Beruflich Dokumente

Kultur Dokumente

Equity and Liabilites: Balance Sheet

Hochgeladen von

MaazJaved0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

39 Ansichten19 Seitenfinancial analysis

Originaltitel

Worksheet

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenfinancial analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

39 Ansichten19 SeitenEquity and Liabilites: Balance Sheet

Hochgeladen von

MaazJavedfinancial analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 19

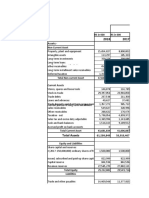

2013 2012

Equity and Liabilites

Capital & Reserves

Authorized capital 36,000,000 36,000,000

Issued, subscride & paid-up capital 8,802,532 8,802,532

Capital reserves 444,451 444,451

Unappropriated profit 16,342,836 14,402,413

25,589,819 23,649,396

Non-Current Liabilities

Long term finances 2,311,346 4,270,905

Liabilities against assests subject to finance lease 81,445 61,454

Deferred liabilities 3,656,788 3,918,411

6,049,579 8,250,770

Current Liabilities

Current portion of long term liabilities 1,987,055 1,677,142

Finances under mark-up arrangements-secured 5,544,967 20,049,549

Trade and other payables 22,993,279 45,718,500

30,525,301 67,445,191

62,164,699 99,345,357

Assets

Non-Current Assets

Propertty, plant & equipment 17,090,199 18,264,486

Intengible assets 14,528 7,388

Assets subject to finance lease 109,751 40,914

Capital work-in-progress 10,547

Long term loans and deposits 56,809 53,198

17,281,834 18,496,754

Current Assests

Stores and spares 4,132,476 3,726,404

Stock-in-trade 4,198,262 4,239,457

Trade debts 34,219,425 69,332,911

Loans, advances, deposits, prepayments & receivables 1,977,767 3,243,061

Cash & bank balances 354,935 306,770

44,882,865 80,848,603

62,164,699 99,345,357

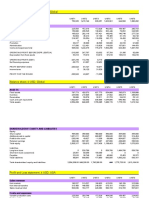

1. Liquidity Ratio:

a. Current Ratio 1.4703 1.1987

b. Quick Ratio 1.1974 1.0806

c. Absolute Quick Ratio 0.0116 0.0045

2.Profitablity Ratio:

a. Net Profit Margin 7.5267 6.0408

Balance Sheet

b. Gross Profit Margin 13.8790 11.1954

c. Cost Of Goods Sold Ratio (86.1210) (88.8046)

d. Operating Profit Ratio 19.3483 18.3252

e. Operating Expense Ratio (0.0253) (0.0006)

f. Administrative Expense Ratio (0.5418) (0.4936)

g. Interest Coverage Ratio 42.3126 53.1132

h. Return on Equity (ROE) 28.7379 25.6721

i. Return on Asset (ROA) 24.6971 15.9580

j. Return on Operating/Fixed Assets 43.0304 33.2409

k. Return on Capital Employeed (ROCE) 48.5246 49.6972

3. Activity Ratio:

a. Total Asset Turnover 1.5717 1.0117

b. Operting Asset Turnover 5.7170 5.5027

c. Inventory Turnover 10.3267 12.1370

d. Inventory Turnover in days 35.3454 30.0732

e. Debtor Turnover 1.8871 1.4731

f. Debtor Turnover in days 193.4214 247.7787

g. Creditor's Turnover 2.4492 2.0974

h. Creditor's Turnover in Days 149.0277 174.0255

i. Operating Cycle 228.7668 277.8520

j.Cash Cycle 79.7391 103.8264

4. Debt / Gearing Ratio:

a.Debt Ratio 0.5884 0.7619

b. Debt to Capital Employeed 1.1560 2.3729

c. Long Term Debt to Capital Employeed 0.1912 0.2586

d. Debt to Equity 0.2364 0.3489

5. Market Ratio:

a. Dividend Payout 0.7311 1.0440

b. Dividend Yield 0.0987 0.1600

c. Price Earning Ratio 10.1308 6.2496

d. Earning Per Share (EPS) 8.3544 6.8972

e. Tobin's Q Ratio 0.9364 0.4388

f. Book Value Per Share 29.0710 26.8666

g. Marris Ratio 2.1286 1.6749

2011 2010 2009

Sales

Cost of sales

36,000,000 36,000,000 36,000,000 Gross Profit

8,802,532 8,802,532 8,802,532 Administrative expenses

444,451 444,451 444,451 Other operating epenses

14,712,962 13,247,745 13,836,253 Other income

23,959,945 22,494,728 23,083,236 Profit from operations

Finance cost

4,209,628 4,247,761 5,147,476 Profit before tax

45,648 45,728 46,214 Taxation

3,362,859 3,178,013 2,943,032 Profit for the year

7,618,135 7,471,502 8,136,722 Earning per share

Dividend Paid

857,502 912,181 908,568 Dividend Per Share (DPS)

23,512,168 17,230,710 8,617,641 Market Price Per Share (MPS)

39,389,473 29,490,972 19,213,087

63,759,143 47,633,863 28,739,296

95,337,223 77,600,093 59,959,254

16,958,177 17,800,135 18,504,118

5,791 2,415 3,335

52,908 50,476 46,745

362,005 81,068 212,606

42,496 31,515 29,621

17,421,377 17,965,609 18,796,425

3,400,571 3,183,207 3,131,479

3,341,020 2,267,205 1,967,212

67,120,940 51,702,270 32,721,969

3,777,202 2,237,806 2,941,816

276,113 243,996 400,353

77,915,846 59,634,484 41,162,829

95,337,223 77,600,093 59,959,254

1.2220 1.2519 1.4323

1.1163 1.1375 1.2549

0.0043 0.0051 0.0139

8.7782 5.9221 8.1777

Balance Sheet Profit & Loss Account

14.3889 11.5482 15.8452

(85.6111) (88.4518) (84.1548)

25.0315 15.2051 21.8170

(0.0217) (0.2101) -

(0.6084) (0.5245) (1.0485)

46.7686 40.8368 42.3590

27.2399 22.6236 24.5735

15.9758 13.4343 20.1513

38.4869 28.5904 30.6546

48.2324 34.7893 38.7015

0.7799 1.1074 1.1569

4.3844 4.8278 3.7486

10.4417 14.4109 22.8973

34.9560 25.3281 15.9408

1.2515 2.0358 4.2396

291.6613 179.2919 86.0932

1.8482 3.1213 6.0764

197.4891 116.9370 60.0686

326.6174 204.6200 102.0339

129.1282 87.6830 41.9653

0.7487 0.7101 0.6150

2.2603 1.8389 1.1812

0.2412 0.2493 0.2606

0.3180 0.3321 0.3525

0.7703 1.1087 0.6846

0.1340 0.1536 0.1044

7.4607 6.5118 9.5790

7.4145 5.7814 6.4440

0.4292 0.5150 0.6703

27.2194 25.5548 26.2234

1.5654 1.6334 1.6115

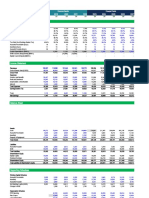

2013 2012 2011 2010 2009

97,705,313 100,504,304 74,350,745 85,934,854 69,363,913

(84,144,758) (89,252,443)

(63,652,527) (76,010,946) (58,373,072)

13,560,555 11,251,861 10,698,218 9,923,908 10,990,841

(529,386) (496,057) (452,349) (450,701) (727,267)

(24,762) (600) (16,150) (180,589)

5,897,915 7,662,456 8,381,420 3,773,832

4,869,530

18,904,322 18,417,660 18,611,139 13,066,450 15,133,104

(7,998,910) (9,782,214) (8,704,178) (5,335,919)

(6,410,224)

10,905,412 8,635,446 9,906,961 7,730,531 8,722,880

(3,551,431) (2,564,159) (3,380,288) (2,641,405)

(3,050,525)

7,353,981 6,071,287 6,526,673 5,089,126 5,672,355

8.35 6.90 7.41 5.78 6.44

5,376,676 6,338,243 5,027,372 5,642,340 3,883,433

6.11 7.20 5.71 6.41 4.41

61.88 45.00 42.61 41.74 42.26

Profit & Loss Account

2013 2012

Equity and Liabilites

Capital & Reserves

Share capital 43,009,284 43,009,284

Capital reserves 5,756,000 4,906,000

Unappropriated profit 274,893,417 220,449,368

323,658,701 268,364,652

Non-Current Liabilities

Deferred taxation 25,129,694 23,545,773

Deferred employee benefits 6,488,099 4,623,153

Provision for decommisioning cost 19,993,556 17,193,813

51,611,349 45,362,739

Current Liabilities

Trade & other payables 36,502,926 22,171,851

Provision for taxation 2,238,065 2,421,831

38,740,991 24,593,682

414,011,041 338,321,073

Assets

Non-Current Assets

Fixed Assets

Property, plant & equipment 52,605,226 40,966,441

Development& production assets-intengibles 74,651,460 64,671,505

Exploration & evaluation assets 7,275,329 10,406,156

134,532,015 116,044,102

Long term investments 140,416,803 3,987,633

Long term loans & receivables 4,152,258 3,066,634

Long term payments 580,432 346,413

279,681,508 123,444,782

Current Assets

Stores, spareparts and loose tools 16,628,579 12,860,723

Stock in trade 263,204 210,523

Trade debts 55,874,924 138,095,764

Loans & advances 6,408,762 5,604,976

Deposits and short term prepayments 1,158,516 984,796

Interest accrued 10,125,851 532,587

Other receivables 1,262,671 998,652

Other financial assets 39,897,151 51,820,581

Cash & bank balances 2,709,875 3,767,689

134,329,533 214,876,291

414,011,041 338,321,073

1. Liquidity Ratio:

a. Current Ratio 3.4674 8.7371

Balance Sheet

b. Quick Ratio 3.0314 8.2056

c. Absolute Quick Ratio 1.3938 2.3225

2.Profitablity Ratio:

a. Net Profit Margin 40.6404 48.9821

b. Gross Profit Margin 70.5865 69.9086

c. Cost Of Goods Sold Ratio 29.4135 30.0914

d. Operating Profit Ratio 65.2815 67.2683

e. Operating Expense Ratio 16.8110 17.3776

f. Administrative Expense Ratio 1.1996 1.1122

g. Interest Coverage Ratio 1.0366 0.8687

h. Return on Equity (ROE) 28.0470 36.1097

i. Return on Asset (ROA) 22.4854 29.1511

j. Return on Operating/Fixed Assets 151.5963 188.6328

k. Return on Capital Employeed (ROCE) 26.5871 33.9871

3. Activity Ratio:

a. Total Asset Turnover 0.5395 0.5848

b. Operting Asset Turnover 3.7302 3.8511

c. Inventory Turnover 4.3854 4.3593

d. Inventory Turnover in days 83.2312 83.7293

e. Debtor Turnover 2.3031 1.8318

f. Debtor Turnover in days 158.4831 199.2597

g. Creditor's Turnover 2.2394 3.0556

h. Creditor's Turnover in Days 162.9866 119.4528

i. Operating Cycle 241.7143 282.9890

j.Cash Cycle 78.7277 163.5362

4. Debt / Gearing Ratio:

a.Debt Ratio 0.1575 0.1372

b. Debt to Capital Employeed 0.1863 0.1599

c. Long Term Debt to Capital Employeed 0.0756 0.0752

d. Debt to Equity 0.0818 0.0813

5. Market Ratio:

a. Dividend Payout 0.3737 0.3159

b. Dividend Yield 0.0345 0.0444

c. Price Earning Ratio 29.0030 22.5417

d. Earning Per Share (EPS) 21.1063 22.5313

e. Tobin's Q Ratio 2.5339 2.1768

f. Book Value Per Share (BPS) 81.0961 67.8715

g. Marris Ratio 2.821 2.364

2011 2010 2009

43,009,284 43,009,284 43,009,284

4,059,138 3,859,682 3,658,318

154,497,155 110,523,520 79,503,794

201,565,577 157,392,486 126,171,396

20,786,195 21,499,184 17,710,497

3,301,169 2,699,773 2,008,499

14,348,981 12,435,365 10,814,506

38,436,345 36,634,322 30,533,502

16,794,297 28,624,204 18,747,328

4,981,309 6,216,639 2,540,170

21,775,606 34,840,843 21,287,498

261,777,528 228,867,651 177,992,396

39,146,582 34,998,898 29,855,966

58,926,897 58,630,857 49,057,766

7,961,196 9,551,394 8,779,699

106,034,675 103,181,149 87,693,431

3,568,930 3,231,435 2,903,133

2,410,907 1,902,330 1,849,707

159,550 118,937 85,357

112,174,062 108,433,851 92,531,628

13,979,854 14,527,278 16,090,579

261,835 172,084 108,301

77,911,312 82,992,291 56,140,092

2,738,873 2,216,881 2,643,354

640,229 616,641 419,621

324,845 17,031 27,156

1,459,073 926,951 969,930

38,445,555 11,120,823 5,087,917

13,841,889 7,843,820 3,973,818

149,603,465 120,433,800 85,460,768

261,777,527 228,867,651 177,992,396

6.8702 3.4567 4.0146

Balance Sheet

6.2162 3.0348 3.2536

2.4831 0.5714 0.4725

40.8191 41.5069 42.4519

66.0076 70.5770 69.9211

33.9924 29.4230 30.0789

58.4601 62.1110 61.8575

21.2026 16.6427 17.3309

1.4352 1.1210 1.0189

0.9540 0.8931 0.7078

31.5169 37.5984 44.0192

24.8348 26.4128 31.7236

134.8552 132.8322 143.7523

29.6567 35.0381 40.6244

0.5945 0.6229 0.7350

3.3037 3.2002 3.3862

3.6559 2.7153 4.8586

99.8386 134.4237 75.1243

1.9345 2.0494 4.6608

188.6825 178.0973 78.3123

2.3296 1.7711 4.1982

156.6812 206.0912 86.9431

288.5211 312.5209 153.4366

131.8399 106.4298 66.4936

0.1506 0.2184 0.1916

0.1798 0.2897 0.2454

0.0805 0.0877 0.0923

0.0876 0.0962 0.1016

0.2937 0.4862 0.7095

0.0284 0.0472 0.1205

35.2622 21.1817 8.3015

14.7706 13.7592 12.9134

2.6642 2.8810 2.0295

51.6986 41.5937 33.4537

2.959 3.407 2.274

2013 2012 2011

Sales-net 223,365,490 197,838,726 155,631,290

Royalty (25,899,469) (23,123,176) (17,703,601)

Operating Expenses (37,549,987) (34,379,542) (32,997,860)

Transpotation charges (2,250,087) (2,029,755) (2,201,339)

Gross profit 157,665,947 138,306,253 102,728,490

Other inccome 15,694,460 9,660,443 3,303,971

Exploration & prospecting expenditure (14,979,612) (4,047,774) (6,621,705)

General & adminstrative expenses (2,679,534) (2,200,313) (2,233,672)

Finance cost (2,315,324) (1,718,651) (1,484,781)

Workers' profit participation (7,674,541) (7,004,359) (4,788,537)

Share of profit in associate-net of taxation 104,892 87,215 78,438

Profit before tax 145,816,288 133,082,814 90,982,204

Taxation (55,039,579) (36,177,239) (27,454,934)

Profit for the year 90,776,709 96,905,575 63,527,270

Earning per share- basic & diluted 21.11 22.53 14.77

Dividends Paid 33,921,898 30,611,695 18,660,181

No. of Shares 4,300,928 4,300,928 4,300,928

Dividend Per Share (DPS) 7.887 7.117 4.339

Market Price of Share (MPS) 228.75 160.44 152.99

Profit & Loss Account

2010 2009

142,571,863 130,829,579

(16,728,843) (15,155,667)

(23,727,818) (22,673,893)

(1,492,267) (1,522,489)

100,622,935 91,477,530

3,300,214 3,370,823

(7,902,370) (7,459,560)

(1,598,161) (1,332,982)

(1,273,312) (926,027)

(4,660,671) (4,259,364)

64,118 57,503

88,552,753 80,927,923

(29,375,628) (25,388,282)

59,177,125 55,539,641

13.76 12.91

28,770,003 39,406,171

4,300,928 4,300,928

6.689 9.162

141.69 76.06

Profit & Loss Account

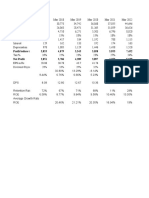

2013 2012

Equity & Liabilities

Equity

Share Capital 2,469,872 1,715,190

Reserves 59,417,732 48,244,718

61,887,604 49,959,908

Non-current Liabilities

Long term deposits 1,342,463 1,176,078

Retirement & other service benefits 2,385,137 2,518,502

3,727,600 3,694,580

Current Liabilities

Trade & other payables 197,302,571 246,767,460

Provisions 688,512 688,512

Accrued interest/ mark-up on short term borrowings 432,270 544,485

Short term borrowings 17,269,681 45,772,649

215,693,034 293,773,106

281,308,238 347,427,594

Assets

Non-Current Assets

Property, plant & equipment 5,524,767 5,831,993

Intangibles 30,068 29,991

Long term investments 48,253,164 1,968,073

Long term loans, advances & receivables 380,213 385,497

Long term deposits & prepayments 113,093 123,740

Deferred tax 2,650,805 1,292,316

56,952,110 9,631,610

Current Assets

Stores, spare parts & loose tools 138,775 134,431

Stock-in-trade 106,089,048 88,523,794

Trade debts 76,596,194 218,022,292

Loans & advances 490,606 526,118

Deposits & short term prepayments 2,405,618 2,528,406

Markup/ interest receivables 2,251,290 -

Other receivables 26,570,948 21,122,166

Taxation-net 4,586,321 5,314,752

Cash & bank balances 5,227,328 1,624,025

224,356,128 337,795,984

281,308,238 347,427,594

1. Liquidity Ratio:

a. Current Ratio 1.0402 1.1499

b. Quick Ratio 0.5477 0.8481

Balance Sheet

c. Absolute Quick Ratio 0.1814 0.0973

2.Profitablity Ratio:

a. Net Profit Margin 0.9701 0.7547

b. Gross Profit Margin 0.0332 0.0286

c. Cost Of Goods Sold Ratio 0.9668 0.9665

d. Operating Profit Ratio 2.3733 2.4271

e. Operating Expense Ratio 1.4852 1.8687

f. Administrative Expense Ratio 0.1441 0.1448

g. Interest Coverage Ratio 29.0752 46.8910

h. Return on Equity (ROE) 20.2915 18.1266

i. Return on Asset (ROA) 7.1626 5.9624

j. Return on Operating/Fixed Assets 227.3027 155.2823

k. Return on Capital Employeed (ROCE) 7.2588 6.0265

3. Activity Ratio:

a. Total Asset Turnover 4.6017 3.4537

b. Operting Asset Turnover 199.1256 175.6558

c. Inventory Turnover 7.0645 7.2585

d. Inventory Turnover in days 51.6666 50.2856

e. Debtor Turnover 7.4681 5.9778

f. Debtor Turnover in days 48.8745 61.0595

g. Creditor's Turnover 4.7903 4.5146

h. Creditor's Turnover in Days 76.1957 80.8482

i. Operating Cycle 100.5410 111.3451

j.Cash Cycle 24.3453 30.4970

4. Debt / Gearing Ratio:

a.Debt Ratio 1.0133 1.0106

b. Debt to Capital Employeed 0.7800 0.8562

c. Long Term Debt to Capital Employeed 0.0568 0.0689

d. Debt to Equity 0.0602 0.0740

5. Market Ratio:

a. Dividend Payout 0.0980 0.0656

b. Dividend Yield 0.0156 0.0233

c. Price Earning Ratio 64.0760 42.8800

d. Earning Per Share (EPS) 50.8445 52.7991

e. Tobin's Q Ratio 0.7800 0.8562

f. Book Value Per Share 250.5701 291.2791

g. Marris Ratio 1.2786 0.8097

2011 2010 2009

1,715,190 1,715,190 1,715,190

40,187,795 27,620,868 19,155,595

41,902,985 29,336,058 20,870,785

1,023,531 948,476 854,718

2,233,717 1,887,751 1,673,020

3,257,248 2,836,227 2,527,738

191,851,017 156,035,716 110,123,702

688,512 688,512 688,512

432,133 330,213 556,380

24,541,511 13,021,015 18,654,526

217,513,173 170,075,456 130,023,120

262,673,406 202,247,741 153,421,643

6,084,731 6,375,233 6,987,025

28,822 36,250 68,872

2,314,168 2,019,270 2,153,514

324,554 317,889 405,780

148,748 125,951 83,655

957,487 - 5,033,273

9,858,510 8,874,593 14,732,119

115,339 113,863 112,143

95,378,393 58,598,668 40,698,209

124,721,832 117,501,074 80,509,830

430,716 409,987 418,015

1,027,381 367,378 551,803

- - -

22,520,278 14,557,542 12,806,779

6,311,951 46,580 709,627

2,309,006 1,778,056 2,883,118

252,814,896 193,373,148 138,689,524

262,673,406 202,247,741 153,421,643

1.1623 1.1370 1.0667

0.7233 0.7918 0.7528

Balance Sheet

0.1451 0.0987 0.1293

1.5160 1.0317 (0.9313)

0.0352 0.0333 0.0042

0.9582 0.9607 0.9951

3.0733 2.8587 (1.0369)

1.0883 1.0229 1.4864

0.1553 0.1284 0.1601

47.2027 46.5399 (98.0910)

35.2703 30.8480 (32.0953)

10.1580 9.3606 (0.3041)

242.8918 141.9493 (95.8711)

10.2856 9.4937 (0.3091)

3.7115 4.3371 4.6883

134.8507 116.5068 87.6905

6.2976 9.0194 14.9395

57.9590 40.4685 24.4319

6.7750 7.5022 15.2204

53.8745 48.6524 23.9810

4.5201 5.3621 11.0727

80.7495 68.0699 32.9638

111.8335 89.1209 48.4129

31.0840 21.0510 15.4490

1.0124 1.0140 1.0165

0.8405 0.8549 0.8640

0.0721 0.0882 0.1080

0.0777 0.0967 0.1211

0.1471 0.0571 (0.4420)

0.0378 0.0307 0.0234

26.4580 32.5250 42.7300

86.1672 52.7615 (39.0542)

0.8405 0.8550 0.8640

244.3052 171.0368 121.6821

1.0830 1.5213 1.7558

2013 2012 2011

Sales-net of trade discounts & allowances 1,294,503,247 1,199,927,907 974,917,064

Sales tax (178,504,835) (163,861,410) (137,969,158)

Inland freight equalization margin (15,876,094) (11,642,892) (16,417,542)

Net sales 1,100,122,318 1,024,423,605 820,530,364

Cost of products sold (1,063,613,380) (990,101,083) (786,250,059)

Gross profit 36,508,938 34,322,522 34,280,305

Other operating income 5,939,114 9,684,575 1,815,951

Operating costs

Distribution & marketing expenses (8,461,834) (8,133,834) (5,175,233)

Adminstative expenses (1,865,657) (1,737,338) (1,514,532)

Other operating expenses (6,011,835) (9,272,048) (2,239,725)

Transportation cost - - (810,423)

Depreciation - - (1,120,999)

Amortisation of intengible assets - - (18,210)

Profit from operations 26,108,726 24,863,877 25,217,134

Finance costs (7,591,156) (11,658,928) (11,903,162)

Other income - - 4,143,710

18,517,570 13,204,949 17,457,682

Share of profit of associates 571,102 469,468 516,752

Profit before taxation 19,088,672 13,674,417 17,974,434

Taxation (6,530,727) (4,618,362) (3,195,120)

Profit for the year 12,557,945 9,056,055 14,779,314

Earning per share-basic & diluted 50.84 36.67 86.17

Dividends Per Share (DPS) 5.00 5.50 10.00

Market Price Per Share (MPS) 320.38 235.84 264.58

No. of Share Outstanding 246,987 171,519 171,519

Dividend Paid 1,231,218 593,751 2,173,429

Profit & Loss Account

2010 2009

877,173,254 719,282,176

(118,563,577) (97,386,723)

(15,851,726) (9,199,864)

742,757,951 612,695,589

(713,591,707) (609,685,478)

29,166,244 3,010,111

1,479,054 1,451,666

(4,055,238) (3,960,953)

(1,125,891) (1,151,793)

(2,416,518) (3,994,389)

(631,849) (513,673)

(1,137,637) (1,141,698)

(44,752) (52,615)

21,233,413 (6,353,344)

(9,882,010) (6,232,056)

6,095,348 776,686

17,446,751 (11,808,714)

516,401 451,850

17,963,152 (11,356,864)

(8,913,556) 4,658,329

9,049,596 (6,698,535)

52.76 39.05

8.00 5.00

260.20 213.65

171,519 171,519

516,757 2,960,697

Profit & Loss Account

Das könnte Ihnen auch gefallen

- United States Census Figures Back to 1630Von EverandUnited States Census Figures Back to 1630Noch keine Bewertungen

- Berger Paints Excel SheetDokument27 SeitenBerger Paints Excel SheetHamza100% (1)

- Netflix Spreadsheet - SMG ToolsDokument9 SeitenNetflix Spreadsheet - SMG ToolsJohn AngNoch keine Bewertungen

- Jumia USD Historical Data 10.08.21Dokument6 SeitenJumia USD Historical Data 10.08.21Salma Es-salmaniNoch keine Bewertungen

- Excel File SuzukiDokument18 SeitenExcel File SuzukiMahnoor AfzalNoch keine Bewertungen

- Income Statement of Arrow Electronics: ItemsDokument78 SeitenIncome Statement of Arrow Electronics: Itemsasifabdullah khanNoch keine Bewertungen

- Urc StatementsDokument6 SeitenUrc StatementsErvin CabangalNoch keine Bewertungen

- Restaurant BusinessDokument14 SeitenRestaurant BusinessSAKIBNoch keine Bewertungen

- Sir Safdar Project (Autosaved) (1) - 5Dokument30 SeitenSir Safdar Project (Autosaved) (1) - 5M.TalhaNoch keine Bewertungen

- Apple V SamsungDokument4 SeitenApple V SamsungCarla Mae MartinezNoch keine Bewertungen

- Beximco Pharmaceuticals LimitedDokument4 SeitenBeximco Pharmaceuticals Limitedsamia0akter-228864Noch keine Bewertungen

- Assets: Balance SheetDokument4 SeitenAssets: Balance SheetAsadvirkNoch keine Bewertungen

- Universe 18Dokument70 SeitenUniverse 18fereNoch keine Bewertungen

- M Saeed 20-26 ProjectDokument30 SeitenM Saeed 20-26 ProjectMohammed Saeed 20-26Noch keine Bewertungen

- No. 1 2 3 4 5 6 7 8 Balance SheetDokument4 SeitenNo. 1 2 3 4 5 6 7 8 Balance SheetOthman Alaoui Mdaghri BenNoch keine Bewertungen

- TCS 10 Year Financial Statement FinalDokument14 SeitenTCS 10 Year Financial Statement Finalgaurav sahuNoch keine Bewertungen

- Atlas Honda - Balance SheetDokument1 SeiteAtlas Honda - Balance SheetMail MergeNoch keine Bewertungen

- Ab Bank RatiosDokument12 SeitenAb Bank RatiosRahnoma Bilkis NavaidNoch keine Bewertungen

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDokument12 SeitenIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNoch keine Bewertungen

- Indus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsDokument12 SeitenIndus Dyeing & Manufacturing Co. LTD: Horizontal Analysis of Financial StatementsSaad NaeemNoch keine Bewertungen

- Final Project - FM - Umar & BilalDokument26 SeitenFinal Project - FM - Umar & BilalbilalNoch keine Bewertungen

- Bhai Bhai SpinningDokument18 SeitenBhai Bhai SpinningSharifMahmudNoch keine Bewertungen

- Total Non Current Assets: (Rupees in 000)Dokument10 SeitenTotal Non Current Assets: (Rupees in 000)Leo_Raja_4486Noch keine Bewertungen

- Atlas Honda Motor Company LimitedDokument10 SeitenAtlas Honda Motor Company LimitedAyesha RazzaqNoch keine Bewertungen

- Berger Paints: Statement of Financial PositionDokument6 SeitenBerger Paints: Statement of Financial PositionMuhammad Hamza ZahidNoch keine Bewertungen

- HCL TECH (AutoRecovered) NewDokument55 SeitenHCL TECH (AutoRecovered) NewKrutika PhutaneNoch keine Bewertungen

- Hira Textile Mill Horizontal Analysis 2015-13Dokument9 SeitenHira Textile Mill Horizontal Analysis 2015-13sumeer shafiqNoch keine Bewertungen

- Round 2Dokument68 SeitenRound 2fereNoch keine Bewertungen

- Horizental Analysis On Income StatementDokument21 SeitenHorizental Analysis On Income StatementMuhib NoharioNoch keine Bewertungen

- DCF 3 CompletedDokument3 SeitenDCF 3 CompletedPragathi T NNoch keine Bewertungen

- Apple Valuation TemplateDokument10 SeitenApple Valuation Templatesavannah williamsNoch keine Bewertungen

- Group D - Case 28 AutozoneDokument29 SeitenGroup D - Case 28 AutozoneVinithi ThongkampalaNoch keine Bewertungen

- Fauji Fertilizer Company Limited: Consolidated Balance SheetDokument5 SeitenFauji Fertilizer Company Limited: Consolidated Balance Sheetnasir mehmoodNoch keine Bewertungen

- 2022.11.07 - Heineken para PraticarDokument6 Seiten2022.11.07 - Heineken para Praticarmartimcrypto1609Noch keine Bewertungen

- Ayala ReportDokument20 SeitenAyala ReportClara Sophia CalayanNoch keine Bewertungen

- Balance Sheet - LifeDokument110 SeitenBalance Sheet - LifeYisehak NibereNoch keine Bewertungen

- Filinvest Land 2006-2010Dokument18 SeitenFilinvest Land 2006-2010Christian VillarNoch keine Bewertungen

- KPJ Financial Comparison 1Dokument15 SeitenKPJ Financial Comparison 1MaryamKhalilahNoch keine Bewertungen

- NCC Bank RatiosDokument20 SeitenNCC Bank RatiosRahnoma Bilkis NavaidNoch keine Bewertungen

- Income Statement 2014 2015: 3. Net Revenue 5. Gross ProfitDokument71 SeitenIncome Statement 2014 2015: 3. Net Revenue 5. Gross ProfitThu ThuNoch keine Bewertungen

- Fin Analysis ExerciseDokument1 SeiteFin Analysis ExercisevavdfvfdNoch keine Bewertungen

- PROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetDokument17 SeitenPROFIT & LOSS ACCOUNT Gross Premium Written Reinsurance Ceded NetmissphNoch keine Bewertungen

- Al Fajar WorkingDokument3 SeitenAl Fajar WorkingsureniimbNoch keine Bewertungen

- Pyramid Analysis Solution: Strictly ConfidentialDokument3 SeitenPyramid Analysis Solution: Strictly ConfidentialSueetYeingNoch keine Bewertungen

- Excel TopgloveDokument21 SeitenExcel Topglovearil azharNoch keine Bewertungen

- 5 Cs of Credit - Caskey Trucking FinancialsDokument5 Seiten5 Cs of Credit - Caskey Trucking FinancialsHazem ElsherifNoch keine Bewertungen

- Ganancia (P: - Gastos Fina - Gastos FinaDokument7 SeitenGanancia (P: - Gastos Fina - Gastos FinaLAURA SANCHEZ FORERONoch keine Bewertungen

- Pak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Dokument14 SeitenPak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Abdul RehmanNoch keine Bewertungen

- Investment ExcelDokument78 SeitenInvestment ExcelByezid LimonNoch keine Bewertungen

- SHIDDokument3 SeitenSHIDChairimanNoch keine Bewertungen

- ConditionDokument4 SeitenConditionapi-3839889Noch keine Bewertungen

- Tire City Case - FMT2Dokument3 SeitenTire City Case - FMT2Udhav JoshiNoch keine Bewertungen

- Pyramid Analysis Solution: Strictly ConfidentialDokument3 SeitenPyramid Analysis Solution: Strictly ConfidentialEmnet AbNoch keine Bewertungen

- Profit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Dokument19 SeitenProfit Before T 3,853 4,879 5,543 5,058 5,953 7,452 Net Profit 2,851 3,786 4,289 3,897 4,353 5,630Abhishek M. ANoch keine Bewertungen

- Act WorkDokument10 SeitenAct WorkAsad Uz JamanNoch keine Bewertungen

- Goldson CompanyDokument10 SeitenGoldson CompanyRabeyaNoch keine Bewertungen

- MCB Financial AnalysisDokument30 SeitenMCB Financial AnalysisMuhammad Nasir Khan100% (4)

- AMULDokument22 SeitenAMULsurprise MFNoch keine Bewertungen

- Complete Financial Model & Valuation of ARCCDokument46 SeitenComplete Financial Model & Valuation of ARCCgr5yjjbmjsNoch keine Bewertungen

- Tugas Metode Common SizeDokument9 SeitenTugas Metode Common SizeDS ReishenNoch keine Bewertungen

- Fdnacct - ProjectDokument2 SeitenFdnacct - ProjectMaria Tamia HensonNoch keine Bewertungen

- Capital Budgeting Questions - UE - FMDokument3 SeitenCapital Budgeting Questions - UE - FMVimoli MehtaNoch keine Bewertungen

- MTN Nigeria Annual Report 2020Dokument153 SeitenMTN Nigeria Annual Report 2020JoshNoch keine Bewertungen

- Naman Devpura and Sakshya Jain PDFDokument22 SeitenNaman Devpura and Sakshya Jain PDFMeghna SinghNoch keine Bewertungen

- Illustrative Questions: Classic TutorsDokument20 SeitenIllustrative Questions: Classic TutorsTbabaNoch keine Bewertungen

- Chapter 1 - Test 1 & 3: The Yellow GroupDokument50 SeitenChapter 1 - Test 1 & 3: The Yellow GroupGUILA REIGN MIRANDANoch keine Bewertungen

- About Financial Statements: Prepared By: Mohammad Shahidul Islam MBA, ACADokument31 SeitenAbout Financial Statements: Prepared By: Mohammad Shahidul Islam MBA, ACAShahid MahmudNoch keine Bewertungen

- Financial Analysis of Nestle LTDDokument43 SeitenFinancial Analysis of Nestle LTDShahbaz AliNoch keine Bewertungen

- Workshop Students) ADM657Dokument15 SeitenWorkshop Students) ADM657Riedhwan AwangNoch keine Bewertungen

- Chapter 2Dokument21 SeitenChapter 2Enna rajpootNoch keine Bewertungen

- Ch22 Accounting Changes and Error AnalysisDokument31 SeitenCh22 Accounting Changes and Error AnalysisknapenaveNoch keine Bewertungen

- To Islamic Finance: DR Masahina SarabdeenDokument20 SeitenTo Islamic Finance: DR Masahina SarabdeenNouf ANoch keine Bewertungen

- Trabajo Parcial 12-10Dokument145 SeitenTrabajo Parcial 12-10Takeshi CastroNoch keine Bewertungen

- Form 3: United States Securities and Exchange CommissionDokument1 SeiteForm 3: United States Securities and Exchange CommissionA. CampbellNoch keine Bewertungen

- Basic Accounting Principles and GuidelinesDokument23 SeitenBasic Accounting Principles and GuidelinesgaurabNoch keine Bewertungen

- Valuation of Stressed Assets: The Institute of Cost Accountants of IndiaDokument43 SeitenValuation of Stressed Assets: The Institute of Cost Accountants of IndiaAny YnaNoch keine Bewertungen

- Insolvency Law in Kenya: A. What Is The Difference Between Insolvency and Bankruptcy?Dokument8 SeitenInsolvency Law in Kenya: A. What Is The Difference Between Insolvency and Bankruptcy?Dickson Tk Chuma Jr.Noch keine Bewertungen

- Capital Budgeting Part1Dokument65 SeitenCapital Budgeting Part1Thenappan GanesenNoch keine Bewertungen

- In-Depth Guide To Public Company Auditing:: The Financial Statement AuditDokument20 SeitenIn-Depth Guide To Public Company Auditing:: The Financial Statement AuditThùy Vân NguyễnNoch keine Bewertungen

- Ifrs 9 PresentationDokument26 SeitenIfrs 9 PresentationJean Damascene HakizimanaNoch keine Bewertungen

- Analysis NewDokument12 SeitenAnalysis NewFairooz AliNoch keine Bewertungen

- Tutorial 6 SolutionDokument3 SeitenTutorial 6 SolutionConstance KeenanNoch keine Bewertungen

- Bank CorrespondenceDokument7 SeitenBank CorrespondenceNitish JainNoch keine Bewertungen

- JP Morgan DR Whitepaper - Unsponsored ADR ProgramsDokument3 SeitenJP Morgan DR Whitepaper - Unsponsored ADR ProgramsIRWebReport.com Investor Relations Research and Intelligence100% (1)

- M&a FMSDokument17 SeitenM&a FMSfunshareNoch keine Bewertungen

- Lisa Eka Cahayati - CH11Dokument5 SeitenLisa Eka Cahayati - CH11Lisa Eka CahayatiNoch keine Bewertungen

- Substantive Test of PPE and Other Noncurrent AssetsDokument65 SeitenSubstantive Test of PPE and Other Noncurrent Assetsjulia4razoNoch keine Bewertungen

- Chapter 2 Financial Statement and Cash Flow AnalysisDokument15 SeitenChapter 2 Financial Statement and Cash Flow AnalysisKapil Singh RautelaNoch keine Bewertungen

- Students Feedback About The Learning OutcomesDokument12 SeitenStudents Feedback About The Learning OutcomesThea BacsaNoch keine Bewertungen

- summary#NFBNFfri 20122019Dokument554 Seitensummary#NFBNFfri 20122019BHAVESH MEHTANoch keine Bewertungen

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyVon EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyBewertung: 4.5 von 5 Sternen4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditVon EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditBewertung: 5 von 5 Sternen5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceVon EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNoch keine Bewertungen

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelVon Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNoch keine Bewertungen

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Von EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Bewertung: 4 von 5 Sternen4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsVon EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsBewertung: 5 von 5 Sternen5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeVon EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeBewertung: 4 von 5 Sternen4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageVon EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageBewertung: 4.5 von 5 Sternen4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Von EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Von EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Bewertung: 4.5 von 5 Sternen4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingVon EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingBewertung: 4.5 von 5 Sternen4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesVon EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesBewertung: 5 von 5 Sternen5/5 (4)