Beruflich Dokumente

Kultur Dokumente

Daily MCX Newsletter 07 July 2014

Hochgeladen von

Jeffrey PateOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily MCX Newsletter 07 July 2014

Hochgeladen von

Jeffrey PateCopyright:

Verfügbare Formate

www.TheEquicom.

com 09200009266

1

PPP

P

07- JULY-2014

DAILY MCX NEWSLETTER

www.TheEquicom.com

09200009266

www.TheEquicom.com 09200009266

2

BULLION:

Gold continues to benefit from safe haven demand due to geo-poltical and financial uncertainty.

Spot gold gain 6% in June, and on a quarterly basis 3.5%.

Gold futures at Multi Commodity Exchange (MCX) is expected to rise to Rs 28200 per 10

grams.However, a correction towards $1280/oz for US gold and Rs 26000/10 gram for India gold

futures are also likely this month.

ENERGY:

Crude futures fell on Thursday after Libya declared an end to a standoff with rebels that had closed

several oil facilities and ports, with markets now expecting global supply to rise with an end to the

confrontation. In the New York Mercantile Exchange, West Texas Intermediate crude oil for delivery

in August traded at $103.97 a barrel during U.S. trading, down 0.50%. New York-traded oil futures

hit a session low of $103.68 a barrel and a high of $104.31 a barrel.

BASE METAL:

Copper stocks at London Metal Exchange (LME) rose by 275 tons to 157050 tons while Lead

stocks were gained by 19900 tons to 213600 tons on Thursday. Aluminium, Nickel and Zinc

stocks recorded a decline by 8075, 456 and 1175 tons respectively.

www.TheEquicom.com 09200009266

3

GOLD (5 AUG.)

SILVER (5 SEP.)

BULLION

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 45300, 45600

SUPPORT : - 44700, 44400

STRATEGY : - SELL ON HIGH

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 27700, 27900

SUPPORT : - 27400, 27200

STRATEGY : - SELL ON HIGH

www.TheEquicom.com 09200009266

4

CRUDEOIL (21 JULY.)

NATURAL GAS (28 JULY)

ENERGY

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 265.00, 270.00

SUPPORT : - 255.00, 250.00

STRATEGY : - SELL ON HIGHS

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 6260, 6320

SUPPORT : - 6150, 6100

STRATEGY : - SELL ON HIGHS

www.TheEquicom.com 09200009266

5

COPPER (29 AUG.)

LEAD (31 JULY.)

BASE METAL

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 130.40, 131.50

SUPPORT : - 129.00, 128.00

STRATEGY : - BUY ON DIPS

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 438.00, 442.00

SUPPORT : - 430.00, 425.00

STRATEGY : - BUY ON DIPS

www.TheEquicom.com 09200009266

6

ZINC (31 JULY.)

ALUMINUM (31 JULY.)

NICKEL (31 JULY.)

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 1168.00, 1180.00

SUPPORT : - 1150.00, 1140.00

STRATEGY : - BUY ON DIPS

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 115.00, 116.00

SUPPORT : - 113.00, 112.00

STRATEGY : - BUY ON DIPS

OUTLOOK:

TREND : - CONSOLIDATE

RESISTANCE : - 134.10, 135.40

SUPPORT : - 132.50, 131.50

STRATEGY : - BUY ON DIPS

www.TheEquicom.com 09200009266

7

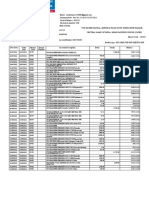

GOLD 1320.54

SILVER 21.124

COPPER 3.267

CRUDEOIL 103.78

PALLANDIUM 865.30

PLATINUM 1501.07

USDINR 59.9975

EURUSD 01.3593

USDJPY 102.077

USDCHF 00.8942

GBPUSD 01.7154

USDCAD 01.0650

www.TheEquicom.com 09200009266

8

www.TheEquicom.com 09200009266

9

DISCLAIMER

The information and views in this report, our website & all the service we provide are believed to be reliable, but

we do not accept any responsibility (or liability) for errors of fact or opinion. Users have the right to choose the

product/s that suits them the most.

Sincere efforts have been made to present the right investment perspective. The information contained herein is

based on analysis and up on sources that we consider reliable.

This material is for personal information and based upon it and takes no responsibility

The information given herein should be treated as only factor, while making investment decision. The report

does not provide individually tailor-made investment advice. TheEquicom recommends that investors

independently evaluate particular investments and strategies, and encourages investors to seek the advice of a

financial adviser. TheEquicom shall not be responsible for any transaction conducted based on the information

given in this report, which is in violation of rules and regulations of NSE and BSE.

The share price projections shown are not necessarily indicative of future price performance. The information

herein, together with all estimates and forecasts, can change without notice. Analyst or any person related to

TheEquicom might be holding positions in the stocks recommended. It is understood that anyone who is

browsing through the site has done so at his free will and does not read any views expressed as a

recommendation for which either the site or its owners or anyone can be held responsible for . Any surfing

and reading of the information is the acceptance of this disclaimer.

All Rights Reserved.

Investment in Commodity and equity market has its own risks.

We, however, do not vouch for the accuracy or the completeness thereof. we are not responsible for any loss

incurred whatsoever for any financial profits or loss which may arise from the recommendations above.

TheEquicom does not purport to be an invitation or an offer to buy or sell any financial instrument. Our Clients

(Paid Or Unpaid), Any third party or anyone else have no rights to forward or share our calls or SMS or Report or

Any Information Provided by us to/with anyone which is received directly or indirectly by them. If found so then

Serious Legal Actions can be taken.

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Daily MCX Newsletter 28 May 2014Dokument9 SeitenDaily MCX Newsletter 28 May 2014Jeffrey PateNoch keine Bewertungen

- 26 To 31 May.'2014: TH STDokument14 Seiten26 To 31 May.'2014: TH STJeffrey PateNoch keine Bewertungen

- Weekly MCX Newsletter 02 June 2014Dokument16 SeitenWeekly MCX Newsletter 02 June 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 27 May 2014Dokument9 SeitenDaily MCX Newsletter 27 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 21 May 2014Dokument9 SeitenDaily MCX Newsletter 21 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 20 May 2014Dokument9 SeitenDaily MCX Newsletter 20 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 16 May 2014Dokument9 SeitenDaily MCX Newsletter 16 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 19 May 2014Dokument9 SeitenDaily MCX Newsletter 19 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 14 May 2014Dokument9 SeitenDaily MCX Newsletter 14 May 2014Jeffrey PateNoch keine Bewertungen

- Daily Equity News Letter 15 May 2014Dokument8 SeitenDaily Equity News Letter 15 May 2014Jeffrey PateNoch keine Bewertungen

- Daily Equity News Letter 13 May 2014Dokument8 SeitenDaily Equity News Letter 13 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 06 May 2014Dokument9 SeitenDaily MCX Newsletter 06 May 2014Jeffrey PateNoch keine Bewertungen

- Daily Equity News Letter 14 May 2014Dokument8 SeitenDaily Equity News Letter 14 May 2014Jeffrey PateNoch keine Bewertungen

- Daily MCX Newsletter 07 May 2014Dokument9 SeitenDaily MCX Newsletter 07 May 2014Jeffrey PateNoch keine Bewertungen

- Daily Equity News Letter 06 May 2014Dokument8 SeitenDaily Equity News Letter 06 May 2014Jeffrey PateNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Itr3 2018 PR1Dokument148 SeitenItr3 2018 PR1Harish Kumar MahavarNoch keine Bewertungen

- Lecture On Fundamental Analysis - Dr. NiveditaDokument32 SeitenLecture On Fundamental Analysis - Dr. NiveditaSanjanaNoch keine Bewertungen

- Practice Test 3Dokument1 SeitePractice Test 3EwanNoch keine Bewertungen

- FASTag Application FormDokument6 SeitenFASTag Application FormLizzi JNoch keine Bewertungen

- Chanda KochharDokument39 SeitenChanda KochharviveknayeeNoch keine Bewertungen

- ZPPF Loan Recoverable ApplicationDokument3 SeitenZPPF Loan Recoverable ApplicationNaga ManoharababuNoch keine Bewertungen

- BUS670 O GradyDokument5 SeitenBUS670 O GradyIndra ZulhijayantoNoch keine Bewertungen

- Finance Car Leasing Final ProjectDokument21 SeitenFinance Car Leasing Final ProjectShehrozAyazNoch keine Bewertungen

- 03 Literature ReviewDokument15 Seiten03 Literature ReviewrakeshNoch keine Bewertungen

- Chapter 9 Cooperative BLAWDokument16 SeitenChapter 9 Cooperative BLAWnovi bag-ayNoch keine Bewertungen

- Bank Management P 52Dokument62 SeitenBank Management P 52revathykchettyNoch keine Bewertungen

- RPSC JR Accountant Second Paper 2015Dokument55 SeitenRPSC JR Accountant Second Paper 2015yeshrockNoch keine Bewertungen

- Caam RM1000Dokument2 SeitenCaam RM1000NinerMike MysNoch keine Bewertungen

- Bank of Mauritius Act Amended Fa 2022Dokument57 SeitenBank of Mauritius Act Amended Fa 2022Bhavna Devi BhoodunNoch keine Bewertungen

- North America Equity ResearchDokument8 SeitenNorth America Equity ResearchshamashmNoch keine Bewertungen

- Indiainc'Sbiggest Merger:Hdfcbank& Hdfcltdwillbeone: Kashmiri Pandit, 2 Migrants Shot At, CRPF Man Killed in ValleyDokument18 SeitenIndiainc'Sbiggest Merger:Hdfcbank& Hdfcltdwillbeone: Kashmiri Pandit, 2 Migrants Shot At, CRPF Man Killed in ValleygoochinaatuNoch keine Bewertungen

- Ithrees's Whole Ion Finalyzed To PrintDokument82 SeitenIthrees's Whole Ion Finalyzed To PrintMohamed FayasNoch keine Bewertungen

- BAM PPT 2019-09 Investor DayDokument92 SeitenBAM PPT 2019-09 Investor DayRocco HuangNoch keine Bewertungen

- Project Chapter 1Dokument62 SeitenProject Chapter 1HUMAIR123456Noch keine Bewertungen

- Chapter 10 Exercise 6Dokument11 SeitenChapter 10 Exercise 6Tri HartonoNoch keine Bewertungen

- 2022 BIR Form 2316 - 2013650Dokument1 Seite2022 BIR Form 2316 - 2013650erik skiNoch keine Bewertungen

- AccountStatement 3286686240 Aug04 185310 PDFDokument2 SeitenAccountStatement 3286686240 Aug04 185310 PDFDarren Joseph VivekNoch keine Bewertungen

- Mergers and AcquisitionDokument61 SeitenMergers and AcquisitionVarsha JaisinghaniNoch keine Bewertungen

- Bonia - Annual Report 2016 (Part 3)Dokument126 SeitenBonia - Annual Report 2016 (Part 3)ameraizahNoch keine Bewertungen

- Final Accounts - Trading, P&L and Balance SheetDokument3 SeitenFinal Accounts - Trading, P&L and Balance SheetVivek Singh SohalNoch keine Bewertungen

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresDokument36 SeitenThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresA cNoch keine Bewertungen

- Accounting Cycle Upto Trial BalanceDokument60 SeitenAccounting Cycle Upto Trial BalancejobwangaNoch keine Bewertungen

- Cocolife Cancellation LetterDokument1 SeiteCocolife Cancellation LetterIanRoseAcelajadoAderes50% (2)

- Statistical Appendix in English PDFDokument175 SeitenStatistical Appendix in English PDFMADHAVNoch keine Bewertungen

- Gold Export GhanaDokument3 SeitenGold Export Ghanamusu35100% (4)