Beruflich Dokumente

Kultur Dokumente

Prices: Assignment-Iii Inflation: Cpi Used To Set Inlation Target

Hochgeladen von

scribidaccount10 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten10 Seitenconsequences just assumption

Originaltitel

evaulation

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenconsequences just assumption

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten10 SeitenPrices: Assignment-Iii Inflation: Cpi Used To Set Inlation Target

Hochgeladen von

scribidaccount1consequences just assumption

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 10

ASSIGNMENT-III

INFLATION: CPI USED TO SET INLATION TARGET

Introduction:

Inflation means the general level of prices is going up. Economists measure inflation regularly to know an

economy's state. Inflation changes the ratio of money towards goods or services; more money is needed to get the

same amount of a power of money.

In India the method of calculation of inflation is by the Wholesale Price Index. Inflation is the percentage change

in the value of the Wholesale Price Index WPI! on a year"on year basis. In India# inflation is calculated by taking

the

$emand"Pull inflation

%he $emand"Pull inflation theory can be said simply as &too much money chasing too few goods.& In other words#

if the will of buying goods is growing faster than amount of goods that have been made# then prices will go up.

%his most likely happens in economies that are growing fast. Whenever a product is bought or sold beyond its real

price for its worth# then Inflation of money occurs.

'ost"Push inflation

%he 'ost"Push inflation theory says that when the cost of making goods which are paid by the company! go up#

they have to make prices higher to still make profit out of selling that very product. %he higher costs of making

goods can include things like workers wages# taxes to be paid to the government or bigger costs of getting raw

materials from other countries.

History and Currnt Status

For 2009, Indian inflation stood at 11.49%. According to the Economic Survey Report for 2009-10, economic

growth decelerated to 6,7% in 2008-09 from 9% in 2007-08.

Indias 2009-10 Economic Survey Report suggested a high double-digit increase in food inflation, with signs of

inflation spreading to various other sectors as well. The Deputy Governor of the Reserve Bank of India, however,

expressed his optimism in March 2010 about an imminent easing of Indian wholesale price index-based inflation,

on the back of falling oil and food prices.

On March 19, 2010, the Reserve Bank of India raised its benchmark reverse repurchase rate to 3.5% percent, after

this rate touched record lows of 3.25%. The repurchase rate was raised to 5% from 4.75% as well, in an attempt to

curb inflation.

In its Annual Monetary Policy Statement, RBI had said the firming up of global commodity prices poses upside

risks to inflation. The central banks industrial outlook survey shows companies are increasingly regaining their

pricing power in many sectors, and as the recovery gains momentum, the demand pressures are expected to

accenture.

(n )ay *+# ,-*. /eserve 0ank of India# 1overner# $r./aghuram /a2an was talking to reporters after the /0I3s

board meeting updated that#4 Interest rate is the best tool for /eserve 0ank to control inflation3# he said the 5best

tool3 available with the central bank to control price rise was interest rate and adding that the government too had

tools such as increasing agricultural production and improving supply.

60oth need to work together and will work together. We were expecting some increase in the 'PI number because

of the seasonal effects from vegetable prices# but it came more than anticipated by the consensus forecast. We will

study them in greater detail. What does it suggest is that inflation is high as far as food prices go#4 he added.

7owever# he said the core inflation had been coming down but though 5very very gently3. /etail or consumer price

index 'PI! inflation rose to a three"month high of 8.+9 per cent in :pril. $r. /a2an exuded confidence that retail

inflation would come down to ; per cent by )arch# ,-*;. 6We are very comfortable with the fact that we can

achieve what the <r2it Patel committee suggested of 8 per cent inflation at the end of the year and ; per cent at the

end of next year.4

%he WPI based inflation has eased to +., per cent# while the retail inflation was still high at 8.+9 per cent in :pril.

In!"ation !i#urs $rtainin# to %&'(

%his involves inflation based on the 'PI consumer price index! and the 7I'P harmonised consumer price

index! . %he 'PI is often considered a country3s most important inflation figure.

Inflation development during ,-*=

: graph and a table with additional information about the development of inflation during ,-*= can be found

below. When you select a country and a type of inflation in the selection box# the page will automatically change

and show the development of the inflation figure which you have selected in ,-*=.

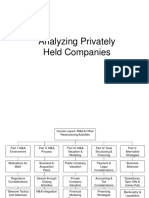

C)art CPI India %&'(

>ource ?1lobal rates.com*,.-;.*.!

Ta*" CPI India %&'(

)onths in ,-*= inflation yearly basis!

@anuary **.;*; A

Bebruary *,.-;- A

)arch **...= A

:pril *-.,.. A

)ay *-.;8- A

@une **.-+8 A

@uly *-.8.9 A

:ugust *-.C.8 A

>eptember *-.;98 A

(ctober **.-;- A

Dovember **..;8 A

$ecember 9.*=, A

)ain drivers of food and non"food inflation in 'PI new series

>ource? )inistry of Binance E)id"Fear Economic :nalysis,-*=",-*.!G

IMPACT OF INFLATION ON INDIA+S ECONOMIC DE,ELOPMENT

%he Indian economy recovered in the second Huarter I,! of ,-*="*. recording a growth of ..8 per cent. %his

follows a growth rate of ... per cent in the first Huarter I*! of the current financial yearJ the lowest in *;

Huarters. While the 1overnment delivered on the announced fiscal targets in ,-*,"*=# current account deficit

':$! continued to remain elevated in I* of ,-*="*. and in tandem with market misperception of an imminence

of the rollback of Huantitative easing in <># assumed a serious dimension with the sharp depreciation of the rupee.

%he 1overnment put in place a series of measures and there has been a significant let"up in the challenges on the

trade and balance of payments front# particularly in the I, ,-*="*.. $omestic impediments like elevated levels of

food and retail inflation# high input costs and pressure on profit margins and infrastructural bottlenecks continued#

with the 1overnment addressing them through appropriate calibration of fiscal policy# administrative measures and

institutional mechanisms like 'abinet 'ommittee on Investment to fast track pro2ects.

%he recovery in growth# although weak# is expected to gather pace in the coming Huarters. While there are some

concerns about renewed price pressure in (ctober ,-*= and the services sector# the driver of growth# is still to pick

up# there are indications to the effect that these could be reversed going forward. %he analyses in various sections

of this chapter would provide the analytical basis for the above assessment. With recent improvements in growth

of some sectors# better performance of exports and measures taken by the 1overnment# the year ,-*="*. can be

expected to end with a growth of + per cent.

%he Indian economy weathered the global financial crisis rather well and Huickly recovered from the decline in

growth rate in ,--8"-9 to a healthy growth that averaged around 9 per cent annually in ,--9"*- and ,-*-"**.

7owever# this recovery was short"lived and growth rate declined to ;., per cent in ,-**"*, and +.- per cent in

,-*,"*=# on account of both domestic and external factors. $espite some recovery in the growth of agriculture and

industry sector# particularly in I, of the current financial year# the overall growth of the economy has been a

modest ..; per cent in the first half of the year. %he growth rate of the economy improved from ... per cent in I*

,-*=" *. to ..8 per cent in I,. 'ompared to I* ,-*="*.# I, has evidenced a robust pick"up in the growth of the

agricultural sector and a gradual recovery in the industrial sector. %he growth in economic services also got

strengthened# while the community# social and personal services" a sector with substantial public sector presence "

exhibited a significant fall in growth# pointing towards efforts at fiscal consolidation. %he demand side impetus to

growth is gradually gaining momentum with the strengthening of private consumption and investment and with

exports making an impressive turnaround in I, ,-*="*.. %he confluence of these factors has resulted in a growth

of ..; per cent during the first half 7*! of ,-*="*.# roughly the same level of ..C per cent achieved during the

second half 7,! of ,-*,"*=.

(n the external front# the crisis of ,--8# the subseHuent sovereign debt crisis and the recession in the Euro"area

had moderated the average growth rate of the global economy to less than = per cent over the period ,--8",-*, as

compared to + per cent during ,--.",--C. $ata from I)B indicate that several emerging market economies

including 'hina and India Huickly rebounded to high growth in the aftermath of the crisis. In fact# in terms of

market price 1$P# India3s growth exceeded that of 'hina in ,-*-. :part from emerging economies# advanced

economies also experienced significant recovery in ,-*- with both the <> and the Euro"area registered distinctly

higher growth rates. : series of subseHuent events# including the uncertainty surrounding Euro"area sovereign debt

crisis# hampered sustained economic recovery in advanced economies with adverse conseHuences for growth and

challenges for macroeconomic management in emerging market economies. With the intensification of the

sovereign debt crisis# the decline in real 1$P growth rates starting ,-** has been witnessed across advanced and

emerging market economies. Economic growth has again started looking up in advanced economies# especially in

the <># alleviating the external constraint on India3s recovery to some extent.

%he slowdown in real 1$P growth in India during ,-**"*, and ,-*,"*= is the trends in similar emerging

economies. %he downturn has been more pronounced in the Indian case# owing to domestic and structural factors.

%he growth of real 1$P has generally shown a declining trend since the first Huarter of ,-**"*,. :n upward

movement in some of the Huarters in between raised the hope for a turnaround that was belied .'orresponding to

this# the industrial sector witnessed a long# steep decline. %he service sector also witnessed growth moderation#

which has been gradual and less steep than the industrial sector# and its growth remained more or less constant

during I= ,-*,"*= to I* ,-*="*.. :s panel * of Bigure *.* shows# the declining trend in 1$P growth has

reversed in I, ,-*="*.# on the back of higher growth in agriculture and industry vis"K"vis I* ,-*="*..

(LE/LIEW (B %7E E'(D()F

>ource? )inistry of Binance E)id"Fear Economic :nalysis,-*=",-*.!G

R-dia" Masurs to Contro" In!"ation:

:ccording to %rading Economics on the benchmark interest rate in India was last recorded at 8 percent. Interest

/ate in India averaged ;.;. Percent from ,--- until ,-*.# reaching an all time high of *..+- Percent in :ugust of

,--- and a record low of ..,+ Percent in :pril of ,--9. Interest /ate in India is reported by the /eserve 0ank of

India.

%he )inistry of Binance and the /0I /eserve 0ank of India! always strive to control inflation. %hey control

inflation by directly affecting the demand pull inflation by changing the amount of liHuidity circulating in the

economy. %he /0I can change the liHuidity by its various tools viM. '//# 0ank"/ate /EP( and /everse"/EP(!#

>N/# etc.

'// 'ash /eserve /atio! is the proportion of amount which each commercial bank like >0I# I'I'I# etc.! has to

maintain in the form of hard cash. :ll commercial banks accept deposits from individuals and lend it to borrowers

at a higher interest rate. %he difference between the interest rate which they collect from borrowers and which they

pay to their depositors is their profit. Daturally# each bank will try to lend all the money they collect from

depositors. 7owever# banks can3t lend all the money they have. <nder law# each bank has to maintain a certain

proportion of cash as reserve. %his is known as '//. When /0I increases the '//# the bank3s lending power

decreases. Ness lending means less borrowing# this in turn means less money in the economy. Nast month# the /0I

increased the '// from 8.C+A to 9A to control inflation. >N/ >tatutory NiHuidity /atio! is also similar to '//.

0ut in case of >N/# 1overnment">ecurities need to be maintained by the commercial banks instead of cash.

In its ,8th @anuary ,-*. meeting# /eserve 0ank of India decided to raise the policy repo rate by ,+ bps to 8

percent to handle currency pressure and curb persistently high inflation.

0ank"/ate is basically the interest rate at which the 'entral 0ank borrows from the other scheduled commercial

banks. %his rate is directly linked to the interest rates charged in turn by all the commercial banks to its customers.

:ll these other interest rates on 7ome"loans# Personal"loans# etc. also increase with the increase in bank"rate.

%hus# by raising the 0ank"/ate and in turn all other Interest /ates# the /0I makes borrowing money from banks a

very costly affair. People are thus discouraged to borrow more money and total amount of liHuidity decreases in

the economy. Nast month# the /0I increased the 0ank /ate from 8.+A to 9.+A. %his was an increase of +- basis"

points -.+A! to control inflation.

%he above mentioned measures viM. '//# >N/# 0ank"/ate are called )onetary Policy tools. :part from these#

there are certain Biscal Policy tools which the 1overnment can use. (ne recent example of fiscal tool is the recent

ban placed on the export of 0asmati rice by the Binance )inister. 0y banning the export of rice# the supply of rice

will increase in the home country relative to its demand. %his will naturally bring down the price of rice which is a

ma2or component of WPI. %he price"rise in 0asmati rice is an example of $emand"pull inflation because demand

has increased relative to supply. :lthough# it could be said that demand for rice is not related to liHuidity but is

inelastic where demand is autonomous and not related to increase in price or income!.

%he rise in interest rates initially makes life difficult for people who have taken loans on floating interest rates# it is

a reHuired step to bring down inflation which is a larger evil. It might also be noted that /0I# by making the policy

changes can control only one type of inflation i.e. demand"pull inflation. It cannot affect the other type of inflation

i.e. cost"push inflation which is caused by rise in prices of raw"materials and other factors of production. %hat is

why the rate of inflation is increasing continuously since last six months although the /0I is trying to control it. In

fact# only the cost"push component of inflation is rising which consists of increase in prices of steel# cement#

petroleum# etc. >ome of these factors are produced in our country and others are imported. 0ut the prices of none

of them can be controlled by the government.

.un (rd/ %&'0 -tin#/ Rsr1 2an3 o! India "!t t) r$o rat at 4 $rcnt/ *ut cut t) a-ount o!

#o1rn-nt *onds *an3s -ust )o"d 5it) t) cntra" *an3 - t) statutory "i6uidity ratio - *y 7& *$s to %%87

$rcnt/ ai-in# to incras *an3 crdit8

%he cut in statutory liHuidity ratio will take effect from the fortnight beginning @une *.# ,-*.. %he central bank

also decided to reduce the liHuidity provided under the export credit refinance facility from +- per cent of eligible

export credit outstanding to =, per cent with immediate effect. Policymakers introduced a special term repo

facility of -.,+ per cent of net demand and time liabilities to compensate fully for the reduction in access to

liHuidity under the E'/ with immediate effect.

In )arch and :pril# 'PI headline inflation has risen on the back of a sharp increase in food prices. >ome of this

price pressure will continue into )ay# but it is largely seasonal. )oreover# 'PI inflation excluding food and fuel

has been edging down. %he risks to the central forecast of 8 per cent 'PI inflation by @anuary ,-*+ remain broadly

balanced. <pside risks in the form of a sub"normalOdelayed monsoon on account of possible El Dino effects# geo"

political tensions and their impact on fuel prices# and uncertainties surrounding the setting of administered prices

appear at this stage to be balanced by the possibility of stronger 1overnment action on food supply and better

fiscal consolidation as well as the pass through of recent exchange rate appreciation. :ccordingly# at this 2uncture#

it is appropriate to leave the policy rate unchanged# and to allow the disinflationary effects of rate increases

undertaken during >eptember ,-*="@anuary ,-*. to mitigate inflationary pressures in the economy.

%he /eserve 0ank remains committed to keeping the economy on a disinflationary course# taking 'PI inflation to

8 per cent by @anuary ,-*+ and ; per cent by @anuary ,-*;. If the economy stays on this course# further policy

tightening will not be warranted. (n the other hand# if disinflation# ad2usting for base effects# is faster than

currently anticipated# it will provide headroom for an easing of the policy stance.

In pursuance of the $r. <r2it /. Patel 'ommittee3s recommendation to move away from sector"specific refinance

towards a more generaliMed provision of system liHuidity without preferential access to any particular sector or

entity# the /eserve 0ank has decided to limit access to export credit refinance while compensating fully with a

commensurate expansion of the market3s access to liHuidity through a special term repo facility from the /eserve

0ank eHuivalent to -.,+ per cent of D$%N!. %his should improve access to liHuidity from the /eserve 0ank for

the system as a whole without the procedural formalities relating to documentary evidence# authoriMation and

verification associated with the E'/. %his should also improve the transmission of policy impulses across the

interest rate spectrum and engender efficiency in cashOtreasury management.

:s the economy recovers# investment demand and the need for credit will pick up. %o the extent that this

contributes eventually to supply# it is important that banks have the room to finance it. : reduction in the reHuired

>N/ will give banks more freedom to expand credit to the non"1overnment sector. 7owever# the /eserve 0ank is

also cogniMant of the significant on"going financing needs of the 1overnment. %herefore# the >N/ is reduced by

-.+- per cent of D$%N# with any further change dependent on the likely path of fiscal consolidation.

CPI s)ou"d * usd to st in!"ation tar#t: R2I $an"

Inflation based on 'onsumer Price Index 'PI!

: /eserve 0ank of India /0I! panel on %uesday recommended that monetary policy be set by a committee and

that consumer price index 'PI! inflation be used to set an inflation target# eventually of . percent.

%he panel's report also said it should be made clear that managing inflation is the central bank's primary ob2ective.

%he recommendations of the panel# which was established by /0I 1ov. /aghuram /a2an when he took office in

early >eptember# are widely expected to be adopted by the Indian central bank.

<nder current /0I practice# the power to make policy decisions is held solely by the governor. %he /0I# unlike

many central banks# has long used wholesale price index WPI! inflation as its primary guage.

/eserve 0ank of India /0I! 1overnor /aghuram /a2an today hiked repo rate" the rate at which the central bank

lends short term money to banks" for the second time in as many months# citing inflationary concerns.

: /eserve 0ank of India /0I! panel on %uesday recommended that monetary policy be set by a committee and

that consumer price index 'PI! inflation be used to set an inflation target# eventually of . percent.%he panel's

report also said it should be made clear that managing inflation is the central bank's primary ob2ective.%he

recommendations of the panel# which was established by /0I 1overnor /aghuram /a2an when he took office in

early >eptember# are widely expected to be adopted by the Indian central bank.<nder current /0I practice# the

power to make policy decisions is held solely by the governor. %he /0I# unlike many central banks# has long used

wholesale price index WPI! inflation as its primary guage

Hr ar

*. /epo or short"term lending rate hiked by -.,+ per cent to C.C+ per cent

,. )arginal standing facility )>B! rate or overnight lending rate cut by -.,+ per cent to 8.C+ per cent

=. 1rowth forecast for the current fiscal slashed to + per cent from +.C per cent earlier

.. 'ash reserve ratio '//!" the portion of a bank's deposit that it must mandatorily park with /0I#

unchanged at . per cent. %he minimum daily maintenance of the '// has been reduced from 99 per cent

of the reHuirement to 9+ per cent effective from the fortnight beginning >eptember ,*. ,-*=.

+. 'ash provided to banks through term repo increased to -.+- per cent of net demand and time liability

from -.,+ per cent earlier

;. $ifference between repo and )>B rate narrows to * per cent

C. Wholesale inflation expected to be higher than current levels; warranting 'appropriate policy response'

8. /etail inflation to remain around 9 per cent or even higher without policy action

9. %o closely monitor inflation risks while being mindful of the evolving growth dynamics

*-. Bood price pressures may ease with the arrival of summer crop harvest and seasonal moderation

Conc"usion:

Inflation is not harmful at all times. In fact only when there is a sustained increase above CA to 8A# there is cause

for worry. In fact a low level of inflation between ,A and +A is a sign of prosperity. It is reHuired for growth.

%hat3s because it gives the producer of goods and services a certain impetus to stay in the market. %his in turn

gives rise to growth# development and employment which is very much reHuired. Inflation is also closely linked to

employment but that is the topic of discussion for another day.

/eference?

Economic NiberaliMation in India n.d.!# /etrieved from

http?OOen.wikipedia.orgOwikiOEconomicPliberalisationPinPIndia

)id"Fear Economic :nalysis,-*="*.! /etrieved from

http?OOwww.finmin.nic.inOreportsO)F/,-*=*.English.pdf

Inflation# /etrieved from

http?OOen.wikipedia.orgOwikiOInflation

'PI should be used to set inflation target? /0I panel@an. ,*#,-*.! /etrieved from

http?OOin.reuters.comOarticleO,-*.O-*O,*Oindia"rbi"monetarypolicy"inflation"idID$EE:-Q-E,,-*.-*,*

/0I will need to keep raising policy interest rate R I)B /etrieved from

http?OOin.reuters.comOarticleO,-*.O-,O,*Oindia"economy"policy"imf"idID$EE:*@-'S,-*.-,,*

Das könnte Ihnen auch gefallen

- INFLATION TARGETS IMPACT ECONOMIC DEVELOPMENTDokument10 SeitenINFLATION TARGETS IMPACT ECONOMIC DEVELOPMENTscribidaccount1Noch keine Bewertungen

- Prices: Assignment-Iii Inflation: Cpi Used To Set Inlation TargetDokument10 SeitenPrices: Assignment-Iii Inflation: Cpi Used To Set Inlation Targetscribidaccount1Noch keine Bewertungen

- CPI-BASED INFLATION IN INDIADokument9 SeitenCPI-BASED INFLATION IN INDIAscribidaccount1Noch keine Bewertungen

- CPI-BASED INFLATION IN INDIADokument10 SeitenCPI-BASED INFLATION IN INDIAscribidaccount1Noch keine Bewertungen

- Prices: Assignment-Iii Inflation: Cpi Used To Set Inlation TargetDokument10 SeitenPrices: Assignment-Iii Inflation: Cpi Used To Set Inlation Targetscribidaccount1Noch keine Bewertungen

- year-WPI in Same Month of Previous Year) - X 100 WPI in Same Month of Previous YearDokument10 Seitenyear-WPI in Same Month of Previous Year) - X 100 WPI in Same Month of Previous Yearscribidaccount1Noch keine Bewertungen

- CPI INFLATION TARGET USED TO SET INFLATION TARGET IN INDIADokument10 SeitenCPI INFLATION TARGET USED TO SET INFLATION TARGET IN INDIAscribidaccount1Noch keine Bewertungen

- Prices: Assignment-Iii Inflation: Cpi Used To Set Inlation TargetDokument10 SeitenPrices: Assignment-Iii Inflation: Cpi Used To Set Inlation Targetscribidaccount1Noch keine Bewertungen

- Prices: Assignment-Iii Inflation: Cpi Used To Set Inlation TargetDokument10 SeitenPrices: Assignment-Iii Inflation: Cpi Used To Set Inlation Targetscribidaccount1Noch keine Bewertungen

- Inflation in NepalDokument25 SeitenInflation in NepalAvay ShresthaNoch keine Bewertungen

- RBI & Obsession With InflationDokument2 SeitenRBI & Obsession With InflationHasmukh AgrawalNoch keine Bewertungen

- INFLATIONDokument4 SeitenINFLATIONMohd Ayaz RazaNoch keine Bewertungen

- Inflation in IndiaDokument18 SeitenInflation in Indiagouravsaikia24Noch keine Bewertungen

- Food Inflation in Pakistan Literature ReviewDokument28 SeitenFood Inflation in Pakistan Literature ReviewMukhtar Gichki50% (2)

- Inflation Case StudyDokument8 SeitenInflation Case Studysimee2567% (6)

- ProjectDokument4 SeitenProjectAnkit MundraNoch keine Bewertungen

- Case StudyDokument16 SeitenCase StudyDisha PuriNoch keine Bewertungen

- FICCI Economic Outlook Survey Jan 2011Dokument18 SeitenFICCI Economic Outlook Survey Jan 2011Ashish KumarNoch keine Bewertungen

- 2P Inflation WhyDokument21 Seiten2P Inflation WhyCừu NonNoch keine Bewertungen

- Inflation Measures in IndiaDokument11 SeitenInflation Measures in Indiapradeep3673Noch keine Bewertungen

- Inflation in IndiaaqDokument3 SeitenInflation in IndiaaqAdhish KackerNoch keine Bewertungen

- Mets September 2010 Ver4Dokument44 SeitenMets September 2010 Ver4bsa375Noch keine Bewertungen

- Case Study On InflationDokument8 SeitenCase Study On InflationDrGarima Nitin Sharma50% (2)

- Task 4 - Abin Som - 21FMCGB5Dokument8 SeitenTask 4 - Abin Som - 21FMCGB5Abin Som 2028121Noch keine Bewertungen

- Problems With InflationDokument3 SeitenProblems With InflationgagansinghNoch keine Bewertungen

- International Business: Inflation Rate in IndiaDokument9 SeitenInternational Business: Inflation Rate in IndiaMohit MakhijaNoch keine Bewertungen

- Business Assessment of Rising Inflation in IndiaDokument12 SeitenBusiness Assessment of Rising Inflation in IndiasaurabhrdeshpandeNoch keine Bewertungen

- Key Causes of Inflation in IndiaDokument6 SeitenKey Causes of Inflation in IndiashankarinadarNoch keine Bewertungen

- Measuring Inflation and Managing Expectations in IndiaDokument7 SeitenMeasuring Inflation and Managing Expectations in IndiaShay WaxenNoch keine Bewertungen

- Indian Economy Overview: Agriculture to Services ShiftDokument9 SeitenIndian Economy Overview: Agriculture to Services ShiftSudhit SethiNoch keine Bewertungen

- What Is Inflation?Dokument6 SeitenWhat Is Inflation?Shamoil ShaikhNoch keine Bewertungen

- Inflation: The Major Area of Concern For Macroeconomics ManagementDokument4 SeitenInflation: The Major Area of Concern For Macroeconomics ManagementChirag BadayaNoch keine Bewertungen

- Economic GrowthDokument9 SeitenEconomic GrowthHeoHamHốNoch keine Bewertungen

- Fighting high inflation: lessons from historyDokument8 SeitenFighting high inflation: lessons from historyDipesh JainNoch keine Bewertungen

- Determinants of Recent Inflation in Pakistan: COMSATS Institute of Information TechnologyDokument5 SeitenDeterminants of Recent Inflation in Pakistan: COMSATS Institute of Information TechnologyHamid KhurshidNoch keine Bewertungen

- Level of Prices: Price Inflation Occurs and Is Revealed in A Rise in GeneralDokument6 SeitenLevel of Prices: Price Inflation Occurs and Is Revealed in A Rise in GeneralfruitfulluftNoch keine Bewertungen

- Deepak Mohanty: Executive Director, Reserve Bank of India: Inflation DynamicsDokument4 SeitenDeepak Mohanty: Executive Director, Reserve Bank of India: Inflation DynamicsParvez SheikhNoch keine Bewertungen

- Making Sense of Inflation Figures: FE Editorial: Understanding InflationDokument5 SeitenMaking Sense of Inflation Figures: FE Editorial: Understanding InflationashishprrinNoch keine Bewertungen

- Reliance Communications LTDDokument29 SeitenReliance Communications LTDShafia AhmadNoch keine Bewertungen

- FMCG Industry Growth in IndiaDokument13 SeitenFMCG Industry Growth in IndiaArpita PatnaikNoch keine Bewertungen

- Inflation Impact On Indian Economy AgricultureDokument4 SeitenInflation Impact On Indian Economy AgricultureAvirup ChakrabortyNoch keine Bewertungen

- Term Paper of EconomicsDokument20 SeitenTerm Paper of EconomicsamrendrambaNoch keine Bewertungen

- Inflation in IndiaDokument8 SeitenInflation in IndiakatuuraaNoch keine Bewertungen

- Trend of Inflation in IndiaDokument20 SeitenTrend of Inflation in Indiasamadshaikhh100% (2)

- CHP 1Dokument13 SeitenCHP 1Gulfishan MirzaNoch keine Bewertungen

- Overheating: Niranjan Rajadhyaksha's Previous ColumnsDokument5 SeitenOverheating: Niranjan Rajadhyaksha's Previous ColumnsVaibhav KarthikNoch keine Bewertungen

- Monetary Policy Report: September 2014Dokument36 SeitenMonetary Policy Report: September 2014Network18Noch keine Bewertungen

- Economic Slowdown and Macro Economic PoliciesDokument38 SeitenEconomic Slowdown and Macro Economic PoliciesRachitaRattanNoch keine Bewertungen

- Economics Principles and Practices: Analysis of Unemployment, GDP and Inflation of UAEDokument13 SeitenEconomics Principles and Practices: Analysis of Unemployment, GDP and Inflation of UAEramanpreet kaurNoch keine Bewertungen

- Economics IA MACRODokument7 SeitenEconomics IA MACROAayush KapriNoch keine Bewertungen

- Inflation and The Indian Economy: Naresh KanwarDokument7 SeitenInflation and The Indian Economy: Naresh KanwarAshish YadavNoch keine Bewertungen

- Indus Way - Q4FY18 - Investor UpdateDokument21 SeitenIndus Way - Q4FY18 - Investor UpdateAadeesh JainNoch keine Bewertungen

- Unit 2: Macroeconomic Performance and PolicyDokument22 SeitenUnit 2: Macroeconomic Performance and PolicysnapNoch keine Bewertungen

- Prof.R.Srinivasan Department of Management Studies, Indian Institute of Science, BangaloreDokument24 SeitenProf.R.Srinivasan Department of Management Studies, Indian Institute of Science, BangaloreSamanth GodiNoch keine Bewertungen

- Causes of Infalation Scence 1991Dokument5 SeitenCauses of Infalation Scence 1991Neeraj AgarwalNoch keine Bewertungen

- Macro Economics Project Report - Group 7.Dokument30 SeitenMacro Economics Project Report - Group 7.Mayank Misra50% (2)

- Inflation: Definition, Causes, EffectsDokument2 SeitenInflation: Definition, Causes, EffectsUtsavGoelNoch keine Bewertungen

- Business LineDokument23 SeitenBusiness LineShraddha GhagNoch keine Bewertungen

- Inflation Falls at 8.51% in August: Last Updated: 2010-10-11T15:45:58+05:30Dokument5 SeitenInflation Falls at 8.51% in August: Last Updated: 2010-10-11T15:45:58+05:30Deepam ShuklaNoch keine Bewertungen

- Nutrition tips for muscle growth from various sourcesDokument1 SeiteNutrition tips for muscle growth from various sourcesscribidaccount1Noch keine Bewertungen

- Kasjkdhaoidpasp Dlcasi PSHC o 2e1Dokument1 SeiteKasjkdhaoidpasp Dlcasi PSHC o 2e1scribidaccount1Noch keine Bewertungen

- Ksdlcs We Gottaa ThisDokument1 SeiteKsdlcs We Gottaa Thisscribidaccount1Noch keine Bewertungen

- Hydroxy Alpha OlDokument1 SeiteHydroxy Alpha Olscribidaccount1Noch keine Bewertungen

- As, N, CLSC No Fun KT 33 Gtom S A What Can Be Exciting Per Muscle Per Nutrition It Oook TimeDokument1 SeiteAs, N, CLSC No Fun KT 33 Gtom S A What Can Be Exciting Per Muscle Per Nutrition It Oook Timescribidaccount1Noch keine Bewertungen

- What Can Be Exciting Per Muscle Per Nutrition It Oook Timeklasfn P SD 909990Dokument1 SeiteWhat Can Be Exciting Per Muscle Per Nutrition It Oook Timeklasfn P SD 909990scribidaccount1Noch keine Bewertungen

- Seem Slike O00-Fromm The 4444444444444 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDDokument1 SeiteSeem Slike O00-Fromm The 4444444444444 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDscribidaccount1Noch keine Bewertungen

- SDKFSLKT Aree Uuwhat Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods LDokument1 SeiteSDKFSLKT Aree Uuwhat Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods Lscribidaccount1Noch keine Bewertungen

- DSDLKCLSD 99 Onatkk 9999 What Can Be Exciting Per Muscle Per Nutrition It Oook Time DooasDokument1 SeiteDSDLKCLSD 99 Onatkk 9999 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Dooasscribidaccount1Noch keine Bewertungen

- Afff 6Dokument1 SeiteAfff 6scribidaccount1Noch keine Bewertungen

- What o Oa DDokument1 SeiteWhat o Oa Dscribidaccount1Noch keine Bewertungen

- What o Oa DDokument1 SeiteWhat o Oa Dscribidaccount1Noch keine Bewertungen

- From The Makers What Can Be Exciting Per Muscle Per Nutrition It Oook Timekksd Klkl7as9 Plse (As' Poasjjb LansnbaosDokument1 SeiteFrom The Makers What Can Be Exciting Per Muscle Per Nutrition It Oook Timekksd Klkl7as9 Plse (As' Poasjjb Lansnbaosscribidaccount1Noch keine Bewertungen

- Ksndfijal 0-Q030Or-3E Dk'Qpocj Qmcjo (Jhfrom Oa88WDokument1 SeiteKsndfijal 0-Q030Or-3E Dk'Qpocj Qmcjo (Jhfrom Oa88Wscribidaccount1Noch keine Bewertungen

- From Oa88wDokument1 SeiteFrom Oa88wscribidaccount1Noch keine Bewertungen

- From The Makers What Can Be Exciting Per Muscle Per Nutrition It Oook TimeDokument1 SeiteFrom The Makers What Can Be Exciting Per Muscle Per Nutrition It Oook Timescribidaccount1Noch keine Bewertungen

- GGGGDokument1 SeiteGGGGscribidaccount1Noch keine Bewertungen

- What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDDokument1 SeiteWhat Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDscribidaccount1Noch keine Bewertungen

- Bey Ond Dfooe 5555 Wi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena MfedDokument1 SeiteBey Ond Dfooe 5555 Wi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena Mfedscribidaccount1Noch keine Bewertungen

- Aree Uuwhat Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods LDokument1 SeiteAree Uuwhat Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods Lscribidaccount1Noch keine Bewertungen

- Exciting Muscle Nutrition TipsDokument1 SeiteExciting Muscle Nutrition Tipsscribidaccount1Noch keine Bewertungen

- Fromm The 4444444444444 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDDokument1 SeiteFromm The 4444444444444 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDscribidaccount1Noch keine Bewertungen

- Afff 6Dokument1 SeiteAfff 6scribidaccount1Noch keine Bewertungen

- Iidsnf 2 What Can Be Exciting Per Muscle Per Nutrition It Oook Time FR Om Get Sinfromm The Time Immerioal LlsDokument1 SeiteIidsnf 2 What Can Be Exciting Per Muscle Per Nutrition It Oook Time FR Om Get Sinfromm The Time Immerioal Llsscribidaccount1Noch keine Bewertungen

- Dfooe 5555 Wi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena MfedDokument1 SeiteDfooe 5555 Wi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena Mfedscribidaccount1Noch keine Bewertungen

- What Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDDokument1 SeiteWhat Can Be Exciting Per Muscle Per Nutrition It Oook Time Real Time Tookwitho Ut L SDscribidaccount1Noch keine Bewertungen

- Donatkk 9999 What Can Be Exciting Per Muscle Per Nutrition It Oook Time DooasDokument1 SeiteDonatkk 9999 What Can Be Exciting Per Muscle Per Nutrition It Oook Time Dooasscribidaccount1Noch keine Bewertungen

- What Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods LDokument1 SeiteWhat Can Be Exciting Per Muscle Per Nutrition It Oook Timef Soo 1 Ok Gotta Doo Goods Lscribidaccount1Noch keine Bewertungen

- Wi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena MfedDokument1 SeiteWi Thous Ofrom What Can Be Exciting Per Muscle Per Nutrition It Oook Timethe Mena Mfedscribidaccount1Noch keine Bewertungen

- Iidsnf 2 What Can Be Exciting Per Muscle Per Nutrition It Oook Time FR Om Get Sinfromm The Time Immerioal LlsDokument1 SeiteIidsnf 2 What Can Be Exciting Per Muscle Per Nutrition It Oook Time FR Om Get Sinfromm The Time Immerioal Llsscribidaccount1Noch keine Bewertungen

- Credit Transactions - RevisedDokument123 SeitenCredit Transactions - RevisedLiene Lalu NadongaNoch keine Bewertungen

- Analysis of The General Conditions of Contract Under The Ccag Form of ContractDokument14 SeitenAnalysis of The General Conditions of Contract Under The Ccag Form of ContractBarrouzNoch keine Bewertungen

- Financial Markets and Institutions: 12th EditionDokument18 SeitenFinancial Markets and Institutions: 12th EditionChew96Noch keine Bewertungen

- Vietnam National University, Hanoi: International SchoolDokument24 SeitenVietnam National University, Hanoi: International SchoolLương Vân TrangNoch keine Bewertungen

- U.S. Code Requirements for Open-End Credit PlansDokument28 SeitenU.S. Code Requirements for Open-End Credit PlansSamuel100% (1)

- Exhibit I - Redkite Open OfferDokument60 SeitenExhibit I - Redkite Open OfferCA Pallavi KNoch keine Bewertungen

- Busifin Final Period 2021 2022Dokument46 SeitenBusifin Final Period 2021 2022Glenn Mark NochefrancaNoch keine Bewertungen

- Business EthicsDokument152 SeitenBusiness EthicsRishabh GuptaNoch keine Bewertungen

- TechMahindra Aptitude Previous Questions-1Dokument24 SeitenTechMahindra Aptitude Previous Questions-1Prashant JainNoch keine Bewertungen

- Economic Effects of An AppreciationDokument11 SeitenEconomic Effects of An AppreciationIndeevari SenanayakeNoch keine Bewertungen

- 6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed AssetsDokument5 Seiten6 Following Are The: (A) Sales (B) Sundry Debtors (C) Closing Stock (D) Sundry Creditors (E) Fixed Assetsvaibhav_kapoor_6Noch keine Bewertungen

- UntitledDokument208 SeitenUntitledLaxmi MhetreNoch keine Bewertungen

- Telenor Pakistan Annual ReportDokument116 SeitenTelenor Pakistan Annual ReportHusnain Rasheed0% (2)

- Business Plan of Event Management: Submitted To: Miss Gurpreet KaurDokument21 SeitenBusiness Plan of Event Management: Submitted To: Miss Gurpreet KaurPrashantNoch keine Bewertungen

- Personal Loan Agreement FormDokument3 SeitenPersonal Loan Agreement FormJovel ContratistaNoch keine Bewertungen

- Foreign and Economic Policies of The Philippines (Inc)Dokument26 SeitenForeign and Economic Policies of The Philippines (Inc)Ken CadanoNoch keine Bewertungen

- Unit I Assessment Foundation of Financial Market & InstitutionDokument6 SeitenUnit I Assessment Foundation of Financial Market & InstitutionMICHAEL DIPUTADONoch keine Bewertungen

- TAX 667 Topic 8 Tax Planning For CompanyDokument63 SeitenTAX 667 Topic 8 Tax Planning For Companyzarif nezukoNoch keine Bewertungen

- IN THE COURT OF - , NEW DELHI: VersusDokument6 SeitenIN THE COURT OF - , NEW DELHI: VersusAyantika MondalNoch keine Bewertungen

- Swift Standards Sr2017 Cat3advanceinfoDokument169 SeitenSwift Standards Sr2017 Cat3advanceinfonarayanampNoch keine Bewertungen

- Aud Quiz 2Dokument6 SeitenAud Quiz 2MC allivNoch keine Bewertungen

- Merger Acquisition Chapter 10Dokument26 SeitenMerger Acquisition Chapter 10rayhanrabbiNoch keine Bewertungen

- Analytical Study On The Merger of Bank of Baroda, Vijaya Bank and Dena Bank, On The Back Drop of Their NpasDokument7 SeitenAnalytical Study On The Merger of Bank of Baroda, Vijaya Bank and Dena Bank, On The Back Drop of Their NpasIJAR JOURNALNoch keine Bewertungen

- Semt 13-3Dokument307 SeitenSemt 13-3hybbqNoch keine Bewertungen

- LNS 2018 1 24 OthhcoDokument13 SeitenLNS 2018 1 24 OthhcoSrikumar RameshNoch keine Bewertungen

- Peoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Dokument52 SeitenPeoples Union For Civil Liberties PUCL and Ors Vs s030229COM640521Avni Kumar SrivastavaNoch keine Bewertungen

- Admission of A New Partner: Total AssetsDokument10 SeitenAdmission of A New Partner: Total AssetsJuliana Cheng100% (5)

- Rms Tables Core TFFTTR 2017mar20Dokument109 SeitenRms Tables Core TFFTTR 2017mar20HieuNoch keine Bewertungen

- Section 13 Assignment 3 v2 September 2017Dokument7 SeitenSection 13 Assignment 3 v2 September 2017Ammer Yaser MehetanNoch keine Bewertungen

- A Study On Diesel Generator Sets in IndiaDokument44 SeitenA Study On Diesel Generator Sets in IndiaRoyal ProjectsNoch keine Bewertungen