction from the brand and the

convenience of buying this product.

4. Amul need to build new strategies to build and enhance connect with the

audience in rural and urban areas.

16

5.0 Recommendations

The study in different phases of the project gained the insights from the respondents

on multiple parameters. With the findings gathered from the respondents, we

recommend that followings inputs be implemented for strengthening the AMUL

brand with the youth:

1. Amul is considered to be a popular brand and the products are readily accepted.

With Amulya, awareness is lagging in the market. Amul should target local

channels and local newspapers to increase the awareness level in rural sector

(Tier 2, Tier3 cities).

2. AMUL must use its image of Quality, Purity and Taste in all its product categories

to ensure consistent image and perception. The consistent image in all product

categories will benefit the brand as well as the products.

3. AMUL is perceived to be the brand that offers products with best price. Hence,

price should not be emphasized in promoting the brand. It should not be very

high as compared to local brands like Nandini.

4. AMUL must promote its healthy nature of products offered and build a healthy

brand image.

5. Brand associations with Events/Causes, that help the society, generate

significant impact on the youth. Hence, AMUL must setup some taste stalls in

More/Big Bazaar stores so that people can taste the new products live.

6. Consumers are driven by knowledge and simplicity, hence the advertisements

and campaigns must appeal to their self-conscious appeal. This will ensure an

instant connect of the brand.

17

6.0 APPENDIX

A. Questionnaire

Research Objective 1:

1. Are you aware of the daily whitener product?

Not at all aware

Slightly aware

Somewhat aware

Moderately aware

Extremely aware

2. Are you aware of Amulya Dairy Whitener?

Not at all aware

Slightly aware

Somewhat aware

Moderately aware

Extremely aware

3. Can you recall the last advertisement of Amulya product?

Not at all aware

Slightly aware

Somewhat aware

Moderately aware

Extremely aware

18

Research Objective 2:

1. How often do you use Dairy Whiteners/ Milk powder?

Daily

2-3 days

1-2 weeks

Monthly

Others

2. How often do you buy these products from Class A stores (Big Bazaars)?

Daily

2-3 days

1-2 weeks

Monthly

Others

3. How many times you prepare tea/coffee in a day?

0-2 times

2-3 times

4-5 times

5-6 times

>6 times

Research Objective 3:

1. When do you use dairy whiteners/Milk powder?

Travelling

19

At Home

Hostel/PG

Office

2. Rate on 1-5 scale for using Milk Powder as a satisfactory option for Tea/Coffee?

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

3. Rate on 1-5 scale for using Milk Powder as a satisfactory option for Ice

creams/Sweets/Cakes etc.?

Strongly Agree

Agree

Neutral

Disagree

Strongly Disagree

Research Objective 4:

1. Which brand of Dairy Whiteners/Milk powder have you used recently?

Amulya

Nestle Everyday

Others

2. Do you buy the same brand of Dairy Whitener/Milk powder?(In Probability, 1-5)

20

Highly Probable

Moderately Probable

Neutral

Less Probable

Worst

3. What is the probability that you will buy Dairy whitener/Milk powder if the retailer

gives discounts? (In Probability, 1-5)

Highly Probable

Moderately Probable

Neutral

Less Probable

Worst

4. On a scale of 1 to 5, how much does brand affect your choice while buying milk

powder? (1-5, High to Low Importance)

Highly Important

Moderately Important

Neutral

Less Important

Worst

Research Objective 5:

1. On a scale of 1 to 5, how much does Qualityaffect your choice while buying

milk powder?

21

Highly Important

Moderately Important

Neutral

Less Important

Worst

2. On a scale of 1 to 5, how much does Purity affect your choice while buying

milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

3. On a scale of 1 to 5, how much does Availability affect your choice while

buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

4. On a scale of 1 to 5, how much does Packaging affect your choice while

buying milk powder?

Highly Important

Moderately Important

22

Neutral

Less Important

Worst

5. On a scale of 1 to 5, how much does Taste affect your choice while buying

milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

6. On a scale of 1 to 5, how much does Price affect your choice while buying

milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

7. On a scale of 1 to 5, how much does Freshness affect your choice while

buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

23

Worst

8. On a scale of 1 to 5, how much does Nutrition affect your choice while buying

milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

9. On a scale of 1 to 5, how much does Nature Friendly affect your choice while

buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

10. On a scale of 1 to 5, how much does Value for Money affect your choice

while buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

24

11. On a scale of 1 to 5, how much does Convenience affect your choice while

buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

12. On a scale of 1 to 5, how much do advertisements affect your choice while

buying milk powder?

Highly Important

Moderately Important

Neutral

Less Important

Worst

25

7.0 REFERENCES

7.1 Books

1. Malhotra, Naresh (2012). Marketing Research An Applied Orientation. New

Jersey:Prentice Hall

2. Nargundkar, Rajendra(2011). Marketing Research. Noida: Tata Magraw Hill

7.2 Websites

1.Balakrishna,V.N.(n.d.), Amul-brand of milk products, Retrieved from

http://www.thehindubusinessline.com/features/amul-brand-of-milk-and-

products/article4746936.ece

8.0 LIST OF ILLUSTRATIONS

A. Figures

Fig.1. Gender of Respondents

26

Fig.2. Age Group of Respondents

Fig.4. Tea/Coffee Usage Frequency

80%

8%

12%

STUDENT

PROFESSIONAL

OTHERS

PROFESSION OF RESPONDENTS

5.71

11.43

37.14

34.29

11.43

0.00

10.00

20.00

30.00

40.00

0-2 TIMES 2-3 TIMES 4-5 TIMES 5-6 TIMES >6 TIMES

FREQUENCY OF TEA/COFFEE CONSUMPTION IN A

DAY

PERCENTAGE

Fig.3 Profession of

respondentsresporespondents

27

Fig.5 Overall Awareness Level of Amul Brand

Fig.7. No. of cases processed for Cronbachs Alpha

6.12

36.73

22.86

20.00

14.29

0.00

10.00

20.00

30.00

40.00

NOT AT ALL

AWARE (1)

SLIGHTLY

AWARE (2)

SOMEWHAT

AWARE (3)

MODERATELY

AWARE (4)

EXTREMEMLY

AWARE (5)

OVERALL AWARENESS

PERCENTAGE

11.43

31.43

21.63

17.55

17.96

0.00

5.00

10.00

15.00

20.00

25.00

30.00

35.00

NOT AT ALL

AWARE (1)

SLIGHTLY

AWARE (2)

SOMEWHAT

AWARE (3)

MODERATELY

AWARE (4)

EXTREMEMLY

AWARE (5)

AWARENESS ON AMULYA

PERCENTAGE

Fig.6 Frequency of Awareness of Amulya Product

28

Fig.8. Number of items (variables used) and CronbachsAlpha(0.709->Accepted value)

Fig.9. Independent Variables Means and Standard Deviation

29

Fig.10. Brand Loyalty

Fig.11 Quality of Product

11%

11%

20%

29%

29%

ARE YOU BRAND LOYAL ?

HIGHLY PROBABLE

MODERATELY

PROBABLE

NEUTRAL

LESS PROBABLE

Fig.12. shows the acceptance of respondents for Amulya in Sweets,

Cakes

30

Fig.13. shows the acceptance of respondents for Amulya in Tea/Coffee

Fig.14. shows the discountspreferences for Amulya

26%

14%

9% 14%

37%

DAIRY WHITENER AS A SUBSTITUTE IN

TEA/COFFEE

STRONGLY AGREE

AGREE

NEUTRAL

DISAGREE

23%

14%

26%

28%

9%

EFFECT OF DISCOUNTS ON REPURCHASE

HIGHLY PROBABLE

MODERATELY PROBABLE

NEUTRAL

LESS PROBABLE

UNLIKELY

Fig.15. shows the taste preferences of customers

31

Fig.16. shows the purity preferences of customers

Fig.17. shows the freshness preferences of customers

Fig.18. shows the advertisements preferences of customers

32

Fig.19. shows the packaging preferences of customers

Fig.20. shows the price preferences of customers

Fig.21. shows the nutrition preferences of customers

17%

20%

49%

14%

0%

EFFECT OF PACKAGING ON PURCHASE

HIGHLY IMPORTANT

MODERATELY

IMPORTANT

NEUTRAL

LESS IMPORTANT

20%

14%

17%

23%

26%

EFFECT OF PRICE ON PURCHASE

HIGHLY IMPORTANT

MODERATELY IMPORTANT

NEUTRAL

LESS IMPORTANT

LEAST IMPORTANT

3%

26%

34%

37%

0%

EFFECT OF NUTRITION ON PURCHASE

HIGHLY IMPORTANT

MODERATELY IMPORTANT

NEUTRAL

LESS IMPORTANT

LEAST IMPORTANT

33

Fig.22. shows the value for money preferences of customers

Fig.23. shows the convenience preferences of customers

Fig.24. shows the nature friendliness preferences of customers

34%

9%

51%

6% 0%

EFFECT OF VALUE FOR MONEY ATTRIBUTE

ON PURCHASE

HIGHLY IMPORTANT

MODERATELY

IMPORTANT

NEUTRAL

LESS IMPORTANT

6%

26%

37%

31%

0%

EFFECT OF CONVENIENCE ON PURCHASE

HIGHLY IMPORTANT

MODERATELY

IMPORTANT

NEUTRAL

LESS IMPORTANT

26%

11%

20%

23%

20%

PREFERENCE TOWARDS NATURE FRIENDLY

DAIRY WHITENERS

HIGHLY IMPORTANT

MODERATELY IMPORTANT

NEUTRAL

LESS IMPORTANT

LEAST IMPORTANT

34

Fig.25 Factor Analysis Communality Matrix

Fig.26. Total Variance Explained

35

Fig.27. Component Matrix

Fig.28 Rotated Component Matrix

36

Fig.29. Factor Analysis Variables Similarity

Fig.30 Factor

Fig.31 Scree Plot

Factors Similar Behavior Patterns

Factor1 Taste, Value for Money, Advertisements,

Freshness

Factor2 Nature Friendly, Quality, Packaging

Factor3 Nutrition, Convenience, Price

Factor4 Brand Satisfaction (Cakes, Sweets), Brand

Satisfaction (Tea/Coffee), Brand Loyalty

Factor5 Brand Recall

Factors New Names

Factor1 Product Benefits

Factor2 Health Related Concerns

Factor3 Convenience

Factor4 Brand Satisfaction

Factor5 Brand Recall

37

Fig.32.All Case Analysis

Fig.33. Group Means

Fig.34.Retest on Group Means

38

Fig.37. Amulya Buyers vsAmulyaNonBuyers

Fig.35.Canonical Discriminant

Function

Fig.36.Structure Matrix

Das könnte Ihnen auch gefallen

- Study On Retailers Perspective On Juicy+Dokument71 SeitenStudy On Retailers Perspective On Juicy+Swarn LataNoch keine Bewertungen

- A Study On Penetration of Amul Milk in Retail Outlets of Panvel CityDokument43 SeitenA Study On Penetration of Amul Milk in Retail Outlets of Panvel CitypratikyaulNoch keine Bewertungen

- Amul NewDokument69 SeitenAmul NewSwati MiraniNoch keine Bewertungen

- Lulit Adamu PDFDokument72 SeitenLulit Adamu PDFEmmanuel PhilipoNoch keine Bewertungen

- Impact of Brand Equity on Customer Perception in Food IndustryDokument49 SeitenImpact of Brand Equity on Customer Perception in Food IndustryPrabhu ShankarNoch keine Bewertungen

- Project On Brand AwarenessDokument75 SeitenProject On Brand AwarenessRekha Bhojwani50% (2)

- The Effect of The Marketing Mix ElementsDokument63 SeitenThe Effect of The Marketing Mix Elementsbirku ayanNoch keine Bewertungen

- Vishal Amballa - Project - 3 PDFDokument45 SeitenVishal Amballa - Project - 3 PDFBhupendra Bhangale100% (1)

- FSC MR 15Dokument50 SeitenFSC MR 15Shitanshu YadavNoch keine Bewertungen

- A Report ON Understanding Channel Dynamics For Enhancing The Sales of Itc Product (B-Natural Juices.)Dokument33 SeitenA Report ON Understanding Channel Dynamics For Enhancing The Sales of Itc Product (B-Natural Juices.)PANKAJNoch keine Bewertungen

- ConsumerDokument102 SeitenConsumerShahzadNoch keine Bewertungen

- To Study The Consumer Satisfaction For Amul Milk in Nashik Region For Gujarat Co-Operative Milk Marketing Federation.Dokument72 SeitenTo Study The Consumer Satisfaction For Amul Milk in Nashik Region For Gujarat Co-Operative Milk Marketing Federation.Yash DesaiNoch keine Bewertungen

- Moshood ProjectDokument97 SeitenMoshood ProjectGodwin Ndukwu100% (1)

- Hindustan Unilever Limited: Summer Internship Project ReportDokument67 SeitenHindustan Unilever Limited: Summer Internship Project ReportAB.Noch keine Bewertungen

- Submitted in Partial Fulfillment of The Requirement For The AwardDokument46 SeitenSubmitted in Partial Fulfillment of The Requirement For The AwardKaustubh ShindeNoch keine Bewertungen

- Final Marketing ReportDokument35 SeitenFinal Marketing ReportSauharda SigdelNoch keine Bewertungen

- Lulit AdamuDokument73 SeitenLulit AdamudevsantosNoch keine Bewertungen

- Cadbury's Marketing Strategies and Product PortfolioDokument73 SeitenCadbury's Marketing Strategies and Product PortfolioSasan Nilesh MaruNoch keine Bewertungen

- Lux Soap: On Marketing Analysis ofDokument31 SeitenLux Soap: On Marketing Analysis ofShantoNoch keine Bewertungen

- KunalJain - Dr. S Senthil KumarDokument37 SeitenKunalJain - Dr. S Senthil KumarShubham Tiwari0% (1)

- A Study On Customer Preference Towards Amul ProductsDokument50 SeitenA Study On Customer Preference Towards Amul ProductsHari PriyaNoch keine Bewertungen

- Vikas Dairy Project 2022 ChangenewDokument32 SeitenVikas Dairy Project 2022 ChangenewAnchitJaiswalNoch keine Bewertungen

- Bba Bba Batchno 12Dokument46 SeitenBba Bba Batchno 12AAFREEN MUJEEB A COPA22011Noch keine Bewertungen

- Cheng LuDokument90 SeitenCheng LurichyNoch keine Bewertungen

- Executive Summary MergedDokument30 SeitenExecutive Summary MergedJohn SujithNoch keine Bewertungen

- Vipul STPRDokument100 SeitenVipul STPRArjun RanaNoch keine Bewertungen

- Managerial Usefulness of The StudyDokument18 SeitenManagerial Usefulness of The StudyJennifer GibbsNoch keine Bewertungen

- Khushi Minor Project FinalDokument63 SeitenKhushi Minor Project FinalSharif ZayanNoch keine Bewertungen

- A Study On Consumer Satisfaction Towards Good Day Biscuits With Special Reference To Coimbatore CityDokument4 SeitenA Study On Consumer Satisfaction Towards Good Day Biscuits With Special Reference To Coimbatore Cityshivam pratap singhNoch keine Bewertungen

- Analysing Branding Strategies of Dove in Ireland and IndiaDokument82 SeitenAnalysing Branding Strategies of Dove in Ireland and IndiaakshayNoch keine Bewertungen

- Amar Deep Singh - Dr. N. JadiyappaDokument30 SeitenAmar Deep Singh - Dr. N. JadiyappaShubham TiwariNoch keine Bewertungen

- A Project Report On " "Dokument47 SeitenA Project Report On " "mousam gogoiNoch keine Bewertungen

- A Study On Customer Satisfaction of Aavin Milk Products KrishnagiriDokument52 SeitenA Study On Customer Satisfaction of Aavin Milk Products KrishnagiriSasikumarNoch keine Bewertungen

- Niraj Satwani (1) 2023 SipDokument32 SeitenNiraj Satwani (1) 2023 Sipsiddhant pawarNoch keine Bewertungen

- SIP Report - Chetan WayalDokument50 SeitenSIP Report - Chetan Wayalrishi shahNoch keine Bewertungen

- Report ModelDokument62 SeitenReport ModelKiran Joseph RCBSNoch keine Bewertungen

- Britannia Milk Marketing Strategies of Britannia Milk ProducDokument66 SeitenBritannia Milk Marketing Strategies of Britannia Milk ProducRohit YadavNoch keine Bewertungen

- Customer Insights & Sales Distribution Report on Dukes India LtdDokument34 SeitenCustomer Insights & Sales Distribution Report on Dukes India Ltdanish sharma0% (1)

- Final Major Research Project ReportDokument56 SeitenFinal Major Research Project ReportVidhi SaraffNoch keine Bewertungen

- Promotional Strategies of Cadbury - 1Dokument63 SeitenPromotional Strategies of Cadbury - 1CatHuntNoch keine Bewertungen

- Project Report: Consumer Preference and Brand Recallability of Saras Dairy Products in Jaipur City"Dokument71 SeitenProject Report: Consumer Preference and Brand Recallability of Saras Dairy Products in Jaipur City"Karthik KumarNoch keine Bewertungen

- CSR and Brand TrustDokument79 SeitenCSR and Brand TrustNagendra Manral100% (2)

- Dipin Sarvottam 2003Dokument24 SeitenDipin Sarvottam 2003DIPINTEJANINoch keine Bewertungen

- Project ReportDokument41 SeitenProject ReportM SameerNoch keine Bewertungen

- Activity 2 23MBA01R1223Dokument30 SeitenActivity 2 23MBA01R1223vedhanarayanan2404Noch keine Bewertungen

- A Study On Customer SatisfactionDokument51 SeitenA Study On Customer SatisfactionRoyal Projects50% (6)

- Amul Project Report FinalsssDokument38 SeitenAmul Project Report FinalsssPratik Rakesh BakliwalNoch keine Bewertungen

- Project Report On Mother DairyDokument42 SeitenProject Report On Mother Dairyashwanibdmw80% (30)

- A Study On Consumer Satisfaction Towards New Hamam Neem Soap PDFDokument49 SeitenA Study On Consumer Satisfaction Towards New Hamam Neem Soap PDFSuresh Kumar100% (1)

- A Study On Consumer Satisfaction Towards New Hamam Neem Soap PDFDokument49 SeitenA Study On Consumer Satisfaction Towards New Hamam Neem Soap PDFstony fernando89% (9)

- Sales PromotionDokument47 SeitenSales PromotionpraveedasNoch keine Bewertungen

- Patanjali Project ReportDokument56 SeitenPatanjali Project ReportJanvi SinghNoch keine Bewertungen

- Comparing Amul and Vita Milk Brands in SonipatDokument32 SeitenComparing Amul and Vita Milk Brands in SonipatGarima GuptaNoch keine Bewertungen

- Summer Training Project Report Titled: Sales and Distribution of PatanjaliDokument66 SeitenSummer Training Project Report Titled: Sales and Distribution of PatanjaliAbhinav DaggNoch keine Bewertungen

- Factors Influencing Purchase of Hair Care ProductsDokument32 SeitenFactors Influencing Purchase of Hair Care ProductsP RAGHU VAMSYNoch keine Bewertungen

- Gilletine ProjectDokument78 SeitenGilletine Projectrohit.a100% (3)

- Understanding Consumer Behaviour and Promotional Strategies for Fruit DrinksDokument56 SeitenUnderstanding Consumer Behaviour and Promotional Strategies for Fruit DrinksIsha GargNoch keine Bewertungen

- Marketing Management Worked Assignment: Model Answer SeriesVon EverandMarketing Management Worked Assignment: Model Answer SeriesNoch keine Bewertungen

- Case Studies in Food Retailing and DistributionVon EverandCase Studies in Food Retailing and DistributionJohn ByromNoch keine Bewertungen

- Group 7 DmbiDokument8 SeitenGroup 7 DmbiTonmoy BanerjeeNoch keine Bewertungen

- Group 9 AssignmentDokument9 SeitenGroup 9 AssignmentTonmoy BanerjeeNoch keine Bewertungen

- Data MiningDokument6 SeitenData MiningTonmoy BanerjeeNoch keine Bewertungen

- Group 2D HimalayaDokument14 SeitenGroup 2D HimalayaTonmoy Banerjee0% (1)

- The Case of A Summer ReportDokument10 SeitenThe Case of A Summer ReportTonmoy BanerjeeNoch keine Bewertungen

- Brand Value Measurement of DoveDokument15 SeitenBrand Value Measurement of DoveSujit100% (1)

- Consumer Based Brand EquityDokument12 SeitenConsumer Based Brand EquityTonmoy BanerjeeNoch keine Bewertungen

- India Brand EquityDokument4 SeitenIndia Brand EquityTonmoy BanerjeeNoch keine Bewertungen

- EMR/EHR System Implementation ChallengesDokument13 SeitenEMR/EHR System Implementation ChallengesTonmoy Banerjee100% (1)

- Intellectual Property LawsDokument40 SeitenIntellectual Property LawsTonmoy BanerjeeNoch keine Bewertungen

- LS4 - Life & Career Skills - Making Business ProposalDokument3 SeitenLS4 - Life & Career Skills - Making Business ProposalNell FerrerNoch keine Bewertungen

- Organisation Study Repot On Seafood IndustryDokument62 SeitenOrganisation Study Repot On Seafood IndustryShazi NajNoch keine Bewertungen

- Aboite and About - February 2012Dokument32 SeitenAboite and About - February 2012KPC Media Group, Inc.Noch keine Bewertungen

- 4 P's of Coca ColaDokument2 Seiten4 P's of Coca Colagurjeetkaur1991Noch keine Bewertungen

- Kellogg SDokument10 SeitenKellogg SHouria Nadif50% (2)

- Paper 6 Practice Questions-Units 1 - 7Dokument39 SeitenPaper 6 Practice Questions-Units 1 - 7silNoch keine Bewertungen

- Cactuspear PDFDokument168 SeitenCactuspear PDFpapintoNoch keine Bewertungen

- BritaniaDokument67 SeitenBritaniaGarima GuptaNoch keine Bewertungen

- Meeting Room and Video Conference Rates under 40 charactersDokument1 SeiteMeeting Room and Video Conference Rates under 40 charactersJayaraj TNoch keine Bewertungen

- Ebiz Group8Dokument7 SeitenEbiz Group8Prachi MehtaNoch keine Bewertungen

- Danone Lebanon Office LocationDokument1 SeiteDanone Lebanon Office LocationSamer GhneimNoch keine Bewertungen

- TOEIC Speaking Test - 2Dokument27 SeitenTOEIC Speaking Test - 2Rey-Ann JuntillaNoch keine Bewertungen

- DetoursDokument95 SeitenDetoursB.RandNoch keine Bewertungen

- Issues in Halal Packaging. A Conceptual PaperDokument5 SeitenIssues in Halal Packaging. A Conceptual PaperSyazwan Talib100% (1)

- Spencer's RetailDokument35 SeitenSpencer's RetailKarishma Seth89% (18)

- Revised Guidelines of Gramodyog Vikas YojanaDokument29 SeitenRevised Guidelines of Gramodyog Vikas YojanaETERNAL CONSULTANCY AND SERVICESNoch keine Bewertungen

- PRODUCT PORTFOLIO OF PATANJALIDokument6 SeitenPRODUCT PORTFOLIO OF PATANJALIashwin balajiNoch keine Bewertungen

- Heston Blumenthal Dinner 2011Dokument5 SeitenHeston Blumenthal Dinner 2011SeymourpowellNoch keine Bewertungen

- Training Academy Courses CalendarDokument9 SeitenTraining Academy Courses CalendarCitra FerdyanNoch keine Bewertungen

- Roasting For CoffeeDokument62 SeitenRoasting For CoffeeUnder Nine100% (20)

- Press Release (Company Update)Dokument2 SeitenPress Release (Company Update)Shyam SunderNoch keine Bewertungen

- WEF The New Plastics Economy PDFDokument36 SeitenWEF The New Plastics Economy PDFAurelio Sartori100% (1)

- UntitledDokument3 SeitenUntitledSHARMINENoch keine Bewertungen

- Value Chain - GingerDokument15 SeitenValue Chain - Gingerraveendhar.kNoch keine Bewertungen

- 2023-03-02 Calvert County TimesDokument32 Seiten2023-03-02 Calvert County TimesSouthern Maryland OnlineNoch keine Bewertungen

- Yusayrr Fs Output FinalDokument116 SeitenYusayrr Fs Output Finalbelinda dagohoyNoch keine Bewertungen

- Supply Chain Coordination Problems in Dairy IndustryDokument12 SeitenSupply Chain Coordination Problems in Dairy IndustrySiddharth Mertia100% (1)

- Swot Analysis of Mars Incorporated 1Dokument4 SeitenSwot Analysis of Mars Incorporated 1Shrinidhi Priyankaa 1912985630Noch keine Bewertungen

- Si Ames E Cat Club of Sou TH Au ST Ralia (S CC)Dokument11 SeitenSi Ames E Cat Club of Sou TH Au ST Ralia (S CC)Leigh1976Noch keine Bewertungen

- Final DraftDokument19 SeitenFinal Draftapi-273800861Noch keine Bewertungen