Beruflich Dokumente

Kultur Dokumente

Profit From Crisis - Frontline

Hochgeladen von

Sourabh SharmaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Profit From Crisis - Frontline

Hochgeladen von

Sourabh SharmaCopyright:

Verfügbare Formate

5/11/2014 Profit from crisis | Frontline

http://www.frontline.in/world-affairs/profit-from-crisis/article5915462.ece?css=print 1/2

WORLD AFFAIRS

Published: April 16, 2014 12:30 IST | Updated: April 19, 2014 12:48 IST

ESSAY

Profit from crisis

Why capitalists do not want recovery, and what that means for America. By JONATHAN NITZAN and

SHIMSHON BICHLER

Can it be true that capitalists prefer crisis to growth? On the face of it, the idea sounds silly. According to Economics 101, everyone

loves growth, especially capitalists. Profit and growth go hand in hand. When capitalists profit, real investment rises and the economy

thrives, and when the economy booms the profits of capitalists soar. Growth is the very lifeline of capitalists.

Or is it?

What motivates capitalists?

The answer depends on what motivates capitalists. Conventional economic theories tell us that capitalists are hedonic creatures. Like

all other economic agents from busy managers and hectic workers to active criminals and idle welfare recipientstheir ultimate

goal is maximum utility. In order for them to achieve this goal, they need to maximise their profit and interest; and this incomelike

any other incomedepends on economic growth. Conclusion: utility-seeking capitalists have every reason to love booms and hate

crises.

But, then, are capitalists really motivated by utility? Is it realistic to believe that large American corporations are guided by the hedonic

pleasure of their ownersor do we need a different starting point altogether?

So try this: in our day and age, the key goal of leading capitalists and corporations is not absolute utility but relative power. Their real

purpose is not to maximise hedonic pleasure but to beat the average. Their ultimate aim is not to consume more goods and services

(although that happens too) but to increase their power over others. And the key measure of this power is their distributive share of

income and assets.

Note that capitalists have no choice in this matter. Beating the average is not a subjective preference but a rigid rule, dictated and

enforced by the conflictual nature of the system. Capitalism pits capitalists against other groups in societyas well as against each

other. And in this multifaceted struggle for greater power, the yardstick is always relative. Capitalistsand the corporations they

operate throughare compelled and conditioned to accumulate differentially; to augment not their personal utility but their relative

earnings. Whether they are private owners like Warren Buffet or institutional investors like Bill Gross, they all seek not to perform but

to outperformand outperformance means redistribution. Capitalists who beat the average redistribute income and assets in their

favour; this redistribution raises their share of the total; and a larger share of the total means greater power stacked against others. In

the final analysis, capitalists accumulate not hedonic pleasure but differential power.

Now, if you look at capitalists through the lens of relative power, the notion that they should love growth and yearn for recovery is no

longer self-evident. In fact, the very opposite seems to be the case. For any group to increase its relative power in society, that group

must be able to strategically sabotage others in that society. This rule derives from the very logic of power relations. It means that

capitalists, seeking to augment their income shareread powerhave to threaten or undermine the rest of society. And one of the key

weapons they use in this power strugglesometimes consciously, though usually by defaultis unemployment.

Joblessness affects redistribution

Unemployment affects distribution mainly through the impact it has on relative prices and wages. If higher unemployment causes the

ratio of price to unit wage cost to decline, capitalists will fall behind in the redistributional struggle, and this retreat is sure to make

them eager for recovery. But if the opposite turns out to be the casethat is, if higher unemployment helps raise the price/wage cost

ratiocapitalists would have good reason to love crises and indulge in stagnation.

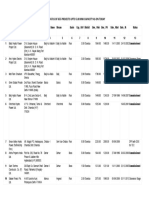

In principle, both scenarios are possible. But as Figure 1 shows, in America the second prevails: unemployment redistributes income

systematically in favour of capitalists. The chart contrasts the share of pre-tax profit and net interest in domestic income on the one

hand with the rate of unemployment on the other (both series are smoothed as five-year moving averages). Note that the

Show Caption

5/11/2014 Profit from crisis | Frontline

http://www.frontline.in/world-affairs/profit-from-crisis/article5915462.ece?css=print 2/2

Printable v ersion | May 1 1 , 201 4 1 1 :58:1 5 AM | http://www.frontline.in/world-affairs/profit-from-crisis/article591 5462.ece

Frontline

unemployment rate is lagged three years, meaning that every observation shows the situation prevailing three years earlier.

This chart does not sit well with received wisdom. Mainstream economics tells us that the two series should be inversely correlated;

that the capitalist income share should rise in the boom when unemployment falls and decline in the bust when unemployment rises.

But that is not the case in the United States. In this country, the correlation is positive, not negative. The share of capitalists moves

countercyclically: it rises in downturns and falls in boomsexactly the opposite of what economic convention would have us believe.

The maths is straightforward: for every 1 per cent rise in unemployment, capitalists can expect their income share three years later to

jump by 0.8 per cent. Needless to say, this equation is very bad news for most Americansprecisely because it is such good news for

the countrys capitalists.

Remarkably, the positive correlation shown in Figure 1 holds not only over the short-term business cycle but also in the long term.

During the booming 1940s, when unemployment was very low, capitalists appropriated a relatively small share of domestic income.

But as the boom fizzled, growth decelerated and stagnation started to creep in, the share of capital began to trend upward. The peak

power of capital, measured by its overall income share, was recorded in the early 1990s, when unemployment was at post-War highs.

The neoliberal globalisation that followed brought lower unemployment and a smaller capital share, but not for long. In the late 2000s,

the trend reversed again, with unemployment soaring and the distributive share of capital rising in tandem. Looking forward,

capitalists have reason to remain crisis-happy: with the rate of unemployment again approaching post-War highs, their income share

has more room to rise in the years ahead.

The power of capitalists can also be examined from the viewpoint of the infamous Top 1 per cent. Most commentators stress the

social and political problems created by the disproportional wealth of this group, but this emphasis puts the world on its head.

Redistribution is not an unfortunate side effect of growth and stagnation but the main force driving them.

Figure 2 shows the century-long relationship between the income share of the Top 1 per cent and the annual growth rate of U.S.

employment (with both series smoothed as 10-year moving averages). And as the chart makes clear, the distributional gains of this

group have been boosted not by growth, but by stagnation. The overall relationship is clearly negative. When stagnation sets in and

employment growth decelerates, the income share of the Top 1 per cent actually risesand vice versa during a long-term boom.

Historically, this negative relationship can be divided into three distinct periods, indicated by the dashed, freely drawn line going

through the employment growth series. The first period, from the turn of the 20th century until the 1930s, is the so-called Gilded Age.

Income inequality is rising and employment growth is plummeting.

The second period, from the Great Depression until the early 1980s, is marked by the Keynesian welfare-warfare state. Higher

taxation and public spending make distribution more equal, while employment growth accelerates. Note the massive acceleration of

employment growth during the Second World War and its subsequent deceleration brought by post-War demobilisation. Obviously,

these dramatic movements were unrelated to income inequality, but they did not alter the series overall upward trend.

The third period, from the early 1980s to the present, is marked by neoliberalism. In this period, monetarism assumes commanding

heights, inequality soars and employment growth plummets. The current rate of employment growth hovers around zero while the

Top 1 per cent appropriates 20 per cent of all incomesimilar to the numbers recorded during the Great Depression.

So what do these facts mean for America?

First, they make the fault lines obvious. The old slogan whats good for GM is good for America now rings hollow. Capitalists seek not

utility through consumption but more power through redistribution. And they achieve their goal not by raising investment and fuelling

growth but by allowing unemployment to rise and jobs to become scarce. Clearly, we are not all in the same boat. There is a

distributional struggle for power, and this struggle is not a mere sociological issue. It is the centre of our political economy, and we

need a new theoretical framework to understand it.

Second, macroeconomic policy, whether old or new, cannot offset the aggregate consequences of this distributional struggle. Not by a

long shot. Until the late 1970s, the budget deficit was small, yet America boomed. And why? Because progressive taxation, transfer

payments and social programmes made the distribution of income less unequal. By the early 1980s, this relationship inverted.

Although the budget deficit ballooned and interest rates fell, economic growth decelerated. New methods of upward redistribution have

caused the share of the Top 1 per cent to zoom, making stagnation the new norm.

Third, and finally, Washington can no longer hide behind the bush. On the one hand, the concentration of Americas income and assets,

having been boosted by large post-crisis bailouts and massive quantitative easing, is now at record levels. On the other hand, long-term

unemployment remains at post-War highs while job growth is at a standstill. Eventually, this situation will be reversed. The only

question is whether it will be reversed through a new policy trajectory or through the calamity of systemic crisis.

Jonathan Nitzan teaches political economy at York University in Canada. Shimshon Bichler teaches political economy at colleges

and universities in Israel. All of their publications are available for free on The Bichler & Nitzan Archives (http://bnarchives.net).

For their full paper on the subject, see Shimshon Bichler and Jonathan Nitzan, Can Capitalists Afford Recovery? Economic Policy

When Capital is Power, Working Papers on Capital as Power, No. 2013/01, October 2013, pages 1-36.

(http://bnarchives.yorku.ca/377/)

Das könnte Ihnen auch gefallen

- Karan AnandDokument1 SeiteKaran AnandSourabh SharmaNoch keine Bewertungen

- Vartul MittalDokument3 SeitenVartul MittalSourabh SharmaNoch keine Bewertungen

- Syed Abdul SaleemDokument4 SeitenSyed Abdul SaleemSourabh SharmaNoch keine Bewertungen

- Sample Offered Anirban SinhaDokument4 SeitenSample Offered Anirban SinhaSourabh SharmaNoch keine Bewertungen

- Jetty Supervisor Joel Balahadia ResumeDokument11 SeitenJetty Supervisor Joel Balahadia ResumeSourabh SharmaNoch keine Bewertungen

- VIKRANT BANSAL - : PGDITM (MBA-IT), Six Sigma Green Belt, ITIL Foundations, CCNA, MCSE, CNEDokument3 SeitenVIKRANT BANSAL - : PGDITM (MBA-IT), Six Sigma Green Belt, ITIL Foundations, CCNA, MCSE, CNESourabh SharmaNoch keine Bewertungen

- Sanjay GuptaDokument4 SeitenSanjay GuptaSourabh SharmaNoch keine Bewertungen

- Senior Systems Manager Rakesh Kumar Chaurasia Seeks New IT RoleDokument5 SeitenSenior Systems Manager Rakesh Kumar Chaurasia Seeks New IT RoleSourabh SharmaNoch keine Bewertungen

- Vinesh BhandariDokument4 SeitenVinesh BhandariSourabh SharmaNoch keine Bewertungen

- Sunish Samuel Key Skills: Career SummaryDokument2 SeitenSunish Samuel Key Skills: Career SummarySourabh SharmaNoch keine Bewertungen

- Amarjeet SinghDokument6 SeitenAmarjeet SinghSourabh SharmaNoch keine Bewertungen

- JD - AD Finance Change and RiskDokument2 SeitenJD - AD Finance Change and RiskSourabh SharmaNoch keine Bewertungen

- Amit Kumar ShrivastavDokument3 SeitenAmit Kumar ShrivastavSourabh SharmaNoch keine Bewertungen

- Auto CTC Salary CalculatorDokument1 SeiteAuto CTC Salary CalculatorSathvika SaaraNoch keine Bewertungen

- MainDokument2 SeitenMainSourabh SharmaNoch keine Bewertungen

- Allama IqbalDokument1 SeiteAllama IqbalSourabh SharmaNoch keine Bewertungen

- Performance Summary 2015-1Dokument6 SeitenPerformance Summary 2015-1Sourabh SharmaNoch keine Bewertungen

- Ola Invoice 3 Hotel To Airport BLR To DelDokument1 SeiteOla Invoice 3 Hotel To Airport BLR To DelSourabh SharmaNoch keine Bewertungen

- Preliminary Discussion For Prospective Investment - Archelons GlobalDokument2 SeitenPreliminary Discussion For Prospective Investment - Archelons GlobalSourabh SharmaNoch keine Bewertungen

- Telecom Professional Manohar PedipinaDokument4 SeitenTelecom Professional Manohar PedipinaSourabh SharmaNoch keine Bewertungen

- Optimize your marketing career with ARJIT MATHURDokument6 SeitenOptimize your marketing career with ARJIT MATHURSourabh SharmaNoch keine Bewertungen

- No Dues FormDokument2 SeitenNo Dues FormSourabh Sharma100% (1)

- JD & MainDokument2 SeitenJD & MainSourabh Sharma100% (1)

- Prat Yu SH RathoreDokument4 SeitenPrat Yu SH RathoreSourabh SharmaNoch keine Bewertungen

- Uttam S IkariaDokument2 SeitenUttam S IkariaSourabh SharmaNoch keine Bewertungen

- VocabDokument66 SeitenVocabSourabh SharmaNoch keine Bewertungen

- ShipraChauhan (8 0)Dokument5 SeitenShipraChauhan (8 0)Sourabh SharmaNoch keine Bewertungen

- Anurag Tiwari (2 10)Dokument3 SeitenAnurag Tiwari (2 10)Sourabh SharmaNoch keine Bewertungen

- Carbon Nanotubes Graphene SupercapacitorsDokument1 SeiteCarbon Nanotubes Graphene SupercapacitorsSourabh SharmaNoch keine Bewertungen

- Resultacio II Exe 231112Dokument23 SeitenResultacio II Exe 231112Sourabh SharmaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The RF Line: Semiconductor Technical DataDokument4 SeitenThe RF Line: Semiconductor Technical DataJuan David Manrique GuerraNoch keine Bewertungen

- EDMOTO 4th TopicDokument24 SeitenEDMOTO 4th TopicAngel Delos SantosNoch keine Bewertungen

- Training of Local Government Personnel PHDokument5 SeitenTraining of Local Government Personnel PHThea ConsNoch keine Bewertungen

- 22 Reasons To Go Mgtow Troofova ReethinDokument291 Seiten22 Reasons To Go Mgtow Troofova Reethinalbert86% (7)

- Cambridge IGCSE: 0500/12 First Language EnglishDokument16 SeitenCambridge IGCSE: 0500/12 First Language EnglishJonathan ChuNoch keine Bewertungen

- Effective Instruction OverviewDokument5 SeitenEffective Instruction Overviewgene mapaNoch keine Bewertungen

- Symbian Os-Seminar ReportDokument20 SeitenSymbian Os-Seminar Reportitsmemonu100% (1)

- Chapter 1Dokument30 SeitenChapter 1Sneha AgarwalNoch keine Bewertungen

- Unit 5 The Teacher As ProfessionalDokument23 SeitenUnit 5 The Teacher As ProfessionalLeame Hoyumpa Mazo100% (5)

- Article Summary Assignment 2021Dokument2 SeitenArticle Summary Assignment 2021Mengyan XiongNoch keine Bewertungen

- List/Status of 655 Projects Upto 5.00 MW Capacity As On TodayDokument45 SeitenList/Status of 655 Projects Upto 5.00 MW Capacity As On Todayganvaqqqzz21Noch keine Bewertungen

- Unitrain I Overview enDokument1 SeiteUnitrain I Overview enDragoi MihaiNoch keine Bewertungen

- Qatar Star Network - As of April 30, 2019Dokument7 SeitenQatar Star Network - As of April 30, 2019Gends DavoNoch keine Bewertungen

- (Click Here) : Watch All Paid Porn Sites For FreeDokument16 Seiten(Click Here) : Watch All Paid Porn Sites For Freexboxlivecode2011Noch keine Bewertungen

- Navavarana ArticleDokument9 SeitenNavavarana ArticleSingaperumal NarayanaNoch keine Bewertungen

- LESSON 2 - Nguyễn Thu Hồng - 1917710050Dokument2 SeitenLESSON 2 - Nguyễn Thu Hồng - 1917710050Thu Hồng NguyễnNoch keine Bewertungen

- General Ethics: The Importance of EthicsDokument2 SeitenGeneral Ethics: The Importance of EthicsLegendXNoch keine Bewertungen

- 7 Q Ans Pip and The ConvictDokument3 Seiten7 Q Ans Pip and The ConvictRUTUJA KALE50% (2)

- Chapter 15-Writing3 (Thesis Sentence)Dokument7 SeitenChapter 15-Writing3 (Thesis Sentence)Dehan Rakka GusthiraNoch keine Bewertungen

- E2415 PDFDokument4 SeitenE2415 PDFdannychacon27Noch keine Bewertungen

- 14 Worst Breakfast FoodsDokument31 Seiten14 Worst Breakfast Foodscora4eva5699100% (1)

- Financial Management Module - 3Dokument2 SeitenFinancial Management Module - 3Roel AsduloNoch keine Bewertungen

- Mental Health Admission & Discharge Dip NursingDokument7 SeitenMental Health Admission & Discharge Dip NursingMuranatu CynthiaNoch keine Bewertungen

- Inferences Worksheet 6Dokument2 SeitenInferences Worksheet 6Alyssa L0% (1)

- Voiceless Alveolar Affricate TsDokument78 SeitenVoiceless Alveolar Affricate TsZomiLinguisticsNoch keine Bewertungen

- Edpb 506 Intergrated Unit Project RubricDokument1 SeiteEdpb 506 Intergrated Unit Project Rubricapi-487414247Noch keine Bewertungen

- Visual and Performing Arts Standards For California K-12Dokument172 SeitenVisual and Performing Arts Standards For California K-12Vhigherlearning100% (2)

- Installation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpsDokument28 SeitenInstallation, Operation and Maintenance Instructions Stainless Steel, Liquid Ring Vacuum PumpspinplataNoch keine Bewertungen

- Global Pre-Qualification - Registration of Vendors For Supply of Various Raw Materials - ProductsDokument2 SeitenGlobal Pre-Qualification - Registration of Vendors For Supply of Various Raw Materials - Productsjavaidkhan83Noch keine Bewertungen

- Under the Angels Restaurant Transports Guests to Old CracowDokument2 SeitenUnder the Angels Restaurant Transports Guests to Old CracowBence KlusóczkiNoch keine Bewertungen