Beruflich Dokumente

Kultur Dokumente

ICAI Presentation 27413 Formatted Revised

Hochgeladen von

S Dharam Singh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten46 SeitenHotel industry - typical indirect tax issues impact of indirect taxes Applicability of multiple indirect taxes have an impact on the pricing of food and beverages, room tariffs, etc.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenHotel industry - typical indirect tax issues impact of indirect taxes Applicability of multiple indirect taxes have an impact on the pricing of food and beverages, room tariffs, etc.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

24 Ansichten46 SeitenICAI Presentation 27413 Formatted Revised

Hochgeladen von

S Dharam SinghHotel industry - typical indirect tax issues impact of indirect taxes Applicability of multiple indirect taxes have an impact on the pricing of food and beverages, room tariffs, etc.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 46

Hospitality industry

Key indirect tax issues

27 April 2013

Divyesh Lapsiwala, Parnter

Sanket Desai, Senior Manager

Key indirect taxes impacted

27 April 2013 Page 3 Hotel industry typical indirect tax issues

Key Indirect Taxes - Hotel Industry

VAT Service tax

FTP, Customs &

Excise

Room rentals

Restaurant services

Banquet services

Convention services

Club membership

Rent a cab services

Dry cleaning

services

Health club/ Spa/

Beauty parlour

services

Renting of

immovable property

Internet services

Money changing

services

Sale of food and

beverages in

restaurant(s)

Sale of food under

banquet

arrangements

Sale of goods from

retail shops

In-room sales of

food (such as in-

room dining, mini

bar, etc)

Customs duty

payable on import of

capital goods, motor

cars, etc

Concessional

customs duty rates

under EPCG

scheme

Duty credit scrips

under SFIS

Central Excise on

manufacture of

bakery products

State Excise on

alcoholic beverages

Luxury tax

applicable on room

rentals

Entertainment tax

on casinos, discos,

video game

parlours, etc

Luxury tax and

entertainment tax

rates vary from

State to State

Other taxes

27 April 2013 Page 4 Hotel industry typical indirect tax issues

Impact of indirect taxes

Indirect taxes have an impact on the following

Applicability of multiple indirect taxes have an impact on the pricing of food

and beverages, room tariffs, etc, thereby impacting the price competitiveness

Eligibility to claim credit / set off of taxes have an impact on the cost

effectiveness

Burden of compliance under various indirect tax legislations

Ambiguities on taxability and credit eligibility on various transactions

Service tax

27 April 2013 Page 6 Hotel industry typical indirect tax issues

Service tax key taxable services

Restaurant services

Particulars From 1 May 11 to

31 March 2012

From 1 April 2012

to 30 June 2012

From 1 July

2012 to 31

March 2013

From 1 April

2013

Scope Restaurants having

AC and liquor

license

Restaurants having

AC and liquor license

Restaurants

having AC

and liquor

license

Restaurants

having AC

Abatement 70% 70% 60% 60%

Effective

rate

3.09% 3.708% 4.944% 4.944%

CENVAT

credit

No credit on inputs,

input services and

capital goods

No credit on inputs,

input services and

capital goods

Credit not

permitted on

inputs under

chapters 1 to

22

Credit not

permitted on

inputs under

chapters 1 to

22

27 April 2013 Page 7 Hotel industry typical indirect tax issues

Service tax key taxable services

Outdoor catering services

Particul

ars

Upto 31 March 2012 1 April 2012 to 30 June

2012

From 1 July 2012

onwards

Abatem

ent

50% 50% 40%

Effective

rate

5.15% 6.18% 7.416%

CENVAT

credit

No credit on inputs, input

services and capital

goods

No credit on inputs, input

services and capital

goods

Credit on inputs, input

services and capital

goods available except

inputs under chapters 1

to 22 (food stuffs,

consumables, etc)

27 April 2013 Page 8 Hotel industry typical indirect tax issues

Service tax key taxable services

Hotel accommodation services

Particul

ars

Upto 31 March 2012 1 April 2012 to 30 June

2012

From 1 July 2012

onwards

Abatem

ent

50% 50% 40%

Effective

rate

5.15% 6.18% 7.416%

CENVAT

credit

No credit on inputs, input

services and capital

goods

No credit on inputs, input

services and capital

goods

Credit on inputs

services available

No credit on inputs and

capital goods

27 April 2013 Page 9 Hotel industry typical indirect tax issues

Service tax key taxable services

Other key services provided by hotels

Services Service tax rate

Rent a cab services 40% abatement (rate 7.416%)

Health & fitness services 12.36%

Fitness centre services 12.36%

Internet caf services 12.36%

Cleaning services 12.36% (prior to 1 July 2012 only dry cleaning

was taxable)

Renting of shops in the hotel premises 12.36%

VAT

27 April 2013 Page 11 Hotel industry typical indirect tax issues

VAT key taxable transactions

Transaction Maharashtra VAT rate

Sale of food 12.5%

Sale of non alcoholic aerated

beverages

20%

Sale of alcoholic beverages 20%

Sale of non aerated non

alcoholic beverages (mineral

water, juices, etc)

12.5%

Sale of Spa products 12.5%

Sale of cigarettes 20%

Sale of food in composite

packages

Rule 59 - Taxable turnover shall be:

- 5% - where charges which include breakfast

- 15% - where charges which include breakfast and lunch

- 30% - where charges which include breakfast, lunch and

dinner

Central Excise

27 April 2013 Page 13 Hotel industry typical indirect tax issues

Central Excise key taxable transactions

Transaction Central Excise duty rate

Food preparations prepared or served in a

hotel, restaurant or retail outlet

Exempt from Central Excise duty

Cakes, pastries & cookies prepared by the

hotel

6.18%

Chocolates prepared by the hotel

12.36%

Luxury tax

27 April 2013 Page 15 Hotel industry typical indirect tax issues

Luxury tax key taxable transactions

Transaction Maharashtra luxury tax rate

Room tariff payable on actual tariff (not declared

tariff)*

-Exceeding Rs 1,200 per day per room

-Rs 200 - 1,200 per day per room

-Tariff up to Rs 200 per day per room

10%

4%

Nil

Other services provided in a hotel including charges for

air-conditioning, television, radio etc if charges exceed

Rs 200 per day per room

10%

Services provided to consulate/foreign diplomats Exempt from luxury tax

Telephone, laundry, valet, courier, photo copy, fax, etc Not regarded as luxury based

on a circular

*In some states such as Delhi, luxury tax is payable on declared tariff and not actual tariff.

Case study

27 April 2013 Page 17 Hotel industry typical indirect tax issues

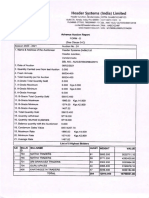

Case study computation of indirect taxes

Transaction Service tax VAT Luxury tax

Room Tariff Rs 9,000

covering only

accommodation

Room Tariff Rs 10,000

including breakfast

Dining at a restaurant

having AC Rs 1,000

Supply of food in a

convention with total

charges of Rs 2 lacs

Outdoor caterer with total

charges of Rs 2 lacs

Transaction Service tax VAT Luxury tax

Room Tariff Rs 9,000

covering only

accommodation

9,000*12.36%*60%

= 667.44

Not

applicable

9,000*10%= 900

Room Tariff Rs 10,000

including breakfast

Dining at a restaurant

having AC Rs 1,000

Supply of food in a

convention with total

charges of Rs 2 lacs

Outdoor caterer with total

charges of Rs 2 lacs

Transaction Service tax VAT Luxury tax

Room Tariff Rs 9,000

covering only

accommodation

9,000*12.36%*60%

= 667.44

Not

applicable

9,000*10%= 900

Room Tariff Rs 10,000

including breakfast

10,000*12.36%*60

%= 741.6

10,000*5%*

12.5%= 62.5

10,000*10%

=1,000

Dining at a restaurant

having AC Rs 1,000

Supply of food in a

convention with total

charges of Rs 2 lacs

Outdoor caterer with total

charges of Rs 2 lacs

Transaction Service tax VAT Luxury tax

Room Tariff Rs 9,000

covering only

accommodation

9,000*12.36%*60%

= 667.44

Not

applicable

9,000*10%= 900

Room Tariff Rs 10,000

including breakfast

10,000*12.36%*60

%= 741.6

10,000*5%*

12.5%= 62.5

10,000*10%

=1,000

Dining at a restaurant

having AC Rs 1,000

1,000*12.36%*40%

= 49.44

1,000*

12.5%=125

Not applicable

Supply of food in a

convention with total

charges of Rs 2 lacs

Outdoor caterer with total

charges of Rs 2 lacs

Transaction Service tax VAT Luxury tax

Room Tariff Rs 9,000

covering only

accommodation

9,000*12.36%*60%

= 667.44

Not

applicable

9,000*10%= 900

Room Tariff Rs 10,000

including breakfast

10,000*12.36%*60

%= 741.6

10,000*5%*

12.5%= 62.5

10,000*10%

=1,000

Dining at a restaurant

having AC Rs 1,000

1,000*12.36%*40%

= 49.44

1,000*

12.5%=125

Not applicable

Supply of food in a

convention with total

charges of Rs 2 lacs

Rs 2 lacs

*12.36%*70%= Rs

17,304

Rs 2

lac*12.5%=

Rs 25,000

Not applicable

Outdoor caterer with total

charges of Rs 2 lacs

Transaction Service tax VAT Luxury tax Effective tax

Room Tariff Rs 9,000

covering only

accommodation

9,000*12.36%*60

%= 667.44

Not

applicable

9,000*10%=

900

17.42%

Room Tariff Rs 10,000

including breakfast

10,000*12.36%*6

0%= 741.6

10,000*5%

*12.5%=

62.5

10,000*10%

=1,000

18.04%

Dining at a restaurant

having AC Rs 1,000

1,000*12.36%*40

%= 49.44

1,000*

12.5%=12

5

Not applicable 17.44%

Supply of food in a

convention with total

charges of Rs 2 lacs

Rs 2 lacs

*12.36%*70%=

Rs 17,304

Rs 2

lac*12.5%

= Rs

25,000

Not applicable

21.15%

Outdoor caterer with

total charges of Rs 2

lacs

2 lacs*12.36%*

60%= Rs 14,832

2lacs*12.5

%=Rs

25,000

Not applicable 19.92%

Service tax issues

27 April 2013 Page 19 Hotel industry typical indirect tax issues

Restaurants / supply of food service tax

issues

Taxing entry:

(zzzzv) to any person, by a restaurant, by whatever name called, having the facility

of air-conditioning in any part of the establishment, at any time during the financial

year, which has licence to serve alcoholic beverages, in relation to serving of food

or beverage, including alcoholic beverages or both, in its premises

Post Negative List, the exemption reads:

19. Services provided in relation to serving of food or beverages by a restaurant,

eating joint or a mess, other than those having (i) the facility of air-conditioning or

central air-heating in any part of the establishment, at any time during the year,

and (ii) a licence to serve alcoholic beverages;

Rule 2C of Valuation Rules

Service portion in an activity wherein goods, being food or any other article of

human consumption or any drink (whether or not intoxicating) is supplied in any

manner as a part of the activity, at a restaurant (or as a part of outdoor catering)

27 April 2013 Page 20 Hotel industry typical indirect tax issues

Restaurants / supply of food service tax

issues

Is service tax applicable on service charges charged by restaurants?

Clarified in TRU Circular dated 25 April 2011 - service charge to be included

Whether service tax applies on take away parcels provided by restaurants?

Customers do not use restaurants facilities while ordering food or collecting

parcels no clarification on this aspect

Is service tax applicable on counters at theatres?

Is service tax applicable on self service restaurants?

TRU circular dated 28 February 2011 that mere sale of goods is not a service

Supreme Court in of K Dharmodharanswamy Naidu held that value cannot be split

and VAT applies on entire amount charged in a restaurant

Is service tax applicable on food supplied by office canteens?

Exemption available only to serving food or beverages by a restaurant, eating joint

or a mess, other than those having air-conditioning / central air-heating facility

Can service tax be levied on value including VAT?

27 April 2013 Page 21 Hotel industry typical indirect tax issues

Restaurants / supply of food service tax

issues

Is service tax applicable on mini bar consumption?

Argument could be adopted that mini bar consumption is a pure sale of goods and

does not involve any sale of goods hence should not attract service tax

Sky Gourmet - is it sale or service?

LSG Sky Chefs v. CST (2009) 19 STT 440 and 25 STT 10 (CESTAT)

Supreme court in Tamil Nadu Kalyan Mandapam while upholding service tax

on outdoor catering services made a clear distinction from restaurants where

choices or "service" is fairly limited

Delhi High Court in IRCTC case held that there is no service in catering

inside a train as there is no choice or service provided - once the food is

loaded onto the train, it is sold

However, Kerala High Court in Saj Flight Services held that supply of goods

and beverages to aircrafts falls under outdoor catering services

Services are provided by air port lounges?

Entertainment combined with food?

27 April 2013 Page 22 Hotel industry typical indirect tax issues

Restaurant/ catering services valuation

issue

It appears that Valuation Rule 2C is not optional but to be followed

mandatorily

Issue for caterers who charge separate amounts for sale of F&B and for

services and where value charged for services is substantially lower than

60% of total amount charged

Impact on the Airline catering industry

Some arguments in favor of valuation on basis of actual amounts:

If value of service is clearly ascertainable, service tax should be levied on actual

value - Valuation Rules triggered only if value of services not ascertainable

Based on Guidance note, the legislative intent appears to be only to address the

difficulty normally arising in determining the value of service portion

Section 67 provides that value of services is the gross amount charged for

services Section 67 should override Rules

27 April 2013 Page 23 Hotel industry typical indirect tax issues

In-room dining services

Up to 1 July 2012 Specific clarification in Circular 139/8/2011 - TRU dated

10 May 2011 that

When the food is served in the room, service tax cannot be charged under the

restaurant service as the service is not provided in the premises of the air-

conditioned restaurant with a licence to serve liquor

With effect from 1 July 2012, in room dining may qualify as a taxable service

since its not specifically covered under negative/ exempt list

Rule 2C of Valuation Rules allows valuation of service portion in any activity

involving supply of food, drink, etc in a restaurant at 40% of total amount

charged

May not apply to in-room dining

No other specific valuation rule regarding in-room dining

27 April 2013 Page 24 Hotel industry typical indirect tax issues

Issues - CENVAT Credit reversal computation

Restaurant services

Position post 1 July 2012

"exempted service" means a taxable service whose part of value is exempted

on the condition that no credit of inputs and input services, used for providing

such taxable service, shall be taken

Services not covered under abatement scheme

40% of total amount charged is deemed to be value of services as per

Valuation Rules

Services may not qualify as exempted services

CBECs Guidance Note states that sale of food in restaurants is clearance of

exempted goods and Rule 6 of CENVAT Credit Rules would be applicable to

such clearances

Whether restaurant services should be considered as exempt services?

If yes, whether the deemed portion of food and beverages sold ie 60%

or full amount ie 100% should be considered as exempted turnover?

If no, whether still Cenvat reversal is required?

27 April 2013 Page 25 Hotel industry typical indirect tax issues

Hotel accommodation - Bundled Services

Taxing entry:

(zzzzw) to any person by a hotel, inn, guest house, club or campsite, by whatever

name called, for providing of accommodation for a continuous period of less than

three months

Post Negative List, the exemption reads:

18. Services by way of renting of a hotel, inn, guest house, club, campsite or other

commercial places meant for residential or lodging purposes, having declared tariff

of a unit of accommodation below rupees one thousand per day or equivalent

Valuation:

70% in case of bundled service by way of supply of food or any other article of

human consumption or any drink, in a premises (including hotel, convention center,

club, pandal, shamiana or any other place, specially arranged for organizing a

function) together with renting of such premises

60% if only renting

27 April 2013 Page 26 Hotel industry typical indirect tax issues

Hotel accommodation - Bundled Services

Defined as provision of one type of service with another type or types of

services

If services are bundled in the ordinary course of business

The bundle of services will be treated as consisting entirely of such service which

determines the dominant nature of such a bundle

If services are not bundled in the ordinary course of business

The bundle of services will be treated as consisting entirely of such service which

attracts the highest liability of service tax

Whether the services are naturally bundled in the ordinary course of business

or not needs consideration

It is crucial to determine correct nature of services to ascertain place of

provision of service

27 April 2013 Page 27 Hotel industry typical indirect tax issues

Hotel accommodation - Bundled Services

Hotel accommodation package with breakfast / dinner, etc

Presently classifiable under accommodation services and abatement from

value of services is claimed

Whether such services could be classified as naturally bundled services of

accommodation

CBECs Education guide clarifies that hotel accommodation gives essential

character to the bundle & should, therefore, be treated as service of providing

hotel accommodation

Accordingly, Hotel accommodation package with meals should be eligible for

40% abatement from value of services

27 April 2013 Page 28 Hotel industry typical indirect tax issues

Hotel accommodation - Bundled Services

Bouquet of services covering accommodation, conference, biz. centre, etc

For eg where hotel is booked for a conference on lump sum package with

following facilities:

Accommodation for delegates

Breakfast and one meal for delegates,

Tea and coffee during conference

Availability of conference room

Business centre services

Where the service is described as convention service, it is able to capture the

entire essence of the package - Service may be regarded as convention

service

However, hotel may also charge individually for the services as long as there

is no attempt to offload the value of one service on to another service that is

chargeable at a concessional rate

27 April 2013 Page 29 Hotel industry typical indirect tax issues

Issues - CENVAT Credit reversal computation

Accommodation services

As Per Rule 6(3) of CENVAT Credit Rules, credit attributable to exempted

services is required to be reversed by service provider

Reversal amount = CENVAT credit availed * (Exempt Turnover )/ (Total

turnover)

Exempted turnover includes exempted goods as well as exempted services

Position prior to 1 July 2012

Entire turnover of accommodation services & restaurant service required to

be considered as exempt services for calculation of reversal amount, if

abatement scheme applied

27 April 2013 Page 30 Hotel industry typical indirect tax issues

Issues - CENVAT Credit reversal computation

Accommodation services

Position after 1 July 2012

Services for which part value is taxable, are covered in definition of

exempted services only if no credit permitted on inputs as well as input

services

For accommodation services, credit of input services, capital goods as well

as specified inputs is available even under abatement scheme

Should accommodation services be considered as exempt services?

If yes, whether exempted portion ie 40% or full amount ie 100% to be considered

as exempted turnover?

27 April 2013 Page 31 Hotel industry typical indirect tax issues

Other service tax issues

Loyalty program

Customers avail services such as accommodation, dining, etc by redeeming

reward points whether service tax applicable on such amounts?

Typically in such cases, customers does not pay to the hotel, however the

hotel receives amounts equivalent to points redeemed from the loyalty

program manager

Booking cancellation charges

Amounts received from the loyalty manager should typically be regarded as

consideration for services received

If the hotel recovers cancellation charges from customers for booking

cancellation whether service tax should be applicable?

Definition of service includes any activity done for a consideration.

Blocking rooms / reservations for guests could be regarded as an activity

27 April 2013 Page 32 Hotel industry typical indirect tax issues

Other service tax issues

Paid outs on guests demand, hotels arrange for facilities such as doctor on

call, baby sitter, nurses, etc where hotel recovers these charges from

guests at cost (without mark up) whether service tax is applicable

If the hotel recovers cancellation charges from customers for booking

cancellation whether service tax should be applicable?

Definition of service includes any activity done for a consideration.

Blocking rooms / reservations for guests could be regarded as an activity

VAT

27 April 2013 Page 34 Hotel industry typical indirect tax issues

VAT key issues

Article 366(29A) (f)

a tax on the supply, by way of or as part of any service or in any other manner

whatsoever,

of goods, being food or any other article for human consumption or any drink

(whether or not intoxicating),

where such supply or service, is for cash, deferred payment or other valuable

consideration,

and such transfer, delivery or supply of any goods

shall be deemed to be

a sale of those goods by the person making the transfer, delivery or supply and

a purchase of those goods by the person to whom such transfer, delivery or supply is

made;

27 April 2013 Page 35 Hotel industry typical indirect tax issues

VAT key issues

No abatements provided

Service tax law provides for abatements in case of services such as

accommodation, restaurant, banquet, outdoor caterer, etc

However, under the VAT laws, typically there are no abatements ie VAT is

payable on total amount charged

This results in the same amounts being charged to both service tax and VAT

Banquet arrangements valuation

Where amounts are charged on lump sum basis, VAT authorities have

issued notices seeking to levy VAT on the entire value

DDQ in the case of Tiptop Enterprises that in case of banquet arrangements,

VAT is payable on the lump sum amount charged

27 April 2013 Page 36 Hotel industry typical indirect tax issues

VAT key issues

VAT on service charge recovered by restaurants

Whether VAT is applicable on service charges recovered by restaurants?

As per definition of sales price, any sum charged by seller in respect of the

goods at the time of or before delivery is to be included in the definition of

sales price

Loyalty program

Customers avail services such as dining, purchase of merchandise, etc by

redeeming reward points whether VAT applicable on such amounts?

Typically in such cases, customers does not pay to the hotel, however the

hotel receives amounts equivalent to points redeemed from the loyalty

program manager

Is VAT applicable on mini bar consumption?

27 April 2013 Page 37 Hotel industry typical indirect tax issues

VAT key issues

Accommodation packages with meals

Certain states such as Maharashtra have specific provisions for valuation of

meals Rule 59

In other states, such as Delhi, no specific provisions for valuation of goods

what should be the basis of valuation? Should value be based on similar

meals provided to other customers?

Whether VAT is applicable on sale of food to employees at discounted rates?

Where food / beverages are provided by air port lounges to members, free of

charge, airline company pays the air port lounge whether VAT applicable

on such goods provided ?

Whether VAT is applicable on complimentary food, mineral water , beverages

supplied during conferences?

27 April 2013 Page 38 Hotel industry typical indirect tax issues

VAT key issues

Whether VAT is applicable on sale of food at the oil rigs located in high

seas?

Based on certain judgments, sale within 12 nautical miles liable to VAT

27 April 2013 Page 39 Hotel industry typical indirect tax issues

VAT airline catering industry

Scenario 1: Sale of F&B to airline companies at the port of origin premium

airlines

transaction typically regarded as a local sale in the state where goods are sold.

For eg: In case of Mumbai Delhi flight, MVAT applicable on goods sold to F&B

Scenario 2: Sale of F&B on Buy on Board (BoB) basis low cost airlines

Airline acts as an agent of the air line caterer and sells ready to serve meal to

passengers

At the time of handing over of meal to Airline, it is not certain that the meal will be

ultimately sold to passengers or will be returned back

Whether such transaction would attract VAT / CST given that sale takes place in

mid air if yes, whether local sale or inter state sale

DDQ iby Andhra Pradesh VAT authorities in the case of Sky Gourmet that

any sale that takes place after commencement and before termination of interstate

movement falls under Section 3(b) of the CST legislation

If aircraft travels from one state to another, CST should be applicable

If aircraft travels within the state (say Mumbai to Pune), MVAT should apply

27 April 2013 Page 40 Hotel industry typical indirect tax issues

Various transactions (eg - banquets, conferences, restaurant services etc)

attract multiple levies VAT/ Service tax/ Luxury tax

Different legislations contain different definitions for the taxable base

Different options available under various service categories such as

mandap keeper, hotel accommodation services, restaurant services, etc for

payment of Service tax

Option 1: Service tax on total amount charged less abatement at prescribed

percentages with no CENVAT credit

Option 2: Payment of service tax on value charged for provision of services only

Similarly schemes available under VAT legislations also (such as

composition scheme)

Composite supplies Multiple levies

Key issue:

Inclusion of one tax for purposes of computing taxable base for another for eg

whether service tax to be included to compute luxury tax on room rentals?

Key issue:

Optimization of indirect tax costs and credits cost benefit analysis required

Key challenges & planning avenues

27 April 2013 Page 42 Hotel industry typical indirect tax issues

Key indirect tax challenges

Multiplicity of taxes

No uniformity in taxes across States

Cascading of indirect taxes due to lack of credits across taxes

Burden of compliance under various indirect tax legislations

Ambiguities on taxability and credit eligibility on various transactions

CENVAT credit restrictions on taxes paid on construction of hotels

27 April 2013 Page 43 Hotel industry typical indirect tax issues

Planning avenues to be explored

Construction of hotels

Optimization of service tax and VAT cost - general scheme vis--vis

composition scheme

Exploring contract structuring options for EPC contracts in order to optimise

indirect tax costs for the Project Owner

Use of tax efficient structures such as in-transit sale, high sea sale, etc

Issuance of Form C by Hotel for inter-state purchase of capital goods

permissibility to examined

CENVAT credit vs. Depreciation cost benefit analysis

Export Promotion Capital Goods (EPCG) scheme

Import of capital goods at 3.09% (0% with effect from April 2013) subject to

fulfillment of export obligation and other conditions.

Special provisions allowing hotels to import motor vehicles for hotel

operations under EPCG custom duty on motor vehicles typically more than

100%.

27 April 2013 Page 44 Hotel industry typical indirect tax issues

Planning avenues to be explored

Served From India Scheme (SFIS)

Duty credit of 10% of free foreign exchange earned which can be used for

payment of custom / excise duties on procurement of capital goods, office

furniture & consumables

Special provisions allowing hotels to import consumables including food

items and alcoholic beverages against SFIS duty credit

State level incentives

Fiscal benefits to hotel projects under State tourism policies

Key objective - high investments and employment generation

Customized benefits possible for mega investment projects. Typical fiscal

incentives include:

Stamp duty exemption on purchase/ lease of land

Luxury tax exemption for specified number of years (5 - 7 years)

Exemption from entertainment tax for specified number of years

Electricity duty concessions

27 April 2013 Page 45 Hotel industry typical indirect tax issues

Planning avenues to be explored

Ongoing operations

Cost benefit analysis of service tax payable and credit available under

abatement scheme v/s normal scheme

Exploring the possibility to claim CENVAT credit on certain goods such as

furniture, electronics, air conditioners, etc used by hotels

Unbundling services i.e. split consideration wherever possible to avoid

double taxation

In cases where there is pure supply of food (and food not served) to

explored whether position can be taken that service tax is not applicable

Thank you

The information in this presentation pack is confidential and contains proprietary information of

Ernst & Young LLP. It should not be provided to anyone other than the intended recipients without

our written consent. Anyone who receives a copy of this presentation pack other than in the

context of our oral presentation / communication should note that we do not have any responsibility

to anyone other than our client in respect of the information contained in this document.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- English Is A Crazy LanguageDokument18 SeitenEnglish Is A Crazy Languageangora6750232Noch keine Bewertungen

- 2012-398 Iloilo City Zoning Ordinance PDFDokument63 Seiten2012-398 Iloilo City Zoning Ordinance PDFMaya Julieta Catacutan-Estabillo100% (3)

- Be Active Kids GUIDE TO EARLY Childhood Physical Activity:: Motor Skills and Movement Concepts For Children Birth To FiveDokument125 SeitenBe Active Kids GUIDE TO EARLY Childhood Physical Activity:: Motor Skills and Movement Concepts For Children Birth To FiveS Dharam SinghNoch keine Bewertungen

- PowerPoint 2016 Step by Step PDFDokument186 SeitenPowerPoint 2016 Step by Step PDFEngrSymaIqbalNoch keine Bewertungen

- Childrensmaths PDFDokument281 SeitenChildrensmaths PDFS Dharam SinghNoch keine Bewertungen

- Specified Bank Notes (SBN)Dokument1 SeiteSpecified Bank Notes (SBN)S Dharam SinghNoch keine Bewertungen

- Vat AuditDokument46 SeitenVat AuditS Dharam SinghNoch keine Bewertungen

- ASanskritGrammarforBeginners 100830170Dokument325 SeitenASanskritGrammarforBeginners 100830170Antonio Carlos JoaquimNoch keine Bewertungen

- Chapter 2 - Tax On Sales Trade EtcDokument42 SeitenChapter 2 - Tax On Sales Trade EtcS Dharam SinghNoch keine Bewertungen

- Indian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersDokument4 SeitenIndian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersS Dharam SinghNoch keine Bewertungen

- Chapter 2 - Tax On Sales Trade EtcDokument42 SeitenChapter 2 - Tax On Sales Trade EtcS Dharam SinghNoch keine Bewertungen

- Chapter 2 - Tax On Sales Trade EtcDokument42 SeitenChapter 2 - Tax On Sales Trade EtcS Dharam SinghNoch keine Bewertungen

- JaDokument164 SeitenJaS Dharam SinghNoch keine Bewertungen

- A Traders Guide To FuturesDokument34 SeitenA Traders Guide To FuturesAggelos KotsokolosNoch keine Bewertungen

- Fema f2Dokument2 SeitenFema f2S Dharam SinghNoch keine Bewertungen

- Affidavit in Lieu of Date of Birth Certificate For Obtaining PAN CardDokument1 SeiteAffidavit in Lieu of Date of Birth Certificate For Obtaining PAN Cardjha.sofcon5941100% (1)

- Aml Kyc Notice PDFDokument4 SeitenAml Kyc Notice PDFabhishek50% (2)

- Syllabus CCB PDFDokument6 SeitenSyllabus CCB PDFiamitgarg7Noch keine Bewertungen

- Cetf PDFDokument8 SeitenCetf PDFS Dharam SinghNoch keine Bewertungen

- Indian Institute of Banking & Finance: Rules & Syllabus 2016Dokument14 SeitenIndian Institute of Banking & Finance: Rules & Syllabus 2016Anubhav RawatNoch keine Bewertungen

- Indian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersDokument4 SeitenIndian Institute of Banking & Finance: Certificate Examination in SME Finance For BankersS Dharam SinghNoch keine Bewertungen

- Gist of Daily Cash ExpensesDokument2 SeitenGist of Daily Cash ExpensesS Dharam SinghNoch keine Bewertungen

- IOCL Refund Claim FormDokument2 SeitenIOCL Refund Claim FormS Dharam SinghNoch keine Bewertungen

- Indian Institute of Banking & Finance: Rules & Syllabus 2016Dokument16 SeitenIndian Institute of Banking & Finance: Rules & Syllabus 2016Shree ChaudharyNoch keine Bewertungen

- IOCL Refund Claim FormDokument2 SeitenIOCL Refund Claim FormS Dharam SinghNoch keine Bewertungen

- Limited Review ReportDokument1 SeiteLimited Review ReportS Dharam SinghNoch keine Bewertungen

- Higher Algebra - Hall & KnightDokument593 SeitenHigher Algebra - Hall & KnightRam Gollamudi100% (2)

- Courses: Common Proficiency Test (CPT) About The TestDokument5 SeitenCourses: Common Proficiency Test (CPT) About The TestPurushothaman YogeswaranNoch keine Bewertungen

- Irr and NPVDokument13 SeitenIrr and NPVAbin VargheseNoch keine Bewertungen

- TDS Rate Chart Financial Year 2012-13Dokument3 SeitenTDS Rate Chart Financial Year 2012-13jeet2211Noch keine Bewertungen

- AttendanceDokument1 SeiteAttendanceS Dharam SinghNoch keine Bewertungen

- Gilthead Sea Bream, Sparus Aurata: Life CycleDokument2 SeitenGilthead Sea Bream, Sparus Aurata: Life CycleRiccardoNoch keine Bewertungen

- Role of Packaging On Consumer Buying BehaviorDokument93 SeitenRole of Packaging On Consumer Buying BehaviorAqeelaBabar67% (3)

- Wind in The Willows AnswersDokument28 SeitenWind in The Willows AnswersPiyumi Chathurangi100% (1)

- A Day OutDokument5 SeitenA Day OutTamer AmrNoch keine Bewertungen

- Lactose Intolerance: C2 - Group 3Dokument29 SeitenLactose Intolerance: C2 - Group 3Mark PadulloNoch keine Bewertungen

- Academy Bonded For Life @otaworthlovingDokument238 SeitenAcademy Bonded For Life @otaworthlovingkrishnaNoch keine Bewertungen

- OPRP PlanDokument3 SeitenOPRP Plan20125320Noch keine Bewertungen

- Elara Securities - Strategy - India EconomicsDokument7 SeitenElara Securities - Strategy - India EconomicsgirishrajsNoch keine Bewertungen

- Volume 94, Issue 18Dokument28 SeitenVolume 94, Issue 18The TechniqueNoch keine Bewertungen

- Espela History of Food StylingDokument1 SeiteEspela History of Food StylingYohenyoNoch keine Bewertungen

- List of FPOs State of WestBengal11 9 2015Dokument3 SeitenList of FPOs State of WestBengal11 9 2015SandipNoch keine Bewertungen

- Practice - There Is - There AreDokument3 SeitenPractice - There Is - There AreMiguel Angel Gutierrez SanchezNoch keine Bewertungen

- Science City Equipment ListDokument2 SeitenScience City Equipment Listrkpatel40Noch keine Bewertungen

- Food and Beverage Service Trainee: CurriculumDokument76 SeitenFood and Beverage Service Trainee: CurriculumNyi Lwin HtetNoch keine Bewertungen

- PNS BAFS 195 - 2017 Mushroom SpecificationDokument14 SeitenPNS BAFS 195 - 2017 Mushroom SpecificationNorman Rafael EspejoNoch keine Bewertungen

- Yearly Plan - Science Year OneDokument0 SeitenYearly Plan - Science Year OneE-jarn ShahNoch keine Bewertungen

- Got LunchDokument7 SeitenGot LunchROSA MARIA EL CAJUTAYNoch keine Bewertungen

- Prevalence and Awareness of Obesity and Its Risk Factors Among Adolescents in Two Schools in A Northeast Indian CityDokument12 SeitenPrevalence and Awareness of Obesity and Its Risk Factors Among Adolescents in Two Schools in A Northeast Indian CityShamerra SabtuNoch keine Bewertungen

- Restaurant Opening and Closing Checklist PDFDokument7 SeitenRestaurant Opening and Closing Checklist PDFNiniNoch keine Bewertungen

- Winter Holidays Christmas and New Year'S Eve: Christmas or Christmas Day Is ADokument6 SeitenWinter Holidays Christmas and New Year'S Eve: Christmas or Christmas Day Is ARoxana Ecaterina ParuschiNoch keine Bewertungen

- Unit 10A It Changed My Life 1 Grammar A)Dokument4 SeitenUnit 10A It Changed My Life 1 Grammar A)Carmen GloriaNoch keine Bewertungen

- Fat Kids Are Adorable The Experiences of Mothers Caring For Overweight Children in IndonesiaDokument9 SeitenFat Kids Are Adorable The Experiences of Mothers Caring For Overweight Children in IndonesiaLina Mahayaty SembiringNoch keine Bewertungen

- Culinary History and Nouvelle CuisineDokument4 SeitenCulinary History and Nouvelle CuisineARPITA BHUNIANoch keine Bewertungen

- Bathari Menu SEMENTARADokument16 SeitenBathari Menu SEMENTARAamaliska nandaNoch keine Bewertungen

- 08.02.2021 HeaderDokument17 Seiten08.02.2021 HeaderRoshniNoch keine Bewertungen

- Cassia Gum (CTA) CASSIA GUM Chemical and Technical Assessment (CTA) Prepared by Professor Symon M. Mahungu and Mrs. Inge MeylandDokument9 SeitenCassia Gum (CTA) CASSIA GUM Chemical and Technical Assessment (CTA) Prepared by Professor Symon M. Mahungu and Mrs. Inge MeylandMerci MoralesNoch keine Bewertungen

- Soal NarrativeDokument7 SeitenSoal NarrativeAi ChanNoch keine Bewertungen

- Price List Juni 2022 Plus GramasiDokument4 SeitenPrice List Juni 2022 Plus GramasiElva ElvaNoch keine Bewertungen