Beruflich Dokumente

Kultur Dokumente

Mas

Hochgeladen von

kevinlim1860 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

463 Ansichten27 SeitenCPAR

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCPAR

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

463 Ansichten27 SeitenMas

Hochgeladen von

kevinlim186CPAR

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 27

MANAGEMENT ADVISORY SEVICES REVIEWERS / TESTBANKS

1. The term "committed costs" refers to costs that

a. are likely to respond to the amount of attention devoted to

them by a specified manager

b. are governed mainly by past decisions that established the

present levels of operating and organizational capacity and

that only change slowly in response to small changes in

capacity

c. fluctuate in total in response to small changes in the rate of

utilization of capacity

d. management decides to incur in the current period to enable

the company to achieve objectives other than the filling of

orders placed by customers

2. Which of the following is likely to be a discretionary cost in most

organizations?

a. managerial training programs c.

managerial labor costs

b. factory utilities d. factory

rent

3. A cost driver

a. causes fied costs to rise because of

production changes

b. has a direct cause!effect relationship to a cost

c. can predict the cost behavior of a variable" but

not a fied" cost

d. is an overhead cost that causes distribution

costs to change in distinct increments with changes in

production volume

4. #osts that are incurred for monitoring and inspecting are$

a. prevention costs c. appraisal

costs

b. detection costs d. failure

costs

5. The cost estimation method that gives the most mathematically

precise cost production e%uation is

a. The high!low method c. The

scatter!graph method

b. The contribution margin method d.

The regression analysis

6. A local &'(A chapter wants to rent a half for ')"*** a day to

hold a +ingo fund raiser. ,very session of bingo re%uires a

caller for '-**. There are supplies that are needed that cost

') per person playing bingo. .n average each bingo player

spends '-* and /"*** people attend each session. '/*"*** in

prizes are awarded each session. Total cost for / session can

be classified as$

0ied #osts!1ariable #osts 0ied#osts!1ariable

#osts

a. ' /)"-**!' ) c. ' )"***!'

/)"-**

b. ' /)"-**!' )"*** d. ' /*"***!'

)"-**

7. Which is not a common accounting classification of costs?

a. +y the method of payment for the ependiture

b. +y the objective of ependiture

c. +y behavior

d. +y the function incurring the ependiture

8. The principal advantage of the scatter!diagram method over the

high!low method of cost estimation is that the scatter!diagram

method

a. includes costs outside the relevant range

b. considers more than two points

c. can be used with more types of costs than the high!low

method

d. gives a precise mathematical fit of the points to the line

9. Which statement is true?

a. A variable cost remains constant on a per!unit basis as

production increases

b. A fied cost remains constant on a per!unit basis as

production changes

c. The relevant range is valid for all levels of activity

d. An indirect cost can be easily traced to a cost object.

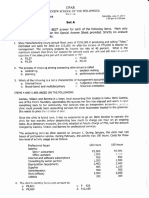

'ure 0oods wishes to analyze the fied and variable

components of the semi!variable costs. The following

information is available$

.utput

.utput

2onth 3nits #osts 2onth 3nits #osts

&anuary /"*** ' /-"*** April 4** ' //"***

0ebruary 5** /*"*** 2ay /"6** /4"57*

2arch /"/** /6"*** &une /"-** /7"***

10. 3sing the high!low method" which one of the following is

correct. application

a. 1ariable costs is ' /7 per unit c. 0ied costs is

' /"-7* per month

b. 1ariable costs is ' /* per unit d. 0ied costs is

' /"*** per month

11. +8' #ompany earned ' /**"*** on sales of ' /"***"***. (t

earned ' /)*"*** on sales of ' /"/**"***. Total fied costs are

a. ' * b. ' -**"*** c. ' 6-*"***

d. ' 9**"***

12. Which of the following is a prevention cost?

a. (nspecting and testing materials c. %uality audits

b. 'ackaging inspection d. cost of recalls

13. Which of the following costs is an internal failure cost?

a. 'ackaging inspection c. %uality engineering

b. :ework d. lost sales

14. .ne of the ways managerial accounting differs from financial

accounting is that managerial accounting

a. is bound by generally accepted accounting

principles

b. classifies information in different ways

c. does not use financial statements

d. deals only with economic events

15. 2anagerial accounting places considerable weight on$

a. generally accepted accounting principles

b. the financial history of the entity

c. ensuring that all transactions are properly recorded

d. detailed segment reports about departments" products and

customers

16. The cost management function is usually under

a. the chief information officer c. purchasing

manager

b. controller d. treasurer

17. 'lanning is a function that involves

a. hiring the right people for a particular job

b. coordinating the accounting information system

c. setting goals and objectives for an entity

d. analyzing financial statements

18. The treasurer function is usually not concerned with

a. investors relation c. financial

reports

b. short!term financing d. credit

etension and collection of bad debts

19. The following characterized management advisory services"

ecept

a. (t involves decision for the future

b. (t broader in scope and varied in nature

c. (t utilizes more junior staff than senior members

of the firm

d. (t relates to specific problems where epert help

is re%uired

20. 3nder which ethical standard of conduct does the managerial

accountant have the responsibility to disclose fully all relevant

information that could reasonably be epected to influence an

intended user;s understanding of the reports" comments and

recommendations presented?

a. .bjectivity b. competence c.

confidentiality d. integrity

<anson #ompany manufactures two different types of

receivers" a regular 2odel : and a special features 2odel 8.

The company has limited resources. .n an annual basis it has

a total of 64* direct labor!hours and a total of )** lbs. of

material available for use in the manufacture of these receivers.

The company uses linear programming to determine a

production schedule that will maimize the company;s profit.

+ased on the company;s current data on selling prices and

production costs" it is estimated that the sale of 2odel : will

contribute '5 profit per unit and the sale of 2odel 8 will

contribute '/* profit per unit. :esources used in the production

of the two receivers are as follows. =>et 2odel 8 ? 8 and 2odel

: ? :.@

2odel 8

2odel :

:aw materials used per unit 7 lbs.

) lbs.

>abor used per unit A hours

6 hours

21. The objective function for <anson #ompany can be epressed

as

a. 78 B ): C ? )** c. A8 B 6:

C ? 64*

b. 2a ? 5: B /*8 d. 2in ? 78

B ) :

22. A beverage stand can sell either softdrinks or coffee on any

given day. (f the stand sells softdrinks and the weather is hotD it

will make '-"7**D if the weather is cold" the profit will be

'/"***. (f the stand sells coffee and the weather is hot" it will

make '/"9**D if the weather is cold" the profit will be '-"***.

The probability of cold weather on a given day at this time is

A*E. The epected payoff if the vendor has perfect information

is$

a. ')"9** b. '/")A* c. '-"-** d. '/"9A*

23. 8oft (nc. has a target total labor cost of ' )"A** for the first four

batches of a product. >abor is paid '/* an hour. (f 8oft epects

an 4*E learning curve" how many hours should the first batch

take?

a. )A* hours b. /6*.A) hours c. 75.A

hours d. -)*.6 hours

24. #ritical 'ath 2ethod =#'2@ is a techni%ue for analyzing"

planning" and scheduling large" comple projects by

determining the critical path from single time estimate from

each event in a project. The critical path$

a. (s the shortest path from the first event to the last event for a

project

b. (s an activity within the path that re%uires the most number of

time

c. <as completion that reflects the earliest time to complete the

project

d. (s the maimum amount of time an activity may be delayed

without delaying the total project beyond its target

completion time

25. A company is designing a new regional distribution warehouse.

To minimize delays in loading and unloading trucks" an

ade%uate number of loading docks must be built. The most

relevant techni%ue to assist in determining the proper number

docks is

a. #ost!volume!profit analysis c. ',:T F #'2

analysis

b. Gueuing theory d. >inear programming

A& #onstruction (nc. is considering a three!phase research

project. The time estimates for completion of 'hase / of the

project are$

'essimistic -9 weeks

2ost likely -7 weeks

.ptimistic /7 weeks

26. 3sing the program evaluation and review techni%ue =',:T@"

the epected time for completion of 'hase / should be

a. -* weeks b. /9 weeks c. /4 weeks

d. -6 weeks

2oon" (nc. manufactures product H and product I" which are

processed as follows$

Type A machine Type + machine

'roduct H A hours 6 hours

'roduct I 9 hours 7 hours

27. The contribution margin is '/- for product H and '5 for product

I. The available time daily for processing the two products is

/-* hours for machine Type A and 4* hours for machine Type

+. What is the best combination of product that will maimize

profit?

a. /*H" /*I b. /7H" 7I c. -*H" *I d.

*H" -*I

28. >inear programming is used most commonly to determine

a. The fastest timing

b. The best use of scarce resources

c. The most advantageous prices

d. The mi of variable that will result in the largest %uantity

The network below describes the interrelationships of several

activities necessary to complete a project. The arrows

represent the activities. The numbers between the arrows

indicate the number of months to complete each activity.

-

6

6

8tart A ,nd

-

A 6

29. The shortest time to complete the project is

a. /* months b. /- months c. /A months

d. -4 months

30. 8uper #ompany is preparing -*// budget and" taking into

consideration the recent pace of economic recovery" has

developed several sales forecasts and the estimated probability

associated with each sales forecasts. To determine the sales

forecasts to be used for -*// budgeting purposes" which of the

following techni%ues should 8uper use?

a. ,pected value analysis c. 2onte #arlo

simulation

b. #ontinuous probability simulation d. 8ensitivity

Analysis

31. The epected value of perfect information is the

a. Jifference between the epected profit under certainty and

the epected monetary value of the best act under

uncertainty.

b. Jifference between the epected profit under certainty and

the epected opportunity loss

c. 8um of the conditional profit =loss@ for the best event of each

act times the probability of each events occurring

d. 8ame as the epected profit under certainty

A dough distributor has decided to increase its daily muffin

purchases by /** boes. A bo of muffins costs ' - and sells for

' ) through regular stores. Any boes not sold through regular

stores are sold through Jough;s thrift store for ' /. Jough

assigns the following probabilities to selling additional boes.

Additional sales probabilities

A* .6*

1

2

4

3

5

5

/** .A*

32. What is the epected value of Jough;s decision to buy /**

additional boes of muffins?

a. ' -4 b. ' 6* c. ' 7-

d. ' A4

33. As a company becomes more conservative with respect to

working capital policy" it would tend to have a=n@

a. (ncrease in the operating cycle.

b. Jecrease in the operating cycle.

c. (ncrease in the ratio of current assets to current liabilities.

d. (ncrease in the ratio of current liabilities to noncurrent

liabilities.

34. Temporary working capital supports

a. The cash needs of the company c. 'ayment

of long term debt.

b. Ac%uisition of capital e%uipment d. 8easonal

peaks

35. Kap #ompany follows an aggressive financing policy in its

working capital management while King #orporation follows a

conservative financing policy. Which one of the following

statements is correct?

a. Kap has a low current ratio while King has a high current

ratio.

b. Kap has less li%uidity risk while King has more li%uidity risk.

c. Kap finances short!term assets with long term debt while

King finances short!term assets with short!term debt.

d. Kap has low ratio of short!term debt to total debt while King

has a high ratio of short!term debt to total debt.

36. All of these factors are used in credit policy administration"

ecept$

a. #redit standards c. Terms of trade

b. 'eso amount of receivables d.

#ollection policy

37. The use of safety stock by a firm will$

a. :educe inventory costs c. (ncrease

inventory costs

b. <ave no effect on inventory costs d. Lone of

the above

38. Which of the following statements is correct for a firm that

currently has total costs of carrying and ordering inventory that

is 7*E higher than total carrying costs?

a. #urrent order size is greater than optimal c. #urrent

order size is less than optimal

b. 'er unit carrying costs are too high d. The

optimal order size is currently being used

39. The 8pades #ompany has an inventory conversion period of 57

days" a receivables conversion period of )4 days" and a

payable payment period of )* days. What is the length of the

firm;s cash conversion cycle?

a. 4) days b. //) days c. A5 days d. 67

days

40. 8amaritan 8upplies" (nc. has '7 million in inventory and '-

million in accounts receivable. (ts average daily sales are

'/**"***. The company has '/.7 million in accounts payable.

(ts average daily purchases are '7*"***. What is the length of

the company;s inventory conversion period?

a. /-* days b. 9* days c. 7* days d. 6* days

41. :awson #orporation;s order %uantity for 2aterial T is 7"*** lbs.

(f the company maintains a safety stock of T at 7** lbs." and its

order point is /"7** lbs. What is the lead time assuming daily

usage is 7* lbs.?

a. )* days b. /** days c. /* days d. -*

days

42. :efer to M /AD what would be the total annual carrying costs

assuming the carrying cost per unit is '4.6*?

a. ' 6-"*** b. ' -7"-** c. ' 6"-** d. ' 6A"-**

43. 8imile (nc. has a total annual cash re%uirement of ' 9"*57"***

which is to be paid uniformly. 8imile has the opportunity to

invest the money at -6E per annum. The company spends" on

the average" '6* for every cash conversion to marketable

securities. What is the optimal cash conversion size?

a. '77"*** b. 'A*"*** c. '67"*** d. '57"7**

44. 'alm #ompany;s budgeted sales of the coming year are '

6*"7**"*** of which 4*E are epected to be credit sales at

terms of nF)*. 'alm estimates that a proposed relaation of

credit standards will increase credit sales by -*E and increase

the average collection period from )* days to 6* days. +ased

on a )A*!day year" the proposed relaation of credit to

standards will result in an epected increase in the average

accounts receivable balance of

a. '76*"*** b. '9**"*** c.'-"5**"***

d. '/"A-*"***

45. (f a firm is given a trade credit terms of -F/*" net )*" then the

cost to the firm failing to take the discounts and pay instead its

obligation at the end of the maturity date is$

a. -E b. )*E c. )A.5E

d. /*E

6A.@ Jepreciation is incorporated eplicitly in the discounted cash flow

analysis of an investment proposal because it

A. (s a cash inflow.

+. (s a cost of operations that cannot be avoided.

#. Reduces te cas outla! "o# inco$e ta%es&

J. :epresents the initial cash outflow spread over the life of the

investment.

65.@ Assume that the old e%uipment must be sold in order to

purchase the new e%uipment. Niven a constant effective corporate

income ta rate and straight!line depreciation on both disposed and

newly purchased pieces of e%uipment" the depreciation ta shield

during the later years of a capital project" assuming the old e%uipment

was not yet fully depreciated when it was disposed of" is generally

A.@ >ess than that during the earlier years.

+.@ Lot determinable from the information given.

#.@ G#eate# tan tat du#in' te ea#lie# !ea#s&

J.@ The same as that during the earlier years.

64.@ 0uture" (nc. is in the enviable situation of having unlimited capital

funds. The best decision rule" in an economic sense" for it to follow

would be to invest in all projects in which the

a.@ (nternal rate of return is greater than zero.

b.@ Net p#esent (alue is '#eate# tan )e#o&

c.@ Accounting rate of return is greater than the earnings as a percent

of sales.

d.@ 'ayback reciprocal is greater than the internal rate of return.

69.@ Oore (ndustries is analyzing a capital investment proposal for

new e%uipment to produce a product over the net 4 years. The

analyst is attempting to determine the appropriate "end!of!life" cash

flows for the analysis. At the end of 4 years" the e%uipment must be

removed from the plant and will have a net book value of zero" a ta

basis of '57"***" a cost to remove of '6*"***" and scrap salvage

value of '/*"***. Oore;s effective ta rate is 6*E. What is the

appropriate "end!of!life" cash flow related to these items that should

be used in the analysis?

a. '-5"*** inflow

b. '/4"*** outflow

c. '67"*** outflow

d. *+,-... in"lo/

7*.@ +arker" (nc. has no capital rationing constraint and is analyzing

many independent investment alternatives. +arker should accept all

investment proposals

a. That provide returns greater than the before!ta cost of debt.

b. Tat a(e a positi(e net p#esent (alue&

c. (f debt financing is available for them.

d. That have positive cash flows.

7/.@ The rankings of mutually eclusive investments determined using

the internal rate of return method =(::@ and the net present value

method =L'1@ may be different when

a. The lives of the multiple projects are e%ual and the size of the

re%uired investments is e%ual.

b. The re%uired rate of return e%uals the (:: of each project.

c. The re%uired rate of return is higher than the (:: of each

project.

d. Multiple p#o0ects a(e une1ual li(es and te si)e o" te

in(est$ent "o# eac p#o0ect is di""e#ent&

7-. All of the following items are included in discounted cash flow analysis

ecept

a. 0uture operating cash savings.

b. Te "utu#e asset dep#eciation e%pense&

c. The current asset disposal price.

d. The ta effects of future asset depreciation.

7).@ A firm is considering a capital project for which the following

information is available$ An eisting piece of e%uipment that would be

disposed of to make room for new e%uipment has a historical cost of

')5*"***. (t has a salvage value of '/*"*** and has been

depreciated on a straight!line basis for /A of the estimated /4 years

of its useful life. The new e%uipment has a cost of '7**"*** and the

firm epects it will have to devote '-*"*** in cash and '-6"*** in

accounts receivable to the new project. The firm;s effective ta rate is

6*E. The re%uired net initial investment in the new project is

a. '7)6"***

2& *3+4-...

c. '766"***

d. '694"***

76.@ (f income ta considerations are ignored" how is depreciation

handled by the following capital budgeting techni%ues?

A. E%cluded&&&Included&&&E%cluded

#. (ncluded...,cluded...(ncluded

+. ,cluded...,cluded...(ncluded

J. (ncluded...(ncluded...(ncluded

77. The following are inherent to management accounting$

/. ,ternal report

-. <istorical information

). #ontribution approach income statement

6. Nenerally accepted accounting principle

7. prospective financial statements

a. All of them b. -")"7 c& 5-3

d. /.-"7

7A. What is the study of the need for activities and whether they are

operating efficiently called?

a. Jirect and indirect cost management

2&Acti(it!62ased $ana'e$ent

c. 1ariable and fied cost management

d. Total %uality management

75. Which of the following is the appropriate procedure to apply

overhead to production using normal costing?

a& Assi'n actual di#ect $ate#ial and di#ect la2o# costs plus an

a$ount #ep#esentin' 7no#$al8 $anu"actu#in' o(e#ead to

p#oducts&

b. Assign PnormalQ direct material and direct labor costs plus an

amount representing PnormalQ manufacturing overhead to

products.

c. Assign actual direct material and direct labor costs plus an

amount representing PnormalQ manufacturing overhead to

products.

d. All of the above answers are correct.

74. '& #ompany;s direct labor is )*E of its conversion cost. (f the

direct materials costs last week was '7-"7** and the

manufacturing overhead cost was '-/"***" compute the cost of

the direct labor for the week.

a. '57"*** b. P9,000 c. ')*"*** d. 'A")**

Guestions 7 through 4 are based on the following information$ ,lvin

#orporation manufactures and sells T!shirts inspired with college

names and slogans. >ast year" the shirts sold for '5.7* each" and the

variable epenses was '-.-7 per unit. The company needed to sell

-*"** shirts to breakeven. The net operating income last year was

'4"6**. ,lvin;s epectations for the coming year include the

following$

- The selling price of the t!shirts would be '9.**

- 1ariable epenses would increase by one!third.

- 0ied epenses will increase by /*E.

79. The number of t!shirts ,lvin #orporation must sell to breakeven

in the coming year is$

b. /5"7** b. 19,250 c. -*"*** d.

--"***

A*. 8ales for the coming year are epected to eceed last years by

/"*** units. if this occurs" ,lvin;s sales volume in the coming year

will be$

c. 22,600 units b. -/"9A* units c. -)"6** units d.

-/"*** units

A/. (f ,lvin wishes to earn '--"7** in net operating income for the

coming year" the company;s sales volume in pesos must be$

d. -/5"57* b. '-75"A-7 c. P207,000

d. '--9"7**

A-. The selling price needed net year to maintain the same

contribution margin ratio as last year is$

e. '9.** b. '4.-7 c. P10.00 d.

'9.57

A). W #ompany had a net operating income of '57"*** using

variable costing and a net operating income of '75"*** using

absorption costing. 1ariable production costs were '/7 per unit.

Total fied manufacturing overhead was '/-*"*** and /*"***

units were produced. Juring the year" the inventory level$

f. (ncreased by /"-** units. c. Decreased by

1,500 units.

g. (ncreased by /"7** units. d. Jecreased by

/"-** units.

A6. An activity!based costing system that is designed for internal

decision!making will not conform to generally accepted accounting

principles because$

h. 8ome manufacturing costs =the cost of idle capacity and

organization sustaining costs@ will not be assigned to products.

i. 8ome nonmanufacturing costs are assigned to products.

j. 0irst!sage allocation may be based on subjective interview

data.

k. All of the above are reasons hy an activity!based costin"

syste# that is desi"ned for internal decision!#akin" ill

not confor# to "enerally acce$ted accountin" $rinci$les.

A7. &O> #ompany has a standard of /7 parts of component H

costing '/.7* each. &O> purchases /6"*/* units of component H

for '--"/-7. &O> generated a '--* favorable price variance and a

')")57 favorable %uantity variance. (f there were no changes in

the component inventory" how many units of finished product were

produced?

a. 996 units b. /"A7* units c. /"*** units

d. 1,160 units

AA. 8hown below is the sales forecast for # (nc." for the first four

months of the coming year$

&an 0eb 2ar Apr

#ash 8ales '/7"*** ' -6"*** ' /4"*** ' /6"***

#redit 8ales /**"*** /-*"*** 9*"***

5*"***

.n average" 7*E of credit sales are paid for in the month of the

sale" )*E in the month following sale" and the remainder is paid

two months after the month of the sale. Assuming there are no

bad debts" the epected cash inflow in 2arch is$

l. '/)4"*** b. '/--"*** c. P119,000

d. '/*4"***

A5. T #ompany budgeted sales on account of '/-*"*** for &uly"

'-//"*** for August" and '/94"*** for 8eptember. #ollection

eperience indicates that none of the budgeted sales will be

collected in the month of the sale" A*E will be collected the month

after the sale" )AE in the second month" and 6E will be

uncollectible. The cash receipts from accounts receivable that

should be budgeted for 8eptember would be$

a.P169,%00 b. '/65"9A* c. '/95"44*

d.'/96"4A*

A4. ' #ompany budgets on an annual basis for its fiscal year. The

following beginning and ending inventory levels =in units@ are

planned for the net year$

+eginning ,nding

:aw 2aterials 6*"*** 7*"***

0inished goods 4*"*** 7*"***

Three pounds of materials are needed to produce each unit of

finished product. (f ' #ompany plans to sell 64*"*** units during

net year" the number of units it would have to manufacture during

the year would be

m. 66*"*** units b. 64*"*** units c. 7/*"*** units

d. &50,000 units

A9. + #ompany is preparing its budget for -**A. 0or -**7" the

following were reported$

8ales =/**"*** units@ '/"***"***

#ost of goods sold A**"***

Nross profit 6**"***

.perating epensesR -6*"***

Let (ncome ' /A*"***

Rincluding depreciation of '6*"***

8elling prices will increase by /*E and sales volume in units will

decrease by 7E. The cost of goods sold as a percent of sales will

increase to A-E. .ther than depreciation" all operating costs are

variable. + will budget a net income for -**A of

a. P167,100 b. '/A5"7**

c. '/A4"*** d. '/5A"***

Guestions /A through /9 are based on the following information$ A

(ndustries employs a standard cost system in which direct materials

inventory is carried at standard cost. A has established the following

standards for the prime costs of one unit of product.

8tandard Guantity 8tandard 'rice

8tandard #ost

Jirect materials 4 pounds '/.4* per pound

/6.6*

Jirect labor *.-7 hour '4.** per hour

-.**

Juring 2ay" A purchased /A*"*** pounds of direct materials at a

cost of ')*6"***. The total direct labor for 2ay were ')5"4**. A

manufactured /9"*** units of product during 2ay using /6-"7**

pounds of direct materials and 7"*** direct labor hours.

5*. The direct materials price variance for 2ay is

a. '/A"*** 0 b. P16,000 '( c. '/6"-7* 0 d.

'/6"-7* 30

5/. The direct materials %uantity variance for 2ay is

a. '/6"6** 30 b. '/"/** 0 c. '/5"/** 30

d. P17,100 (

5-. The direct labor rate variance for 2ay is

a. P2,200 ( b. '/"9** 30 c. '-"*** 30

d. '-"*9* 0

5). The direct labor efficiency variance for 2ay is

a. '-"-** 0 b. '-"*** 0 c. P2,000 '(

d. '/"4** 30

0 Nlass Works uses a standard cost system in which manufacturing

overhead is applied to units of product on the basis of direct labor!

hours. ,ach unit re%uires two standard hours of labor for completion.

The denominator activity for the year was based on budgeted

production of -**"*** units. Total overhead was budgeted at

'9**"*** for the year" and the fied overhead rate was ').** per

unit. The actual data pertaining to the manufacturing overhead for the

year are presented below$

Actual production /94"*** units

Actual J>< 66*"***

Actual variable overhead ')7-"***

Actual fied overhead '757"***

56. The standard hours allowed for actual production for the year

total

a. -65"7** b. )96,000 c. 6**"*** d.

697"***

57. 0;s variable overhead efficiency variance for the year is

a. P)),000 '( b. ')7"-** 0 c. ')7"-**

30 d. ')"*** 0

5A. 0;s variable overhead spending variance for the year is

a. '-*"*** 30 b. '--"*** 0 c. P22,000

'( d. '-*"*** 0

55. 0;s fied overhead budget variance for the year is

a. '/9"*** 0 b. P25,000 ( c. '-7"*** 30

d. '/9"*** 30

54. The fied overhead applied in 0;s production for the year is

a. '646"-** b. '757"*** c. P59&,000

d. '4**"***

59. 0;s overhead volume variance for the year is

a. P6,000 '( b. '/9"*** 0 c. '-7"*** 0

d. '77"*** 30

4*. 0ollowing is information relating to O #ompany;s H Jivision last

year$

8ales '7**"***

1ariable epenses )**"***

Traceable fied epenses 7*"***

Average operating assets /**"***

2inimum re%uired rate of return AE

H;s residual income was

a. P1&&,000 b. '/7*"*** c. '/7A"***

d. '-**"***

4/. #J, #ompany manufactures communication satellites used in

T1 in signal transmission. The firm currently purchases one

component for its satellite from a ,uropean firm. A #J,

engineering team has found a way to use the company;s own

component" namely 'art Lo. A-** instead of the ,uropean

component. <owever" the #J, component must be modified at a

cost of '7** per part. The ,uropean component costs '4"9** per

part. #J,;s part no A-** costs '7"/** before it is modified. #J,

currently uses /* of the ,uropean component per year. <ow much

is the annual differential cost between #J,;s two production

alternatives?

a. P)),000 b. ')5"*** c.')6"*** d.

')7"***

4-. 2 #ompany plans to discontinue a department that has a

contribution margin of '-6"*** and '64"*** in fied costs. .f the

fied costs" '-/"*** cannot be eliminated. The effect of this

discontinuance on 2;s net operating income would be a=n@

a. Jecrease of ')"*** c. Jecrease of

'-6"***

b. *ncrease of P),000 d. (ncrease of

'-6"***

The T #ompany has 7** obsolete microcomputers that are carried in

inventory at a total cost of '5-*"***. (f these microcomputers are

upgraded at a total cost of '/**"***" they can be sold for a total of

'/A*"***. As an alternative" the microcomputers can be sold in their

present condition for '7*"***.

4). The sunk cost in this situation

a. P720,000 b. '/A*"*** c. '7*"***

d. '/**"***

46. What is net advantage or disadvantage to the company from

upgrading the computers rather than selling in their present

condition?

a. '//*"*** advantage c. P10,000

advanta"e

b. 'AA*"*** disadvantage d. 'A*"***

advantage

47. 8uppose the selling price of the upgraded computers has not

been set. At what selling price per unit would the company be as

well off upgrading the computers as if it just sold the computers in

their present condition?

a. '/** b. '55* c. P)00 d.

'-/*

4A. 0 #aterers %uotes price of 'A* per person for a dinner party.

This price includes the AE sales ta and the /7E service charge.

8ales ta is computed on the food plus service charge. The

service charge is computed on the food only. At what amount does

0 #aterers price the food?

a. '77.6* b. '7*.** c.'65.6*

d. P&9.22

45. Which is L.T a common accounting classification of costs?

a& B! te $etod o" pa!$ent "o# te e%penditu#e&

b. +y the objective of ependiture.

c. +y behavior.

d. +y the function incurring the ependiture.

44. (ntroducing income taes into cost!volume!profit analysis

a. raises the break!even point.

b. lowers the break!even point.

c& inc#eases unit sales needed to ea#n a pa#ticula# ta#'et

p#o"it&

d. decreases the contribution margin percentage.

49. The principal advantage of the scatter!diagram method over the

high!low method of cost estimation is that the scatter!diagram

method

a. includes costs outside the relevant range.

2& conside#s $o#e tan t/o points&

c. can be used with more types of costs than the high!low

method.

d. gives a precise mathematical fit of the points to the line.

9*. >ooking at the following scatter diagrams we can conclude that

S S

T R R T RR

T R R R T RR R

T R R R R T R R

T R R T R R

T T

T T

TUUUUUUUUUUUUUUUUUU TUUUUUUUUUUUUUUUUUU

activity activity

#ost A #ost +

a. cost A will be easier to predict than cost +.

2& cost B /ill 2e easie# to p#edict tan cost A&

c. cost A is out!of!control.

d. cost + has no fied component.

9/. The cost to repair a unit of product that fails after it is sold is

a=n@

a. appraisal cost.

2& e%te#nal "ailu#e cost&

c. internal failure cost.

d. prevention cost.

9-. Nenco manufactures two versions of a product. 'roduction and

cost information show the following$

2odel A 2odel +

3nits produced -** 6**

2aterial moves =total@ -* 4*

Jirect labor hours per unit / -

2aterial handling costs total S-**"***. 3nder A+#" the material

handling costs allocated to each unit of 2odel A would be$

a. S/*

2& 9,..

c. S)))

d. 8ome other number

9). +uchanan #ompany currently sells 6"*** units of product G for

S/ each. #apacity is 7"*** units. 1ariable costs are S*.6* and

avoidable fied costs are S6**. A chain store has offered S*.4*

per unit for 6** units of G. (f +uchanan accepts the order" the

change in income will be a

a. SA* decrease.

b. S4* decrease.

c& 9+:. inc#ease&

d. S64* increase.

96. An imposed budget

a. is the same as a static budget.

2& can lead to poo# pe#"o#$ance&

c. is best for planning purposes.

d. eliminates the need for a sales forecast.

97. (f the present value of the future cash flows for an investment

e%uals the re%uired investment" the (:: is

a& e1ual to te cuto"" #ate&

b. e%ual to the cost of borrowed capital.

c. e%ual to zero.

d. lower than the companyVs cutoff rate of return.

9A. Which of the following combinations is possible?

'rofitability (nde L'1 (::

!!!!!!!!!!!!!!!!!!! !!!!!!!! !!!!!!!!!!!!!!!!!!!!!!!!!

a. greater than / positive e%uals cost of capital

b. greater than / negative less than cost of capital

c& less tan + ne'ati(e less tan cost o" capital

d. less than / positive less than cost of capital

95. Altoona #ompany is considering replacing a machine with a book

value of S-**"***" a remaining useful life of 6 years" and

annual straight!line depreciation of S7*"***. The eisting

machine has a current market value of S/57"***. The

replacement machine would cost S)-*"***" have a 6 year life"

and save S/**"*** per year in cash operating costs. (f the

replacement machine would be depreciated using the straight!

line method and the ta rate is 6*E" what would be the

increase in annual income taes if the company replaces the

machine?

a& 9,4-...

b. S6*"***

c. S6-"***

d. SA6"***

94. Jirect" step!down" and reciprocal are names for

a. the allocation methods most likely to produce goal congruence.

b. transfer!pricing methods.

c& $etods "o# allocatin' costs o" se#(ice depa#t$ents to

ope#atin' depa#t$ents&

d. alternative organizational structures.

99. #ascade #ompany had the following results in &une.

'lanned Actual

!!!!!!! !!!!!!!

8ales S4*"*** S54"9**

1ariable costs 7*"*** 64"7**

!!!!!!! !!!!!!!

#ontribution margin S)*"*** S)*"6**

??????? ???????

'lanned sales were /*"*** unitsD actual sales were 9"5** units.

The sales price variance is

a. S/"/** 3.

2& 9+-... ;&

c. S9** 3.

d. S6** 0.

/**. Alcatraz Jivision of HIK #orp. sells 4*"*** units of part H to the

outside market. 'art H sells for S6*" has a variable cost of S--"

and a fied cost per unit of S/*. Alcatraz has a capacity to

produce /**"*** units per period. #apone Jivision currently

purchases /*"*** units of part H from Alcatraz for S6*. #apone

has been approached by an outside supplier willing to supply

the parts for S)A. What is the effect on HIKVs overall profit if

Alcatraz :,038,8 the outside price and #apone decides to

buy outside?

a. no change

2& 9+<.-... dec#ease in =Y> p#o"its

c. S4*"*** decrease in HIK profits

d. S6*"*** increase in HIK profits

/*/. 0ilter #ompanyVs budget for overhead costs is$

total overhead cost ? S7*"*** B =S6 direct labor hours@

8tandard direct labor time is /.7 hours per unit of product. The

standard wage rate is SA per hour. 8tandard variable overhead

cost for a unit of product is

a. S6.**.

2& 9:&..&

c. S9.**.

d. S/*.**.

/*-. #hippewa paid S)-"--7 to direct labor for the production of

/"5** units. 8tandards allow ) labor hours per unit at a rate of

SA.7* per hour. Actual hours totaled 7"/7*. The direct labor rate

variance was

a& 9+-,3. "a(o#a2le

b. S9-7 favorable

c. S)-7 favorable

d. S)-7 unfavorable

/*). A company using activity!based overhead rates

a. will usually have higher budget variances than one using a

single rate.

b. will usually have higher volume variances than one using a

single rate.

c. cannot compute fied and variable components of overhead

cost.

d& sould a(e 2ette# in"o#$ation "o# plannin' and cont#ol

tan one usin' a sin'le #ate&

/*6. 1ariable costing and absorption costing will show the same

incomes when there are no

a. beginning inventories.

b. ending inventories.

c. variable costs.

d& 2e'innin' and endin' in(ento#ies&

/*7. 2adison (ndustries manufactures a single product using

standard costing. 1ariable production costs are S-A and fied

production costs are S-7*"***. 2adison uses a normal activity

of /-"7** units to set its standard costs. 2adison began the

year with /"*** units in inventory" produced //"*** units" and

sold //"7** units. The standard cost of goods sold under

variable costing would be

a. S-)*"***.

2& 9,??-...&

c. S7*A"***.

d. S7-9"***.

/*A. +ackflushing" or backflush costing

a& #e1ui#es si'ni"icantl! less #eco#d@eepin' tan ote#

$etods&

b. can be used by any company.

c. ignores inventories.

d. does not distinguish between materials and conversion

costs.

/*5. Which of the following will not impair the independence of a

#'A in the rendition of 2anagement 8ervices?

a. The #'A performs decision!making services for his client.

b. The #'A performs services wherein he is in effect" acting as

an employee of the client.

c. The #'A loses his objectivity and acts in a manner as if he

is advocating for the interest of his client.

d& Te C*A does not e%tend is se#(ices 2e!ond te

p#esentation o" #eco$$endations o# 'i(in' o" ad(ice&

/*4. The type of data processing in which remote terminals provide

direct access to the computer is

a. On6line p#ocessin' c. +atch

processing

b. :emote processing d. #entral processing

/*9. 8e%uential access means that

a. Jata are stored on magnetic tape.

b. The address of the location of data is found through the

use of either an algorithm or an inde.

c. ,ach record can be accessed in the same amount of

time.

d& To #ead #eco#d 3..- #eco#ds + t#ou' <?? $ust 2e

#ead "i#st&

Das könnte Ihnen auch gefallen

- Accountin 07-07 Cost Acctg 1Dokument11 SeitenAccountin 07-07 Cost Acctg 1Yella Mae Pariña RelosNoch keine Bewertungen

- Chapter 13 - Tor F and MCDokument13 SeitenChapter 13 - Tor F and MCAnika100% (1)

- AttachmentDokument34 SeitenAttachmentPia SurilNoch keine Bewertungen

- Financial Statement Ratio AnalysisDokument45 SeitenFinancial Statement Ratio Analysisbilly100% (1)

- 208 BDokument10 Seiten208 BXulian ChanNoch keine Bewertungen

- Chap 009Dokument15 SeitenChap 009Ahmed A HakimNoch keine Bewertungen

- Chap 07 - Study GuideDokument8 SeitenChap 07 - Study Guidedimitra triantosNoch keine Bewertungen

- MANAGEMENT ADVISORY SERVICES REVIEWDokument11 SeitenMANAGEMENT ADVISORY SERVICES REVIEWNica Jane MacapinigNoch keine Bewertungen

- MA2 04 Relevant Costing Problem 20Dokument4 SeitenMA2 04 Relevant Costing Problem 20Joy Deocaris100% (1)

- Audit Control Risk AssessmentDokument26 SeitenAudit Control Risk AssessmentMary GarciaNoch keine Bewertungen

- MasDokument21 SeitenMasYesha Manalo100% (1)

- Tactical DecisionDokument2 SeitenTactical DecisionLovely Del MundoNoch keine Bewertungen

- 5 6235268602178568335Dokument45 Seiten5 6235268602178568335Maristella Gaton100% (1)

- HO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFDokument7 SeitenHO9 - Decentralized and Segment Reporting, Quantitative Techniques, and Standard Costing PDFPATRICIA PEREZNoch keine Bewertungen

- Testbank-Quizlet RelevantCost2Dokument12 SeitenTestbank-Quizlet RelevantCost2Lokie PlutoNoch keine Bewertungen

- 01 x01 Basic ConceptsDokument10 Seiten01 x01 Basic ConceptsXandae MempinNoch keine Bewertungen

- Responsibility Accounting and Reporting: Multiple ChoiceDokument23 SeitenResponsibility Accounting and Reporting: Multiple ChoiceARISNoch keine Bewertungen

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDokument6 Seiten02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNoch keine Bewertungen

- RRC FAR Property Plant and EquipmentDokument18 SeitenRRC FAR Property Plant and Equipmenthazel alvarezNoch keine Bewertungen

- Chap8 PDFDokument63 SeitenChap8 PDFFathinus SyafrizalNoch keine Bewertungen

- Theory of Accounts On Business CombinationDokument2 SeitenTheory of Accounts On Business CombinationheyNoch keine Bewertungen

- 2 PFRS For SMEs Business CombinationDokument1 Seite2 PFRS For SMEs Business CombinationRay Allen UyNoch keine Bewertungen

- IAS 16 Property, Plant and EquipmentDokument4 SeitenIAS 16 Property, Plant and Equipmentisaac2008100% (5)

- Subjects Icare Resa: MAS FAR Afar TOA TAX RFBT AT APDokument14 SeitenSubjects Icare Resa: MAS FAR Afar TOA TAX RFBT AT APlloydNoch keine Bewertungen

- 1Dokument10 Seiten1Viannice AcostaNoch keine Bewertungen

- ToaDokument5 SeitenToaGelyn CruzNoch keine Bewertungen

- CPA Review Quiz on Quality Costs, Productivity, and Activity-Based CostingDokument22 SeitenCPA Review Quiz on Quality Costs, Productivity, and Activity-Based CostingTokkiNoch keine Bewertungen

- AbuegDokument10 SeitenAbuegswit_kamoteNoch keine Bewertungen

- Basic Consideration in MAS Management Accounting EnvironmentDokument25 SeitenBasic Consideration in MAS Management Accounting EnvironmentLeslie Beltran Chiang100% (1)

- Mixed PDFDokument8 SeitenMixed PDFChris Tian FlorendoNoch keine Bewertungen

- FAR 2733 - Share-Based-Payment PDFDokument4 SeitenFAR 2733 - Share-Based-Payment PDFPHI NGUYEN HOANGNoch keine Bewertungen

- Multiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Dokument3 SeitenMultiple Choice: Choose The Best Answer Among The Choices. Write Your Answers in CAPITAL Letters. (2 Points Per Requirement)Kimmy ShawwyNoch keine Bewertungen

- c2 2Dokument3 Seitenc2 2Kath LeynesNoch keine Bewertungen

- Module 1 Relevant CostingDokument6 SeitenModule 1 Relevant CostingJohn Rey Bantay RodriguezNoch keine Bewertungen

- Operation AuditingDokument3 SeitenOperation AuditingRosette RevilalaNoch keine Bewertungen

- Week17 2010 CorDokument20 SeitenWeek17 2010 CormdafeshNoch keine Bewertungen

- (D) The Liability Is Payable To A Specifically Identified PayeeDokument13 Seiten(D) The Liability Is Payable To A Specifically Identified PayeeAngela Luz de LimaNoch keine Bewertungen

- Since 1977: TAXATION Methods and Computation FormatsDokument2 SeitenSince 1977: TAXATION Methods and Computation FormatsMay Grethel Joy PeranteNoch keine Bewertungen

- Right of Stoppage in TransitDokument8 SeitenRight of Stoppage in TransitMara Shaira SiegaNoch keine Bewertungen

- College of Accountancy & Economics Auditing Theory DocumentDokument15 SeitenCollege of Accountancy & Economics Auditing Theory DocumentmaekaellaNoch keine Bewertungen

- CVP AssignmentDokument5 SeitenCVP AssignmentAccounting MaterialsNoch keine Bewertungen

- Quiz 1 ConsulDokument4 SeitenQuiz 1 ConsulJenelyn Pontiveros40% (5)

- Capitalizable Make-Ready Costs Related To A New Machine Do Not IncludeDokument1 SeiteCapitalizable Make-Ready Costs Related To A New Machine Do Not Includejahnhannalei marticioNoch keine Bewertungen

- 5 6181699682708750974Dokument123 Seiten5 6181699682708750974Kay SanNoch keine Bewertungen

- Financial Accounting ExamDokument12 SeitenFinancial Accounting Examjano_art21Noch keine Bewertungen

- Management Accounting Information For Activity and Process DecisionsDokument30 SeitenManagement Accounting Information For Activity and Process DecisionsCarmelie CumigadNoch keine Bewertungen

- ExerciseonEstateTaxDokument1 SeiteExerciseonEstateTaxJohn Carlo CruzNoch keine Bewertungen

- Asset Turnover, ROI, and Financial Ratios Practice TestDokument5 SeitenAsset Turnover, ROI, and Financial Ratios Practice TestMaketh.ManNoch keine Bewertungen

- Part 4D (Information Systems) 264Dokument71 SeitenPart 4D (Information Systems) 264Colleidus Khoppe100% (2)

- MA Cabrera 2010 - SolManDokument4 SeitenMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- CMPC312 QuizDokument19 SeitenCMPC312 QuizNicole ViernesNoch keine Bewertungen

- TAXATION 1 - Income Taxation PrinciplesDokument6 SeitenTAXATION 1 - Income Taxation PrinciplesCrizel A. AggasigNoch keine Bewertungen

- On January 1Dokument3 SeitenOn January 1Jude Santos0% (1)

- MAS - Capital BudgetingDokument15 SeitenMAS - Capital Budgetingkevinlim186100% (7)

- Managerial AccountingDokument13 SeitenManagerial AccountingSagar BansalNoch keine Bewertungen

- Job Order Cost Accounting: True-False StatementsDokument48 SeitenJob Order Cost Accounting: True-False StatementsValerie Marquez100% (4)

- Quiz 1Dokument5 SeitenQuiz 1SarahNoch keine Bewertungen

- Case 5-49 Activity-Based Costing: Budgeted Operating MarginDokument5 SeitenCase 5-49 Activity-Based Costing: Budgeted Operating MarginMurnawaty Narthy0% (1)

- Lesson 6 - PricingDokument13 SeitenLesson 6 - PricingAnjo EllisNoch keine Bewertungen

- Managerial Accounting MCQDokument6 SeitenManagerial Accounting MCQPurnamasidi SimanjuntakNoch keine Bewertungen

- MAS PreweekDokument46 SeitenMAS Preweekclaire_charm27100% (1)

- Chapter 8Dokument1 SeiteChapter 8kevinlim186Noch keine Bewertungen

- CPAR MAS Preweek Quizzer May2004Dokument23 SeitenCPAR MAS Preweek Quizzer May2004kevinlim186100% (1)

- MAS - Capital BudgetingDokument15 SeitenMAS - Capital Budgetingkevinlim186100% (7)

- Chapter 6Dokument3 SeitenChapter 6kevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument4 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- MAS PreweekDokument46 SeitenMAS Preweekclaire_charm27100% (1)

- MAS - Cost of Capital 11pagesDokument11 SeitenMAS - Cost of Capital 11pageskevinlim186100% (1)

- MAS FS Analysis 40pagesDokument50 SeitenMAS FS Analysis 40pageskevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument4 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument6 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- Chapter 3Dokument3 SeitenChapter 3kevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument4 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- Chapter 7Dokument3 SeitenChapter 7kevinlim186Noch keine Bewertungen

- Chapter 5Dokument4 SeitenChapter 5kevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument4 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- Chapter 5Dokument4 SeitenChapter 5kevinlim186Noch keine Bewertungen

- Chapter 7Dokument3 SeitenChapter 7kevinlim186Noch keine Bewertungen

- Chapter 6Dokument3 SeitenChapter 6kevinlim186Noch keine Bewertungen

- Rittenberg SummaryDokument4 SeitenRittenberg Summarykevinlim186Noch keine Bewertungen

- Chapter 8Dokument1 SeiteChapter 8kevinlim186Noch keine Bewertungen

- Chapter 3Dokument3 SeitenChapter 3kevinlim186Noch keine Bewertungen

- Singer Annual Report 2011Dokument88 SeitenSinger Annual Report 2011Cryptic MishuNoch keine Bewertungen

- Trading Strategy With RSI CalculationDokument28 SeitenTrading Strategy With RSI CalculationjamalNoch keine Bewertungen

- Canara DemateDokument6 SeitenCanara DemateGagan PrasadNoch keine Bewertungen

- Sap FundamentalsDokument8 SeitenSap FundamentalsrifkicayNoch keine Bewertungen

- Generic Ic Disc PresentationDokument55 SeitenGeneric Ic Disc PresentationInternational Tax Magazine; David Greenberg PhD, MSA, EA, CPA; Tax Group International; 646-705-2910Noch keine Bewertungen

- BP Investment AppraisalDokument71 SeitenBP Investment Appraisalprashanth AtleeNoch keine Bewertungen

- JAMA - The End of Quality Improvement: Long Live Improving ValueDokument3 SeitenJAMA - The End of Quality Improvement: Long Live Improving ValuekcochranNoch keine Bewertungen

- CAGR, XIRR, Rolling ReturnDokument9 SeitenCAGR, XIRR, Rolling ReturnKarthick AnnamalaiNoch keine Bewertungen

- FA RevaluationDokument54 SeitenFA RevaluationABCNoch keine Bewertungen

- AC222 Final Exam Study GuideDokument12 SeitenAC222 Final Exam Study GuidePablo MercadoNoch keine Bewertungen

- How To Capitalise On French Retail Investor Appetite For HealthcareDokument4 SeitenHow To Capitalise On French Retail Investor Appetite For HealthcareNishant KhatriNoch keine Bewertungen

- Chey Khana Research by Arif HussainDokument17 SeitenChey Khana Research by Arif HussainArif KhanNoch keine Bewertungen

- Opportunity BrochureDokument2 SeitenOpportunity BrochureCherry San DiegoNoch keine Bewertungen

- Amanpreet Singh DissertationDokument54 SeitenAmanpreet Singh DissertationAmanpreet SinghNoch keine Bewertungen

- ACCA ATX Paper Sep 2018Dokument16 SeitenACCA ATX Paper Sep 2018Dilawar HayatNoch keine Bewertungen

- (Centre For Central Banking Studies Bank of EnglandDokument54 Seiten(Centre For Central Banking Studies Bank of Englandmalik naeemNoch keine Bewertungen

- Prelim Quiz 1 and Key AnswersDokument3 SeitenPrelim Quiz 1 and Key AnswersJordan P HunterNoch keine Bewertungen

- Transitional Living Program For Young AdultsDokument5 SeitenTransitional Living Program For Young AdultsBrian HaraNoch keine Bewertungen

- Trade War Between China and USDokument5 SeitenTrade War Between China and USShayan HiraniNoch keine Bewertungen

- Need Expectation of Interested Parties According To I So 220002018Dokument2 SeitenNeed Expectation of Interested Parties According To I So 220002018Shivyog SanatanNoch keine Bewertungen

- GA502166-New Policy Welcome LetterDokument1 SeiteGA502166-New Policy Welcome LetterNelly HNoch keine Bewertungen

- Sept 2018 Top Links Work Round DocumentDokument65 SeitenSept 2018 Top Links Work Round DocumentAndrew Richard ThompsonNoch keine Bewertungen

- Chartered Financial Analyst: Us Cfa®Dokument14 SeitenChartered Financial Analyst: Us Cfa®Amit ManyalNoch keine Bewertungen

- 1st Part of Loan AmortizationDokument3 Seiten1st Part of Loan AmortizationOptimistic ShanNoch keine Bewertungen

- Carrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)Dokument23 SeitenCarrefour Expansion To Pakistan: International Business Management (MGT 521) Spring 2017-2018 (Term B)WerchampiomsNoch keine Bewertungen

- Solutions Week 12 - Intangible AssetsDokument6 SeitenSolutions Week 12 - Intangible AssetsjoseluckNoch keine Bewertungen

- Answer Key 3Dokument8 SeitenAnswer Key 3Hari prakarsh NimiNoch keine Bewertungen

- Mr. Yasir Ali: The Bright Future SchoolDokument47 SeitenMr. Yasir Ali: The Bright Future SchoolWaqas AliNoch keine Bewertungen

- Financial Statement AnalysisDokument33 SeitenFinancial Statement Analysisfirst name100% (3)

- 3 MDokument12 Seiten3 MRicha KothariNoch keine Bewertungen

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsVon EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsBewertung: 4 von 5 Sternen4/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyVon EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyBewertung: 5 von 5 Sternen5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomVon EverandProfit First for Therapists: A Simple Framework for Financial FreedomNoch keine Bewertungen

- Financial Accounting For Dummies: 2nd EditionVon EverandFinancial Accounting For Dummies: 2nd EditionBewertung: 5 von 5 Sternen5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanVon EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanBewertung: 4.5 von 5 Sternen4.5/5 (79)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Von EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Bewertung: 4.5 von 5 Sternen4.5/5 (14)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantVon EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantBewertung: 4.5 von 5 Sternen4.5/5 (146)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetVon EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNoch keine Bewertungen

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineVon EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNoch keine Bewertungen

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Von EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Bewertung: 5 von 5 Sternen5/5 (1)

- Project Control Methods and Best Practices: Achieving Project SuccessVon EverandProject Control Methods and Best Practices: Achieving Project SuccessNoch keine Bewertungen

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItVon EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItBewertung: 5 von 5 Sternen5/5 (13)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesVon EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesNoch keine Bewertungen

- Basic Accounting: Service Business Study GuideVon EverandBasic Accounting: Service Business Study GuideBewertung: 5 von 5 Sternen5/5 (2)

- The CEO X factor: Secrets for Success from South Africa's Top Money MakersVon EverandThe CEO X factor: Secrets for Success from South Africa's Top Money MakersNoch keine Bewertungen

- Finance Basics (HBR 20-Minute Manager Series)Von EverandFinance Basics (HBR 20-Minute Manager Series)Bewertung: 4.5 von 5 Sternen4.5/5 (32)

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungVon EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungBewertung: 4 von 5 Sternen4/5 (1)