Beruflich Dokumente

Kultur Dokumente

HDFC Consolidate Q3

Hochgeladen von

Satish Mehta0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten5 Seitenhdfc result

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenhdfc result

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten5 SeitenHDFC Consolidate Q3

Hochgeladen von

Satish Mehtahdfc result

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

______________________________________________________________________________________________________

Housi ng Devel opment Fi nanc e Cor por at i on Li mi t ed

U

U

U

N

N

N

A

A

A

U

U

U

D

D

D

I

I

I

T

T

T

E

E

E

D

D

D

C

C

C

O

O

O

N

N

N

S

S

S

O

O

O

L

L

L

I

I

I

D

D

D

A

A

A

T

T

T

E

E

E

D

D

D

F

F

F

I

I

I

N

N

N

A

A

A

N

N

N

C

C

C

I

I

I

A

A

A

L

L

L

R

RR

E

E

E

S

S

S

U

U

U

L

L

L

T

T

T

S

S

S

F

F

F

O

O

O

R

R

R

T

T

T

H

H

H

E

E

E

Q

Q

Q

U

U

U

A

A

A

R

R

R

T

T

T

E

E

E

R

R

R

/

/

/

N

N

N

I

I

I

N

N

N

E

E

E

M

M

M

O

O

O

N

N

N

T

T

T

H

H

H

S

S

S

E

E

E

N

N

N

D

D

D

E

E

E

D

D

D

D

D

D

E

E

E

C

C

C

E

E

E

M

M

M

B

B

B

E

EE

R

R

R

3

3

3

1

1

1

,

,

,

2

2

2

0

0

0

1

1

1

3

3

3

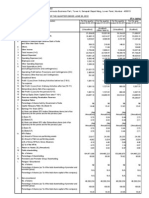

PART I STATEMENT OF UNAUDITED CONSOLIDATED FINANCIAL RESULTS FOR THE QUARTER / NINE

MONTHS ENDED DECEMBER 31, 2013

PARTICULARS

Quarter

ended

31.12.2013

Quarter

ended

30.9.2013

Quarter

ended

31.12.2012

Nine

Months

ended

31.12.2013

Nine

Months

ended

31.12.2012

Year

ended

31.3.2013

R e v i e w e d Audited

` in Crore

Income from Operations 6,344.07 6,279.89 5,538.35 18,463.90 16,084.90 22,032.46

Premium Income from

Insurance Business

3,224.30 3,274.06 3,006.47 8,788.89 7,985.09 12,650.29

Other Operating Income from

Insurance Business

327.52 322.80 215.77 988.16 617.49 887.08

Profit on Sale of Investments 144.97 94.25 101.87 245.75 225.53 378.35

Total Income 10,040.86 9,971.00 8,862.46 28,486.70 24,913.01 35,948.18

Expenses:

- Interest and Other Charges

- Staff Expenses

- Claims paid pertaining to

Insurance Business

- Commission and Operating

Expenses pertaining to

Insurance Business

- Other expenses and

appropriations pertaining to

Insurance Business

- Provision for Contingencies

- Other Expenses

- Depreciation and

Amortisation

4,228.19

152.77

1,621.22

460.49

1,361.17

35.85

150.64

12.32

4,187.32

147.01

1,169.65

356.40

1,872.17

20.51

162.29

12.87

3,627.16

135.64

1,365.78

572.03

1,146.46

46.14

143.09

13.47

12,299.21

451.61

4,125.67

1,268.13

3,758.57

96.24

472.15

34.20

10,746.59

394.97

3,239.37

1,584.04

3,370.40

135.86

416.59

39.51

14,295.52

528.13

4,866.93

2,278.56

5,792.21

148.59

555.51

54.20

Total Expenditure 8,022.65 7,928.22 7,049.77 22,505.78 19,927.33 28,519.65

Profit from Operations

before Other Income

2,018.21 2,042.78 1,812.69 5,980.92 4,985.68 7,428.53

Other Income 12.12 11.71 10.79 31.84 31.04 38.75

Profit Before Tax 2,030.33 2,054.49 1,823.48 6,012.76 5,016.72 7,467.28

Tax Expense 557.14 521.95 469.28 1,593.44 1,358.86 2,002.03

Net Profit (before profit of

Associates and adjustment for

minority interest)

1,473.19 1,532.54 1,354.20 4,419.32 3,657.86 5,465.25

Net share of profit of

Associates (Equity Method)

538.46 465.02 432.94 1,430.28 1,128.48 1,516.27

Share of profit of minority

shareholders

(76.80) (106.39) (81.31) (316.48) (229.75) (341.80)

Profit After Tax attributable

to the Corporation and Its

Subsidiaries

1,934.85 1,891.17 1,705.83 5,533.12 4,556.59 6,639.72

______________________________________________________________________________________________________

Housi ng Devel opment Fi nanc e Cor por at i on Li mi t ed

PART II SELECT INFORMATION FOR THE QUARTER / NINE MONTHS ENDED DECEMBER 31, 2013

Particulars Quarter

ended

31.12.2013

Quarter

ended

30.9.2013

Quarter

ended

31.12.2012

Nine

Months

ended

31.12.2013

Nine

Months

ended

31.12.2012

Year

ended

31.3.2013

A] PARTICULARS OF

SHAREHOLDING

Public Shareholding :

- Number of Shares

- Percentage of

Shareholding

155,92,48,440

100

155,81,60,055

100

154,09,84,385

100

155,92,48,440

100

154,09,84,385

100

154,63,47,255

100

Promoters and Promoter

Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares

(as a % of the total

shareholding of promoter

and promoter group)

- Percentage of Shares

(as a % of total share

capital of the

Corporation)

b) Non-Encumbered

- Number of Shares

- Percentage of Shares

(as a % of the total

shareholding of promoter

and promoter group)

- Percentage of Shares

(as a % of total share

capital of the

Corporation)

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

-

B] INVESTOR COMPLAINTS Quarter ended 31.12.2013

- Pending at the beginning of the quarter

- Received during the quarter

- Disposed off during the quarter

- Remaining unresolved at the end of the quarter

Nil

8

8

Nil

Contd three

Earnings per Share (of `2

each)(not annualized)

- Basic (`)

- Diluted (`)

12.41

12.33

12.14

12.06

11.10

10.94

35.57

35.29

30.11

29.76

43.63

43.09

Paid-up Equity Share Capital

(Face value ` 2)

311.85 311.63 308.20 311.85 308.20 309.27

Reserves as at March 31 31,751.08

______________________________________________________________________________________________________

Housi ng Devel opment Fi nanc e Cor por at i on Li mi t ed

Notes :

1. The disclosure in terms of Accounting Standard 17 on Segment Reporting as notified under the

Companies (Accounting Standards) Rules, 2006

PARTICULARS

Quarter

ended

31.12.2013

Quarter

ended

30.9.2013

Quarter

ended

31.12.2012

Nine

Months

ended

31.12.2013

Nine

Months

ended

31.12.2012

Year

ended

31.3.2013

R e v i e w e d Audited

` in Crore

Segment Revenues

- Loans

- Life Insurance

- General Insurance

- Asset Management

- Others

6,287.02

3,135.21

471.16

217.62

52.94

6,199.07

3,186.60

462.88

345.75

56.15

5,440.73

2,870.89

383.62

211.77

47.27

18,048.65

8,544.31

1,379.79

800.28

165.89

15,835.01

7,655.30

1,044.10

607.26

138.36

21,717.90

12,217.18

1,455.50

851.50

222.32

Total Segment Revenues

Add : Unallocated Revenues

Less: Inter-segment Adjustments

10,163.95

3.72

(114.69)

10,250.45

3.22

(270.96)

8,954.28

4.01

(85.04)

28,938.92

8.26

(428.64)

25,280.03

8.57

(344.55)

36,464.40

56.22

(533.69)

Total Revenues 10,052.98 9,982.71 8,873.25 28,518.54 24,944.05 35,986.93

Segment Results

- Loans

- Life Insurance

- General Insurance

- Asset Management

- Others

1,819.37

119.26

29.75

127.88

6.52

1,776.62

154.20

74.81

258.45

11.93

1,594.64

126.74

34.31

114.49

4.74

5,038.19

555.29

166.00

522.75

28.99

4,430.61

357.10

121.52

330.36

16.90

6,608.16

507.33

181.92

455.10

50.08

Total Segment Results

Add / (Less) : Unallocated

Less: Inter-segment Adjustments

2,102.78

3.72

(76.17)

2,276.01

3.40

(224.92)

1,874.92

4.01

(55.45)

6,311.22

8.26

(306.72)

5,256.49

8.56

(248.33)

7,802.59

53.23

(388.54)

Profit Before Tax 2,030.33 2,054.49 1,823.48 6,012.76 5,016.72 7,467.28

Capital Employed

- Loans

- Life Insurance

- General Insurance

- Asset Management

- Others

18,585.31

1,563.25

863.65

768.43

220.20

17,442.37

1,580.91

846.00

853.68

210.93

15,425.40

1,110.43

633.62

810.35

202.65

18,585.31

1,563.25

863.65

768.43

220.20

15,425.40

1,110.43

633.62

810.35

202.65

14,736.09

1,225.59

734.32

766.92

217.68

Total Segment Capital

Employed

22,000.84 20,933.89 18,182.45

22,000.84

18,182.45

17,680.60

Unallocated 17,240.11 16,360.91 14,928.91 17,240.11 14,928.91 15,451.22

Total 39,240.95 37,294.80 33,111.36 39,240.95 33,111.36 33,131.82

a) Loans segment mainly comprises of Groups financing activities for housing and also includes financing of commercial

real estate and others through the Corporation and its subsidiaries GRUH Finance Limited and Credila Financial

Services Pvt. Ltd.

b) Asset Management segment includes portfolio management, mutual fund and property investment management.

c) Others include project management, investment consultancy and property related services.

d) The Group does not have any material operations outside India and hence disclosure of geographic segments is not

given.

Contd four

______________________________________________________________________________________________________

Housi ng Devel opment Fi nanc e Cor por at i on Li mi t ed

2. The key data relating to standalone results of Housing Development Finance Corporation

Limited is as under:

` in Crore

3. During the nine months ended December 31, 2013, the Corporation utilised ` 268.42

crore (` 355.49 crore (net of tax) during the corresponding nine months of the previous

year) out of the securities premium account in accordance with Section 78 of the

Companies Act, 1956, towards the proportionate premium payable on redemption of Zero

coupon secured redeemable non-convertible debentures. Had the same been debited to

the Statement of Profit and Loss, the adjusted consolidated profits (net of tax) of the

Corporation and its subsidiaries for the nine months ended December 31, 2013 would be

` 5,264.70 crore (` 4,201.10 crore in the corresponding nine months of the previous year).

4. As at December 31, 2013, the loan book of the Corporation stood at ` 1,92,266 crore as

against ` 1,60,941 crore in the Previous Year. This is after considering the loans sold

during the preceding 12 months amounting to ` 3,263 crore.

5. During the quarter ended December 31, 2013, the Corporation has sold its investment in

one of the Associate Companies at a loss of ` 0.49 crore.

6. The accounts of Grandeur Properties Pvt. Ltd., Winchester Properties Pvt. Ltd. and

Windermere Properties Pvt. Ltd. have been excluded from consolidation on the principles

of materiality as also since the Corporation proposes to dispose off these investments in

the near future.

Contd five

PARTICULARS

Quarter ended

31.12.2013

Quarter ended

30.9.2013

Quarter

ended

31.12.2012

Nine

Months

ended

31.12.2013

Nine

Months

ended

31.12.2012

Year

ended

31.3.2013

Reviewed Audited

Total Income

6,030.93 5,953.98 5,250.40 17,549.85 15,469.91 21,147.62

Profit Before Tax

1,757.71 1,721.33 1,545.10 5,087.14 4,473.13 6,572.84

Net Profit After Tax

1,277.71 1,266.33 1,140.10 3,717.14 3,293.13 4,848.34

______________________________________________________________________________________________________

Housi ng Devel opment Fi nanc e Cor por at i on Li mi t ed

7. During the quarter ended December 31, 2013, the Corporation has allotted 10, 88,385

equity shares of Rs. 2 each pursuant to exercise of stock options by certain employees/

directors.

8. The standalone financial results are available on the Corporations website (www.hdfc.com)

and on the website of BSE (www.bseindia.com) and NSE (www.nseindia.com).

9. Figures for the previous period have been regrouped wherever necessary, in order to

make them comparable.

The above results for the quarter / nine months ended December 31, 2013, which have

been subject to a Limited Review by the Auditors of the Corporation, were reviewed by the

Audit Committee of Directors and subsequently approved by the Board of Directors at its

meeting held on January 22, 2014, in terms of Clause 41 of the Listing Agreements.

Place: Mumbai Keki Mistry

Date: J anuary 22, 2014 Vice Chairman & CEO

Das könnte Ihnen auch gefallen

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryVon EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Mothersum Standalone Results Q3 FY2012Dokument4 SeitenMothersum Standalone Results Q3 FY2012kpatil.kp3750Noch keine Bewertungen

- Credit Union Revenues World Summary: Market Values & Financials by CountryVon EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Analysis of Apollo TiresDokument12 SeitenAnalysis of Apollo TiresTathagat ChatterjeeNoch keine Bewertungen

- Business Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryVon EverandBusiness Credit Institutions Miscellaneous Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Final Exam Financial ManagementDokument2 SeitenFinal Exam Financial ManagementAnonymous 0PsfK9wKNoch keine Bewertungen

- Introduction of MTM: StatementDokument23 SeitenIntroduction of MTM: StatementALI SHER HaidriNoch keine Bewertungen

- TCS Ifrs Q3 13 Usd PDFDokument23 SeitenTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNoch keine Bewertungen

- 28 Consolidated Financial Statements 2013Dokument47 Seiten28 Consolidated Financial Statements 2013Amrit TejaniNoch keine Bewertungen

- Accounts AssignmentDokument7 SeitenAccounts AssignmentHari PrasaadhNoch keine Bewertungen

- Assignments Semester IDokument13 SeitenAssignments Semester Idriger43Noch keine Bewertungen

- Teuer Furniture A Case Solution PPT (Group-04)Dokument13 SeitenTeuer Furniture A Case Solution PPT (Group-04)sachin100% (4)

- Indian Oil Corporation Project 2Dokument30 SeitenIndian Oil Corporation Project 2Rishika GoelNoch keine Bewertungen

- ITC Consolidated FinancialsDokument49 SeitenITC Consolidated FinancialsVishal JaiswalNoch keine Bewertungen

- Nations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118Dokument19 SeitenNations Trust Bank PLC and Its Subsidiaries: Company Number PQ 118haffaNoch keine Bewertungen

- ITC LimitedDokument7 SeitenITC LimitedlovemethewayiamNoch keine Bewertungen

- Financial Statement Analysis of United Motors Lanka PLCDokument37 SeitenFinancial Statement Analysis of United Motors Lanka PLCPuwanachandran KaniegahNoch keine Bewertungen

- Financially Distressed State of The Company: Flow-Based Financial DistressDokument5 SeitenFinancially Distressed State of The Company: Flow-Based Financial DistressMd Shakawat HossainNoch keine Bewertungen

- First Resources Q1 2013 Financial Statements SummaryDokument17 SeitenFirst Resources Q1 2013 Financial Statements SummaryphuawlNoch keine Bewertungen

- Letter To Shareholders and Financial Results September 2012Dokument5 SeitenLetter To Shareholders and Financial Results September 2012SwamiNoch keine Bewertungen

- 4.1-Hortizontal/Trends Analysis: Chapter No # 4Dokument32 Seiten4.1-Hortizontal/Trends Analysis: Chapter No # 4Sadi ShahzadiNoch keine Bewertungen

- NTB - 1H2013 Earnings Note - BUY - 27 August 2013Dokument4 SeitenNTB - 1H2013 Earnings Note - BUY - 27 August 2013Randora LkNoch keine Bewertungen

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDokument33 SeitenLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100Noch keine Bewertungen

- JFHFFDokument18 SeitenJFHFFUjjwal SharmaNoch keine Bewertungen

- Industry OverviewDokument7 SeitenIndustry OverviewBathula JayadeekshaNoch keine Bewertungen

- HUL MQ 12 Results Statement - tcm114-286728Dokument3 SeitenHUL MQ 12 Results Statement - tcm114-286728Karunakaran JambunathanNoch keine Bewertungen

- INDIGO Cash FlowsDokument9 SeitenINDIGO Cash FlowsAyush SarawagiNoch keine Bewertungen

- NTBCL Q1 FY2012 Financial ResultsDokument4 SeitenNTBCL Q1 FY2012 Financial ResultsAlok SinghalNoch keine Bewertungen

- 1Q2013 AnnouncementDokument17 Seiten1Q2013 AnnouncementphuawlNoch keine Bewertungen

- KFA - Published Unaudited Results - Sep 30, 2011Dokument3 SeitenKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNoch keine Bewertungen

- Cash Flows Statement - Two ExamplesDokument4 SeitenCash Flows Statement - Two Examplesakash srivastavaNoch keine Bewertungen

- India Infoline Q2 Results 2005Dokument6 SeitenIndia Infoline Q2 Results 2005Shatheesh LingamNoch keine Bewertungen

- Toyota Annual Report 2013 Financial SummaryDokument82 SeitenToyota Annual Report 2013 Financial SummaryshanzarapunzleNoch keine Bewertungen

- Consolidated AFR 31mar2011Dokument1 SeiteConsolidated AFR 31mar20115vipulsNoch keine Bewertungen

- MMH SGXnet 03 12 FinalDokument16 SeitenMMH SGXnet 03 12 FinalJosephine ChewNoch keine Bewertungen

- Budgetary Control as a Tool for Cost ManagementDokument8 SeitenBudgetary Control as a Tool for Cost ManagementDileepkumar K DiliNoch keine Bewertungen

- Cognizant 10qDokument53 SeitenCognizant 10qhaha_1234Noch keine Bewertungen

- Introduction L&T FinalDokument31 SeitenIntroduction L&T Finaltushar kumarNoch keine Bewertungen

- FY 2012 Audited Financial StatementsDokument0 SeitenFY 2012 Audited Financial StatementsmontalvoartsNoch keine Bewertungen

- PDF Processed With Cutepdf Evaluation EditionDokument2 SeitenPDF Processed With Cutepdf Evaluation EditionShyam SunderNoch keine Bewertungen

- Accounts AssignDokument9 SeitenAccounts AssigngauravdangeNoch keine Bewertungen

- KFA Published Results March 2011Dokument3 SeitenKFA Published Results March 2011Abhay AgarwalNoch keine Bewertungen

- Binani Zinc Company ProfileDokument22 SeitenBinani Zinc Company ProfileHaseena ShameemNoch keine Bewertungen

- ASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedDokument14 SeitenASX Appendix 4E Results For Announcement To The Market: Ilh Group LimitedASX:ILH (ILH Group)Noch keine Bewertungen

- HCL Technologies: Balance Sheet - in Rs. Cr.Dokument20 SeitenHCL Technologies: Balance Sheet - in Rs. Cr.Kuldeep SinghNoch keine Bewertungen

- Condensed Consolidated Financial Statements (Company Update)Dokument39 SeitenCondensed Consolidated Financial Statements (Company Update)Shyam SunderNoch keine Bewertungen

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Dokument16 SeitenOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522Noch keine Bewertungen

- Accounting Presentation (Beximco Pharma)Dokument18 SeitenAccounting Presentation (Beximco Pharma)asifonikNoch keine Bewertungen

- Consolidated Financial StatementsDokument78 SeitenConsolidated Financial StatementsAbid HussainNoch keine Bewertungen

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Lecture Common Size and Comparative AnalysisDokument28 SeitenLecture Common Size and Comparative AnalysissumitsgagreelNoch keine Bewertungen

- AYALADokument26 SeitenAYALARodrigo HagnayaNoch keine Bewertungen

- Financial Results For The Quarter Ended 30 June 2012Dokument2 SeitenFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNoch keine Bewertungen

- Company Profile: Customer Touchpoint SSS Countries of OperationsDokument7 SeitenCompany Profile: Customer Touchpoint SSS Countries of OperationsShivani KelvalkarNoch keine Bewertungen

- Nigeria German Chemicals Final Results 2012Dokument4 SeitenNigeria German Chemicals Final Results 2012vatimetro2012Noch keine Bewertungen

- Jamna Auto Industries Limited Unaudited ResultsDokument4 SeitenJamna Auto Industries Limited Unaudited ResultspoloNoch keine Bewertungen

- Student Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalDokument19 SeitenStudent Number (UWL Registration Number) : 21452742 Assignment Name: Consolidation and Analysis On The MusicalSavithri NandadasaNoch keine Bewertungen

- Audited Results 31.3.2012 TVSMDokument2 SeitenAudited Results 31.3.2012 TVSMKrishna KrishnaNoch keine Bewertungen

- Fin Resu Dec 12Dokument1 SeiteFin Resu Dec 12Adil SiddiquiNoch keine Bewertungen

- Coca Cola Financial Statements 2008Dokument75 SeitenCoca Cola Financial Statements 2008James KentNoch keine Bewertungen

- Reliance Infrastructure LTDDokument1 SeiteReliance Infrastructure LTDSatish MehtaNoch keine Bewertungen

- As 28Dokument68 SeitenAs 28Satish MehtaNoch keine Bewertungen

- Statements Guidance Notes Issued by IcaiDokument9 SeitenStatements Guidance Notes Issued by IcaiSatish MehtaNoch keine Bewertungen

- 6 Banking and Financial ServicesDokument5 Seiten6 Banking and Financial ServicesSatish MehtaNoch keine Bewertungen

- Bangladesh-China-India-Myanmar (BCIM) Economic Corridor: Challenges and ProspectsDokument20 SeitenBangladesh-China-India-Myanmar (BCIM) Economic Corridor: Challenges and ProspectsSammer RajNoch keine Bewertungen

- Domain Property Guide 2013Dokument56 SeitenDomain Property Guide 2013El RuloNoch keine Bewertungen

- Conceptual On Between Takaful and ConventionalDokument87 SeitenConceptual On Between Takaful and ConventionalAbbas Al-RowaishNoch keine Bewertungen

- Dairy IndustryDokument20 SeitenDairy IndustryMEGHANA SNoch keine Bewertungen

- 2 - NPV Capital BudgetingDokument56 Seiten2 - NPV Capital BudgetingRafi RahmanNoch keine Bewertungen

- DemonstraDokument104 SeitenDemonstraJBS RINoch keine Bewertungen

- Group Assignment 1Dokument5 SeitenGroup Assignment 1Swapnil ChaudhariNoch keine Bewertungen

- The Somalia Investor - Daallo AirlinesDokument2 SeitenThe Somalia Investor - Daallo AirlinesMLR123Noch keine Bewertungen

- Internship Report PDFDokument47 SeitenInternship Report PDFSushma S83% (6)

- Q1 Module 1 To 5Dokument16 SeitenQ1 Module 1 To 5Rajiv WarrierNoch keine Bewertungen

- DPNS (PT Duta Pertiwi Nusantara)Dokument4 SeitenDPNS (PT Duta Pertiwi Nusantara)ayusekariniNoch keine Bewertungen

- Scarborough Eesbm11e Ppt08Dokument23 SeitenScarborough Eesbm11e Ppt08Afshan RahmanNoch keine Bewertungen

- (BNP Paribas) Quantitative Option StrategyDokument5 Seiten(BNP Paribas) Quantitative Option StrategygneymanNoch keine Bewertungen

- Comparison Table of Luxembourg Investment Vehicles Chevalier Sciales 6 PDFDokument14 SeitenComparison Table of Luxembourg Investment Vehicles Chevalier Sciales 6 PDFdemetraNoch keine Bewertungen

- Cma Tax PaperDokument760 SeitenCma Tax Paperritesh shrinewarNoch keine Bewertungen

- Historical Background of World BankDokument19 SeitenHistorical Background of World Bankasifshah4557022Noch keine Bewertungen

- Block-4 Unit-13Dokument24 SeitenBlock-4 Unit-13Rushi RoyNoch keine Bewertungen

- ShitDokument6 SeitenShitgejayan memanggilNoch keine Bewertungen

- Inland Revenue Board Malaysia: Employee Share Scheme BenefitDokument35 SeitenInland Revenue Board Malaysia: Employee Share Scheme Benefit123dddNoch keine Bewertungen

- Leasing Companies in BDDokument21 SeitenLeasing Companies in BDMd Tareq50% (2)

- Acconting History (Definition and Relevance by Ama Ogbonnaya KaluDokument13 SeitenAcconting History (Definition and Relevance by Ama Ogbonnaya KaluNewman Enyioko100% (1)

- IPM 3.11.2016 Financial Portfolio ManagementDokument9 SeitenIPM 3.11.2016 Financial Portfolio Managementavinash rNoch keine Bewertungen

- Assisting To The Stock Count - A Procedure of The Audit AssignmentDokument21 SeitenAssisting To The Stock Count - A Procedure of The Audit AssignmentBufan Ioana-DianaNoch keine Bewertungen

- IBPS PO Mains 2018 - Memory Based Question Paper by AffairsCloudDokument17 SeitenIBPS PO Mains 2018 - Memory Based Question Paper by AffairsCloudsakthiraja07Noch keine Bewertungen

- L&T Fi PDFDokument127 SeitenL&T Fi PDFkaran pawarNoch keine Bewertungen

- The Buffett Essays Symposium - Annotated 20th Anniversary TranscriptDokument3 SeitenThe Buffett Essays Symposium - Annotated 20th Anniversary Transcriptusermj9111Noch keine Bewertungen

- Research Proposal ForDokument14 SeitenResearch Proposal ForMaitri PandyaNoch keine Bewertungen

- Currency Future & Option For StudentsDokument8 SeitenCurrency Future & Option For StudentsAmit SinhaNoch keine Bewertungen

- International BankingDokument28 SeitenInternational BankingVijay KumarNoch keine Bewertungen